Key Insights

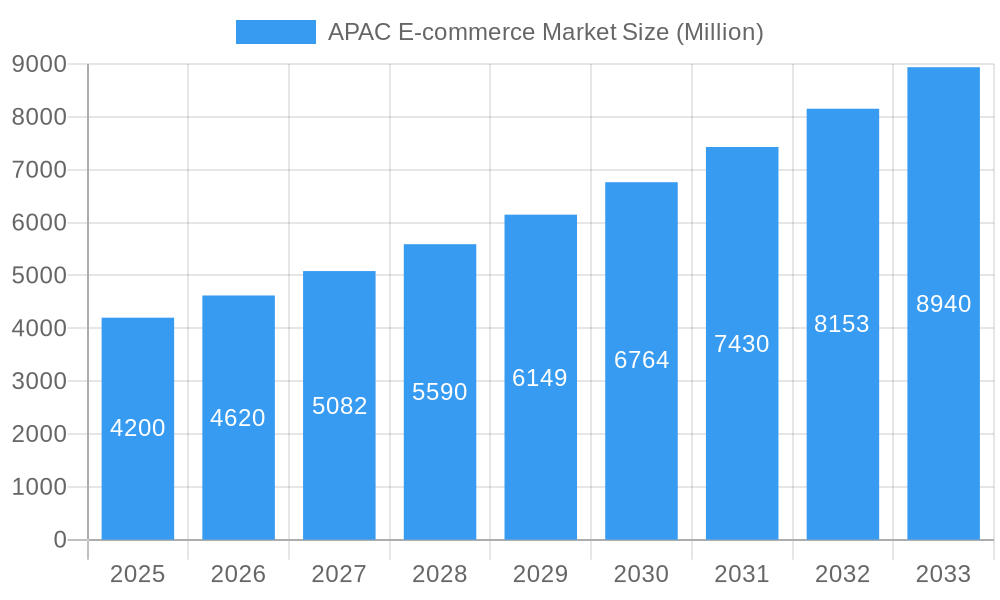

The Asia-Pacific (APAC) e-commerce market, valued at $4.20 billion in 2025, is projected to experience robust growth, driven by rising internet and smartphone penetration, increasing disposable incomes, and a burgeoning young population embracing online shopping. This expansion is further fueled by advancements in digital payment infrastructure, improved logistics and delivery networks, and the increasing adoption of e-commerce platforms by both businesses and consumers across diverse demographics. The market's Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033 signifies significant potential for continued expansion. Key players like Shopify, JD.com, Alibaba, Rakuten, Amazon, and eBay are instrumental in shaping this market, while regional variations exist depending on factors like digital literacy, infrastructure development, and consumer preferences. China and India are currently the dominant markets, exhibiting high growth rates, while countries like Japan and South Korea contribute significantly to the overall market size, reflecting a mature yet still-growing e-commerce landscape. The segmentation by application (e.g., fashion, electronics, groceries) further reveals specific market niches and opportunities for focused growth strategies.

APAC E-commerce Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained growth, driven by factors such as the increasing popularity of mobile commerce, the growth of social commerce platforms, and the expansion of cross-border e-commerce activities within the region. However, challenges remain, including ensuring cybersecurity and data privacy, navigating complex regulatory landscapes, and addressing the digital divide in less developed areas of APAC. Addressing these issues will be crucial to realizing the full potential of the APAC e-commerce market and promoting inclusive digital economic growth across the region. Despite these challenges, the overarching trend suggests a persistently expanding market with significant opportunities for businesses to capitalize on the region's dynamic consumer base and technological advancements.

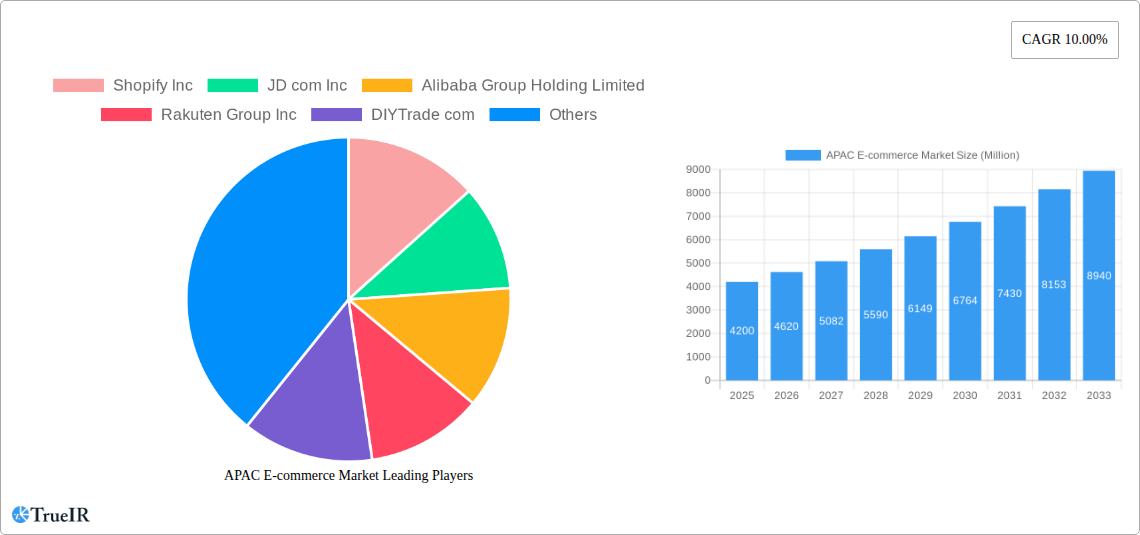

APAC E-commerce Market Company Market Share

APAC E-commerce Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Asia-Pacific e-commerce market, covering its structure, competitive landscape, trends, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for businesses, investors, and stakeholders seeking to navigate this rapidly evolving market. The report leverages extensive data analysis to project a market size exceeding xx Million by 2033, showcasing significant growth opportunities across diverse segments.

APAC E-commerce Market Structure & Competitive Landscape

The APAC e-commerce market exhibits a complex interplay of established giants and emerging players. Market concentration is high, with a few dominant players controlling a significant share. However, the market is far from stagnant; innovation is a key driver, particularly in areas like mobile commerce, artificial intelligence, and personalized shopping experiences. Regulatory impacts vary across countries, with some regions exhibiting more stringent data privacy laws or cross-border trade regulations than others. Product substitutes, such as traditional brick-and-mortar retail, still pose a challenge, though their market share continues to decrease. End-user segmentation is diverse, encompassing various demographics and purchasing behaviors, influenced by factors such as income levels, digital literacy, and cultural preferences. Mergers and acquisitions (M&A) activity is substantial, with larger players seeking to expand their market reach and capabilities through strategic acquisitions. The M&A volume in the past five years totaled approximately xx Million, indicating substantial consolidation. Concentration ratios show a clear dominance by a few key players, with the top 5 controlling approximately xx% of the market.

APAC E-commerce Market Trends & Opportunities

The APAC e-commerce market is characterized by robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a burgeoning middle class. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), exceeding xx Million by 2033. Technological advancements, such as the rise of mobile commerce, the integration of artificial intelligence (AI) and machine learning (ML), and the growing adoption of blockchain technology, are reshaping the landscape, fostering personalization and enhancing the overall shopping experience. Shifting consumer preferences towards convenience, value-for-money, and seamless omnichannel experiences continue to shape the market. Competitive dynamics are intense, with companies constantly vying for market share through innovative product offerings, aggressive pricing strategies, and enhanced customer service. Market penetration rates show significant variation across countries, with developed economies exhibiting higher penetration levels compared to developing economies.

Dominant Markets & Segments in APAC E-commerce Market

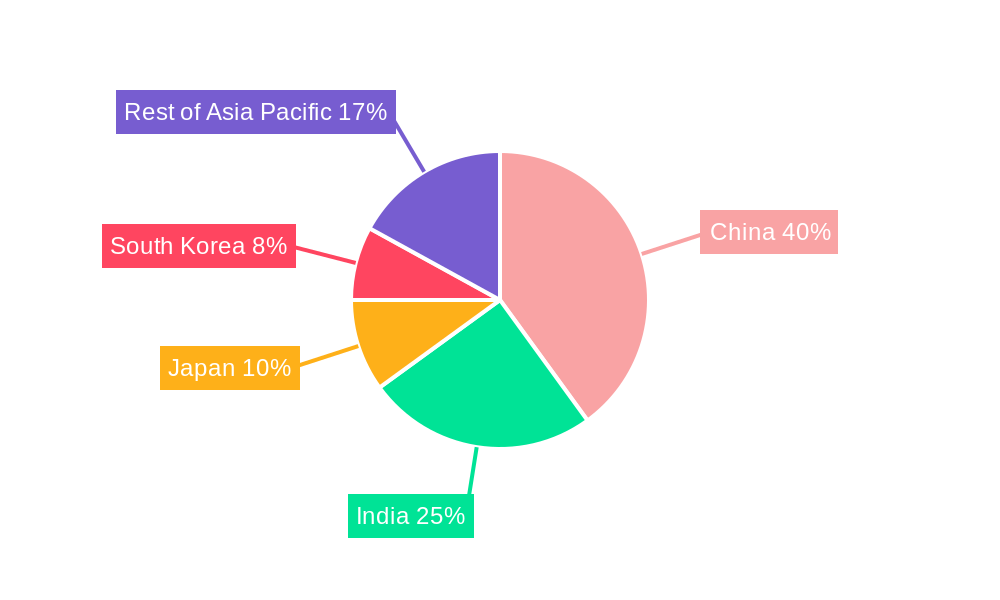

China remains the dominant market in the APAC e-commerce sector, holding the largest market share in terms of both revenue and transaction volume. This dominance is fueled by factors such as a large and rapidly growing consumer base, advanced digital infrastructure, and government support for e-commerce development. Other key markets include India, Japan, South Korea, and Australia. Within market segmentation by application, the fastest-growing segment is xx, driven by increasing consumer demand for convenience and personalized shopping experiences.

Key Growth Drivers in China:

- Extensive digital infrastructure (high internet and smartphone penetration)

- Supportive government policies fostering e-commerce growth

- Large and rapidly growing consumer base with increasing disposable incomes

- Robust logistics and delivery networks

Growth Drivers in Other Key Markets:

- Increasing internet and smartphone penetration

- Rising middle class with increasing disposable incomes

- Government initiatives to promote digital economy

- Growing adoption of e-commerce platforms

APAC E-commerce Market Product Analysis

Product innovation is central to the APAC e-commerce market's dynamism. Advances in mobile technologies, AI-powered personalization tools, and immersive shopping experiences (like augmented reality) are key differentiators. Companies are increasingly leveraging data analytics to understand consumer behavior and tailor their product offerings and marketing strategies accordingly. The success of new products is determined by their ability to seamlessly integrate into consumers' lives, offering convenience, value, and a positive overall shopping experience. Competition is fierce, driven by the need to constantly innovate and provide a superior consumer experience.

Key Drivers, Barriers & Challenges in APAP E-commerce Market

Key Drivers:

Rapidly increasing internet and smartphone penetration, the rise of mobile commerce, growing adoption of digital payments, increasing disposable incomes, and supportive government policies are key drivers. These factors create a conducive environment for e-commerce growth.

Challenges and Restraints:

Challenges include complex regulatory landscapes, supply chain disruptions, cybersecurity threats, the digital divide (unequal access to technology and the internet), and intense competition. These factors can hinder growth, impacting market expansion and profitability. For example, supply chain disruptions can lead to delays and increased costs, while regulatory complexities can create barriers to entry for new players.

Growth Drivers in the APAC E-commerce Market

Technological advancements, particularly in areas like mobile commerce, artificial intelligence, and blockchain, are crucial drivers. Economic factors, such as rising disposable incomes and a growing middle class, fuel consumer spending. Supportive government policies in certain countries further encourage e-commerce development.

Challenges Impacting APAC E-commerce Market Growth

Regulatory hurdles, including data privacy regulations and cross-border trade restrictions, pose significant challenges. Supply chain disruptions, especially those caused by geopolitical events or natural disasters, lead to delays and increased costs. Intense competition, especially among established players, can compress profit margins.

Key Players Shaping the APAC E-commerce Market

- Shopify Inc

- JD.com Inc

- Alibaba Group Holding Limited

- Rakuten Group Inc

- DIYTrade com

- ChinaAseanTrade com

- Amazon.com Inc

- eBay Inc

- Apple Inc

- AliExpress

Significant APAC E-commerce Market Industry Milestones

- February 2023: JD.com, Inc. launched "ChatJD," an AI-powered chatbot focused on retail and finance, signifying the integration of advanced technologies into e-commerce operations.

- April 2023: TMON launched a "Sports & Leisure Special Hall," demonstrating the increasing focus on specialized niche markets and strategic partnerships to enhance consumer engagement.

Future Outlook for APAC E-commerce Market

The APAC e-commerce market is poised for sustained growth, driven by ongoing technological advancements, increasing consumer adoption of digital channels, and expanding market penetration in emerging economies. Strategic opportunities abound for businesses that can leverage these trends effectively, focusing on personalized experiences, seamless omnichannel integration, and innovative payment solutions. The market's potential is immense, with further growth expected across diverse segments and geographies.

APAC E-commerce Market Segmentation

-

1. Product Type

- 1.1. Corn

- 1.2. rice

- 1.3. wheat

- 1.4. soybean

- 1.5. vegetables

-

2. Application

- 2.1. Commercial farming

- 2.2. small-scale farming

-

3. Distribution Channel

- 3.1. Online

- 3.2. offline

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Other APAC countries

APAC E-commerce Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

APAC E-commerce Market Regional Market Share

Geographic Coverage of APAC E-commerce Market

APAC E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disposable Income of Consumers; Increasing Consumer Interest towards Convenient Shopping solutions; Extensive Internet Accessibility

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Corn

- 5.1.2. rice

- 5.1.3. wheat

- 5.1.4. soybean

- 5.1.5. vegetables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial farming

- 5.2.2. small-scale farming

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. offline

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Other APAC countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Corn

- 6.1.2. rice

- 6.1.3. wheat

- 6.1.4. soybean

- 6.1.5. vegetables

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial farming

- 6.2.2. small-scale farming

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. offline

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Other APAC countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India APAC E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Corn

- 7.1.2. rice

- 7.1.3. wheat

- 7.1.4. soybean

- 7.1.5. vegetables

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial farming

- 7.2.2. small-scale farming

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. offline

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Other APAC countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Corn

- 8.1.2. rice

- 8.1.3. wheat

- 8.1.4. soybean

- 8.1.5. vegetables

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial farming

- 8.2.2. small-scale farming

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. offline

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Other APAC countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea APAC E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Corn

- 9.1.2. rice

- 9.1.3. wheat

- 9.1.4. soybean

- 9.1.5. vegetables

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial farming

- 9.2.2. small-scale farming

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. offline

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Other APAC countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Shopify Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 JD com Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alibaba Group Holding Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rakuten Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DIYTrade com

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ChinaAseanTrade com

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amazon com Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 eBay Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Apple Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ali Express

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Shopify Inc

List of Figures

- Figure 1: APAC E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: APAC E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: APAC E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: APAC E-commerce Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: APAC E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: APAC E-commerce Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: APAC E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: APAC E-commerce Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: APAC E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: APAC E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: APAC E-commerce Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 17: APAC E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: APAC E-commerce Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: APAC E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: APAC E-commerce Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: APAC E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 23: APAC E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: APAC E-commerce Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 27: APAC E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: APAC E-commerce Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: APAC E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: APAC E-commerce Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: APAC E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: APAC E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: APAC E-commerce Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: APAC E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: APAC E-commerce Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: APAC E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: APAC E-commerce Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: APAC E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: APAC E-commerce Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: APAC E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: APAC E-commerce Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: APAC E-commerce Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: APAC E-commerce Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 47: APAC E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: APAC E-commerce Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: APAC E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: APAC E-commerce Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-commerce Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the APAC E-commerce Market?

Key companies in the market include Shopify Inc, JD com Inc, Alibaba Group Holding Limited, Rakuten Group Inc, DIYTrade com, ChinaAseanTrade com, Amazon com Inc, eBay Inc, Apple Inc, Ali Express.

3. What are the main segments of the APAC E-commerce Market?

The market segments include Product Type, Application, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Disposable Income of Consumers; Increasing Consumer Interest towards Convenient Shopping solutions; Extensive Internet Accessibility.

6. What are the notable trends driving market growth?

Fashion and Apparel to Witness the Growth.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

April 2023: TMON announced that the company would open a 'Sports & Leisure Special Hall" and introduce popular sports and outdoor items at exceptional prices. An additional 8% discount was also available when paying with Kakao Pay. This is expected to help athletic people stretch in warm spring weather.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-commerce Market?

To stay informed about further developments, trends, and reports in the APAC E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence