Key Insights

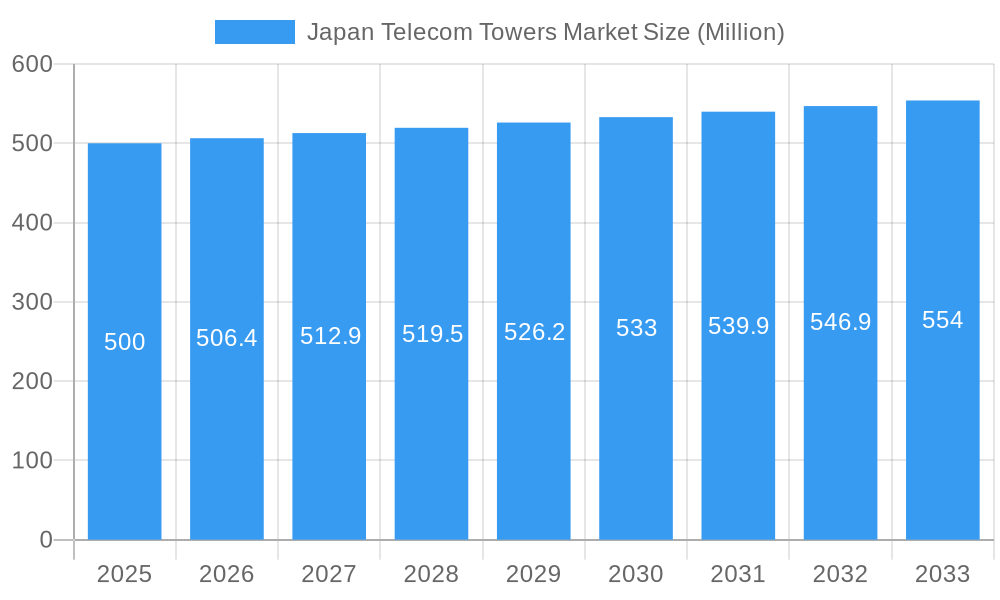

The Japan Telecom Towers market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.28%, presents a steady growth trajectory over the forecast period 2025-2033. Driven by the increasing demand for high-speed mobile broadband services and the expansion of 5G networks, the market is witnessing significant investment in infrastructure development. Major players like Rakuten Mobile Inc, SoftBank Group Corp, and KDDI Corporation are actively expanding their tower networks to meet the rising connectivity needs of the Japanese population. Furthermore, the government's initiatives to promote digitalization and improve telecommunications infrastructure are bolstering market growth. While challenges such as land scarcity and stringent regulatory approvals can act as restraints, the overall market outlook remains positive. The segmentation of the market likely includes towers based on height, type (macro, micro, small cells), and ownership (private, public). The historical period (2019-2024) likely shows a relatively stable growth rate, providing a strong foundation for future expansion. Competition among existing players is intense, necessitating strategic partnerships and technological advancements to maintain a competitive edge. The regional data, though not explicitly provided, would likely showcase a relatively even distribution across major metropolitan areas and densely populated regions of Japan. Considering the 2025 market value is not specified, let’s assume it is around $500 million for this analysis. With the 1.28% CAGR, this implies a moderately expanding market, potentially reaching over $560 million by 2033.

Japan Telecom Towers Market Market Size (In Million)

The long-term prospects for the Japan Telecom Towers market are optimistic. The continuous rollout of 5G and the anticipated development of 6G technology will necessitate further infrastructure development, creating significant opportunities for market expansion. The increasing adoption of IoT devices and smart city initiatives also contribute to the demand for robust and reliable telecom tower infrastructure. The strategic partnerships between tower companies and mobile network operators will play a crucial role in shaping the market landscape in the coming years. To sustain its growth trajectory, the sector will need to address challenges efficiently and adapt to technological advancements promptly. Competition is expected to remain fierce, with the established players continuing to invest heavily in network upgrades and expansion.

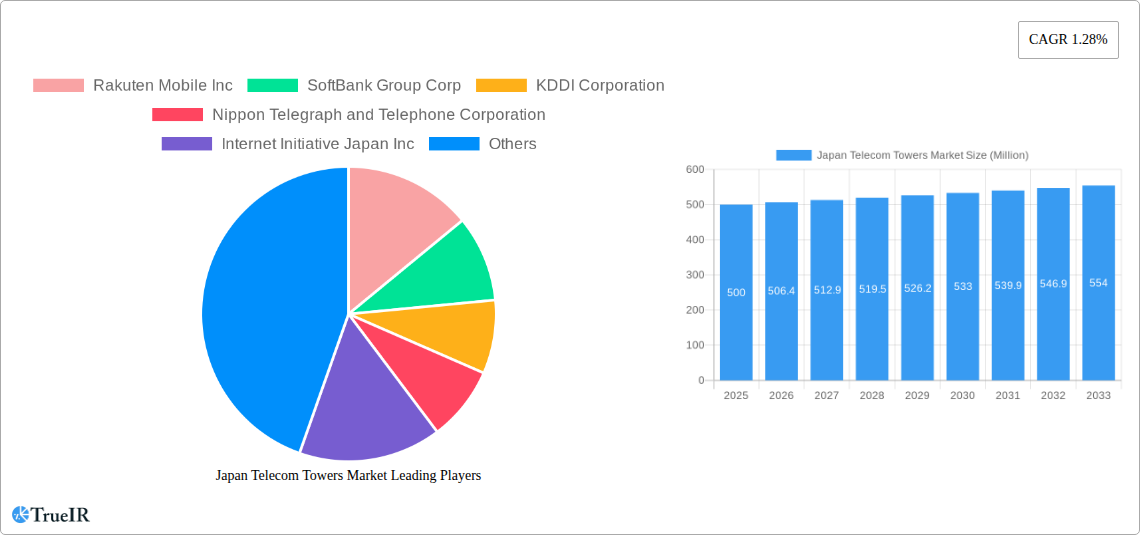

Japan Telecom Towers Market Company Market Share

Japan Telecom Towers Market: A Comprehensive Market Analysis (2019-2033)

This dynamic report provides an in-depth analysis of the Japan Telecom Towers Market, offering invaluable insights for investors, industry professionals, and strategic planners. With a comprehensive study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report meticulously examines market trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis and qualitative insights to provide a holistic understanding of this rapidly evolving market, reaching a projected market size of xx Million by 2033.

Japan Telecom Towers Market Structure & Competitive Landscape

The Japanese telecom towers market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share. The market is influenced by intense competition, continuous technological innovation, and a complex regulatory environment. Key factors shaping the landscape include:

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderately consolidated market. Further analysis reveals a Herfindahl-Hirschman Index (HHI) of xx, suggesting a competitive but not overly fragmented market.

- Innovation Drivers: The rapid rollout of 5G networks, coupled with increasing demand for improved network coverage and capacity, is a primary driver of innovation in tower technology and infrastructure development. The recent introduction of glass antennas (see Industry Milestones section) exemplifies this trend.

- Regulatory Impacts: Government regulations concerning spectrum allocation, infrastructure deployment, and environmental impact assessments significantly influence market dynamics. Strict adherence to these regulations is paramount for market participants.

- Product Substitutes: While traditional macrocell towers remain dominant, the market is witnessing the emergence of alternative solutions, such as small cells and distributed antenna systems (DAS). These substitutes cater to specific needs and offer potential competition to traditional tower deployments.

- End-User Segmentation: The market caters to multiple end-users, including Mobile Network Operators (MNOs), Internet Service Providers (ISPs), and private enterprises. Understanding the varying needs of these segments is crucial for tailored solutions and targeted growth strategies.

- M&A Trends: The sector has seen a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024, totaling approximately xx Million in transaction value. These activities are driven by consolidation efforts, expansion strategies, and access to new technologies and markets.

Japan Telecom Towers Market Market Trends & Opportunities

The Japan Telecom Towers market is poised for significant growth, driven by several key factors:

The market is experiencing substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing smartphone penetration, rising data consumption, the expansion of 5G networks, and government initiatives to enhance digital infrastructure. The market penetration rate for 5G is projected to reach xx% by 2033, offering significant opportunities for tower operators. Technological advancements, such as the adoption of small cells and private 5G networks, are further contributing to market expansion. Competitive dynamics are shaping the market through strategic alliances, technological innovations, and service differentiation. The emergence of new business models, such as tower co-location and infrastructure-as-a-service (IaaS), further enhances the growth trajectory. Consumer preferences for high-speed, reliable mobile connectivity are driving the demand for advanced tower infrastructure.

Dominant Markets & Segments in Japan Telecom Towers Market

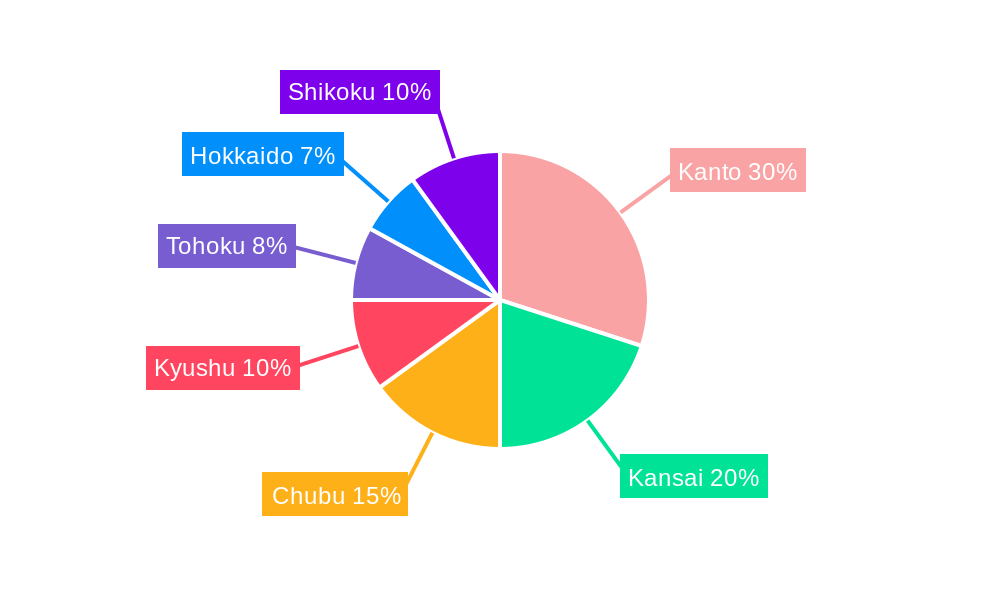

The Kanto region, encompassing Tokyo and its surrounding prefectures, constitutes the most dominant market segment, driven by:

- High Population Density: The region's dense population necessitates extensive network coverage, translating into high demand for telecom towers.

- Robust Economic Activity: The strong economy fuels higher investment in digital infrastructure and technology upgrades.

- Government Initiatives: Government support for infrastructure development further boosts the market in this region.

- Advanced Technological Adoption: The Kanto region demonstrates early adoption of advanced technologies such as 5G, creating higher demand for advanced tower infrastructure.

Other significant regions include Kansai, Chubu, and Kyushu. The market is segmented primarily based on tower type (macrocell, small cell, etc.), location (urban, suburban, rural), and ownership (carrier-owned, independent). The urban areas experience higher demand due to increased network congestion and population density. The growth trajectory of each segment varies based on its unique characteristics. Macrocell towers still dominate the market, while small cells are witnessing increasing adoption. The growth in independent tower companies is further boosting the market competition and providing alternative solutions.

Japan Telecom Towers Market Product Analysis

The market offers a diverse range of products, including macrocell towers, small cells, distributed antenna systems (DAS), and related infrastructure components. Technological advancements focus on enhanced capacity, improved energy efficiency, and streamlined deployment. The introduction of innovative solutions, such as JTower's glass antenna, signifies a shift towards integrating tower infrastructure seamlessly into the urban landscape. The competitive advantage lies in offering cost-effective, reliable, and adaptable solutions that meet the diverse needs of the telecom industry.

Key Drivers, Barriers & Challenges in Japan Telecom Towers Market

Key Drivers:

- 5G Network Rollout: The widespread adoption of 5G requires significant tower infrastructure investment.

- Increasing Data Consumption: Growing data usage necessitates denser network deployments.

- Government Investments in Digital Infrastructure: Government initiatives support the development of advanced telecom infrastructure.

Challenges:

- High Land Costs: Acquisition and maintenance of land for tower deployment are significantly expensive, especially in urban areas.

- Regulatory Hurdles: Obtaining necessary permits and approvals for tower installation can be complex and time-consuming. The average time to obtain permits is estimated to be approximately xx months. This creates bottlenecks and delays in project execution, ultimately hindering market growth.

- Competition: The presence of multiple established players leads to intense competition, affecting pricing and profit margins.

Growth Drivers in the Japan Telecom Towers Market Market

The market's growth is fueled by the increasing penetration of mobile devices and the demand for high-speed data. 5G network expansion requires additional tower infrastructure. Government initiatives encouraging digital transformation are accelerating growth. The adoption of new technologies, such as AI-powered network management, also fuels market expansion.

Challenges Impacting Japan Telecom Towers Market Growth

High land costs in urban areas, complex regulatory processes, and intense competition among established players present challenges. These factors increase the cost of infrastructure deployment and limit potential market expansion. Furthermore, maintaining the aging infrastructure of existing towers is an ongoing issue.

Key Players Shaping the Japan Telecom Towers Market Market

- Rakuten Mobile Inc

- SoftBank Group Corp

- KDDI Corporation

- Nippon Telegraph and Telephone Corporation

- Internet Initiative Japan Inc

- JSAT Corporation

- TOKAI Communications Corporation

- Wowow Inc

- Okinawa Cellular Telephone Company

- Mitsui & Co Ltd

Significant Japan Telecom Towers Market Industry Milestones

- August 2024: JTower announces a glass antenna, transforming windows into 5G base stations. This innovation exemplifies the pursuit of aesthetically pleasing and space-efficient solutions.

- February 2024: NTT Docomo partners with NEC to establish a joint venture for expanding 5G open RAN networking gear internationally, aiming to challenge established industry players. This signifies a strategic shift towards open-standard technologies and international expansion.

Future Outlook for Japan Telecom Towers Market Market

The Japan Telecom Towers market is projected to experience sustained growth driven by continued 5G network expansion, the growing demand for higher bandwidth and improved network coverage, and ongoing government support for digital infrastructure. The emergence of new technologies and business models presents strategic opportunities for existing and new market entrants. The market potential is significant, presenting promising avenues for growth and innovation in the years to come.

Japan Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Japan Telecom Towers Market Segmentation By Geography

- 1. Japan

Japan Telecom Towers Market Regional Market Share

Geographic Coverage of Japan Telecom Towers Market

Japan Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G is Expected to be a Catalyst for the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Mobile Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SoftBank Group Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KDDI Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Telegraph and Telephone Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Internet Initiative Japan Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSAT Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TOKAI Communications Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wowow Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Okinawa Cellular Telephone Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsui & Co Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Mobile Inc

List of Figures

- Figure 1: Japan Telecom Towers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 4: Japan Telecom Towers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 6: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 7: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 8: Japan Telecom Towers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Telecom Towers Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Japan Telecom Towers Market?

Key companies in the market include Rakuten Mobile Inc, SoftBank Group Corp, KDDI Corporation, Nippon Telegraph and Telephone Corporation, Internet Initiative Japan Inc, JSAT Corporation, TOKAI Communications Corporation, Wowow Inc, Okinawa Cellular Telephone Company, Mitsui & Co Lt.

3. What are the main segments of the Japan Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G is Expected to be a Catalyst for the Market's Growth.

7. Are there any restraints impacting market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

August 2024: JTower, a Japanese tower operator, announced a glass antenna, asserting its capability to "transform windows into base stations" for 5G services in Tokyo. In an official statement, JTower revealed its collaboration with fellow Japanese carrier NTT DoCoMo and glass producer AGC. Together, they installed the innovative glass antenna at the Shinjuku 3Chome East Building in Tokyo, linking it to JTower's 5G carrier-neutral network infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Japan Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence