Key Insights

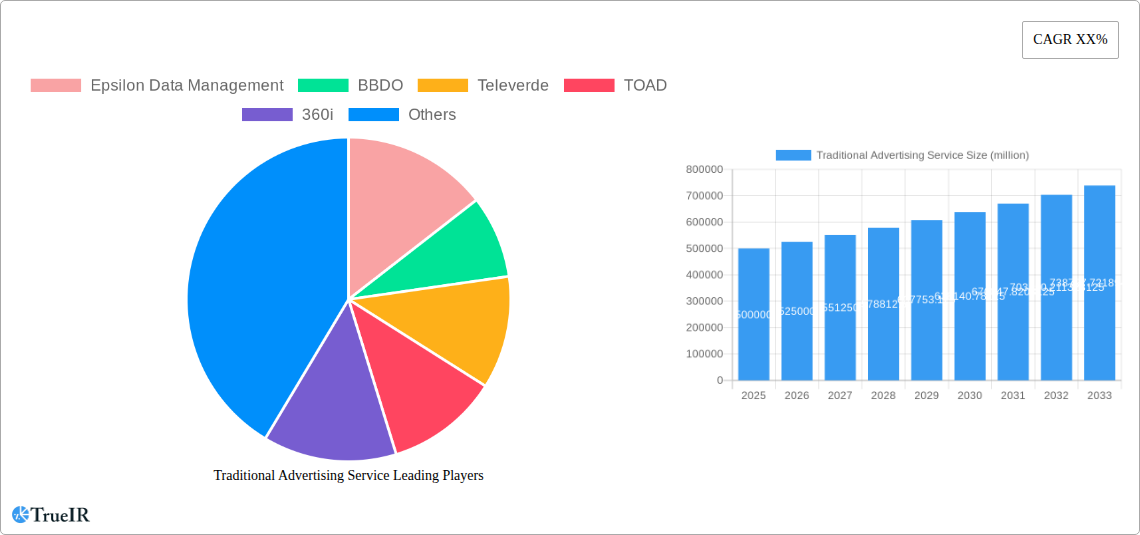

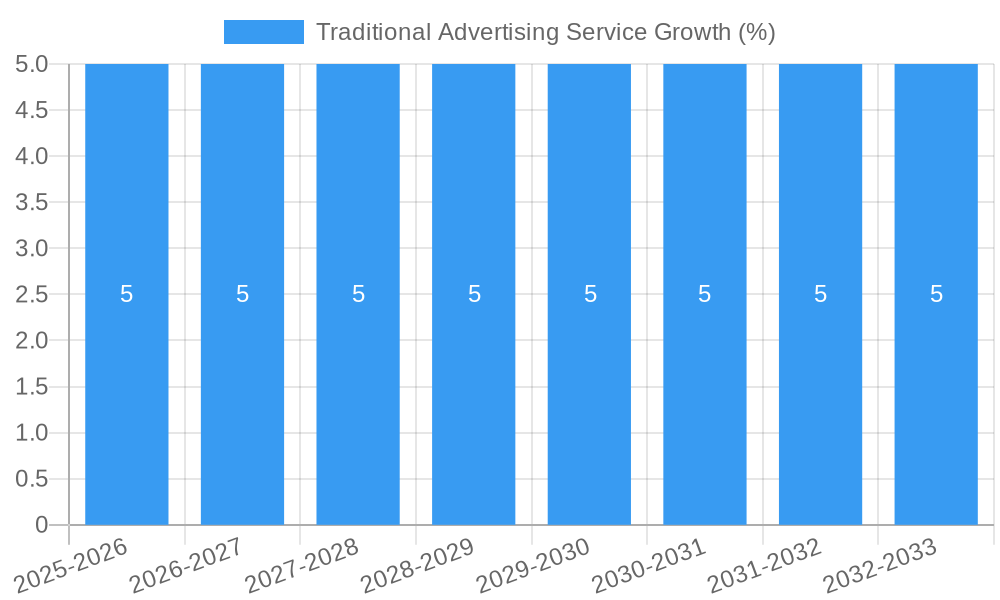

The traditional advertising services market, projected to reach a substantial $500 billion in 2025, is poised for steady growth with a compound annual growth rate (CAGR) of 5% through 2033. This robust expansion is fueled by several key drivers, including the continued reliance of large enterprises on established media channels for broad reach and brand building. Companies like Epsilon Data Management and BBDO are instrumental in shaping this landscape by offering sophisticated data-driven strategies and creative excellence. The enduring impact of television commercials and newspaper advertisements, despite the digital surge, ensures a consistent demand for traditional mediums, particularly for reaching older demographics and in regions with lower digital penetration. Furthermore, the tangible nature of direct mail continues to appeal to specific consumer segments, offering a personalized touch that digital channels sometimes struggle to replicate. The market's resilience is also a testament to the strategic integration of traditional and digital advertising by major players like MediaCom and MullenLowe, recognizing the synergistic benefits of a multi-channel approach.

Despite the undeniable dominance of digital, traditional advertising services are experiencing a resurgence driven by strategic innovations and a focus on measurable impact. While SMEs may be more budget-conscious, they increasingly leverage targeted direct mail campaigns and localized newspaper ads to connect with their immediate customer base. The market's growth trajectory is further supported by emerging trends such as the increasing use of programmatic advertising for traditional channels and the demand for integrated campaigns that seamlessly blend offline and online experiences. However, the market is not without its restraints. The escalating costs associated with prime-time television slots and prominent newspaper placements, coupled with the perceived difficulty in precisely measuring ROI compared to digital alternatives, present significant challenges. Nevertheless, the intrinsic value of broad audience engagement and the established credibility associated with traditional media ensure its continued relevance. Companies like DDB Worldwide and Goodby Silverstein & Partners continue to innovate in creative development and campaign execution, ensuring traditional advertising remains a potent force in the marketing mix.

Traditional Advertising Service Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the Traditional Advertising Service market, leveraging high-volume keywords for enhanced search rankings and engaging industry professionals. Our research spans a study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024. This report requires no further modification and offers comprehensive insights into market structure, trends, dominant segments, product analysis, key drivers, challenges, and a detailed look at the key players shaping this vital industry.

Traditional Advertising Service Market Structure & Competitive Landscape

The Traditional Advertising Service market exhibits a moderate level of concentration, with a few dominant players holding substantial market share, alongside a more fragmented landscape of specialized agencies. Innovation is primarily driven by evolving media consumption patterns and the integration of data analytics to refine targeting for TV Commercials, Newspaper Advertisements, and Direct Mail campaigns. Regulatory impacts, while present in terms of advertising standards and data privacy, have largely not stifled core traditional advertising functions. Product substitutes, such as digital advertising and influencer marketing, are continuously evolving, necessitating a strategic focus on the unique value proposition of traditional channels.

End-user segmentation reveals a strong reliance on Large Enterprises, which constitute approximately 70% of the market value, attributed to their substantial advertising budgets and established brand recognition efforts. SMEs represent a growing segment, increasingly recognizing the reach and credibility of traditional media, particularly for local and regional campaigns. Merger and Acquisition (M&A) trends are indicative of consolidation, with an estimated XX million in M&A volumes observed in the historical period, driven by the pursuit of expanded service offerings and market reach. Key M&A strategies often involve larger agencies acquiring specialized creative or media buying firms to enhance their comprehensive service portfolios. The overall market concentration ratio (CR4) is estimated at XX%, highlighting the significant influence of the top four players.

Traditional Advertising Service Market Trends & Opportunities

The Traditional Advertising Service market, valued at an estimated $XXX million in the base year of 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This sustained growth is underpinned by a persistent demand for broad reach and brand building capabilities that traditional channels excel at delivering. Technological shifts, while often associated with digital, are indirectly influencing traditional advertising through advancements in data analytics, programmatic buying for television, and the integration of QR codes within print and direct mail for enhanced trackability. These innovations are enabling more sophisticated measurement and optimization of traditional campaigns, moving beyond simple reach metrics.

Consumer preferences, while increasingly digital-first, still demonstrate a significant appreciation for the tangibility and perceived trustworthiness of traditional advertising. TV commercials continue to command mass audiences for major product launches and brand awareness initiatives. Newspaper advertisements, though facing circulation declines, remain a critical channel for local businesses, community announcements, and reaching specific demographics not as heavily engaged online. Direct Mail, with its personalized approach and ability to cut through digital clutter, is experiencing a resurgence in certain sectors, particularly for targeted offers and high-value customer acquisition. The competitive dynamics are characterized by agencies adapting their strategies to integrate traditional and digital efforts seamlessly, offering omnichannel solutions. Market penetration rates for traditional advertising services remain high, particularly among established brands seeking to maintain broad consumer engagement. Opportunities lie in leveraging the perceived credibility and impact of traditional media to complement digital strategies, creating a more robust and holistic marketing approach. This synergy is crucial for brands aiming to build lasting trust and awareness. The market is expected to see continued investment in creative excellence and strategic media placement to maximize the impact of traditional campaigns.

Dominant Markets & Segments in Traditional Advertising Service

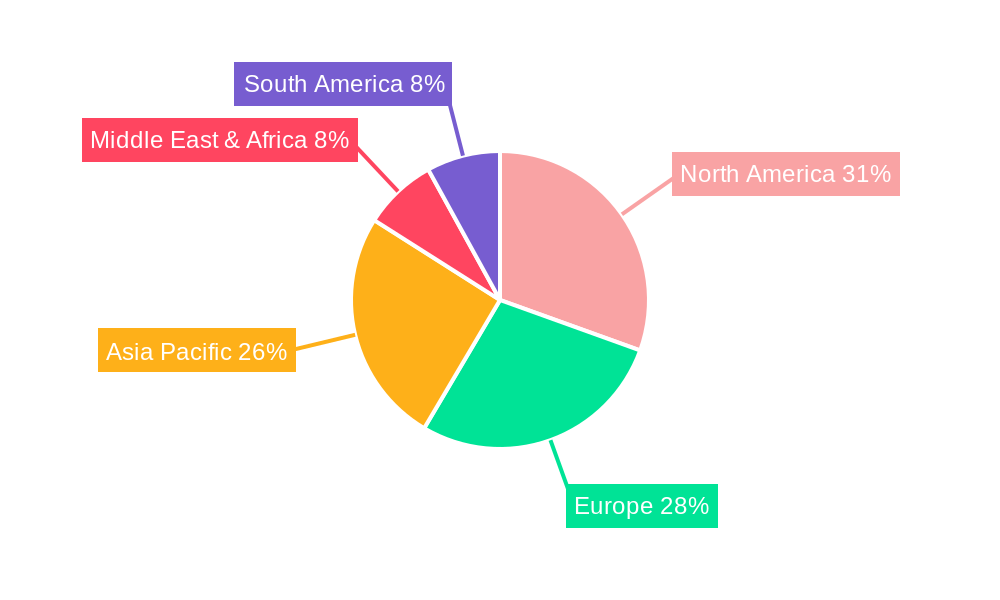

The Traditional Advertising Service market demonstrates significant dominance in North America, accounting for an estimated XX% of the global market value in 2025. This regional leadership is driven by a mature advertising ecosystem, substantial corporate investment in marketing, and a strong historical reliance on television and print media. Within North America, the United States stands out as the leading country, with an estimated market share of XX% of the global total. Key growth drivers in this region include robust economic conditions, a high disposable income, and a well-established infrastructure for media production and distribution. Government policies supporting free speech and commercial activities also contribute to a favorable environment for advertising services.

Among the applications, Large Enterprises represent the most dominant segment, comprising approximately XX% of the total market. These entities leverage traditional advertising for broad brand building, national campaigns, and reinforcing corporate image. Their substantial budgets allow for extensive media buys across various traditional platforms. SMEs, while a smaller segment in terms of individual spend, collectively represent a significant and growing opportunity, especially for localized newspaper advertisements and direct mail campaigns aimed at specific geographic areas.

When examining the types of traditional advertising, TV Commercials remain a dominant force, accounting for an estimated XX% of the market share. This is due to their unparalleled ability to reach vast audiences simultaneously and create emotional connections through visual and auditory storytelling. Newspaper Advertisements, despite facing some decline, continue to hold a significant position, particularly for local markets and specific demographic targeting, estimated at XX% of the market. Direct Mail, with its personalized touch and high engagement potential for targeted offers, is estimated at XX%, showing resilience and strategic relevance in niche applications. The "Others" category, which could encompass radio advertising, outdoor billboards, and event sponsorships, collectively accounts for the remaining XX%, each serving distinct purposes and target audiences within the broader traditional advertising landscape. The sustained demand for mass reach, brand credibility, and targeted engagement across these segments ensures the continued importance of traditional advertising services.

Traditional Advertising Service Product Analysis

Traditional advertising services encompass a range of enduring product innovations designed for mass reach and brand impact. TV Commercials leverage compelling storytelling and visual artistry to build emotional connections and brand awareness, offering advertisers unparalleled reach. Newspaper Advertisements provide tangible, localized, and highly targeted communication for community engagement and immediate offers. Direct Mail, with its personalized approach, offers a tactile experience for direct response marketing and customer loyalty programs. These services are increasingly integrated with digital analytics for improved targeting and measurement, enhancing their competitive advantage by providing a measurable impact beyond traditional metrics.

Key Drivers, Barriers & Challenges in Traditional Advertising Service

The Traditional Advertising Service market is propelled by several key drivers. Established Brand Recognition and Trust are paramount; traditional media often carries a perception of credibility that digital channels sometimes lack. Mass Reach and Broad Audience Engagement remain a core strength, particularly for TV commercials reaching diverse demographics. Tangibility and Permanence of print and direct mail offer a unique consumer experience. Targeted Localized Campaigns, especially through newspapers and local radio, continue to be effective for specific businesses.

Conversely, significant barriers and challenges exist. Declining Readership and Viewership in some traditional mediums due to digital migration poses a substantial restraint. High Cost of Production and Media Placement for national campaigns can be prohibitive for smaller businesses. Difficulty in Precise Measurement and Attribution compared to digital channels is a persistent challenge. Evolving Consumer Habits favoring digital interaction necessitate a strategic integration of traditional and digital efforts. Regulatory Scrutiny and Advertising Standards can add complexity and compliance costs.

Growth Drivers in the Traditional Advertising Service Market

Key growth drivers in the Traditional Advertising Service market include the enduring need for brand building and mass awareness that traditional channels excel at. The inherent credibility and trustworthiness associated with established media platforms like television and print continue to attract significant advertising investment. Furthermore, the increasing ability to integrate data analytics and programmatic buying into traditional media, especially television, allows for more precise targeting and ROI measurement, revitalizing its appeal. Event-driven advertising, such as during major sporting events or seasonal holidays, also remains a significant catalyst.

Challenges Impacting Traditional Advertising Service Growth

Challenges impacting Traditional Advertising Service growth are multifaceted. The pervasive shift towards digital media consumption continues to fragment audiences and reduce the reach of traditional channels like print. High production costs and media buying expenses for TV commercials and large-scale print campaigns present a significant barrier, particularly for SMEs. Attribution and measurement complexities compared to the granular data available in digital marketing can make demonstrating ROI more challenging. Increasing regulatory oversight concerning advertising content and data privacy adds layers of compliance and potential restrictions.

Key Players Shaping the Traditional Advertising Service Market

- Epsilon Data Management

- BBDO

- Televerde

- TOAD

- 360i

- Cox Media

- DDB Worldwide

- FRED & FARID

- Fuse

- Goodby Silverstein & Partners

- Martin Agency

- MediaCom

- MONDAY

- MullenLowe

Significant Traditional Advertising Service Industry Milestones

- 2019: Increased integration of QR codes in print and direct mail for trackable digital engagement.

- 2020: Rise of socially conscious advertising in TV commercials, reflecting global events and consumer sentiment.

- 2021: Growing adoption of programmatic buying for TV advertising, enhancing targeting capabilities.

- 2022: Renewed focus on the tactile and personalized experience of direct mail campaigns for customer retention.

- 2023: Development of more sophisticated measurement tools for traditional advertising, bridging the gap with digital analytics.

- 2024: Increased strategic partnerships between traditional advertising agencies and digital marketing firms to offer integrated solutions.

Future Outlook for Traditional Advertising Service Market

The future outlook for the Traditional Advertising Service market is one of strategic integration and continued relevance. While digital channels will undoubtedly dominate in many aspects, traditional advertising will thrive by serving as a crucial component in holistic marketing strategies. Growth catalysts include the ongoing need for broad brand building, the unique impact of tangible media in a digital-saturated world, and the increasing sophistication of data integration to enhance targeting and measurement. The market is poised for sustained growth by emphasizing its strengths in mass reach, credibility, and emotional connection, adapting to evolving consumer behaviors and technological advancements to remain a vital force in the advertising landscape.

Traditional Advertising Service Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. TV Commercials

- 2.2. Newspaper Advertisements

- 2.3. Direct Mail

- 2.4. Others

Traditional Advertising Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Traditional Advertising Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. TV Commercials

- 5.2.2. Newspaper Advertisements

- 5.2.3. Direct Mail

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. TV Commercials

- 6.2.2. Newspaper Advertisements

- 6.2.3. Direct Mail

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. TV Commercials

- 7.2.2. Newspaper Advertisements

- 7.2.3. Direct Mail

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. TV Commercials

- 8.2.2. Newspaper Advertisements

- 8.2.3. Direct Mail

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. TV Commercials

- 9.2.2. Newspaper Advertisements

- 9.2.3. Direct Mail

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Traditional Advertising Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. TV Commercials

- 10.2.2. Newspaper Advertisements

- 10.2.3. Direct Mail

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Epsilon Data Management

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BBDO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Televerde

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TOAD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 360i

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cox Media

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DDB Worldwide

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FRED & FARID

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fuse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Goodby Silverstein & Partners

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Martin Agency

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MediaCom

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MONDAY

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MullenLowe

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Epsilon Data Management

List of Figures

- Figure 1: Global Traditional Advertising Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Traditional Advertising Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Traditional Advertising Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Traditional Advertising Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Traditional Advertising Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Traditional Advertising Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Traditional Advertising Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Traditional Advertising Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Traditional Advertising Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Traditional Advertising Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Traditional Advertising Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Traditional Advertising Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Traditional Advertising Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Traditional Advertising Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Traditional Advertising Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Traditional Advertising Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Traditional Advertising Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Traditional Advertising Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Traditional Advertising Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Traditional Advertising Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Traditional Advertising Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Traditional Advertising Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Traditional Advertising Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Traditional Advertising Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Traditional Advertising Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Traditional Advertising Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Traditional Advertising Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Traditional Advertising Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Traditional Advertising Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Traditional Advertising Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Traditional Advertising Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Traditional Advertising Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Traditional Advertising Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Traditional Advertising Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Traditional Advertising Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Traditional Advertising Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Traditional Advertising Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Traditional Advertising Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Traditional Advertising Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Traditional Advertising Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Traditional Advertising Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Traditional Advertising Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Traditional Advertising Service?

Key companies in the market include Epsilon Data Management, BBDO, Televerde, TOAD, 360i, Cox Media, DDB Worldwide, FRED & FARID, Fuse, Goodby Silverstein & Partners, Martin Agency, MediaCom, MONDAY, MullenLowe.

3. What are the main segments of the Traditional Advertising Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Traditional Advertising Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Traditional Advertising Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Traditional Advertising Service?

To stay informed about further developments, trends, and reports in the Traditional Advertising Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence