Key Insights

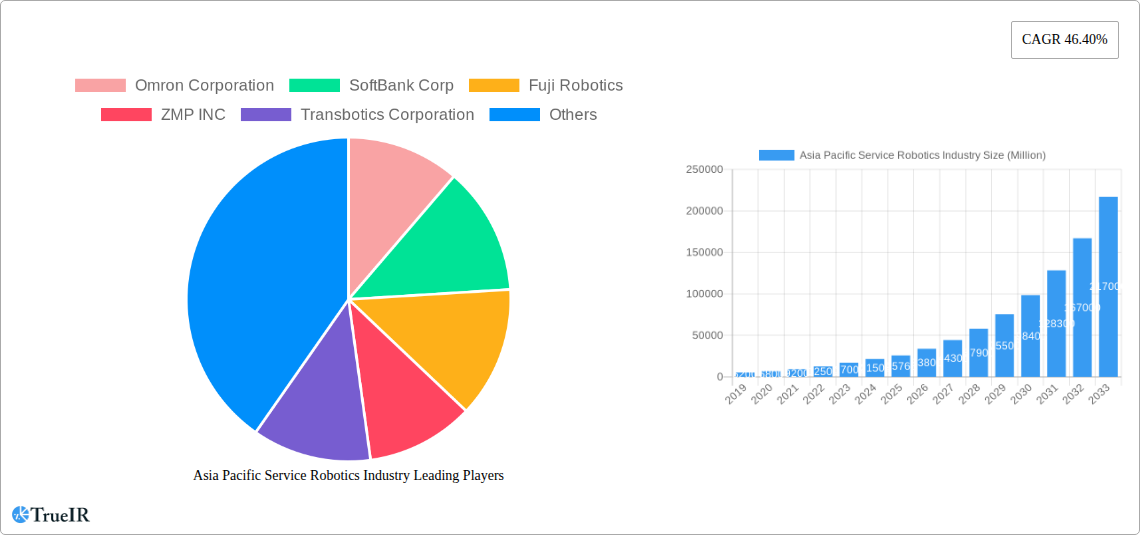

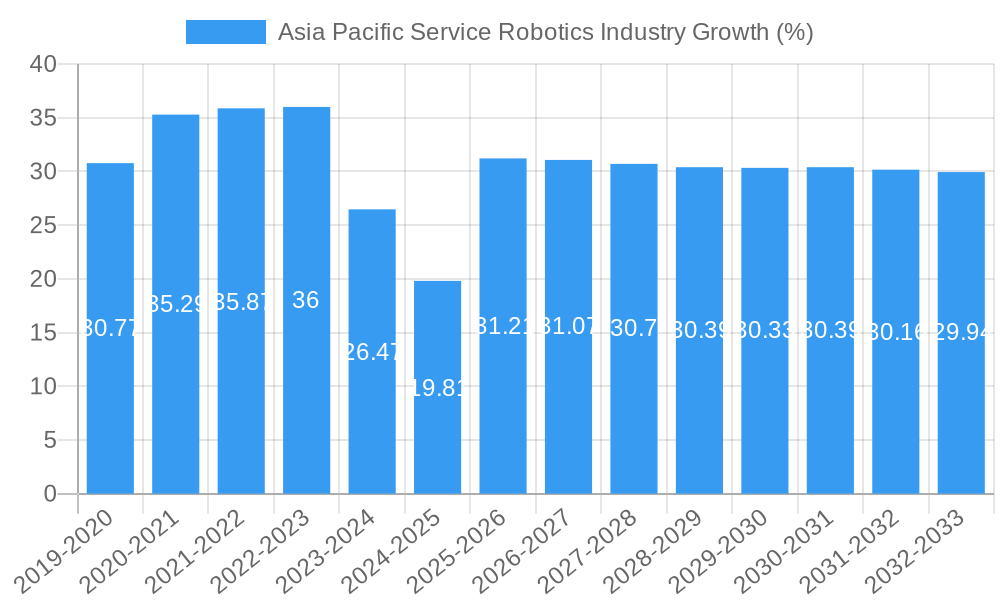

The Asia Pacific service robotics market is poised for unprecedented growth, driven by a remarkable CAGR of 46.40% and an estimated market size of USD 25,760 Million in 2025. This surge is fueled by rapid technological advancements, increasing adoption in key sectors like healthcare and logistics, and government initiatives promoting automation. The region's dynamic economic landscape, particularly in China and Japan, is a significant contributor to this expansion. Professional robots, encompassing logistic systems, medical robots, and public relation robots, are expected to lead the charge, supported by investments in sophisticated manufacturing and smart city development. Personal robots, including domestic and entertainment variants, are also gaining traction as disposable incomes rise and consumer demand for convenience and engagement grows.

The forecast period from 2025 to 2033 anticipates sustained high growth, with the market value projected to reach approximately USD 70,480 Million by 2033. Key drivers include the escalating need for efficiency and labor augmentation in industries like agriculture, construction, and transportation, where service robots can perform complex and hazardous tasks. Furthermore, the burgeoning healthcare sector is leveraging medical robots for surgery, patient care, and rehabilitation, addressing an aging population and a demand for advanced medical treatments. Restraints, such as the high initial investment cost of sophisticated robotics and the need for skilled personnel for operation and maintenance, are being gradually mitigated by falling technology prices and increasing availability of specialized training programs. Emerging trends like the integration of AI and IoT in service robots are further enhancing their capabilities and market appeal, promising a future where robots are integral to everyday life and industrial operations across the Asia Pacific.

Asia Pacific Service Robotics Industry Market Structure & Competitive Landscape

The Asia Pacific service robotics market is characterized by a moderately consolidated structure, with a blend of established global players and emerging regional innovators. The concentration ratio in key segments like logistic systems and medical robots is estimated to be around 55% in the base year 2025, indicating a significant market share held by the top 5-7 companies. Innovation is a primary driver, with companies heavily investing in R&D for advanced AI, machine learning, and sophisticated sensor technologies to enhance robot functionality and autonomy. The regulatory impact varies across nations, with some governments actively promoting robotics adoption through subsidies and favorable policies, while others present more complex compliance frameworks. Product substitutes are a growing concern, particularly in personal robotics, where advancements in smart home devices and IoT offer alternative solutions. End-user segmentation reveals a strong preference for professional robots in the transportation and logistics and healthcare sectors, driven by the need for increased efficiency and precision. M&A trends are on the rise, with an estimated volume of 15-20 significant M&A deals projected between 2025 and 2033, aimed at consolidating market share, acquiring new technologies, and expanding geographical reach.

- Market Concentration: Moderately consolidated with significant presence of both global and regional players.

- Innovation Drivers: AI, machine learning, advanced sensors, and autonomous capabilities.

- Regulatory Impact: Varies by country; supportive policies in some, complex frameworks in others.

- Product Substitutes: Growing competition from smart home devices and IoT in personal robotics.

- End-User Segmentation: Strong demand for professional robots in Transportation & Logistics and Healthcare.

- M&A Trends: Increasing activity for market consolidation and technology acquisition.

Asia Pacific Service Robotics Industry Market Trends & Opportunities

The Asia Pacific service robotics industry is poised for substantial growth, with a projected market size of approximately $55 Billion in the base year 2025 and an anticipated CAGR of 18.5% during the forecast period of 2025-2033. This robust expansion is fueled by a confluence of factors, including rapid technological advancements, increasing labor costs, and a growing demand for automation across diverse sectors. The market is experiencing a significant shift towards more sophisticated and versatile robots capable of performing complex tasks in unstructured environments. Technological shifts are prominently visible in the integration of advanced AI, sophisticated computer vision, and enhanced dexterity in robotic arms, leading to improved performance and wider application possibilities.

Consumer preferences are also evolving, with a rising demand for robots that offer enhanced user experience, safety, and personalized functionalities, particularly within the personal robots segment for domestic and elderly assistance. Competitive dynamics are intensifying, with established players like Omron Corporation, SoftBank Corp, and Hyundai Robotics investing heavily in R&D and strategic partnerships to maintain their market leadership. Simultaneously, emerging players such as SIASUN Robot & Automation Co Ltd and UBTECH Robotics Inc are rapidly gaining traction by offering cost-effective solutions and focusing on niche applications.

The market penetration rate for service robots is expected to climb from an estimated 25% in 2024 to over 40% by 2033, indicating significant untapped potential. Opportunities abound in sectors such as healthcare, where medical robots are revolutionizing surgical procedures and patient care; transportation and logistics, with autonomous mobile robots (AMRs) transforming warehousing and supply chain operations; and agriculture, where robotic solutions are enhancing crop management and harvesting efficiency. Furthermore, government initiatives and increasing investments in smart city infrastructure are creating fertile ground for the deployment of public relation robots and robots for infrastructure maintenance. The growing adoption of Industry 4.0 principles across manufacturing and service industries further underscores the transformative role of service robotics. The increasing per capita income and a growing middle class in many Asia Pacific nations are also contributing to the demand for personal robots, particularly for domestic chores and entertainment.

Dominant Markets & Segments in Asia Pacific Service Robotics Industry

The Asia Pacific service robotics industry is witnessing significant dominance across several key markets and segments. In terms of geographical dominance, China is expected to lead the market, driven by its vast manufacturing base, supportive government policies, and substantial investment in AI and automation technologies. Countries like Japan and South Korea also represent significant markets, with advanced technological infrastructure and a high propensity for adopting cutting-edge robotics.

Within the Type segmentation, Professional Robots are currently the dominant category, projected to account for over 70% of the total market share in 2025.

- Logistic systems are a primary growth driver within professional robots, propelled by the booming e-commerce sector and the need for efficient warehouse automation. Major contributors to this segment include companies like SoftBank Corp and ZMP INC.

- Medical robots are also experiencing rapid adoption, fueled by an aging population, increasing healthcare expenditures, and the demand for minimally invasive surgical procedures. Omron Corporation and Hyundai Robotics are key players in this high-growth segment.

- Powered Human Exoskeletons are gaining traction in industrial applications for worker augmentation and in rehabilitation settings.

- Public relation robots are finding increasing use in customer service, education, and tourism, enhancing user engagement and providing information.

The Personal Robots segment, while smaller in current market share, is exhibiting strong growth potential.

- Domestic robots, such as robotic vacuum cleaners and lawnmowers, are becoming mainstream due to convenience and increasing disposable incomes. Ecovacs Robotics Co Ltd is a prominent player in this area.

- Entertainment robots are appealing to a younger demographic and are finding applications in education and interactive experiences. Yukai Engineering Inc is notable here.

- Elderly and Handicap Assistance robots represent a critical and rapidly expanding area, addressing the needs of an aging population and enhancing independence for individuals with disabilities.

In terms of Application segmentation, the Transportation and Logistics sector is the largest contributor, driven by the need for efficiency in supply chains and warehousing. This is followed closely by the Healthcare sector, where medical robots are transforming patient care and surgical outcomes.

- Military and Defense applications are seeing increased investment in robotic systems for surveillance, reconnaissance, and logistical support.

- Agriculture is a growing application area, with robots being deployed for precision farming, automated harvesting, and crop monitoring.

- Construction and Mining are adopting robotics for hazardous tasks, improving safety and productivity.

- Government sectors are utilizing robots for public safety, inspection, and infrastructure maintenance.

Asia Pacific Service Robotics Industry Product Analysis

The Asia Pacific service robotics industry is characterized by a rapid influx of innovative products designed to meet diverse end-user needs. Key product advancements focus on enhancing autonomy, dexterity, and human-robot interaction. Logistic systems now feature advanced navigation and object recognition capabilities, enabling seamless warehouse operations. Medical robots are exhibiting greater precision in surgical procedures, aided by sophisticated AI algorithms and haptic feedback systems. In personal robotics, domestic robots are becoming more intelligent, learning user preferences and adapting to home environments. The competitive advantage for many companies lies in their ability to integrate cutting-edge AI and machine learning into their robotic platforms, offering superior performance and greater value to customers.

Key Drivers, Barriers & Challenges in Asia Pacific Service Robotics Industry

Key Drivers: The Asia Pacific service robotics market is propelled by several key drivers. Technological advancements, particularly in AI, machine learning, and sensor technology, are enabling the development of more sophisticated and capable robots. Economic factors, including rising labor costs and the pursuit of increased productivity, are compelling industries to adopt automation. Government initiatives and supportive policies in countries like China and South Korea, offering subsidies and R&D funding, are accelerating market growth. The growing demand for automation in sectors like healthcare and logistics, driven by efficiency needs and an aging population, further fuels adoption.

Barriers & Challenges: Despite the growth, several barriers and challenges impact the Asia Pacific service robotics industry. High upfront investment costs for robotic systems can be a deterrent for small and medium-sized enterprises (SMEs). Regulatory complexities and the lack of standardized safety protocols in some regions can hinder widespread deployment. Supply chain disruptions and the dependence on specialized components can also pose challenges. Intense competition from established players and emerging startups necessitates continuous innovation and cost optimization, leading to price pressures. The need for skilled personnel for robot operation, maintenance, and programming is another significant challenge.

Growth Drivers in the Asia Pacific Service Robotics Industry Market

The growth of the Asia Pacific service robotics industry is primarily driven by technological advancements and economic imperatives. The increasing sophistication of artificial intelligence, coupled with breakthroughs in sensor technology and machine learning, is enabling robots to perform more complex and autonomous tasks. Economically, rising labor costs across the region and the relentless pursuit of enhanced productivity and operational efficiency are compelling businesses to invest in robotic solutions. Government initiatives in key markets, such as China and South Korea, that promote automation through subsidies, tax incentives, and R&D funding, are further accelerating market penetration. The aging demographic in many Asia Pacific countries also creates a significant demand for assistive robots in healthcare and elder care sectors, acting as a strong growth catalyst.

Challenges Impacting Asia Pacific Service Robotics Industry Growth

Several challenges impact the growth trajectory of the Asia Pacific service robotics industry. The high initial capital investment required for robotic systems can be a significant barrier for many businesses, particularly small and medium-sized enterprises. Regulatory hurdles and the absence of standardized safety and operational frameworks in certain countries can impede widespread adoption and integration. Furthermore, complex supply chains and reliance on imported components for advanced robotics can lead to vulnerabilities and price fluctuations. Intense competition, both from established global players and agile local manufacturers, necessitates continuous innovation and cost-effectiveness, leading to considerable market pressure. The shortage of skilled labor capable of operating, maintaining, and programming these sophisticated machines also presents a substantial challenge.

Key Players Shaping the Asia Pacific Service Robotics Industry Market

- Omron Corporation

- SoftBank Corp

- Fuji Robotics

- ZMP INC

- Transbotics Corporation

- CtrlWorks Pte Ltd

- Aubot Pty Ltd

- SIASUN Robot & Automation Co Ltd

- Yukai Engineering Inc

- iRobot Corporation

- Minirobot

- Hyundai Robotics

- LG Electronics Inc

- Inbot Technology Ltd

- Ecovacs Robotics Co Ltd

- FBR Ltd

- Robomation

- UBTECH Robotics Inc

- Machine Development Technology Co Ltd

- Hanwha Corporation

- Shandong Guoxing Intelligent Technology Co Ltd

- Robosoft Technologies Private Limited

- Milagrow HumanTech

- AiTreat

- Rainbow Robotics Co Ltd

Significant Asia Pacific Service Robotics Industry Industry Milestones

- 2020/04: Omron Corporation launches its next-generation mobile robots, enhancing logistics automation capabilities.

- 2021/07: SoftBank Corp. invests in AI-powered robotics startups to expand its service robot portfolio.

- 2022/01: Fuji Robotics announces a strategic partnership to develop advanced robotic solutions for the healthcare sector.

- 2022/08: ZMP INC. secures funding for autonomous driving robot development.

- 2023/03: Hyundai Robotics unveils a new collaborative robot designed for manufacturing efficiency.

- 2023/09: SIASUN Robot & Automation Co Ltd expands its product line with industrial and service robots for diverse applications.

- 2024/02: UBTECH Robotics Inc. showcases humanoid robots with advanced AI capabilities at a major tech expo.

- 2024/07: Ecovacs Robotics Co Ltd introduces AI-powered domestic robots with enhanced navigation and cleaning performance.

- 2025/01: A major industry consortium announces significant investment in R&D for next-generation medical robotics.

- 2025/06: Government of Japan announces new incentives to promote the adoption of service robots in the agricultural sector.

Future Outlook for Asia Pacific Service Robotics Industry Market

The future outlook for the Asia Pacific service robotics industry is exceptionally promising, driven by a persistent demand for automation, ongoing technological innovation, and supportive government policies. The market is expected to witness a surge in the deployment of more intelligent, adaptable, and human-centric robots across a broader spectrum of applications. Strategic opportunities lie in the continued expansion of robotic solutions within healthcare for assisted living and remote patient monitoring, as well as in logistics for hyper-efficient supply chains. The increasing acceptance and demand for personal robots in domestic and entertainment settings also present a significant growth avenue. Furthermore, advancements in AI and edge computing will enable robots to operate with greater autonomy and perform tasks in increasingly complex and dynamic environments, solidifying service robotics as a cornerstone of future economic development and societal well-being in the Asia Pacific region.

Asia Pacific Service Robotics Industry Segmentation

-

1. Type

-

1.1. Professional Robots

- 1.1.1. Logistic systems

- 1.1.2. Medical robots

- 1.1.3. Powered Human Exoskeletons

- 1.1.4. Public relation robots

-

1.2. Personal Robots

- 1.2.1. Domestic

- 1.2.2. Entertainment

- 1.2.3. Elderly and Handicap Assistance

-

1.1. Professional Robots

-

2. Application

- 2.1. Military and Defense

- 2.2. Agriculture, Construction, and Mining

- 2.3. Transportation and Logistics

- 2.4. Healthcare

- 2.5. Government

- 2.6. Other Applications

Asia Pacific Service Robotics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Service Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 46.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Automated Solutions from Dynamic Industries and Robot Innovations; Increased Demand for Professional Robots in Healthcare

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Installation

- 3.4. Market Trends

- 3.4.1. Logistic Systems is Expected to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Professional Robots

- 5.1.1.1. Logistic systems

- 5.1.1.2. Medical robots

- 5.1.1.3. Powered Human Exoskeletons

- 5.1.1.4. Public relation robots

- 5.1.2. Personal Robots

- 5.1.2.1. Domestic

- 5.1.2.2. Entertainment

- 5.1.2.3. Elderly and Handicap Assistance

- 5.1.1. Professional Robots

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Defense

- 5.2.2. Agriculture, Construction, and Mining

- 5.2.3. Transportation and Logistics

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Omron Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SoftBank Corp

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fuji Robotics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ZMP INC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Transbotics Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 CtrlWorks Pte Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Aubot Pty Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 SIASUN Robot & Automation Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Yukai Engineering Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 iRobot Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Minirobot

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Hyundai Robotics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 LG Electronics Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Inbot Technology Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Ecovacs Robotics Co Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 FBR Ltd

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Robomation

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 UBTECH Robotics Inc

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Machine Development Technology Co Ltd

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Hanwha Corporation

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Shandong Guoxing Intelligent Technology Co Ltd

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 Robosoft Technologies Private Limited

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 Milagrow HumanTech

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.24 AiTreat

- 13.2.24.1. Overview

- 13.2.24.2. Products

- 13.2.24.3. SWOT Analysis

- 13.2.24.4. Recent Developments

- 13.2.24.5. Financials (Based on Availability)

- 13.2.25 Rainbow Robotics Co Ltd

- 13.2.25.1. Overview

- 13.2.25.2. Products

- 13.2.25.3. SWOT Analysis

- 13.2.25.4. Recent Developments

- 13.2.25.5. Financials (Based on Availability)

- 13.2.1 Omron Corporation

List of Figures

- Figure 1: Asia Pacific Service Robotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Service Robotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Service Robotics Industry?

The projected CAGR is approximately 46.40%.

2. Which companies are prominent players in the Asia Pacific Service Robotics Industry?

Key companies in the market include Omron Corporation, SoftBank Corp, Fuji Robotics, ZMP INC, Transbotics Corporation, CtrlWorks Pte Ltd, Aubot Pty Ltd, SIASUN Robot & Automation Co Ltd, Yukai Engineering Inc, iRobot Corporation, Minirobot, Hyundai Robotics, LG Electronics Inc, Inbot Technology Ltd, Ecovacs Robotics Co Ltd, FBR Ltd, Robomation, UBTECH Robotics Inc, Machine Development Technology Co Ltd, Hanwha Corporation, Shandong Guoxing Intelligent Technology Co Ltd, Robosoft Technologies Private Limited, Milagrow HumanTech, AiTreat, Rainbow Robotics Co Ltd.

3. What are the main segments of the Asia Pacific Service Robotics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Automated Solutions from Dynamic Industries and Robot Innovations; Increased Demand for Professional Robots in Healthcare.

6. What are the notable trends driving market growth?

Logistic Systems is Expected to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

; High Cost of Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Service Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Service Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Service Robotics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Service Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence