Key Insights

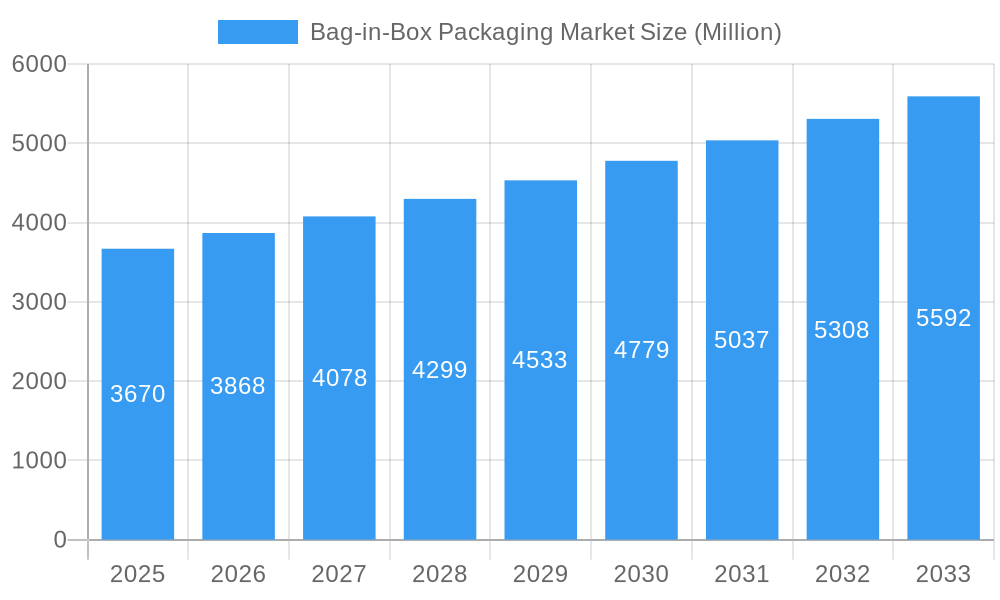

The Bag-in-Box Packaging market, valued at $3.67 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for sustainable and eco-friendly packaging solutions is a major catalyst, as Bag-in-Box offers a significantly reduced carbon footprint compared to traditional packaging formats like glass bottles or rigid plastic containers. This is further amplified by the rising consumer awareness regarding environmental concerns and the growing preference for convenient and portable packaging options. The food and beverage industry, particularly the non-alcoholic drinks segment, is a substantial contributor to market growth, owing to the suitability of Bag-in-Box for extended shelf life and efficient storage and transportation of liquids. Furthermore, the expansion of e-commerce and the increasing demand for home delivery of food and beverages are bolstering the adoption of Bag-in-Box packaging. The pharmaceutical and personal care industries also contribute significantly, benefiting from its protective qualities and ability to preserve product integrity. While some challenges exist related to the initial investment cost for packaging machinery and potential consumer perception issues, these are largely outweighed by the overall advantages and projected market expansion.

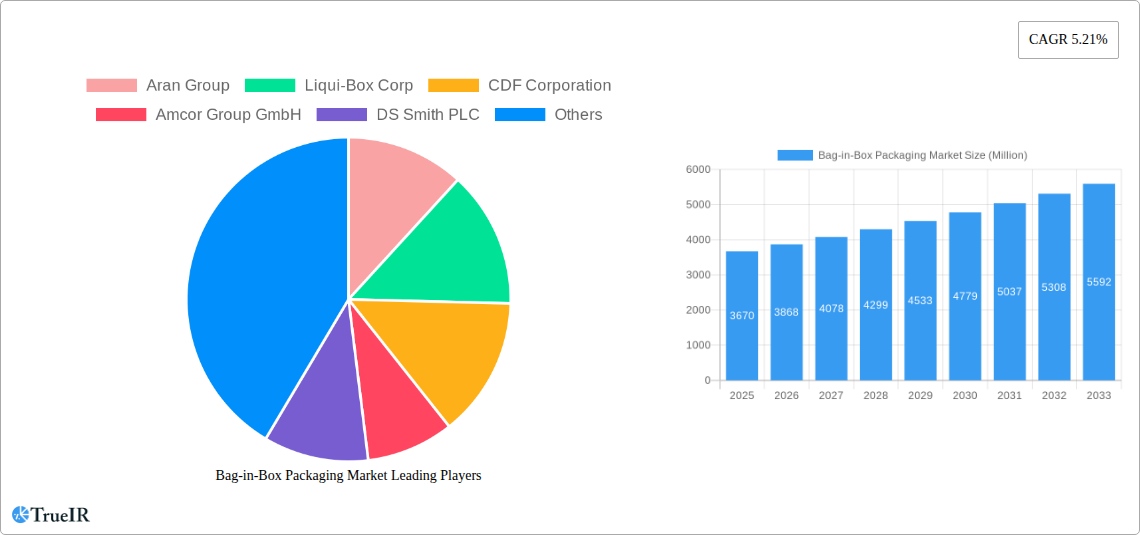

Bag-in-Box Packaging Market Market Size (In Billion)

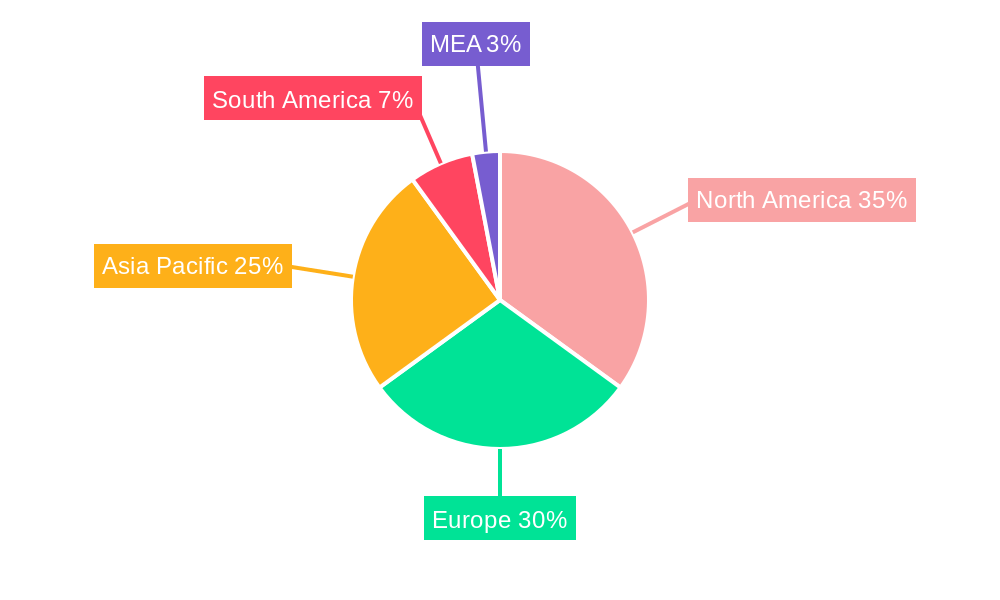

Significant regional variations are anticipated. North America and Europe currently hold a large share of the market, driven by established infrastructure and high consumer adoption. However, the Asia-Pacific region, particularly China and India, is poised for rapid growth fueled by increasing disposable incomes, rising urbanization, and a surge in demand for packaged food and beverages. The competitive landscape is marked by established players like Amcor, Smurfit Kappa, and Liqui-Box, alongside smaller regional manufacturers. Innovation in materials, barrier technologies, and design is expected to further shape the market landscape, leading to more sustainable and functional Bag-in-Box solutions. The 5.21% CAGR suggests a steady and consistent market expansion throughout the forecast period (2025-2033), presenting significant opportunities for both established players and new entrants.

Bag-in-Box Packaging Market Company Market Share

Bag-in-Box Packaging Market: A Comprehensive Market Report (2019-2033)

This dynamic report offers an in-depth analysis of the Bag-in-Box Packaging market, providing invaluable insights for businesses and investors seeking to navigate this evolving landscape. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive data and expert analysis to forecast market trends, identify key players, and uncover lucrative opportunities. The global Bag-in-Box Packaging market is projected to reach xx Million by 2033.

Bag-in-Box Packaging Market Structure & Competitive Landscape

The Bag-in-Box packaging market exhibits a moderately consolidated structure, with several major players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for this market is estimated at xx, indicating a moderately competitive landscape. Innovation is a crucial driver, with companies constantly striving to improve barrier properties, reduce material usage, and enhance dispensing mechanisms. Stringent regulatory compliance regarding food safety and material recyclability significantly impacts market dynamics. Substitute packaging options, such as rigid containers and pouches, exert competitive pressure, forcing Bag-in-Box manufacturers to offer cost-effective and sustainable alternatives.

Market segmentation is driven by capacity (0-5 Liter, 5-10 Liter, >10 Liter) and end-user industry (Beverage, Non-alcoholic Drinks, Food, Pharmaceutical and Medicine, Industrial (Chemical, Paintings and Coatings), Personal Care and Homecare). The beverage segment currently holds the largest share due to increasing demand for convenient and shelf-stable packaging. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million in M&A volume in 2024. Notable deals have involved companies focusing on expanding geographical reach and enhancing product portfolios.

- Market Concentration: Moderately Consolidated (HHI: xx)

- Innovation Drivers: Improved barrier properties, reduced material usage, enhanced dispensing.

- Regulatory Impacts: Stringent food safety and recyclability standards.

- Product Substitutes: Rigid containers, pouches.

- M&A Trends: Moderate activity, focusing on expansion and product portfolio diversification.

Bag-in-Box Packaging Market Trends & Opportunities

The Bag-in-Box packaging market is experiencing robust growth, driven by several key factors. The market size is estimated at xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the incorporation of sustainable materials (e.g., biodegradable polymers) and improved dispensing systems, are significantly influencing consumer preferences and market penetration. E-commerce growth is also boosting demand for convenient and lightweight packaging formats. The market is witnessing increased adoption in emerging economies, driven by rising disposable incomes and changing consumer lifestyles. Competitive dynamics are shaped by price competition, product innovation, and brand loyalty. The market penetration rate for Bag-in-Box packaging is projected to reach xx% by 2033, driven by its cost-effectiveness and sustainability advantages over traditional packaging options.

Dominant Markets & Segments in Bag-in-Box Packaging Market

The dominant segment within the Bag-in-Box Packaging market is currently the Beverage sector, specifically focusing on wine and juice. Within the capacity segments, the 5-10 Liter range holds the largest share owing to its optimal balance of cost-effectiveness and consumer usage.

- Leading Regions/Countries: North America and Europe currently dominate the market, but significant growth potential exists in Asia-Pacific.

- Key Growth Drivers (By Segment):

- Beverage: Increasing demand for convenient and shelf-stable packaging for wine, juice, and other beverages.

- Food: Growing demand for extended shelf-life food products.

- 0-5 Liter Capacity: Cost-effective for smaller households and single-serve applications.

- 5-10 Liter Capacity: Optimal balance of cost-effectiveness and consumer usage.

- >10 Liter Capacity: Primarily used in industrial applications.

The strong growth in these segments is primarily fueled by rising consumer preference for convenient packaging, the increasing popularity of online grocery shopping, and government initiatives promoting sustainable packaging solutions.

Bag-in-Box Packaging Market Product Analysis

Bag-in-Box packaging continues to evolve with innovations focusing on enhanced barrier properties to extend shelf life, improved tap systems for easier dispensing, and the use of sustainable and recyclable materials. These advancements cater to growing consumer demand for convenience and environmentally friendly packaging options, while offering manufacturers competitive advantages in the market. The market is witnessing a surge in the use of recyclable and biodegradable materials, responding to stringent environmental regulations.

Key Drivers, Barriers & Challenges in Bag-in-Box Packaging Market

Key Drivers: Growing demand for convenient and shelf-stable packaging across various sectors, rising consumer preference for sustainable packaging, increasing adoption of e-commerce, and technological advancements in material science and dispensing systems. For example, the increased adoption of online grocery shopping directly fuels the demand for safe and convenient packaging solutions like Bag-in-Box.

Challenges & Restraints: Fluctuations in raw material prices, stringent regulatory compliance requirements, and the need to compete with alternative packaging solutions pose significant challenges. Supply chain disruptions, especially during global events like pandemics, can also significantly impact production and distribution, resulting in estimated losses of xx Million annually in revenue for some manufacturers. Competition from other packaging types also presents a substantial barrier.

Growth Drivers in the Bag-in-Box Packaging Market Market

Technological advancements, rising consumer demand for sustainable and convenient packaging, and increasing regulations promoting eco-friendly packaging options are driving significant growth. The expanding e-commerce sector is also contributing significantly to market expansion.

Challenges Impacting Bag-in-Box Packaging Market Growth

Fluctuations in raw material costs, stringent regulatory hurdles, and intense competition from alternative packaging formats present significant challenges to market growth. Supply chain disruptions can lead to production delays and increased costs.

Key Players Shaping the Bag-in-Box Packaging Market Market

- Aran Group

- Liqui-Box Corp

- CDF Corporation

- Amcor Group GmbH

- DS Smith PLC

- Fujimori Kogyo Co Ltd (Zacros Cubitainer)

- Scholle IPN Corp

- AstraPouch (Vine Valley Ventures LLC)

- Goglio SpA

- Smurfit Kappa

Significant Bag-in-Box Packaging Market Industry Milestones

- November 2023: Campo Viejo launches its Winemakers’ Blend in a bag-in-box format, highlighting the growing consumer acceptance of this packaging type for premium wines.

- April 2024: Peak Packaging invests USD 1.08 Million in its UK facility, significantly boosting bag-in-box production capacity to over 60 Million bags annually. This demonstrates the industry's commitment to expanding production capabilities to meet the increasing demand.

Future Outlook for Bag-in-Box Packaging Market Market

The Bag-in-Box packaging market is poised for continued growth, driven by sustained demand for sustainable and convenient packaging. Strategic opportunities exist in expanding into emerging markets, developing innovative packaging solutions, and focusing on sustainable materials. The market's future prospects are bright, with significant potential for expansion across diverse end-user industries.

Bag-in-Box Packaging Market Segmentation

-

1. Capacity

- 1.1. 0-5 Liter

- 1.2. 5-10 Liter

- 1.3. Greater than 10 Liter

-

2. End-User Industry

-

2.1. Beverage

- 2.1.1. Alcoholic Drinks

- 2.1.2. Non-alcoholic Drinks

- 2.2. Food

- 2.3. Pharmaceutical and Medicine

- 2.4. Industrial (Chemical, Paintings and Coatings)

- 2.5. Perosnal Care and Homecare

-

2.1. Beverage

Bag-in-Box Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Bag-in-Box Packaging Market Regional Market Share

Geographic Coverage of Bag-in-Box Packaging Market

Bag-in-Box Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Demand for BIB Packaging Format Among Beverage Manufacturers; The Rising Need for Convenience and Eco-friendly Packaging in E-commerce

- 3.3. Market Restrains

- 3.3.1. Restrictions on Using Plastic Retail Bags

- 3.4. Market Trends

- 3.4.1. The Rising Demand From Beverage Sector Aids Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. 0-5 Liter

- 5.1.2. 5-10 Liter

- 5.1.3. Greater than 10 Liter

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Beverage

- 5.2.1.1. Alcoholic Drinks

- 5.2.1.2. Non-alcoholic Drinks

- 5.2.2. Food

- 5.2.3. Pharmaceutical and Medicine

- 5.2.4. Industrial (Chemical, Paintings and Coatings)

- 5.2.5. Perosnal Care and Homecare

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. 0-5 Liter

- 6.1.2. 5-10 Liter

- 6.1.3. Greater than 10 Liter

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Beverage

- 6.2.1.1. Alcoholic Drinks

- 6.2.1.2. Non-alcoholic Drinks

- 6.2.2. Food

- 6.2.3. Pharmaceutical and Medicine

- 6.2.4. Industrial (Chemical, Paintings and Coatings)

- 6.2.5. Perosnal Care and Homecare

- 6.2.1. Beverage

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. 0-5 Liter

- 7.1.2. 5-10 Liter

- 7.1.3. Greater than 10 Liter

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Beverage

- 7.2.1.1. Alcoholic Drinks

- 7.2.1.2. Non-alcoholic Drinks

- 7.2.2. Food

- 7.2.3. Pharmaceutical and Medicine

- 7.2.4. Industrial (Chemical, Paintings and Coatings)

- 7.2.5. Perosnal Care and Homecare

- 7.2.1. Beverage

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. 0-5 Liter

- 8.1.2. 5-10 Liter

- 8.1.3. Greater than 10 Liter

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Beverage

- 8.2.1.1. Alcoholic Drinks

- 8.2.1.2. Non-alcoholic Drinks

- 8.2.2. Food

- 8.2.3. Pharmaceutical and Medicine

- 8.2.4. Industrial (Chemical, Paintings and Coatings)

- 8.2.5. Perosnal Care and Homecare

- 8.2.1. Beverage

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Latin America Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. 0-5 Liter

- 9.1.2. 5-10 Liter

- 9.1.3. Greater than 10 Liter

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Beverage

- 9.2.1.1. Alcoholic Drinks

- 9.2.1.2. Non-alcoholic Drinks

- 9.2.2. Food

- 9.2.3. Pharmaceutical and Medicine

- 9.2.4. Industrial (Chemical, Paintings and Coatings)

- 9.2.5. Perosnal Care and Homecare

- 9.2.1. Beverage

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Middle East and Africa Bag-in-Box Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. 0-5 Liter

- 10.1.2. 5-10 Liter

- 10.1.3. Greater than 10 Liter

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Beverage

- 10.2.1.1. Alcoholic Drinks

- 10.2.1.2. Non-alcoholic Drinks

- 10.2.2. Food

- 10.2.3. Pharmaceutical and Medicine

- 10.2.4. Industrial (Chemical, Paintings and Coatings)

- 10.2.5. Perosnal Care and Homecare

- 10.2.1. Beverage

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aran Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liqui-Box Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CDF Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor Group GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujimori Kogyo Co Ltd (Zacros Cubitainer)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scholle IPN Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AstraPouch (Vine Valley Ventures LLC)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Goglio SpA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smurfit Kappa

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aran Group

List of Figures

- Figure 1: Global Bag-in-Box Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 3: North America Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: North America Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 9: Europe Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 10: Europe Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 15: Asia Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 16: Asia Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 21: Latin America Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 22: Latin America Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Latin America Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by Capacity 2025 & 2033

- Figure 27: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 28: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Bag-in-Box Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bag-in-Box Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 2: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 5: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 10: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 17: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia and New Zealand Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 24: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Mexico Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 29: Global Bag-in-Box Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 30: Global Bag-in-Box Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Arab Emirates Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Saudi Arabia Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: South Africa Bag-in-Box Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bag-in-Box Packaging Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Bag-in-Box Packaging Market?

Key companies in the market include Aran Group, Liqui-Box Corp, CDF Corporation, Amcor Group GmbH, DS Smith PLC, Fujimori Kogyo Co Ltd (Zacros Cubitainer), Scholle IPN Corp, AstraPouch (Vine Valley Ventures LLC)*List Not Exhaustive, Goglio SpA, Smurfit Kappa.

3. What are the main segments of the Bag-in-Box Packaging Market?

The market segments include Capacity, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Demand for BIB Packaging Format Among Beverage Manufacturers; The Rising Need for Convenience and Eco-friendly Packaging in E-commerce.

6. What are the notable trends driving market growth?

The Rising Demand From Beverage Sector Aids Market Growth.

7. Are there any restraints impacting market growth?

Restrictions on Using Plastic Retail Bags.

8. Can you provide examples of recent developments in the market?

April 2024: Peak Packaging, a specialist in liquid packaging, announced an investment exceeding USD 1.08 million in its UK facility. The move is set to bolster its bag-in-box production capabilities, with the goal of ramping up capacity to over 60 million bags annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bag-in-Box Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bag-in-Box Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bag-in-Box Packaging Market?

To stay informed about further developments, trends, and reports in the Bag-in-Box Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence