Key Insights

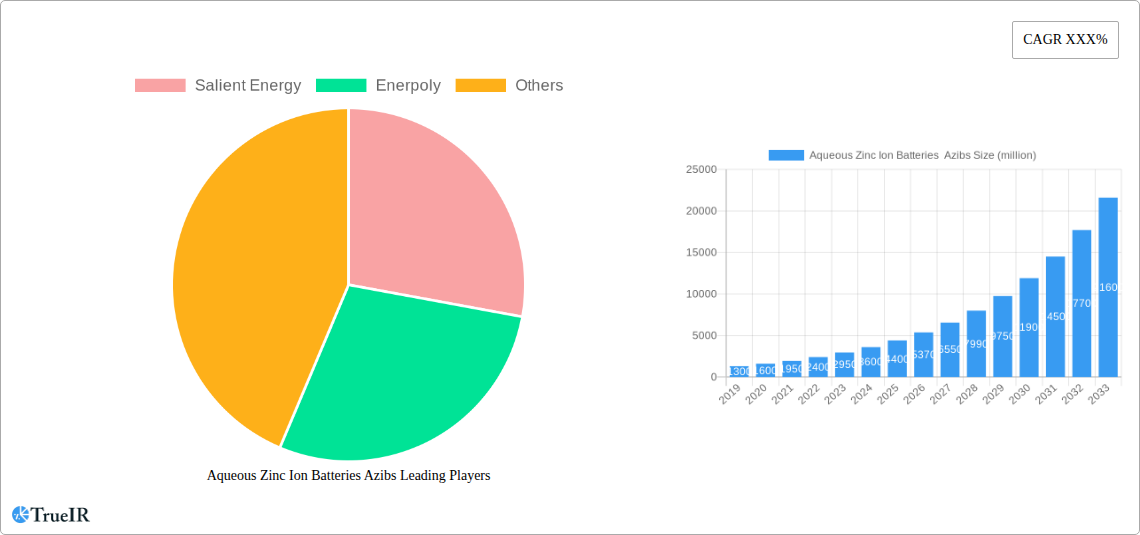

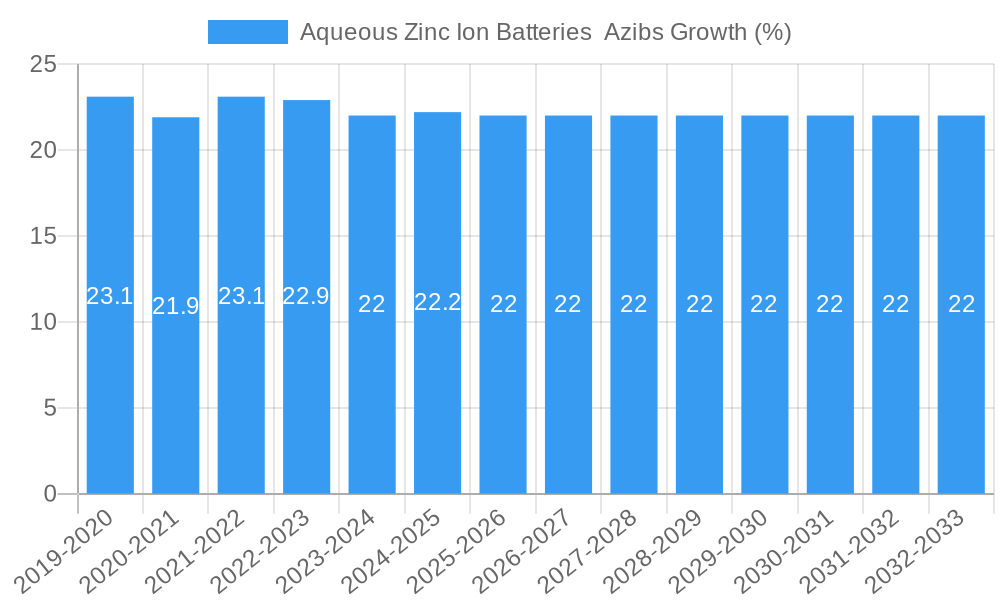

The Aqueous Zinc Ion Battery (AZIB) market is poised for significant expansion, driven by its compelling combination of safety, cost-effectiveness, and environmental friendliness. Expected to reach a substantial market size of approximately $5,500 million by 2025, the sector is projected to grow at a robust Compound Annual Growth Rate (CAGR) of around 22% through 2033. This rapid ascent is fueled by increasing demand from the residential sector, particularly for home energy storage solutions that offer a safer alternative to lithium-ion technologies. Industrial applications are also a key driver, with AZIBs being increasingly explored for grid-scale energy storage, backup power systems, and uninterruptible power supplies (UPS) due to their inherent safety features and extended cycle life. The absence of flammable organic electrolytes makes AZIBs a more sustainable and less hazardous choice, aligning with global sustainability goals and stricter environmental regulations. Innovations in next-generation battery designs and ongoing research into battery under-development stages are further poised to unlock new performance benchmarks, broadening the application spectrum.

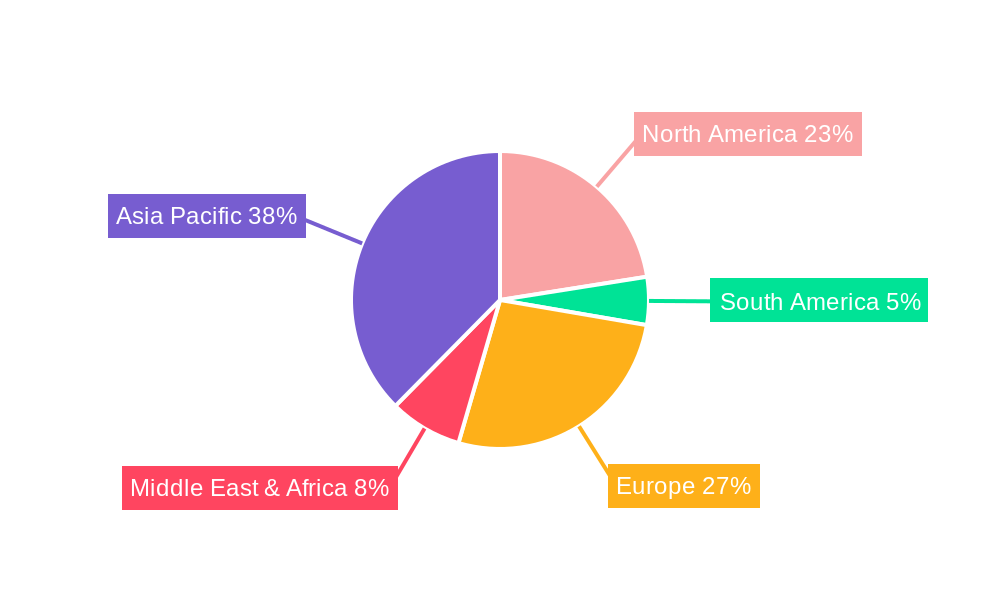

While the market's growth is impressive, certain restraints need to be addressed to fully capitalize on its potential. Current limitations in energy density compared to some advanced lithium-ion chemistries can be a hurdle for applications demanding ultra-compact power solutions. Additionally, the widespread adoption of AZIBs is dependent on further scaling of manufacturing processes to achieve economies of scale and drive down costs, making them even more competitive. However, the inherent advantages in terms of safety, affordability, and reduced environmental impact are strong counterpoints. The market is segmented by application into Residential, Industrial, and Others, with Residential applications showing particularly strong growth potential. On the technology front, Battery Under Development and Next Generation Battery segments highlight the dynamic nature of innovation within the AZIB space, promising improved performance and wider applicability. Companies like Salient Energy and Enerpoly are at the forefront of this innovation, pushing the boundaries of AZIB technology. Geographically, Asia Pacific is expected to lead market share due to its vast manufacturing capabilities and growing demand for energy storage solutions, followed closely by North America and Europe, where sustainability initiatives and grid modernization are driving adoption.

Here's a dynamic, SEO-optimized report description for Aqueous Zinc Ion Batteries (AZIBs), designed for industry audiences and search engines, without requiring further modification:

Unlock critical insights into the burgeoning Aqueous Zinc Ion Batteries (AZIBs) market. This comprehensive report provides an in-depth analysis of market dynamics, technological advancements, and future growth trajectories, essential for stakeholders navigating the next generation of energy storage. Our study encompasses a Study Period of 2019–2033, with a Base Year of 2025 and an Estimated Year also of 2025, followed by a robust Forecast Period of 2025–2033. Historical trends from 2019–2024 are meticulously examined. This report leverages high-volume keywords such as "AZIBs market," "aqueous zinc batteries," "next-generation batteries," "residential energy storage," "industrial battery solutions," and "sustainable battery technology" to maximize search engine visibility and attract relevant industry professionals.

Aqueous Zinc Ion Batteries Azibs Market Structure & Competitive Landscape

The Aqueous Zinc Ion Batteries (AZIBs) market is characterized by a dynamic and evolving competitive landscape. While the market is currently exhibiting moderate concentration, driven by early-stage innovation and a growing number of promising startups, it is poised for significant shifts as commercialization accelerates. Key innovation drivers include the relentless pursuit of enhanced energy density, improved cycle life, and superior safety profiles compared to existing lithium-ion technologies. Regulatory impacts are increasingly shaping the market, with a growing emphasis on sustainable materials and circular economy principles, pushing for AZIBs as a greener alternative. Product substitutes, primarily lithium-ion batteries and emerging solid-state technologies, pose a competitive challenge, but AZIBs offer distinct advantages in terms of cost and safety. End-user segmentation is broadening, with significant potential in both residential and industrial applications. Mergers & Acquisitions (M&A) trends are expected to intensify as larger players seek to integrate promising AZIB technologies, potentially consolidating market share. Current M&A volumes are in the range of xx million dollars, indicating early-stage strategic interest. Concentration ratios for the top 5 players are estimated to be around xx%, highlighting an opportunity for new entrants to capture market share.

Aqueous Zinc Ion Batteries Azibs Market Trends & Opportunities

The Aqueous Zinc Ion Batteries (AZIBs) market is on a trajectory of substantial growth, projected to reach a global market size of over xx million dollars by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of xx%. This expansion is fueled by a confluence of technological breakthroughs, shifting consumer preferences towards sustainable energy solutions, and evolving competitive dynamics. The primary market trend is the increasing demand for safer, more environmentally friendly, and cost-effective battery chemistries. AZIBs are emerging as a strong contender due to their inherent safety benefits, including non-flammability and the use of abundant and low-cost zinc and aqueous electrolytes. Technological shifts are focused on enhancing energy density to compete with established lithium-ion batteries, improving charge/discharge rates, and extending cycle life to meet the demands of various applications. Researchers and companies are actively developing novel electrolyte formulations and electrode materials to overcome existing limitations. Consumer preferences are increasingly leaning towards green technologies, with growing awareness of the environmental impact of traditional battery production and disposal. This growing eco-consciousness is a significant opportunity for AZIBs, which offer a more sustainable lifecycle. The competitive landscape is characterized by intense R&D efforts from both established battery manufacturers and agile startups. Companies are strategically investing in AZIB technology to secure a first-mover advantage in this nascent but rapidly growing market. Opportunities abound for market penetration in sectors such as grid-scale energy storage, electric vehicles (EVs) for certain segments, and portable electronics, where safety and cost are paramount. The estimated market penetration rate for AZIBs is projected to grow from xx% in 2025 to xx% by 2033, reflecting their increasing adoption. The unique selling proposition of AZIBs – their inherent safety and the abundance of zinc – positions them to capture significant market share from incumbent technologies, especially in applications where thermal runaway is a critical concern. The development of advanced manufacturing techniques will also play a crucial role in scaling production and reducing costs, further accelerating market growth.

Dominant Markets & Segments in Aqueous Zinc Ion Batteries Azibs

The Aqueous Zinc Ion Batteries (AZIBs) market's dominance is poised to be significantly influenced by the Residential application segment, driven by the increasing global adoption of distributed energy resources and the growing demand for reliable home energy storage solutions. The Battery Under Development category also represents a crucial segment, as ongoing research and development efforts are continuously refining AZIB performance and cost-effectiveness, paving the way for broader commercial applications.

Residential Application Dominance:

- Key Growth Drivers:

- Decentralized Energy Grids: The shift towards smart grids and microgrids necessitates localized energy storage to ensure grid stability and reliability. AZIBs' inherent safety makes them ideal for deployment in residential environments, mitigating fire risks.

- Renewable Energy Integration: The widespread adoption of rooftop solar photovoltaic (PV) systems creates a strong demand for efficient energy storage solutions to maximize self-consumption and reduce reliance on grid electricity. AZIBs offer a cost-effective and sustainable option for solar energy storage.

- Cost Competitiveness: As production scales up, AZIBs are expected to offer a lower cost per kilowatt-hour (kWh) compared to lithium-ion batteries, making them an attractive investment for homeowners seeking long-term energy savings.

- Policy Support: Government incentives and renewable energy targets are further encouraging the adoption of residential energy storage systems, directly benefiting the AZIB market.

- Key Growth Drivers:

Battery Under Development Segment:

- Key Growth Drivers:

- Performance Enhancement: Continuous innovation in electrode materials (e.g., novel zinc alloys, advanced cathode materials) and electrolyte formulations is leading to significant improvements in energy density, power density, and cycle life. This ongoing development is critical for unlocking new market opportunities.

- Manufacturing Advancements: Innovations in manufacturing processes, including roll-to-roll production and improved electrode coating techniques, are crucial for scaling up AZIB production and reducing manufacturing costs. This segment is where the foundational technologies are being solidified.

- Safety and Sustainability Focus: The inherent safety advantages of AZIBs are a primary research focus, aiming to eliminate any potential safety concerns and further differentiate them from other battery chemistries. The use of abundant and eco-friendly materials is also a key driver of development.

- Diversification of Applications: As performance improves, AZIBs are being explored for a wider range of applications beyond stationary storage, including electric mobility and specialized industrial uses, driven by the progress made in this developmental stage.

- Key Growth Drivers:

The Industrial segment also presents substantial growth potential, driven by the need for large-scale energy storage for grid stabilization, peak shaving, and backup power. However, the residential sector, with its immediate need for cost-effective and safe energy storage for renewable energy integration, is anticipated to be the initial dominant market for AZIBs. The "Others" segment, encompassing niche applications and emerging markets, will also contribute to overall growth as the technology matures.

Aqueous Zinc Ion Batteries Azibs Product Analysis

Aqueous Zinc Ion Batteries (AZIBs) are emerging as a compelling alternative to conventional battery technologies, driven by significant product innovations focused on enhanced safety, sustainability, and cost-effectiveness. Key product advancements include the development of novel cathode materials that improve energy density and cycle life, alongside refined aqueous electrolytes that enhance ion mobility and battery stability. These improvements translate into competitive advantages such as non-flammability, reduced environmental impact due to the use of abundant and eco-friendly materials like zinc, and a lower manufacturing cost. AZIBs are finding promising applications in grid-scale energy storage, residential backup power, and potentially in certain electric vehicle segments where safety and cost are paramount.

Key Drivers, Barriers & Challenges in Aqueous Zinc Ion Batteries Azibs

Key Drivers: The AZIB market is propelled by several critical factors. Technologically, the pursuit of safer and more sustainable energy storage solutions is a primary driver, with AZIBs offering inherent non-flammability and utilizing abundant materials. Economically, the lower projected cost of zinc and aqueous electrolytes compared to lithium and cobalt presents a significant advantage for market penetration, particularly in large-scale applications. Policy-driven factors, such as government mandates for renewable energy adoption and carbon footprint reduction, further encourage the development and deployment of AZIBs. For example, increasing investments in grid modernization and the need for resilient energy infrastructure are directly benefiting AZIBs.

Barriers & Challenges: Despite promising drivers, the AZIB market faces several hurdles. Supply chain issues for specific advanced electrode materials or manufacturing components, while not as critical as for some rare earth elements in lithium-ion batteries, can still impact scalability. Regulatory hurdles related to standardization and safety certifications for novel battery chemistries can slow down market adoption. Competitive pressures from mature lithium-ion battery technologies, which benefit from established infrastructure and economies of scale, remain a significant challenge. Additionally, overcoming the lower energy density compared to some lithium-ion chemistries is an ongoing research and development challenge, although significant progress is being made.

Growth Drivers in the Aqueous Zinc Ion Batteries Azibs Market

The growth of the Aqueous Zinc Ion Batteries (AZIBs) market is primarily driven by the escalating global demand for safe, sustainable, and cost-effective energy storage solutions. Technologically, advancements in electrode materials and electrolyte formulations are continuously improving AZIB performance, making them increasingly competitive. Economically, the abundance and low cost of zinc and aqueous electrolytes offer a significant advantage over lithium-ion batteries, appealing to price-sensitive markets. Policy incentives and environmental regulations promoting renewable energy integration and carbon emission reductions are creating a favorable market landscape, encouraging the adoption of greener battery technologies.

Challenges Impacting Aqueous Zinc Ion Batteries Azibs Growth

Several challenges are impacting the growth trajectory of the Aqueous Zinc Ion Batteries (AZIBs) market. Regulatory complexities surrounding the certification and standardization of new battery chemistries can create delays in commercial deployment. Supply chain vulnerabilities for specialized components or precursors, though less pronounced than for some other battery chemistries, still need to be addressed for large-scale manufacturing. Intense competitive pressure from established lithium-ion battery manufacturers, who benefit from existing infrastructure and economies of scale, poses a significant market barrier. Furthermore, ongoing efforts to increase the energy density and cycle life of AZIBs to match or exceed lithium-ion capabilities remain a critical technical challenge.

Key Players Shaping the Aqueous Zinc Ion Batteries Azibs Market

- Salient Energy

- Enerpoly

- xx

Significant Aqueous Zinc Ion Batteries Azibs Industry Milestones

- 2019: Initial research breakthroughs in advanced aqueous electrolytes demonstrating improved stability.

- 2020: Emergence of early-stage startups focusing on commercializing AZIB technology.

- 2021: Significant private investment rounds for key AZIB developers, indicating growing industry confidence.

- 2022: First pilot production lines established for AZIB cells, paving the way for larger-scale manufacturing.

- 2023: Successful demonstration projects showcasing AZIBs in residential and small-scale industrial applications.

- 2024: Announcement of strategic partnerships between AZIB companies and established energy sector players.

- 2025: Projected widespread commercial product launches and increased market penetration.

Future Outlook for Aqueous Zinc Ion Batteries Azibs Market

- 2019: Initial research breakthroughs in advanced aqueous electrolytes demonstrating improved stability.

- 2020: Emergence of early-stage startups focusing on commercializing AZIB technology.

- 2021: Significant private investment rounds for key AZIB developers, indicating growing industry confidence.

- 2022: First pilot production lines established for AZIB cells, paving the way for larger-scale manufacturing.

- 2023: Successful demonstration projects showcasing AZIBs in residential and small-scale industrial applications.

- 2024: Announcement of strategic partnerships between AZIB companies and established energy sector players.

- 2025: Projected widespread commercial product launches and increased market penetration.

Future Outlook for Aqueous Zinc Ion Batteries Azibs Market

The future outlook for the Aqueous Zinc Ion Batteries (AZIBs) market is exceptionally promising, driven by an increasing global emphasis on sustainable and safe energy storage. Strategic opportunities lie in expanding applications in grid-scale energy storage, residential backup power systems, and potentially in niche electric vehicle segments. Continued R&D will focus on further enhancing energy density and cycle life, while manufacturing innovations will drive down costs, making AZIBs a formidable competitor to existing battery technologies. The inherent safety and eco-friendly nature of AZIBs position them as a key enabler of the global transition to a cleaner energy future.

Aqueous Zinc Ion Batteries Azibs Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Industrial

- 1.3. Others

-

2. Type

- 2.1. Battery Under Development

- 2.2. Next Generation Battery

Aqueous Zinc Ion Batteries Azibs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aqueous Zinc Ion Batteries Azibs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Industrial

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Battery Under Development

- 5.2.2. Next Generation Battery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Industrial

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Battery Under Development

- 6.2.2. Next Generation Battery

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Industrial

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Battery Under Development

- 7.2.2. Next Generation Battery

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Industrial

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Battery Under Development

- 8.2.2. Next Generation Battery

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Industrial

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Battery Under Development

- 9.2.2. Next Generation Battery

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aqueous Zinc Ion Batteries Azibs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Industrial

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Battery Under Development

- 10.2.2. Next Generation Battery

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Salient Energy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Enerpoly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.1 Salient Energy

List of Figures

- Figure 1: Global Aqueous Zinc Ion Batteries Azibs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Application 2024 & 2032

- Figure 3: North America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Type 2024 & 2032

- Figure 5: North America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Country 2024 & 2032

- Figure 7: North America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Application 2024 & 2032

- Figure 9: South America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Type 2024 & 2032

- Figure 11: South America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Aqueous Zinc Ion Batteries Azibs Revenue (million), by Country 2024 & 2032

- Figure 13: South America Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Aqueous Zinc Ion Batteries Azibs Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Aqueous Zinc Ion Batteries Azibs Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Aqueous Zinc Ion Batteries Azibs Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Aqueous Zinc Ion Batteries Azibs Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Aqueous Zinc Ion Batteries Azibs Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aqueous Zinc Ion Batteries Azibs?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Aqueous Zinc Ion Batteries Azibs?

Key companies in the market include Salient Energy, Enerpoly.

3. What are the main segments of the Aqueous Zinc Ion Batteries Azibs?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aqueous Zinc Ion Batteries Azibs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aqueous Zinc Ion Batteries Azibs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aqueous Zinc Ion Batteries Azibs?

To stay informed about further developments, trends, and reports in the Aqueous Zinc Ion Batteries Azibs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence