Key Insights

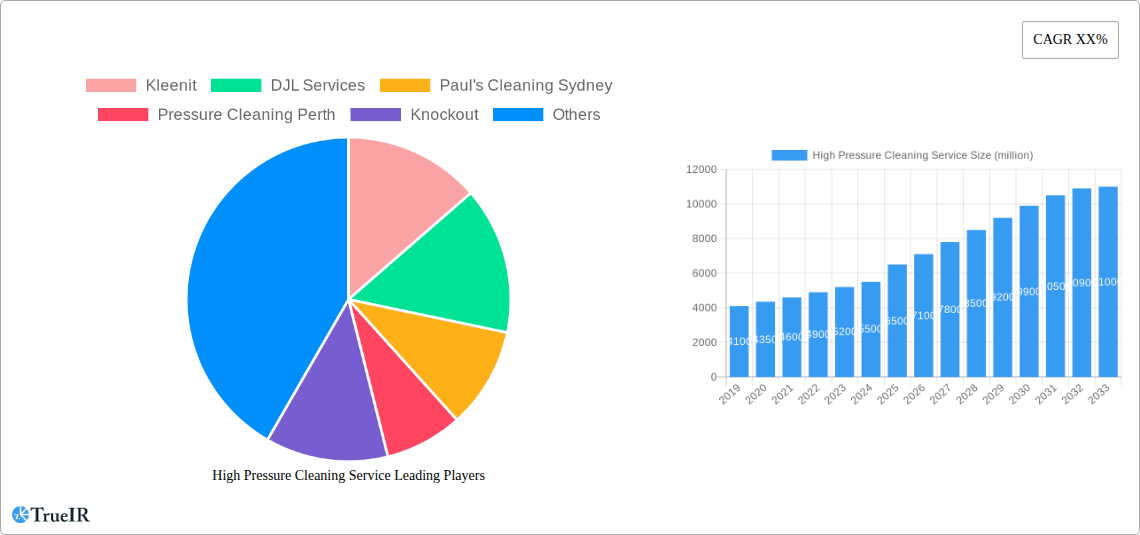

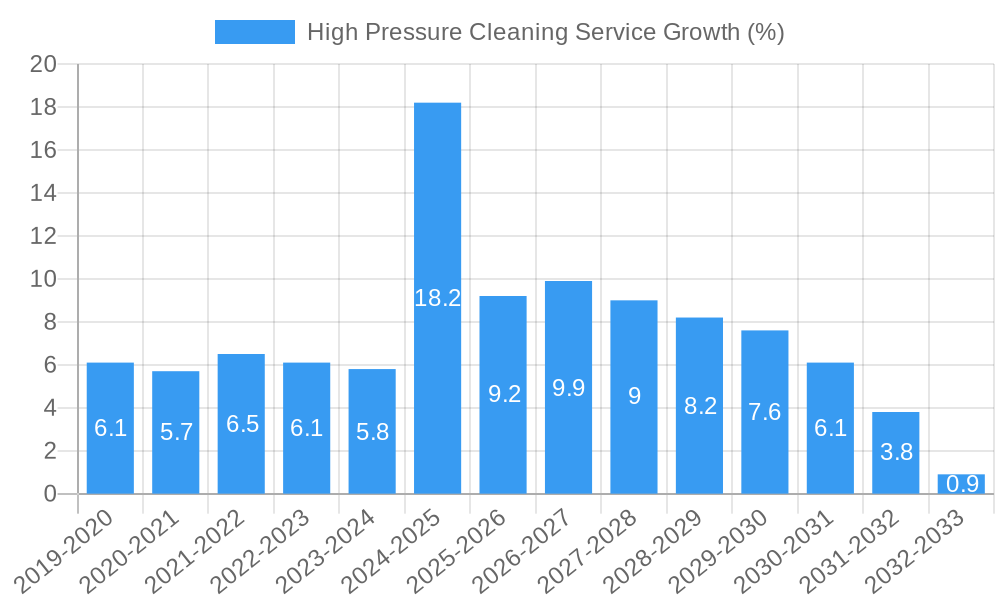

The global High Pressure Cleaning Service market is poised for substantial growth, projected to reach an estimated $6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% expected to drive it to $11,000 million by 2033. This expansion is fueled by an increasing demand for pristine outdoor spaces in both residential and commercial sectors. Key drivers include the rising awareness of property maintenance and curb appeal, especially in urbanized areas where exterior aesthetics significantly impact property value. The growing need for efficient and effective cleaning solutions for patios, lanes, and exterior walls, particularly in tackling stubborn grime, mold, and pollution residue, further propels market adoption. Furthermore, the burgeoning construction and infrastructure development across various regions contribute to the sustained demand for professional high-pressure cleaning services to maintain new and existing structures.

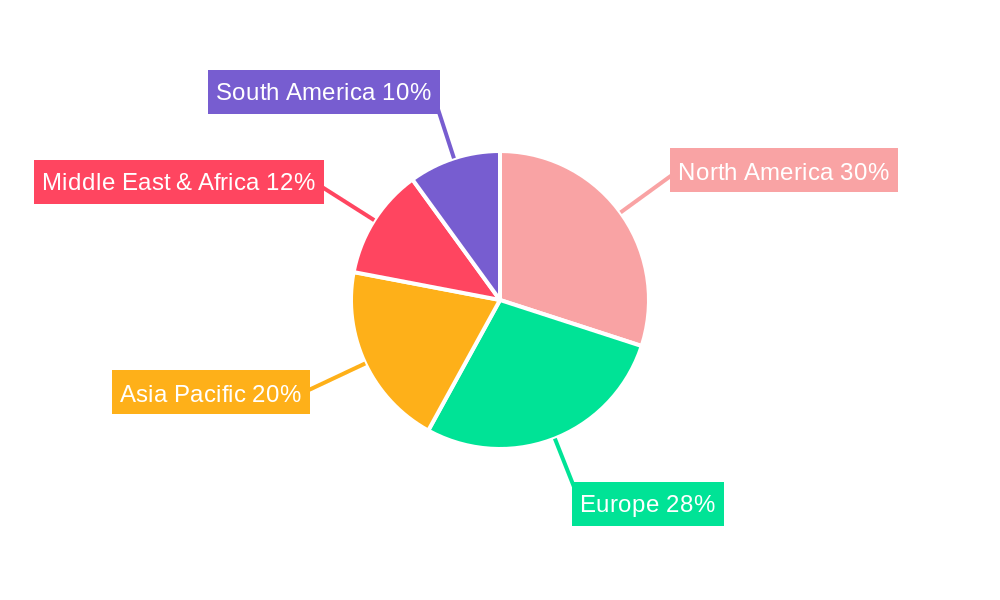

The market is segmenting effectively to meet diverse client needs. The application segment highlights significant opportunities in residential areas (patio cleaning) and commercial infrastructure (lane and exterior wall cleaning). In terms of cleaning types, while manual cleaning remains prevalent, the adoption of automatic cleaning solutions is on an upward trajectory, driven by technological advancements and the pursuit of greater efficiency and safety. Geographically, North America and Europe are anticipated to lead the market share, owing to mature economies with a strong emphasis on property upkeep and higher disposable incomes. However, the Asia Pacific region is expected to witness the fastest growth, propelled by rapid urbanization, increasing disposable incomes, and a burgeoning real estate market. Restraints such as the initial investment cost for professional equipment and the availability of skilled labor may present challenges, but the overall market outlook remains exceptionally positive due to the clear benefits and escalating demand for professional high-pressure cleaning services.

This dynamic report delves into the burgeoning High Pressure Cleaning Service market, offering a deep dive into its structure, competitive landscape, evolving trends, and future trajectory. Analyzing data from the Historical Period (2019–2024) and projecting growth through the Forecast Period (2025–2033), with 2025 serving as both the base and estimated year, this study leverages high-volume keywords to provide actionable insights for industry stakeholders. The report covers a wide array of applications including Patio, Lane, Exterior Wall, and Others, and cleaning types such as Manual Cleaning and Automatic Cleaning, providing a granular view of market segmentation.

High Pressure Cleaning Service Market Structure & Competitive Landscape

The High Pressure Cleaning Service market exhibits a moderate to fragmented concentration, with numerous regional and specialized players coexisting alongside larger national service providers. Innovation drivers are primarily focused on efficiency, eco-friendliness, and enhanced cleaning performance, fueled by advancements in equipment technology and chemical formulations. Regulatory impacts, while varying by region, generally emphasize environmental protection, water usage reduction, and worker safety standards, influencing operational practices and service offerings. Product substitutes, such as traditional washing methods or specialized cleaning solutions, pose a competitive challenge but are often outmatched by the speed and efficacy of high-pressure cleaning. End-user segmentation reveals significant demand from residential, commercial, and industrial sectors, each with distinct needs and service requirements. Merger and acquisition (M&A) trends are gradually consolidating market share, particularly among larger players seeking to expand their service portfolios and geographic reach. M&A volumes are projected to increase by approximately 15% in the coming forecast period as companies seek economies of scale and market dominance. Concentration ratios in key metropolitan areas are estimated to be around 30-40%, indicating room for further consolidation and growth.

High Pressure Cleaning Service Market Trends & Opportunities

The High Pressure Cleaning Service market is experiencing robust growth, driven by an increasing awareness of property maintenance and hygiene across residential, commercial, and industrial sectors. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, translating to a market value exceeding one million US dollars by the end of the forecast period. Technological shifts are pivotal, with the adoption of advanced, eco-friendly cleaning agents and more energy-efficient, water-saving high-pressure systems gaining traction. Innovations in automated cleaning solutions and specialized nozzle technologies are enhancing efficiency and precision, catering to diverse cleaning needs. Consumer preferences are increasingly leaning towards convenient, professional, and environmentally conscious services. This demand is further amplified by property owners seeking to maintain and enhance their asset values, particularly in urbanized areas where exterior aesthetics and structural integrity are paramount. Competitive dynamics are intensifying, with companies differentiating themselves through service quality, pricing strategies, and the adoption of sustainable practices. The rise of specialized cleaning services, catering to specific substrates like historic buildings or delicate surfaces, presents a significant niche opportunity. Market penetration rates are estimated to be around 40% in developed economies, with substantial room for growth in emerging markets. The convenience and effectiveness of professional high-pressure cleaning services, especially for large-scale or difficult-to-access areas, are key factors driving market penetration. The report forecasts a market value of over two million US dollars in the residential segment alone by 2033.

Dominant Markets & Segments in High Pressure Cleaning Service

The Exterior Wall segment is poised for significant dominance within the High Pressure Cleaning Service market, driven by its widespread application across both residential and commercial properties. The sheer volume of buildings requiring regular facade cleaning for aesthetic appeal, maintenance, and preventing structural damage makes this a perennial growth area. Infrastructure development and urban renewal projects worldwide are further bolstering demand for exterior wall cleaning services. Policies promoting improved urban aesthetics and building longevity also indirectly support this segment's growth.

- Key Growth Drivers for Exterior Wall Cleaning:

- Urbanization and increased construction of high-rise buildings.

- Government initiatives for city beautification and building maintenance.

- Growing awareness of the impact of pollution and environmental factors on building exteriors.

- Demand for increased property value through enhanced curb appeal.

The Patio segment also holds substantial market share, particularly in residential areas, fueled by the increasing popularity of outdoor living spaces. Homeowners are investing more in the upkeep and aesthetic appeal of their patios, driveways, and outdoor entertainment areas.

- Key Growth Drivers for Patio Cleaning:

- Rise in home improvement spending and focus on outdoor living.

- Demand for removal of moss, algae, stains, and grime from paved surfaces.

- Seasonal cleaning cycles that drive consistent demand.

In terms of cleaning types, Automatic Cleaning technologies are steadily gaining prominence, offering greater efficiency and consistency, especially for large-scale commercial and industrial applications. While Manual Cleaning continues to be crucial for intricate jobs and smaller residential properties, the trend towards automation is undeniable. The market value for automatic cleaning solutions is projected to grow at a CAGR of over 7% within the forecast period.

High Pressure Cleaning Service Product Analysis

Product innovations in the High Pressure Cleaning Service market are centered on developing more powerful yet energy-efficient equipment, alongside eco-friendly cleaning solutions. Advancements in nozzle technology allow for precise application and reduced water wastage, while smarter, automated systems are streamlining large-scale operations. Competitive advantages are increasingly derived from specialized cleaning formulations that tackle tough stains without damaging surfaces, and from integrated service platforms that enhance customer experience and operational management. These technological advancements are key to capturing market share and meeting the evolving demands of a diverse clientele.

Key Drivers, Barriers & Challenges in High Pressure Cleaning Service

The High Pressure Cleaning Service market is propelled by several key drivers.

- Growth Drivers:

- Technological Advancements: Development of more efficient, water-saving, and eco-friendly cleaning equipment and solutions.

- Increasing Property Maintenance Awareness: Growing recognition of the importance of regular cleaning for property value, aesthetics, and longevity.

- Urbanization and Infrastructure Growth: Expansion of urban areas and new construction projects necessitate extensive cleaning services.

- Environmental Consciousness: Demand for services utilizing sustainable practices and biodegradable cleaning agents.

However, the market also faces significant barriers and challenges.

- Barriers & Challenges:

- High Initial Equipment Cost: Significant capital investment required for professional-grade high-pressure cleaning equipment.

- Regulatory Compliance: Adherence to environmental regulations regarding water usage and wastewater disposal can increase operational costs.

- Skilled Labor Shortage: Requirement for trained personnel to operate equipment safely and effectively.

- Intense Competition: Presence of numerous small and large players leading to price sensitivity in certain segments.

- Supply Chain Disruptions: Potential for delays in equipment and chemical supply, impacting service delivery. The estimated impact of supply chain issues on project timelines is around 10-15%.

Growth Drivers in the High Pressure Cleaning Service Market

Growth in the High Pressure Cleaning Service market is significantly fueled by ongoing technological advancements, leading to more efficient and environmentally friendly cleaning solutions. The increasing emphasis on property maintenance and aesthetic appeal, especially in urban environments, acts as a major economic driver. Furthermore, favorable government policies promoting urban renewal and infrastructure development indirectly boost demand for these services. The rising disposable income in many regions also contributes to increased spending on home and commercial property upkeep, making professional cleaning services more accessible and desirable.

Challenges Impacting High Pressure Cleaning Service Growth

The growth of the High Pressure Cleaning Service market is tempered by several challenges. Stringent environmental regulations concerning water usage and chemical runoff can impose additional compliance costs. Supply chain disruptions for specialized equipment and cleaning agents can lead to service delays and increased operational expenses, potentially impacting project timelines by 10-15%. Intense competition, particularly from informal service providers, can exert downward pressure on pricing, affecting profit margins for established companies. Furthermore, the need for skilled labor to operate equipment safely and effectively presents an ongoing human resource challenge.

Key Players Shaping the High Pressure Cleaning Service Market

- Kleenit

- DJL Services

- Paul's Cleaning Sydney

- Pressure Cleaning Perth

- Knockout

- Rhino

- JimsCleaning

- Famous Cleaning

- The Pressure Cleaning Guys

- A & D Pressure Cleaning

- DS Pressure Cleaning

- High Pressure Cleaning Specialist

- Paul's Cleaning Melbourne

- Majestic Cleaning Pros

- Waterworx

- Aatach

- Jetclean

- Protech Property Solutions

- Get Wet Cleaning

- Polar Cleaning

- Magic Bubbles

- White Knight

- pressurecleaners

- Ideal Cleaning Centre

- biostar cleaning

- City Cleaning

- SGClean Xpert

- Home Cleanz

- Nouve

- Easi Porta

- C&S Pressure

- Exterior Clean Melbourne

- Premium Pressure

- Perth Surface

- ARD Cleaning Services

- MKL

- Mint Cleaning

- Student Suds

- All Clean

- Judge Mobile

- PSI

- TASwash

- Poseidon

- Cleanpass

- t-rifik

- GWS

- Corporate Clean

- CJH

- Ultimate Cleaners

- Himalayas

- Xtreme Klean

- Dirt2Neat

- Industrial Clean

- Duckies

- Dyson Painters

Significant High Pressure Cleaning Service Industry Milestones

- 2019: Introduction of advanced eco-friendly cleaning agents with improved biodegradability.

- 2020: Increased adoption of remote monitoring and diagnostic tools for high-pressure cleaning equipment.

- 2021: Significant growth in demand for residential patio and driveway cleaning services post-lockdowns.

- 2022: Emergence of specialized cleaning techniques for delicate heritage building facades.

- 2023: Enhanced focus on water reclamation and recycling technologies in commercial cleaning operations.

- 2024: Increased investment in automated robotic cleaning systems for large industrial facilities.

Future Outlook for High Pressure Cleaning Service Market

- 2019: Introduction of advanced eco-friendly cleaning agents with improved biodegradability.

- 2020: Increased adoption of remote monitoring and diagnostic tools for high-pressure cleaning equipment.

- 2021: Significant growth in demand for residential patio and driveway cleaning services post-lockdowns.

- 2022: Emergence of specialized cleaning techniques for delicate heritage building facades.

- 2023: Enhanced focus on water reclamation and recycling technologies in commercial cleaning operations.

- 2024: Increased investment in automated robotic cleaning systems for large industrial facilities.

Future Outlook for High Pressure Cleaning Service Market

The future outlook for the High Pressure Cleaning Service market is exceptionally positive, driven by sustained demand for property maintenance and a continuous stream of technological innovations. Strategic opportunities lie in expanding service offerings to include specialized cleaning niches, such as solar panel cleaning or graffiti removal, and in developing integrated smart cleaning solutions for commercial properties. The growing global emphasis on sustainability will further propel the adoption of eco-friendly cleaning methods and water-saving technologies. The market is expected to see a continued rise in investment in advanced equipment and training, ensuring a high standard of service delivery and paving the way for significant market growth, potentially exceeding ten million US dollars in total market value by 2033.

High Pressure Cleaning Service Segmentation

-

1. Application

- 1.1. Patio

- 1.2. Lane

- 1.3. Exterior Wall

- 1.4. Others

-

2. Types

- 2.1. Manual Cleaning

- 2.2. Automatic Cleaning

High Pressure Cleaning Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Pressure Cleaning Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Patio

- 5.1.2. Lane

- 5.1.3. Exterior Wall

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Manual Cleaning

- 5.2.2. Automatic Cleaning

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Patio

- 6.1.2. Lane

- 6.1.3. Exterior Wall

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Manual Cleaning

- 6.2.2. Automatic Cleaning

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Patio

- 7.1.2. Lane

- 7.1.3. Exterior Wall

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Manual Cleaning

- 7.2.2. Automatic Cleaning

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Patio

- 8.1.2. Lane

- 8.1.3. Exterior Wall

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Manual Cleaning

- 8.2.2. Automatic Cleaning

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Patio

- 9.1.2. Lane

- 9.1.3. Exterior Wall

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Manual Cleaning

- 9.2.2. Automatic Cleaning

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High Pressure Cleaning Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Patio

- 10.1.2. Lane

- 10.1.3. Exterior Wall

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Manual Cleaning

- 10.2.2. Automatic Cleaning

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kleenit

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DJL Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Paul's Cleaning Sydney

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pressure Cleaning Perth

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Knockout

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rhino

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JimsCleaning

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Famous Cleaning

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Pressure Cleaning Guys

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 A & D Pressure Cleaning

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DS Pressure Cleaning

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 High Pressure Cleaning Specialist

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Paul's Cleaning Melbourne

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Majestic Cleaning Pros

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Waterworx

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Aatach

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Jetclean

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Protech Property Solutions

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Get Wet Cleaning

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Polar Cleaning

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Magic Bubbles

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 White Knight

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 pressurecleaners

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Ideal Cleaning Centre

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 biostar cleaning

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 City Cleaning

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 SGClean Xpert

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Home Cleanz

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Nouve

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Easi Porta

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 C&S Pressure

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Exterior Clean Melbourne

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Premium Pressure

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Perth Surface

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 ARD Cleaning Services

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 MKL

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 Mint Cleaning

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Student Suds

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 All Clean

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 Judge Mobile

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 PSI

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 TASwash

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 Poseidon

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 Cleanpass

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 t-rifik

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.46 GWS

- 11.2.46.1. Overview

- 11.2.46.2. Products

- 11.2.46.3. SWOT Analysis

- 11.2.46.4. Recent Developments

- 11.2.46.5. Financials (Based on Availability)

- 11.2.47 Corporate Clean

- 11.2.47.1. Overview

- 11.2.47.2. Products

- 11.2.47.3. SWOT Analysis

- 11.2.47.4. Recent Developments

- 11.2.47.5. Financials (Based on Availability)

- 11.2.48 CJH

- 11.2.48.1. Overview

- 11.2.48.2. Products

- 11.2.48.3. SWOT Analysis

- 11.2.48.4. Recent Developments

- 11.2.48.5. Financials (Based on Availability)

- 11.2.49 Ultimate Cleaners

- 11.2.49.1. Overview

- 11.2.49.2. Products

- 11.2.49.3. SWOT Analysis

- 11.2.49.4. Recent Developments

- 11.2.49.5. Financials (Based on Availability)

- 11.2.50 Himalayas

- 11.2.50.1. Overview

- 11.2.50.2. Products

- 11.2.50.3. SWOT Analysis

- 11.2.50.4. Recent Developments

- 11.2.50.5. Financials (Based on Availability)

- 11.2.51 Xtreme Klean

- 11.2.51.1. Overview

- 11.2.51.2. Products

- 11.2.51.3. SWOT Analysis

- 11.2.51.4. Recent Developments

- 11.2.51.5. Financials (Based on Availability)

- 11.2.52 Dirt2Neat

- 11.2.52.1. Overview

- 11.2.52.2. Products

- 11.2.52.3. SWOT Analysis

- 11.2.52.4. Recent Developments

- 11.2.52.5. Financials (Based on Availability)

- 11.2.53 Industrial Clean

- 11.2.53.1. Overview

- 11.2.53.2. Products

- 11.2.53.3. SWOT Analysis

- 11.2.53.4. Recent Developments

- 11.2.53.5. Financials (Based on Availability)

- 11.2.54 Duckies

- 11.2.54.1. Overview

- 11.2.54.2. Products

- 11.2.54.3. SWOT Analysis

- 11.2.54.4. Recent Developments

- 11.2.54.5. Financials (Based on Availability)

- 11.2.55 Dyson Painters

- 11.2.55.1. Overview

- 11.2.55.2. Products

- 11.2.55.3. SWOT Analysis

- 11.2.55.4. Recent Developments

- 11.2.55.5. Financials (Based on Availability)

- 11.2.1 Kleenit

List of Figures

- Figure 1: Global High Pressure Cleaning Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High Pressure Cleaning Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America High Pressure Cleaning Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High Pressure Cleaning Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America High Pressure Cleaning Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High Pressure Cleaning Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America High Pressure Cleaning Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High Pressure Cleaning Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America High Pressure Cleaning Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High Pressure Cleaning Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America High Pressure Cleaning Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High Pressure Cleaning Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America High Pressure Cleaning Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High Pressure Cleaning Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High Pressure Cleaning Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High Pressure Cleaning Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High Pressure Cleaning Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High Pressure Cleaning Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High Pressure Cleaning Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High Pressure Cleaning Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High Pressure Cleaning Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High Pressure Cleaning Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High Pressure Cleaning Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High Pressure Cleaning Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High Pressure Cleaning Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Pressure Cleaning Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High Pressure Cleaning Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High Pressure Cleaning Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High Pressure Cleaning Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High Pressure Cleaning Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High Pressure Cleaning Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High Pressure Cleaning Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High Pressure Cleaning Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High Pressure Cleaning Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High Pressure Cleaning Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High Pressure Cleaning Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High Pressure Cleaning Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High Pressure Cleaning Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High Pressure Cleaning Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High Pressure Cleaning Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High Pressure Cleaning Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Pressure Cleaning Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High Pressure Cleaning Service?

Key companies in the market include Kleenit, DJL Services, Paul's Cleaning Sydney, Pressure Cleaning Perth, Knockout, Rhino, JimsCleaning, Famous Cleaning, The Pressure Cleaning Guys, A & D Pressure Cleaning, DS Pressure Cleaning, High Pressure Cleaning Specialist, Paul's Cleaning Melbourne, Majestic Cleaning Pros, Waterworx, Aatach, Jetclean, Protech Property Solutions, Get Wet Cleaning, Polar Cleaning, Magic Bubbles, White Knight, pressurecleaners, Ideal Cleaning Centre, biostar cleaning, City Cleaning, SGClean Xpert, Home Cleanz, Nouve, Easi Porta, C&S Pressure, Exterior Clean Melbourne, Premium Pressure, Perth Surface, ARD Cleaning Services, MKL, Mint Cleaning, Student Suds, All Clean, Judge Mobile, PSI, TASwash, Poseidon, Cleanpass, t-rifik, GWS, Corporate Clean, CJH, Ultimate Cleaners, Himalayas, Xtreme Klean, Dirt2Neat, Industrial Clean, Duckies, Dyson Painters.

3. What are the main segments of the High Pressure Cleaning Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Pressure Cleaning Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Pressure Cleaning Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Pressure Cleaning Service?

To stay informed about further developments, trends, and reports in the High Pressure Cleaning Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence