Key Insights

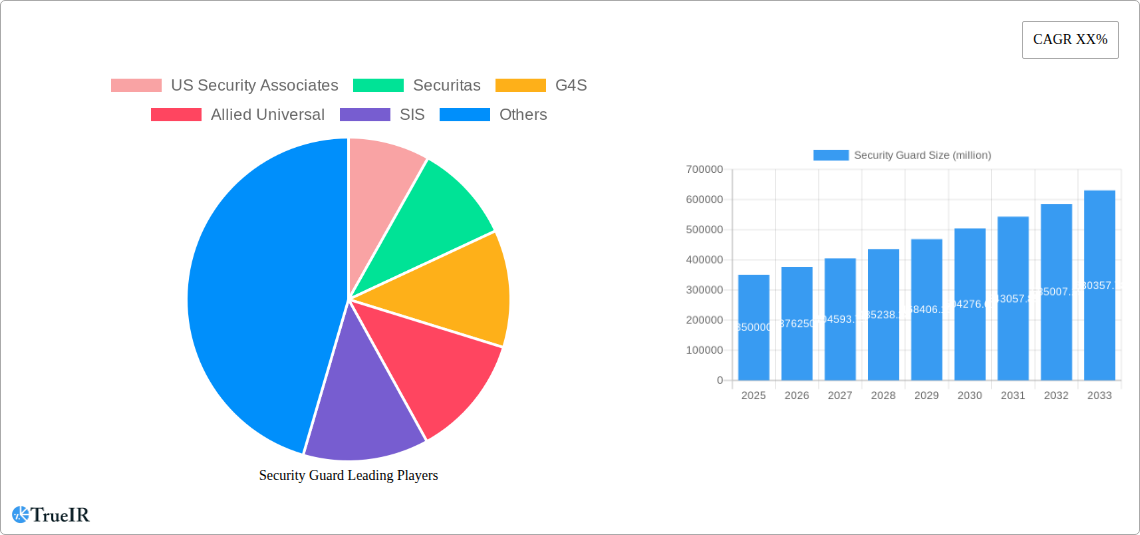

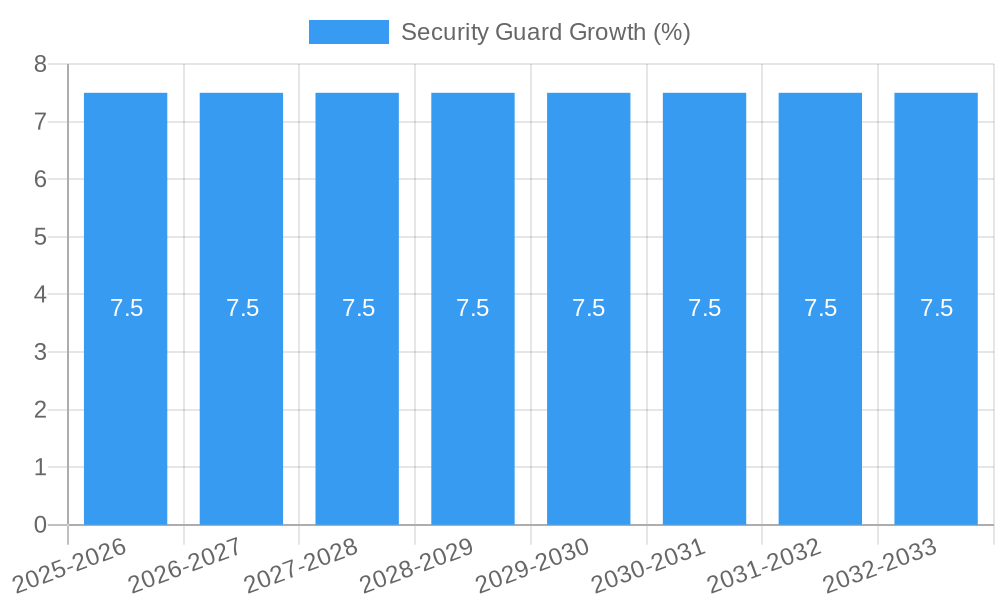

The global Security Guard market is poised for significant expansion, projected to reach an estimated USD 350 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This robust growth is underpinned by a confluence of escalating security concerns across both personal and commercial sectors. The increasing incidence of crime, terrorism threats, and the need for robust physical surveillance in high-risk environments are primary drivers. Furthermore, the expanding global business landscape, particularly in emerging economies, necessitates enhanced security protocols for assets, personnel, and intellectual property. The market is segmented into the "Personal" application, encompassing residential security and event management, and the "Commercial" application, which includes corporate offices, retail spaces, industrial facilities, and public infrastructure. Within these applications, the "Service" segment, focusing on human security personnel, is expected to dominate, although the "Equipment" segment, including surveillance systems and access control, will also witness steady growth as a complementary offering.

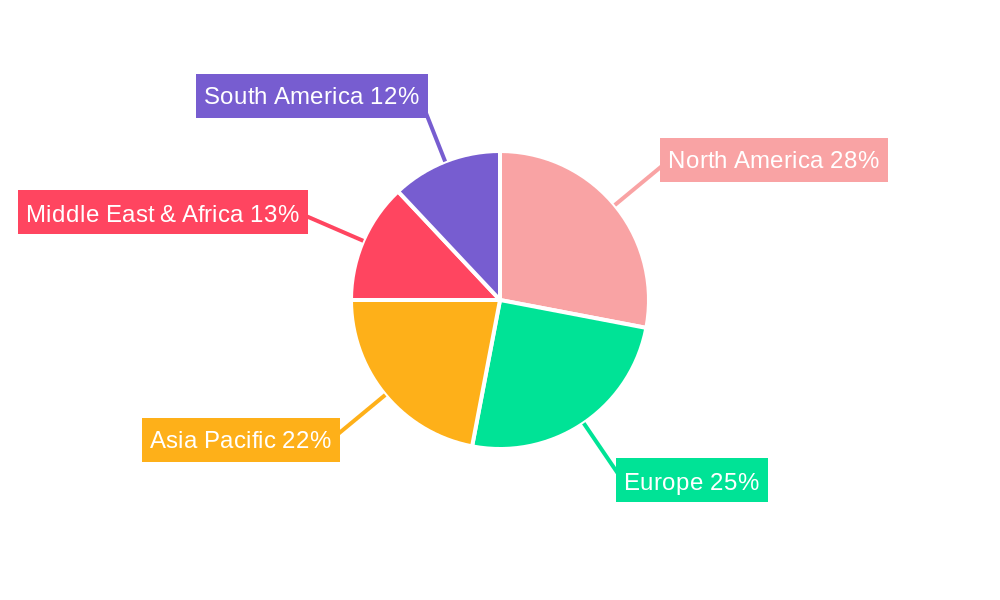

Several key trends are shaping the security guard industry. The integration of technology with traditional guarding services is paramount, with a growing adoption of AI-powered surveillance, drone security, and advanced monitoring systems. This technological integration aims to enhance efficiency, proactive threat detection, and reduce reliance on purely human patrols. Geographically, the Asia Pacific region is anticipated to emerge as a major growth engine, driven by rapid industrialization, increasing foreign investments, and a burgeoning middle class with higher disposable incomes for security services. Conversely, established markets like North America and Europe are focusing on sophisticated, tech-enabled security solutions and specialized guarding services. However, challenges such as the high cost of labor, the need for continuous training and upskilling of personnel to adapt to new technologies, and intense competition among numerous players, including giants like Securitas, G4S, and Allied Universal, will continue to shape market dynamics. The industry is also navigating evolving regulatory landscapes and a growing demand for customized security solutions tailored to specific client needs.

This in-depth security guard market report provides a dynamic, SEO-optimized analysis of the global security guard industry, covering critical segments like personal and commercial applications, and service and equipment types. Leveraging high-volume keywords such as "security services," "private security," "guarding solutions," and "security personnel," this report aims to enhance search rankings and engage a wide range of industry stakeholders. The study encompasses a comprehensive historical period from 2019 to 2024, with a base year of 2025 and an extensive forecast period extending to 2033, offering unparalleled insights into market evolution and future trajectories. With an estimated market value of several million dollars and projected growth, this report is an indispensable resource for understanding the security guard industry landscape.

Security Guard Market Structure & Competitive Landscape

The global security guard market is characterized by a moderate to high level of concentration, with major players collectively holding significant market share, estimated at over 70% in 2025. Key innovation drivers include advancements in surveillance technology, AI integration for threat detection, and the increasing demand for specialized security personnel. Regulatory impacts are substantial, with varying national and regional licensing requirements and compliance standards influencing market entry and operational costs. Product substitutes, such as advanced alarm systems and automated surveillance, pose a growing challenge, necessitating continuous innovation in human-centric security services. The end-user segmentation reveals a strong reliance on both the personal security segment, driven by high-net-worth individuals and VIP protection needs, and the commercial sector, encompassing retail, corporate offices, and industrial facilities. Mergers and acquisitions (M&A) trends indicate strategic consolidation, with an estimated xx number of significant M&A deals valued in the tens of millions annually between 2019 and 2024, aimed at expanding geographical reach and service portfolios. Companies like Securitas and Allied Universal have been particularly active in this space.

Security Guard Market Trends & Opportunities

The security guard market is poised for substantial growth, projected to reach a valuation of over several million dollars by 2033. This expansion is fueled by a consistent Compound Annual Growth Rate (CAGR) of approximately xx% from the historical period of 2019-2024 to the forecast period of 2025-2033. Technological shifts are profoundly reshaping the industry, with the integration of IoT devices, drones for aerial surveillance, and sophisticated biometric access control systems becoming increasingly prevalent. This evolution is not replacing human guards but augmenting their capabilities, leading to a demand for more tech-savvy security professionals. Consumer preferences are leaning towards integrated security solutions that combine physical presence with technological oversight, offering a layered defense against evolving threats. Competitive dynamics are intensifying, with established global players vying for market dominance against emerging regional specialists. The increasing global emphasis on safety and security across public and private sectors, coupled with a rising awareness of the need for professional guarding services in both personal and commercial applications, presents significant opportunities for market penetration and revenue growth. The market penetration rate is expected to rise from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Security Guard

The commercial security guard segment is identified as the dominant force in the global market, driven by substantial investments in infrastructure protection and corporate security. This segment is projected to account for over xx% of the total market revenue in 2025. Key growth drivers within the commercial sector include the expansion of retail spaces, the construction of new industrial facilities, and the increasing need for manned guarding services in the hospitality and healthcare industries. In terms of applications, the commercial segment encompasses a wide array of needs, from retail loss prevention and event security to critical infrastructure protection and executive protection for corporate leaders. The service type within the security guard market, specifically manned guarding, is also a leading segment, expected to contribute over xx% to the market value in 2025. This dominance is attributed to the inherent trust and immediate response capabilities that human security personnel provide, which technology alone cannot fully replicate. Factors such as stringent regulatory frameworks mandating physical security presence for certain industries and the rising threat landscape contribute significantly to the demand for professional security guards. Regional dominance is observed in North America and Europe, owing to a mature market with high security spending, followed by the rapidly growing Asia-Pacific region.

Security Guard Product Analysis

Product innovations in the security guard industry are increasingly focused on enhancing the effectiveness and efficiency of human personnel. This includes the development of advanced communication devices for seamless coordination, body-worn cameras for real-time monitoring and evidence collection, and integrated software platforms that manage guard deployments and incident reporting. Competitive advantages are being derived from specialized training programs that equip guards with skills in de-escalation, emergency response, and the use of new security technologies. The market fit for these enhanced security guard services is strong across both personal and commercial applications, addressing the growing need for robust, responsive, and technologically supported security solutions.

Key Drivers, Barriers & Challenges in Security Guard

The security guard market is propelled by several key drivers, including increasing global security concerns, the rising incidence of crime, and the growing awareness of the necessity for professional security personnel across various sectors. Technological advancements in surveillance and communication also act as catalysts, enabling more efficient and effective guarding services. Economic growth and infrastructure development in emerging markets further contribute to demand.

However, significant challenges impact growth. Supply chain issues for specialized equipment and training materials can create bottlenecks. Regulatory hurdles, including varying licensing requirements and background checks, can impede market entry and expansion. Intense competitive pressures among numerous service providers, often leading to price wars, can also restrain profitability.

Growth Drivers in the Security Guard Market

Key growth drivers in the security guard market are multi-faceted. Technologically, the integration of AI-powered surveillance and drone technology enhances the capabilities of human guards, creating demand for advanced service packages. Economically, rapid urbanization and infrastructure development in emerging economies like those in Asia are creating substantial new markets for security services. Policy-driven factors, such as stricter safety regulations for public spaces and critical infrastructure, are compelling businesses to invest in professional security. The rising global threat landscape, from terrorism to petty crime, continues to fuel the demand for reliable security personnel.

Challenges Impacting Security Guard Growth

Challenges impacting security guard growth are primarily rooted in regulatory complexities. Diverse licensing requirements across different jurisdictions create significant administrative burdens and can slow down expansion for international service providers. Supply chain issues can affect the availability of critical equipment such as communication devices and protective gear, potentially delaying service deployment. Competitive pressures are intense, with a fragmented market and a constant need to differentiate services. Furthermore, the perception of security guards as a commodity rather than a specialized service can lead to downward pressure on pricing, affecting the profitability and ability to invest in advanced training and technology.

Key Players Shaping the Security Guard Market

- US Security Associates

- Securitas

- G4S

- Allied Universal

- SIS

- TOPSGRUP

- Beijing Baoan

- OCS Group

- ICTS Europe

- Transguard

- Andrews International

- Control Risks

- Covenant

- China Security & Protection Group

- Axis Security

- DWSS

Significant Security Guard Industry Milestones

- 2019: Increased investment in AI-powered surveillance integration with manned guarding services.

- 2020: Rise in demand for essential services security during global health events.

- 2021: Expansion of drone surveillance capabilities for large-scale event security.

- 2022: Strategic M&A activities focused on regional market consolidation and service diversification.

- 2023: Growing adoption of biometric access control systems managed by security personnel.

- 2024: Focus on enhanced training programs for specialized security roles.

Future Outlook for Security Guard Market

The future outlook for the security guard market is exceptionally positive, driven by an increasing demand for comprehensive security solutions that blend human expertise with advanced technology. Strategic opportunities lie in the expansion of specialized services, such as cybersecurity guarding, executive protection, and crowd management for large-scale events. Market potential is further amplified by the ongoing infrastructure development in developing economies and the persistent global security concerns. Companies that can effectively integrate technology, offer specialized training, and adapt to evolving regulatory landscapes are well-positioned for significant growth and market leadership in the coming years.

Security Guard Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Commercial

-

2. Types

- 2.1. Service

- 2.2. Equipment

Security Guard Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Security Guard REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Guard Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Service

- 5.2.2. Equipment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Security Guard Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Service

- 6.2.2. Equipment

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Security Guard Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Service

- 7.2.2. Equipment

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Security Guard Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Service

- 8.2.2. Equipment

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Security Guard Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Service

- 9.2.2. Equipment

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Security Guard Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Service

- 10.2.2. Equipment

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 US Security Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Securitas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 G4S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allied Universal

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SIS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TOPSGRUP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beijing Baoan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OCS Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ICTS Europe

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Transguard

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Andrews International

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Control Risks

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Covenant

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 China Security & Protection Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Axis Security

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DWSS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 US Security Associates

List of Figures

- Figure 1: Global Security Guard Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Security Guard Revenue (million), by Application 2024 & 2032

- Figure 3: North America Security Guard Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Security Guard Revenue (million), by Types 2024 & 2032

- Figure 5: North America Security Guard Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Security Guard Revenue (million), by Country 2024 & 2032

- Figure 7: North America Security Guard Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Security Guard Revenue (million), by Application 2024 & 2032

- Figure 9: South America Security Guard Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Security Guard Revenue (million), by Types 2024 & 2032

- Figure 11: South America Security Guard Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Security Guard Revenue (million), by Country 2024 & 2032

- Figure 13: South America Security Guard Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Security Guard Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Security Guard Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Security Guard Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Security Guard Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Security Guard Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Security Guard Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Security Guard Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Security Guard Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Security Guard Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Security Guard Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Security Guard Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Security Guard Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Security Guard Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Security Guard Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Security Guard Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Security Guard Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Security Guard Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Security Guard Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Security Guard Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Security Guard Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Security Guard Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Security Guard Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Security Guard Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Security Guard Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Security Guard Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Security Guard Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Security Guard Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Security Guard Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Security Guard Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Guard?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Security Guard?

Key companies in the market include US Security Associates, Securitas, G4S, Allied Universal, SIS, TOPSGRUP, Beijing Baoan, OCS Group, ICTS Europe, Transguard, Andrews International, Control Risks, Covenant, China Security & Protection Group, Axis Security, DWSS.

3. What are the main segments of the Security Guard?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Guard," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Guard report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Guard?

To stay informed about further developments, trends, and reports in the Security Guard, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence