Key Insights

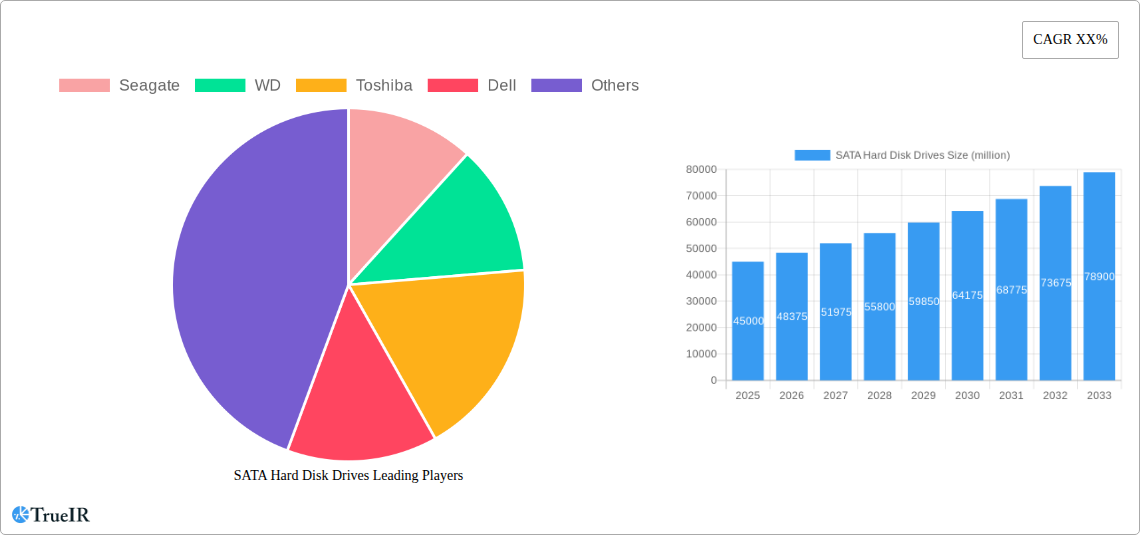

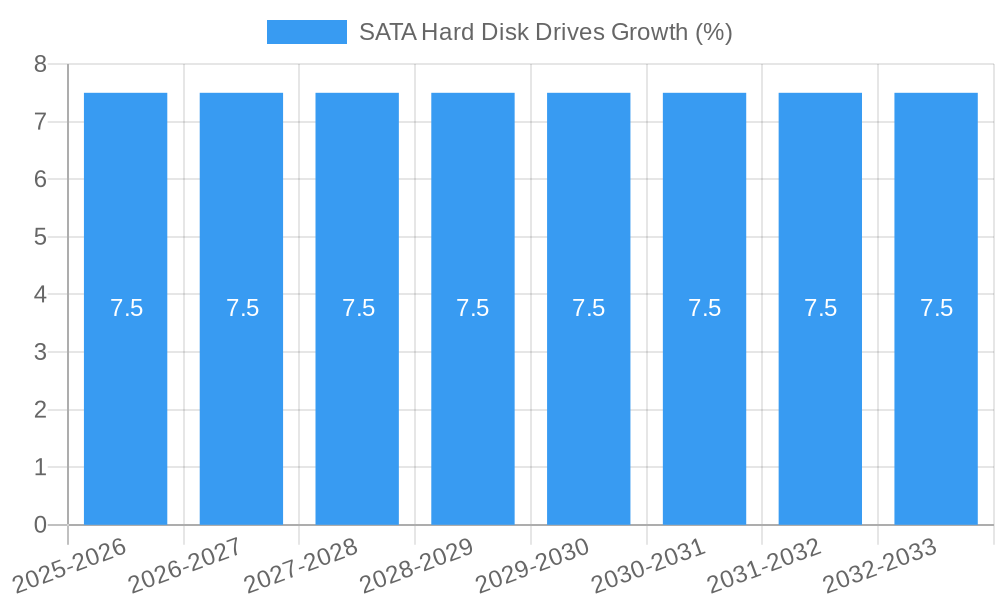

The global SATA Hard Disk Drive (HDD) market is projected to reach a substantial market size of approximately USD 45,000 million by 2025, demonstrating robust growth driven by persistent demand for affordable, high-capacity storage solutions. This growth is further underscored by an estimated Compound Annual Growth Rate (CAGR) of around 7.5% from 2025 to 2033. The market is propelled by key drivers such as the ever-increasing volume of data generated across various sectors, including cloud computing, big data analytics, and the burgeoning Internet of Things (IoT). Enterprises continue to rely on SATA HDDs for cost-effective bulk storage in data centers, surveillance systems, and for archival purposes. The affordability and reliability of SATA HDDs, especially for capacities exceeding 1 terabyte (1T), make them indispensable for a wide range of applications where sheer storage volume is prioritized over extreme speed.

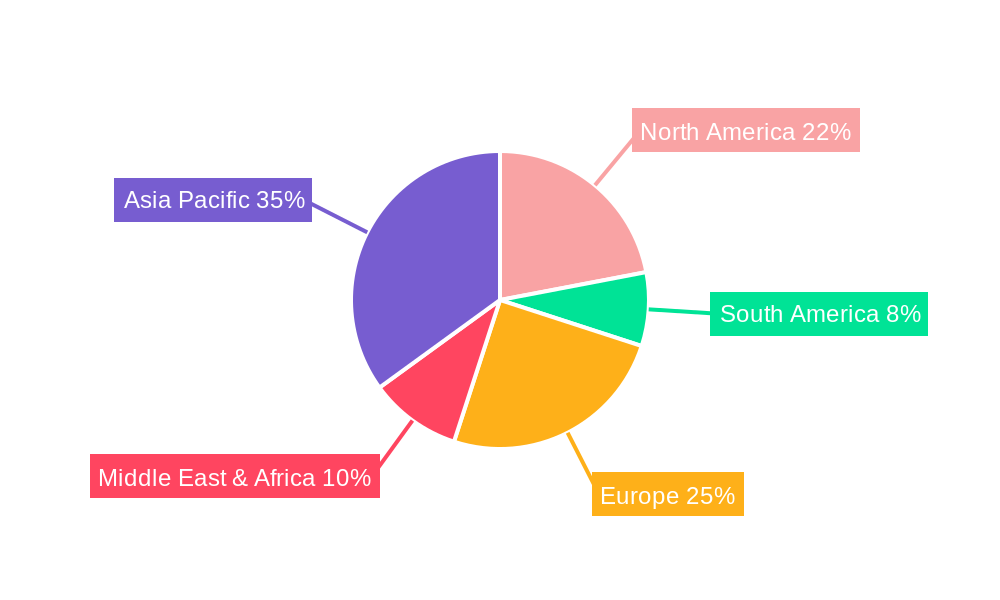

Despite the rise of solid-state drives (SSDs), SATA HDDs are expected to maintain a significant market presence due to their superior cost-per-gigabyte ratio. Emerging trends, such as the expansion of 5G networks and the proliferation of smart devices, will continue to fuel data creation, thereby bolstering the demand for traditional storage. However, the market faces restraints from the increasing adoption of SSDs in performance-critical applications and for consumer laptops where speed is paramount. Nonetheless, the market's segmentation reveals a strong inclination towards larger capacity drives (Above 1T) due to the continuous need for extensive data storage. Geographically, the Asia Pacific region, led by China and India, is anticipated to dominate the market share, owing to its rapid industrialization, growing IT infrastructure, and a vast consumer base.

SATA Hard Disk Drives Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global SATA Hard Disk Drives (HDD) market. Leveraging high-volume keywords, it offers comprehensive insights for industry stakeholders, covering market structure, trends, opportunities, dominant segments, product analysis, key drivers, challenges, competitive landscape, significant milestones, and future outlook. The study period spans from 2019 to 2033, with the base year and estimated year set at 2025 and the forecast period from 2025 to 2033, building upon the historical data from 2019 to 2024.

SATA Hard Disk Drives Market Structure & Competitive Landscape

The SATA Hard Disk Drives market exhibits a moderate concentration ratio, with major players like Seagate, WD, and Toshiba commanding significant market share. Innovation drivers include the relentless demand for higher storage capacities and improved performance, fueled by the proliferation of data in cloud computing, big data analytics, and digital content creation. Regulatory impacts are generally minimal, primarily focused on environmental standards for manufacturing and energy efficiency. Product substitutes, such as Solid State Drives (SSDs), present a growing competitive pressure, particularly in high-performance applications, but HDDs maintain an advantage in cost-per-gigabyte for bulk storage. End-user segmentation reveals strong demand from enterprise storage, consumer electronics, and surveillance systems. Mergers and acquisitions (M&A) trends have been relatively subdued in recent years, with a focus on strategic partnerships and technological collaborations rather than outright consolidations. The market for SATA HDDs in the historical period (2019-2024) saw an estimated M&A volume of approximately 500 million USD, with an estimated concentration ratio of around 60% held by the top three players. Future M&A activity is expected to remain cautious, focusing on niche technologies and market access.

SATA Hard Disk Drives Market Trends & Opportunities

The SATA Hard Disk Drives market is poised for sustained growth, driven by the ever-increasing global data generation and the enduring need for cost-effective, high-capacity storage solutions. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This growth is underpinned by several critical trends. Technological shifts continue to focus on increasing areal density, enabling higher capacities within the traditional 3.5-inch form factor, with capacities now exceeding 20 terabytes becoming more prevalent. Innovations in firmware and caching technologies are also enhancing performance and reliability, bridging some of the performance gap with SSDs. Consumer preferences, while increasingly leaning towards SSDs for primary storage in personal devices, still heavily favor HDDs for secondary storage, media libraries, and budget-conscious purchases. The sheer volume of data generated by online sales platforms, streaming services, and the Internet of Things (IoT) necessitates robust and affordable storage infrastructure, a domain where SATA HDDs excel. Market penetration rates for SATA HDDs remain high in enterprise data centers, Network Attached Storage (NAS) devices, and desktop computers, largely due to their superior cost-efficiency for mass storage. The continued expansion of cloud infrastructure, especially for cold storage and archival purposes, presents a significant opportunity for SATA HDDs. Furthermore, the growth in emerging economies, with their increasing adoption of digital technologies and the need for affordable data storage, will act as a key growth catalyst. The offline sales segment, though potentially facing pressure from direct-to-consumer online channels, will continue to be relevant for enterprise procurement and specialized retail. The total market size is estimated to reach over 150 billion USD by 2033.

Dominant Markets & Segments in SATA Hard Disk Drives

The SATA Hard Disk Drives market exhibits dominance across several key segments and regions. In terms of application, Online Sales are increasingly becoming the dominant channel, driven by the convenience of e-commerce platforms and the global reach they offer. This segment is projected to account for approximately 65% of the total SATA HDD market revenue by 2033. The ease of comparison, competitive pricing, and direct delivery models favor online transactions for both individual consumers and businesses. However, Offline Sales, particularly for enterprise solutions and large-scale deployments, will remain significant, facilitating direct engagement with vendors, customized solutions, and immediate procurement for critical infrastructure.

Analyzing by type, the Above 1T terabyte segment is the clear leader and fastest-growing category. The exponential growth of data demands larger storage capacities, making drives exceeding 1TB the standard for most applications. This segment is expected to capture over 70% of the market by 2033. Within the Above 1T segment, drives ranging from 8TB to 20TB and beyond are experiencing the highest demand. The 300GB-1TB segment still holds a considerable market share, particularly for older systems, budget-friendly consumer devices, and specific industrial applications where extreme capacity is not a primary requirement. The Below 300GB segment is gradually shrinking, primarily relegated to legacy systems and highly specialized embedded applications.

Geographically, North America and Asia-Pacific are the dominant markets for SATA Hard Disk Drives.

- North America benefits from a mature IT infrastructure, a high concentration of data centers, and significant investment in cloud computing and enterprise storage solutions. Key growth drivers include the expansion of hyperscale data centers, robust cybersecurity initiatives requiring extensive data storage, and the ongoing digital transformation across various industries.

- Asia-Pacific is the fastest-growing region, fueled by rapid digitalization, a burgeoning middle class with increasing demand for consumer electronics, and government initiatives promoting technology adoption. The expansion of 5G infrastructure, smart cities, and the growth of e-commerce in countries like China, India, and Southeast Asian nations are significant drivers for SATA HDD adoption. Government policies supporting domestic manufacturing and IT infrastructure development further bolster this growth. The total market size in the Asia-Pacific region is projected to exceed 60 billion USD by 2033.

SATA Hard Disk Drives Product Analysis

SATA Hard Disk Drives continue to evolve with a focus on increasing capacity, improving reliability, and optimizing power efficiency. Innovations in magnetic recording technologies, such as Shingled Magnetic Recording (SMR) and Conventional Magnetic Recording (CMR), allow for higher data densities on platters, pushing capacities well beyond 20TB for enterprise-grade drives. Advanced error correction codes (ECC) and firmware algorithms enhance data integrity, making them suitable for mission-critical applications. Competitive advantages lie in their cost-effectiveness for mass data storage, making them the preferred choice for cloud providers, backup solutions, and large archives. Their proven track record and widespread compatibility further solidify their market position, especially in systems where performance is not the absolute bottleneck.

Key Drivers, Barriers & Challenges in SATA Hard Disk Drives

Key Drivers: The SATA Hard Disk Drives market is propelled by the insatiable demand for digital storage, driven by the exponential growth of data from cloud computing, big data, AI, and IoT devices. The cost-effectiveness of HDDs for bulk storage remains a primary driver, making them the go-to solution for enterprises and consumers needing high capacities at a low price point. Technological advancements in areal density continue to push the capacity limits of HDDs, making them increasingly competitive.

Barriers & Challenges: The primary challenge for SATA HDDs is the rapid advancement and decreasing cost of Solid State Drives (SSDs), which offer superior performance and durability, especially in high-transaction environments. Supply chain disruptions, geopolitical factors, and the increasing reliance on global manufacturing can pose significant risks. Regulatory pressures related to e-waste and energy consumption, though generally manageable, require ongoing compliance. The competitive landscape is fierce, with established players constantly vying for market share and technological superiority.

Growth Drivers in the SATA Hard Disk Drives Market

Key growth drivers for the SATA Hard Disk Drives market include the ever-increasing global data generation across all sectors, from consumer entertainment to enterprise analytics and the Internet of Things. The fundamental economic advantage of HDDs in offering a lower cost per gigabyte for mass storage remains a crucial factor, especially for data archiving and cold storage. Continued innovation in areal density technology allows manufacturers to pack more data onto each platter, leading to higher capacity drives that meet growing storage demands. Government initiatives and investments in digital infrastructure, particularly in emerging economies, further stimulate the demand for reliable and affordable storage solutions. The expansion of cloud services and the need for robust data backup and recovery systems also represent significant growth catalysts.

Challenges Impacting SATA Hard Disk Drives Growth

Despite robust growth drivers, several challenges impact the expansion of the SATA Hard Disk Drives market. The primary restraint comes from the rapid technological advancements and cost reductions in Solid State Drives (SSDs), which offer superior performance, speed, and durability, making them increasingly attractive for various applications, including some enterprise use cases. Supply chain vulnerabilities, including component shortages and logistics bottlenecks, can disrupt production and increase costs. Intense market competition among major players can lead to price pressures, impacting profit margins. Furthermore, evolving environmental regulations concerning energy efficiency and end-of-life disposal require continuous adaptation and investment in sustainable manufacturing practices.

Key Players Shaping the SATA Hard Disk Drives Market

The SATA Hard Disk Drives market is primarily shaped by a few key global manufacturers. These include:

- Seagate

- WD

- Toshiba

- Dell (primarily as an integrator and OEM)

Significant SATA Hard Disk Drives Industry Milestones

- 2019: Introduction of enterprise-grade HDDs exceeding 18TB capacity.

- 2020: Increased adoption of SMR technology in consumer drives to boost capacities.

- 2021: Global supply chain disruptions impacting raw material availability and component sourcing for HDD manufacturing.

- 2022: Seagate and WD announce development of HAMR (Heat-Assisted Magnetic Recording) technology for future high-density drives.

- 2023: Continued growth in cloud storage demand driving steady sales for high-capacity enterprise SATA HDDs.

- 2024: Focus on improving energy efficiency in enterprise HDD models to reduce operational costs for data centers.

Future Outlook for SATA Hard Disk Drives Market

The future outlook for the SATA Hard Disk Drives market remains positive, albeit with evolving dynamics. While SSDs will continue to dominate high-performance applications, HDDs will retain their stronghold in bulk data storage, archiving, and scenarios where cost-effectiveness is paramount. The market is expected to witness continued innovation in increasing drive capacities, with technologies like HAMR promising drives well beyond 50TB in the coming years. Growth will be fueled by the expansion of cloud infrastructure, the burgeoning data needs of artificial intelligence and machine learning applications, and the increasing digitization of developing economies. Strategic opportunities lie in catering to the specific needs of hyperscale data centers, surveillance systems, and emerging IoT data storage requirements. The market will likely see a bifurcation, with high-capacity enterprise drives experiencing robust demand and lower-capacity consumer drives facing increasing competition from SSDs. The total market value is projected to grow steadily, reaching an estimated 180 billion USD by 2033.

SATA Hard Disk Drives Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Below 300G

- 2.2. 300G-1T

- 2.3. Above 1T

SATA Hard Disk Drives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

SATA Hard Disk Drives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 300G

- 5.2.2. 300G-1T

- 5.2.3. Above 1T

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 300G

- 6.2.2. 300G-1T

- 6.2.3. Above 1T

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 300G

- 7.2.2. 300G-1T

- 7.2.3. Above 1T

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 300G

- 8.2.2. 300G-1T

- 8.2.3. Above 1T

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 300G

- 9.2.2. 300G-1T

- 9.2.3. Above 1T

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific SATA Hard Disk Drives Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 300G

- 10.2.2. 300G-1T

- 10.2.3. Above 1T

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Seagate

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Seagate

List of Figures

- Figure 1: Global SATA Hard Disk Drives Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America SATA Hard Disk Drives Revenue (million), by Application 2024 & 2032

- Figure 3: North America SATA Hard Disk Drives Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America SATA Hard Disk Drives Revenue (million), by Types 2024 & 2032

- Figure 5: North America SATA Hard Disk Drives Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America SATA Hard Disk Drives Revenue (million), by Country 2024 & 2032

- Figure 7: North America SATA Hard Disk Drives Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America SATA Hard Disk Drives Revenue (million), by Application 2024 & 2032

- Figure 9: South America SATA Hard Disk Drives Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America SATA Hard Disk Drives Revenue (million), by Types 2024 & 2032

- Figure 11: South America SATA Hard Disk Drives Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America SATA Hard Disk Drives Revenue (million), by Country 2024 & 2032

- Figure 13: South America SATA Hard Disk Drives Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe SATA Hard Disk Drives Revenue (million), by Application 2024 & 2032

- Figure 15: Europe SATA Hard Disk Drives Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe SATA Hard Disk Drives Revenue (million), by Types 2024 & 2032

- Figure 17: Europe SATA Hard Disk Drives Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe SATA Hard Disk Drives Revenue (million), by Country 2024 & 2032

- Figure 19: Europe SATA Hard Disk Drives Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa SATA Hard Disk Drives Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa SATA Hard Disk Drives Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa SATA Hard Disk Drives Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa SATA Hard Disk Drives Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa SATA Hard Disk Drives Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa SATA Hard Disk Drives Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific SATA Hard Disk Drives Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific SATA Hard Disk Drives Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific SATA Hard Disk Drives Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific SATA Hard Disk Drives Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific SATA Hard Disk Drives Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific SATA Hard Disk Drives Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global SATA Hard Disk Drives Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global SATA Hard Disk Drives Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global SATA Hard Disk Drives Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global SATA Hard Disk Drives Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global SATA Hard Disk Drives Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global SATA Hard Disk Drives Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global SATA Hard Disk Drives Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global SATA Hard Disk Drives Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global SATA Hard Disk Drives Revenue million Forecast, by Country 2019 & 2032

- Table 41: China SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific SATA Hard Disk Drives Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the SATA Hard Disk Drives?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the SATA Hard Disk Drives?

Key companies in the market include Seagate, WD, Toshiba, Dell.

3. What are the main segments of the SATA Hard Disk Drives?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "SATA Hard Disk Drives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the SATA Hard Disk Drives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the SATA Hard Disk Drives?

To stay informed about further developments, trends, and reports in the SATA Hard Disk Drives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence