Key Insights

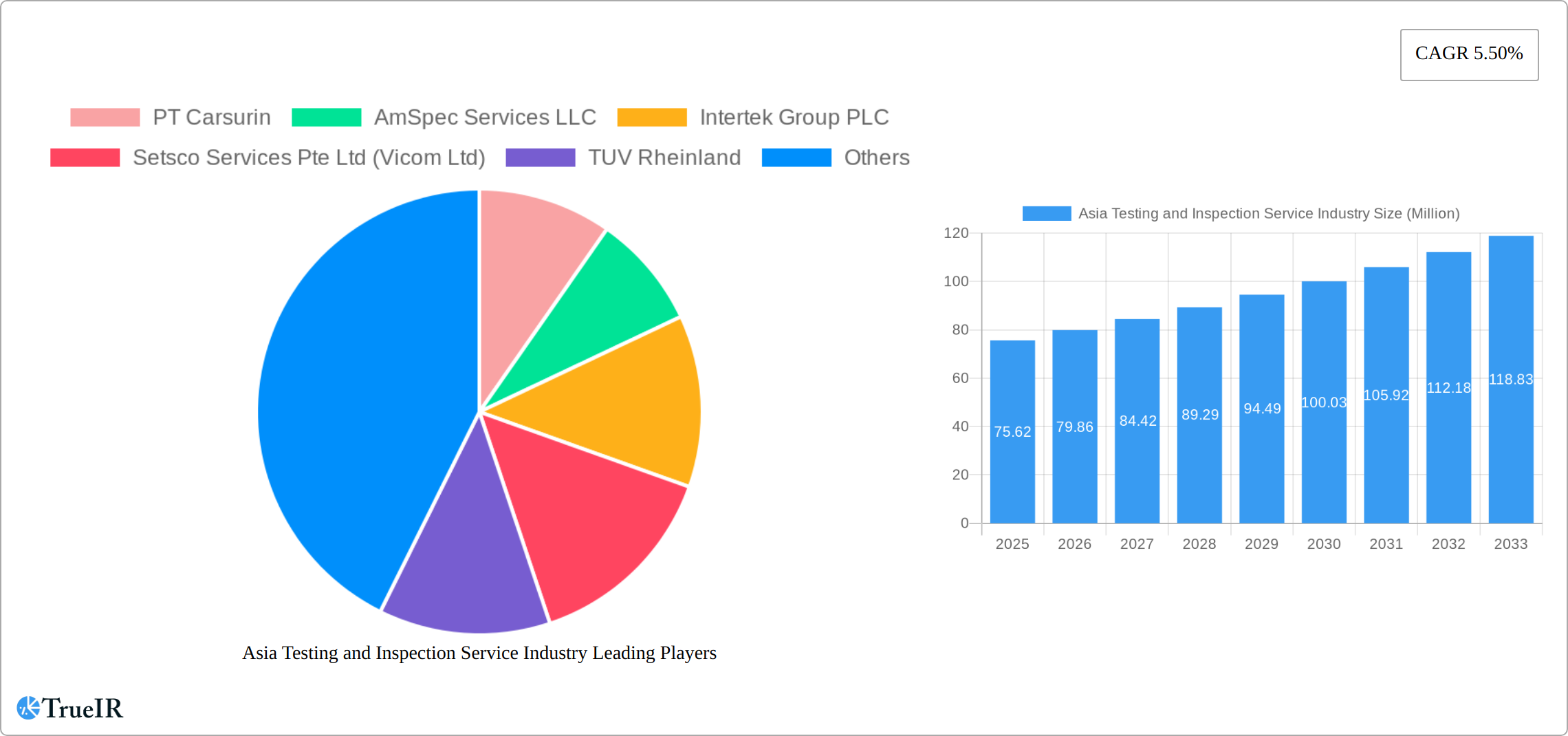

The Asia-Pacific Testing and Inspection Services market, valued at $75.62 million in 2025, is projected to experience robust growth, driven by several key factors. The region's burgeoning industrialization, particularly in manufacturing, automotive, and infrastructure sectors, fuels a significant demand for quality assurance and compliance testing. Stringent government regulations across countries like China, India, and Japan are further driving market expansion, compelling businesses to prioritize testing and inspection to meet safety and environmental standards. Growth is also fueled by increasing consumer awareness of product safety and quality, leading to higher demand for third-party verification services. The outsourcing trend within businesses, aiming for cost optimization and specialization, also contributes positively to market expansion. While specific data on individual segment growth isn't available, it's reasonable to assume that the industrial manufacturing, automotive and transportation, and building and infrastructure segments will be the leading contributors, given their high growth potential and regulatory pressures within Asia-Pacific.

Asia Testing and Inspection Service Industry Market Size (In Million)

The market's growth trajectory, exhibiting a Compound Annual Growth Rate (CAGR) of 5.50%, suggests continuous expansion through 2033. However, certain challenges may moderate this growth. These could include economic fluctuations impacting investment in infrastructure projects, or potential variations in regulatory frameworks across different Asian nations. Nevertheless, the long-term prospects remain positive, given Asia's sustained economic development and increasing focus on quality and safety across various industries. The competitive landscape is characterized by a mix of global players and regional service providers, resulting in a dynamic market where innovation and specialization become key differentiators for success. The prevalence of both in-house and outsourced testing and inspection services indicates a flexible market structure catering to varied client needs and organizational structures.

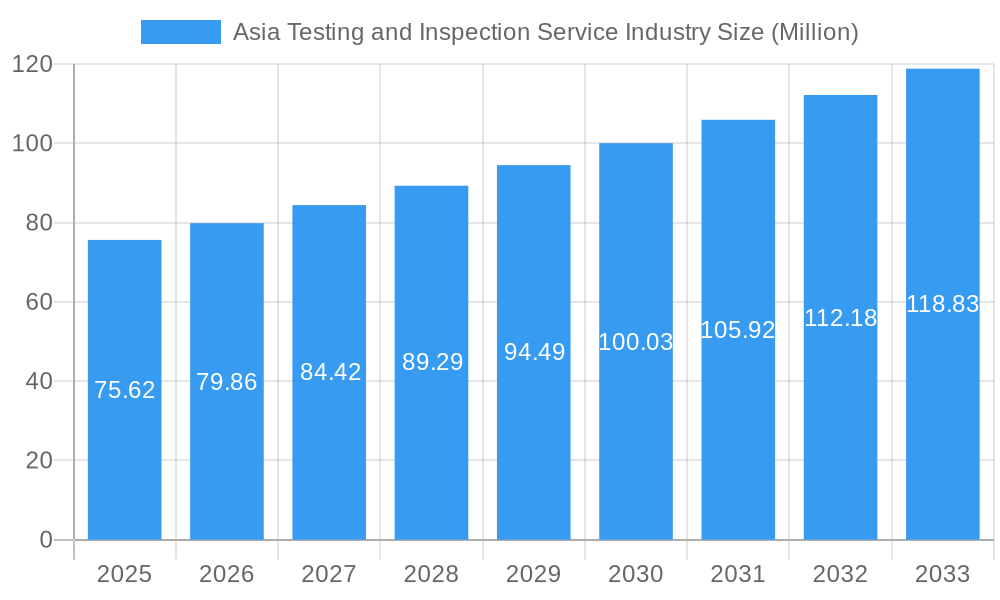

Asia Testing and Inspection Service Industry Company Market Share

Asia Testing and Inspection Service Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Asia Testing and Inspection Service industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a focus on market trends, competitive dynamics, and future growth opportunities, this report covers the period from 2019 to 2033, with a base year of 2025. The study encompasses key segments, including service types, end-users, countries, and outsourcing models, providing a granular understanding of this rapidly evolving market. The report projects a market value of xx Million by 2033, fueled by significant growth drivers and substantial market opportunities across various sectors.

Asia Testing and Inspection Service Industry Market Structure & Competitive Landscape

The Asia Testing and Inspection service industry presents a moderately concentrated market structure, dominated by several large multinational corporations while numerous regional and specialized firms contribute substantially. While a precise Herfindahl-Hirschman Index (HHI) value is unavailable for public disclosure, the market exhibits characteristics of moderate concentration. Key innovation drivers include the escalating demand for rigorous quality control, intensified regulatory scrutiny across diverse sectors, and the proliferation of advanced testing technologies. Regulatory shifts, particularly concerning product safety and environmental compliance, exert a considerable influence on market dynamics, presenting both significant opportunities and challenges for industry participants. Product substitution remains limited, with most testing and inspection services demonstrating high specialization tailored to specific industry requirements. Nevertheless, the increasing adoption of digital technologies and automation introduces indirect substitution possibilities. Mergers and acquisitions (M&A) activity is prominent, with larger players strategically expanding their market presence and service portfolios. While precise M&A figures for the period 2019-2024 are confidential, substantial activity was observed, with an anticipated increase in future forecast periods. Key M&A trends include cross-border acquisitions, expansion into new geographic territories, and the integration of complementary technologies and services to offer comprehensive solutions.

- Major Players: PT Carsurin, AmSpec Services LLC, Intertek Group PLC, Setsco Services Pte Ltd (Vicom Ltd), TÜV Rheinland, Apave Japan Co Limited, Singapore Test Lab Pte Ltd, SGS Group, Bureau Veritas Group, ALS Malaysia (ALS Limited), HQTS Group Ltd, Seoul Inspection & Testing Co Limited, Cotecna Inspection SA, PT SUCOFINDO Perseo, SIRIM QAS International Sdn Bhd, UL LLC, ABS Group, TÜV SÜD. (List Not Exhaustive)

- Market Concentration: Moderately Concentrated (HHI: [Insert HHI value if available, otherwise remove this line])

- Innovation Drivers: Advanced technologies, stringent quality standards, evolving regulations, and the increasing demand for sustainable practices.

- Regulatory Impact: Significant influence on market dynamics and service demand, shaping investment strategies and operational compliance.

- M&A Activity: Significant activity observed (2019-2024), driven by expansion, technological integration, and diversification of service offerings.

Asia Testing and Inspection Service Industry Market Trends & Opportunities

The Asia Testing and Inspection Service market is exhibiting robust growth, fueled by factors such as accelerating industrialization, heightened consumer awareness of product quality and safety, and increasingly stringent regulatory mandates. The market size is projected to reach [Insert Projected Market Size in 2025] in 2025 and is expected to demonstrate a Compound Annual Growth Rate (CAGR) of [Insert CAGR] during the forecast period (2025-2033). Technological progress, encompassing automation, artificial intelligence (AI), and big data analytics, is transforming testing and inspection procedures, resulting in enhanced efficiency and reduced costs. Evolving consumer preferences towards superior quality and safer products further stimulate demand for comprehensive testing and inspection services. The competitive landscape remains dynamic, with both established multinational players and emerging regional entities vying for market share. Market penetration is more advanced in developed economies like Japan and South Korea, while considerable growth potential exists in developing economies, including India and Southeast Asia. The growing emphasis on sustainability and environmental compliance presents substantial opportunities for specialized testing services. The integration of innovative technologies like blockchain for improving supply chain transparency and traceability is also opening new market avenues. These technological advancements are streamlining processes, enhancing accuracy, and fostering increased customer confidence. This amplified confidence in product quality and safety translates into a sustained increase in demand for testing and inspection services across various sectors.

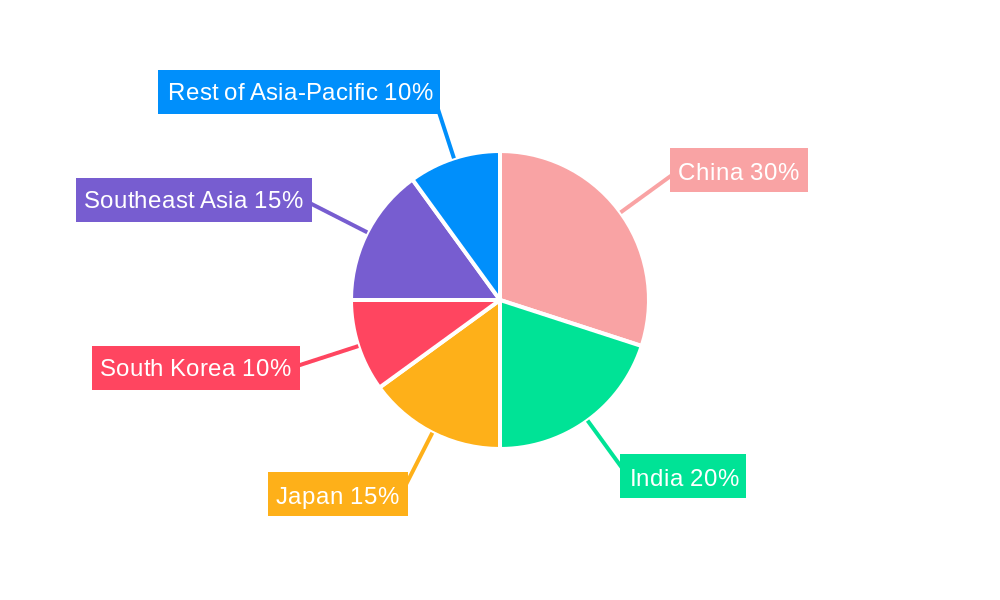

Dominant Markets & Segments in Asia Testing and Inspection Service Industry

The Asia Testing and Inspection Service market comprises diverse segments, with certain areas exhibiting significant dominance. China and India, driven by their rapidly expanding economies and industrialization, constitute the largest national markets. In terms of service type, Testing and Inspection maintains market leadership due to its broad applications across numerous industries, while the certification segment experiences rapid expansion due to escalating regulatory compliance needs. Among end-users, the Industrial Manufacturing, Automotive and Transportation, and Oil and Gas sectors are major consumers of testing and inspection services, owing to their complex supply chains and stringent quality control requirements. The outsourced segment commands a larger market share compared to in-house testing due to cost efficiency and access to specialized expertise. The increasing focus on sustainable manufacturing is also driving demand for specific testing services related to environmental impact and compliance.

- Leading Regions/Countries: China, India, Japan, South Korea, with significant emerging markets in Southeast Asia.

- Dominant Service Type: Testing and Inspection, with Certification showing strong growth.

- Largest End-User Sectors: Industrial Manufacturing, Automotive and Transportation, Oil and Gas, Electronics and Consumer Goods.

- Dominant Type: Outsourced, driven by cost-effectiveness and specialized expertise.

Key Growth Drivers:

- Rapid Industrialization: Fueling demand for quality control and regulatory compliance across various sectors.

- Stringent Regulations: Increased regulatory scrutiny necessitates higher demand for testing and certification services to ensure compliance.

- Infrastructure Development: Large-scale infrastructure projects generate substantial opportunities for testing and inspection of materials and construction methodologies.

- Rising Consumer Awareness: Growing consumer emphasis on product quality and safety enhances demand for dependable testing services.

- Emphasis on Sustainability: Growing demand for eco-friendly practices and materials is driving the need for sustainable testing and certification.

Asia Testing and Inspection Service Industry Product Analysis

Product innovation within the Asia Testing and Inspection Service industry centers on enhancing testing accuracy, efficiency, and speed. This involves the integration of advanced technologies such as AI-powered image recognition for accelerated defect detection, automation to optimize workflows, and sophisticated analytical tools to deliver more precise test results. These innovations are pivotal in addressing the growing demand for efficient and dependable testing and inspection services, particularly within high-volume manufacturing environments. The increasing significance of sustainability is also prompting innovation in eco-friendly testing methodologies and the development of services to assess the environmental impact of products and processes. Market demand is robust across diverse industries, and the competitive advantage hinges on providing cutting-edge, cost-effective, and sustainable testing solutions that address evolving regulatory requirements and consumer expectations.

Key Drivers, Barriers & Challenges in Asia Testing and Inspection Service Industry

Key Drivers:

- Technological advancements driving automation and efficiency gains.

- Rising regulatory compliance needs across various sectors.

- Increasing focus on sustainability and environmental protection.

- Growth in e-commerce and global supply chains necessitating stringent quality checks.

Key Challenges:

- Regulatory complexity and variations across different countries.

- Maintaining consistent quality standards across diverse operations.

- Skilled labor shortages and the need for continuous training and upskilling.

- Supply chain disruptions and geopolitical uncertainties impacting operations. For example, xx% of businesses experienced delays due to supply chain disruptions in 2022, impacting their ability to meet testing deadlines.

Growth Drivers in the Asia Testing and Inspection Service Industry Market

The Asia Testing and Inspection Service industry is propelled by rapid industrialization and urbanization across the region, leading to increased demand for infrastructure development and manufacturing. Stringent government regulations on product safety and environmental compliance further boost the need for testing and inspection services. Technological advancements like AI and automation enhance efficiency and accuracy, driving industry growth. Finally, rising consumer awareness of product quality and safety plays a key role in increasing demand.

Challenges Impacting Asia Testing and Inspection Service Industry Growth

Challenges include navigating diverse regulatory landscapes across different Asian countries, maintaining consistent service quality across geographically dispersed operations, and addressing potential supply chain disruptions. Competition among established players and new entrants also puts pressure on pricing and profitability. A shortage of skilled professionals adds to the operational complexities, while the need for continuous technological upgrades requires significant investments.

Key Players Shaping the Asia Testing and Inspection Service Industry Market

- PT Carsurin

- AmSpec Services LLC

- Intertek Group PLC

- Setsco Services Pte Ltd (Vicom Ltd)

- TÜV Rheinland

- Apave Japan Co Limited

- Singapore Test Lab Pte Ltd

- SGS Group

- Bureau Veritas Group

- ALS Malaysia (ALS Limited)

- HQTS Group Ltd

- Seoul Inspection & Testing Co Limited

- Cotecna Inspection SA

- PT SUCOFINDO Perseo

- SIRIM QAS International Sdn Bhd

- UL LLC

- ABS Group

- TÜV SÜD

Significant Asia Testing and Inspection Service Industry Milestones

- December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai, focusing on cosmetic and personal care product testing. This expansion signifies a commitment to serving the growing demand for specialized testing in the region.

- October 2022: Intertek Group PLC launched the "As Advertised" Program, aimed at enhancing trust and transparency in online marketplaces by ensuring that products meet advertised quality standards. This initiative demonstrates a strategic shift towards addressing emerging challenges in e-commerce.

Future Outlook for Asia Testing and Inspection Service Industry Market

The Asia Testing and Inspection Service industry is poised for continued strong growth, driven by sustained industrialization, technological innovation, and increasing regulatory requirements. Strategic opportunities exist in expanding service offerings to encompass emerging technologies and sustainability-focused solutions. The market's potential is substantial, with significant growth prospects in both established and emerging markets across Asia. Further consolidation through M&A activity is expected, leading to larger, more diversified players better positioned to serve the evolving needs of the industry.

Asia Testing and Inspection Service Industry Segmentation

-

1. Type

- 1.1. In-house

- 1.2. Outsourced

-

2. Service Type

- 2.1. Testing and Inspection

- 2.2. Certification

-

3. End User

- 3.1. Industrial Manufacturing

- 3.2. Automotive and Transportation

- 3.3. Oil and Gas

- 3.4. Mining and Downstream Applications

- 3.5. Food and Agriculture

- 3.6. Building and Infrastructure

- 3.7. Consumer Goods and Retail

- 3.8. Other End Users

Asia Testing and Inspection Service Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Testing and Inspection Service Industry Regional Market Share

Geographic Coverage of Asia Testing and Inspection Service Industry

Asia Testing and Inspection Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 3.3. Market Restrains

- 3.3.1. Low Awareness about the Facility Management Services

- 3.4. Market Trends

- 3.4.1. Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Testing and Inspection Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Testing and Inspection

- 5.2.2. Certification

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industrial Manufacturing

- 5.3.2. Automotive and Transportation

- 5.3.3. Oil and Gas

- 5.3.4. Mining and Downstream Applications

- 5.3.5. Food and Agriculture

- 5.3.6. Building and Infrastructure

- 5.3.7. Consumer Goods and Retail

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Carsurin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AmSpec Services LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Setsco Services Pte Ltd (Vicom Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TUV Rheinland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apave Japan Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Test Lab Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bureau Veritas Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALS Malaysia (ALS Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HQTS Group Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seoul Inspection & Testing Co Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cotecna Inspection SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 PT SUCOFINDO Perseo*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SIRIM QAS International Sdn Bhd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ABS Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 TUV SUD

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 PT Carsurin

List of Figures

- Figure 1: Asia Testing and Inspection Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Testing and Inspection Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Testing and Inspection Service Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Testing and Inspection Service Industry?

Key companies in the market include PT Carsurin, AmSpec Services LLC, Intertek Group PLC, Setsco Services Pte Ltd (Vicom Ltd), TUV Rheinland, Apave Japan Co Limited, Singapore Test Lab Pte Ltd, SGS Group, Bureau Veritas Group, ALS Malaysia (ALS Limited), HQTS Group Ltd, Seoul Inspection & Testing Co Limited, Cotecna Inspection SA, PT SUCOFINDO Perseo*List Not Exhaustive, SIRIM QAS International Sdn Bhd, UL LLC, ABS Group, TUV SUD.

3. What are the main segments of the Asia Testing and Inspection Service Industry?

The market segments include Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

6. What are the notable trends driving market growth?

Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

7. Are there any restraints impacting market growth?

Low Awareness about the Facility Management Services.

8. Can you provide examples of recent developments in the market?

December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai. The laboratory will concentrate on analytical testing - physical, chemical, and microbial contamination - for cosmetic and personal care products. It is ISO/IEC 17025 accredited and has a Class 10,000 cleanroom certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Testing and Inspection Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Testing and Inspection Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Testing and Inspection Service Industry?

To stay informed about further developments, trends, and reports in the Asia Testing and Inspection Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence