Key Insights

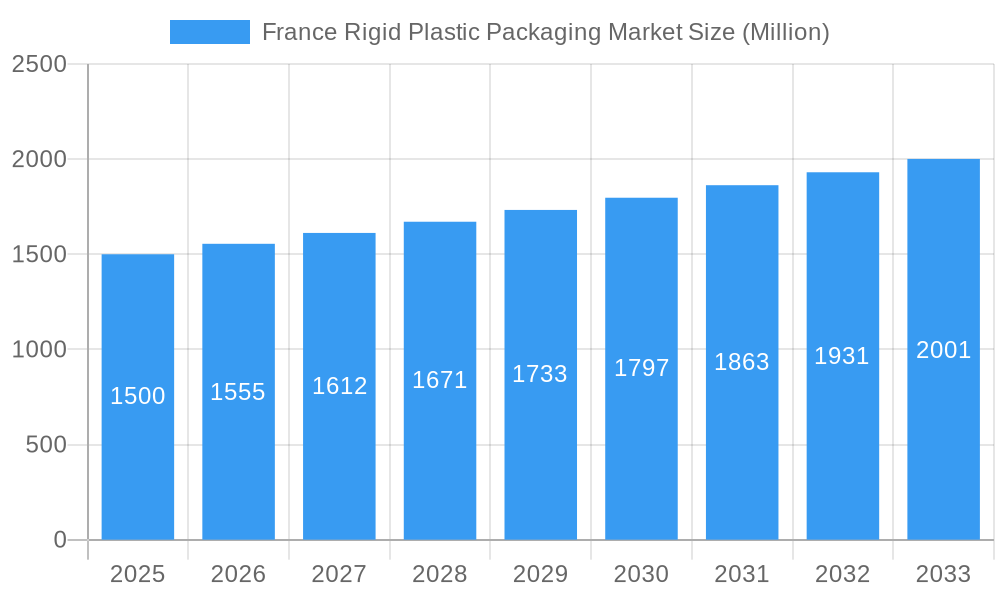

The France rigid plastic packaging market, valued at €220.2 billion in 2025, is forecast for robust expansion, projecting a compound annual growth rate (CAGR) of 3.6% between 2025 and 2033. This upward trend is propelled by escalating demand for convenient, lightweight packaging solutions across key industries, including food and beverages, personal care, and pharmaceuticals. The surge in e-commerce further amplifies the need for durable and protective plastic packaging. Evolving consumer preferences and stringent regulatory frameworks are driving the adoption of sustainable packaging alternatives, emphasizing recycled and recyclable materials. Consequently, manufacturers are prioritizing the development of eco-friendly solutions, such as biodegradable and compostable plastics, to address environmental concerns and plastic waste challenges. The market is comprehensively segmented by packaging type (bottles, containers, films), application (food and beverages, healthcare), and material (PET, HDPE, PP). Intense competition characterizes the landscape, with established global leaders and emerging innovators actively pursuing market share through strategic alliances and product advancements.

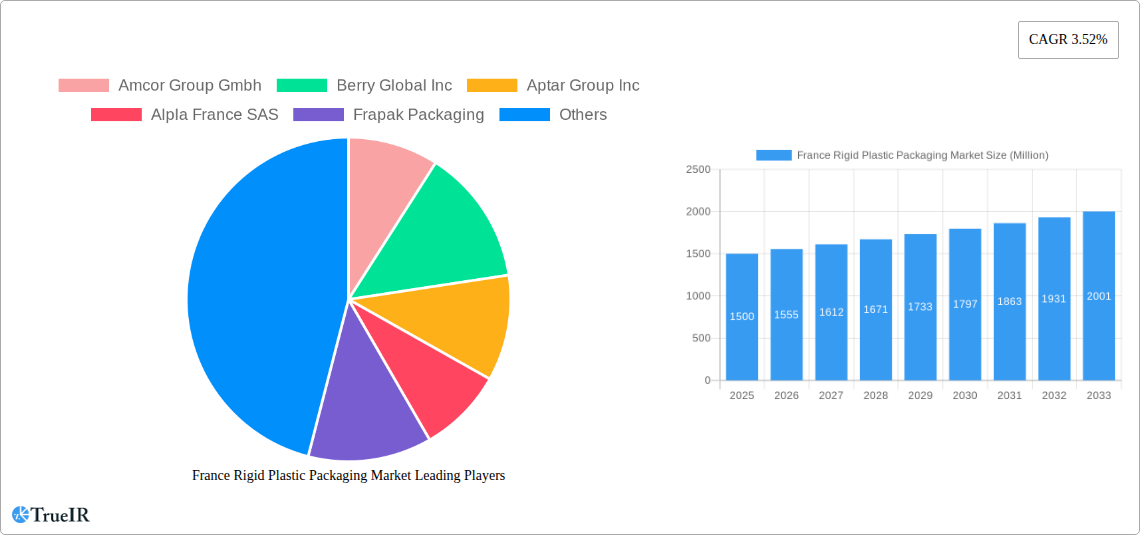

France Rigid Plastic Packaging Market Market Size (In Billion)

Projected to reach approximately €304.1 billion by 2033, the France rigid plastic packaging market's growth trajectory is underpinned by sustained sector demand and a commitment to innovation. Market participants are strategically focusing on advanced solutions and collaborations to secure substantial market positions while aligning with evolving consumer expectations and regulatory mandates. The competitive environment underscores the critical role of product differentiation and sustainable practices for enduring success within the French rigid plastic packaging sector. Continued investment in research and development for sustainable materials and cutting-edge packaging technologies remains paramount for sustained market expansion.

France Rigid Plastic Packaging Market Company Market Share

France Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Rigid Plastic Packaging Market, covering market size, segmentation, competitive landscape, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for businesses seeking to understand the dynamics of this evolving market and capitalize on emerging opportunities. The market is projected to reach xx Million by 2033.

France Rigid Plastic Packaging Market Structure & Competitive Landscape

The France rigid plastic packaging market exhibits a moderately concentrated structure, with a few dominant players and a number of smaller, specialized companies. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately consolidated landscape. Innovation is a key driver, with companies focusing on sustainable and eco-friendly packaging solutions to meet growing consumer demand and increasingly stringent regulations. Regulatory impacts, particularly those related to plastic waste reduction and recycling, are significantly shaping the market. Product substitutes, such as biodegradable and compostable packaging materials, are gaining traction, though rigid plastic remains dominant due to its cost-effectiveness and performance characteristics.

The market is segmented by packaging type (bottles, containers, closures, etc.), application (food & beverage, personal care, pharmaceuticals, etc.), and material type (PET, HDPE, PP, etc.). Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, primarily driven by consolidation among smaller players and expansion into new product categories. Key factors influencing M&A activity include achieving economies of scale, expanding geographic reach, and accessing new technologies.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Sustainable packaging solutions, eco-friendly materials.

- Regulatory Impacts: Stringent regulations on plastic waste, driving innovation.

- Product Substitutes: Biodegradable and compostable packaging gaining market share.

- End-User Segmentation: Food & beverage, personal care, pharmaceuticals, industrial goods.

- M&A Trends: Moderate activity, driven by consolidation and expansion.

France Rigid Plastic Packaging Market Market Trends & Opportunities

The France rigid plastic packaging market is experiencing robust growth, driven by factors such as rising consumption of packaged goods, increasing demand for convenient and protective packaging, and expanding e-commerce activities. The market is estimated to have reached xx Million in 2024 and is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is being fueled by several key trends, including the rising adoption of sustainable and eco-friendly packaging solutions, technological advancements in packaging materials and manufacturing processes (e.g., lightweighting, improved barrier properties), evolving consumer preferences towards convenient and aesthetically pleasing packaging, and increased focus on brand differentiation and product protection. Market penetration rates for innovative packaging materials such as bioplastics and recycled content are steadily increasing. Competitive dynamics are characterized by innovation, brand building, and strategic partnerships to ensure supply chain reliability and sustainability.

Dominant Markets & Segments in France Rigid Plastic Packaging Market

The dominant segment within the France rigid plastic packaging market is the food and beverage sector, accounting for approximately xx% of the total market value in 2024. This high market share is due to the extensive use of rigid plastic packaging for various food and beverage products, ranging from bottled water and dairy products to processed foods and confectionery. Within this segment, PET bottles remain the leading product, followed by HDPE containers. The personal care and cosmetics sector is another significant segment, showcasing strong growth driven by the rising demand for convenient and aesthetically appealing packaging for beauty products.

- Key Growth Drivers in Food & Beverage: High consumption of packaged foods and beverages, demand for convenient and protective packaging.

- Key Growth Drivers in Personal Care: Rising demand for convenient and attractive packaging, increasing focus on sustainable packaging solutions.

- Geographic Dominance: The Ile-de-France region, benefiting from strong economic activity and high population density, is a leading market.

France Rigid Plastic Packaging Market Product Analysis

Significant product innovations are being driven by the need for enhanced sustainability and improved functionality. Lightweighting technologies are reducing material consumption and improving transportation efficiency. The use of recycled content and bio-based materials is gaining momentum, responding to environmental concerns and consumer demand for eco-friendly options. Innovative closure systems, tamper-evident seals, and improved barrier properties against oxygen and moisture are enhancing product shelf life and maintaining quality. This focus on sustainable and functional solutions is driving significant market differentiation and enhancing the competitive landscape.

Key Drivers, Barriers & Challenges in France Rigid Plastic Packaging Market

Key Drivers:

- Growing demand for packaged goods: Driven by increasing population and changing lifestyles.

- Technological advancements: Lightweighting, improved barrier properties, and sustainable materials.

- Evolving consumer preferences: Demand for convenience, aesthetics, and sustainability.

- Government regulations: Promoting recycling and reducing plastic waste.

Challenges:

- Fluctuating raw material prices: Impacting the cost of production and profitability.

- Stringent environmental regulations: Increasing compliance costs and limiting material choices.

- Intense competition: Pressuring profit margins and driving the need for innovation.

- Supply chain disruptions: Impacting the availability of raw materials and packaging solutions.

Growth Drivers in the France Rigid Plastic Packaging Market Market

The market's growth is propelled by rising consumption of packaged goods, technological advancements in packaging materials (e.g., lighter weight, improved barriers), and the increasing adoption of sustainable and eco-friendly packaging options. Government regulations promoting recycling and reducing plastic waste also serve as significant catalysts.

Challenges Impacting France Rigid Plastic Packaging Market Growth

Major challenges include fluctuating raw material prices impacting production costs, stringent environmental regulations increasing compliance costs, and intense competition driving the need for constant innovation to maintain market share. Supply chain disruptions related to raw material sourcing and logistics also pose significant risks.

Key Players Shaping the France Rigid Plastic Packaging Market Market

- Amcor Group Gmbh

- Berry Global Inc

- Aptar Group Inc

- Alpla France SAS

- Frapak Packaging

- Axium Packaging

- Retal Group

- PDG Plastiques

- ActiPack SAS

- Pinard Beauty Pack

- SCHUTZ France SAS

- Caps Packaging

- Greif France SAS

Significant France Rigid Plastic Packaging Market Industry Milestones

- July 2024: Coverpla launches a refillable bottle and cap made from bio-based resin in collaboration with Terre d’Oc, showcasing a commitment to sustainable packaging.

- June 2024: Carbios develops a biologically recycled plastic bottle for L’Occitane en Provence, demonstrating advancements in circular economy solutions within the industry.

Future Outlook for France Rigid Plastic Packaging Market Market

The France rigid plastic packaging market is poised for continued growth, driven by ongoing innovations in sustainable packaging solutions, increasing demand for convenient and protective packaging, and the supportive regulatory environment promoting eco-friendly practices. Strategic partnerships and investments in research and development will be crucial for companies to maintain competitiveness and capitalize on emerging market opportunities. The focus on circular economy initiatives and the adoption of recycled content will significantly shape the future landscape.

France Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE and LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl Chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

-

3.1. Food

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, and Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industri

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food

France Rigid Plastic Packaging Market Segmentation By Geography

- 1. France

France Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of France Rigid Plastic Packaging Market

France Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Beverage Sector Is Set to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE and LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl Chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, and Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industri

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group Gmbh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aptar Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpla France SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frapak Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Retal Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PDG Plastiques

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ActiPack SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pinard Beauty Pack

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SCHUTZ France SAS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Caps Packaging

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Greif France SAS7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Amcor Group Gmbh

List of Figures

- Figure 1: France Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: France Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: France Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: France Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 4: France Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: France Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: France Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: France Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 8: France Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the France Rigid Plastic Packaging Market?

Key companies in the market include Amcor Group Gmbh, Berry Global Inc, Aptar Group Inc, Alpla France SAS, Frapak Packaging, Axium Packaging, Retal Group, PDG Plastiques, ActiPack SAS, Pinard Beauty Pack, SCHUTZ France SAS, Caps Packaging, Greif France SAS7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the France Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Beverage Sector Is Set to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

July 2024: Coverpla, in collaboration with Terre d’Oc, a natural beauty and lifestyle brand hailing from the French Provence, unveiled a refillable bottle and a cap crafted from bio-based resin. Following this, Coverpla broadened its eco-design initiative by introducing a range of caps that boast a diminished carbon footprint. Terre d’Oc selected the Lord cap, molded from PHA. Derived from rapeseed oil, PHAs are biopolymers that not only mirror the mechanical properties of PE but also offer compostability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the France Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence