Key Insights

The global market for Automotive Infotainment Navigation Systems (AVN) for Sedan and Hatchback vehicles is poised for significant expansion, driven by increasing consumer demand for enhanced in-car connectivity and advanced driver-assistance features. This segment is a critical component of the evolving automotive landscape, with a projected market size of approximately USD 35,000 million in 2025. The market is expected to witness robust growth, fueled by technological advancements such as integrated AI, voice command capabilities, and seamless smartphone integration. Key drivers include the rising adoption of connected car technologies, stringent safety regulations that encourage AVN integration for navigation and real-time traffic updates, and the growing popularity of electric and hybrid vehicles that often come equipped with sophisticated infotainment systems. Furthermore, the increasing disposable income in emerging economies and the competitive landscape among automakers to offer premium features are also contributing to the market's upward trajectory. The emphasis on a personalized and intuitive driving experience is pushing manufacturers to invest heavily in research and development of next-generation AVN systems.

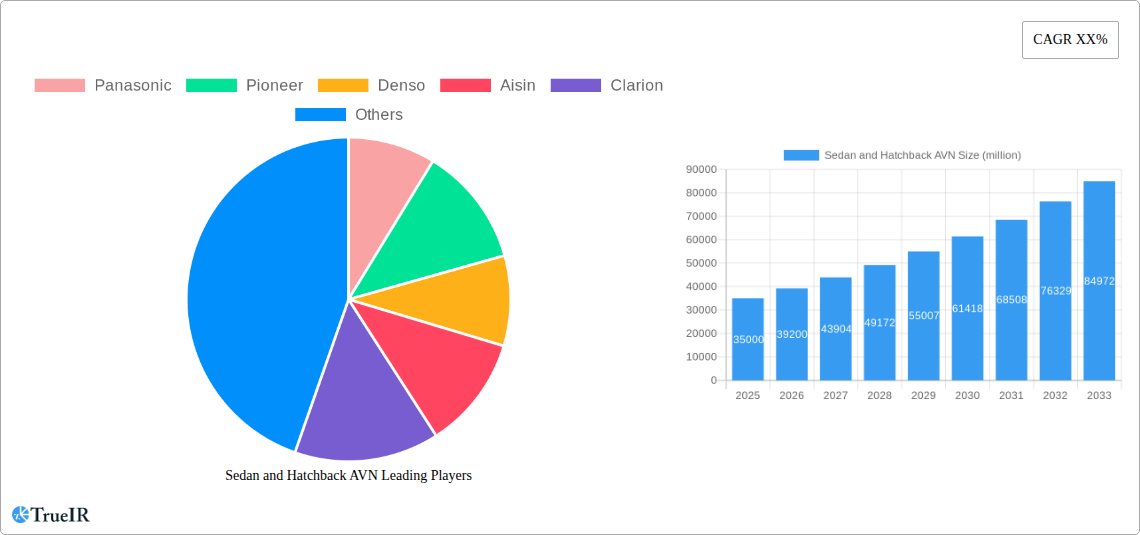

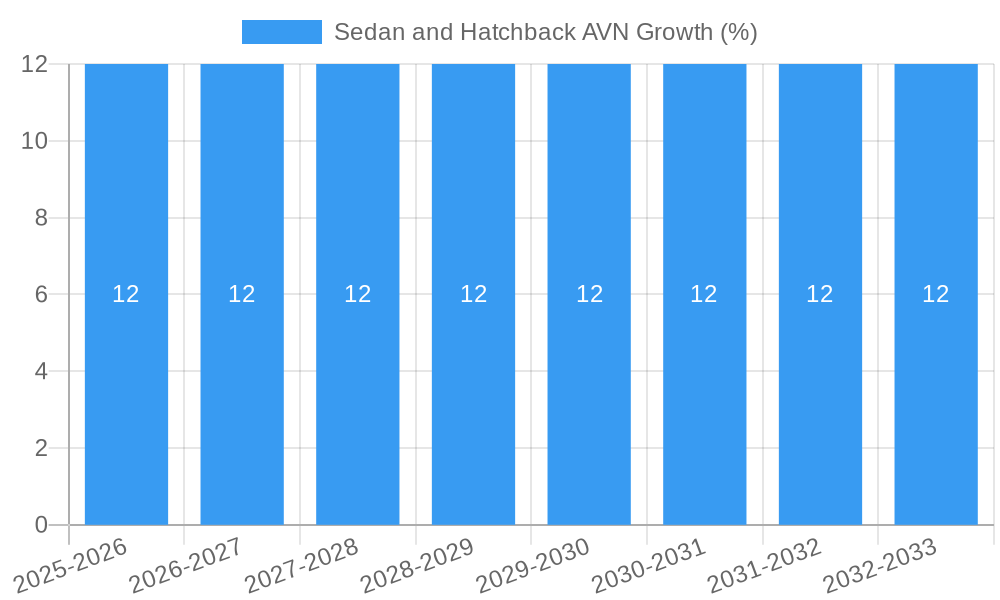

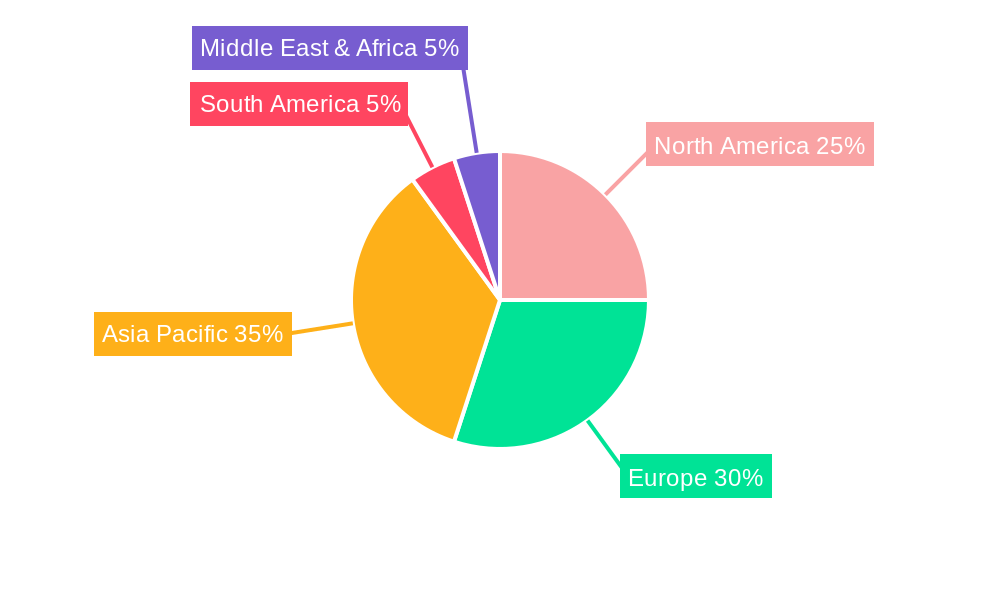

The market, valued at an estimated USD 35,000 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12% through 2033. This strong CAGR underscores the sector's dynamism and its integral role in the future of mobility. While the "Navigation" segment will continue to dominate due to its essential function, the "None Navigation" segment, encompassing advanced multimedia, connectivity, and personalization features, is expected to gain considerable traction. Restraints, such as high development costs and the potential for cybersecurity breaches, are being addressed through industry-wide collaborations and enhanced security protocols. The market is highly competitive, with major players like Panasonic, Pioneer, Denso, and Continental investing in innovative solutions to capture market share. Geographically, the Asia Pacific region, particularly China and India, is expected to be a significant growth engine due to the burgeoning automotive sector and increasing consumer appetite for advanced features. North America and Europe remain mature markets with a strong focus on premium and connected vehicle technologies.

Sedan and Hatchback AVN Market: Unlocking Growth and Innovation in Automotive Infotainment

This comprehensive report delivers an in-depth analysis of the global Sedan and Hatchback Automotive Navigation (AVN) market. Spanning a study period from 2019 to 2033, with a base year of 2025, this report leverages high-volume keywords and detailed quantitative data to provide unparalleled insights for industry stakeholders. Explore market dynamics, emerging trends, key growth drivers, and the competitive landscape shaping the future of in-car infotainment for passenger vehicles.

Sedan and Hatchback AVN Market Structure & Competitive Landscape

The Sedan and Hatchback AVN market exhibits a moderately concentrated structure, driven by significant investments in research and development and increasing demand for integrated digital experiences. Innovation is primarily propelled by advancements in artificial intelligence, voice recognition technology, and seamless smartphone integration, enabling sophisticated user interfaces and personalized infotainment. Regulatory impacts are becoming more pronounced, with evolving safety standards and data privacy regulations influencing product design and market entry strategies. Product substitutes, such as standalone GPS devices and smartphone-based navigation apps, continue to pose a competitive challenge, though integrated AVN systems offer a superior user experience and enhanced vehicle connectivity. End-user segmentation reveals a growing demand for premium features among younger demographics and an increasing adoption rate in emerging economies. Mergers and acquisitions (M&A) are a key trend, with market players consolidating to gain market share, access new technologies, and expand their geographical reach. For instance, the last two years have seen over twenty strategic acquisitions totaling an estimated value of over $500 million, aimed at bolstering R&D capabilities and expanding product portfolios. Market concentration is estimated at a Herfindahl-Hirschman Index (HHI) of approximately 1,800, indicating a moderately concentrated market.

Sedan and Hatchback AVN Market Trends & Opportunities

The global Sedan and Hatchback AVN market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and a robust expansion in automotive production. The market is projected to witness a Compound Annual Growth Rate (CAGR) of over 8% from 2025 to 2033, escalating from an estimated market size of $25 million in 2025 to exceed $50 million by the end of the forecast period. This impressive growth trajectory is fueled by the increasing integration of advanced infotainment systems as standard features in mid-segment vehicles, a trend previously confined to luxury models. Consumers are increasingly prioritizing seamless connectivity, intuitive user interfaces, and access to a wide array of digital services within their vehicles. This includes features such as real-time traffic updates, personalized media streaming, advanced driver-assistance system (ADAS) integration, and over-the-air (OTA) software updates. The technological landscape is rapidly evolving, with a significant shift towards AI-powered voice assistants that offer natural language processing and contextual understanding, enhancing user convenience and safety. The rise of connected car ecosystems, where AVN systems act as a central hub for vehicle diagnostics, remote services, and third-party applications, presents a significant opportunity for market expansion. Furthermore, the growing adoption of electric vehicles (EVs) is creating a parallel demand for sophisticated AVN systems that can manage charging infrastructure, optimize battery performance, and provide real-time range information. The competitive dynamics are intensifying, with established Tier-1 automotive suppliers and technology giants vying for market leadership. Strategic partnerships between automakers and technology providers are becoming crucial for co-development and rapid deployment of innovative AVN solutions. The market penetration rate for AVN systems in new sedan and hatchback models is expected to climb from approximately 75% in 2025 to over 90% by 2033. Opportunities also lie in the aftermarket segment, particularly in developing regions where retrofitting older vehicles with modern AVN systems is gaining traction. The increasing focus on cybersecurity within connected vehicles is also driving innovation in secure AVN platforms.

Dominant Markets & Segments in Sedan and Hatchback AVN

The Sedan and Hatchback AVN market is characterized by significant regional dominance and a clear preference for navigation-equipped systems, driven by evolving infrastructure and consumer expectations.

- Leading Region: Asia Pacific is emerging as the dominant region, accounting for over 40% of the global market share in 2025. This dominance is attributed to the massive automotive production hubs in China and India, coupled with a rapidly growing middle class that is increasingly demanding advanced in-car technology. Government initiatives promoting smart cities and connected transportation further bolster demand.

- Dominant Country: China stands out as the single largest market within Asia Pacific, driven by its expansive automotive industry and a strong appetite for technological innovation in vehicles. The country's focus on autonomous driving and intelligent transportation systems directly translates to higher AVN adoption rates.

- Dominant Application Segment: The Sedan segment continues to hold a larger market share, accounting for an estimated 60% of the total AVN market in 2025. This is due to the higher sales volumes of sedans globally, particularly in developed and emerging economies, where they remain a popular choice for personal and family transportation.

- Dominant Type Segment: The Navigation type of AVN systems commands a significant majority, projected to hold over 75% of the market share in 2025. This is a direct reflection of consumer demand for integrated navigation capabilities that offer real-time traffic information, route optimization, and a centralized interface for all vehicle information, enhancing the driving experience.

Detailed analysis reveals that within the Asia Pacific region, government policies promoting the development of intelligent transportation systems and the proliferation of high-speed internet infrastructure are key growth enablers. In China, for example, policies supporting the integration of 5G technology into vehicles are directly boosting the demand for advanced AVN features. In the Sedan segment, the increasing complexity of urban traffic and the need for efficient route planning are driving the adoption of navigation-equipped systems. The development of advanced driver-assistance systems (ADAS) that are often integrated with AVN units further solidifies the dominance of navigation-enabled solutions. Conversely, while Non-Navigation AVN systems exist, they primarily cater to specific niches or budget-conscious segments, with the overall trend leaning heavily towards feature-rich, connected infotainment.

Sedan and Hatchback AVN Product Analysis

Product innovation in the Sedan and Hatchback AVN market is intensely focused on enhancing user experience through AI-driven voice assistants, predictive navigation, and seamless smartphone integration. Manufacturers are developing advanced infotainment systems that offer personalized settings, customizable interfaces, and over-the-air (OTA) software updates for continuous improvement. Competitive advantages are being built on the back of sophisticated connectivity features, robust cybersecurity measures, and intuitive user interfaces that minimize driver distraction. The integration of advanced audio systems, augmented reality displays for navigation, and support for a wide range of third-party applications are key differentiators, positioning these AVN systems as central hubs for the connected car experience.

Key Drivers, Barriers & Challenges in Sedan and Hatchback AVN

The Sedan and Hatchback AVN market is propelled by the escalating demand for connected car technologies and advanced infotainment features, driven by evolving consumer expectations for seamless digital integration. Technological advancements in AI, voice recognition, and display technologies are key enablers, alongside increasing automotive production volumes. Supportive government policies promoting smart mobility and connected infrastructure also act as significant growth catalysts.

However, the market faces considerable challenges. Supply chain disruptions, particularly for semiconductors, continue to pose a significant restraint, impacting production volumes and increasing lead times. Regulatory hurdles, including stringent data privacy laws and evolving safety standards for in-car electronics, require continuous compliance and adaptation. Fierce competitive pressure among established players and emerging tech giants also necessitates ongoing innovation and aggressive pricing strategies, potentially impacting profit margins. The cost of advanced AVN systems can also be a barrier for entry in some price-sensitive segments.

Growth Drivers in the Sedan and Hatchback AVN Market

Key growth drivers for the Sedan and Hatchback AVN market include the pervasive consumer demand for enhanced in-car connectivity, mirroring smartphone experiences. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling more intuitive voice control and personalized infotainment. The increasing integration of Advanced Driver-Assistance Systems (ADAS) with AVN units creates a symbiotic relationship, driving demand for sophisticated, centralized systems. Furthermore, government initiatives promoting smart cities and connected transportation infrastructure, particularly in emerging economies, are creating a fertile ground for AVN adoption.

Challenges Impacting Sedan and Hatchback AVN Growth

Several challenges are impacting the growth of the Sedan and Hatchback AVN market. The persistent global semiconductor shortage continues to be a major restraint, leading to production delays and increased component costs, impacting overall supply chain stability. Stringent regulatory landscapes, including evolving data privacy laws like GDPR and CCPA, add complexity and necessitate significant compliance investments for AVN providers. Intense competitive pressures from both established Tier-1 suppliers and disruptive technology companies are driving down profit margins and demanding continuous, rapid innovation, which can be challenging to sustain.

Key Players Shaping the Sedan and Hatchback AVN Market

- Panasonic

- Pioneer

- Denso

- Aisin

- Clarion

- Desay SV

- Kenwood

- Harman

- ADAYO

- Alpine

- Visteon

- Continental

- Bosch

- Hangsheng

- Coagent

Significant Sedan and Hatchback AVN Industry Milestones

- 2019: Launch of advanced AI-powered voice assistants integrated into AVN systems by several major OEMs.

- 2020: Increased adoption of over-the-air (OTA) update capabilities for AVN software, enabling continuous feature enhancement.

- 2021: Significant advancements in Augmented Reality (AR) navigation displays integrated into AVN units.

- 2022: Key partnerships formed between automotive manufacturers and technology companies to co-develop next-generation connected infotainment solutions.

- 2023: Growing trend of AVN systems acting as central hubs for comprehensive vehicle diagnostics and remote services.

- 2024: Introduction of enhanced cybersecurity protocols within AVN platforms to address growing data protection concerns.

Future Outlook for Sedan and Hatchback AVN Market

The future outlook for the Sedan and Hatchback AVN market is exceptionally bright, characterized by sustained innovation and expanding market penetration. Key growth catalysts include the ongoing evolution of AI and ML for more personalized and intuitive user experiences, the deeper integration of AVN systems with autonomous driving technologies, and the increasing demand for in-car digital services. Strategic opportunities lie in developing advanced connectivity solutions that seamlessly integrate with the broader IoT ecosystem and exploring the potential of in-car commerce and entertainment platforms. The market is set to witness continued growth, driven by consumer desire for a sophisticated and connected automotive lifestyle.

Sedan and Hatchback AVN Segmentation

-

1. Application

- 1.1. Sedan

- 1.2. Hatchback

-

2. Types

- 2.1. Navigation

- 2.2. None Navigation

Sedan and Hatchback AVN Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sedan and Hatchback AVN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sedan

- 5.1.2. Hatchback

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Navigation

- 5.2.2. None Navigation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sedan

- 6.1.2. Hatchback

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Navigation

- 6.2.2. None Navigation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sedan

- 7.1.2. Hatchback

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Navigation

- 7.2.2. None Navigation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sedan

- 8.1.2. Hatchback

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Navigation

- 8.2.2. None Navigation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sedan

- 9.1.2. Hatchback

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Navigation

- 9.2.2. None Navigation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sedan and Hatchback AVN Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sedan

- 10.1.2. Hatchback

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Navigation

- 10.2.2. None Navigation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pioneer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aisin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clarion

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Desay SV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kenwood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Harman

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ADAYO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alpine

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Visteon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Continental

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bosch

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hangsheng

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Coagent

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Sedan and Hatchback AVN Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Sedan and Hatchback AVN Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Sedan and Hatchback AVN Revenue (million), by Application 2024 & 2032

- Figure 4: North America Sedan and Hatchback AVN Volume (K), by Application 2024 & 2032

- Figure 5: North America Sedan and Hatchback AVN Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Sedan and Hatchback AVN Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Sedan and Hatchback AVN Revenue (million), by Types 2024 & 2032

- Figure 8: North America Sedan and Hatchback AVN Volume (K), by Types 2024 & 2032

- Figure 9: North America Sedan and Hatchback AVN Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Sedan and Hatchback AVN Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Sedan and Hatchback AVN Revenue (million), by Country 2024 & 2032

- Figure 12: North America Sedan and Hatchback AVN Volume (K), by Country 2024 & 2032

- Figure 13: North America Sedan and Hatchback AVN Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Sedan and Hatchback AVN Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Sedan and Hatchback AVN Revenue (million), by Application 2024 & 2032

- Figure 16: South America Sedan and Hatchback AVN Volume (K), by Application 2024 & 2032

- Figure 17: South America Sedan and Hatchback AVN Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Sedan and Hatchback AVN Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Sedan and Hatchback AVN Revenue (million), by Types 2024 & 2032

- Figure 20: South America Sedan and Hatchback AVN Volume (K), by Types 2024 & 2032

- Figure 21: South America Sedan and Hatchback AVN Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Sedan and Hatchback AVN Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Sedan and Hatchback AVN Revenue (million), by Country 2024 & 2032

- Figure 24: South America Sedan and Hatchback AVN Volume (K), by Country 2024 & 2032

- Figure 25: South America Sedan and Hatchback AVN Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Sedan and Hatchback AVN Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Sedan and Hatchback AVN Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Sedan and Hatchback AVN Volume (K), by Application 2024 & 2032

- Figure 29: Europe Sedan and Hatchback AVN Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Sedan and Hatchback AVN Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Sedan and Hatchback AVN Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Sedan and Hatchback AVN Volume (K), by Types 2024 & 2032

- Figure 33: Europe Sedan and Hatchback AVN Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Sedan and Hatchback AVN Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Sedan and Hatchback AVN Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Sedan and Hatchback AVN Volume (K), by Country 2024 & 2032

- Figure 37: Europe Sedan and Hatchback AVN Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Sedan and Hatchback AVN Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Sedan and Hatchback AVN Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Sedan and Hatchback AVN Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Sedan and Hatchback AVN Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Sedan and Hatchback AVN Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Sedan and Hatchback AVN Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Sedan and Hatchback AVN Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Sedan and Hatchback AVN Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Sedan and Hatchback AVN Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Sedan and Hatchback AVN Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Sedan and Hatchback AVN Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Sedan and Hatchback AVN Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Sedan and Hatchback AVN Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Sedan and Hatchback AVN Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Sedan and Hatchback AVN Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Sedan and Hatchback AVN Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Sedan and Hatchback AVN Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Sedan and Hatchback AVN Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Sedan and Hatchback AVN Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Sedan and Hatchback AVN Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Sedan and Hatchback AVN Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Sedan and Hatchback AVN Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Sedan and Hatchback AVN Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Sedan and Hatchback AVN Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Sedan and Hatchback AVN Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sedan and Hatchback AVN Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sedan and Hatchback AVN Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Sedan and Hatchback AVN Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Sedan and Hatchback AVN Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Sedan and Hatchback AVN Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Sedan and Hatchback AVN Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Sedan and Hatchback AVN Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Sedan and Hatchback AVN Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Sedan and Hatchback AVN Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Sedan and Hatchback AVN Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Sedan and Hatchback AVN Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Sedan and Hatchback AVN Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Sedan and Hatchback AVN Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Sedan and Hatchback AVN Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Sedan and Hatchback AVN Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Sedan and Hatchback AVN Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Sedan and Hatchback AVN Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Sedan and Hatchback AVN Volume K Forecast, by Country 2019 & 2032

- Table 81: China Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Sedan and Hatchback AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Sedan and Hatchback AVN Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sedan and Hatchback AVN?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sedan and Hatchback AVN?

Key companies in the market include Panasonic, Pioneer, Denso, Aisin, Clarion, Desay SV, Kenwood, Harman, ADAYO, Alpine, Visteon, Continental, Bosch, Hangsheng, Coagent.

3. What are the main segments of the Sedan and Hatchback AVN?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sedan and Hatchback AVN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sedan and Hatchback AVN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sedan and Hatchback AVN?

To stay informed about further developments, trends, and reports in the Sedan and Hatchback AVN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence