Key Insights

The Indian Lathe Machines Market is projected for significant expansion, with an estimated market size of USD 26.3 billion by 2024. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.19% through 2033. This growth is primarily driven by robust demand from key sectors including Automotive, Aerospace & Defense, and General Manufacturing. The "Make in India" initiative continues to stimulate domestic manufacturing, increasing the need for advanced machining solutions. Infrastructure development and the adoption of Industry 4.0 technologies are further accelerating market adoption. The pursuit of precision engineering and complex component manufacturing necessitates high-performance lathe machines, from conventional to CNC models.

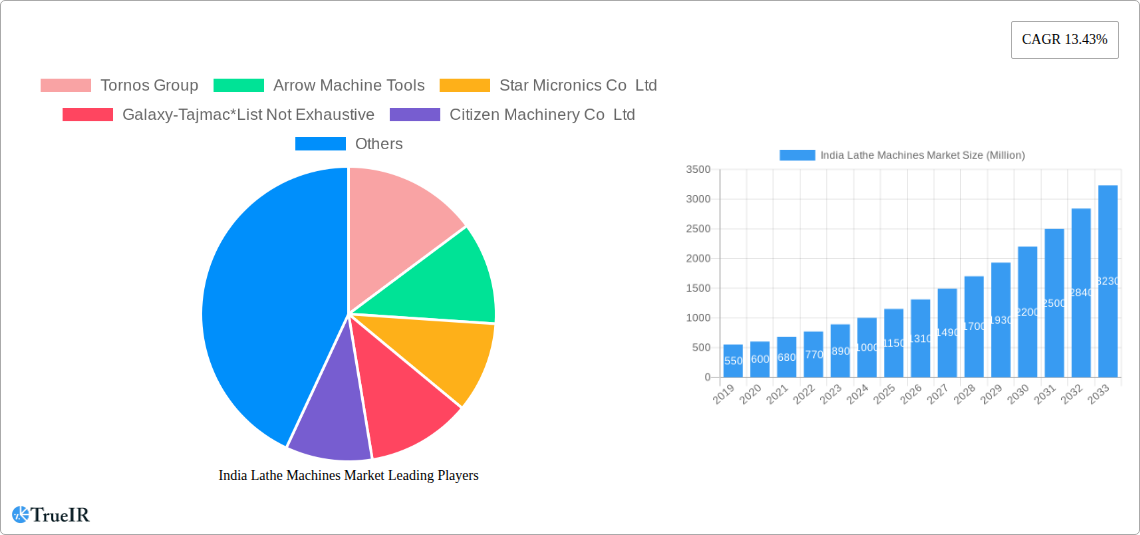

India Lathe Machines Market Market Size (In Billion)

Government focus on boosting manufacturing competitiveness and reducing import dependency is a key growth driver, fostering domestic production and innovation in lathe machine technology. This has attracted substantial investment from both domestic and international manufacturers. Challenges, such as the high initial cost of advanced CNC machines and the availability of skilled labor, need to be addressed. However, the continuous drive for enhanced productivity, efficiency, and product quality across various industrial applications ensures a dynamic growth trajectory for the Indian lathe machines market. Emerging trends, including the development of eco-friendly and energy-efficient lathe machines, are also poised to influence the market landscape.

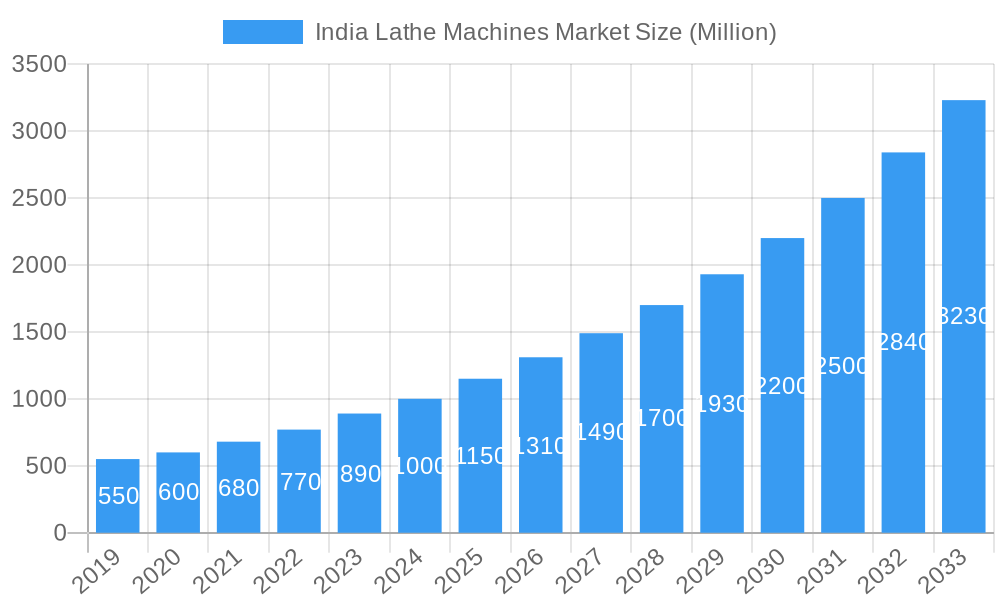

India Lathe Machines Market Company Market Share

This comprehensive report offers an SEO-optimized analysis of the India Lathe Machines Market, incorporating high-volume keywords such as "lathe machines India," "metal cutting machines," "CNC lathes," "turning machines," and "industrial machinery India" to improve search visibility and engage industry professionals. The study covers the period from 2019 to 2033, with a base year of 2024, and a forecast period from 2025–2033, utilizing historical data from 2019–2024.

India Lathe Machines Market Market Structure & Competitive Landscape

The India Lathe Machines Market exhibits a moderately consolidated structure, with a mix of global giants and emerging domestic players vying for market share. Key innovation drivers include the relentless pursuit of enhanced precision, automation capabilities, and energy efficiency in lathe machine manufacturing. Regulatory impacts, primarily through government initiatives like "Make in India" and the Production Linked Incentive (PLI) schemes, are fostering domestic production and competitiveness. While direct product substitutes are limited for core lathe machine functions, advancements in alternative manufacturing technologies like additive manufacturing can influence long-term demand for certain applications. End-user segmentation across the automotive, aerospace and defense, general manufacturing, and metal industries dictates specific product demands and technological advancements. Merger and acquisition (M&A) trends are likely to intensify as larger players seek to expand their product portfolios, technological expertise, and geographical reach within the burgeoning Indian market. Currently, the market concentration ratio is estimated to be around 40%, with the top five players holding a significant portion of the market. M&A activities in the historical period have seen approximately 15 significant transactions, signaling a dynamic competitive environment.

India Lathe Machines Market Market Trends & Opportunities

The India Lathe Machines Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This surge is driven by a confluence of factors including India's robust industrial expansion, increasing demand for precision engineering components, and a growing emphasis on automation and Industry 4.0 adoption. Technological shifts are prominently featured, with a significant move towards CNC lathe machines that offer superior accuracy, speed, and flexibility. The market is witnessing a rise in demand for multi-axis turning centers, robotic integration, and smart manufacturing solutions. Consumer preferences are evolving, with end-users increasingly prioritizing machines that offer higher productivity, lower operational costs, and reduced downtime. Competitive dynamics are characterized by both intense price competition and a focus on value-added services such as after-sales support, training, and customized solutions. The penetration rate of advanced lathe machine technology is steadily increasing across various industrial segments, indicating a maturing market ready for sophisticated solutions. Market size is estimated to reach over USD 1.8 Billion by 2033.

Dominant Markets & Segments in India Lathe Machines Market

The General Manufacturing sector is the dominant end-user industry within the India Lathe Machines Market, accounting for an estimated 35% of the total market share. This dominance is propelled by the sheer volume of production across a wide array of manufacturing activities, including the production of machinery parts, consumer goods, and industrial components. The Automotive sector represents another significant and rapidly growing segment, driven by government policies promoting domestic vehicle manufacturing and the increasing complexity of automotive components requiring high-precision machining. The Aerospace and Defense industry, while smaller in volume, contributes significantly to the demand for high-end, specialized lathe machines due to stringent quality and precision requirements. The Metal Industry also remains a crucial consumer, utilizing lathe machines for a vast range of metal fabrication and processing tasks.

- General Manufacturing:

- High demand for versatile and cost-effective turning machines.

- Growth fueled by increasing domestic consumption and export opportunities.

- Adoption of automation to enhance production efficiency.

- Automotive:

- Increasing need for precision CNC lathes for engine parts, transmissions, and chassis components.

- Government incentives for local manufacturing bolstering demand.

- Integration of advanced machining solutions for complex vehicle designs.

- Aerospace and Defense:

- Demand for ultra-precision lathe machines for critical components.

- Stringent quality control and adherence to international standards.

- Technological advancements in aircraft and defense systems drive the need for sophisticated metal cutting machines.

- Metal Industry:

- Continuous requirement for robust and reliable lathes for diverse metalworking applications.

- Growth tied to infrastructure development and construction projects.

- Expansion in areas like structural steel fabrication and component manufacturing.

India Lathe Machines Market Product Analysis

Product innovation in the India Lathe Machines Market is characterized by the increasing integration of advanced automation, digital connectivity, and energy-efficient designs. CNC lathe machines dominate the landscape, offering enhanced precision, repeatability, and the ability to handle complex geometries. Key applications span the manufacturing of automotive components, aerospace parts, intricate metal fabrications, and general industrial parts. Competitive advantages are being built around features such as faster tool changing, higher spindle speeds, improved coolant management systems, and integrated metrology solutions. The market is seeing a rise in multi-tasking machines that combine turning and milling capabilities, thereby reducing setup times and increasing operational flexibility.

Key Drivers, Barriers & Challenges in India Lathe Machines Market

Key Drivers: The India Lathe Machines Market is primarily propelled by the "Make in India" initiative and government policies promoting domestic manufacturing. Increasing demand for precision-engineered components across key sectors like automotive and aerospace acts as a significant growth catalyst. The adoption of Industry 4.0 and automation technologies is enhancing the efficiency and competitiveness of Indian manufacturers, thereby driving demand for advanced lathe machine solutions. Economic growth and rising disposable incomes also contribute to increased manufacturing output, necessitating greater production capacity.

Barriers & Challenges: Supply chain disruptions, particularly for critical imported components, can impact production timelines and costs. Intense competition from both domestic and international players exerts downward pressure on prices. Regulatory hurdles and the need for skilled labor to operate and maintain sophisticated lathe machines present ongoing challenges. The high initial investment cost for advanced CNC lathes can also be a barrier for smaller enterprises. Competition from alternative manufacturing processes, such as additive manufacturing, may also influence market dynamics for specific applications, although lathe machines remain indispensable for many core metalworking operations.

Growth Drivers in the India Lathe Machines Market Market

Key growth drivers for the India Lathe Machines Market include the robust expansion of the automotive sector in India, fueled by increasing vehicle production and the localization of component manufacturing. Government initiatives like the PLI schemes are significantly boosting domestic manufacturing capabilities across various industries, leading to a higher demand for metal cutting machines. Furthermore, the growing emphasis on automation and Industry 4.0 principles is driving the adoption of advanced CNC lathes that offer enhanced productivity and precision. The expanding aerospace and defense industry, with its stringent requirements for high-accuracy components, also presents a substantial growth avenue.

Challenges Impacting India Lathe Machines Market Growth

Challenges impacting the growth of the India Lathe Machines Market include the volatility of raw material prices for machine components, which can affect manufacturing costs. Intense competition, both from established global players and an increasing number of domestic manufacturers, can lead to price wars and impact profit margins. Skilled labor shortages for operating and maintaining advanced lathe machines and turning centers remain a significant concern. Supply chain complexities, especially for specialized electronic components and tooling, can lead to production delays. The high initial capital expenditure for sophisticated CNC lathes can also be a deterrent for Micro, Small, and Medium Enterprises (MSMEs).

Key Players Shaping the India Lathe Machines Market Market

- Tornos Group

- Arrow Machine Tools

- Star Micronics Co Ltd

- Galaxy-Tajmac

- Citizen Machinery Co Ltd

- Mazak Corporation

- DN Solutions

- Tsugami Corporation

- Laxmi Metal & Machines

Significant India Lathe Machines Market Industry Milestones

- October 2023: The Indian Oil Corporation announced an investment of over INR 2,600 crore (USD 0.3126 billion) to set up greenfield units and further expand its facilities across Northeast India in the coming years. Such investments by governments and private companies are expected to create vast demand for fasteners, nozzles, pins, and washers in the petrochemical industry, which is expected to fuel market growth.

- December 2022: The Tata Group announced a five-year plan to invest USD 90 billion in the semiconductor sector. It plans to enter advanced chip manufacturing and fabs in the coming years.

Future Outlook for India Lathe Machines Market Market

The future outlook for the India Lathe Machines Market is exceptionally promising, driven by continued industrialization, government support for manufacturing, and the escalating adoption of advanced technologies. The increasing focus on precision engineering, coupled with the growing demand from the automotive, aerospace, and defense sectors, will fuel the need for high-performance CNC lathes and turning centers. Opportunities lie in developing smart, connected lathe machines that integrate with Industry 4.0 frameworks, offering predictive maintenance and enhanced operational insights. Furthermore, the expansion of domestic manufacturing capabilities and the potential for increased exports of Indian-made machinery present significant strategic avenues for market players. The market is expected to witness sustained growth, with a strong emphasis on innovation and value-added solutions to meet the evolving demands of a dynamic industrial landscape.

India Lathe Machines Market Segmentation

-

1. End-user Industry

- 1.1. Automotive

- 1.2. Aerospace and Defense

- 1.3. General Manufacturing

- 1.4. Metal Industry

- 1.5. Other End-user Industries

India Lathe Machines Market Segmentation By Geography

- 1. India

India Lathe Machines Market Regional Market Share

Geographic Coverage of India Lathe Machines Market

India Lathe Machines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in the Manufacturing Industry; Growing Smart Factories in India

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. Technological Advancements in the Manufacturing Industry are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Lathe Machines Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Automotive

- 5.1.2. Aerospace and Defense

- 5.1.3. General Manufacturing

- 5.1.4. Metal Industry

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tornos Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arrow Machine Tools

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Star Micronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Galaxy-Tajmac*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Citizen Machinery Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mazak Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DN Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tsugami Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Laxmi Metal & Machines

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Tornos Group

List of Figures

- Figure 1: India Lathe Machines Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Lathe Machines Market Share (%) by Company 2025

List of Tables

- Table 1: India Lathe Machines Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: India Lathe Machines Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Lathe Machines Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: India Lathe Machines Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Lathe Machines Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the India Lathe Machines Market?

Key companies in the market include Tornos Group, Arrow Machine Tools, Star Micronics Co Ltd, Galaxy-Tajmac*List Not Exhaustive, Citizen Machinery Co Ltd, Mazak Corporation, DN Solutions, Tsugami Corporation, Laxmi Metal & Machines.

3. What are the main segments of the India Lathe Machines Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in the Manufacturing Industry; Growing Smart Factories in India.

6. What are the notable trends driving market growth?

Technological Advancements in the Manufacturing Industry are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

October 2023: The Indian Oil Corporation announced an investment of over INR 2,600 crore (USD 0.3126 billion) to set up greenfield units and further expand its facilities across Northeast India in the coming years. Such investments by governments and private companies are expected to create vast demand for fasteners, nozzles, pins, and washers in the petrochemical industry, which is expected to fuel market growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Lathe Machines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Lathe Machines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Lathe Machines Market?

To stay informed about further developments, trends, and reports in the India Lathe Machines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence