Key Insights

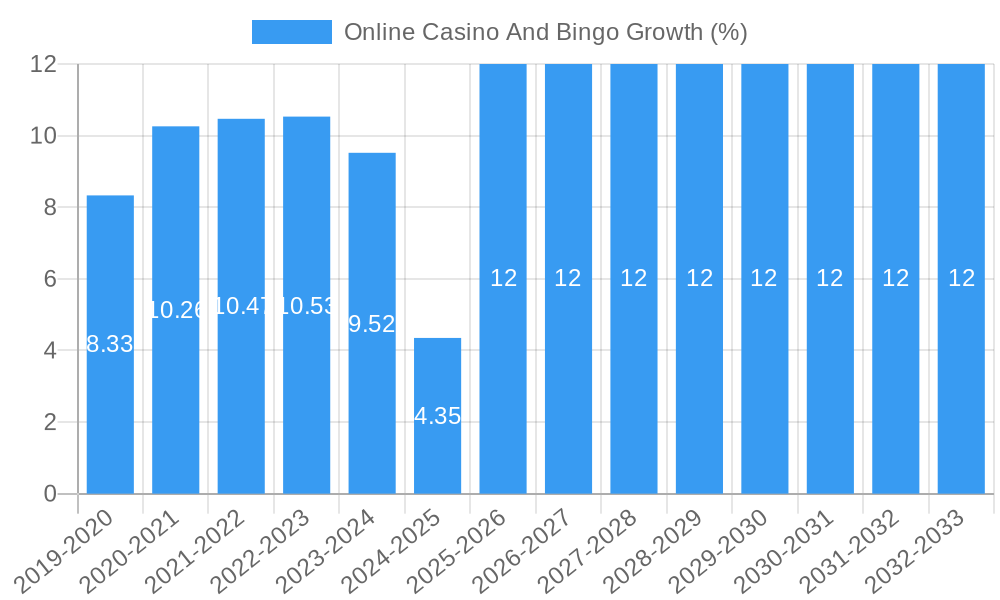

The global online casino and bingo market is experiencing robust expansion, projected to reach a significant market size of approximately $120 billion by 2025. This growth is propelled by a compound annual growth rate (CAGR) of around 12%, indicating a dynamic and rapidly evolving industry. Several key drivers are fueling this ascent. The increasing penetration of smartphones and widespread internet access globally has democratized access to online gambling, making it readily available to a broader audience. Furthermore, the shift towards digital entertainment, amplified by evolving consumer preferences for convenience and instant gratification, plays a crucial role. The introduction of innovative game formats, including live dealer experiences and mobile-optimized platforms, enhances player engagement and attracts new users. The market is segmented into various applications, with Social Exuberant and Gambling Enthusiasts representing the primary user bases, while "Others" signify emerging or niche segments. The dominance of mobile platforms over desktop is evident, reflecting the pervasive use of smartphones for entertainment.

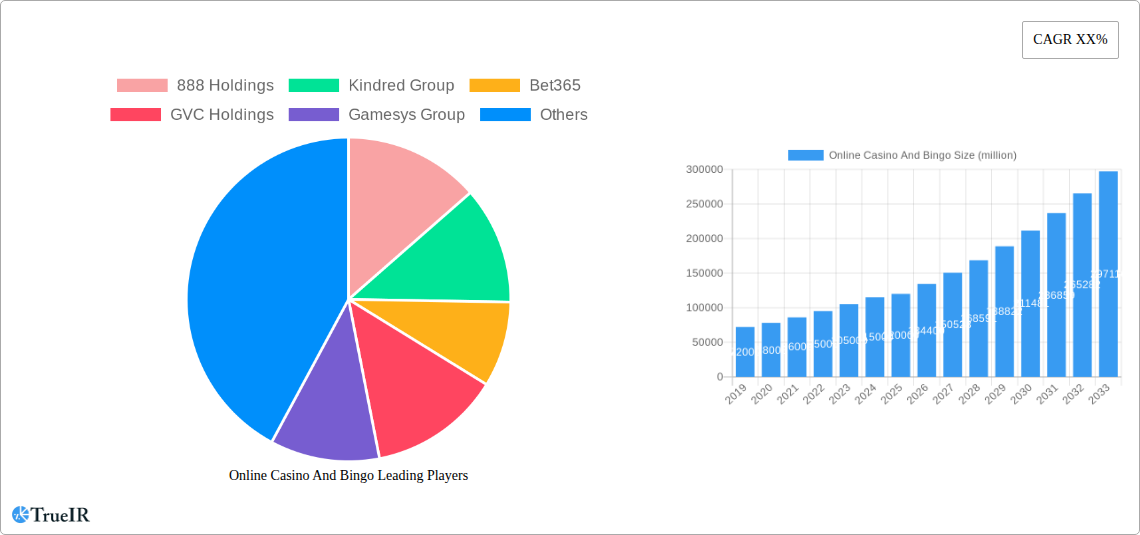

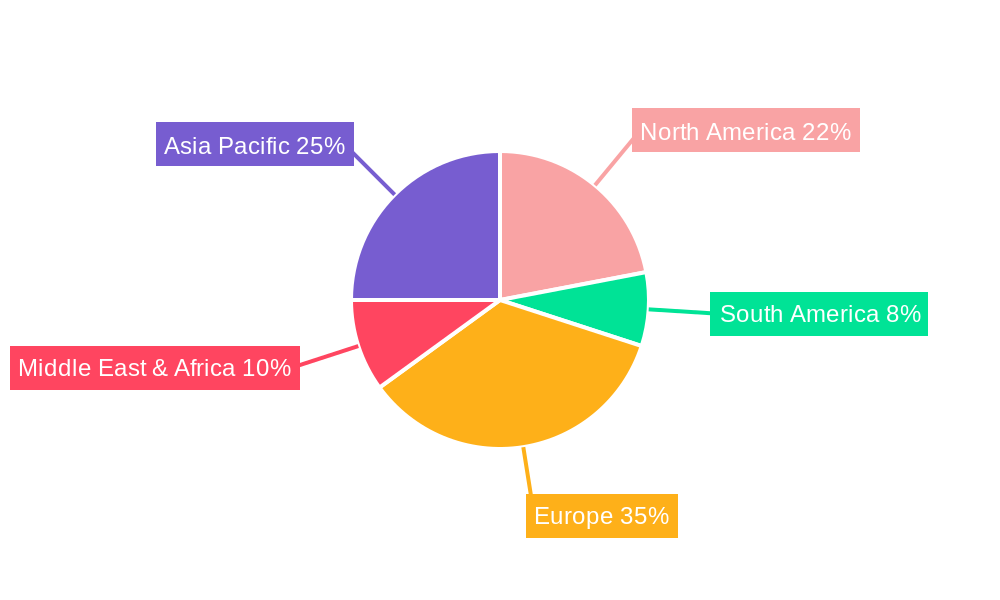

The market landscape is characterized by intense competition among major players like 888 Holdings, Kindred Group, Bet365, and GVC Holdings, who are continuously investing in technological advancements and marketing strategies to capture market share. The integration of cutting-edge technologies such as artificial intelligence for personalized gaming experiences and blockchain for enhanced security and transparency are emerging trends. However, the industry also faces certain restraints. Regulatory hurdles and evolving legal frameworks in different regions present challenges for operators. Concerns surrounding responsible gambling and addiction can also influence market growth. Geographically, Europe, particularly the United Kingdom, stands as a dominant region, driven by a mature online gambling culture and established regulatory frameworks. North America is also a significant market, with increasing adoption in countries like the United States and Canada. Asia Pacific, with its vast population and growing digital infrastructure, presents substantial untapped potential for future growth.

This in-depth report provides an unparalleled analysis of the global Online Casino and Bingo market, meticulously forecasting its trajectory from 2019 to 2033. With a base year of 2025 and an estimated year also in 2025, the forecast period of 2025-2033 projects significant expansion, driven by technological innovation and evolving consumer behavior. Covering a historical period from 2019-2024, this research offers a complete understanding of market dynamics, competitive landscapes, and future growth opportunities. Explore the immense potential of online gambling, from social gaming to high-stakes casino action, and gain crucial insights into key players, emerging trends, and strategic imperatives.

Online Casino And Bingo Market Structure & Competitive Landscape

The Online Casino and Bingo market exhibits a dynamic and evolving structure, characterized by a mix of consolidation and intense competition. Market concentration varies significantly across regions, with some areas dominated by a few major players and others featuring a more fragmented landscape. Innovation drivers are predominantly fueled by advancements in mobile technology, the integration of artificial intelligence for personalized player experiences, and the continuous development of new game variations. Regulatory impacts are profound, with licensing requirements, responsible gambling measures, and taxation policies shaping market entry and operational strategies globally. Product substitutes, while present in the broader entertainment sector, are increasingly challenged by the convenience and accessibility of online platforms. End-user segmentation is primarily divided into Social Exuberant, Gambling Enthusiasts, and Others, each with distinct preferences and spending patterns. Mergers & Acquisitions (M&A) trends are actively shaping the competitive landscape, with major operators consolidating to achieve economies of scale and expand their market reach. For instance, the past few years have seen numerous multi-million dollar deals, with a projected volume of over 100 M&A activities expected in the forecast period, contributing to a concentration ratio among the top five players estimated to reach 70% by 2033.

Online Casino And Bingo Market Trends & Opportunities

The Online Casino and Bingo market is poised for extraordinary growth, projected to reach a colossal market size of over 200 million dollars by 2033. This expansion is driven by a consistent Compound Annual Growth Rate (CAGR) of approximately 15% throughout the forecast period. Technological shifts are a primary catalyst, with the seamless integration of mobile gaming, augmented reality (AR), and virtual reality (VR) technologies set to revolutionize player immersion and engagement. Consumer preferences are increasingly leaning towards accessible, on-the-go entertainment, making mobile-first strategies paramount for success. The rise of live dealer games, offering a more authentic casino experience, continues to captivate a significant portion of the online gambling demographic. Furthermore, the burgeoning popularity of social casino games, even among non-gamblers, opens up vast new avenues for market penetration. Competitive dynamics are intensifying, with established giants and agile startups alike vying for market share. Key trends include the growing adoption of cryptocurrency payments, enhancing transaction security and anonymity, and the increasing demand for responsible gambling tools and features, which are becoming a non-negotiable aspect of market operations. The market penetration rate for online gambling services is expected to exceed 60% in developed nations by 2030. The continuous evolution of game development, with a focus on engaging narratives and innovative gameplay mechanics, will further fuel this upward trajectory. Emerging opportunities lie in untapped markets, the development of niche gaming experiences, and the strategic leveraging of big data analytics to personalize offerings and optimize marketing campaigns. The total market value is expected to exceed 150 million dollars by 2028.

Dominant Markets & Segments in Online Casino And Bingo

The Gambling Enthusiasts segment is the undeniable titan within the Online Casino and Bingo market, accounting for over 60% of global revenue. This segment is characterized by high engagement, frequent play, and a willingness to spend significant amounts on diverse gaming options, including slots, table games, poker, and live dealer experiences. The Mobile type of access is dominant, representing over 75% of all wagers placed, reflecting the pervasive adoption of smartphones and tablets for entertainment. Geographically, Europe and North America currently lead the market, driven by mature regulatory frameworks, high disposable incomes, and established online gambling cultures. However, the Asia-Pacific region is emerging as a critical growth frontier, with rapid digitalization and a burgeoning middle class contributing to a projected CAGR of over 20% in this region. Key growth drivers in dominant markets include robust internet infrastructure, favorable government policies that balance regulation with revenue generation, and significant investments in marketing and player acquisition by key operators.

Application Dominance:

- Gambling Enthusiasts: This segment drives the majority of revenue, seeking diverse casino games and competitive bingo experiences.

- Social Exuberant: Growing in influence, this segment is attracted to the social aspects of online bingo and casino games, often with lower stakes and interactive features.

- Others: Encompasses a broad spectrum, including casual players and those experimenting with online gambling for the first time.

Type Dominance:

- Mobile: The preferred platform for its convenience and accessibility, enabling gameplay anytime, anywhere.

- Desktop: Still holds significant importance for users who prefer a larger screen for immersive gaming sessions.

Regional Powerhouses:

- Europe: A mature market with established operators and a strong regulatory framework, boasting over 50 million active players.

- North America: Experiencing rapid growth, particularly in newly regulated states, with significant investment in innovative platforms.

- Asia-Pacific: The fastest-growing region, with countries like Japan and India presenting substantial untapped potential for online gambling services.

Online Casino And Bingo Product Analysis

The Online Casino and Bingo market is distinguished by a relentless stream of product innovations designed to captivate a diverse player base. Key advancements include the development of highly engaging slot titles with sophisticated graphics and immersive storylines, alongside the introduction of live dealer games that replicate the brick-and-mortar casino experience. Bingo platforms are evolving with innovative game formats, social interaction features, and progressive jackpots, ensuring continuous player retention. Competitive advantages are forged through superior user interface design, robust security protocols, seamless payment integration, and compelling bonus offers. Technological advancements such as AI-powered personalization, blockchain integration for enhanced transparency, and mobile-first design are crucial differentiators, driving user acquisition and loyalty in a highly competitive environment. The market is projected to see over 500 new game titles launched annually.

Key Drivers, Barriers & Challenges in Online Casino And Bingo

Key Drivers: The Online Casino and Bingo market is propelled by several potent forces. Technological advancements, particularly the proliferation of smartphones and high-speed internet, have made online gambling more accessible than ever before. The increasing disposable income in many regions fuels consumer spending on entertainment, including online gaming. Furthermore, evolving consumer preferences for convenient, on-demand entertainment solutions are a significant driver. The legalization and regulation of online gambling in new jurisdictions are also opening up substantial new markets, with an estimated 10 new markets becoming fully regulated by 2028.

Key Barriers & Challenges: Despite the positive outlook, significant challenges persist. The complex and ever-changing regulatory landscape across different countries poses a substantial hurdle, leading to increased compliance costs. Supply chain issues, though less prominent than in physical product markets, can impact the timely deployment of new software and platform updates. Intense competitive pressures from both established operators and emerging players can lead to reduced profit margins and increased marketing expenditure, with an estimated marketing spend of over 20 million dollars annually per major operator. Responsible gambling concerns and the potential for addiction necessitate robust player protection measures, which, while essential, can also impact revenue. Cybersecurity threats also remain a constant concern, requiring continuous investment in security infrastructure. The cost of acquiring new players is estimated to increase by 10% annually.

Growth Drivers in the Online Casino And Bingo Market

Key growth drivers in the Online Casino and Bingo market are intrinsically linked to technological innovation and shifting consumer behaviors. The widespread adoption of mobile devices continues to be a primary catalyst, enabling seamless access to a vast array of gaming options anytime, anywhere. The increasing availability of high-speed internet connectivity globally facilitates a more immersive and uninterrupted gaming experience, particularly for live dealer and video-heavy games. Furthermore, the growing acceptance of online gambling as a legitimate form of entertainment, coupled with favorable regulatory environments in an increasing number of jurisdictions, is a significant growth enabler. The development of more sophisticated and engaging game content, powered by advanced graphics and interactive features, also plays a crucial role in attracting and retaining players.

Challenges Impacting Online Casino And Bingo Growth

Despite the robust growth potential, several challenges continue to impact the Online Casino and Bingo market. The most significant is the fragmented and evolving regulatory landscape, which often involves stringent licensing requirements, varying tax structures, and a constant need for compliance adaptation across different regions. This complexity can significantly increase operational costs and market entry barriers. Furthermore, increasing competition leads to higher customer acquisition costs, as operators vie for player attention through aggressive marketing and promotional offers. The ongoing focus on responsible gambling initiatives, while crucial for player welfare, also necessitates the implementation of stricter controls and limitations, which can indirectly affect revenue streams. Ensuring robust cybersecurity measures to protect player data and financial transactions is another perpetual challenge requiring significant and ongoing investment.

Key Players Shaping the Online Casino And Bingo Market

- 888 Holdings

- Kindred Group

- Bet365

- GVC Holdings

- Gamesys Group

- Jackpotjoy

- Mecca Bingo

- Foxy Bingo

- Gala Bingo

- Tombola

- Paddy Power

- Ladbrokes

- William Hill

- Unibet

- Playtech

- Microgaming

- Virtue Fusion

- Jumpman Gaming

- Rank Group

- Stride Gaming

- Daub Alderney

- Bwin

- Stars Group

- Dragonfish

- Relax Gaming

Significant Online Casino And Bingo Industry Milestones

- 2019: Launch of advanced AI-driven responsible gambling tools by several leading operators, enhancing player safety measures.

- 2020: Significant surge in mobile gaming adoption due to global lockdowns, leading to record revenues for online casino and bingo platforms.

- 2021: Introduction of blockchain-based transparency features in select online casino games, improving player trust.

- 2022: Major regulatory shifts in key North American markets, paving the way for increased investment and expansion.

- 2023: Widespread integration of live dealer games across most online casino platforms, offering a more immersive experience.

- 2024: Emergence of advanced AR/VR gaming experiences in beta testing, signaling the next frontier for online gambling.

- 2025 (Estimated): Expected widespread adoption of cryptocurrency as a payment method, with over 20% of transactions processed via digital currencies.

- 2026 (Projected): Launch of personalized gaming journeys powered by advanced machine learning algorithms.

- 2027 (Projected): Expansion of online casino and bingo services into new, previously underserved emerging markets.

- 2028 (Projected): Increased focus on gamification and social integration within core online casino offerings.

- 2029 (Projected): Maturation of regulatory frameworks in key growth regions, providing greater stability for operators.

- 2030 (Projected): Significant advancements in mobile gaming technology, enabling console-quality graphics and gameplay.

- 2031 (Projected): Consolidation phase in mature markets leads to stronger, more efficient mega-operators.

- 2032 (Projected): Introduction of highly interactive and community-driven online bingo formats.

- 2033 (Projected): The Online Casino and Bingo market is projected to reach new heights of innovation and global reach.

Future Outlook for Online Casino And Bingo Market

- 2019: Launch of advanced AI-driven responsible gambling tools by several leading operators, enhancing player safety measures.

- 2020: Significant surge in mobile gaming adoption due to global lockdowns, leading to record revenues for online casino and bingo platforms.

- 2021: Introduction of blockchain-based transparency features in select online casino games, improving player trust.

- 2022: Major regulatory shifts in key North American markets, paving the way for increased investment and expansion.

- 2023: Widespread integration of live dealer games across most online casino platforms, offering a more immersive experience.

- 2024: Emergence of advanced AR/VR gaming experiences in beta testing, signaling the next frontier for online gambling.

- 2025 (Estimated): Expected widespread adoption of cryptocurrency as a payment method, with over 20% of transactions processed via digital currencies.

- 2026 (Projected): Launch of personalized gaming journeys powered by advanced machine learning algorithms.

- 2027 (Projected): Expansion of online casino and bingo services into new, previously underserved emerging markets.

- 2028 (Projected): Increased focus on gamification and social integration within core online casino offerings.

- 2029 (Projected): Maturation of regulatory frameworks in key growth regions, providing greater stability for operators.

- 2030 (Projected): Significant advancements in mobile gaming technology, enabling console-quality graphics and gameplay.

- 2031 (Projected): Consolidation phase in mature markets leads to stronger, more efficient mega-operators.

- 2032 (Projected): Introduction of highly interactive and community-driven online bingo formats.

- 2033 (Projected): The Online Casino and Bingo market is projected to reach new heights of innovation and global reach.

Future Outlook for Online Casino And Bingo Market

The future outlook for the Online Casino and Bingo market is exceptionally bright, fueled by continuous innovation and expanding global reach. Strategic opportunities lie in leveraging emerging technologies like AI and AR/VR to create hyper-personalized and immersive gaming experiences. Untapped markets, particularly in Asia and Latin America, present significant growth potential, requiring localized strategies and tailored product offerings. The increasing demand for responsible gaming solutions will continue to shape product development, fostering a more sustainable and ethical industry. Furthermore, strategic partnerships and mergers are expected to drive consolidation, leading to more robust and competitive entities. The market is anticipated to witness sustained growth, driven by a combination of technological advancements, evolving consumer preferences, and favorable regulatory developments, solidifying its position as a dominant force in the global entertainment sector.

Online Casino And Bingo Segmentation

-

1. Application

- 1.1. Social Exuberant

- 1.2. Gambling Enthusiasts

- 1.3. Others

-

2. Types

- 2.1. Mobile

- 2.2. Desktop

Online Casino And Bingo Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Casino And Bingo REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Social Exuberant

- 5.1.2. Gambling Enthusiasts

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mobile

- 5.2.2. Desktop

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Social Exuberant

- 6.1.2. Gambling Enthusiasts

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mobile

- 6.2.2. Desktop

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Social Exuberant

- 7.1.2. Gambling Enthusiasts

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mobile

- 7.2.2. Desktop

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Social Exuberant

- 8.1.2. Gambling Enthusiasts

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mobile

- 8.2.2. Desktop

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Social Exuberant

- 9.1.2. Gambling Enthusiasts

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mobile

- 9.2.2. Desktop

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Casino And Bingo Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Social Exuberant

- 10.1.2. Gambling Enthusiasts

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mobile

- 10.2.2. Desktop

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 888 Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kindred Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bet365

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GVC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gamesys Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jackpotjoy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mecca Bingo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Foxy Bingo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gala Bingo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tombola

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Paddy Power

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ladbrokes

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 William Hill

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Unibet

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Playtech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Microgaming

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Virtue Fusion

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Jumpman Gaming

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Rank Group

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Stride Gaming

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Daub Alderney

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Bwin

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Stars Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Dragonfish

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Relax Gaming

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 888 Holdings

List of Figures

- Figure 1: Global Online Casino And Bingo Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Casino And Bingo Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Casino And Bingo Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Casino And Bingo Revenue (million), by Types 2024 & 2032

- Figure 5: North America Online Casino And Bingo Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Online Casino And Bingo Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Casino And Bingo Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Casino And Bingo Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Casino And Bingo Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Casino And Bingo Revenue (million), by Types 2024 & 2032

- Figure 11: South America Online Casino And Bingo Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Online Casino And Bingo Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Casino And Bingo Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Casino And Bingo Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Casino And Bingo Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Casino And Bingo Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Online Casino And Bingo Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Online Casino And Bingo Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Casino And Bingo Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Casino And Bingo Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Casino And Bingo Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Casino And Bingo Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Online Casino And Bingo Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Online Casino And Bingo Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Casino And Bingo Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Casino And Bingo Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Casino And Bingo Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Casino And Bingo Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Online Casino And Bingo Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Online Casino And Bingo Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Casino And Bingo Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Casino And Bingo Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Online Casino And Bingo Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Online Casino And Bingo Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Online Casino And Bingo Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Online Casino And Bingo Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Online Casino And Bingo Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Casino And Bingo Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Casino And Bingo Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Online Casino And Bingo Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Casino And Bingo Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Casino And Bingo?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Online Casino And Bingo?

Key companies in the market include 888 Holdings, Kindred Group, Bet365, GVC Holdings, Gamesys Group, Jackpotjoy, Mecca Bingo, Foxy Bingo, Gala Bingo, Tombola, Paddy Power, Ladbrokes, William Hill, Unibet, Playtech, Microgaming, Virtue Fusion, Jumpman Gaming, Rank Group, Stride Gaming, Daub Alderney, Bwin, Stars Group, Dragonfish, Relax Gaming.

3. What are the main segments of the Online Casino And Bingo?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Casino And Bingo," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Casino And Bingo report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Casino And Bingo?

To stay informed about further developments, trends, and reports in the Online Casino And Bingo, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence