Key Insights

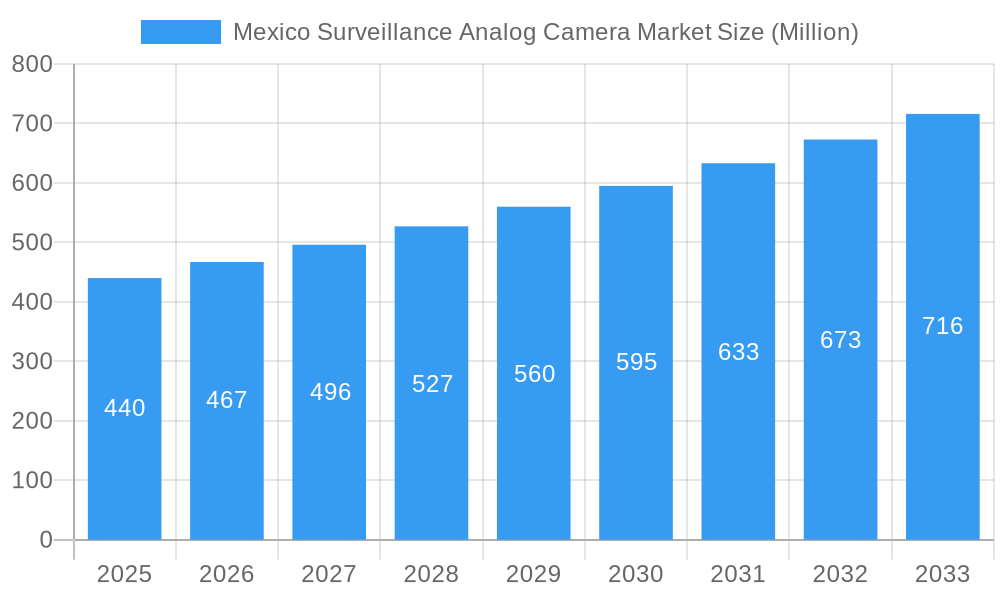

The Mexico surveillance analog camera market, valued at $440 million in 2025, is projected to experience robust growth, driven by increasing security concerns across various sectors, including residential, commercial, and governmental entities. The market's Compound Annual Growth Rate (CAGR) of 5.96% from 2025 to 2033 indicates a steady expansion, fueled by factors such as rising adoption of advanced surveillance technologies, government initiatives promoting public safety, and the increasing affordability of analog camera systems. This growth is expected despite the gradual shift toward IP-based systems, as analog cameras continue to hold a significant market share due to their cost-effectiveness and ease of installation, particularly in smaller-scale applications. Key players in the market, such as Teledyne FLIR, Hikvision, and Hanwha Vision, are likely to capitalize on this growth by focusing on product innovation, strategic partnerships, and expansion into new market segments. The market will likely see increased competition, potentially leading to price reductions and further market penetration. However, challenges such as technological obsolescence and the need for robust maintenance infrastructure could pose some restraints.

Mexico Surveillance Analog Camera Market Market Size (In Million)

The market segmentation within Mexico likely reflects the diverse application needs. While precise segment data is unavailable, we can infer a breakdown based on industry best practices. The residential segment is likely to be a significant contributor, driven by rising household incomes and increasing awareness of home security. The commercial sector, encompassing retail, hospitality, and offices, is also expected to contribute substantially to market growth, driven by the need to protect assets and ensure employee safety. The governmental sector, encompassing law enforcement and public infrastructure monitoring, is likely to represent another significant market segment. Within each sector, demand will be influenced by factors such as budget constraints, regulatory requirements, and technological advancements. The forecast period of 2025-2033 presents significant opportunities for market players to strategically position themselves for continued growth and capitalize on market trends.

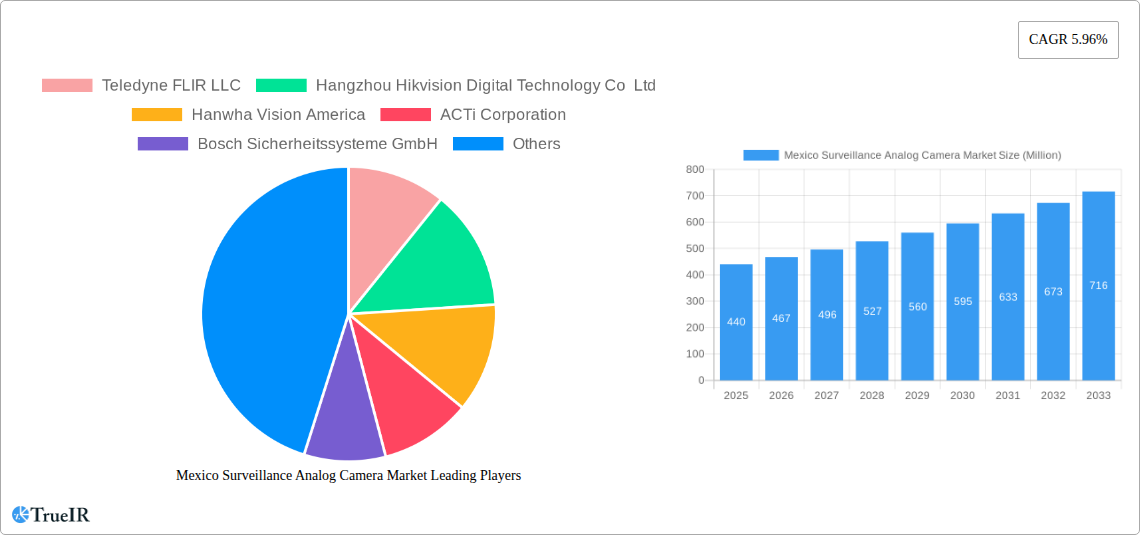

Mexico Surveillance Analog Camera Market Company Market Share

Mexico Surveillance Analog Camera Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Mexico Surveillance Analog Camera Market, offering invaluable insights for industry stakeholders. With a focus on key market trends, competitive landscapes, and future growth projections, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report projects substantial market growth, driven by factors detailed within.

Mexico Surveillance Analog Camera Market Structure & Competitive Landscape

The Mexico surveillance analog camera market exhibits a moderately concentrated structure, with a handful of dominant players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. However, the market shows signs of increasing concentration due to mergers and acquisitions (M&A) activities. The total value of M&A deals in the period 2019-2024 reached approximately xx Million, primarily driven by strategic acquisitions by larger players aiming for market consolidation.

Innovation is a critical driver, with companies like Hikvision continuously introducing advanced features such as improved night vision, wider angle lenses, and enhanced image processing capabilities. Regulatory influences, such as data privacy laws and cybersecurity standards, are also shaping market dynamics. Product substitutes, primarily IP-based cameras, are posing a challenge, but the cost-effectiveness and established infrastructure of analog systems continue to sustain demand, particularly in the SMB segment.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx in 2024.

- Innovation Drivers: Advanced features like improved night vision, wider angle lenses, and enhanced image processing.

- Regulatory Impacts: Data privacy laws and cybersecurity standards influence market practices.

- Product Substitutes: IP-based cameras are emerging as a competitive alternative.

- End-User Segmentation: Dominated by government, commercial, and residential sectors.

- M&A Trends: Significant M&A activity (xx Million in 2019-2024) drives market consolidation.

Mexico Surveillance Analog Camera Market Market Trends & Opportunities

The Mexico surveillance analog camera market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by increasing demand from various sectors, including government, commercial establishments, and residential properties. Market penetration rates are expected to rise as awareness of security solutions and affordability improve. Technological advancements, such as the introduction of higher-resolution analog cameras and enhanced features, are further boosting market expansion. Consumer preferences are shifting towards feature-rich, cost-effective solutions, driving the demand for cameras offering features like improved night vision, wider viewing angles, and better image quality. The competitive landscape is dynamic, with existing players focused on innovation and expansion while new entrants strive to gain market share.

Dominant Markets & Segments in Mexico Surveillance Analog Camera Market

While data on precise regional segmentation is not readily available, the Mexico City Metropolitan Area and other major urban centers are expected to dominate the market due to higher population density, greater security concerns, and significant infrastructural investments.

- Key Growth Drivers:

- Expanding urbanization and increased crime rates in major cities.

- Growing government initiatives to improve public safety and infrastructure.

- Rising disposable incomes and increased consumer spending on security systems.

- Favorable regulatory environment promoting security technology adoption.

The commercial sector, encompassing businesses of varying sizes, represents a substantial portion of the market demand, followed by residential and government sectors. The demand from the commercial segment is driven by the need to enhance security and loss prevention, especially in high-value establishments like retail stores, banks, and warehouses. Government initiatives focusing on public safety and infrastructure development will also contribute to market expansion.

Mexico Surveillance Analog Camera Market Product Analysis

The market is characterized by a range of analog cameras offering various features and functionalities, including different resolutions, lens types, and night vision capabilities. Recent innovations center on enhancing image quality and expanding functionalities in existing analog technology (like Hikvision's Turbo HD 8.0). Competitive advantages stem from technological advancements, such as enhanced image processing, robust construction, and ease of integration with existing security infrastructure. The market fit is strong, especially for budget-conscious consumers and businesses seeking a reliable and cost-effective security solution.

Key Drivers, Barriers & Challenges in Mexico Surveillance Analog Camera Market

Key Drivers:

- Rising crime rates: Increased security concerns drive demand for surveillance solutions.

- Government initiatives: Public safety programs and infrastructural development boost the market.

- Technological advancements: Improved image quality, features, and cost-effectiveness stimulate adoption.

Key Challenges and Restraints:

- Competition from IP cameras: The shift towards IP-based systems poses a significant challenge.

- Supply chain disruptions: Global supply chain issues can impact product availability and pricing.

- Economic fluctuations: Economic downturns can negatively affect consumer spending on security systems. Estimated impact: xx% reduction in market growth during periods of recession.

Growth Drivers in the Mexico Surveillance Analog Camera Market Market

The key drivers for growth are the rising crime rates in urban areas, government initiatives to improve public safety and infrastructure, and technological advancements in analog camera technology making them more efficient and cost-effective. Additionally, increasing disposable incomes are leading consumers to adopt security systems.

Challenges Impacting Mexico Surveillance Analog Camera Market Growth

The market faces challenges from the rising popularity of IP cameras, supply chain disruptions affecting the availability and pricing of components, and economic fluctuations influencing consumer spending on non-essential goods like security systems. Regulatory hurdles related to data privacy and cybersecurity add to the complexity.

Key Players Shaping the Mexico Surveillance Analog Camera Market Market

Significant Mexico Surveillance Analog Camera Market Industry Milestones

- October 2023: Hikvision launched the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) cameras, featuring an F1.0 aperture, enhancing low-light performance and full-color imaging.

- April 2024: Hikvision unveiled its Turbo HD 8.0, featuring real-time communication, 180-degree video coverage, enhanced night vision, and a compact design.

Future Outlook for Mexico Surveillance Analog Camera Market Market

The Mexico surveillance analog camera market is poised for continued growth, driven by sustained demand from various sectors and ongoing technological advancements. While the transition to IP-based systems is inevitable, the cost-effectiveness and reliability of analog solutions will ensure a continued market presence, especially in price-sensitive segments. Strategic opportunities lie in innovation, focusing on features that bridge the gap between analog and IP capabilities, as well as expanding into underserved regions. The market's potential remains strong, particularly as urbanization and security concerns continue to rise.

Mexico Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

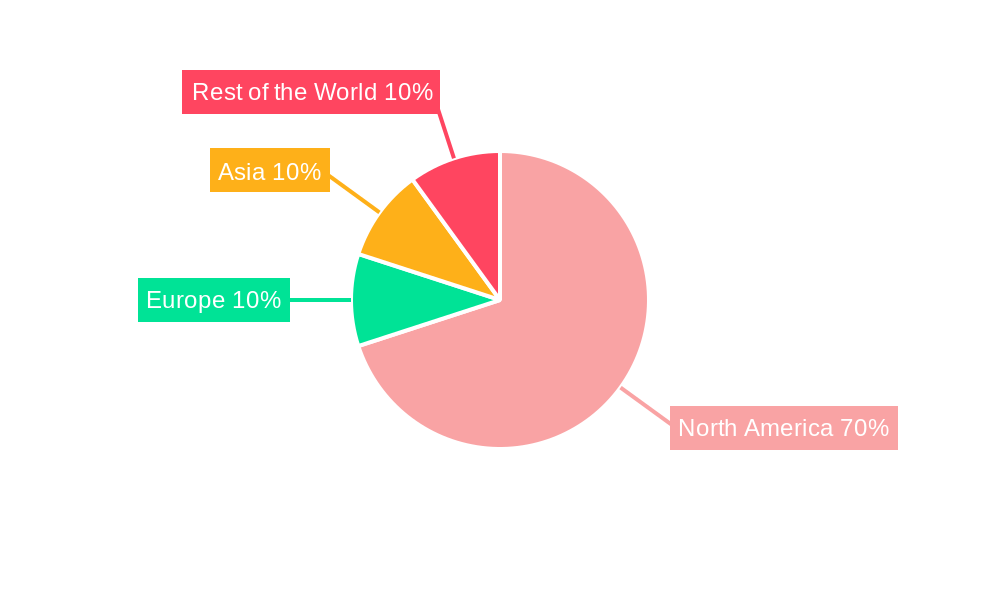

Mexico Surveillance Analog Camera Market Segmentation By Geography

- 1. Mexico

Mexico Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of Mexico Surveillance Analog Camera Market

Mexico Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime

- 3.4. Market Trends

- 3.4.1. Cost Effectiveness and Affordability of Analog Cameras are Driving their Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CP Plu

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Mexico Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Mexico Surveillance Analog Camera Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Mexico Surveillance Analog Camera Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Mexico Surveillance Analog Camera Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Mexico Surveillance Analog Camera Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Surveillance Analog Camera Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the Mexico Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Panasonic Corporation, CP Plu.

3. What are the main segments of the Mexico Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 440 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime.

6. What are the notable trends driving market growth?

Cost Effectiveness and Affordability of Analog Cameras are Driving their Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its latest Turbo HD 8.0, the newest iteration of its analog security product line. This upgraded version boasts four key features, namely real-time communication, 180-degree video coverage, enhanced night vision capabilities, and a more compact design. The dual-lens camera, a highlight of this release, leverages proprietary image-stitching technology to seamlessly deliver vivid, colorful 180-degree images, day or night. Due to its large F1.0 aperture and high-sensitivity sensors, these images maintain their vibrancy even in low-light conditions. Moreover, the camera's new compact design enhances its discretion, making it an ideal fit for small and medium businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Mexico Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence