Key Insights

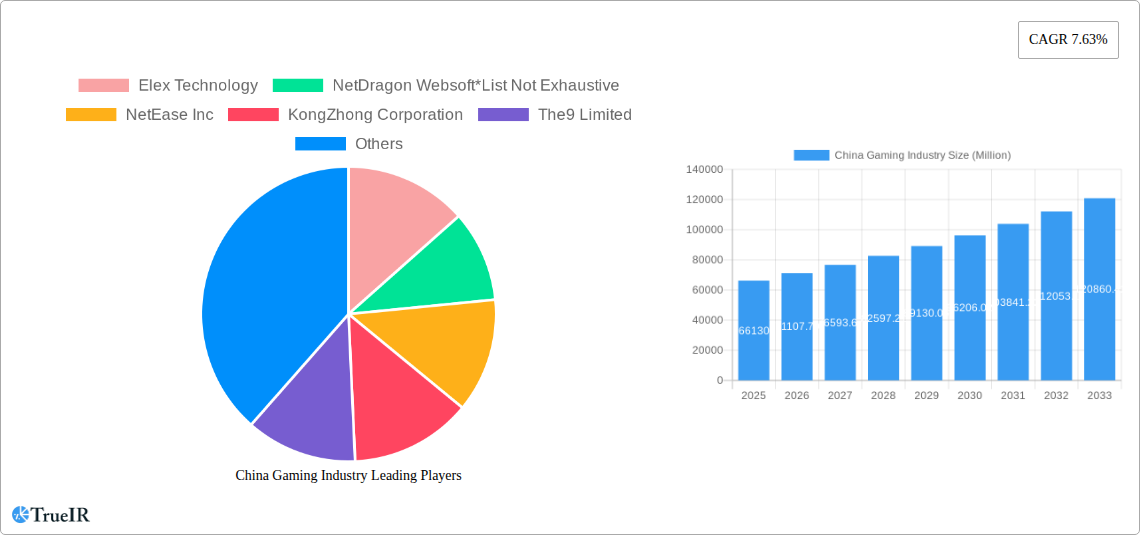

The China gaming market, a powerhouse in the global gaming landscape, is projected to reach a substantial size, exhibiting robust growth. With a 2025 market value of $66.13 billion and a Compound Annual Growth Rate (CAGR) of 7.63% from 2025 to 2033, the industry demonstrates significant potential for continued expansion. This growth is fueled by several key factors. The increasing penetration of smartphones and high-speed internet access has broadened the player base, especially amongst younger demographics. The rise of esports and its mainstream acceptance further contributes to market expansion, driving engagement and revenue generation. Furthermore, the evolution of gaming technology and the release of innovative and engaging game titles continue to attract a larger audience. The market is segmented across PC, console, and mobile gaming platforms, with mobile gaming likely dominating due to its accessibility and widespread adoption. Leading companies like Tencent Holdings, NetEase Inc., and others play a significant role, shaping the market with their strategic investments and game releases. While challenges exist – including regulatory changes and competition – the overall outlook remains positive, indicating a trajectory of sustained growth in the coming years.

China Gaming Industry Market Size (In Billion)

Despite the considerable potential, the China gaming market faces certain constraints. Government regulations regarding game content and playtime limits can impact revenue generation. Competition among established giants and emerging players is intense, requiring continuous innovation and adaptation to maintain a competitive edge. Furthermore, shifts in consumer preferences and the emergence of new technologies could influence the market's trajectory. However, the industry's resilience, demonstrated by its consistent growth despite these challenges, underscores its strong foundation and ability to navigate the changing market dynamics. The ongoing development of sophisticated gaming technologies and the sustained demand for engaging interactive experiences promise to fuel the long-term growth and expansion of the Chinese gaming industry. The integration of innovative features and the expansion into new market segments will be pivotal in driving future expansion.

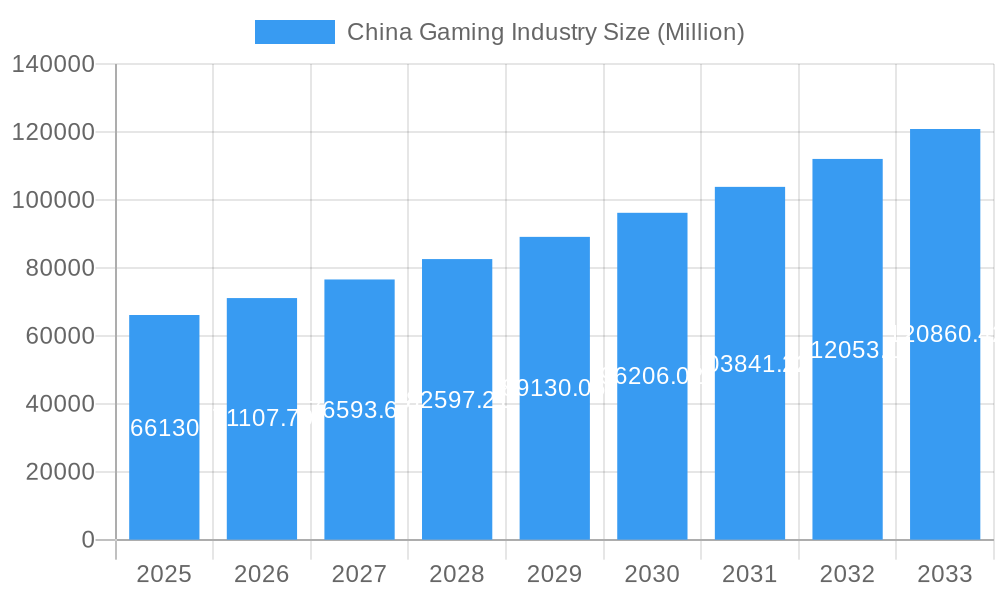

China Gaming Industry Company Market Share

China Gaming Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic China gaming industry, covering market size, segmentation, competitive landscape, key players, and future growth prospects from 2019 to 2033. The report leverages extensive market research and data analysis to offer actionable insights for industry stakeholders. With a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for understanding the intricacies of this rapidly evolving market. The report's findings are crucial for strategic decision-making, investment strategies, and competitive positioning within the Chinese gaming sector. The estimated market value for 2025 is xx Million, and the report projects significant growth over the forecast period.

China Gaming Industry Market Structure & Competitive Landscape

The China gaming market exhibits a highly concentrated structure, dominated by a few major players. Tencent Holdings and NetEase Inc. hold significant market share, shaping the competitive landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a highly concentrated market. Innovation is a key driver, fueled by continuous advancements in game technology and evolving consumer preferences. Stringent regulations, including licensing requirements and content restrictions, significantly influence market dynamics. Product substitutes, such as esports viewing and other forms of entertainment, present competitive challenges. End-user segmentation encompasses a broad demographic, ranging from casual gamers to hardcore enthusiasts, further influencing product development and marketing strategies.

- Market Concentration: High, with Tencent and NetEase dominating.

- Innovation Drivers: Technological advancements (VR/AR, AI), evolving game genres.

- Regulatory Impacts: Significant influence on market entry and game content.

- Product Substitutes: Esports, streaming services, social media.

- End-User Segmentation: Casual, mid-core, hardcore gamers; diverse age and demographic groups.

- M&A Trends: High volume in recent years, driven by consolidation and expansion strategies. The total value of M&A transactions in the period 2019-2024 is estimated at xx Million.

China Gaming Industry Market Trends & Opportunities

The China gaming market is experiencing substantial growth, driven by increasing smartphone penetration, rising disposable incomes, and evolving consumer preferences. The market size experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Technological advancements, such as the rise of mobile gaming and esports, are reshaping the landscape. Market penetration rates for mobile gaming are particularly high, reaching xx% in 2024. The shift towards mobile gaming presents significant opportunities for developers and publishers. The growing popularity of esports further fuels market expansion, while the competitive landscape is characterized by both intense competition and strategic collaborations. This creates significant challenges and opportunities for all participants.

Dominant Markets & Segments in China Gaming Industry

The mobile games segment is the dominant force in the China gaming industry, accounting for the largest market share. This is driven by the widespread adoption of smartphones and mobile internet access. While the PC games market remains significant, its growth is outpaced by mobile gaming. The console games market is relatively smaller, facing challenges related to market access and regulatory approvals.

- Mobile Games:

- Growth Drivers: High smartphone penetration, affordable data plans, convenient accessibility.

- Market Dominance: Largest segment by revenue and user base.

- PC Games:

- Growth Drivers: Established player base, high-quality graphics and gameplay.

- Market Position: Significant but facing competition from mobile gaming.

- Console Games:

- Growth Drivers: Increasing interest in console gaming, improved game quality.

- Market Position: Smallest segment, hampered by regulatory hurdles and limited market access.

China Gaming Industry Product Analysis

The Chinese gaming market showcases a diverse range of products, reflecting both established genres and emerging innovations. Technological advancements, such as improved graphics, AI-powered game design, and virtual reality (VR) integration, are enhancing the gaming experience. The market is characterized by a strong emphasis on mobile games, catering to a vast user base with diverse preferences. This leads to an ongoing evolution of game design to address market demands for novel gameplay and engaging experiences.

Key Drivers, Barriers & Challenges in China Gaming Industry

Key Drivers: Technological advancements (e.g., 5G, VR/AR), rising disposable incomes, increasing smartphone penetration, favorable government policies (at times).

Key Challenges: Stringent regulatory approvals, content restrictions, intense competition, piracy, and fluctuations in macroeconomic conditions. The total cost of regulatory compliance for the industry in 2024 is estimated at xx Million.

Growth Drivers in the China Gaming Industry Market

Growth is fueled by technological innovation, a burgeoning mobile gaming sector, increasing disposable income amongst younger generations, and a gradual relaxation of government regulations, albeit subject to periodic tightening.

Challenges Impacting China Gaming Industry Growth

Stringent regulations, licensing requirements, and content restrictions pose significant hurdles. High competition for market share, issues with intellectual property theft, and macroeconomic uncertainty also impact growth.

Key Players Shaping the China Gaming Industry Market

- Elex Technology

- NetDragon Websoft

- NetEase Inc

- KongZhong Corporation

- The9 Limited

- 37 Interactive Entertainment

- Perfect World Games

- Tencent Holdings

- Beijing Kunlun Technology Co Ltd

- Shanda Games

Significant China Gaming Industry Industry Milestones

- September 2022: Tencent and NetEase receive approvals for new paid games, signaling easing of regulatory restrictions. 73 online game licenses issued, including 69 for mobile games.

- August 2022: NetEase acquires Quantic Dream, expanding its game development capabilities.

Future Outlook for China Gaming Industry Market

The China gaming market presents substantial growth opportunities, driven by technological innovation, expanding mobile gaming, and evolving consumer preferences. Strategic partnerships, diversification into new markets (e.g., global expansion), and continuous innovation will be crucial for sustained success in this competitive environment. The market is projected to reach xx Million by 2033.

China Gaming Industry Segmentation

- 1. China Gaming Market Sizing & Forecast

- 2. Gamers Population in China

- 3. Gamers Population Age and Gender

-

4. Market Segmentation Platform

- 4.1. PC Games

- 4.2. Console Games

- 4.3. Mobile Games

- 5. PC Games

- 6. Console Games

- 7. Mobile Games

- 8. Top 20 Android Games & Apps in China

- 9. Top 20 iOS Games & Apps in China

- 10. Suspension of Gaming Licenses in China

- 11. Foreign Companies Share in Chinese Gaming Industry

China Gaming Industry Segmentation By Geography

- 1. China

China Gaming Industry Regional Market Share

Geographic Coverage of China Gaming Industry

China Gaming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Advancement in Technological Developments

- 3.3. Market Restrains

- 3.3.1. Fluctuating Government Regulations Regarding Gaming Industry

- 3.4. Market Trends

- 3.4.1. Mobile Games Occupies the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gaming Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 5.2. Market Analysis, Insights and Forecast - by Gamers Population in China

- 5.3. Market Analysis, Insights and Forecast - by Gamers Population Age and Gender

- 5.4. Market Analysis, Insights and Forecast - by Market Segmentation Platform

- 5.4.1. PC Games

- 5.4.2. Console Games

- 5.4.3. Mobile Games

- 5.5. Market Analysis, Insights and Forecast - by PC Games

- 5.6. Market Analysis, Insights and Forecast - by Console Games

- 5.7. Market Analysis, Insights and Forecast - by Mobile Games

- 5.8. Market Analysis, Insights and Forecast - by Top 20 Android Games & Apps in China

- 5.9. Market Analysis, Insights and Forecast - by Top 20 iOS Games & Apps in China

- 5.10. Market Analysis, Insights and Forecast - by Suspension of Gaming Licenses in China

- 5.11. Market Analysis, Insights and Forecast - by Foreign Companies Share in Chinese Gaming Industry

- 5.12. Market Analysis, Insights and Forecast - by Region

- 5.12.1. China

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Elex Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NetDragon Websoft*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NetEase Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KongZhong Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The9 Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 37 Interactive Entertainment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perfect World Games

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tencent Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Kunlun Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shanda Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Elex Technology

List of Figures

- Figure 1: China Gaming Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Gaming Industry Share (%) by Company 2025

List of Tables

- Table 1: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2020 & 2033

- Table 2: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2020 & 2033

- Table 3: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2020 & 2033

- Table 4: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2020 & 2033

- Table 5: China Gaming Industry Revenue Million Forecast, by PC Games 2020 & 2033

- Table 6: China Gaming Industry Revenue Million Forecast, by Console Games 2020 & 2033

- Table 7: China Gaming Industry Revenue Million Forecast, by Mobile Games 2020 & 2033

- Table 8: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2020 & 2033

- Table 9: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2020 & 2033

- Table 10: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2020 & 2033

- Table 11: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2020 & 2033

- Table 12: China Gaming Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 13: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2020 & 2033

- Table 14: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2020 & 2033

- Table 15: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2020 & 2033

- Table 16: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2020 & 2033

- Table 17: China Gaming Industry Revenue Million Forecast, by PC Games 2020 & 2033

- Table 18: China Gaming Industry Revenue Million Forecast, by Console Games 2020 & 2033

- Table 19: China Gaming Industry Revenue Million Forecast, by Mobile Games 2020 & 2033

- Table 20: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2020 & 2033

- Table 21: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2020 & 2033

- Table 22: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2020 & 2033

- Table 23: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2020 & 2033

- Table 24: China Gaming Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gaming Industry?

The projected CAGR is approximately 7.63%.

2. Which companies are prominent players in the China Gaming Industry?

Key companies in the market include Elex Technology, NetDragon Websoft*List Not Exhaustive, NetEase Inc, KongZhong Corporation, The9 Limited, 37 Interactive Entertainment, Perfect World Games, Tencent Holdings, Beijing Kunlun Technology Co Ltd, Shanda Games.

3. What are the main segments of the China Gaming Industry?

The market segments include China Gaming Market Sizing & Forecast, Gamers Population in China, Gamers Population Age and Gender, Market Segmentation Platform, PC Games, Console Games, Mobile Games, Top 20 Android Games & Apps in China, Top 20 iOS Games & Apps in China, Suspension of Gaming Licenses in China, Foreign Companies Share in Chinese Gaming Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Advancement in Technological Developments.

6. What are the notable trends driving market growth?

Mobile Games Occupies the Largest Market Share.

7. Are there any restraints impacting market growth?

Fluctuating Government Regulations Regarding Gaming Industry.

8. Can you provide examples of recent developments in the market?

September 2022: Tencent Holdings and NetEase, two of China's largest video game companies, got approval to launch new paid games for the first time since July last year, indicating Beijing's relaxation of a two-year crackdown on the tech sector. Seventy-three online games, including 69 mobile games, were given publishing licenses by the National Press and Publication Administration. Licenses were also granted to CMGE Technology Group., Leiting, XD Inc, and Zhong Qing Bao.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gaming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gaming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gaming Industry?

To stay informed about further developments, trends, and reports in the China Gaming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence