Key Insights

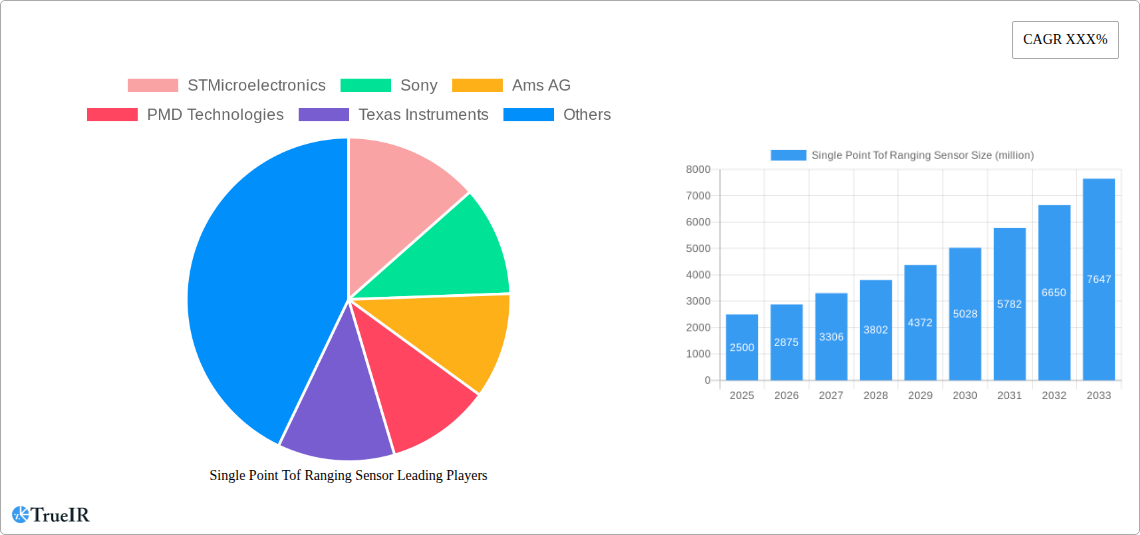

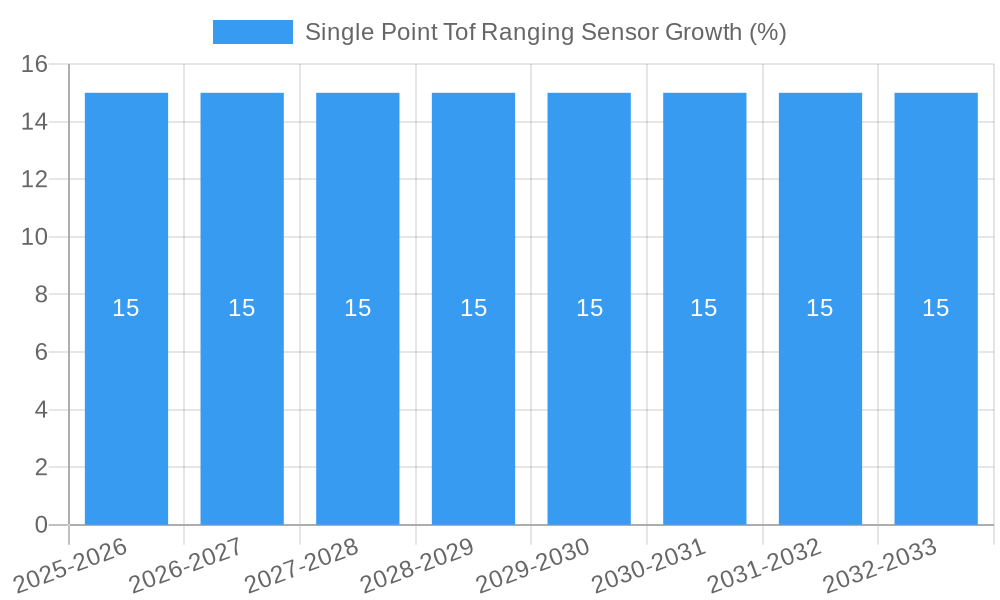

The global Single Point Time-of-Flight (ToF) Ranging Sensor market is poised for significant expansion, projected to reach approximately $2.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 15% anticipated over the forecast period (2025-2033). This dynamic growth is primarily fueled by the escalating demand for advanced sensing capabilities across a multitude of industries. Factory automation stands out as a major application driver, where ToF sensors are integral for precise object detection, robotic guidance, and automated assembly processes, enhancing efficiency and safety. The burgeoning use of drones for surveillance, delivery, and inspection also contributes substantially, as ToF sensors provide crucial altimetry and obstacle avoidance functionalities. Furthermore, the increasing integration of robotics in logistics, manufacturing, and even healthcare applications necessitates the accuracy and reliability offered by these sensors. The market's trajectory is also shaped by a growing trend towards miniaturization and enhanced performance, with advancements in sensor technology enabling smaller form factors and improved detection ranges, from short-range precision applications to long-range environmental monitoring.

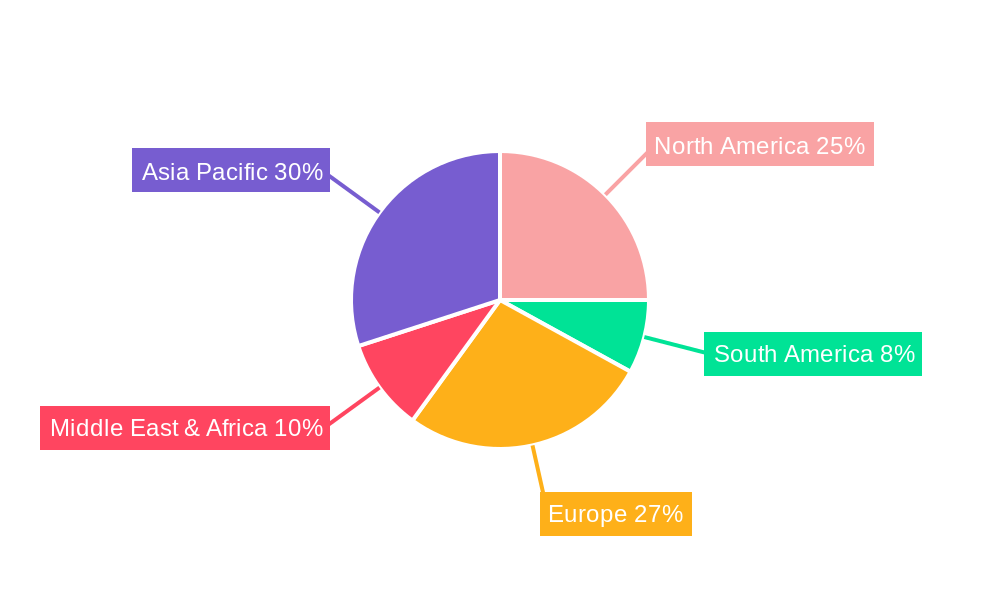

While the market exhibits strong growth potential, certain factors could present challenges. The cost of advanced ToF sensor technology, particularly for highly specialized applications, might be a restraint for smaller enterprises or in price-sensitive markets. Additionally, the development and adoption of alternative sensing technologies could offer competition, requiring continuous innovation from ToF sensor manufacturers. However, the inherent advantages of ToF, such as direct distance measurement, immunity to ambient light variations, and high accuracy, are expected to maintain its competitive edge. The market is segmented by type into Short Range, Medium Range, and Long Range sensors, catering to diverse application requirements. Geographically, Asia Pacific, led by China and Japan, is expected to emerge as a dominant region due to its strong manufacturing base and rapid technological adoption. North America and Europe also represent significant markets, driven by their advanced industrial automation and robotics sectors.

Single Point ToF Ranging Sensor Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive market research report offers an in-depth analysis of the global Single Point Time-of-Flight (ToF) Ranging Sensor market. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study provides critical insights into market dynamics, competitive landscapes, emerging trends, and future growth opportunities. The report is designed for industry stakeholders seeking to understand market size, segmentation, key players, and the technological advancements shaping the future of single-point ToF ranging sensors.

Single Point Tof Ranging Sensor Market Structure & Competitive Landscape

The single-point ToF ranging sensor market is characterized by moderate to high concentration, driven by significant R&D investments and the need for advanced technological capabilities. Innovation is a primary driver, with companies continuously striving for enhanced accuracy, reduced power consumption, and smaller form factors. Regulatory impacts are becoming increasingly significant, particularly concerning data privacy and safety standards in consumer electronics and automotive applications. Product substitutes, such as ultrasonic sensors and other optical ranging technologies, present a competitive challenge, though ToF sensors offer distinct advantages in terms of speed and accuracy. End-user segmentation reveals a strong reliance on industrial and consumer electronics sectors. Mergers and acquisitions (M&A) are playing a crucial role in market consolidation and expansion, with an estimated volume of over 100 M&A deals recorded during the historical period. Key players like STMicroelectronics, Sony, and Ams AG are actively engaged in strategic partnerships and acquisitions to bolster their market positions. The competitive landscape is dynamic, with established players and emerging innovators vying for market share. The innovation driver ratio, reflecting the percentage of revenue reinvested in R&D, is estimated to be around 15% for leading companies, signifying a strong commitment to technological advancement.

Single Point Tof Ranging Sensor Market Trends & Opportunities

The global single-point ToF ranging sensor market is poised for substantial growth, driven by the increasing demand for accurate and efficient distance measurement solutions across a multitude of applications. The market size is projected to expand from an estimated xx billion USD in the base year 2025 to over xxx billion USD by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 18%. This impressive growth is underpinned by several interconnected trends. Technological shifts are a major catalyst, with advancements in miniaturization, power efficiency, and signal processing enabling ToF sensors to be integrated into an ever-wider array of devices. Consumer preferences are increasingly leaning towards smart and connected devices that leverage precise spatial awareness, fueling demand in areas like augmented reality (AR), virtual reality (VR), and advanced smartphone features. Competitive dynamics are intensifying, leading to price optimizations and a focus on differentiated product offerings that cater to specific application needs.

The increasing adoption of automation in manufacturing and logistics is a significant growth driver, with single-point ToF sensors playing a vital role in robotic navigation, object detection, and quality control. The drone industry's rapid expansion, driven by applications in surveillance, delivery, and aerial photography, further fuels demand for reliable and compact ranging solutions. In robotics, ToF sensors are essential for safe human-robot interaction, obstacle avoidance, and precise manipulation. The automotive sector's push towards advanced driver-assistance systems (ADAS) and autonomous driving technologies presents a massive opportunity, with ToF sensors contributing to blind-spot detection, parking assistance, and pedestrian recognition. Beyond these dominant segments, emerging applications in smart homes, healthcare, and industrial IoT (Internet of Things) are creating new avenues for market penetration. The market penetration rate for single-point ToF sensors in consumer electronics is estimated to reach over 60% by 2033. The development of sophisticated algorithms for noise reduction and environmental compensation is enhancing the performance and reliability of these sensors in challenging conditions, further expanding their application scope and market appeal. The continuous miniaturization of these sensors is also a critical trend, allowing for seamless integration into space-constrained devices.

Dominant Markets & Segments in Single Point Tof Ranging Sensor

The global single-point ToF ranging sensor market exhibits clear dominance across specific regions and application segments. Asia-Pacific stands out as the leading region, driven by its robust manufacturing base, rapid technological adoption, and significant investments in automation and consumer electronics. Within this region, China, South Korea, and Japan are key markets, fueled by the presence of major electronics manufacturers and a growing domestic demand for advanced sensing technologies. North America and Europe follow closely, with strong contributions from the automotive, industrial automation, and consumer electronics sectors.

In terms of Application, Factory Automation emerges as the most dominant segment, accounting for an estimated 30% of the market share. This dominance is attributed to the critical need for precision and efficiency in modern manufacturing processes. Robots require accurate distance sensing for navigation, pick-and-place operations, and safe interaction with human workers. Quality control systems also benefit from ToF sensors for precise measurement and defect detection.

The Drone segment represents another significant growth area, projected to contribute approximately 20% to the market by 2033. The proliferation of drones for commercial and industrial purposes, including logistics, inspection, and security, necessitates reliable and compact ranging solutions for obstacle avoidance, altitude control, and navigation.

Robotics, beyond industrial automation, is also a key segment, expected to capture around 18% of the market. This includes collaborative robots, autonomous mobile robots (AMRs), and service robots, all of which rely on ToF sensors for environmental perception, navigation, and safe operation in complex environments.

The Others segment, encompassing applications in consumer electronics (smartphones, AR/VR headsets), automotive (ADAS, interior sensing), and smart home devices, is rapidly expanding and collectively holds a substantial share.

Analyzing the Type segmentation, Short Range ToF sensors are currently the most prevalent, catering to a wide array of consumer electronics and proximity sensing applications. However, Medium Range and Long Range ToF sensors are witnessing accelerated growth, driven by demand in industrial automation, robotics, and automotive applications where extended detection capabilities are crucial. The increasing sophistication of ToF technology is enabling higher accuracy and longer detection distances even in challenging environmental conditions. Infrastructure development, such as the expansion of smart factories and the rollout of 5G networks, indirectly supports the growth of these sensor technologies. Favorable government policies promoting industrial automation and the adoption of advanced technologies also contribute to market expansion.

Single Point Tof Ranging Sensor Product Analysis

Single-point ToF ranging sensors are at the forefront of accurate and efficient distance measurement, offering a compelling alternative to traditional sensing technologies. Their product innovation is characterized by continuous improvements in accuracy, range, power efficiency, and miniaturization. Key advancements include enhanced signal processing algorithms to mitigate interference from ambient light and other reflective surfaces, leading to more reliable readings in diverse environments. The integration of advanced optical components and highly sensitive detectors contributes to improved performance. These sensors find widespread application in industrial automation for robot guidance and object detection, in drones for obstacle avoidance and navigation, and in robotics for precise movement and human interaction. Competitive advantages stem from their speed, non-contact operation, and ability to provide precise depth information, making them ideal for applications requiring real-time spatial awareness.

Key Drivers, Barriers & Challenges in Single Point Tof Ranging Sensor

The single-point ToF ranging sensor market is propelled by several key drivers. Technologically, advancements in laser diodes, SPAD (Single Photon Avalanche Diode) detectors, and CMOS image sensors are enhancing sensor performance and reducing costs. Economically, the growing demand for automation across industries and the increasing adoption of smart devices create a strong market pull. Policy-driven factors, such as government initiatives promoting Industry 4.0 and smart city development, further fuel adoption. Specific examples include the integration of ToF sensors in smartphones for advanced camera features and in smart home devices for presence detection.

However, the market faces significant challenges. Regulatory complexities, particularly concerning eye safety standards for laser-based sensors in consumer applications, can impact product development and market entry. Supply chain issues, including the availability of specialized components and potential geopolitical disruptions, can lead to production delays and increased costs. Competitive pressures from alternative sensing technologies and the rapid pace of innovation necessitate continuous R&D investment, posing a financial burden for smaller players. The cost of high-performance ToF sensors can also be a barrier for some applications with tight budget constraints, estimated to impact adoption in xx% of potential small-scale industrial use cases.

Growth Drivers in the Single Point Tof Ranging Sensor Market

The single-point ToF ranging sensor market is experiencing robust growth driven by a confluence of factors. Technologically, continuous innovation in miniaturization, power efficiency, and signal processing capabilities allows for integration into increasingly diverse devices and applications. Economically, the global trend towards automation in manufacturing and logistics, coupled with the booming consumer electronics sector, creates substantial demand. Policy-driven initiatives promoting smart infrastructure, Industry 4.0 adoption, and the development of autonomous systems further accelerate market expansion. For instance, government incentives for smart factory adoption directly boost the demand for ToF sensors in industrial robots and automated guided vehicles. The increasing consumer desire for advanced features in smartphones, wearables, and augmented reality devices also plays a crucial role.

Challenges Impacting Single Point Tof Ranging Sensor Growth

Despite the strong growth trajectory, the single-point ToF ranging sensor market confronts several critical challenges that can impede its expansion. Regulatory complexities, particularly concerning human eye safety standards for laser-based ToF systems, necessitate rigorous testing and certification processes, potentially increasing development timelines and costs. Supply chain vulnerabilities, including the reliance on specialized semiconductor components and the potential for geopolitical disruptions, can lead to production bottlenecks and price volatility. Competitive pressures, both from alternative sensing technologies like ultrasonic and lidar, and from rapid innovation within the ToF segment itself, demand continuous investment in research and development to maintain a competitive edge. The cost-effectiveness of high-performance ToF sensors remains a consideration for broader adoption in price-sensitive applications, potentially limiting market penetration in certain emerging markets by up to 15%.

Key Players Shaping the Single Point Tof Ranging Sensor Market

- STMicroelectronics

- Sony

- Ams AG

- PMD Technologies

- Texas Instruments

- Melexis

- Infineon

- Panasonic

- TDK Corporation

- Silicon Integrated

- OPNOUS

- Hypersen Technologies

Significant Single Point Tof Ranging Sensor Industry Milestones

- 2019: Launch of new generation ToF sensors with enhanced range and accuracy by STMicroelectronics.

- 2020: Sony introduces advanced SPAD array technology for ToF applications, improving image quality and depth sensing.

- 2021: Ams AG acquires OSRAM, strengthening its position in optical sensing and automotive applications.

- 2022: PMD Technologies showcases advancements in ToF for industrial automation, enabling precise object detection in challenging environments.

- 2022: Texas Instruments releases new low-power ToF sensors, expanding opportunities in battery-operated devices.

- 2023: Melexis launches integrated ToF solutions for automotive interior sensing applications.

- 2023: Infineon expands its portfolio with robust ToF sensors designed for harsh industrial conditions.

- 2024: Panasonic introduces compact and cost-effective ToF modules for consumer electronics.

- 2024: Hypersen Technologies announces breakthroughs in long-range ToF sensing for outdoor applications.

- Q1 2025: Estimated widespread integration of ToF sensors in flagship smartphone models for enhanced augmented reality experiences.

Future Outlook for Single Point Tof Ranging Sensor Market

The future outlook for the single-point ToF ranging sensor market is exceptionally bright, driven by relentless technological innovation and expanding application horizons. Strategic opportunities lie in the continued miniaturization and power efficiency improvements, enabling deeper integration into the Internet of Things (IoT) ecosystem, wearables, and medical devices. The automotive sector's trajectory towards advanced driver-assistance systems (ADAS) and autonomous driving will continue to be a major growth catalyst. Furthermore, advancements in multi-pixel ToF sensors and sophisticated algorithms will unlock new possibilities in 3D scanning, gesture recognition, and advanced human-computer interaction. The market is expected to witness significant growth in emerging applications such as smart agriculture, retail analytics, and advanced robotics, cementing its position as a foundational technology for future intelligent systems.

Single Point Tof Ranging Sensor Segmentation

-

1. Application

- 1.1. Factory Automation

- 1.2. Drone

- 1.3. Robotics

- 1.4. Others

-

2. Type

- 2.1. Short Range

- 2.2. Medium Range

- 2.3. Long Range

Single Point Tof Ranging Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Single Point Tof Ranging Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Factory Automation

- 5.1.2. Drone

- 5.1.3. Robotics

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Short Range

- 5.2.2. Medium Range

- 5.2.3. Long Range

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Factory Automation

- 6.1.2. Drone

- 6.1.3. Robotics

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Short Range

- 6.2.2. Medium Range

- 6.2.3. Long Range

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Factory Automation

- 7.1.2. Drone

- 7.1.3. Robotics

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Short Range

- 7.2.2. Medium Range

- 7.2.3. Long Range

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Factory Automation

- 8.1.2. Drone

- 8.1.3. Robotics

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Short Range

- 8.2.2. Medium Range

- 8.2.3. Long Range

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Factory Automation

- 9.1.2. Drone

- 9.1.3. Robotics

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Short Range

- 9.2.2. Medium Range

- 9.2.3. Long Range

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Single Point Tof Ranging Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Factory Automation

- 10.1.2. Drone

- 10.1.3. Robotics

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Short Range

- 10.2.2. Medium Range

- 10.2.3. Long Range

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 STMicroelectronics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sony

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ams AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PMD Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Melexis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infineon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Panasonic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TDK Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silicon Integrated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OPNOUS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hypersen Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 STMicroelectronics

List of Figures

- Figure 1: Global Single Point Tof Ranging Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Single Point Tof Ranging Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Single Point Tof Ranging Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Single Point Tof Ranging Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Single Point Tof Ranging Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Single Point Tof Ranging Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Single Point Tof Ranging Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Single Point Tof Ranging Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Single Point Tof Ranging Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Single Point Tof Ranging Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Single Point Tof Ranging Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Single Point Tof Ranging Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Single Point Tof Ranging Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Single Point Tof Ranging Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Single Point Tof Ranging Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Single Point Tof Ranging Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Single Point Tof Ranging Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Single Point Tof Ranging Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Single Point Tof Ranging Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Single Point Tof Ranging Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Single Point Tof Ranging Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Single Point Tof Ranging Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Single Point Tof Ranging Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Single Point Tof Ranging Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Single Point Tof Ranging Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Single Point Tof Ranging Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Single Point Tof Ranging Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Single Point Tof Ranging Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Single Point Tof Ranging Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Single Point Tof Ranging Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Single Point Tof Ranging Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Single Point Tof Ranging Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Single Point Tof Ranging Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Point Tof Ranging Sensor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Single Point Tof Ranging Sensor?

Key companies in the market include STMicroelectronics, Sony, Ams AG, PMD Technologies, Texas Instruments, Melexis, Infineon, Panasonic, TDK Corporation, Silicon Integrated, OPNOUS, Hypersen Technologies.

3. What are the main segments of the Single Point Tof Ranging Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single Point Tof Ranging Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single Point Tof Ranging Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single Point Tof Ranging Sensor?

To stay informed about further developments, trends, and reports in the Single Point Tof Ranging Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence