Key Insights

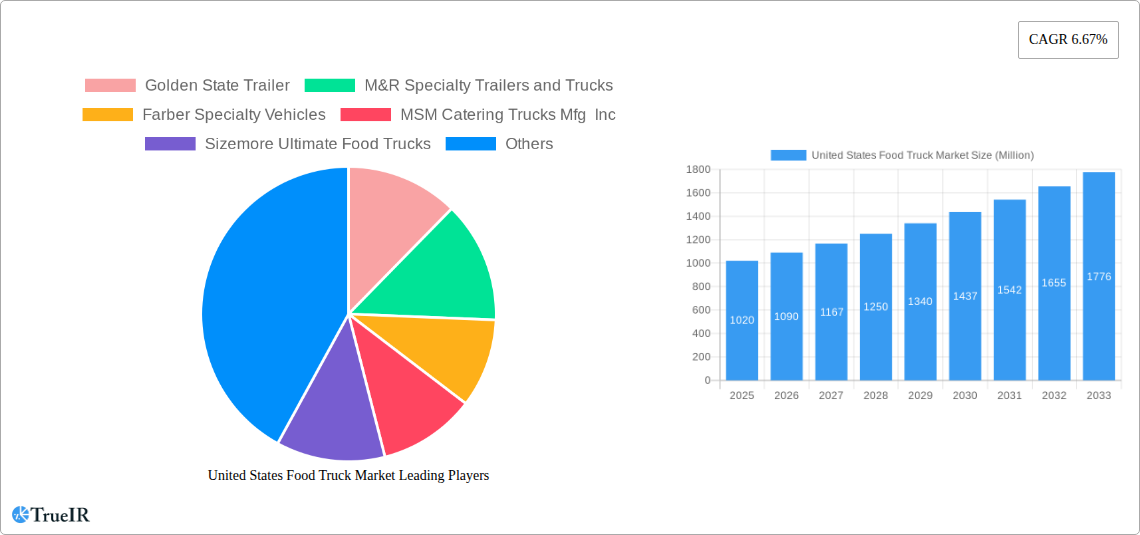

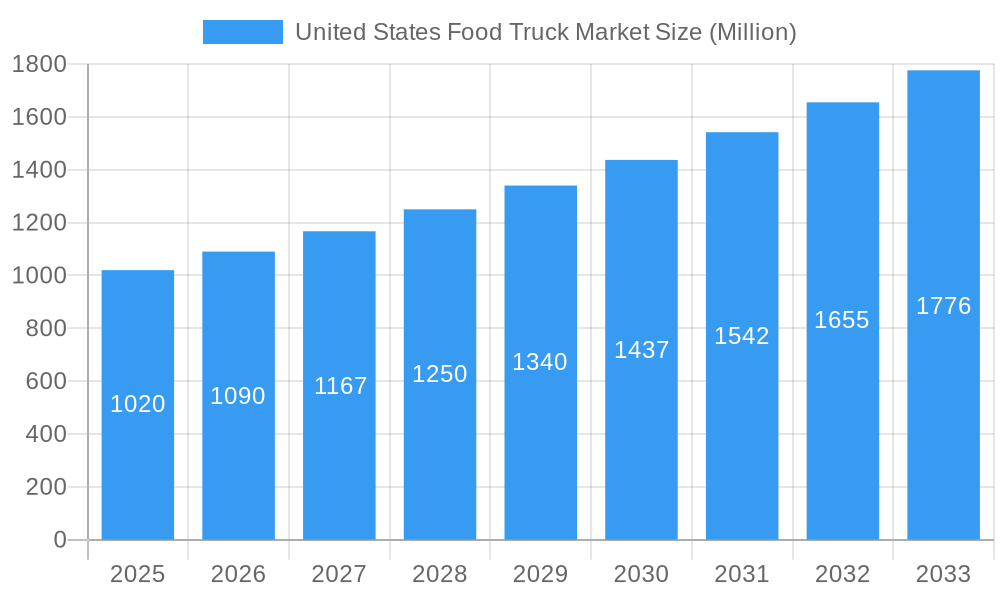

The United States food truck market, valued at $1.02 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.67% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing popularity of diverse culinary experiences, coupled with the affordability and convenience offered by food trucks, attracts a broad consumer base. Furthermore, the relatively lower overhead costs compared to traditional brick-and-mortar restaurants make food truck ventures attractive to entrepreneurs, leading to market expansion and increased competition, driving innovation and culinary creativity. The rising prevalence of food truck festivals and events further enhances market visibility and consumer engagement. Specific segments like customized trucks and those offering vegan/plant-based options are experiencing particularly strong growth, reflecting broader consumer trends towards personalization and health-conscious eating. However, regulatory hurdles, including permitting and zoning regulations, pose challenges to market expansion. Competition from established restaurants and the inherent seasonality of the food truck business also act as potential restraints. The market is segmented by truck type (vans, trailers, customized trucks, others), application (fast food, vegan/plant-based, barbeque, desserts, others), and size (up to 15 feet, 16-25 feet, above 25 feet). Growth in the coming years will likely be driven by an increase in the number of specialized food trucks catering to niche markets, alongside technological advancements improving operational efficiency and customer experience (e.g., mobile ordering apps, cashless payment systems).

United States Food Truck Market Market Size (In Billion)

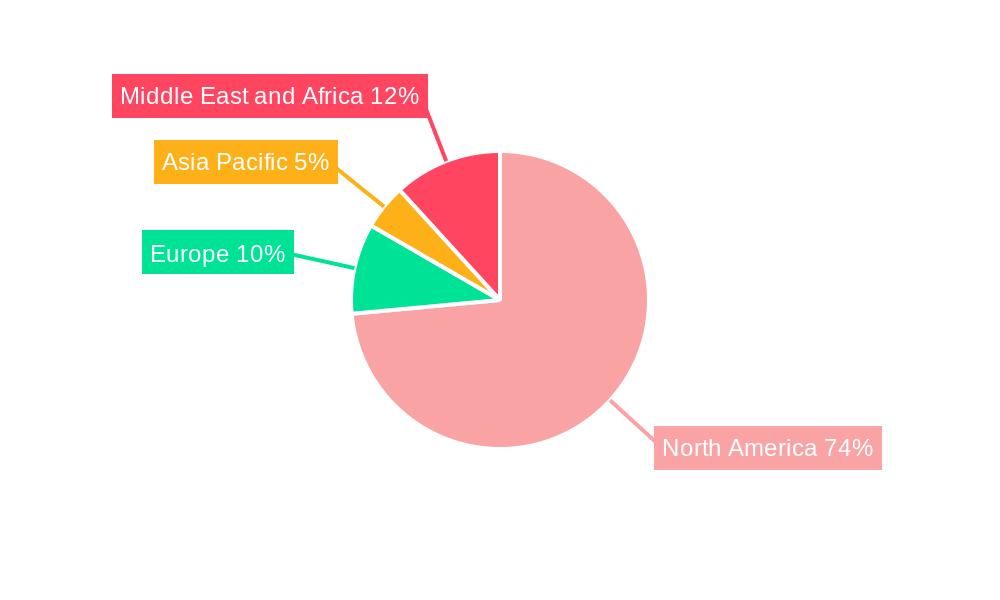

The geographic distribution of the US food truck market is expected to be heavily concentrated in major metropolitan areas with high population density and strong tourism sectors. Regions with a vibrant food culture and favorable regulatory environments will likely witness faster growth. Key players in the market, including Golden State Trailer, M&R Specialty Trailers and Trucks, and others, are continuously innovating to meet evolving consumer preferences and expand their market share. The continued rise of social media marketing and online food delivery platforms will further contribute to market expansion by enabling enhanced brand visibility and reach to a wider customer base. Strategic partnerships between food truck operators and technology providers will likely become increasingly crucial for sustained growth and competitiveness. The market's future success hinges on navigating regulatory challenges, embracing technological innovations, and catering to the ever-evolving demands of a diverse and sophisticated consumer base.

United States Food Truck Market Company Market Share

United States Food Truck Market: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic United States food truck market, offering invaluable insights for investors, entrepreneurs, and industry stakeholders. With a detailed study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report meticulously examines market size, segmentation, competitive landscape, and future growth prospects. The report leverages extensive data analysis, encompassing historical data (2019-2024) and projected figures, to provide a clear and actionable understanding of this thriving sector. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

United States Food Truck Market Market Structure & Competitive Landscape

The United States food truck market exhibits a moderately fragmented structure, with a handful of prominent players alongside numerous smaller, independent operators. The market concentration ratio (CR5) is estimated at xx%, indicating a balance between established brands and emerging competitors. Innovation plays a crucial role, driven by technological advancements in food preparation, mobile payment systems, and marketing strategies. Regulatory landscapes vary significantly across states and municipalities, impacting operational costs and licensing requirements. Product substitutes include traditional brick-and-mortar restaurants and online food delivery services, constantly pressuring food truck operators to differentiate themselves through unique offerings and efficient operations. The market is segmented by end-users, primarily encompassing diverse demographics with varying food preferences and budgets.

Mergers and acquisitions (M&A) activity in the food truck sector is relatively low compared to other segments of the food service industry. However, strategic acquisitions by larger food companies or catering businesses aiming to diversify their offerings are expected to increase, driving consolidation in the market. Based on available data, the total M&A volume between 2019 and 2024 amounted to approximately xx Million USD, with an average deal size of approximately xx Million USD.

United States Food Truck Market Market Trends & Opportunities

The US food truck market is experiencing substantial growth, fueled by evolving consumer preferences for convenient and diverse culinary experiences. The market size is projected to reach xx Million by 2025, driven by factors like increasing disposable income, a growing preference for quick-service dining, and the rise of social media marketing, which helps food trucks reach broader customer bases. Technological advancements in food truck design, mobile payment systems, and online ordering platforms are enhancing efficiency and operational capabilities. The increasing demand for specialized food options such as vegan and plant-based cuisine, gourmet burgers, and ethnic foods is presenting exciting opportunities for food truck entrepreneurs to cater to niche markets. Furthermore, strategic partnerships with local farmers' markets and community events provide valuable exposure and build brand loyalty. The market is expected to maintain a steady growth trajectory in the coming years, reflecting the enduring popularity of food trucks as a dynamic and adaptable food service model. Competitive dynamics are shaped by factors like food quality, pricing strategies, location selection, and brand recognition. The market penetration rate for food trucks, particularly in urban areas, is high and growing, indicating the significant influence food trucks hold in the broader foodservice industry.

Dominant Markets & Segments in United States Food Truck Market

The US food truck market shows robust growth across different segments, with certain areas and categories exhibiting particularly high potential. While data for precise market share is limited, the trends strongly suggest the following:

By Region: Urban areas with high population density and tourist traffic, like major cities along the coasts and in the southwest, demonstrate the highest market concentration.

By Type:

- Trailers: This segment is currently dominant, owing to its versatility in size, adaptability to diverse food offerings, and relative affordability.

- Customized Trucks: This segment is experiencing high growth, driven by entrepreneurs seeking unique brand identities and functionalities.

By Application:

- Fast Food: This segment remains the largest, driven by high demand for quick and affordable options.

- Vegan and Plant-Based: This segment shows significant growth potential, as consumer preference shifts towards healthier and more sustainable dietary choices.

By Size:

- 16-25 Feet: This size range offers a balance between operating capacity and maneuverability, resulting in strong market presence.

Key Growth Drivers:

- Favorable regulatory environment in many regions, allowing food trucks to operate more freely.

- Increased investment and support from venture capitalists and private investors.

- Technological advancements that make operating food trucks more efficient and cost-effective.

- Changing consumer preferences and rising demand for convenient and diversified food choices.

United States Food Truck Market Product Analysis

Product innovation in the food truck sector is primarily focused on enhancing efficiency, customization, and brand building. Technological advancements include integration of mobile payment systems, energy-efficient cooking equipment, and streamlined food preparation workflows. The market is increasingly seeing specialized designs that optimize space utilization, mobility, and brand visibility. Competitive advantages are created through unique food offerings, efficient operations, strategic location selection, targeted marketing efforts, and building a strong brand identity. The focus is on creating a seamless customer experience, combining convenience with high-quality food and branding.

Key Drivers, Barriers & Challenges in United States Food Truck Market

Key Drivers:

The food truck market thrives on evolving consumer preferences for diverse and convenient culinary experiences, facilitated by the rise of social media marketing and a growing preference for on-the-go dining options. Increasing disposable incomes and favorable regulatory environments in some regions further boost growth. Technological advancements streamline operations and enhance customer experience.

Challenges & Restraints:

Stringent regulations across various jurisdictions increase licensing and operating costs and create barriers to entry. Supply chain disruptions, particularly in sourcing food ingredients and equipment, impact operational stability and profitability. Intense competition, especially in densely populated urban areas, leads to price wars and pressures profit margins. These factors, coupled with economic downturns that reduce consumer spending, create considerable challenges.

Growth Drivers in the United States Food Truck Market Market

Technological advancements, such as mobile ordering apps and optimized kitchen designs, contribute to increased operational efficiency and improved customer experience. Evolving consumer preferences towards diverse and convenient food options fuel demand. Favorable regulatory environments in some regions simplify licensing and operations.

Challenges Impacting United States Food Truck Market Growth

Regulatory complexities and varying licensing requirements across different states and municipalities create significant barriers to entry and operation. Supply chain challenges impacting ingredient sourcing and equipment availability directly influence operational costs and profitability. Intense competition in major metropolitan areas creates price wars and reduces profit margins.

Key Players Shaping the United States Food Truck Market Market

- Golden State Trailer

- M&R Specialty Trailers and Trucks

- Farber Specialty Vehicles

- MSM Catering Trucks Mfg Inc

- Sizemore Ultimate Food Trucks

- The Fud Trailer Company

- Custom Concessions

- Titan Trucks Manufacturing

- All American Food Trucks

- US Food Truck Factory

- Prestige Food Trucks

- United Food Truck LLC

Significant United States Food Truck Market Industry Milestones

- April 2023: AggieEats food truck launch at University of California, Davis, addresses student food insecurity and demonstrates the market's social impact.

- March 2024: Boston National Park's call for bids for food truck vendors at the Charlestown Navy Yard highlights growing opportunities in public spaces and underscores the potential for revenue generation through concessions.

Future Outlook for United States Food Truck Market Market

The US food truck market is poised for continued growth, driven by consumer demand for diverse and convenient dining, technological advancements improving efficiency and customer experience, and the increasing adoption of innovative food concepts. Strategic partnerships, targeted marketing efforts, and a focus on sustainable practices will be crucial for success. The market presents a promising landscape for entrepreneurs and established players alike, offering significant potential for revenue generation and market expansion.

United States Food Truck Market Segmentation

-

1. Type

- 1.1. Vans

- 1.2. Trailers

- 1.3. Customized Trucks

- 1.4. Others (Expandable Food Trucks, etc.)

-

2. Application

- 2.1. Fast Food

- 2.2. Vegan and Plant Meat

- 2.3. Barbeque and Snacks

- 2.4. Desserts and Confectionery

- 2.5. Others (Fruits and Vegetables, etc.)

-

3. Size

- 3.1. Up to 15 Feet

- 3.2. 16-25 Feet

- 3.3. Above 25 Feet

United States Food Truck Market Segmentation By Geography

- 1. United States

United States Food Truck Market Regional Market Share

Geographic Coverage of United States Food Truck Market

United States Food Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Food Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vans

- 5.1.2. Trailers

- 5.1.3. Customized Trucks

- 5.1.4. Others (Expandable Food Trucks, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fast Food

- 5.2.2. Vegan and Plant Meat

- 5.2.3. Barbeque and Snacks

- 5.2.4. Desserts and Confectionery

- 5.2.5. Others (Fruits and Vegetables, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Size

- 5.3.1. Up to 15 Feet

- 5.3.2. 16-25 Feet

- 5.3.3. Above 25 Feet

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Golden State Trailer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 M&R Specialty Trailers and Trucks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farber Specialty Vehicles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MSM Catering Trucks Mfg Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sizemore Ultimate Food Trucks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Fud Trailer Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Custom Concessions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Titan Trucks Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 All American Food Trucks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Food Truck Factory

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prestige Food Trucks

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 United Food Truck LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Golden State Trailer

List of Figures

- Figure 1: United States Food Truck Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Food Truck Market Share (%) by Company 2025

List of Tables

- Table 1: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 4: United States Food Truck Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Food Truck Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Food Truck Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: United States Food Truck Market Revenue Million Forecast, by Size 2020 & 2033

- Table 8: United States Food Truck Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Food Truck Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the United States Food Truck Market?

Key companies in the market include Golden State Trailer, M&R Specialty Trailers and Trucks, Farber Specialty Vehicles, MSM Catering Trucks Mfg Inc, Sizemore Ultimate Food Trucks, The Fud Trailer Company, Custom Concessions, Titan Trucks Manufacturing, All American Food Trucks, US Food Truck Factory, Prestige Food Trucks, United Food Truck LLC.

3. What are the main segments of the United States Food Truck Market?

The market segments include Type, Application, Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Customized Truck Segment is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: The National Park of Boston in the United States announced the call for bids for food truck vendors to operate at the Charlestown Navy Yard through a Request for Bids (RFB) proposal. The administration is willing to lease two spaces identified by the National Park Service (NPS) as suitable for mobile food and beverage vending in the Charlestown Navy Yard at Boston National Historical Park. Further, the administration stated that the minimum rent for the lease is USD 40 per shift per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Food Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Food Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Food Truck Market?

To stay informed about further developments, trends, and reports in the United States Food Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence