Key Insights

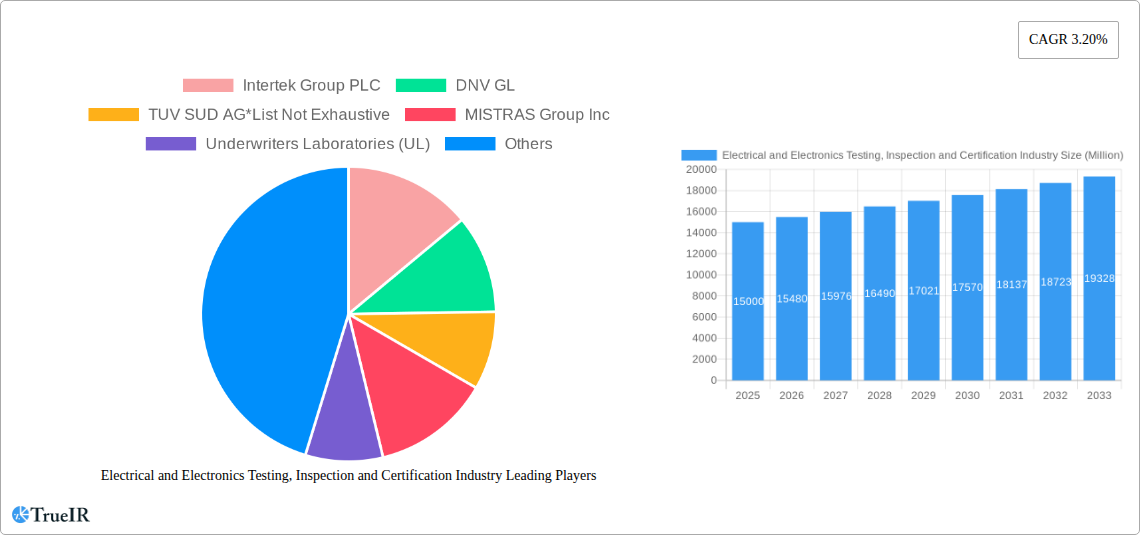

The Electrical and Electronics Testing, Inspection, and Certification (E&E TIC) industry is experiencing steady growth, driven by increasing demand for safety and quality assurance in electronic products globally. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key factors. Stringent regulatory requirements for product safety and compliance across diverse sectors like consumer electronics, automotive, and industrial automation are driving demand for TIC services. The increasing complexity of electronic devices, coupled with the rise of IoT and connected devices, necessitate rigorous testing and certification to ensure reliability and performance. Furthermore, the growing emphasis on supply chain transparency and risk mitigation is pushing manufacturers to engage external TIC providers to ensure product quality and ethical sourcing throughout the manufacturing process. The outsourcing of testing and certification services is also a significant growth driver, as companies increasingly focus on their core competencies.

Electrical and Electronics Testing, Inspection and Certification Industry Market Size (In Billion)

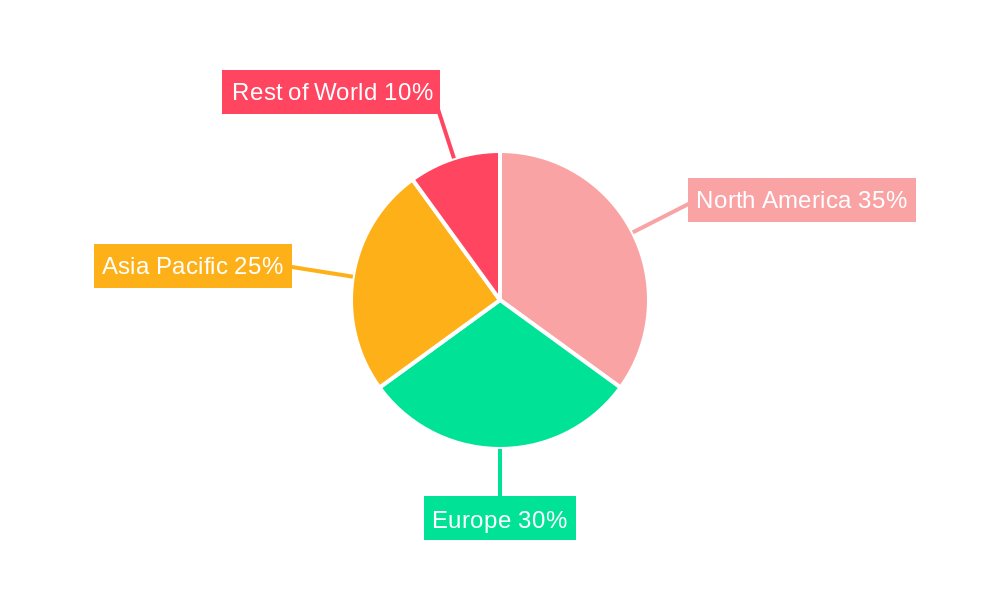

Significant regional variations exist within the E&E TIC market. North America and Europe are currently major markets, benefiting from established regulatory frameworks and a high concentration of leading TIC providers like Intertek, DNV GL, and TÜV SÜD. However, the Asia-Pacific region, particularly China and India, is witnessing rapid growth due to expanding manufacturing bases and increasing consumer demand for electronic goods. The market segmentation reveals strong growth across various end-user verticals, with the construction and engineering, chemicals, and food and healthcare sectors exhibiting significant demand for reliable testing and certification services. While the industry faces challenges like the rising cost of testing and certification and the need for continuous technological advancements to keep pace with emerging technologies, the overall outlook remains positive, indicating continued growth and expansion throughout the forecast period. The competitive landscape is characterized by both large multinational corporations and specialized niche players, leading to innovation and a broad range of service offerings catering to diverse industry needs.

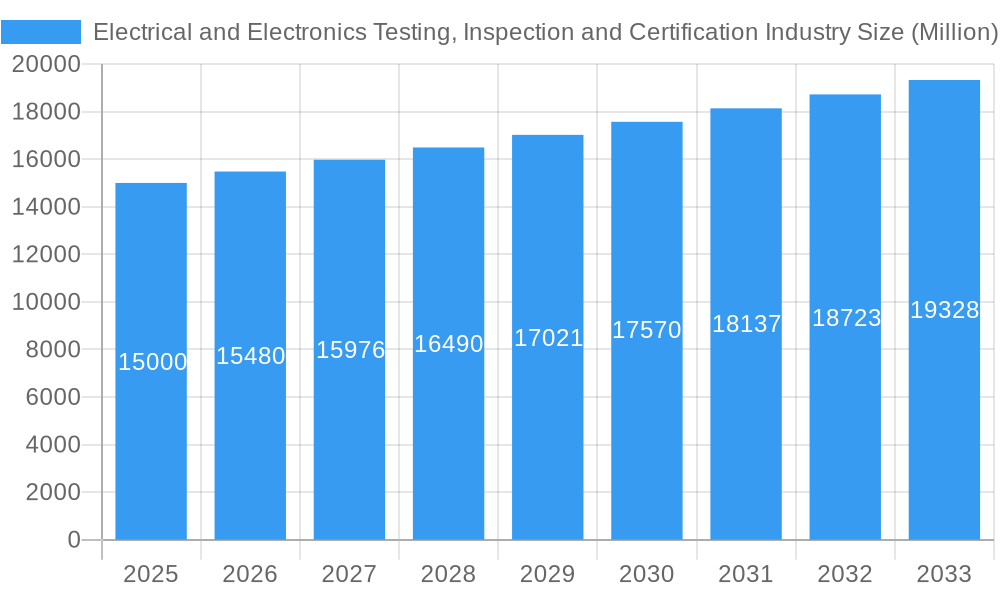

Electrical and Electronics Testing, Inspection and Certification Industry Company Market Share

Electrical and Electronics Testing, Inspection, and Certification Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Electrical and Electronics Testing, Inspection, and Certification market, covering the period 2019-2033. With a focus on key trends, growth drivers, and competitive dynamics, this report is an essential resource for industry professionals, investors, and stakeholders seeking a deep understanding of this rapidly evolving market. The report projects a market size exceeding $XX Million by 2033, representing a significant growth opportunity.

Electrical and Electronics Testing, Inspection and Certification Industry Market Structure & Competitive Landscape

The Electrical and Electronics Testing, Inspection, and Certification market is characterized by a moderately concentrated structure, with several multinational corporations holding significant market share. The industry's competitive landscape is shaped by a combination of factors, including technological innovation, stringent regulatory environments, the availability of product substitutes, and a diverse range of end-user verticals. Major players such as Intertek Group PLC, DNV GL, TÜV SÜD AG, MISTRAS Group Inc., Underwriters Laboratories (UL), BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, and Exova Group PLC compete based on factors like service breadth, geographical reach, technological expertise, and brand reputation.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be approximately xx, suggesting a moderately concentrated market.

- Innovation Drivers: Continuous advancements in testing technologies, automation, and data analytics drive market innovation. The adoption of AI and machine learning is transforming inspection processes.

- Regulatory Impacts: Stringent safety and quality standards, varying by region, significantly influence market dynamics. Compliance requirements drive demand for testing and certification services.

- Product Substitutes: The availability of alternative testing methods and technologies can impact market growth, though specialized testing often remains irreplaceable.

- End-User Segmentation: The industry caters to a vast range of end-user verticals, including construction, energy, healthcare, and manufacturing, each with specific testing needs.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) has been a significant trend, with xx major M&A deals occurring between 2019 and 2024, totaling approximately $xx Million in value. This trend is expected to continue, driven by the pursuit of scale and expansion into new markets.

Electrical and Electronics Testing, Inspection and Certification Industry Market Trends & Opportunities

The global Electrical and Electronics Testing, Inspection, and Certification market is experiencing robust growth, driven by several key factors. The market size is estimated to reach $XX Million in 2025, expanding at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for safety and quality assurance in various industries, the proliferation of electronic devices, stricter regulatory compliance requirements, and rising global trade volumes. Technological advancements, such as the increasing adoption of digital technologies and automation in testing processes, further contribute to market expansion. Consumers are increasingly demanding high-quality, safe products, creating a robust demand for testing and certification services. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and geographical expansion by leading players. Market penetration rates vary significantly across regions and end-user verticals, with higher penetration in developed economies.

Dominant Markets & Segments in Electrical and Electronics Testing, Inspection and Certification Industry

The Electrical and Electronics Testing, Inspection, and Certification market exhibits significant regional variations in growth and dominance. While North America and Europe currently hold considerable market share, Asia-Pacific is projected to experience the fastest growth during the forecast period. The outsourced segment is expected to dominate the market driven by cost efficiency and access to specialized expertise.

By Sourcing Type:

- Outsourced: The outsourcing segment is expected to hold the largest market share due to the increasing demand for specialized expertise and cost-effectiveness.

- In-house: The in-house segment is likely to witness slower growth compared to the outsourced segment.

By End-user Vertical:

- Energy and Commodities: This segment is experiencing significant growth due to increasing safety and regulatory concerns within the energy sector.

- Construction and Engineering: Stringent building codes and safety regulations drive high demand for testing and certification services in this sector.

- Food and Healthcare: Stringent regulatory compliance and consumer safety concerns fuel market growth in this segment.

- Transportation: Safety standards and regulatory compliance requirements within the automotive and aerospace sectors are key drivers of market growth.

- Products and Retail: Demand is driven by quality control, brand reputation, and consumer confidence.

Key Growth Drivers:

- Infrastructure Development: Large-scale infrastructure projects across developing economies are driving demand for testing and certification services.

- Stringent Regulations: Increased regulatory scrutiny and compliance requirements in numerous sectors are pushing demand.

- Technological Advancements: Adoption of advanced testing technologies and automation is improving efficiency and accuracy.

Electrical and Electronics Testing, Inspection and Certification Industry Product Analysis

The Electrical and Electronics Testing, Inspection, and Certification (TIC) industry provides a comprehensive suite of services essential for ensuring product safety, compliance, and performance. This diverse range includes rigorous electrical safety testing to prevent hazards, electromagnetic compatibility (EMC) testing to ensure devices do not interfere with each other, robust product performance testing to validate functionality and durability, and detailed quality assurance audits to uphold manufacturing standards. The sector is rapidly evolving, with technological advancements such as AI-powered testing solutions dramatically enhancing efficiency and accuracy, enabling more predictive analysis and faster iteration cycles. Furthermore, the integration of remote inspection technologies is revolutionizing how assessments are conducted, offering greater flexibility and reduced turnaround times. These innovations are not only improving the speed and accuracy of testing but also facilitating more detailed and comprehensive evaluations of product safety and performance. The market fit and successful adoption of new technologies and innovative product offerings are intrinsically linked to, and significantly influenced by, evolving global regulatory requirements and the specific, often complex, needs of clients across various sectors.

Key Drivers, Barriers & Challenges in Electrical and Electronics Testing, Inspection and Certification Industry

Key Drivers:

Stringent safety and quality standards, growing global trade, technological advancements in testing methodologies, and rising demand for reliable and efficient quality assurance processes across diverse industries are key drivers of market growth. Government regulations and initiatives mandating thorough testing and certification procedures are also significant factors.

Key Challenges:

- Regulatory Complexity: Varying and evolving regulatory landscapes across different regions create challenges for compliance and standardization.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of testing equipment and expertise.

- Competitive Pressure: Intense competition among established players and new entrants necessitates continuous innovation and efficiency improvements. Price competition is a significant factor, impacting margins. Estimated impact on revenue: a projected $xx Million loss annually due to price pressure.

Growth Drivers in the Electrical and Electronics Testing, Inspection and Certification Industry Market

The global Electrical and Electronics TIC market is experiencing robust growth fueled by several key drivers. A heightened societal and corporate awareness of product safety, reliability, and quality assurance is paramount. This is directly supported by increasingly stringent and evolving regulatory requirements imposed by governments and international bodies worldwide, necessitating comprehensive testing and certification. Technological innovations in testing methodologies, including the adoption of advanced automation and data analytics, are making testing more efficient and insightful. The pervasive demand for stringent quality control mechanisms across a vast array of industries, from consumer electronics to industrial machinery and automotive, further propels market expansion. The escalating complexity of modern electronic products, with their intricate functionalities and integrated systems, alongside the continuous expansion of global trade and supply chains, significantly amplifies the importance and demand for expert testing and certification services. Moreover, emerging economies, driven by substantial infrastructural developments and ongoing industrialization, present significant opportunities and contribute to the overall expansion of market demand.

Challenges Impacting Electrical and Electronics Testing, Inspection and Certification Industry Growth

Despite its growth trajectory, the Electrical and Electronics TIC industry faces several significant challenges. Navigating the complex and often disparate regulatory landscapes across different global jurisdictions requires substantial expertise and resources, posing a constant hurdle. Supply chain disruptions, which can impact the timely availability of specialized testing equipment and the sourcing of highly skilled professionals, present operational difficulties. The market is also characterized by intense competition from a growing number of established players and new entrants, which can exert pressure on pricing and profit margins. These combined factors can collectively limit market expansion and affect overall profitability. Furthermore, the imperative for continuous, substantial investment in cutting-edge testing technologies and the ongoing development and upskilling of a highly specialized workforce represent persistent financial and strategic challenges for companies operating within this dynamic sector.

Key Players Shaping the Electrical and Electronics Testing, Inspection and Certification Industry Market

- Intertek Group PLC

- DNV GL

- TÜV SÜD AG

- MISTRAS Group Inc

- Underwriters Laboratories (UL)

- BSI Group

- SAI Global Limited

- Dekra Certification GmbH

- SGS SA

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- Exova Group PLC

Significant Electrical and Electronics Testing, Inspection and Certification Industry Industry Milestones

- 2020: Increased adoption of remote inspection technologies due to pandemic-related restrictions.

- 2021: Several key players invested heavily in AI-powered testing solutions.

- 2022: Significant M&A activity among industry players to expand market share and service offerings.

- 2023: Introduction of new regulatory standards impacting several key sectors.

- 2024: Launch of several innovative testing services incorporating advanced technologies.

Future Outlook for Electrical and Electronics Testing, Inspection and Certification Industry Market

The Electrical and Electronics TIC market is poised for sustained and significant growth in the coming years. This positive outlook is underpinned by the relentless pace of technological advancements, the continuous evolution and tightening of global regulatory frameworks, and an ever-increasing emphasis on ensuring product safety, reliability, and ethical manufacturing practices. Strategic partnerships, aggressive geographical expansion into new and growing markets, and the proactive development of innovative, specialized testing solutions will be critical differentiators and key determinants of success in the competitive landscape. The market presents substantial opportunities for forward-thinking companies that can effectively leverage emerging technologies, adapt swiftly to changing regulatory environments, and meet the evolving demands of a globalized marketplace. The accelerating adoption of digital technologies, including artificial intelligence, IoT integration for testing, and advanced automation, will continue to drive substantial efficiency gains. This will translate into enhanced profitability, deeper market penetration, and a stronger competitive advantage for leading players who embrace these transformative trends.

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation

-

1. Sourcing Type

- 1.1. In-house

- 1.2. Outsourced

-

2. End-user Vertical

- 2.1. Construction and Engineering

- 2.2. Chemicals

- 2.3. Food and Healthcare

- 2.4. Energy and Commodities

- 2.5. Transportation

- 2.6. Products and Retail

- 2.7. Industrial

- 2.8. Other End-user Vertical

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Electrical and Electronics Testing, Inspection and Certification Industry Regional Market Share

Geographic Coverage of Electrical and Electronics Testing, Inspection and Certification Industry

Electrical and Electronics Testing, Inspection and Certification Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products

- 3.3. Market Restrains

- 3.3.1. ; Trade Wars and Growth Fluctuations of End-user Industries

- 3.4. Market Trends

- 3.4.1. Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction and Engineering

- 5.2.2. Chemicals

- 5.2.3. Food and Healthcare

- 5.2.4. Energy and Commodities

- 5.2.5. Transportation

- 5.2.6. Products and Retail

- 5.2.7. Industrial

- 5.2.8. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. North America Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.1.1. In-house

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Construction and Engineering

- 6.2.2. Chemicals

- 6.2.3. Food and Healthcare

- 6.2.4. Energy and Commodities

- 6.2.5. Transportation

- 6.2.6. Products and Retail

- 6.2.7. Industrial

- 6.2.8. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7. Europe Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.1.1. In-house

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Construction and Engineering

- 7.2.2. Chemicals

- 7.2.3. Food and Healthcare

- 7.2.4. Energy and Commodities

- 7.2.5. Transportation

- 7.2.6. Products and Retail

- 7.2.7. Industrial

- 7.2.8. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8. Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.1.1. In-house

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Construction and Engineering

- 8.2.2. Chemicals

- 8.2.3. Food and Healthcare

- 8.2.4. Energy and Commodities

- 8.2.5. Transportation

- 8.2.6. Products and Retail

- 8.2.7. Industrial

- 8.2.8. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9. Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.1.1. In-house

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Construction and Engineering

- 9.2.2. Chemicals

- 9.2.3. Food and Healthcare

- 9.2.4. Energy and Commodities

- 9.2.5. Transportation

- 9.2.6. Products and Retail

- 9.2.7. Industrial

- 9.2.8. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DNV GL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TUV SUD AG*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MISTRAS Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Underwriters Laboratories (UL)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BSI Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SAI Global Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dekra Certification GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SGS SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ALS Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bureau Veritas SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eurofins Scientific SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Exova Group PLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 3: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 4: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 9: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 10: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 15: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 16: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 21: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 22: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 10: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: UK Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 17: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 25: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 26: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrical and Electronics Testing, Inspection and Certification Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Electrical and Electronics Testing, Inspection and Certification Industry?

Key companies in the market include Intertek Group PLC, DNV GL, TUV SUD AG*List Not Exhaustive, MISTRAS Group Inc, Underwriters Laboratories (UL), BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, Exova Group PLC.

3. What are the main segments of the Electrical and Electronics Testing, Inspection and Certification Industry?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products.

6. What are the notable trends driving market growth?

Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Trade Wars and Growth Fluctuations of End-user Industries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrical and Electronics Testing, Inspection and Certification Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrical and Electronics Testing, Inspection and Certification Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrical and Electronics Testing, Inspection and Certification Industry?

To stay informed about further developments, trends, and reports in the Electrical and Electronics Testing, Inspection and Certification Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence