Key Insights

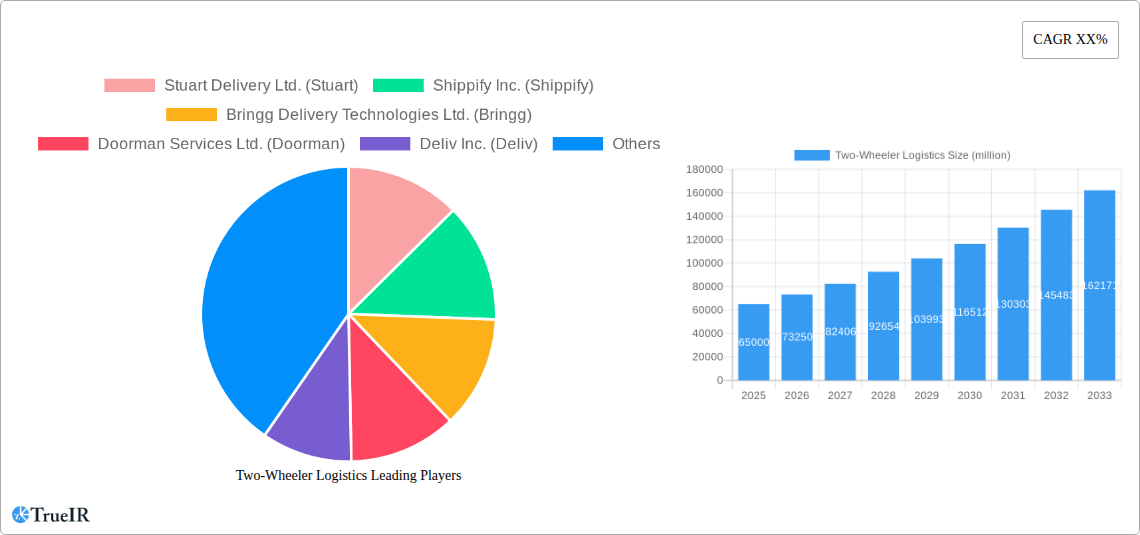

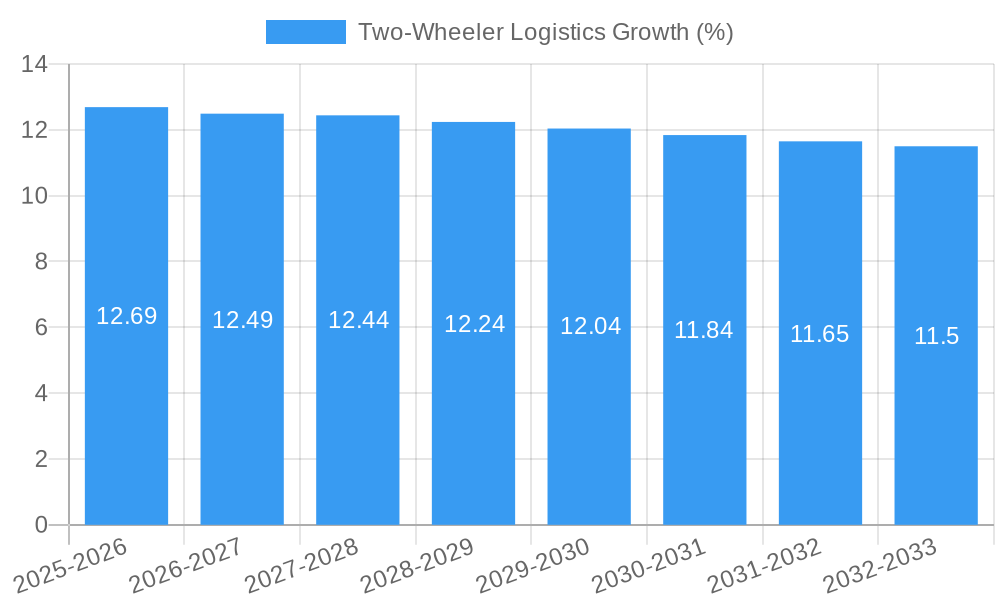

The global two-wheeler logistics market is poised for significant expansion, projected to reach a market size of approximately $150 billion by 2033, with a Compound Annual Growth Rate (CAGR) of around 12% between 2025 and 2033. This robust growth is primarily fueled by the increasing demand for rapid and cost-effective last-mile delivery solutions, particularly in urban environments. The proliferation of e-commerce platforms and the growing consumer preference for on-demand services are key drivers, necessitating efficient and agile logistics networks. Two-wheelers, with their maneuverability and lower operational costs, are ideally suited to navigate congested city streets, making them a preferred mode for delivering goods like food, groceries, pharmaceuticals, and small parcels. Furthermore, the rising adoption of electric two-wheelers in logistics operations is contributing to market growth by offering a sustainable and environmentally friendly alternative, aligning with global environmental initiatives.

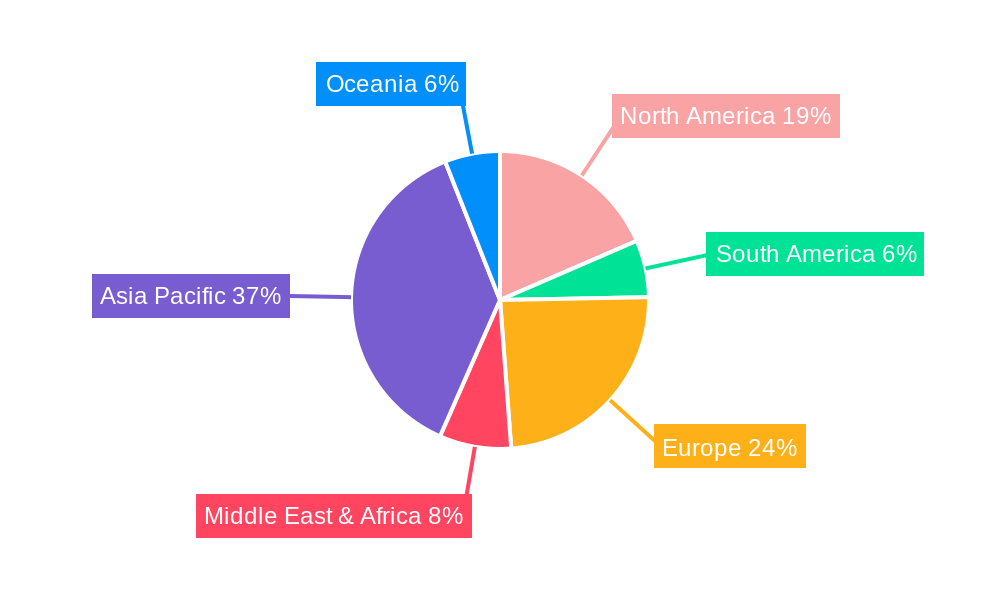

The market is segmented across various applications, with Business-to-Business (B2B) logistics representing the larger share, driven by the needs of businesses for efficient supply chain management and inter-branch transfers. However, the Business-to-Consumer (B2C) segment is experiencing accelerated growth due to the direct-to-consumer delivery models adopted by retailers and service providers. The market encompasses deliveries via bikes, mopeds, and motorcycles, each catering to different delivery scales and urban conditions. Key players such as Stuart, Deliveroo, and Glovo are at the forefront of this transformation, leveraging technology and extensive rider networks to optimize delivery routes and enhance customer experience. Geographically, Asia Pacific, particularly China and India, is expected to dominate the market owing to its dense population, burgeoning e-commerce sector, and a high prevalence of two-wheeler usage. North America and Europe are also witnessing substantial growth, driven by increasing urbanization and the adoption of advanced logistics technologies. Restraints such as increasing fuel prices (though mitigated by EV adoption) and regulatory challenges in some regions are present, but the overall outlook remains highly positive.

This comprehensive report offers an in-depth analysis of the global Two-Wheeler Logistics market, a rapidly evolving sector crucial for efficient urban delivery. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market dynamics, competitive landscapes, key trends, and future projections. Leveraging high-volume SEO keywords, this report is designed to enhance search rankings and engage industry professionals, logistics providers, investors, and policymakers alike.

Two-Wheeler Logistics Market Structure & Competitive Landscape

The Two-Wheeler Logistics market is characterized by a moderate to high level of concentration, driven by significant investments in technology and infrastructure. Innovation is a key differentiator, with companies continuously developing advanced fleet management systems, route optimization algorithms, and eco-friendly vehicle options. Regulatory impacts, such as evolving traffic laws and emission standards, play a crucial role in shaping operational strategies. The emergence of new market entrants and the consolidation of existing players through mergers and acquisitions are also notable trends. While product substitutes like drones and autonomous vehicles are on the horizon, the cost-effectiveness and agility of two-wheelers ensure their continued dominance in last-mile delivery. End-user segmentation, primarily between Business-to-Business (B2B) and Business-to-Consumer (B2C) applications, highlights diverse operational needs and service offerings. The market concentration ratio is estimated to be approximately 65% among the top five players. M&A activities in the historical period (2019-2024) saw an estimated volume of over 50 significant transactions, indicating a dynamic consolidation phase.

- Market Concentration: Moderate to High, driven by technology and infrastructure investment.

- Innovation Drivers: Advanced fleet management, route optimization, eco-friendly vehicles.

- Regulatory Impacts: Evolving traffic laws, emission standards, urban accessibility policies.

- Product Substitutes: Drones, autonomous vehicles (emerging, but not yet mainstream substitutes for last-mile).

- End-User Segmentation: Business-to-Business (B2B) and Business-to-Consumer (B2C) dominate.

- M&A Trends: Active consolidation among key players.

Two-Wheeler Logistics Market Trends & Opportunities

The global Two-Wheeler Logistics market is poised for substantial growth, projected to reach an estimated market size of over one trillion US dollars by the end of the forecast period in 2033. This expansion is fueled by a confluence of factors, including the escalating demand for rapid e-commerce deliveries, the inherent cost-effectiveness and agility of two-wheeler fleets in congested urban environments, and the growing adoption of sustainable logistics solutions. The Compound Annual Growth Rate (CAGR) for the market is estimated at a robust 12.5% from 2025 to 2033. Technological shifts are at the forefront of this evolution, with advancements in GPS tracking, real-time communication platforms, and AI-powered route optimization software significantly enhancing operational efficiency and customer satisfaction. The market penetration rate for specialized two-wheeler logistics services is expected to surpass 70% in major metropolitan areas by 2033. Consumer preferences are increasingly tilting towards faster delivery times and greater transparency in the logistics process, which two-wheeler fleets are uniquely positioned to meet. Competitive dynamics are intensifying, with established players investing heavily in fleet expansion, driver training, and the integration of new technologies. Opportunities abound for niche service providers focusing on specialized deliveries, such as pharmaceutical or perishable goods, and for companies developing innovative, environmentally friendly two-wheeler fleets, including electric bikes and scooters. The increasing urbanization trend worldwide further amplifies the need for nimble and efficient logistics solutions, making two-wheelers an indispensable component of the modern supply chain. The rise of the gig economy has also provided a flexible workforce for delivery operations, further supporting market growth.

Dominant Markets & Segments in Two-Wheeler Logistics

The Business-to-Consumer (B2C) segment is currently the dominant force in the Two-Wheeler Logistics market, driven by the explosive growth of e-commerce and the increasing consumer demand for rapid, last-mile delivery services directly to their homes. This segment is projected to continue its upward trajectory, accounting for an estimated 75% of the market value by 2033. Within the B2C application, the Bike category represents the largest share in terms of operational volume and fleet size, owing to its maneuverability in densely populated urban areas and lower operational costs. The market dominance is further solidified by robust infrastructure, including dedicated bike lanes and widespread charging facilities for electric bikes, particularly in developed economies. Government policies that encourage sustainable transportation and incentivise the use of emission-free vehicles are also significant growth drivers.

Conversely, the Business-to-Business (B2B) segment, while smaller, is experiencing a substantial CAGR of approximately 10%, driven by the need for efficient inter-business deliveries, supply chain replenishment, and specialized courier services. The Motorcycle type often features prominently in B2B logistics, particularly for time-sensitive deliveries or when carrying slightly larger payloads. Key growth drivers in the B2B space include the increasing sophistication of supply chain management and the outsourcing of non-core logistics functions by businesses. Countries in Asia-Pacific, particularly India and Southeast Asian nations, currently lead in terms of overall market size and operational density for two-wheeler logistics due to their high population density, established two-wheeler culture, and growing e-commerce penetration. However, North America and Europe are witnessing rapid growth, fueled by advancements in technology and a strong emphasis on same-day delivery services. The effective integration of two-wheeler logistics into broader omnichannel strategies by retailers is a critical factor underpinning the segment's continued dominance.

- Dominant Application: Business-to-Consumer (B2C) is projected to account for over 75% of the market value by 2033.

- Leading Type: Bikes dominate in terms of operational volume and fleet size within the B2C segment due to urban maneuverability.

- Key Growth Drivers:

- Infrastructure: Dedicated bike lanes, charging facilities, urban planning supporting micro-mobility.

- Policies: Government incentives for electric vehicles, emission reduction mandates, urban accessibility initiatives.

- E-commerce Growth: Surging online retail driving last-mile delivery demand.

- Urbanization: Increasing population density in cities requiring efficient, compact logistics.

- Cost-Effectiveness: Lower operational and maintenance costs compared to larger vehicles.

Two-Wheeler Logistics Market Product Analysis

The Two-Wheeler Logistics market is experiencing a surge in product innovation, with a strong focus on enhancing efficiency, sustainability, and safety. Electric bikes and scooters are gaining significant traction, offering reduced operational costs and environmental benefits. Advanced telematics and IoT devices are being integrated into fleets for real-time tracking, performance monitoring, and predictive maintenance. Route optimization software, powered by AI and machine learning, is crucial for minimizing delivery times and fuel consumption. These technological advancements provide a significant competitive advantage by enabling faster, more reliable, and cost-effective delivery services, catering to the growing demand for same-day and express delivery solutions across both B2B and B2C segments.

Key Drivers, Barriers & Challenges in Two-Wheeler Logistics

Key Drivers:

- Technological Advancements: AI-powered route optimization, GPS tracking, and electric vehicle technology are transforming operational efficiency and sustainability.

- E-commerce Boom: Escalating online retail sales are creating unprecedented demand for rapid last-mile delivery.

- Urbanization: Growing city populations necessitate agile and efficient logistics solutions that can navigate congested streets.

- Cost-Effectiveness: Two-wheelers offer lower operational and maintenance costs compared to traditional delivery vehicles, making them an attractive choice.

- Sustainability Initiatives: Increasing consumer and regulatory pressure for eco-friendly logistics solutions are driving the adoption of electric two-wheelers.

Barriers & Challenges:

- Regulatory Hurdles: Evolving traffic laws, licensing requirements, and urban access restrictions can create operational complexities.

- Infrastructure Deficiencies: Inadequate dedicated lanes, insufficient charging stations, and poor road conditions in some regions can hinder efficiency.

- Safety Concerns: The inherent risks associated with operating two-wheelers in traffic, coupled with driver training and safety equipment, pose ongoing challenges.

- Payload Limitations: The capacity of two-wheelers restricts the volume and weight of goods that can be transported in a single trip, impacting scalability for certain deliveries.

- Competitive Pressures: A crowded market with numerous players, including the emergence of new entrants and innovative delivery models, creates intense competition.

- Weather Dependency: Inclement weather conditions can significantly disrupt operations, leading to delivery delays and increased costs.

Growth Drivers in the Two-Wheeler Logistics Market

The Two-Wheeler Logistics market is propelled by a powerful synergy of technological innovation, economic imperatives, and evolving consumer behavior. The widespread adoption of AI-driven route optimization software significantly enhances delivery efficiency by reducing transit times and fuel consumption. The proliferation of electric bikes and scooters addresses growing environmental concerns and government mandates for reduced carbon emissions, offering a sustainable alternative. Furthermore, the exponential growth of e-commerce, coupled with an increasing consumer expectation for rapid same-day and even same-hour deliveries, creates a consistent and escalating demand for the agile and cost-effective services that two-wheeler logistics provides. Urban density, a growing global trend, further amplifies the advantage of two-wheelers in navigating congested cityscapes, making them indispensable for last-mile delivery.

Challenges Impacting Two-Wheeler Logistics Growth

Despite its robust growth, the Two-Wheeler Logistics market faces significant challenges that can impede its expansion. Regulatory complexities, including varying traffic laws, parking restrictions, and licensing requirements across different jurisdictions, can create operational friction and increase compliance costs. Supply chain disruptions, particularly those related to the availability of skilled drivers and the maintenance of vehicle fleets, can impact service reliability. Intense competitive pressures from both established players and emerging disruptive technologies, such as drones and autonomous vehicles, demand continuous innovation and cost management. Furthermore, the inherent safety risks associated with operating two-wheelers in high-traffic urban environments necessitate stringent safety protocols and ongoing driver training, adding to operational expenses. Weather dependency also remains a considerable challenge, with adverse conditions frequently leading to delivery delays and service disruptions, impacting customer satisfaction and operational efficiency.

Key Players Shaping the Two-Wheeler Logistics Market

- Stuart Delivery Ltd. (Stuart)

- Shippify Inc. (Shippify)

- Bringg Delivery Technologies Ltd. (Bringg)

- Doorman Services Ltd. (Doorman)

- Deliv Inc. (Deliv)

- Glaufraf 23 (Glovo)

- Mara Labs Inc. (Locus)

- Roofoods Ltd. (Deliveroo)

- Postmates Inc. (Postmates)

- Maplebear Inc. (Instacart)

- GEFCO China

Significant Two-Wheeler Logistics Industry Milestones

- 2019: Increased adoption of electric bikes by major delivery platforms in urban centers, driven by sustainability goals.

- 2020: Surge in demand for last-mile delivery services due to the global pandemic, boosting the reliance on two-wheeler logistics.

- 2021: Introduction of advanced AI-powered route optimization software by several key players, leading to significant efficiency gains.

- 2022: Expansion of B2B two-wheeler logistics services catering to specialized deliveries like pharmaceuticals and sensitive documents.

- 2023: Greater integration of IoT devices for real-time fleet tracking and performance analytics across leading companies.

- 2024: Significant investments in driver training programs focused on safety and customer service by prominent two-wheeler logistics providers.

Future Outlook for Two-Wheeler Logistics Market

The future outlook for the Two-Wheeler Logistics market remains exceptionally bright, driven by sustained growth in e-commerce, increasing urbanization, and a relentless pursuit of operational efficiency. Strategic opportunities lie in the further development and integration of eco-friendly fleets, particularly electric two-wheelers, to meet evolving environmental regulations and consumer preferences. Advanced analytics and AI will continue to play a pivotal role in optimizing routes, managing fleets, and enhancing customer experiences. The market is expected to witness continued innovation in service offerings, including hyper-local delivery, specialized goods transport, and the integration of two-wheeler logistics into broader omnichannel retail strategies. The growing demand for faster, more reliable, and sustainable last-mile solutions solidifies the indispensable role of two-wheeler logistics in the global supply chain for the foreseeable future.

Two-Wheeler Logistics Segmentation

-

1. Application

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Consumer (B2C)

-

2. Types

- 2.1. Bike

- 2.2. Moped

- 2.3. Motorcycle

Two-Wheeler Logistics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Two-Wheeler Logistics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Consumer (B2C)

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Bike

- 5.2.2. Moped

- 5.2.3. Motorcycle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Business-to-Business (B2B)

- 6.1.2. Business-to-Consumer (B2C)

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Bike

- 6.2.2. Moped

- 6.2.3. Motorcycle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Business-to-Business (B2B)

- 7.1.2. Business-to-Consumer (B2C)

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Bike

- 7.2.2. Moped

- 7.2.3. Motorcycle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Business-to-Business (B2B)

- 8.1.2. Business-to-Consumer (B2C)

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Bike

- 8.2.2. Moped

- 8.2.3. Motorcycle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Business-to-Business (B2B)

- 9.1.2. Business-to-Consumer (B2C)

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Bike

- 9.2.2. Moped

- 9.2.3. Motorcycle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Two-Wheeler Logistics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Business-to-Business (B2B)

- 10.1.2. Business-to-Consumer (B2C)

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Bike

- 10.2.2. Moped

- 10.2.3. Motorcycle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stuart Delivery Ltd. (Stuart)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shippify Inc. (Shippify)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bringg Delivery Technologies Ltd. (Bringg)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Doorman Services Ltd. (Doorman)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deliv Inc. (Deliv)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glaufraf 23 (Glovo)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mara Labs Inc. (Locus)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roofoods Ltd. (Deliveroo)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Postmates Inc. (Postmates)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maplebear Inc. (Instacart)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GEFCO China

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Stuart Delivery Ltd. (Stuart)

List of Figures

- Figure 1: Global Two-Wheeler Logistics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Two-Wheeler Logistics Revenue (million), by Application 2024 & 2032

- Figure 3: North America Two-Wheeler Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Two-Wheeler Logistics Revenue (million), by Types 2024 & 2032

- Figure 5: North America Two-Wheeler Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Two-Wheeler Logistics Revenue (million), by Country 2024 & 2032

- Figure 7: North America Two-Wheeler Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Two-Wheeler Logistics Revenue (million), by Application 2024 & 2032

- Figure 9: South America Two-Wheeler Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Two-Wheeler Logistics Revenue (million), by Types 2024 & 2032

- Figure 11: South America Two-Wheeler Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Two-Wheeler Logistics Revenue (million), by Country 2024 & 2032

- Figure 13: South America Two-Wheeler Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Two-Wheeler Logistics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Two-Wheeler Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Two-Wheeler Logistics Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Two-Wheeler Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Two-Wheeler Logistics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Two-Wheeler Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Two-Wheeler Logistics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Two-Wheeler Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Two-Wheeler Logistics Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Two-Wheeler Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Two-Wheeler Logistics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Two-Wheeler Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Two-Wheeler Logistics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Two-Wheeler Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Two-Wheeler Logistics Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Two-Wheeler Logistics Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Two-Wheeler Logistics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Two-Wheeler Logistics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Two-Wheeler Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Two-Wheeler Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Two-Wheeler Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Two-Wheeler Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Two-Wheeler Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Two-Wheeler Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Two-Wheeler Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Two-Wheeler Logistics Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Two-Wheeler Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Two-Wheeler Logistics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two-Wheeler Logistics?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Two-Wheeler Logistics?

Key companies in the market include Stuart Delivery Ltd. (Stuart), Shippify Inc. (Shippify), Bringg Delivery Technologies Ltd. (Bringg), Doorman Services Ltd. (Doorman), Deliv Inc. (Deliv), Glaufraf 23 (Glovo), Mara Labs Inc. (Locus), Roofoods Ltd. (Deliveroo), Postmates Inc. (Postmates), Maplebear Inc. (Instacart), GEFCO China.

3. What are the main segments of the Two-Wheeler Logistics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two-Wheeler Logistics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two-Wheeler Logistics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two-Wheeler Logistics?

To stay informed about further developments, trends, and reports in the Two-Wheeler Logistics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence