Key Insights

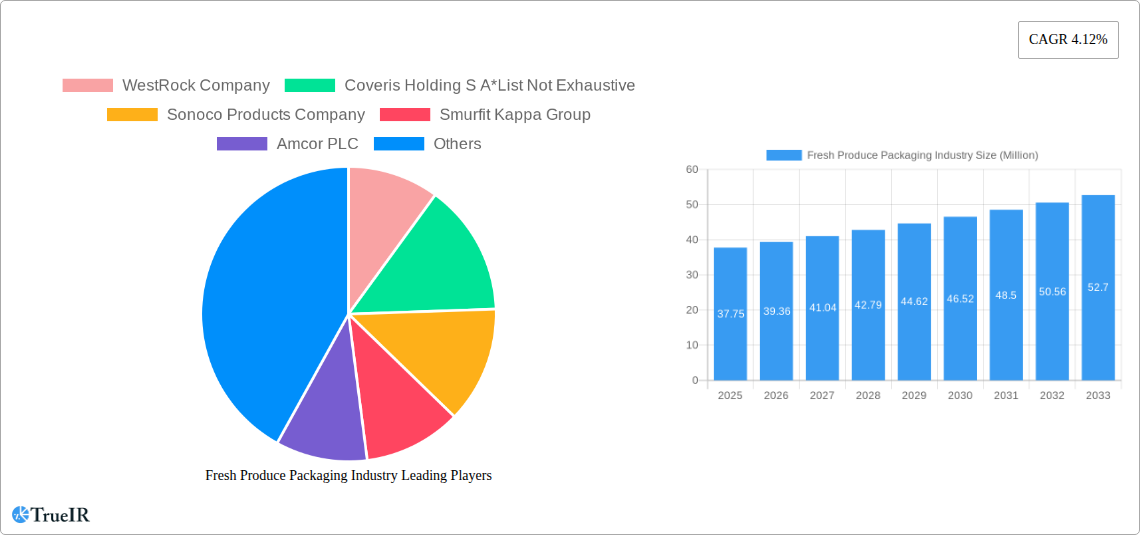

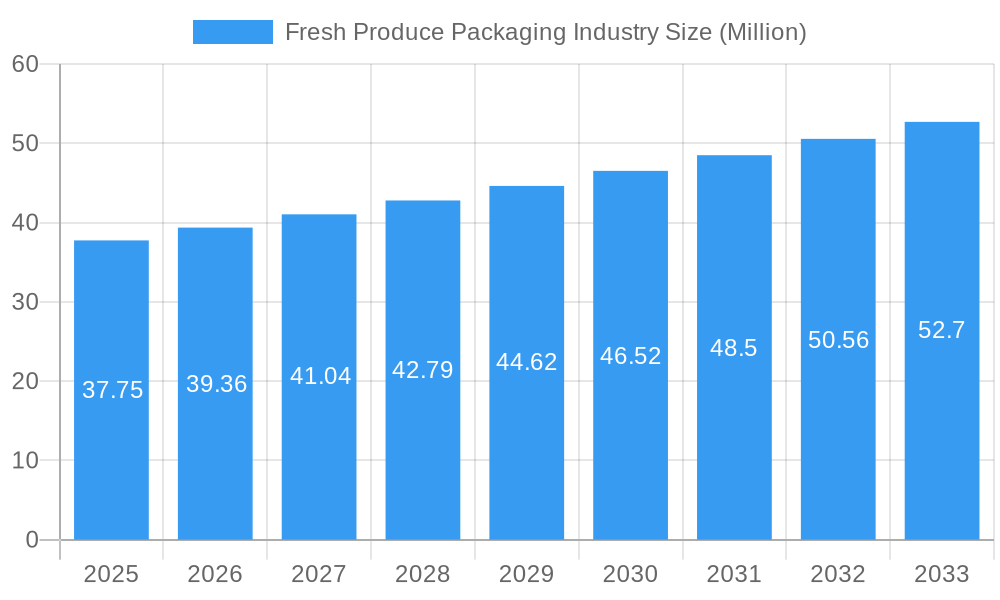

The fresh produce packaging market, valued at $37.75 million in 2025, is experiencing steady growth, projected to expand at a compound annual growth rate (CAGR) of 4.12% from 2025 to 2033. This growth is fueled by several key factors. The increasing demand for convenient and ready-to-eat produce is driving the adoption of innovative packaging solutions that extend shelf life and maintain freshness. Consumer preference for sustainable packaging options, such as biodegradable and compostable materials, is also significantly impacting market dynamics. Furthermore, the rise of e-commerce and online grocery delivery services necessitates robust packaging to ensure produce arrives in optimal condition. The market segmentation reveals a significant preference for plastic containers and corrugated boxes, reflecting the balance between cost-effectiveness and protective properties. Fruits and vegetables constitute the primary application segments, highlighting the crucial role of packaging in preserving the quality and extending the market reach of these perishable goods. Leading players like WestRock, Amcor, and Smurfit Kappa are actively innovating and expanding their product portfolios to cater to the evolving needs of this dynamic market. Competition is intense, with companies focusing on offering customized solutions and sustainable materials to gain a competitive edge.

Fresh Produce Packaging Industry Market Size (In Million)

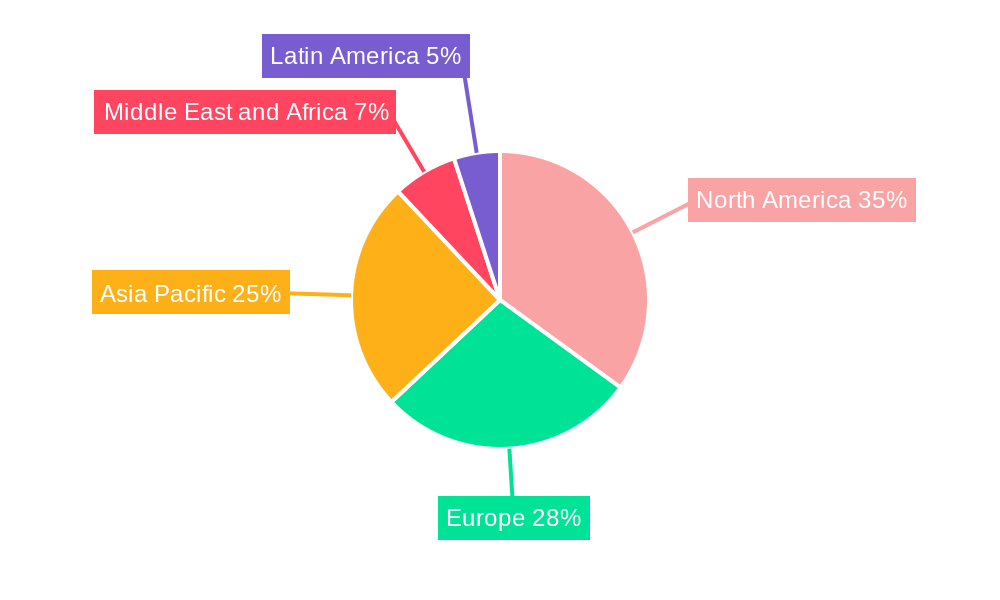

The geographic distribution of the market likely shows strong performance in North America and Europe, driven by high consumption of fresh produce and advanced packaging technologies. Asia Pacific, with its burgeoning middle class and increasing demand for processed and packaged foods, is anticipated to witness robust growth in the coming years. While challenges exist, including fluctuating raw material prices and environmental concerns related to plastic waste, the overall outlook for the fresh produce packaging market remains positive. The industry's focus on sustainability and innovation, coupled with the ever-growing demand for fresh produce, is expected to drive continued market expansion throughout the forecast period. Further research into specific regional performance data and a more granular breakdown of segment contributions would provide a more comprehensive market understanding.

Fresh Produce Packaging Industry Company Market Share

Fresh Produce Packaging Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Fresh Produce Packaging industry, offering invaluable insights for stakeholders seeking to navigate this ever-evolving market. The study period spans 2019-2033, with a base and estimated year of 2025, and a forecast period of 2025-2033. We delve into market size, segmentation, competitive dynamics, and future growth projections, leveraging extensive data and expert analysis to provide actionable intelligence. The report values are expressed in Millions.

Fresh Produce Packaging Industry Market Structure & Competitive Landscape

The global fresh produce packaging market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for the industry is estimated to be around xx, indicating a moderately competitive environment. This concentration is primarily driven by economies of scale, significant investments in R&D, and global distribution networks. Key players like WestRock Company, Smurfit Kappa Group, Amcor PLC, and Mondi PLC command a substantial portion of the market. Innovation is a significant driver, with companies continuously developing sustainable and functional packaging solutions to meet evolving consumer preferences and regulatory requirements. Regulatory pressures, particularly concerning sustainability and food safety, are steadily increasing, influencing packaging material selection and manufacturing processes. Product substitution is also a factor, with ongoing innovation across various packaging materials leading to the adoption of alternatives. The market exhibits significant end-user segmentation, catering to various stakeholders along the produce supply chain, from farmers and distributors to retailers and consumers. M&A activity in the sector has been notable in recent years, with xx mergers and acquisitions recorded between 2019 and 2024, valuing approximately $xx Million. These transactions reflect the ongoing consolidation within the industry and efforts to expand market reach and enhance product portfolios.

Fresh Produce Packaging Industry Market Trends & Opportunities

The fresh produce packaging market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing demand for fresh produce globally, rising consumer awareness of food safety and preservation, and the proliferation of e-commerce channels for grocery shopping. Technological advancements, specifically in material science and automation, are also driving market expansion. The market penetration of sustainable packaging solutions, such as biodegradable and compostable materials, is steadily increasing, driven by consumer demand and environmental regulations. Competitive dynamics are characterized by a focus on innovation, cost-efficiency, and sustainable practices. Companies are increasingly investing in developing eco-friendly packaging materials and exploring circular economy models to improve environmental performance. The market size is projected to reach $xx Million by 2033, representing a significant increase from the $xx Million recorded in 2024. The rising adoption of modified atmosphere packaging (MAP) and active packaging technologies is also impacting market growth positively.

Dominant Markets & Segments in Fresh Produce Packaging Industry

The North American region currently holds the largest market share in the fresh produce packaging industry, followed by Europe and Asia-Pacific. Within these regions, countries like the United States, China, and Germany are key markets due to their large populations, robust agricultural sectors, and well-established retail infrastructure.

By Packaging Material Type:

- Corrugated Boxes: This segment dominates the market owing to its cost-effectiveness, versatility, and recyclability. Growth is driven by the increasing demand for bulk packaging for transportation and distribution.

- Plastic Containers: This segment exhibits significant growth due to its superior barrier properties, protecting produce from spoilage and maintaining freshness.

- Bags and Pouches: The flexible nature of these packaging options makes them suitable for various produce types and sizes, boosting market growth.

- Film Lidding and Laminates: These are gaining traction due to their ability to extend the shelf life of fresh produce, minimizing waste and enhancing product quality.

- Trays: These offer convenient packaging for retail display, leading to significant growth potential.

By Application:

- Fruits: The fruit segment drives the market due to the high demand for packaged fruits for retail and food service applications.

- Vegetables: The vegetable segment exhibits similar growth trends driven by increasing consumer preference for convenience and ready-to-eat options.

Key Growth Drivers:

- Growing demand for packaged fresh produce, particularly for processed and ready-to-eat options.

- Enhanced consumer focus on food safety and preservation.

- Robust retail infrastructure and expansion of e-commerce channels.

- Rising adoption of advanced packaging technologies like MAP and active packaging.

- Stringent environmental regulations and increase in sustainable packaging solutions.

Fresh Produce Packaging Industry Product Analysis

The fresh produce packaging market showcases continuous innovation, encompassing advancements in materials, design, and functionality. Sustainable materials like biodegradable plastics and compostable films are gaining prominence, alongside improved barrier properties and extended shelf-life technologies. These innovations address consumer preferences for eco-friendly packaging and producers' requirements for efficient preservation and transportation. The use of smart packaging technologies, such as time-temperature indicators (TTI), is also growing, enhancing product traceability and ensuring food safety. The competitive advantage hinges on offering packaging solutions that balance sustainability, functionality, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Fresh Produce Packaging Industry

Key Drivers:

The market is propelled by factors such as increasing demand for fresh produce, technological advancements in packaging materials and processes, and rising consumer awareness of food safety and convenience. Government initiatives promoting sustainable packaging and reducing food waste also contribute significantly.

Challenges and Restraints:

The industry faces challenges including fluctuating raw material prices, stringent environmental regulations, and intense competition among packaging manufacturers. Supply chain disruptions and the need to balance sustainability with cost-effectiveness are further hurdles. These factors can constrain the market growth potential. For example, increases in resin costs can directly impact packaging costs and potentially reduce affordability for producers.

Growth Drivers in the Fresh Produce Packaging Industry Market

The rise of e-commerce grocery deliveries is significantly boosting demand for robust and functional packaging that can withstand the rigors of shipping and ensure produce freshness. Government regulations focusing on sustainable and recyclable packaging are also driving innovation in material science and manufacturing processes. The focus on reducing food waste further fuels market growth.

Challenges Impacting Fresh Produce Packaging Industry Growth

Fluctuations in raw material prices, especially for plastics and paper, pose a significant challenge. Supply chain disruptions can lead to production delays and increased costs. Meeting stringent environmental regulations requires continuous investment in research and development of sustainable solutions, adding to operational expenses.

Key Players Shaping the Fresh Produce Packaging Industry Market

Significant Fresh Produce Packaging Industry Milestones

- July 2022: Mondi Group launched its Grow&Go range of corrugated packaging solutions for fresh produce, emphasizing space-saving and stackability.

- April 2022: Berry Global achieved ISCC PLUS certification for its North American rigid plastic foodservice manufacturing sites, facilitating the use of certified circular products.

Future Outlook for Fresh Produce Packaging Industry Market

The fresh produce packaging market is poised for continued growth, driven by technological innovations, sustainable packaging solutions, and rising consumer demand. The increasing focus on reducing food waste and enhancing supply chain efficiency will further fuel market expansion. Strategic partnerships and collaborations within the industry are expected to accelerate innovation and market penetration of eco-friendly packaging materials. The overall outlook is positive, with substantial growth potential over the forecast period.

Fresh Produce Packaging Industry Segmentation

-

1. Packaging Material Type

- 1.1. Plastic Containers

- 1.2. Corrugated Boxes

- 1.3. Bags and Pouches

- 1.4. Film Lidding and Laminates

- 1.5. Trays

-

2. Application

- 2.1. Fruits

- 2.2. Vegetables

Fresh Produce Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Fresh Produce Packaging Industry Regional Market Share

Geographic Coverage of Fresh Produce Packaging Industry

Fresh Produce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need Among Consumers for Healthier Lifestyle; Increased Organic Production Worldwide

- 3.3. Market Restrains

- 3.3.1. Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 3.4. Market Trends

- 3.4.1. Corrugated Boxes as Packaging Material Type to Witness a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 5.1.1. Plastic Containers

- 5.1.2. Corrugated Boxes

- 5.1.3. Bags and Pouches

- 5.1.4. Film Lidding and Laminates

- 5.1.5. Trays

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits

- 5.2.2. Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6. North America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6.1.1. Plastic Containers

- 6.1.2. Corrugated Boxes

- 6.1.3. Bags and Pouches

- 6.1.4. Film Lidding and Laminates

- 6.1.5. Trays

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits

- 6.2.2. Vegetables

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7. Europe Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7.1.1. Plastic Containers

- 7.1.2. Corrugated Boxes

- 7.1.3. Bags and Pouches

- 7.1.4. Film Lidding and Laminates

- 7.1.5. Trays

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits

- 7.2.2. Vegetables

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 8. Asia Pacific Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 8.1.1. Plastic Containers

- 8.1.2. Corrugated Boxes

- 8.1.3. Bags and Pouches

- 8.1.4. Film Lidding and Laminates

- 8.1.5. Trays

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits

- 8.2.2. Vegetables

- 8.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 9. Middle East and Africa Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 9.1.1. Plastic Containers

- 9.1.2. Corrugated Boxes

- 9.1.3. Bags and Pouches

- 9.1.4. Film Lidding and Laminates

- 9.1.5. Trays

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits

- 9.2.2. Vegetables

- 9.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 10. Latin America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 10.1.1. Plastic Containers

- 10.1.2. Corrugated Boxes

- 10.1.3. Bags and Pouches

- 10.1.4. Film Lidding and Laminates

- 10.1.5. Trays

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits

- 10.2.2. Vegetables

- 10.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coveris Holding S A*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smurfit Kappa Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amcor PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Paper Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berry Global Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Reynolds Consumer Products Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sealed Air Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Fresh Produce Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2025 & 2033

- Figure 3: North America Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2025 & 2033

- Figure 4: North America Fresh Produce Packaging Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Fresh Produce Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fresh Produce Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fresh Produce Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2025 & 2033

- Figure 9: Europe Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2025 & 2033

- Figure 10: Europe Fresh Produce Packaging Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Fresh Produce Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Fresh Produce Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Fresh Produce Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2025 & 2033

- Figure 15: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2025 & 2033

- Figure 16: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2025 & 2033

- Figure 21: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2025 & 2033

- Figure 22: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2025 & 2033

- Figure 27: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2025 & 2033

- Figure 28: Latin America Fresh Produce Packaging Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Fresh Produce Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 2: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 5: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 8: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 11: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 14: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2020 & 2033

- Table 17: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fresh Produce Packaging Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Fresh Produce Packaging Industry?

Key companies in the market include WestRock Company, Coveris Holding S A*List Not Exhaustive, Sonoco Products Company, Smurfit Kappa Group, Amcor PLC, Mondi PLC, International Paper Company, Berry Global Inc, Reynolds Consumer Products Inc, Sealed Air Corporation.

3. What are the main segments of the Fresh Produce Packaging Industry?

The market segments include Packaging Material Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 37.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need Among Consumers for Healthier Lifestyle; Increased Organic Production Worldwide.

6. What are the notable trends driving market growth?

Corrugated Boxes as Packaging Material Type to Witness a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power.

8. Can you provide examples of recent developments in the market?

July 2022 - Mondi Group, a global enterprise in packaging and paper, launched a range of fit-for-purpose corrugated packaging solutions named Grow&Go for protecting and transporting fresh produce. The Grow&Go range offers logistical advantages such as space-saving afforded by palletized flat corrugated packaging. After assembly and filling, all packaging options are perfectly stackable and tough enough to prevent damage and waste. These are available for a range of options such as heavy bulk shipments, light fruit and vegetable assortments for on-shelf display, and many more. The entire Grow&Go portfolio complies with food contact standards and is made entirely of paper.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fresh Produce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fresh Produce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fresh Produce Packaging Industry?

To stay informed about further developments, trends, and reports in the Fresh Produce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence