Key Insights

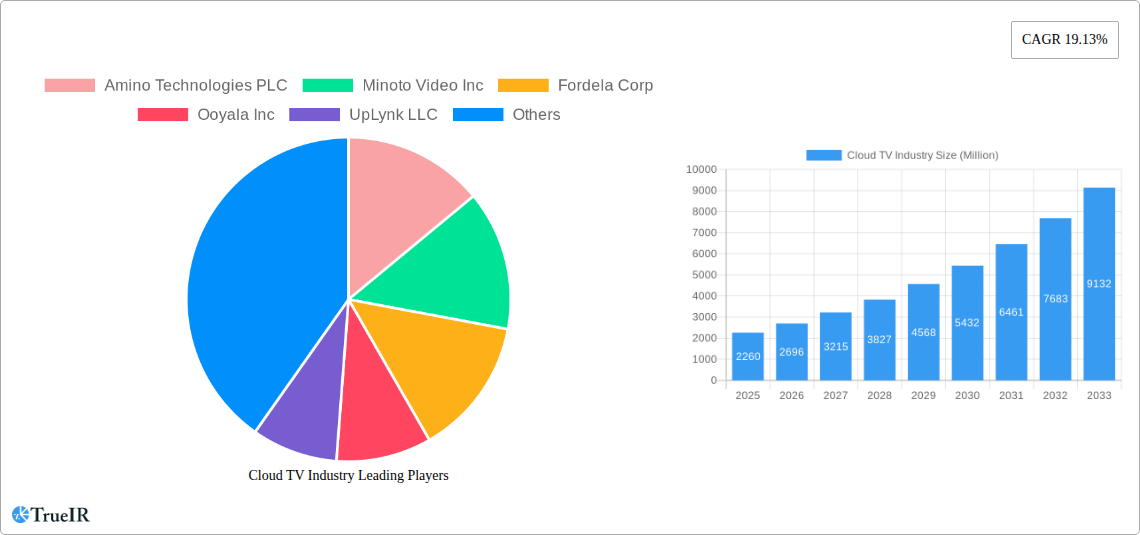

The Cloud TV market is experiencing robust growth, projected to reach $2.26 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 19.13% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-quality, on-demand video content is a primary factor, pushing consumers towards flexible and scalable cloud-based solutions. Furthermore, the rise of connected TV devices (Smart TVs, streaming sticks) and the proliferation of mobile devices capable of accessing streaming services are significantly contributing to market growth. Cost efficiency achieved through cloud infrastructure, enabling broadcasters and content providers to reduce capital expenditure and operational costs, is another crucial driver. Technological advancements, including improvements in video compression techniques and advancements in 5G and broadband infrastructure, further enhance the viewing experience and fuel adoption. The market segmentation reveals a diverse landscape, with significant contributions from the mobile phone segment due to the pervasive use of streaming apps. The Entertainment and Media application segment dominates, driven by the increasing popularity of OTT platforms and streaming services. Large enterprises are major adopters due to their need for advanced functionalities and scalability. The public cloud deployment model is currently the most prevalent due to its affordability and accessibility.

Cloud TV Industry Market Size (In Billion)

However, challenges persist. Security concerns regarding data breaches and piracy remain a significant restraint. The need for robust infrastructure, especially in regions with limited internet penetration, presents hurdles for widespread adoption. Furthermore, competition from established players and the emergence of new technologies pose a continuous challenge to market participants. Despite these restraints, the long-term growth outlook remains positive, driven by consistent technological advancements, improving infrastructure, and the ever-increasing demand for flexible and personalized viewing experiences. Geographic expansion, particularly in the Asia-Pacific region, presents lucrative opportunities for market players. The continuous innovation in features like personalized recommendations, advanced analytics, and improved user interface design will further drive market expansion in the coming years.

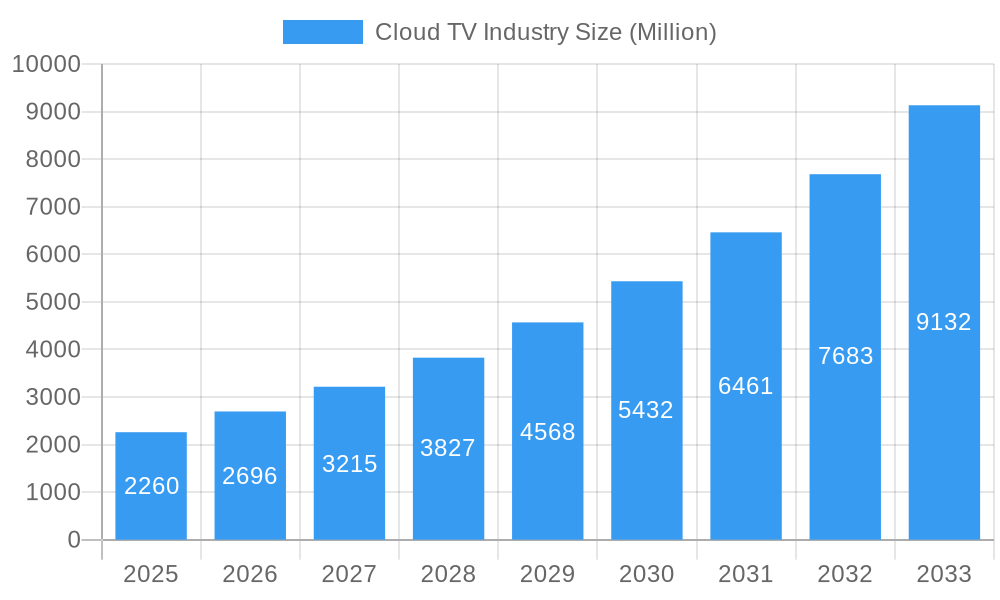

Cloud TV Industry Company Market Share

Cloud TV Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Cloud TV industry, encompassing market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. The study period covers 2019-2024 (historical period), with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for investors, industry professionals, and anyone seeking a deep understanding of this rapidly evolving sector. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

Cloud TV Industry Market Structure & Competitive Landscape

The Cloud TV market exhibits a moderately concentrated structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) for the industry stands at approximately XX, indicating a moderately competitive environment. Innovation is a key driver, with companies continually striving to enhance streaming quality, user experience, and content offerings. Regulatory landscapes vary across different regions, influencing market access and operational strategies. Product substitution, mainly from traditional cable TV and satellite services, presents a significant challenge, while technological advancements in 5G and improved streaming technology are creating new opportunities. M&A activity has been notable, with approximately XX major transactions recorded between 2019 and 2024, leading to consolidation and increased market concentration. End-user segmentation is driven by device type (STB, Mobile Phones, Connected TV), applications (Telecom, Entertainment & Media, IT, Consumer Television), and organization size (SME, Large Enterprise).

- Market Concentration: HHI of XX

- M&A Activity: XX major transactions (2019-2024)

- Key Innovation Drivers: Enhanced streaming quality, improved user interface, personalized content recommendations.

- Regulatory Impacts: Vary by region, affecting market access and operational costs.

- Product Substitutes: Traditional cable and satellite TV.

- End-User Segmentation: Device type, applications, and organization size.

Cloud TV Industry Market Trends & Opportunities

The Cloud TV market is experiencing robust growth, driven by increasing internet penetration, rising demand for on-demand content, and the proliferation of smart TVs and mobile devices. The market size is expanding rapidly, fueled by factors such as the increasing affordability of internet access, expanding availability of high-speed internet, and the rise of over-the-top (OTT) platforms. Technological advancements, such as advancements in video compression, are further enhancing streaming quality and reducing bandwidth consumption. Consumer preferences are shifting towards personalized content and interactive viewing experiences, leading to innovations in recommendation engines and user interfaces. Competitive dynamics are characterized by intense competition among content providers and technology companies. These trends offer several opportunities for new entrants and existing players to innovate and expand their market presence.

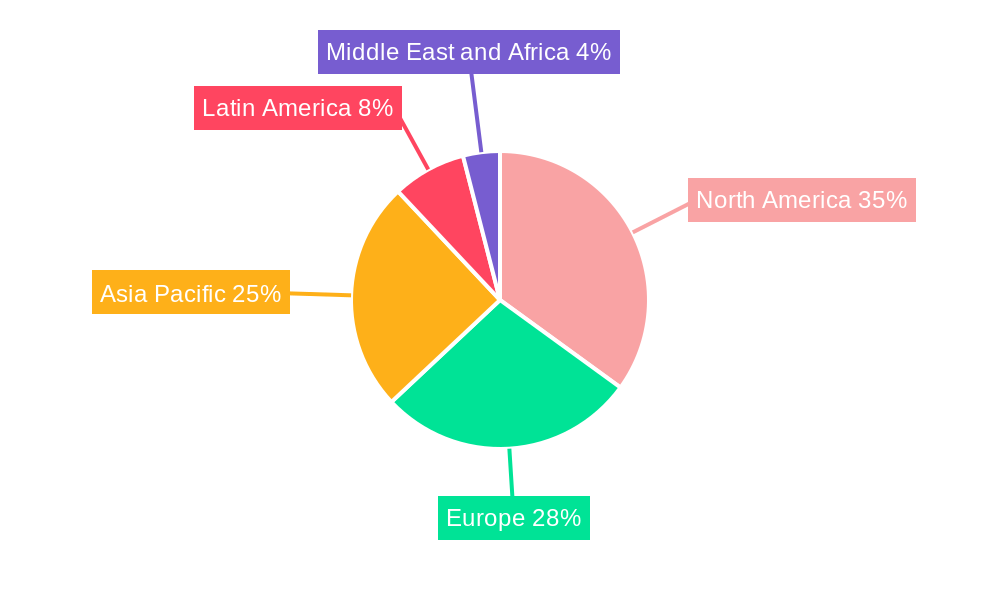

Dominant Markets & Segments in Cloud TV Industry

The North American market currently dominates the Cloud TV landscape, driven by high internet penetration, strong consumer adoption of streaming services, and mature infrastructure. However, the Asia-Pacific region is expected to witness the fastest growth in the coming years.

By Device Type: Connected TVs hold the largest market share, followed by mobile phones and STBs.

By Application: Entertainment and Media account for the major market share due to the high demand for streaming services across the globe. Telecom applications represent another significant portion of the market.

By Organization Size: Large Enterprises are the primary adopters of Cloud TV solutions due to their greater technological expertise and resources. However, the SME segment exhibits significant growth potential.

By Deployment: Public Cloud is the most popular deployment model.

- Key Growth Drivers (North America): Advanced infrastructure, high internet penetration, high consumer disposable income.

- Key Growth Drivers (Asia-Pacific): Rising internet penetration, increasing smartphone usage, growing middle class.

Cloud TV Industry Product Analysis

Cloud TV products are characterized by their versatility, scalability, and cost-effectiveness compared to traditional broadcasting solutions. They offer features such as multi-screen access, personalized content recommendations, and integration with other smart home devices. Competitive advantages stem from superior streaming quality, enhanced user experience, advanced analytics, and strong content partnerships. Technological advancements such as 4K and 8K resolution, HDR, and AI-powered personalization further enhance the product's appeal. The market is seeing increasing adoption of cloud-based solutions due to their cost-effectiveness and ability to scale with demand.

Key Drivers, Barriers & Challenges in Cloud TV Industry

Key Drivers:

- Increasing internet penetration and affordability.

- Growing demand for on-demand and personalized content.

- Proliferation of smart TVs and mobile devices.

- Technological advancements in streaming and video compression.

- Government initiatives to promote digital content and broadband infrastructure.

Key Challenges:

- Competition from traditional media providers.

- Content licensing and copyright issues.

- Cybersecurity risks and data privacy concerns.

- Infrastructure limitations in certain regions.

- Regulatory complexities and varying data privacy laws across regions.

Growth Drivers in the Cloud TV Industry Market

The Cloud TV market's growth is propelled by technological advancements (e.g., 5G, improved streaming technologies), economic factors (e.g., rising disposable incomes), and favorable regulatory environments promoting digital content and infrastructure development. The increasing demand for personalized content and interactive viewing experiences drives innovation in cloud TV solutions.

Challenges Impacting Cloud TV Industry Growth

Challenges include regulatory hurdles (e.g., varying data privacy regulations), supply chain disruptions impacting hardware availability, and intense competition, resulting in price wars and reduced profit margins. These factors impact growth negatively, requiring strategic adaptation from industry players.

Key Players Shaping the Cloud TV Industry Market

- Amino Technologies PLC

- Minoto Video Inc

- Fordela Corp

- Ooyala Inc

- UpLynk LLC

- Kaltura Inc

- NetSuite Inc

- Liberty Global PL

- MatrixStream Technologies Inc

- MUVI Television Ltd

- Monetize Media Inc

- PCCW Limited

- Brightcove Inc

- DaCast LLC

- Spectrum (Charter Communications)

Significant Cloud TV Industry Milestones

- June 2023: OnePlus TV integrates DistroTV, adding 270+ global channels and 180+ Indian channels, expanding content diversity and regional reach.

- August 2022: 24i and Swisscom Broadcast launch FokusOnTV, a cloud-based TVaaS solution showcasing advancements in cloud-based streaming services and partnerships.

Future Outlook for Cloud TV Industry Market

The Cloud TV industry is poised for continued strong growth, driven by technological advancements, increasing consumer demand for high-quality streaming experiences, and the expansion of 5G networks. Strategic partnerships, innovative content offerings, and international expansion will be crucial for success. The market presents significant opportunities for players focusing on personalization, interactive features, and seamless cross-device experiences. The focus on advanced analytics and targeted advertising will further drive revenue growth.

Cloud TV Industry Segmentation

-

1. Deployment

- 1.1. Public Cloud

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

2. Device Type

- 2.1. STB

- 2.2. Mobile Phones

- 2.3. Connected TV

-

3. Applications

- 3.1. Telecom

- 3.2. Entertainment and Media

- 3.3. Information Technology

- 3.4. Consumer Television

- 3.5. Other Applications

-

4. Organization Size

- 4.1. Small and Medium Enterprise

- 4.2. Large Enterprise

Cloud TV Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud TV Industry Regional Market Share

Geographic Coverage of Cloud TV Industry

Cloud TV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Smart Devices; Evolution of Bandwidth-independent Cloud Streaming Services; Increasing Technological Development Leading to Efficient and Quicker Service

- 3.3. Market Restrains

- 3.3.1. Failure of the Widespread Adoption of 4G Services Due to Insufficient Users; Lack of Internet Penetration in Certain Areas

- 3.4. Market Trends

- 3.4.1. Small and Medium Enterprise to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Public Cloud

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. STB

- 5.2.2. Mobile Phones

- 5.2.3. Connected TV

- 5.3. Market Analysis, Insights and Forecast - by Applications

- 5.3.1. Telecom

- 5.3.2. Entertainment and Media

- 5.3.3. Information Technology

- 5.3.4. Consumer Television

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. Small and Medium Enterprise

- 5.4.2. Large Enterprise

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Public Cloud

- 6.1.2. Private Cloud

- 6.1.3. Hybrid Cloud

- 6.2. Market Analysis, Insights and Forecast - by Device Type

- 6.2.1. STB

- 6.2.2. Mobile Phones

- 6.2.3. Connected TV

- 6.3. Market Analysis, Insights and Forecast - by Applications

- 6.3.1. Telecom

- 6.3.2. Entertainment and Media

- 6.3.3. Information Technology

- 6.3.4. Consumer Television

- 6.3.5. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Organization Size

- 6.4.1. Small and Medium Enterprise

- 6.4.2. Large Enterprise

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Public Cloud

- 7.1.2. Private Cloud

- 7.1.3. Hybrid Cloud

- 7.2. Market Analysis, Insights and Forecast - by Device Type

- 7.2.1. STB

- 7.2.2. Mobile Phones

- 7.2.3. Connected TV

- 7.3. Market Analysis, Insights and Forecast - by Applications

- 7.3.1. Telecom

- 7.3.2. Entertainment and Media

- 7.3.3. Information Technology

- 7.3.4. Consumer Television

- 7.3.5. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Organization Size

- 7.4.1. Small and Medium Enterprise

- 7.4.2. Large Enterprise

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Public Cloud

- 8.1.2. Private Cloud

- 8.1.3. Hybrid Cloud

- 8.2. Market Analysis, Insights and Forecast - by Device Type

- 8.2.1. STB

- 8.2.2. Mobile Phones

- 8.2.3. Connected TV

- 8.3. Market Analysis, Insights and Forecast - by Applications

- 8.3.1. Telecom

- 8.3.2. Entertainment and Media

- 8.3.3. Information Technology

- 8.3.4. Consumer Television

- 8.3.5. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Organization Size

- 8.4.1. Small and Medium Enterprise

- 8.4.2. Large Enterprise

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Public Cloud

- 9.1.2. Private Cloud

- 9.1.3. Hybrid Cloud

- 9.2. Market Analysis, Insights and Forecast - by Device Type

- 9.2.1. STB

- 9.2.2. Mobile Phones

- 9.2.3. Connected TV

- 9.3. Market Analysis, Insights and Forecast - by Applications

- 9.3.1. Telecom

- 9.3.2. Entertainment and Media

- 9.3.3. Information Technology

- 9.3.4. Consumer Television

- 9.3.5. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Organization Size

- 9.4.1. Small and Medium Enterprise

- 9.4.2. Large Enterprise

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Cloud TV Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Public Cloud

- 10.1.2. Private Cloud

- 10.1.3. Hybrid Cloud

- 10.2. Market Analysis, Insights and Forecast - by Device Type

- 10.2.1. STB

- 10.2.2. Mobile Phones

- 10.2.3. Connected TV

- 10.3. Market Analysis, Insights and Forecast - by Applications

- 10.3.1. Telecom

- 10.3.2. Entertainment and Media

- 10.3.3. Information Technology

- 10.3.4. Consumer Television

- 10.3.5. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Organization Size

- 10.4.1. Small and Medium Enterprise

- 10.4.2. Large Enterprise

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amino Technologies PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Minoto Video Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fordela Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ooyala Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UpLynk LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kaltura Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NetSuite Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Liberty Global PL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MatrixStream Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MUVI Television Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Monetize Media Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PCCW Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Brightcove Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DaCast LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Spectrum (Charter Communications)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Amino Technologies PLC

List of Figures

- Figure 1: Global Cloud TV Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cloud TV Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Cloud TV Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Cloud TV Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 5: North America Cloud TV Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America Cloud TV Industry Revenue (Million), by Applications 2025 & 2033

- Figure 7: North America Cloud TV Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 8: North America Cloud TV Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 9: North America Cloud TV Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: North America Cloud TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Cloud TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Cloud TV Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 13: Europe Cloud TV Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Europe Cloud TV Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 15: Europe Cloud TV Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 16: Europe Cloud TV Industry Revenue (Million), by Applications 2025 & 2033

- Figure 17: Europe Cloud TV Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 18: Europe Cloud TV Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 19: Europe Cloud TV Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 20: Europe Cloud TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Cloud TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Cloud TV Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 23: Asia Pacific Cloud TV Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: Asia Pacific Cloud TV Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 25: Asia Pacific Cloud TV Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 26: Asia Pacific Cloud TV Industry Revenue (Million), by Applications 2025 & 2033

- Figure 27: Asia Pacific Cloud TV Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 28: Asia Pacific Cloud TV Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Asia Pacific Cloud TV Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Asia Pacific Cloud TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cloud TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Cloud TV Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 33: Latin America Cloud TV Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 34: Latin America Cloud TV Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 35: Latin America Cloud TV Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 36: Latin America Cloud TV Industry Revenue (Million), by Applications 2025 & 2033

- Figure 37: Latin America Cloud TV Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 38: Latin America Cloud TV Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 39: Latin America Cloud TV Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 40: Latin America Cloud TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Cloud TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Cloud TV Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 43: Middle East and Africa Cloud TV Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Middle East and Africa Cloud TV Industry Revenue (Million), by Device Type 2025 & 2033

- Figure 45: Middle East and Africa Cloud TV Industry Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Middle East and Africa Cloud TV Industry Revenue (Million), by Applications 2025 & 2033

- Figure 47: Middle East and Africa Cloud TV Industry Revenue Share (%), by Applications 2025 & 2033

- Figure 48: Middle East and Africa Cloud TV Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 49: Middle East and Africa Cloud TV Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 50: Middle East and Africa Cloud TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cloud TV Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 3: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: Global Cloud TV Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 9: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 10: Global Cloud TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 13: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 14: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global Cloud TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 19: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 20: Global Cloud TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 23: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 24: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 25: Global Cloud TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Cloud TV Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 27: Global Cloud TV Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 28: Global Cloud TV Industry Revenue Million Forecast, by Applications 2020 & 2033

- Table 29: Global Cloud TV Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 30: Global Cloud TV Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud TV Industry?

The projected CAGR is approximately 19.13%.

2. Which companies are prominent players in the Cloud TV Industry?

Key companies in the market include Amino Technologies PLC, Minoto Video Inc, Fordela Corp, Ooyala Inc, UpLynk LLC, Kaltura Inc, NetSuite Inc, Liberty Global PL, MatrixStream Technologies Inc, MUVI Television Ltd, Monetize Media Inc, PCCW Limited, Brightcove Inc, DaCast LLC, Spectrum (Charter Communications).

3. What are the main segments of the Cloud TV Industry?

The market segments include Deployment, Device Type, Applications, Organization Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Smart Devices; Evolution of Bandwidth-independent Cloud Streaming Services; Increasing Technological Development Leading to Efficient and Quicker Service.

6. What are the notable trends driving market growth?

Small and Medium Enterprise to Witness the Growth.

7. Are there any restraints impacting market growth?

Failure of the Widespread Adoption of 4G Services Due to Insufficient Users; Lack of Internet Penetration in Certain Areas.

8. Can you provide examples of recent developments in the market?

Jun 2023: OnePlus TV users can stream DistroTV's content lineup with 270 channels globally and 180 channels in India anytime on the Cloud TV platform, which includes original content and new channel offerings that cater to Hindi, Tamil, Bengali, Marathi, English, Punjabi, and add more languages and channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud TV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud TV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud TV Industry?

To stay informed about further developments, trends, and reports in the Cloud TV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence