Key Insights

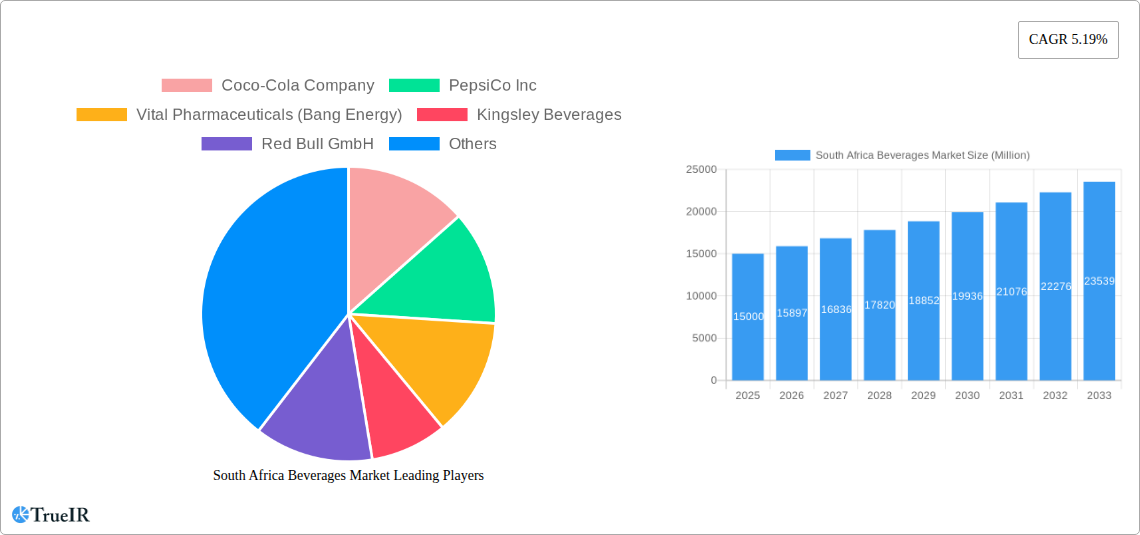

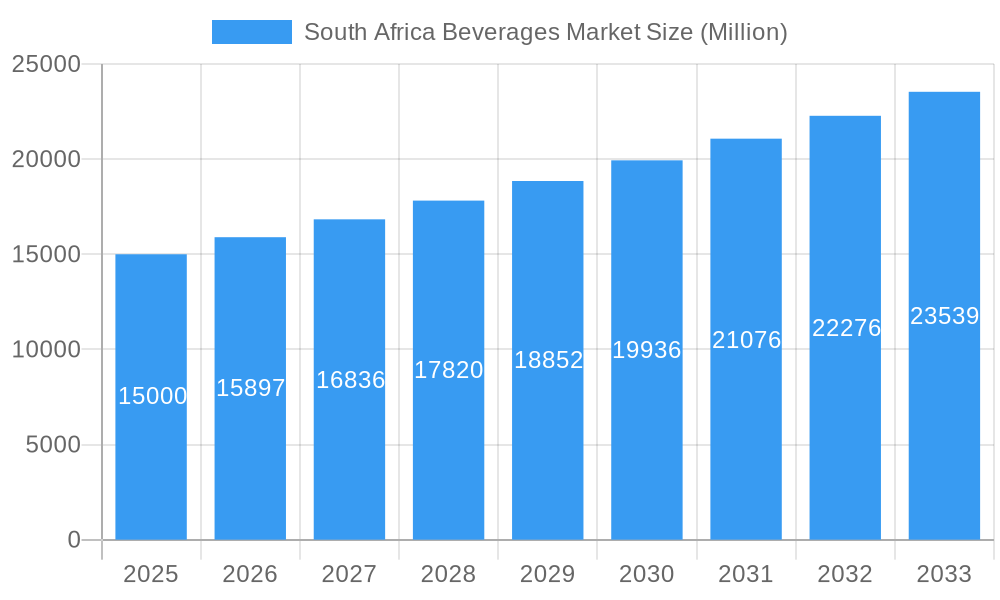

The South African beverage market, projected to reach $19.8 billion by 2025, is anticipated to grow at a CAGR of 13.3% through 2033. This expansion is attributed to rising disposable incomes, a growing middle class, and demand from a young, urbanized demographic for diverse beverage options. Both on-trade and off-trade channels are crucial, with consumer preferences driving distribution strategies. Innovation in healthier, functional beverages, such as energy drinks, also fuels market dynamism. However, challenges include price sensitivity, economic volatility, and health concerns regarding sugar consumption, which have led to the rise of low-sugar alternatives.

South Africa Beverages Market Market Size (In Billion)

The competitive landscape features global leaders like Coca-Cola, PepsiCo, and Red Bull, alongside local players such as Twizza and Kingsley Beverages. Market segmentation includes alcoholic and non-alcoholic beverages, further divided by product type and distribution channel. Regional consumption patterns within South Africa offer targeted marketing opportunities. Key growth avenues involve catering to demand for healthier choices, utilizing digital marketing, and expanding distribution into underserved segments.

South Africa Beverages Market Company Market Share

South Africa Beverages Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa beverages market, covering the period 2019-2033. It delves into market structure, competitive dynamics, emerging trends, and future growth prospects, offering invaluable insights for businesses operating within or seeking to enter this dynamic sector. The report incorporates extensive quantitative and qualitative data, including market sizing, CAGR projections, and competitive landscape assessments. With a focus on key players like Coca-Cola, PepsiCo, and Red Bull, this report is an essential resource for strategic decision-making.

South Africa Beverages Market Structure & Competitive Landscape

The South African beverage market is characterized by a moderately concentrated structure, with a few major players dominating various segments. The Herfindahl-Hirschman Index (HHI) for the overall market is estimated at xx in 2025, indicating a moderately consolidated landscape. Innovation plays a significant role, driven by consumer demand for healthier options and functional beverages. Regulatory impacts, including alcohol control policies and sugar taxes, significantly influence market dynamics. Product substitutes, such as water and other non-alcoholic beverages, pose a competitive threat. The market is segmented by end-users, including households, food service establishments, and retailers. M&A activity in the sector has been moderate in recent years, with an estimated xx Million in transactions between 2019 and 2024.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Consumer preference for healthier and functional drinks.

- Regulatory Impacts: Alcohol control policies, sugar taxes.

- Product Substitutes: Water, juices, other non-alcoholic beverages.

- End-User Segmentation: Households, food service, retail.

- M&A Trends: Estimated xx Million in transactions (2019-2024).

South Africa Beverages Market Trends & Opportunities

The South African beverage market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by factors such as rising disposable incomes, increasing urbanization, and changing consumer preferences. Technological advancements, including improved packaging and distribution systems, are enhancing market efficiency. Consumer preferences are shifting towards healthier options, including functional beverages and low-sugar alternatives. The competitive landscape is dynamic, with existing players constantly innovating and new entrants seeking market share. Market penetration rates for various beverage categories vary considerably, with carbonated soft drinks still holding a significant share but facing increasing competition from healthier alternatives.

Dominant Markets & Segments in South Africa Beverages Market

The largest segment within the South African beverage market in 2025 is expected to be Non-Alcoholic Beverages, contributing xx Million to the overall market value. This is primarily driven by strong consumer demand across urban and rural areas, and is further strengthened by improved distribution channels reaching diverse demographics.

- Non-Alcoholic Beverages Growth Drivers:

- Increasing affordability and availability across different socio-economic classes.

- Strong demand for functional beverages and healthier alternatives.

- Growing adoption of innovative packaging and convenient formats.

- Alcoholic Beverages Growth Drivers:

- Rise in disposable incomes and increased spending capacity in the urban population.

- Robust on-trade sector driven by tourism and leisure activities.

- Diversification of product portfolio to meet specific consumer tastes.

- On-Trade Channel: High concentration in urban centers, driven by the hospitality industry and social gatherings.

- Off-Trade Channel: Wide reach, catering to both urban and rural areas through various retail outlets.

South Africa Beverages Market Product Analysis

Recent product innovations reflect a strong focus on healthier options, functional benefits, and convenient packaging formats. Companies are leveraging technological advancements to enhance product quality, shelf life, and appeal to specific consumer segments. The market shows strong competition with both established players and new entrants vying for market share through product differentiation and innovative marketing strategies.

Key Drivers, Barriers & Challenges in South Africa Beverages Market

Key Drivers: Rising disposable incomes, increasing urbanization, and a growing young population fuel demand for a wider variety of beverages. Furthermore, government initiatives promoting local production and sustainable sourcing create opportunities for market expansion.

Challenges: Supply chain disruptions, rising input costs, and stringent regulations related to labeling and health claims pose significant obstacles. Intense competition from both domestic and international brands also creates pressure on pricing and profitability. Fluctuating exchange rates pose another financial challenge to both domestic and international brands.

Growth Drivers in the South Africa Beverages Market Market

Factors such as a growing middle class with increased purchasing power, improving infrastructure, and governmental support for local businesses have been pivotal in driving market growth. A rising demand for convenience and health-conscious choices also contributes significantly.

Challenges Impacting South Africa Beverages Market Growth

High import tariffs on some raw materials, water scarcity in certain regions, and intense competition among established and emerging players impact growth. Furthermore, fluctuating currency exchange rates and inflation can lead to price instability affecting sales.

Key Players Shaping the South Africa Beverages Market Market

- Coca-Cola Company

- PepsiCo Inc

- Vital Pharmaceuticals (Bang Energy)

- Kingsley Beverages

- Red Bull GmbH

- Anheuser-Busch InBev NV

- The Beverage Company

- Carlsberg Group

- Ekhamanzi Springs (Pty) Ltd

- Twizza Soft Drinks (Pty) Ltd

- Diageo PLC

Significant South Africa Beverages Market Industry Milestones

- June 2022: Bang Energy partners with SG Gateway Services to expand in South Africa.

- July 2022: Red Bull launches a Summer Edition Apricot energy drink.

- September 2022: Coca-Cola introduces its new Cappy juice brand.

Future Outlook for South Africa Beverages Market Market

The South African beverage market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and ongoing investment in the sector. Strategic opportunities exist for companies focused on health and wellness, sustainability, and innovative product development. The market's potential remains significant, offering ample room for expansion and diversification.

South Africa Beverages Market Segmentation

-

1. Product Type

-

1.1. Alcoholic Beverages

- 1.1.1. Beer

- 1.1.2. Wine

- 1.1.3. Spirits

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Energy & Sport Drinks

- 1.2.2. Carbonated Soft Drinks

- 1.2.3. Tea & Coffee

- 1.2.4. Other Non-alcoholic Beverages

-

1.1. Alcoholic Beverages

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Distribution Channels

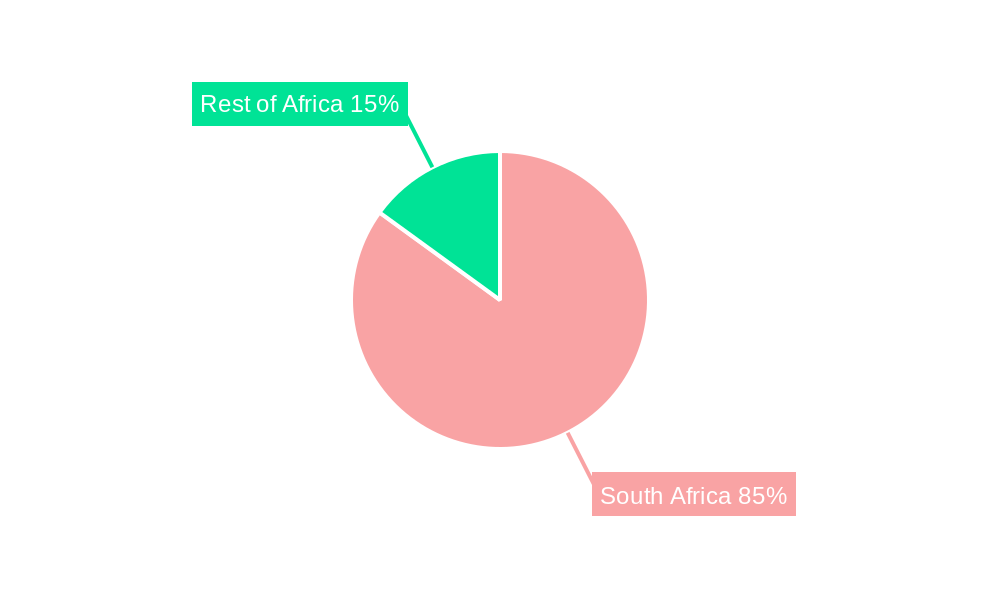

South Africa Beverages Market Segmentation By Geography

- 1. South Africa

South Africa Beverages Market Regional Market Share

Geographic Coverage of South Africa Beverages Market

South Africa Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for flavored beverages in food and beverage industries

- 3.3. Market Restrains

- 3.3.1. Increasing concerns regarding obesity and health awareness

- 3.4. Market Trends

- 3.4.1. Increased Consumption of Alcoholic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcoholic Beverages

- 5.1.1.1. Beer

- 5.1.1.2. Wine

- 5.1.1.3. Spirits

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Energy & Sport Drinks

- 5.1.2.2. Carbonated Soft Drinks

- 5.1.2.3. Tea & Coffee

- 5.1.2.4. Other Non-alcoholic Beverages

- 5.1.1. Alcoholic Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa South Africa Beverages Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Coco-Cola Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PepsiCo Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vital Pharmaceuticals (Bang Energy)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kingsley Beverages

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Red Bull GmbH

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Anheuser-Busch InBev NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Beverage Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Carlsberg Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ekhamanzi Springs (Pty) Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Twizza Soft Drinks (Pty) Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Diageo PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Coco-Cola Company

List of Figures

- Figure 1: South Africa Beverages Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: South Africa Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: South Africa Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Africa Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Africa Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 6: South Africa South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Sudan South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Uganda South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Tanzania South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Kenya South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Africa South Africa Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: South Africa Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: South Africa Beverages Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Beverages Market?

The projected CAGR is approximately 13.3%.

2. Which companies are prominent players in the South Africa Beverages Market?

Key companies in the market include Coco-Cola Company, PepsiCo Inc, Vital Pharmaceuticals (Bang Energy), Kingsley Beverages, Red Bull GmbH, Anheuser-Busch InBev NV, The Beverage Company, Carlsberg Group, Ekhamanzi Springs (Pty) Ltd, Twizza Soft Drinks (Pty) Ltd*List Not Exhaustive, Diageo PLC.

3. What are the main segments of the South Africa Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for flavored beverages in food and beverage industries.

6. What are the notable trends driving market growth?

Increased Consumption of Alcoholic Beverages.

7. Are there any restraints impacting market growth?

Increasing concerns regarding obesity and health awareness.

8. Can you provide examples of recent developments in the market?

September 2022: Coca-Cola introduced a new juice brand in South Africa, Cappy, a 100% fruit juice in various flavors, including Tropical, Orange Mango, Apple, Orange, and Grape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Beverages Market?

To stay informed about further developments, trends, and reports in the South Africa Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence