Key Insights

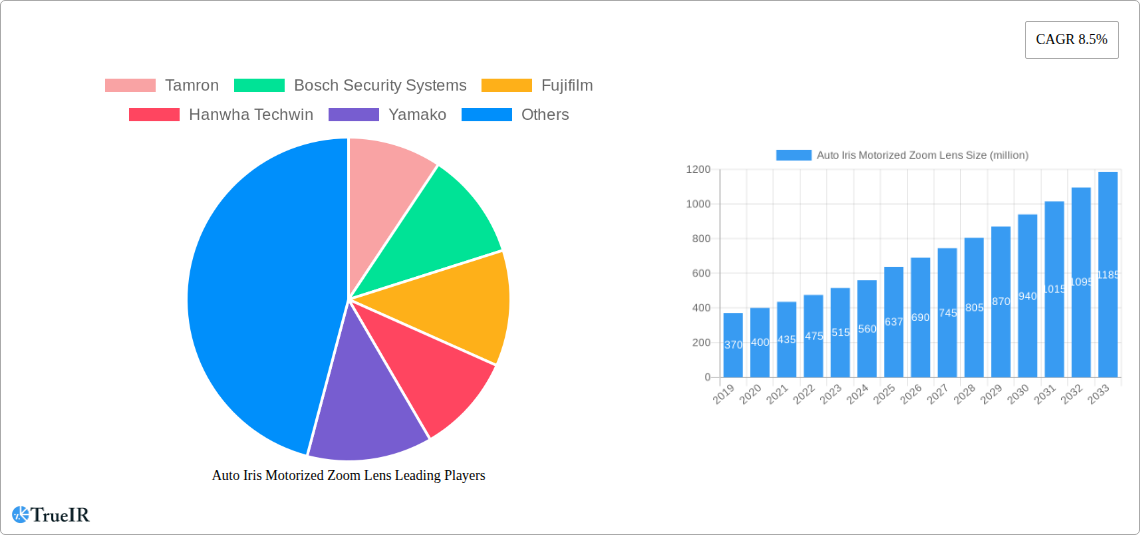

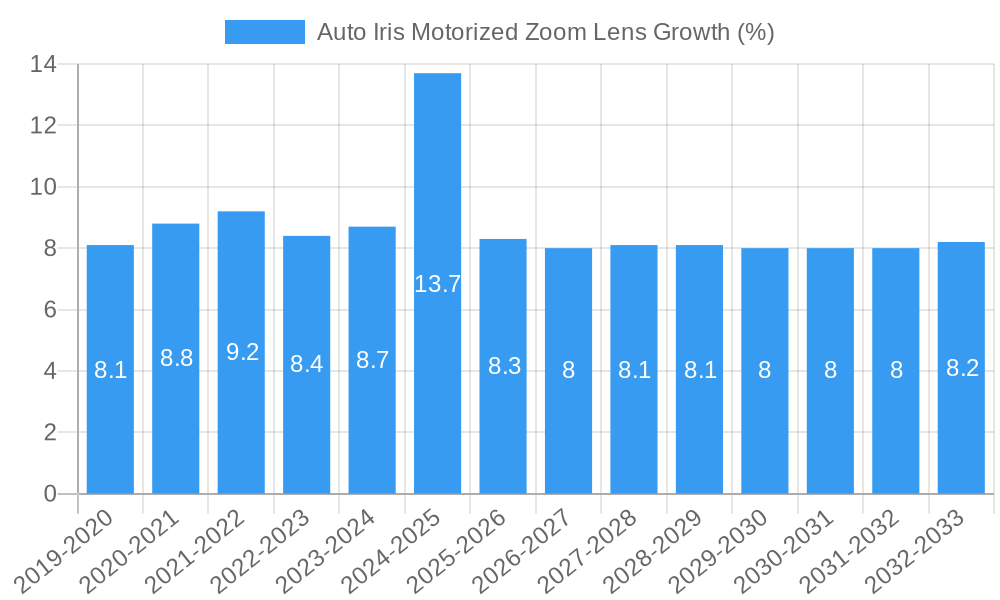

The global Auto Iris Motorized Zoom Lens market is poised for robust expansion, projected to reach USD 637 million by 2025 with a compelling Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This significant growth is primarily fueled by the escalating demand for advanced surveillance and imaging solutions across critical sectors like border defense and city security. The increasing sophistication of security threats necessitates high-resolution, adaptable optical technologies that motorized zoom lenses provide, enabling detailed monitoring from varying distances and angles. Furthermore, the burgeoning adoption of smart city initiatives, which integrate extensive CCTV networks for traffic management, public safety, and urban planning, is a substantial driver. The continuous evolution of imaging technology, coupled with the miniaturization and cost-effectiveness of motorized components, also contributes to the market's upward trajectory.

The market is segmented by application and lens type, indicating diverse adoption patterns. The "Border Defense" and "City Security" applications are expected to dominate, reflecting their critical role in national security and public safety. In terms of lens type, the "300mm-1000mm" category is likely to see substantial traction due to its versatility in capturing detailed imagery for a wide range of surveillance scenarios. While the market benefits from these strong growth drivers, potential restraints could include the high initial investment costs for advanced systems and the rapid pace of technological obsolescence, requiring continuous upgrades. However, the strong underlying demand and ongoing technological advancements, supported by key players like Bosch Security Systems, Honeywell Security, and Canon, are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape.

Auto Iris Motorized Zoom Lens Market: Comprehensive Industry Analysis & Future Forecast (2019-2033)

This in-depth market report delivers an exhaustive analysis of the global Auto Iris Motorized Zoom Lens market, providing critical insights for stakeholders across the security, surveillance, and industrial imaging sectors. Covering the period from 2019 to 2033, with a focus on the Base Year 2025 and Forecast Period 2025-2033, this report equips you with actionable intelligence on market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, competitive landscape, and future outlook. Leverage high-volume keywords such as "motorized zoom lens," "auto iris lens," "security cameras," "surveillance technology," "industrial optics," and "border defense solutions" to enhance your strategic decision-making.

Auto Iris Motorized Zoom Lens Market Structure & Competitive Landscape

The global Auto Iris Motorized Zoom Lens market exhibits a moderately fragmented structure, with a blend of large, established players and numerous niche manufacturers. Innovation serves as a primary driver, fueled by the relentless demand for enhanced imaging capabilities in security and surveillance. Regulatory impacts, particularly concerning data privacy and image resolution standards, are increasingly shaping product development and market entry. Product substitutes, such as fixed-focal length lenses with digital zoom, exist but often fall short in providing the optical flexibility and image quality offered by motorized zoom solutions. End-user segmentation is diverse, spanning critical applications like border defense and city security, alongside industrial and scientific uses. Merger and acquisition (M&A) activities, although not at an extremely high volume, are observed as companies seek to consolidate market share, expand their product portfolios, and acquire specialized technological expertise. The presence of approximately 20-30 significant players, with a combined market share estimated in the range of 70-80 million dollars, indicates a competitive yet accessible market for new entrants with innovative offerings.

Auto Iris Motorized Zoom Lens Market Trends & Opportunities

The Auto Iris Motorized Zoom Lens market is poised for significant expansion driven by escalating global security concerns and advancements in imaging technology. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated market value of over 1.5 billion dollars by the end of the forecast period. This growth is largely attributable to the increasing adoption of high-definition (HD) and ultra-high-definition (UHD) surveillance systems across various sectors, including smart cities, critical infrastructure protection, and intelligent transportation systems. Technological shifts are characterized by the integration of AI-powered analytics directly into lens systems, enabling intelligent object tracking, facial recognition, and anomaly detection. Consumers are increasingly preferring lenses with advanced features such as image stabilization, superior low-light performance, and wider dynamic range, pushing manufacturers to invest heavily in research and development. Competitive dynamics are intensifying, with a focus on miniaturization, improved power efficiency, and enhanced durability for rugged environments. The market penetration rate for advanced motorized zoom lenses is expected to climb from around 30% in 2025 to over 50% by 2033, indicating a substantial opportunity for both established and emerging players. The demand for these lenses in applications ranging from long-range surveillance for border defense to detailed monitoring in urban environments underscores their versatility and indispensable role in modern imaging solutions, creating numerous avenues for market growth and product innovation.

Dominant Markets & Segments in Auto Iris Motorized Zoom Lens

The Auto Iris Motorized Zoom Lens market demonstrates significant dominance within the Application: City Security segment, driven by the continuous global trend towards smart city initiatives and the escalating need for comprehensive urban surveillance to combat crime, manage traffic, and ensure public safety. This segment alone is projected to account for over 30% of the total market share. In terms of Type, the 300mm-1000mm focal length range is currently the most dominant, representing approximately 40% of the market, as it offers a versatile balance between wide-area coverage and detailed object identification suitable for a broad spectrum of urban and infrastructure monitoring applications.

Application: City Security Growth Drivers:

- Smart City Initiatives: Government investments in smart city infrastructure worldwide are a primary catalyst, leading to the widespread deployment of sophisticated surveillance networks.

- Crime Prevention & Public Safety: The persistent need to monitor public spaces, prevent criminal activities, and respond effectively to emergencies fuels demand for advanced security solutions.

- Traffic Management: Real-time monitoring of traffic flow, incident detection, and enforcement of traffic regulations necessitate high-performance zoom lenses.

- Event Security: Large public gatherings and critical infrastructure require robust surveillance capabilities to ensure attendee safety and security.

Type: 300mm-1000mm Dominance Drivers:

- Versatility: This focal length range provides an optimal compromise for observing both broader scenes and capturing detailed images of distant objects without sacrificing significant resolution.

- Cost-Effectiveness: Compared to extremely long-range lenses, these offer a more balanced cost-to-performance ratio for many standard surveillance deployments.

- Application Fit: Ideal for mounting on poles, buildings, and vehicles for general surveillance, perimeter monitoring, and traffic camera systems.

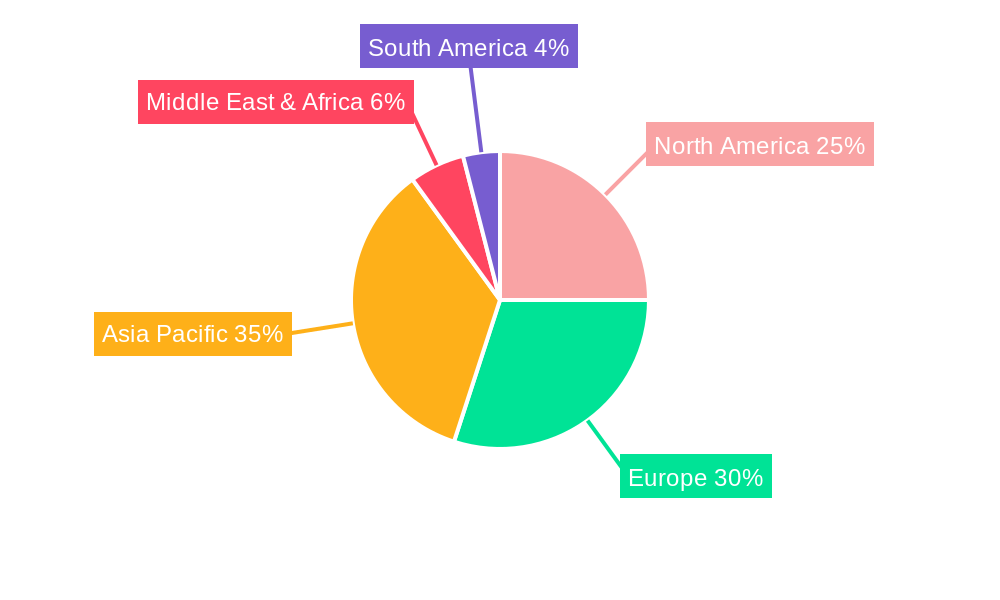

Geographically, Asia Pacific is emerging as the leading region, accounting for over 35% of the global market. This dominance is propelled by rapid urbanization, significant government spending on public safety and defense, and the presence of major manufacturing hubs for optical and electronic components. Countries like China, India, and South Korea are at the forefront of adopting advanced surveillance technologies, further solidifying the region's position. The Highway application segment also presents substantial growth opportunities within this region, linked to the expansion of intelligent transportation systems and the need for traffic monitoring and incident response.

Auto Iris Motorized Zoom Lens Product Analysis

Product innovation in Auto Iris Motorized Zoom Lenses centers on enhancing optical performance, increasing zoom ratios, and integrating intelligent features. Manufacturers are pushing boundaries with lenses offering exceptional clarity, low-light sensitivity, and robust environmental resistance. Applications span critical security surveillance, industrial inspection, and scientific research, where precise and adaptable imaging is paramount. Key competitive advantages lie in advanced coatings for reduced aberrations, sophisticated motor control for smooth and accurate zoom and focus, and compact, durable designs for versatile deployment.

Key Drivers, Barriers & Challenges in Auto Iris Motorized Zoom Lens

The Auto Iris Motorized Zoom Lens market is propelled by the escalating global demand for enhanced surveillance and security solutions across governmental, commercial, and industrial sectors. Technological advancements in sensor technology and AI integration further fuel innovation and adoption. Increased government spending on defense and border security, alongside smart city initiatives, acts as a significant economic driver. Policy shifts promoting advanced security infrastructure also contribute positively.

However, challenges persist. High manufacturing costs and complex supply chains for specialized optical components can lead to price sensitivities and potential delays. Intense competition from both established players and new entrants can pressure profit margins. Stringent international trade regulations and varying quality standards across regions can create market entry barriers. The need for continuous R&D to keep pace with technological obsolescence also presents a financial and operational hurdle.

Growth Drivers in the Auto Iris Motorized Zoom Lens Market

The growth of the Auto Iris Motorized Zoom Lens market is significantly driven by the escalating global emphasis on public safety and security. The proliferation of smart city projects worldwide necessitates advanced surveillance infrastructure, directly boosting demand for these lenses. Technological advancements, such as improved image stabilization and enhanced low-light performance, make these lenses more attractive for diverse applications. Furthermore, substantial government investments in defense, border control, and critical infrastructure protection across various nations are key economic and policy-driven factors stimulating market expansion. The trend towards remote monitoring and the need for precise, long-range observation in challenging environments also contribute to sustained growth.

Challenges Impacting Auto Iris Motorized Zoom Lens Growth

Despite robust growth potential, the Auto Iris Motorized Zoom Lens market faces several challenges. The high cost of advanced optical components and complex manufacturing processes can lead to premium pricing, potentially limiting adoption in budget-constrained markets. Supply chain disruptions, exacerbated by global geopolitical events and component shortages, pose a significant risk to production and delivery timelines. Intense competition among a growing number of manufacturers can lead to price wars and reduced profit margins, particularly for standard product offerings. Evolving regulatory landscapes concerning data privacy and imaging standards can also introduce compliance complexities and necessitate product redesigns, impacting growth trajectories.

Key Players Shaping the Auto Iris Motorized Zoom Lens Market

- Tamron

- Bosch Security Systems

- Fujifilm

- Hanwha Techwin

- Yamako

- CBC Computar

- Tokina Corporation

- ADL,Inc

- Ophir Optronics (mks)

- Kowa Lenses

- Myutron Co.,Ltd

- 2B Security Systems ApS

- Luster

- Theia Technologies

- Honeywell Security

- Canon

- Salvo Technologies

- Edmund Optics

- Navitar

- SPACE Inc

- Seikou Avenir

- Goyo

- Graflex Inc

- Dongguan Pomeas Precision Instrument

- Fuzhou ChuangAn Optics

- Shenzhen Lingying Optics

- Shenzhen Chuangwei Era Optoelectronics

- Foctek Photonics

Significant Auto Iris Motorized Zoom Lens Industry Milestones

- 2019: Increased integration of AI algorithms into lens systems for intelligent object tracking.

- 2020: Launch of ultra-high-resolution (8K) motorized zoom lenses for demanding surveillance applications.

- 2021: Advancements in optical coatings leading to significant improvements in low-light performance and reduced chromatic aberration.

- 2022: Introduction of compact and power-efficient motorized zoom lenses for drone and portable surveillance platforms.

- 2023: Enhanced focus on cybersecurity features for connected camera systems incorporating motorized zoom lenses.

- 2024: Development of advanced image stabilization technologies, reducing the impact of vibrations on captured footage.

Future Outlook for Auto Iris Motorized Zoom Lens Market

The future outlook for the Auto Iris Motorized Zoom Lens market remains exceptionally bright, driven by continuous technological innovation and an unyielding global demand for sophisticated imaging solutions. The integration of artificial intelligence and machine learning directly into lens functionalities will unlock new levels of automation and predictive capabilities in surveillance and industrial applications. We anticipate a sustained growth trajectory, fueled by the expansion of smart cities, critical infrastructure security projects, and the ever-growing need for detailed remote observation. Market participants who focus on developing higher zoom ratios, superior low-light performance, and robust connectivity features will likely secure significant market share. Strategic partnerships and M&A activities are expected to continue as companies seek to expand their technological prowess and global reach, further solidifying the market's dynamic evolution over the next decade.

Auto Iris Motorized Zoom Lens Segmentation

-

1. Application

- 1.1. Border Defense

- 1.2. City Security

- 1.3. Highway

- 1.4. Others

-

2. Type

- 2.1. Below 300mm

- 2.2. 300mm-1000mm

- 2.3. Above 1000mm

Auto Iris Motorized Zoom Lens Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Auto Iris Motorized Zoom Lens REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Border Defense

- 5.1.2. City Security

- 5.1.3. Highway

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Below 300mm

- 5.2.2. 300mm-1000mm

- 5.2.3. Above 1000mm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Border Defense

- 6.1.2. City Security

- 6.1.3. Highway

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Below 300mm

- 6.2.2. 300mm-1000mm

- 6.2.3. Above 1000mm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Border Defense

- 7.1.2. City Security

- 7.1.3. Highway

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Below 300mm

- 7.2.2. 300mm-1000mm

- 7.2.3. Above 1000mm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Border Defense

- 8.1.2. City Security

- 8.1.3. Highway

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Below 300mm

- 8.2.2. 300mm-1000mm

- 8.2.3. Above 1000mm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Border Defense

- 9.1.2. City Security

- 9.1.3. Highway

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Below 300mm

- 9.2.2. 300mm-1000mm

- 9.2.3. Above 1000mm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Auto Iris Motorized Zoom Lens Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Border Defense

- 10.1.2. City Security

- 10.1.3. Highway

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Below 300mm

- 10.2.2. 300mm-1000mm

- 10.2.3. Above 1000mm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tamron

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch Security Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fujifilm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hanwha Techwin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yamako

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CBC Computar

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tokina Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ADLInc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ophir Optronics (mks)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kowa Lenses

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Myutron Co.Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 2B Security Systems ApS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Luster

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Theia Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Honeywell Security

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Canon

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Salvo Technologies

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Edmund Optics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Navitar

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 SPACE Inc

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Seikou Avenir

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Goyo

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Graflex Inc

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Dongguan Pomeas Precision Instrument

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Fuzhou ChuangAn Optics

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Shenzhen Lingying Optics

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Shenzhen Chuangwei Era Optoelectronics

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Foctek Photonics

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 Tamron

List of Figures

- Figure 1: Global Auto Iris Motorized Zoom Lens Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Auto Iris Motorized Zoom Lens Revenue (million), by Application 2024 & 2032

- Figure 3: North America Auto Iris Motorized Zoom Lens Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Auto Iris Motorized Zoom Lens Revenue (million), by Type 2024 & 2032

- Figure 5: North America Auto Iris Motorized Zoom Lens Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Auto Iris Motorized Zoom Lens Revenue (million), by Country 2024 & 2032

- Figure 7: North America Auto Iris Motorized Zoom Lens Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Auto Iris Motorized Zoom Lens Revenue (million), by Application 2024 & 2032

- Figure 9: South America Auto Iris Motorized Zoom Lens Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Auto Iris Motorized Zoom Lens Revenue (million), by Type 2024 & 2032

- Figure 11: South America Auto Iris Motorized Zoom Lens Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Auto Iris Motorized Zoom Lens Revenue (million), by Country 2024 & 2032

- Figure 13: South America Auto Iris Motorized Zoom Lens Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Auto Iris Motorized Zoom Lens Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Auto Iris Motorized Zoom Lens Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Auto Iris Motorized Zoom Lens Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Auto Iris Motorized Zoom Lens Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Auto Iris Motorized Zoom Lens Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Auto Iris Motorized Zoom Lens Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Auto Iris Motorized Zoom Lens Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Auto Iris Motorized Zoom Lens Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Auto Iris Motorized Zoom Lens Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Auto Iris Motorized Zoom Lens Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Auto Iris Motorized Zoom Lens Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Auto Iris Motorized Zoom Lens Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Auto Iris Motorized Zoom Lens Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Auto Iris Motorized Zoom Lens Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Auto Iris Motorized Zoom Lens Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Auto Iris Motorized Zoom Lens?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Auto Iris Motorized Zoom Lens?

Key companies in the market include Tamron, Bosch Security Systems, Fujifilm, Hanwha Techwin, Yamako, CBC Computar, Tokina Corporation, ADL,Inc, Ophir Optronics (mks), Kowa Lenses, Myutron Co.,Ltd, 2B Security Systems ApS, Luster, Theia Technologies, Honeywell Security, Canon, Salvo Technologies, Edmund Optics, Navitar, SPACE Inc, Seikou Avenir, Goyo, Graflex Inc, Dongguan Pomeas Precision Instrument, Fuzhou ChuangAn Optics, Shenzhen Lingying Optics, Shenzhen Chuangwei Era Optoelectronics, Foctek Photonics.

3. What are the main segments of the Auto Iris Motorized Zoom Lens?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 637 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Auto Iris Motorized Zoom Lens," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Auto Iris Motorized Zoom Lens report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Auto Iris Motorized Zoom Lens?

To stay informed about further developments, trends, and reports in the Auto Iris Motorized Zoom Lens, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence