Key Insights

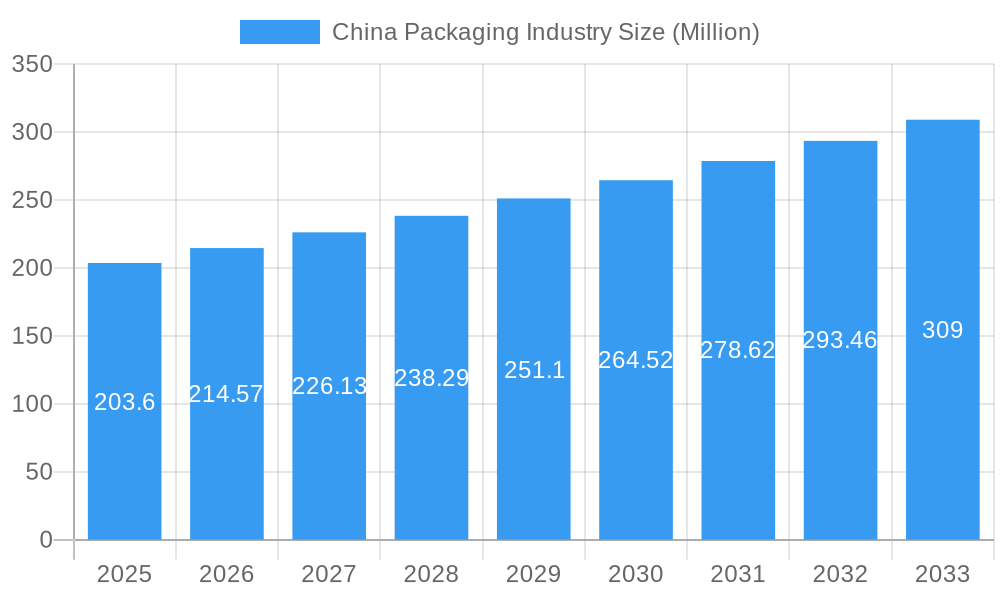

The China packaging industry, valued at $203.60 million in 2025, is projected to experience robust growth, driven by a burgeoning e-commerce sector, rising consumer spending on packaged goods, and increasing demand for sophisticated packaging solutions across diverse sectors. The industry's Compound Annual Growth Rate (CAGR) of 5.22% from 2019 to 2024 suggests a continued upward trajectory, projected to reach approximately $300 million by 2033. Key drivers include the expanding food and beverage industry, the growing healthcare and pharmaceutical sector requiring specialized packaging, and the increasing popularity of beauty and personal care products necessitating attractive and functional packaging. Furthermore, evolving consumer preferences towards sustainable and eco-friendly packaging materials like paper and recycled plastics present both opportunities and challenges for industry players. Growth is segmented across packaging materials (plastic, paper, glass, foam, metal), packaging layers (primary, secondary, tertiary), and end-user industries. While China's dominance in manufacturing offers a substantial advantage, the industry faces potential restraints such as fluctuating raw material prices, stringent environmental regulations, and intense competition among both domestic and international players.

China Packaging Industry Market Size (In Million)

The competitive landscape is characterized by a mix of large multinational corporations like Amcor PLC and Mondi PLC, alongside significant domestic players such as Daklapack Group and Guangzhou Yifeng Printing & Packaging Co Ltd. These companies are continuously innovating to meet evolving market demands, focusing on developing sustainable packaging solutions, enhancing supply chain efficiency, and expanding their product portfolios to cater to specific industry needs. This dynamic interplay between established players and emerging companies is expected to shape the future of the China packaging industry, contributing to further growth and innovation in the coming years. The strategic focus on technological advancements in packaging design, material science, and automation will be crucial for maintaining a competitive edge in this rapidly evolving market.

China Packaging Industry Company Market Share

China Packaging Industry Market Report: 2019-2033

This comprehensive report offers an in-depth analysis of the dynamic China packaging industry, projecting a robust growth trajectory throughout the forecast period (2025-2033). With a base year of 2025 and a study period spanning 2019-2033, this report provides invaluable insights for businesses, investors, and policymakers seeking to understand and capitalize on the immense opportunities within this vital sector. The market is valued at xx Million in 2025 and is expected to reach xx Million by 2033.

China Packaging Industry Market Structure & Competitive Landscape

The China packaging industry exhibits a moderately concentrated market structure, with several large multinational corporations and domestic players dominating specific segments. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include sustainability concerns (pushing eco-friendly materials), e-commerce growth (demand for protective packaging), and evolving consumer preferences for premium packaging. Regulatory impacts, such as stringent environmental regulations and food safety standards, are significant factors shaping industry practices. Product substitutes, including reusable and biodegradable packaging options, are gaining traction, challenging the dominance of traditional materials.

The industry is characterized by significant mergers and acquisitions (M&A) activity, with a total transaction value of approximately xx Million observed between 2019 and 2024. Notable examples include the acquisition of Yantai Xinhui Packing by Datwyler in March 2022.

- Market Concentration: Moderately concentrated, with a HHI of xx.

- Innovation Drivers: Sustainability, e-commerce growth, evolving consumer preferences.

- Regulatory Impacts: Stringent environmental and food safety regulations.

- Product Substitutes: Reusable and biodegradable packaging.

- M&A Activity: Significant activity, with a total transaction value of approximately xx Million (2019-2024).

- Key Players: Daklapack Group, Transpak Inc, Sealed Air Corporation, Jiangyin Aluminum Foil Packaging East Asia Co Ltd, Plastipak Holdings Inc, Amcor PLC, Mondi PLC, Wipak Group, Guangzhou Yifeng Printing & Packaging Co Ltd, Tetra Pak International SA (List Not Exhaustive).

China Packaging Industry Market Trends & Opportunities

The China packaging market is undergoing a dynamic transformation, fueled by a rapidly expanding middle class with increasing disposable incomes, and the explosive growth of e-commerce. This robust growth is projected to continue, with the market exhibiting a significant Compound Annual Growth Rate (CAGR) of [Insert XX]% during the forecast period (2025-2033). Technological innovation is a key differentiator, with the widespread adoption of smart packaging solutions offering enhanced traceability and consumer engagement, alongside increased automation in manufacturing processes that boosts efficiency and reduces operational costs. Consumer preferences are evolving towards environmentally conscious and visually appealing packaging. This shift creates substantial opportunities for companies developing and offering innovative, sustainable, and aesthetically pleasing packaging solutions. The competitive landscape is characterized by fierce rivalry between both established domestic leaders and ambitious international players, all striving to capture a larger market share. While market penetration for sustainable packaging materials is on an upward trajectory, it still represents a developing segment compared to conventional materials, indicating considerable room for future expansion. Beyond mainstream applications, specialized packaging segments, particularly within the pharmaceutical and healthcare sectors, are experiencing high demand for advanced, safety-critical solutions, presenting further avenues for growth.

Dominant Markets & Segments in China Packaging Industry

The food and beverage sector stands as the dominant force within the China packaging market. This is primarily attributed to sustained high consumption levels and a growing appetite for convenient, ready-to-eat, and on-the-go food options. When examining packaging materials, plastics continue to hold the largest market share due to their cost-effectiveness and versatility. However, there is a discernible and significant surge in the demand for paper-based packaging, driven by increasing environmental consciousness and stricter regulations. In terms of packaging layers, the primary layer, which is in direct contact with the product, commands the largest share, underscoring its critical role in product protection, preservation, and safety.

- Leading Segment (by end-user): Food and Beverage

- Leading Segment (by material): Plastic (with strong growth in Paper-based packaging)

- Leading Segment (by layer): Primary Layer

- Key Growth Drivers:

- Food & Beverage: Rising disposable incomes, increased demand for convenience foods, and premiumization of products.

- Plastic: Continued reliance on its cost-effectiveness, durability, and versatile properties for a wide range of applications.

- Primary Layer: Paramount importance for product integrity, shelf-life extension, and consumer safety, especially in sensitive sectors.

- Economic Growth: China's robust and expanding economy continuously fuels the demand for a diverse array of packaged consumer goods.

- Government Policies: Proactive government initiatives and regulations encouraging the adoption of sustainable packaging practices, circular economy principles, and waste reduction.

- E-commerce Boom: The exponential growth of online retail necessitates specialized and robust packaging solutions for safe and efficient delivery.

China Packaging Industry Product Analysis

Product innovation is a cornerstone of the evolving China packaging industry. Significant advancements are being made in material science, leading to the development of innovative materials such as biodegradable plastics, compostable alternatives, and advanced barrier coatings that enhance product performance and significantly improve sustainability metrics. The industry's focus is sharply directed towards creating packaging solutions that not only meet stringent safety and environmental regulations but also offer enhanced convenience and superior aesthetic appeal to discerning consumers. Furthermore, packaging designs meticulously optimized for the demands of e-commerce logistics, ensuring product protection during transit, are gaining significant traction. Competitive advantage in this landscape is increasingly found in the ability to offer highly customized solutions tailored to specific client requirements, coupled with the implementation of sustainable and cost-effective production processes. The integration of smart technologies, such as QR codes for traceability and NFC tags for enhanced consumer interaction, is also becoming a key differentiator.

Key Drivers, Barriers & Challenges in China Packaging Industry

Key Drivers:

- Technological advancements in materials and manufacturing processes.

- Growing e-commerce sector driving demand for protective packaging.

- Rising consumer demand for sustainable and aesthetically pleasing packaging.

- Government support for the development of eco-friendly packaging solutions.

Challenges:

- Intense competition from both domestic and international players.

- Fluctuations in raw material prices impacting production costs.

- Stringent environmental regulations requiring continuous innovation in sustainable materials.

- Supply chain disruptions due to geopolitical factors and the COVID-19 pandemic resulting in a xx% increase in production costs.

Growth Drivers in the China Packaging Industry Market

The China packaging industry's impressive growth is propelled by a confluence of powerful factors. The nation's rapid and sustained economic expansion is a primary engine, leading to increased consumer spending on packaged goods. The meteoric rise of e-commerce continues to be a monumental driver, creating an insatiable demand for specialized, protective, and efficient packaging solutions. Furthermore, evolving consumer preferences are steering the market towards convenience and sustainability, compelling manufacturers to innovate. Government initiatives, particularly those promoting environmentally friendly packaging and a circular economy, are providing a significant impetus for sustainable material adoption and innovation. Technological advancements are also playing a pivotal role, with the integration of automation in manufacturing enhancing efficiency and product quality, while the advent of smart packaging offers new dimensions in functionality and consumer engagement.

Challenges Impacting China Packaging Industry Growth

Significant challenges include the volatility of raw material prices, the need to comply with stringent environmental regulations, and intense competition from both domestic and international players. Supply chain disruptions can also cause significant production delays and cost increases.

Key Players Shaping the China Packaging Industry Market

- Daklapack Group

- Transpak Inc

- Sealed Air Corporation

- Jiangyin Aluminum Foil Packaging East Asia Co Ltd

- Plastipak Holdings Inc

- Amcor PLC

- Mondi PLC

- Wipak Group

- Guangzhou Yifeng Printing & Packaging Co Ltd

- Tetra Pak International SA

Significant China Packaging Industry Industry Milestones

- August 2022: Nippon Paint China, in collaboration with BASF, launched innovative eco-friendly industrial packaging for Nippon Paint's dry-mixed mortar products. This groundbreaking initiative utilized BASF's advanced water-based acrylic dispersion Joncryl High-Performance Barrier (HPB), marking the first commercial application of BASF's water-based barrier coatings in industrial packaging within the Chinese market. This collaboration highlights a strong commitment to sustainable solutions in the industrial packaging sector.

- March 2022: Datwyler, a leading provider of specialized packaging solutions, significantly expanded its presence in the Chinese market by acquiring Yantai Xinhui Packing. This strategic acquisition of a prominent Chinese pharmaceutical packaging manufacturer bolstered Datwyler's local manufacturing capabilities and enhanced its customer service infrastructure, allowing for more responsive and tailored support for its growing clientele in China.

Future Outlook for China Packaging Industry Market

The China packaging industry is poised for continued growth, driven by strong economic fundamentals, technological innovation, and increasing consumer demand for sustainable and high-quality packaging solutions. The market presents significant opportunities for companies offering innovative, eco-friendly packaging materials and technologies. Strategic partnerships and investments in sustainable manufacturing practices will be key to success in this evolving market.

China Packaging Industry Segmentation

-

1. Packaging Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Glass

- 1.4. Metal

- 1.5. Other Packaging Material

-

2. Types of Packaging

- 2.1. Primary Packaging

- 2.2. Secondary Packaging

- 2.3. Tertiary Packaging

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare and Pharmaceutical

- 3.3. Beauty and Personal Care

- 3.4. Industrial

- 3.5. Other End-user Industries

China Packaging Industry Segmentation By Geography

- 1. China

China Packaging Industry Regional Market Share

Geographic Coverage of China Packaging Industry

China Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-commerce Giants; Increasing Demand for Longer Shelf Life of Packaged Goods

- 3.3. Market Restrains

- 3.3.1. Strict Rules and Regulations in the Packaging Industry; Environmental Concerns Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Witness a Slow Growth Owing to Ban on Plastics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Glass

- 5.1.4. Metal

- 5.1.5. Other Packaging Material

- 5.2. Market Analysis, Insights and Forecast - by Types of Packaging

- 5.2.1. Primary Packaging

- 5.2.2. Secondary Packaging

- 5.2.3. Tertiary Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare and Pharmaceutical

- 5.3.3. Beauty and Personal Care

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Daklapack Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transpak Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sealed Air Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jiangyin Aluminum Foil Packaging East Asia Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plastipak Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wipak Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Guangzhou Yifeng Printing & Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tetra Pak International SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Daklapack Group

List of Figures

- Figure 1: China Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: China Packaging Industry Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 2: China Packaging Industry Revenue Million Forecast, by Types of Packaging 2020 & 2033

- Table 3: China Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: China Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Packaging Industry Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 6: China Packaging Industry Revenue Million Forecast, by Types of Packaging 2020 & 2033

- Table 7: China Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: China Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Packaging Industry?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the China Packaging Industry?

Key companies in the market include Daklapack Group, Transpak Inc, Sealed Air Corporation*List Not Exhaustive, Jiangyin Aluminum Foil Packaging East Asia Co Ltd, Plastipak Holdings Inc, Amcor PLC, Mondi PLC, Wipak Group, Guangzhou Yifeng Printing & Packaging Co Ltd, Tetra Pak International SA.

3. What are the main segments of the China Packaging Industry?

The market segments include Packaging Material, Types of Packaging, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-commerce Giants; Increasing Demand for Longer Shelf Life of Packaged Goods.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Witness a Slow Growth Owing to Ban on Plastics.

7. Are there any restraints impacting market growth?

Strict Rules and Regulations in the Packaging Industry; Environmental Concerns Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: Nippon Paint China, a prominent coatings producer, and BASF jointly introduced eco-friendly industrial packaging, which Nippon Paint's dry-mixed mortar series products have since embraced. The innovative packaging material for Nippon Paint's construction dry mortar products is commercialized, using water-based acrylic dispersion Joncryl High-Performance Barrier (HPB) from BASF as the barrier material. China will be the first country where BASF's water-based barrier coatings are employed in industrial packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Packaging Industry?

To stay informed about further developments, trends, and reports in the China Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence