Key Insights

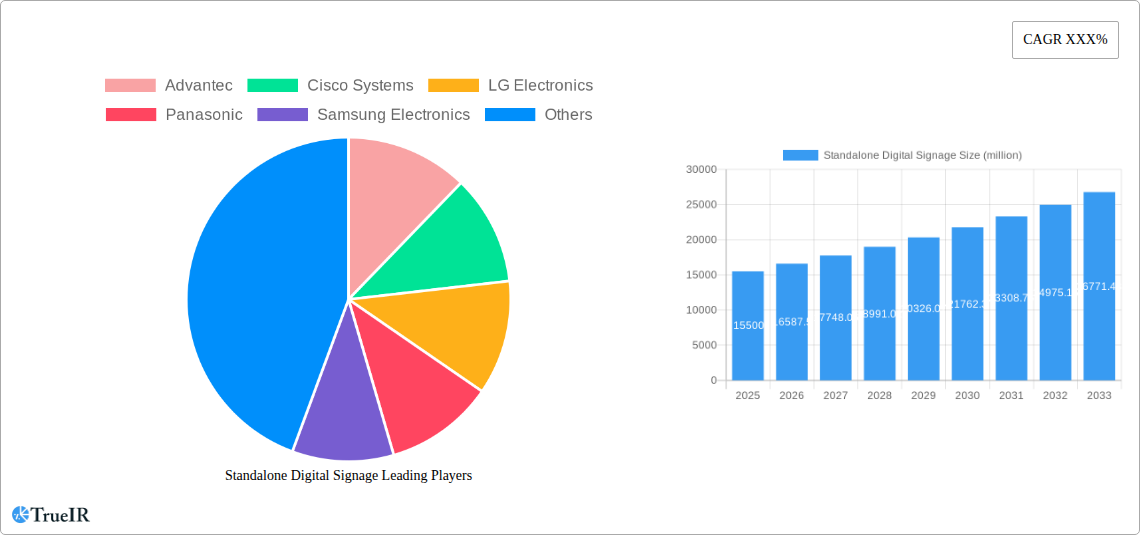

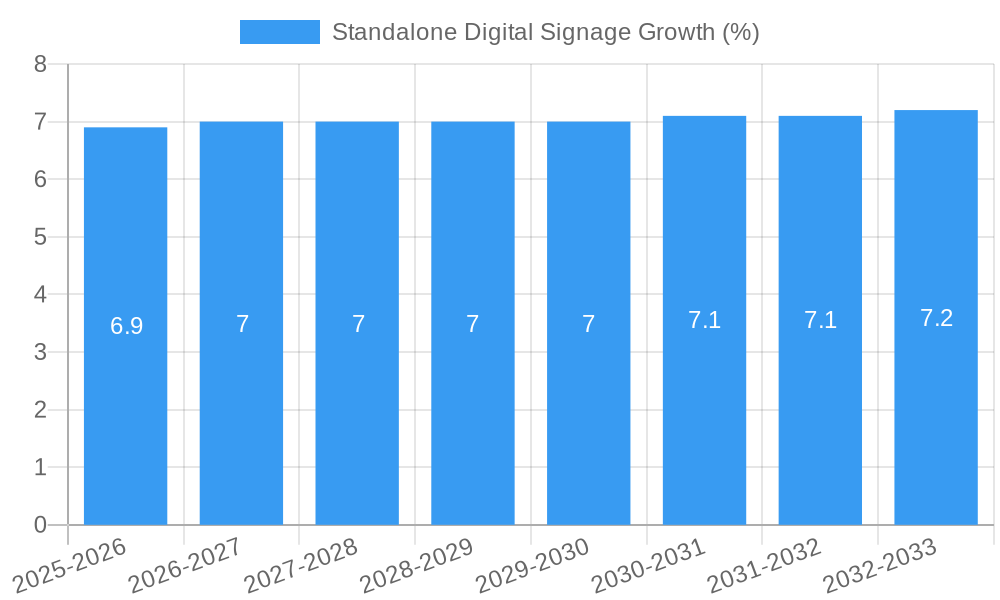

The global Standalone Digital Signage market is poised for robust expansion, projected to reach a substantial market size of approximately USD 15,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This significant growth is fueled by a confluence of factors, with the increasing adoption of advanced display technologies like OLED and LED, offering superior visual quality and energy efficiency, playing a pivotal role. The retail sector continues to be a dominant application, leveraging digital signage for dynamic advertising, enhanced customer engagement, and personalized promotions, leading to increased sales and improved brand visibility. Furthermore, the entertainment and sports industries are increasingly deploying sophisticated digital signage solutions for real-time updates, immersive fan experiences, and interactive content. The growing demand for interactive and engaging customer experiences across various industries, coupled with the declining costs of digital signage hardware and software, are key drivers propelling market growth.

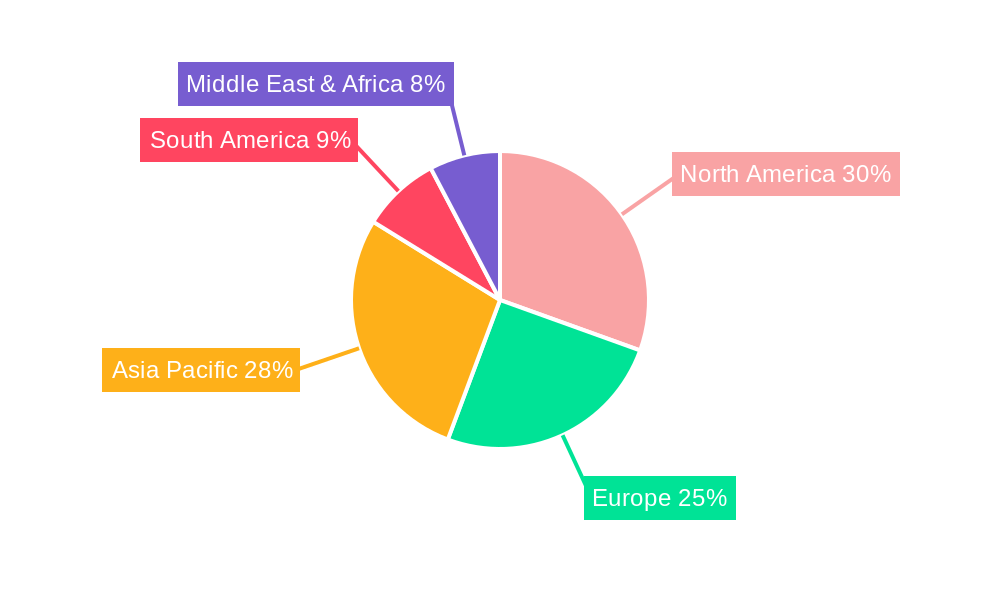

Emerging trends such as the integration of Artificial Intelligence (AI) for audience analytics and content personalization, along with the rise of Internet of Things (IoT) enabled signage for real-time data integration and smart city applications, are further shaping the market landscape. While the market enjoys strong growth, certain restraints, such as the high initial investment cost for large-scale deployments and potential concerns regarding content management complexity, need to be addressed by vendors. However, the widespread adoption of cloud-based solutions and the development of user-friendly content management systems are mitigating these challenges. Geographically, Asia Pacific, driven by rapid urbanization and a burgeoning digital infrastructure in countries like China and India, is expected to witness the highest growth rate. North America and Europe remain significant markets due to the early adoption of digital technologies and a strong focus on customer experience. The market is characterized by intense competition among established players and emerging innovators, all vying to capture market share through product innovation and strategic partnerships.

This in-depth report provides a comprehensive analysis of the standalone digital signage market, exploring its structure, trends, opportunities, and future trajectory. Leveraging high-volume keywords and detailed market intelligence, this report is designed for industry professionals seeking to understand and capitalize on the evolving digital signage landscape. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Historical data from 2019 to 2024 is also incorporated.

Standalone Digital Signage Market Structure & Competitive Landscape

The standalone digital signage market exhibits a moderately concentrated structure, with leading players such as Samsung Electronics, LG Electronics, and NEC holding significant market shares, estimated to be between 15-20% collectively. Innovation is a primary driver, fueled by advancements in display technologies like OLED and LED, and the increasing integration of AI for personalized content delivery and analytics. Regulatory impacts are minimal but include evolving data privacy laws and accessibility standards, which companies must navigate. Product substitutes, such as traditional static signage and printed media, are gradually being displaced by the dynamic and engaging nature of digital displays. End-user segmentation is diverse, with retail, entertainment, and corporate sectors showing the highest adoption rates. Mergers and acquisitions (M&A) activity has been moderate, with approximately 5-7 significant M&A deals per year in the historical period (2019-2024), primarily driven by technology consolidation and market expansion strategies. For instance, companies are acquiring smaller software or analytics firms to bolster their end-to-end solutions. Competitive advantages are built on superior display quality, user-friendly content management systems, robust analytics capabilities, and comprehensive support services. The market is characterized by continuous product development, focusing on interactive features and energy efficiency, ensuring sustained growth and competitive differentiation.

Standalone Digital Signage Market Trends & Opportunities

The standalone digital signage market is experiencing robust growth, projected to expand from an estimated market size of over 5 million units in 2025 to over 10 million units by 2033, driven by a compound annual growth rate (CAGR) of approximately 8-10%. This expansion is underpinned by significant technological shifts, most notably the widespread adoption of high-resolution displays, interactive touchscreens, and the increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) for enhanced content personalization and real-time analytics. Consumer preferences are evolving towards more engaging and immersive brand experiences, making digital signage a crucial tool for customer acquisition and retention across various sectors. In the retail sector, for example, interactive displays are being used for product information, wayfinding, and personalized promotions, significantly boosting sales conversion rates. The entertainment and sports segments are leveraging digital signage for live score updates, fan engagement, and in-venue advertising, creating dynamic and exciting atmospheres. In the corporate environment, digital signage is transforming internal communications, enhancing employee engagement, and streamlining meeting room management. The banking sector is increasingly utilizing digital displays for customer service information, promotional offers, and queue management. Market penetration rates continue to rise, particularly in emerging economies where digital transformation initiatives are gaining momentum. The development of AI-powered content management systems that enable dynamic scheduling and audience-based content adaptation represents a significant opportunity, allowing businesses to deliver the right message to the right audience at the right time. Furthermore, the growing demand for energy-efficient and sustainable digital signage solutions, such as those utilizing LED technology, presents another avenue for growth and market differentiation. The convergence of digital signage with augmented reality (AR) and virtual reality (VR) technologies is also anticipated to unlock new immersive advertising and experiential opportunities in the coming years. The COVID-19 pandemic accelerated the adoption of contactless information delivery and remote management capabilities, further solidifying the importance of standalone digital signage solutions. The continued advancement of network infrastructure and the decreasing cost of high-quality display hardware are also key enablers of this market's expansion.

Dominant Markets & Segments in Standalone Digital Signage

The Retail segment is a dominant force within the standalone digital signage market, projected to account for over 35% of the total market share by 2033. This dominance is driven by the segment's inherent need for dynamic advertising, product showcasing, and enhanced customer engagement. Key growth drivers within the retail sector include the increasing adoption of omnichannel retail strategies, where digital signage plays a pivotal role in bridging the gap between online and offline customer experiences. For instance, interactive displays can provide detailed product information, virtual try-ons, and personalized recommendations, directly influencing purchasing decisions. Infrastructure development, such as the proliferation of smart shopping malls and integrated retail spaces, further supports this growth. Furthermore, supportive policies encouraging business modernization and digital transformation in retail economies contribute significantly to market expansion.

From a technology perspective, LCD Technology currently holds the largest market share, estimated at over 50%, due to its cost-effectiveness, versatility, and widespread availability. However, OLED Technology is rapidly gaining traction, particularly in high-end retail and entertainment applications, owing to its superior contrast ratios, vibrant colors, and flexibility, and is projected to see a CAGR of over 12% during the forecast period. LED Technology is also experiencing substantial growth, especially for large-format displays and outdoor advertising, due to its energy efficiency and brightness.

Geographically, North America and Europe currently lead the market, driven by established economies and high adoption rates of digital technologies. However, the Asia Pacific region is expected to witness the fastest growth during the forecast period, fueled by rapid urbanization, a burgeoning middle class, and significant investments in smart city initiatives and digital infrastructure. Countries like China, India, and South Korea are emerging as key markets due to their large consumer bases and government support for technological advancements.

The Entertainment and Sports segment also represents a significant and growing application area, with digital signage crucial for enhancing fan experiences, advertising, and operational efficiency in stadiums, arenas, and entertainment venues. The Corporate segment is increasingly adopting digital signage for internal communications, branding, and information dissemination. The Education and Banking segments, while smaller, are also exhibiting steady growth as they recognize the benefits of digital displays for information delivery, wayfinding, and customer service.

Standalone Digital Signage Product Analysis

Standalone digital signage solutions are characterized by their integrated, self-contained nature, combining display, playback, and often networking capabilities within a single unit. Innovations focus on enhancing user experience, content management, and data analytics. Product advancements include ultra-high definition (UHD) displays with improved brightness and color accuracy, touch-interactive screens for immersive engagement, and AI-powered analytics for audience measurement and content optimization. Competitive advantages stem from the ease of deployment and management, making them ideal for single-location installations or small-to-medium-sized businesses. The seamless integration of hardware and software, coupled with robust content scheduling and playback functionalities, ensures efficient and effective communication.

Key Drivers, Barriers & Challenges in Standalone Digital Signage

Key Drivers, Barriers & Challenges in Standalone Digital Signage

Key Drivers:

- Technological Advancements: Continuous innovation in display technology (OLED, LED, 8K resolution), AI integration for personalized content, and IoT connectivity are driving adoption.

- Enhanced Customer Engagement: Digital signage offers dynamic, attention-grabbing content that significantly improves customer interaction and brand recall, particularly in retail and entertainment.

- Cost-Effectiveness: Compared to traditional static advertising, digital signage provides a more flexible and cost-effective medium for content updates and promotional campaigns over its lifecycle.

- Data Analytics & Insights: The ability to gather real-time data on viewer engagement and campaign performance enables businesses to optimize their strategies and demonstrate ROI.

- Shift Towards Digital Transformation: Across industries, there is a broad push to modernize communication channels and embrace digital solutions, with standalone signage being a readily deployable component.

Key Barriers & Challenges:

- Initial Investment Costs: While offering long-term savings, the upfront cost of purchasing and installing high-quality digital signage systems can be a barrier for some small businesses.

- Content Creation Complexity: Developing engaging and effective digital content requires specialized skills and resources, which can be a challenge for businesses without dedicated marketing teams.

- Technical Expertise for Maintenance: While standalone units are designed for ease of use, occasional technical issues may require specialized support, leading to potential downtime if not addressed promptly.

- Integration with Existing Systems: Ensuring seamless integration with existing IT infrastructure and marketing platforms can sometimes present technical hurdles.

- Market Saturation and Competition: The growing popularity of digital signage has led to increased competition, necessitating continuous innovation to maintain market share and differentiation.

Growth Drivers in the Standalone Digital Signage Market

The standalone digital signage market is propelled by a confluence of technological, economic, and regulatory factors. Technologically, advancements in display resolutions, touch interactivity, and AI-driven content personalization are creating more engaging and effective communication tools. Economically, the declining cost of hardware and the demonstrable ROI through increased customer engagement and sales are making digital signage an attractive investment for businesses across sectors. Regulatory tailwinds, such as government initiatives promoting digital transformation and urban modernization, are further encouraging the adoption of digital signage solutions. The growing demand for experiential retail and immersive entertainment further amplifies the need for dynamic visual displays.

Challenges Impacting Standalone Digital Signage Growth

Challenges impacting standalone digital signage growth primarily stem from the initial capital expenditure required for premium solutions, the ongoing need for high-quality, dynamic content creation, and the technical expertise needed for seamless operation and maintenance. Supply chain disruptions for key electronic components, as experienced in recent years, can also impact availability and pricing. Furthermore, while market penetration is increasing, some legacy industries may still exhibit slower adoption rates due to entrenched practices or budget constraints. Competitive pressures from a growing number of vendors also necessitate continuous innovation and value proposition refinement.

Key Players Shaping the Standalone Digital Signage Market

- Advantec

- Cisco Systems

- LG Electronics

- Panasonic

- Samsung Electronics

- NEC

- BroadSign International

- Sony

- Sharp

- Quividi

- RedFalcon

- AdMobilize

- Omnivex

Significant Standalone Digital Signage Industry Milestones

- 2019: Increased adoption of 8K displays for ultra-high resolution visual experiences.

- 2020: Rise of AI-powered analytics for audience measurement and content optimization in response to changing consumer behaviors.

- 2021: Enhanced focus on interactive touch capabilities and contactless solutions due to pandemic-induced shifts.

- 2022: Integration of IoT for smart, connected digital signage networks enabling remote management and data exchange.

- 2023: Emergence of more energy-efficient LED display technologies and sustainable signage solutions.

- 2024: Advancements in cloud-based content management systems, simplifying deployment and updates for businesses.

Future Outlook for Standalone Digital Signage Market

The future outlook for the standalone digital signage market is exceptionally bright, driven by continuous technological innovation and expanding application use cases. Anticipated growth catalysts include the further integration of AI for hyper-personalization of content, the development of more immersive augmented reality (AR) overlays on digital displays, and the increasing adoption of programmatic advertising for digital out-of-home (DOOH) networks. The market is poised for substantial expansion in emerging economies as digital infrastructure matures. Strategic opportunities lie in developing end-to-end solutions that encompass hardware, software, content creation, and data analytics, offering a comprehensive value proposition to businesses seeking to enhance their customer engagement and operational efficiency. The market potential is further bolstered by the ongoing digital transformation across all industry verticals.

Standalone Digital Signage Segmentation

-

1. Application

- 1.1. Retail

- 1.2. Entertainment and Sports

- 1.3. Education

- 1.4. Corporate

- 1.5. Banking

-

2. Type

- 2.1. OLED Technology

- 2.2. LCD Technology

- 2.3. HD Projector Technology

- 2.4. LED Technology

Standalone Digital Signage Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Standalone Digital Signage REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Retail

- 5.1.2. Entertainment and Sports

- 5.1.3. Education

- 5.1.4. Corporate

- 5.1.5. Banking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. OLED Technology

- 5.2.2. LCD Technology

- 5.2.3. HD Projector Technology

- 5.2.4. LED Technology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Retail

- 6.1.2. Entertainment and Sports

- 6.1.3. Education

- 6.1.4. Corporate

- 6.1.5. Banking

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. OLED Technology

- 6.2.2. LCD Technology

- 6.2.3. HD Projector Technology

- 6.2.4. LED Technology

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Retail

- 7.1.2. Entertainment and Sports

- 7.1.3. Education

- 7.1.4. Corporate

- 7.1.5. Banking

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. OLED Technology

- 7.2.2. LCD Technology

- 7.2.3. HD Projector Technology

- 7.2.4. LED Technology

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Retail

- 8.1.2. Entertainment and Sports

- 8.1.3. Education

- 8.1.4. Corporate

- 8.1.5. Banking

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. OLED Technology

- 8.2.2. LCD Technology

- 8.2.3. HD Projector Technology

- 8.2.4. LED Technology

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Retail

- 9.1.2. Entertainment and Sports

- 9.1.3. Education

- 9.1.4. Corporate

- 9.1.5. Banking

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. OLED Technology

- 9.2.2. LCD Technology

- 9.2.3. HD Projector Technology

- 9.2.4. LED Technology

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Standalone Digital Signage Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Retail

- 10.1.2. Entertainment and Sports

- 10.1.3. Education

- 10.1.4. Corporate

- 10.1.5. Banking

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. OLED Technology

- 10.2.2. LCD Technology

- 10.2.3. HD Projector Technology

- 10.2.4. LED Technology

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Advantec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cisco Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Electronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panasonic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NEC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BroadSign International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sony

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sharp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quividi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 RedFalcon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AdMobilize

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Omnivex

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Advantec

List of Figures

- Figure 1: Global Standalone Digital Signage Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Standalone Digital Signage Revenue (million), by Application 2024 & 2032

- Figure 3: North America Standalone Digital Signage Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Standalone Digital Signage Revenue (million), by Type 2024 & 2032

- Figure 5: North America Standalone Digital Signage Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Standalone Digital Signage Revenue (million), by Country 2024 & 2032

- Figure 7: North America Standalone Digital Signage Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Standalone Digital Signage Revenue (million), by Application 2024 & 2032

- Figure 9: South America Standalone Digital Signage Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Standalone Digital Signage Revenue (million), by Type 2024 & 2032

- Figure 11: South America Standalone Digital Signage Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Standalone Digital Signage Revenue (million), by Country 2024 & 2032

- Figure 13: South America Standalone Digital Signage Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Standalone Digital Signage Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Standalone Digital Signage Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Standalone Digital Signage Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Standalone Digital Signage Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Standalone Digital Signage Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Standalone Digital Signage Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Standalone Digital Signage Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Standalone Digital Signage Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Standalone Digital Signage Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Standalone Digital Signage Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Standalone Digital Signage Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Standalone Digital Signage Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Standalone Digital Signage Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Standalone Digital Signage Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Standalone Digital Signage Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Standalone Digital Signage Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Standalone Digital Signage Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Standalone Digital Signage Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Standalone Digital Signage Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Standalone Digital Signage Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Standalone Digital Signage Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Standalone Digital Signage Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Standalone Digital Signage Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Standalone Digital Signage Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Standalone Digital Signage Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Standalone Digital Signage Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Standalone Digital Signage Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Standalone Digital Signage Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Standalone Digital Signage?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Standalone Digital Signage?

Key companies in the market include Advantec, Cisco Systems, LG Electronics, Panasonic, Samsung Electronics, NEC, BroadSign International, Sony, Sharp, Quividi, RedFalcon, AdMobilize, Omnivex.

3. What are the main segments of the Standalone Digital Signage?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Standalone Digital Signage," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Standalone Digital Signage report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Standalone Digital Signage?

To stay informed about further developments, trends, and reports in the Standalone Digital Signage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence