Key Insights

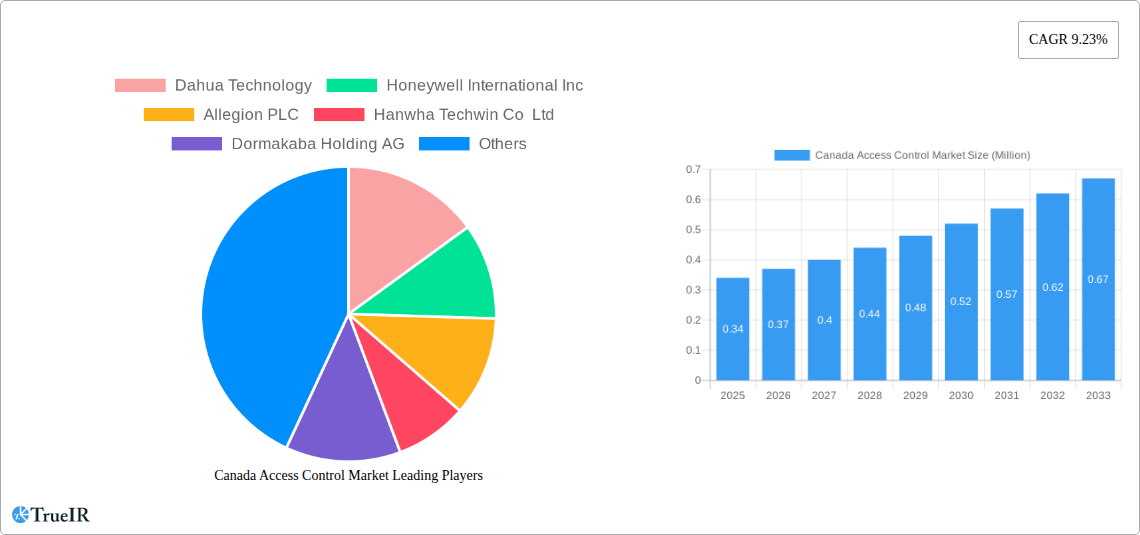

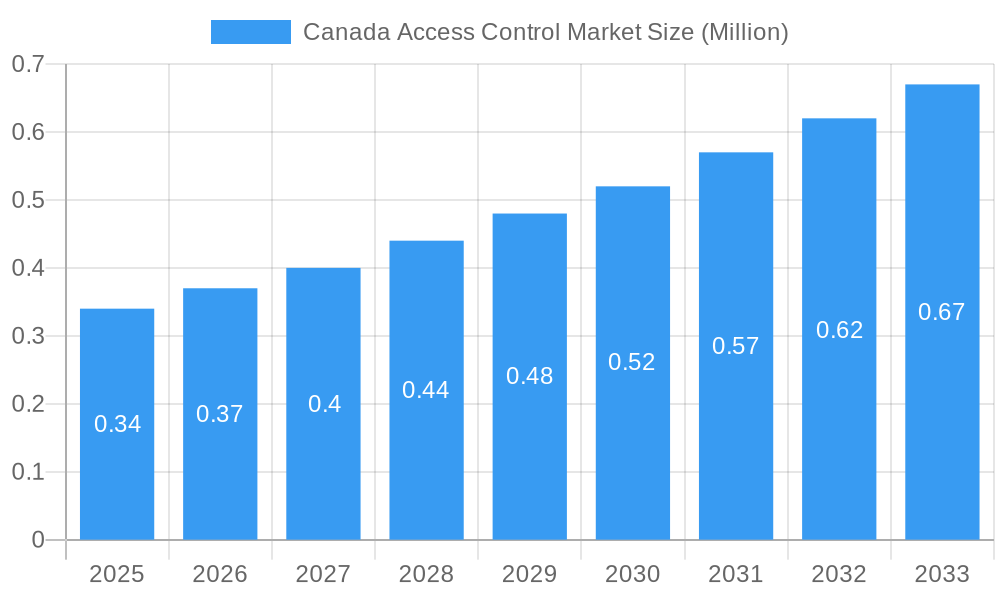

The Canadian access control market is poised for significant expansion, projected to grow from an estimated USD 0.34 million in 2025 to a substantial figure by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 9.23%. This growth is fueled by an increasing emphasis on security across various sectors, including commercial, government, and residential. Key drivers include the rising adoption of advanced technologies like smart cards, proximity cards, and biometric readers, which offer enhanced security and convenience compared to traditional key systems. The integration of access control with broader security management systems, coupled with the growing need for remote management and monitoring capabilities, is also contributing to market dynamism. Furthermore, stringent government regulations and corporate mandates for data protection and physical security are compelling organizations to invest in sophisticated access control solutions.

Canada Access Control Market Market Size (In Million)

The market's expansion is further supported by emerging trends such as the proliferation of IoT-enabled access control devices, allowing for seamless integration with other smart building technologies. The demand for cloud-based access control software is also on the rise, offering scalability, flexibility, and reduced IT overhead for businesses of all sizes. While the market demonstrates a strong growth trajectory, potential restraints could include the initial investment cost for advanced systems and the need for skilled personnel to manage and maintain these sophisticated technologies. Nevertheless, the continuous innovation in product offerings, including the development of more cost-effective and user-friendly solutions, is expected to mitigate these challenges, ensuring a sustained upward trend in the Canadian access control landscape. The diverse application across sectors, from transport and logistics to healthcare and industrial environments, underscores the foundational importance of access control in safeguarding assets and personnel.

Canada Access Control Market Company Market Share

Canada Access Control Market: Comprehensive Analysis and Forecast (2019-2033)

Gain unparalleled insights into the burgeoning Canada access control market. This in-depth report analyzes the dynamic landscape, covering access control systems, biometric readers, electronic locks, and access control software. We dissect market share, identify growth opportunities in sectors like commercial access control, residential access control, and government access control, and explore the impact of smart card technology and proximity readers. With a forecast period extending to 2033, this report provides critical data for stakeholders navigating the evolving physical security market in Canada. Discover the competitive strategies of leading players like Dahua Technology, Honeywell International Inc, and ASSA ABLOY AB Group as we project the Canada access control market size and CAGR.

Canada Access Control Market Market Structure & Competitive Landscape

The Canada access control market exhibits a moderately concentrated structure, with a few key players dominating the access control solutions landscape. Innovation serves as a primary driver, with companies continuously investing in biometric access control, cloud-based access control, and mobile access control technologies to meet evolving security demands. Regulatory frameworks, while fostering a secure environment for physical access control, can also present compliance challenges for new entrants. The availability of product substitutes, such as traditional key-based systems, necessitates a strong emphasis on the superior security and convenience offered by modern access control devices. End-user segmentation highlights significant opportunities across commercial, government, and industrial sectors, each with unique requirements for access management. Mergers and acquisitions (M&A) activity is anticipated to remain a strategic tool for market consolidation and expansion. For instance, the market saw a significant volume of M&A transactions in the historical period (2019-2024) as larger corporations sought to integrate advanced security technology and broaden their product portfolios. Concentration ratios are estimated to be around 60-70% among the top five players, underscoring the competitive intensity.

Canada Access Control Market Market Trends & Opportunities

The Canada access control market is poised for substantial expansion, driven by an escalating demand for enhanced security and seamless user experiences across diverse verticals. The market size is projected to witness robust growth, with a compound annual growth rate (CAGR) estimated at approximately 8.5% from 2025 to 2033. Technological advancements are at the forefront of this expansion, with a notable shift towards integrated access control systems that combine card readers, biometric scanners, and electronic locks with sophisticated access control software. The increasing adoption of IoT (Internet of Things) technologies is enabling the development of smart, connected access solutions, offering remote management capabilities and real-time data analytics for improved security management. Consumer preferences are increasingly leaning towards user-friendly and convenient access methods, such as mobile access control and contactless smartcards, thereby boosting the market penetration rates for these solutions. The competitive dynamics are characterized by strategic product launches, partnerships, and a focus on developing scalable and cost-effective solutions to cater to both large enterprises and small to medium-sized businesses. Opportunities abound in sectors requiring stringent security, including healthcare access control and government security solutions, as well as in the growing residential security market. The ongoing development of interoperable standards like OSDP (Open Supervised Device Protocol) further facilitates the integration of diverse access control components, creating a more unified and secure ecosystem. This trend is expected to drive innovation and create new revenue streams for providers of advanced access control hardware and software.

Dominant Markets & Segments in Canada Access Control Market

The Canada access control market is currently dominated by the Commercial end-user vertical, driven by the robust demand for advanced security solutions in corporate offices, retail spaces, and financial institutions. Within the Type segmentation, Card Reader and Access Control Devices collectively hold the largest market share, further categorized by the increasing popularity of Smartcard (Contact and Contactless) and Proximity technologies due to their balance of security, convenience, and cost-effectiveness. The Government and Industrial sectors also represent significant markets, owing to stringent security mandates and the need to protect critical infrastructure.

- Commercial Sector Dominance: This segment's leadership is attributed to a continuous need for sophisticated access management systems to secure sensitive areas, manage employee access, and comply with various regulatory standards. The increasing deployment of integrated security systems in modern commercial buildings is a key growth driver.

- Card Reader and Access Control Devices: The strong performance of this segment is fueled by the widespread adoption of card-based access control, with smartcard technology leading the way. The ease of implementation, scalability, and the ability to integrate with other building management systems contribute to its market dominance.

- Government and Industrial Growth: Government facilities, including critical infrastructure and public buildings, require high-level security, making government access control a significant market. Similarly, the industrial access control sector benefits from the need to protect manufacturing plants, warehouses, and sensitive operational areas.

- Emerging Trends: While Biometric Readers are gaining traction due to their enhanced security, their market penetration is still growing. Electronic Locks are becoming increasingly integrated into smart home and building solutions, indicating future growth potential. Software solutions, particularly those offering cloud-based management and analytics, are crucial enablers for the overall growth of the access control market.

Canada Access Control Market Product Analysis

The Canada access control market is characterized by a range of innovative products designed to enhance security and operational efficiency. Card readers, encompassing card-based, proximity, and smartcard (contact and contactless) technologies, remain foundational. Biometric readers, offering fingerprint, facial, and iris recognition, are gaining significant traction for their enhanced security capabilities. Electronic locks are increasingly incorporating advanced features like wireless connectivity and mobile access. The market also sees a robust demand for integrated access control software that enables centralized management, real-time monitoring, and sophisticated reporting. These products offer distinct competitive advantages, from the convenience of mobile access to the high-security assurance of multi-factor authentication.

Key Drivers, Barriers & Challenges in Canada Access Control Market

Key Drivers:

- Rising Security Concerns: Escalating threats to data and physical assets are the primary drivers for advanced access control solutions.

- Technological Advancements: The integration of IoT, AI, and cloud computing is enabling smarter, more efficient access management.

- Government Initiatives & Regulations: Stringent security mandates for critical infrastructure and public spaces are boosting demand.

- Growing Adoption of Smart Buildings: The trend towards intelligent infrastructure fuels the adoption of integrated access control systems.

- Demand for Convenience: User preference for contactless and mobile access solutions is a significant growth catalyst.

Barriers & Challenges:

- High Initial Investment: The cost of implementing sophisticated access control systems can be a barrier for small and medium-sized enterprises.

- Data Privacy & Security Concerns: Ensuring the secure handling of sensitive biometric and personal data is paramount.

- Integration Complexity: Integrating new access control hardware and software with existing legacy systems can be challenging.

- Skilled Workforce Shortage: A lack of trained professionals for installation, maintenance, and management of advanced systems poses a challenge.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and pricing of essential access control components. Estimated supply chain disruption impact on market growth in the historical period (2019-2024) was approximately 5-10%.

Growth Drivers in the Canada Access Control Market Market

The Canada access control market is experiencing robust growth propelled by several key factors. Technologically, the increasing integration of IoT devices and the adoption of cloud-based access control platforms are enabling more intelligent and remote management of security. This offers enhanced flexibility and scalability for businesses. Economically, growing investments in infrastructure and real estate development, particularly in urban centers, are creating a consistent demand for advanced security solutions. Government policies and mandates, aimed at enhancing security for critical infrastructure, public spaces, and sensitive government facilities, are also significant growth drivers. For instance, enhanced cybersecurity regulations are indirectly pushing organizations to fortify their physical access points with advanced access control systems. Furthermore, the rising awareness among individuals and businesses about the importance of proactive security measures, coupled with the demand for convenience offered by mobile access control and contactless readers, are collectively shaping a positive growth trajectory for the Canada access control market.

Challenges Impacting Canada Access Control Market Growth

Several challenges are poised to impact the growth of the Canada access control market. Regulatory complexities, particularly concerning data privacy and the management of sensitive personal information acquired through biometric readers, can create compliance hurdles for companies. Supply chain issues, which have been prevalent in recent years, continue to pose a risk to the consistent availability and timely delivery of access control hardware and components, potentially leading to project delays and increased costs. Competitive pressures from both established global players and emerging local providers are intensifying, forcing companies to focus on innovation and competitive pricing strategies. The estimated impact of these competitive pressures on market growth in the forecast period (2025-2033) is an average reduction of 1-2% in profit margins for less differentiated offerings. Furthermore, the need for skilled personnel to install, configure, and maintain advanced access control systems presents a consistent challenge, potentially limiting the widespread adoption of more sophisticated technologies, especially among smaller enterprises.

Key Players Shaping the Canada Access Control Market Market

- Dahua Technology

- Honeywell International Inc

- Allegion PLC

- Hanwha Techwin Co Ltd

- Dormakaba Holding AG

- Schneider Electric SE

- Genetec Inc

- HID Global Corporation

- BioConnect Inc

- Tyco International PLC (Johnson Controls)

- NEC Corporation

- ASSA ABLOY AB Group

- Thales Group (Gemalto NV)

- Idemia Group

- Identiv Inc

- Bosch Security System Inc

- Axis Communications AB

- Brivo Systems LLC

- Panasonic Corporation

Significant Canada Access Control Market Industry Milestones

- July 2023: Anviz announced the launch of its next-generation access control solutions powered by the open supervised protocol. The two new offerings, the C2KA-OSDP RFID keypad reader and SAC921 single-door access controller, are designed to enhance customer safety and provide comprehensive security solutions for modern-day challenges.

- July 2023: Sera4, a Canada-based start-up, enabled its customers to implement entirely keyless physical access control solutions via Teleporte, its back-end cloud platform that virtually manages keys. This technology eliminates the need for physical keys and internet connectivity for accessing public locks, making it easy to grant and revoke access at scale and track access instances.

Future Outlook for Canada Access Control Market Market

The future outlook for the Canada access control market is exceptionally promising, driven by an unceasing demand for enhanced security and operational efficiencies. Strategic opportunities lie in the continued integration of AI and machine learning into access control software for predictive analytics and threat detection, as well as the expansion of mobile access control solutions across various industries, including the transport and logistics sector and healthcare facilities. The increasing focus on smart city initiatives and the development of connected infrastructure will further fuel the adoption of advanced access control systems. Companies that prioritize cybersecurity, user experience, and interoperability are well-positioned to capitalize on the evolving market dynamics. The market potential is significant, with a projected steady increase in the penetration of sophisticated biometric readers and integrated electronic locks within the forecast period (2025-2033).

Canada Access Control Market Segmentation

-

1. Type

-

1.1. Card Reader and Access Control Devices

- 1.1.1. Card-based

- 1.1.2. Proximity

- 1.1.3. Smartcard (Contact and Contactless)

- 1.2. Biometric Readers

- 1.3. Electronic Locks

- 1.4. Software

- 1.5. Other Types

-

1.1. Card Reader and Access Control Devices

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Residential

- 2.3. Government

- 2.4. Industrial

- 2.5. Transport and Logistics

- 2.6. Healthcare

- 2.7. Military and Defense

- 2.8. Other End-user Verticals

Canada Access Control Market Segmentation By Geography

- 1. Canada

Canada Access Control Market Regional Market Share

Geographic Coverage of Canada Access Control Market

Canada Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Operational and ROI Concerns

- 3.4. Market Trends

- 3.4.1. Smart Card Segment is Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Access Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Reader and Access Control Devices

- 5.1.1.1. Card-based

- 5.1.1.2. Proximity

- 5.1.1.3. Smartcard (Contact and Contactless)

- 5.1.2. Biometric Readers

- 5.1.3. Electronic Locks

- 5.1.4. Software

- 5.1.5. Other Types

- 5.1.1. Card Reader and Access Control Devices

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Government

- 5.2.4. Industrial

- 5.2.5. Transport and Logistics

- 5.2.6. Healthcare

- 5.2.7. Military and Defense

- 5.2.8. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dahua Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Allegion PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hanwha Techwin Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dormakaba Holding AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genetec Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HID Global Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BioConnect Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tyco International PLC (Johnson Controls)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 NEC Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY AB Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Thales Group (Gemalto NV)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Idemia Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Identiv Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Bosch Security System Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Axis Communications AB

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Brivo Systems LLC

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Panasonic Corporation

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Dahua Technology

List of Figures

- Figure 1: Canada Access Control Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Access Control Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Canada Access Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Access Control Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Canada Access Control Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Access Control Market?

The projected CAGR is approximately 9.23%.

2. Which companies are prominent players in the Canada Access Control Market?

Key companies in the market include Dahua Technology, Honeywell International Inc, Allegion PLC, Hanwha Techwin Co Ltd, Dormakaba Holding AG, Schneider Electric SE, Genetec Inc, HID Global Corporation, BioConnect Inc, Tyco International PLC (Johnson Controls), NEC Corporation, ASSA ABLOY AB Group, Thales Group (Gemalto NV), Idemia Group, Identiv Inc, Bosch Security System Inc, Axis Communications AB, Brivo Systems LLC, Panasonic Corporation.

3. What are the main segments of the Canada Access Control Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

6. What are the notable trends driving market growth?

Smart Card Segment is Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

Operational and ROI Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: Anviz announced the launch of its next generation of access control solutions powered by the open supervised protocol. The two new offerings, the C2KA-OSDP RFID keypad reader and SAC921 single-door access controller, ensure customer safety and provide a comprehensive security solution for modern-day problems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Access Control Market?

To stay informed about further developments, trends, and reports in the Canada Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence