Key Insights

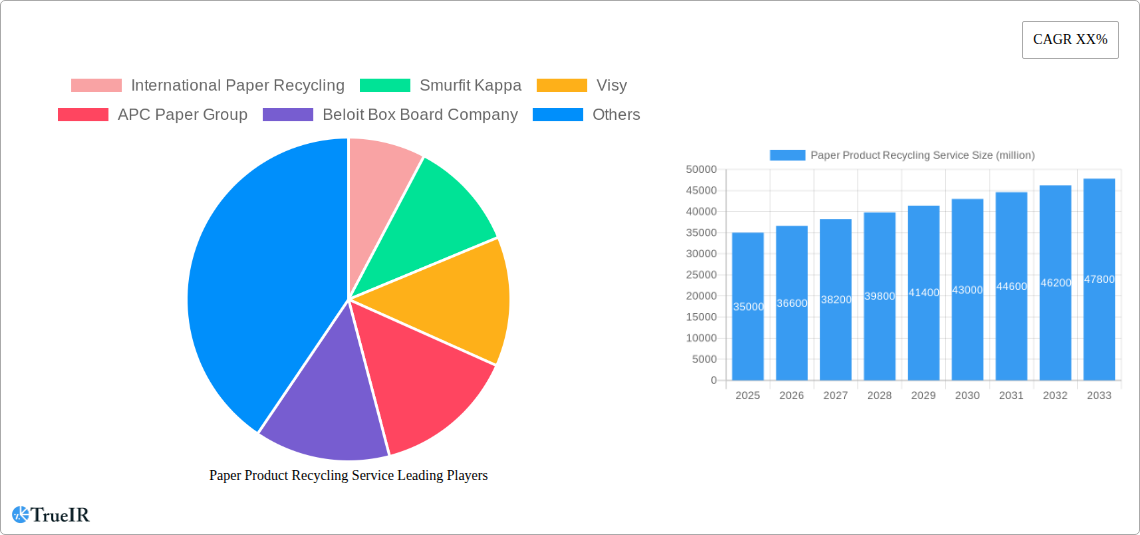

The global Paper Product Recycling Service market is poised for robust expansion, projected to reach approximately USD 35 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 4.5% through 2033. This growth is underpinned by a significant increase in waste paper collection and processing, driven by escalating environmental concerns and stringent government regulations promoting circular economy principles. The increasing consumer awareness regarding the environmental impact of paper consumption further fuels demand for recycling services. Key applications driving this market include the recycling of cardboard for packaging, office paper for administrative reuse, and sanitary products like toilet papers, napkins, and paper towels. The growing e-commerce sector has significantly boosted the demand for recycled cardboard, while a greater emphasis on sustainability in corporate operations is also accelerating the recycling of office paper.

The market is characterized by a dynamic competitive landscape, with major players like International Paper Recycling, Smurfit Kappa, and Visy leading the charge through strategic expansions, technological advancements, and mergers and acquisitions. Emerging trends such as advanced sorting technologies, the development of higher-grade recycled paper products, and increased investment in infrastructure for waste paper collection are expected to shape the market's trajectory. However, the market faces certain restraints, including fluctuations in the price of recycled paper commodities, the high initial investment required for recycling facilities, and challenges in efficiently collecting and transporting waste paper, particularly in developing regions. Despite these hurdles, the persistent global push towards sustainable waste management and the growing economic viability of recycled paper products are expected to propel the Paper Product Recycling Service market to new heights in the coming years.

SEO-Optimized Report Description: Paper Product Recycling Service Market Analysis 2019-2033

Dive deep into the burgeoning Paper Product Recycling Service market with our comprehensive, SEO-optimized report. This in-depth analysis covers the global paper recycling industry from 2019 to 2033, with a base and estimated year of 2025. We explore market dynamics, growth drivers, and competitive strategies for key players like International Paper Recycling, Smurfit Kappa, Visy, APC Paper Group, Beloit Box Board Company, Evergreen Packaging LLC, BPM Inc., Donco Recycling Solutions, Clearwater Paper Corporation, and Domtar Corporation. Understand the impact of recycling cardboard, waste paper, and other paper types across applications including office paper, toilet papers, napkins and paper towels, and newspapers and magazines. This report is essential for stakeholders seeking to capitalize on the circular economy for paper, sustainable packaging solutions, and waste management innovation.

Paper Product Recycling Service Market Structure & Competitive Landscape

The paper product recycling service market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key companies such as International Paper Recycling and Smurfit Kappa have invested heavily in advanced sorting technologies and extensive collection networks, contributing to an estimated concentration ratio of 55% among the top five companies. Innovation is primarily driven by the demand for higher-quality recycled paper pulp and the development of more efficient collection and processing methods. Regulatory impacts, including stringent waste management policies and landfill diversion targets in regions like Europe and North America, are significant drivers of market adoption. Product substitutes, such as virgin paper production and the increasing use of digital communication, pose a moderate competitive threat. End-user segmentation reveals strong demand from packaging manufacturers and tissue product producers, representing over 70% of the market. Mergers and acquisitions (M&A) are a notable trend, with an estimated 15 significant M&A deals valued at over a million dollars occurring in the historical period (2019-2024), aimed at expanding geographical reach and enhancing service capabilities. The competitive landscape is characterized by a balance of established giants and emerging regional players, all striving to optimize operational efficiency and capture market share through sustainable practices.

Paper Product Recycling Service Market Trends & Opportunities

The paper product recycling service market is experiencing robust growth, projected to expand significantly from its 2025 valuation of over ten million dollars. This expansion is fueled by a growing global awareness of environmental sustainability and the increasing imperative for businesses and governments to adopt circular economy principles. The market penetration rate for paper recycling services is steadily climbing, driven by supportive government policies and a rising consumer preference for eco-friendly products. Technological shifts are playing a crucial role, with advancements in sorting technologies, such as artificial intelligence-powered optical sorters, enhancing the efficiency and purity of recycled paper streams. This innovation is crucial for meeting the quality demands of various applications, from cardboard packaging to premium toilet papers and napkins.

Consumer preferences are increasingly leaning towards products with a lower environmental footprint, thereby creating a sustained demand for recycled paper content. This trend is particularly evident in sectors like food and beverage packaging and consumer goods. The competitive dynamics within the market are evolving, with companies not only competing on price and efficiency but also on the sustainability credentials of their operations and the quality of recycled materials they can provide. The CAGR for the forecast period (2025–2033) is estimated to be between 6-8%, indicating a strong upward trajectory.

Opportunities abound for companies that can innovate in areas such as advanced de-inking processes for higher-grade paper recovery, the development of specialized recycling solutions for complex paper products, and the integration of digital platforms for improved supply chain transparency and customer engagement. The expanding global infrastructure for waste collection and sorting further supports market growth. The drive towards reduced carbon emissions and resource conservation are powerful tailwinds for the paper recycling sector. The potential for new market entrants and the expansion of existing players into underserved regions present significant avenues for growth and investment in the coming years. The overarching trend is a move towards a more responsible and resource-efficient paper lifecycle, with recycling services at its core.

Dominant Markets & Segments in Paper Product Recycling Service

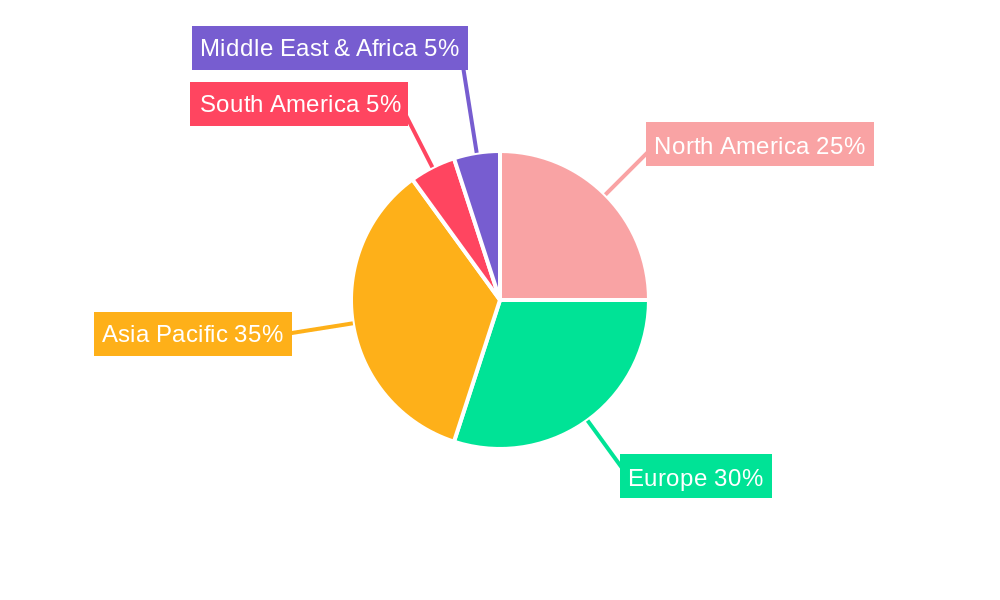

The paper product recycling service market is characterized by several dominant regions and segments driving its substantial growth. North America and Europe currently lead in market dominance, largely due to advanced waste management infrastructure, stringent environmental regulations, and a well-established consumer base that prioritizes sustainability. Within these regions, significant growth drivers include government mandates for waste diversion, extensive public awareness campaigns, and the presence of leading industry players.

The Cardboard segment within the "Types" classification is a primary engine of growth, accounting for over 50% of the market volume. This dominance stems from its widespread use in e-commerce packaging, shipping, and various industrial applications, leading to high generation rates of recyclable cardboard. The "Waste Paper" segment, encompassing a broad range of mixed paper grades, also holds a substantial market share, though its value is often dependent on the efficiency of sorting and reprocessing technologies.

In terms of "Applications," Office Paper recycling services are experiencing consistent demand, driven by corporate sustainability initiatives and the increasing adoption of paperless office policies that paradoxically can lead to concentrated streams of recyclable office paper. The Newspapers and Magazines segment, while historically significant, is seeing a relative decline in volume due to the shift towards digital media, though it remains important in specific markets. Toilet Papers, Napkins and Paper Towels represent a growing segment, fueled by increasing hygiene awareness and a sustained demand for tissue products, with a rising preference for those made from recycled materials. The "Others" category for both types and applications captures niche markets and emerging paper-based products that contribute to the overall diversification of the recycling landscape. The growth in these dominant segments is further bolstered by continuous investments in recycling technologies and expanding collection networks, ensuring that a significant portion of paper waste is diverted from landfills and reintegrated into the production cycle.

Paper Product Recycling Service Product Analysis

Paper product recycling services are continually evolving, focusing on enhancing the quality and versatility of recovered materials. Innovations in de-inking and contaminant removal technologies are enabling the production of higher-grade recycled pulp, suitable for premium applications like toilet papers and napkins, as well as high-quality office paper. Advanced sorting techniques, including optical and artificial intelligence-driven systems, are crucial for segregating different paper grades efficiently, thereby increasing the purity of cardboard and waste paper streams. These technological advancements provide competitive advantages by allowing recyclers to meet the stringent specifications of manufacturers, reduce reliance on virgin fiber, and offer cost-effective, sustainable solutions. The market fit for these services is expanding as industries increasingly prioritize environmental, social, and governance (ESG) goals, making recycled paper products a preferred choice for environmentally conscious consumers and businesses.

Key Drivers, Barriers & Challenges in Paper Product Recycling Service

Key Drivers: The paper product recycling service market is propelled by robust economic incentives stemming from the rising cost of virgin pulp and the increasing demand for sustainable products. Technological advancements in sorting and reprocessing are enhancing efficiency and material quality, making recycling more viable and profitable. Favorable government policies and regulations, including landfill bans and mandatory recycling targets, are significant catalysts. Furthermore, a growing consumer consciousness regarding environmental impact is creating a strong pull for recycled paper products.

Barriers & Challenges: Supply chain issues, particularly inconsistent collection volumes and the presence of contaminants, pose a significant challenge to consistent output quality. Fluctuations in commodity prices for recycled paper can impact the profitability of recycling operations. Intense competition from both established players and informal recycling sectors can exert downward pressure on service fees. Regulatory complexities and varying standards across different regions can also create hurdles for companies operating on a global scale. The logistical costs associated with collecting and transporting large volumes of paper waste are also a constraint.

Growth Drivers in the Paper Product Recycling Service Market

The paper product recycling service market is witnessing substantial growth driven by several interconnected factors. Economically, the rising cost of virgin paper fiber and the increasing global demand for sustainable materials are powerful incentives for businesses to invest in recycling services. Technologically, advancements in automated sorting, de-inking, and pulping processes are enhancing the efficiency and quality of recycled paper, broadening its applicability across various end-use sectors. Regulatory frameworks worldwide are increasingly mandating higher recycling rates and promoting circular economy principles, providing a stable and predictable environment for market expansion. Consumer awareness and preference for eco-friendly products also play a crucial role, creating a demand pull for goods manufactured using recycled paper.

Challenges Impacting Paper Product Recycling Service Growth

Despite its promising growth trajectory, the paper product recycling service market faces several significant challenges. Regulatory complexities and the lack of harmonized standards across different jurisdictions can hinder seamless cross-border operations and increase compliance costs. Supply chain volatility, including inconsistent availability of high-quality recyclable paper feedstock and contamination issues, can impact operational efficiency and the purity of recycled output. Competitive pressures from lower-cost virgin paper production and the growing adoption of digital alternatives for paper-based communication continue to exert influence. Furthermore, the substantial capital investment required for state-of-the-art recycling infrastructure and the logistical costs associated with collecting and transporting dispersed waste streams remain considerable barriers.

Key Players Shaping the Paper Product Recycling Service Market

- International Paper Recycling

- Smurfit Kappa

- Visy

- APC Paper Group

- Beloit Box Board Company

- Evergreen Packaging LLC

- BPM Inc.

- Donco Recycling Solutions

- Clearwater Paper Corporation

- Domtar Corporation

Significant Paper Product Recycling Service Industry Milestones

- 2019: Increased global focus on plastic waste reduction leads to renewed attention on paper as a sustainable alternative, boosting demand for paper recycling.

- 2020: The COVID-19 pandemic temporarily disrupted collection and processing, but also highlighted the resilience of the paper supply chain and the importance of local recycling efforts.

- 2021: Major paper manufacturers announce ambitious targets for increasing recycled fiber content in their products, signaling sustained market demand.

- 2022: Advancements in AI-powered sorting technology begin to gain traction, promising to significantly improve the efficiency and accuracy of paper recycling.

- 2023: Several key companies invest heavily in expanding their recycling infrastructure and exploring innovative uses for lower-grade recycled paper streams.

- 2024: Growing adoption of extended producer responsibility (EPR) schemes globally begins to shape collection and recycling responsibilities for paper products.

Future Outlook for Paper Product Recycling Service Market

The future outlook for the paper product recycling service market is exceptionally bright, driven by an unwavering global commitment to sustainability and the principles of a circular economy. Continued advancements in sorting and reprocessing technologies will further enhance the quality and value of recycled paper, opening up new application areas and reducing reliance on virgin fiber. Government policies and corporate ESG initiatives are expected to intensify, creating a more robust demand for recycled content across all paper product segments. Strategic opportunities lie in the development of specialized recycling solutions for complex paper composites and the integration of digital platforms to optimize supply chain management and enhance customer traceability. The market is poised for sustained growth, fueled by innovation, regulatory support, and increasing environmental consciousness among consumers and businesses alike.

Paper Product Recycling Service Segmentation

-

1. Application

- 1.1. Office Paper

- 1.2. Toilet Papers

- 1.3. Napkins and Paper Towels

- 1.4. Newspapers and Magazines

- 1.5. Others

-

2. Types

- 2.1. Cardboard

- 2.2. Waste Paper

- 2.3. Others

Paper Product Recycling Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Paper Product Recycling Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Office Paper

- 5.1.2. Toilet Papers

- 5.1.3. Napkins and Paper Towels

- 5.1.4. Newspapers and Magazines

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cardboard

- 5.2.2. Waste Paper

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Office Paper

- 6.1.2. Toilet Papers

- 6.1.3. Napkins and Paper Towels

- 6.1.4. Newspapers and Magazines

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cardboard

- 6.2.2. Waste Paper

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Office Paper

- 7.1.2. Toilet Papers

- 7.1.3. Napkins and Paper Towels

- 7.1.4. Newspapers and Magazines

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cardboard

- 7.2.2. Waste Paper

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Office Paper

- 8.1.2. Toilet Papers

- 8.1.3. Napkins and Paper Towels

- 8.1.4. Newspapers and Magazines

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cardboard

- 8.2.2. Waste Paper

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Office Paper

- 9.1.2. Toilet Papers

- 9.1.3. Napkins and Paper Towels

- 9.1.4. Newspapers and Magazines

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cardboard

- 9.2.2. Waste Paper

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Paper Product Recycling Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Office Paper

- 10.1.2. Toilet Papers

- 10.1.3. Napkins and Paper Towels

- 10.1.4. Newspapers and Magazines

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cardboard

- 10.2.2. Waste Paper

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 International Paper Recycling

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smurfit Kappa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Visy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 APC Paper Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Beloit Box Board Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evergreen Packaging LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BPM Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Donco Recycling Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Clearwater Paper Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Domtar Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 International Paper Recycling

List of Figures

- Figure 1: Global Paper Product Recycling Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Paper Product Recycling Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Paper Product Recycling Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Paper Product Recycling Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Paper Product Recycling Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Paper Product Recycling Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Paper Product Recycling Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Paper Product Recycling Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Paper Product Recycling Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Paper Product Recycling Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Paper Product Recycling Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Paper Product Recycling Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Paper Product Recycling Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Paper Product Recycling Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Paper Product Recycling Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Paper Product Recycling Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Paper Product Recycling Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Paper Product Recycling Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Paper Product Recycling Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Paper Product Recycling Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Paper Product Recycling Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Paper Product Recycling Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Paper Product Recycling Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Paper Product Recycling Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Paper Product Recycling Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Paper Product Recycling Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Paper Product Recycling Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Paper Product Recycling Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Paper Product Recycling Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Paper Product Recycling Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Paper Product Recycling Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Paper Product Recycling Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Paper Product Recycling Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Paper Product Recycling Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Paper Product Recycling Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Paper Product Recycling Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Paper Product Recycling Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Paper Product Recycling Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Paper Product Recycling Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Paper Product Recycling Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Paper Product Recycling Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Product Recycling Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Paper Product Recycling Service?

Key companies in the market include International Paper Recycling, Smurfit Kappa, Visy, APC Paper Group, Beloit Box Board Company, Evergreen Packaging LLC, BPM Inc., Donco Recycling Solutions, Clearwater Paper Corporation, Domtar Corporation.

3. What are the main segments of the Paper Product Recycling Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paper Product Recycling Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paper Product Recycling Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paper Product Recycling Service?

To stay informed about further developments, trends, and reports in the Paper Product Recycling Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence