Key Insights

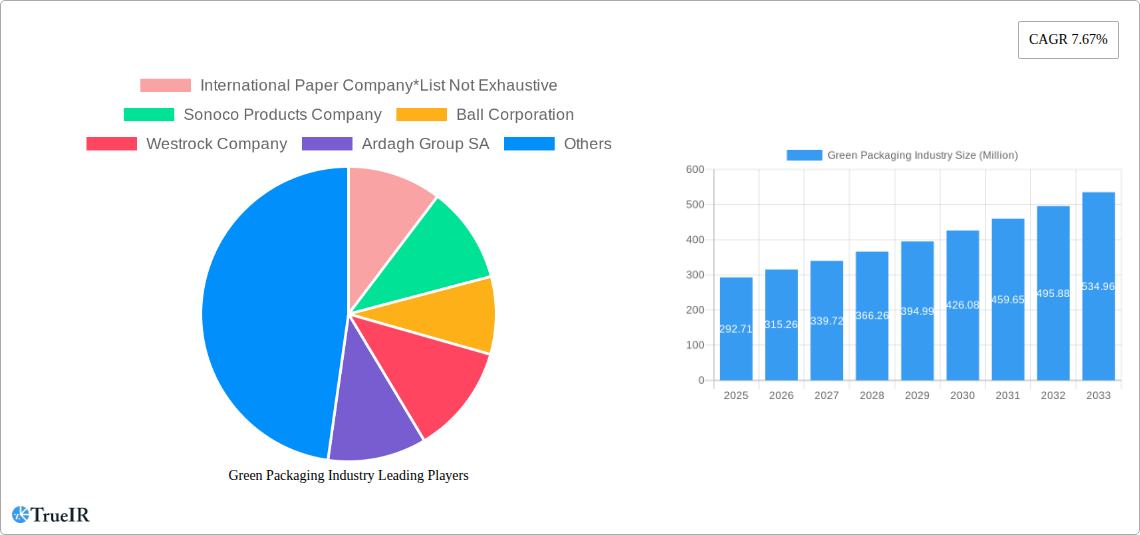

The green packaging market, valued at $292.71 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.67% from 2025 to 2033. This surge is driven by increasing consumer awareness of environmental sustainability, stringent government regulations on plastic waste, and a growing demand for eco-friendly alternatives across various sectors. Key drivers include the rising popularity of reusable packaging systems, advancements in biodegradable and compostable materials, and the increasing adoption of recycled content in packaging solutions. The pharmaceutical and healthcare, cosmetics and personal care, and food and beverage industries are significant end-users, fueling market expansion. While challenges exist, such as the higher cost of sustainable materials compared to conventional options and the need for improved infrastructure for recycling and waste management, innovative solutions and technological advancements are mitigating these restraints. The market is segmented by process (reusable, degradable, recycled), material type (glass, plastic, metal, paper), and end-user, offering diverse opportunities for growth. The dominance of specific regions within this market is likely to vary based on consumer preference, regulatory landscapes, and the level of investment in sustainable infrastructure, with North America and Europe expected to hold significant shares due to established environmental consciousness and regulatory frameworks. The market is competitive, with major players such as International Paper, Sonoco Products, Ball Corporation, and others vying for market share through innovation, strategic partnerships, and acquisitions.

Green Packaging Industry Market Size (In Million)

The forecast period (2025-2033) promises continued expansion, influenced by factors like evolving consumer preferences toward ethically sourced and environmentally responsible products, and increased corporate social responsibility initiatives. Companies are responding by investing in research and development of innovative green packaging solutions, including plant-based materials, improved recycling technologies, and closed-loop systems. The market's future growth hinges on the successful integration of sustainable practices across the supply chain, collaborative efforts between businesses and governments, and continued consumer support for environmentally friendly packaging options. The long-term outlook remains positive, with significant potential for growth as sustainability gains further momentum globally.

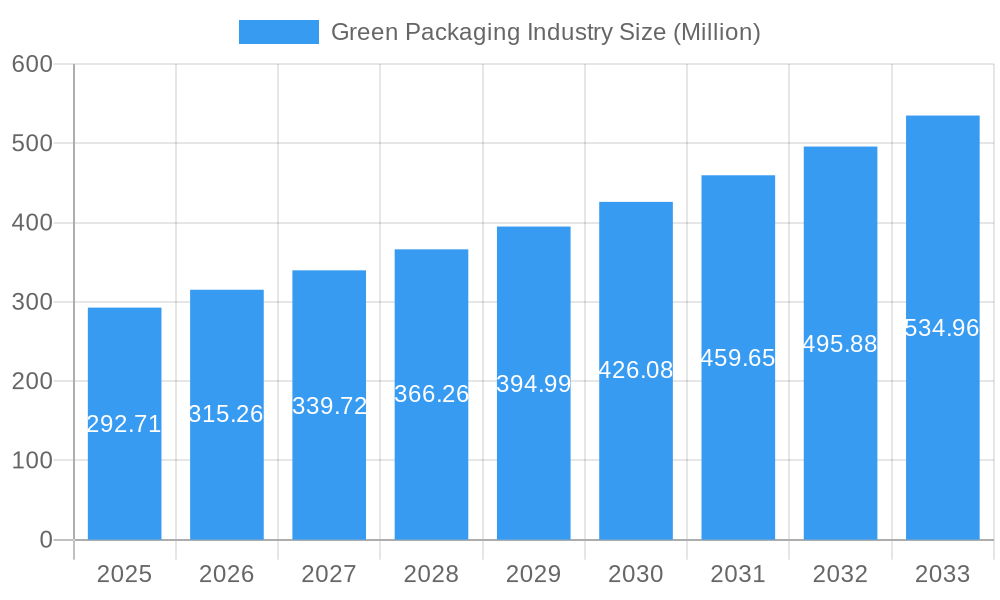

Green Packaging Industry Company Market Share

Green Packaging Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Green Packaging Industry, projecting a market size exceeding $XX Million by 2033. Leveraging a robust methodology and incorporating extensive primary and secondary research, this report offers invaluable insights for stakeholders across the value chain. We analyze market trends, competitive landscapes, key players, and future growth potential, empowering businesses to make informed strategic decisions in this rapidly evolving sector.

Green Packaging Industry Market Structure & Competitive Landscape

The green packaging market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. The industry’s Herfindahl-Hirschman Index (HHI) is estimated at [Insert HHI Value Here] in 2025, indicating a moderately consolidated structure. However, significant fragmentation exists among smaller, specialized players focusing on niche segments like biodegradable or compostable packaging, offering diverse and innovative solutions.

- Market Concentration: The top five players – International Paper Company, Sonoco Products Company, Ball Corporation, Westrock Company, and Ardagh Group SA – collectively account for an estimated [Insert Market Share Percentage Here]% of the global market share (2025). This dominance highlights the importance of strategic partnerships and competitive differentiation for smaller entities.

- Innovation Drivers: Growing consumer demand for sustainable and eco-friendly products is a primary catalyst for innovation, compelling companies to develop advanced recycled, biodegradable, and compostable packaging solutions. Stringent environmental regulations worldwide are also significantly fueling R&D efforts, encouraging the exploration of novel materials and processes.

- Regulatory Impacts: Governments globally are increasingly implementing robust regulations to curtail plastic waste and champion sustainable packaging, profoundly reshaping market dynamics. The EU's Single-Use Plastics Directive and comparable national-level initiatives are creating both substantial opportunities for forward-thinking companies and significant challenges for those slow to adapt.

- Product Substitutes: The evolving landscape includes the growing availability of alternative materials and cutting-edge packaging technologies—such as advanced bioplastics, edible coatings, and sophisticated reusable packaging systems. These present both potent competitive threats to traditional packaging methods and promising avenues for diversification and growth for established players.

- End-User Segmentation: The market is strategically segmented across a diverse array of end-user industries. The food and beverage, pharmaceutical and healthcare, and cosmetics and personal care sectors consistently emerge as the dominant segments, showcasing a high demand for safe, sustainable, and aesthetically pleasing packaging solutions.

- M&A Trends: The industry has experienced a notable surge in mergers and acquisitions (M&A) activity in recent years. This trend is largely driven by the strategic imperative for companies to broaden their product portfolios, enhance their technological capabilities, secure greater supply chain control, and gain advantageous access to new and expanding markets. The total M&A volume in the green packaging sector reached an estimated $XX Million in 2024, reflecting significant investment and consolidation.

Green Packaging Industry Market Trends & Opportunities

The global green packaging market is experiencing robust and sustained growth, with a projected Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage Here]% during the forecast period (2025-2033). This impressive expansion is fueled by a confluence of powerful factors, including the escalating adoption of sustainable practices by both forward-thinking businesses and environmentally conscious consumers, a heightened global awareness of critical environmental issues, and the ever-increasing demand for eco-friendly and responsibly sourced products. Market penetration rates for green packaging solutions exhibit considerable variation across different segments and geographic regions, with demonstrably higher adoption rates observed in developed economies that have established strong sustainability mandates. Technological advancements, particularly the ongoing development of innovative biodegradable materials and more efficient and scalable recycling technologies, are profoundly impacting and accelerating market development. Shifting consumer preferences are increasingly influencing manufacturers to unequivocally prioritize sustainability, thereby driving a surging demand for a wider array of eco-friendly packaging options. The intense and dynamic competition amongst key industry players is not only driving relentless innovation but also contributing to price reductions, further accelerating overall market growth and accessibility.

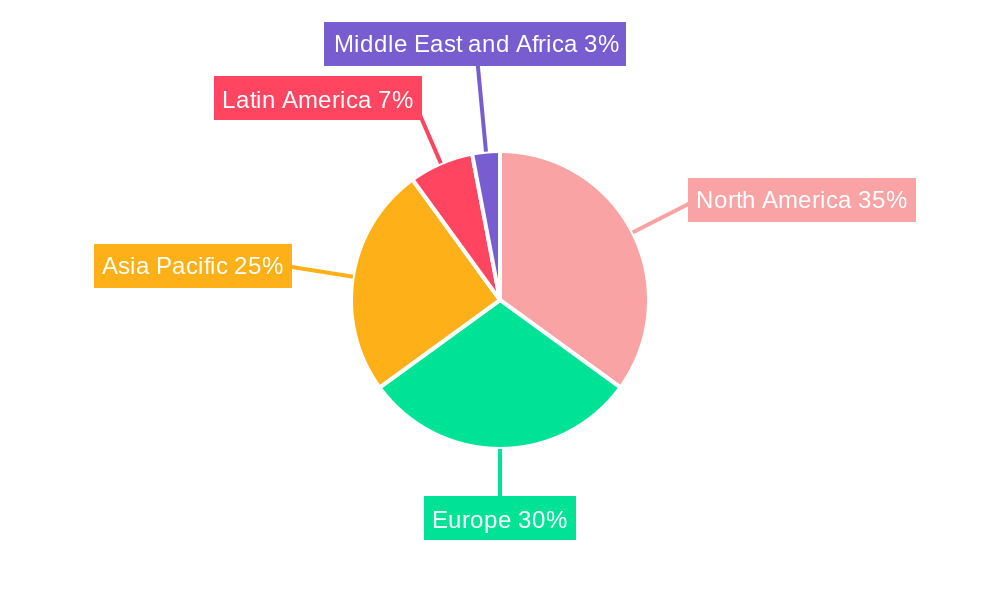

Dominant Markets & Segments in Green Packaging Industry

The North American region currently dominates the green packaging market, driven by stringent environmental regulations, heightened consumer awareness of sustainability, and the presence of major industry players. Within the segments, the paper-based packaging category holds the largest market share, followed by recycled packaging and degradable packaging.

- By Process: Recycled packaging is expected to experience significant growth due to increasing environmental concerns and government regulations.

- By Material Type: Paper continues to be the dominant material due to its recyclability and biodegradability. However, biodegradable plastics and innovative bio-based materials are gaining traction.

- By End User: The food and beverage industry remains the largest end-user segment, followed by the pharmaceutical and healthcare sectors.

Key Growth Drivers:

- Stringent environmental regulations and government incentives are boosting market growth.

- Increasing consumer demand for sustainable and eco-friendly products is a key factor.

- Technological advancements in biodegradable and compostable materials are driving innovation.

- Rising disposable incomes and improved living standards are leading to increased demand for packaged goods.

Green Packaging Industry Product Analysis

The green packaging industry showcases a diverse range of products, including biodegradable plastics, compostable packaging, recycled paperboard, and reusable containers. These innovations leverage advancements in material science, manufacturing processes, and design to offer superior environmental performance compared to traditional packaging. The primary competitive advantages lie in the reduced environmental impact, enhanced brand image, and compliance with evolving regulatory standards. The market fit for these products is strong, driven by increasing consumer and corporate demand for sustainable solutions.

Key Drivers, Barriers & Challenges in Green Packaging Industry

Key Drivers:

- Technological Advancements: Development of innovative, bio-based materials and advanced recycling technologies.

- Economic Incentives: Government subsidies and tax breaks for green packaging adoption.

- Policy Support: Stringent regulations on plastic waste and promotion of sustainable packaging solutions.

Challenges & Restraints:

- Supply Chain Issues: Limited availability of sustainable materials and challenges in ensuring a reliable supply chain. This results in xx% increase in production cost in 2024.

- Regulatory Hurdles: Complex and ever-evolving regulations across different regions create compliance challenges.

- Competitive Pressures: Intense competition from traditional packaging manufacturers and emerging players.

Growth Drivers in the Green Packaging Industry Market

The green packaging market is powerfully propelled by a trifecta of critical factors: increasingly stringent and comprehensive environmental regulations enacted globally, a significant and growing consumer awareness regarding the imperative of sustainability, and rapid technological advancements that are consistently yielding more cost-effective, efficient, and versatile green packaging solutions. Furthermore, proactive government incentives and support programs are actively stimulating wider adoption and investment across the value chain.

Challenges Impacting Green Packaging Industry Growth

Significant hurdles continue to impact the widespread adoption and scalability of green packaging. These include the often higher initial capital investment required for adopting green packaging solutions compared to established conventional options, the inherent complexities and underdeveloped state of recycling infrastructure in many regions, and the limited availability of certain sustainable raw materials, which can impact production scalability and drive up costs. These factors collectively contribute to increased price points, affecting affordability for some market segments.

Key Players Shaping the Green Packaging Industry Market

- International Paper Company - A global leader in fiber-based packaging, exploring sustainable solutions.

- Sonoco Products Company - Known for its innovative and sustainable packaging solutions across various industries.

- Ball Corporation - A major player in metal packaging, focusing on recyclability and sustainable materials.

- Westrock Company - Offers a broad range of sustainable packaging solutions, emphasizing innovation and circular economy principles.

- Ardagh Group SA - A prominent producer of metal and glass packaging, with a growing focus on sustainable alternatives.

- TetraPak International SA - A leader in carton packaging, committed to renewable and recyclable materials.

- Crown Holdings Inc. - Specializes in metal packaging, actively pursuing sustainable manufacturing and product development.

- BASF SE - A leading chemical company contributing to the development of advanced biodegradable and compostable materials.

- DS Smith PLC - Focuses on sustainable packaging solutions, particularly corrugated cardboard, emphasizing recycling and resource efficiency.

- Mondi PLC - A global leader in sustainable packaging and paper, committed to responsible forestry and product innovation.

- Smurfit Kappa Group PLC - A major player in paper-based packaging, dedicated to developing sustainable and circular solutions.

- Huhtamaki OYJ - Offers a wide range of sustainable packaging solutions for food and beverages, with a focus on innovation.

- Amcor Limited - A global leader in responsible packaging solutions, with a strong emphasis on sustainability and recyclability.

- Sealed Air Corporation - Provides innovative packaging solutions, including sustainable options for various industries.

- Genpak LLC - A manufacturer of rigid plastic packaging, increasingly exploring sustainable material options.

Significant Green Packaging Industry Industry Milestones

- July 2022: Mondi and Fiorini International collaborated on 100% recyclable paper packaging for Antico Pastificio Umbro, potentially reducing plastic use by 20 tonnes annually. This highlights the industry's shift towards sustainable material solutions and collaboration between producers and converters.

- April 2022: DS Smith launched a single-material corrugated cardboard box for medical device e-commerce shipping, replacing glued packaging with plastic inserts. This signifies progress in eliminating single-use plastics in various sectors.

Future Outlook for Green Packaging Industry Market

The green packaging industry is poised for continued strong growth, driven by intensifying environmental concerns and supportive government policies. Strategic opportunities exist in developing innovative materials, improving recycling infrastructure, and expanding into new market segments. The potential for market expansion is substantial, with significant untapped opportunities in emerging economies and specialized sectors. The forecast period promises substantial growth and consolidation within the industry.

Green Packaging Industry Segmentation

-

1. Process

- 1.1. Reusable Packaging

- 1.2. Degradable Packaging

- 1.3. Recycled Packaging

-

2. Material Type

- 2.1. Glass

- 2.2. Plastic

- 2.3. Metal

- 2.4. Paper

-

3. End User

- 3.1. Pharmaceutical and Healthcare

- 3.2. Cosmetics and Personal Care

- 3.3. Food and Beverage

- 3.4. Other End Users

Green Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Green Packaging Industry Regional Market Share

Geographic Coverage of Green Packaging Industry

Green Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives toward Sustainable Packaging; Downsizing of Packaging; Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials

- 3.3. Market Restrains

- 3.3.1. Capacity Constraint of Manufacturing Plants; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Sustainable Plastic Packaging Solutions to Hold Major Share in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Reusable Packaging

- 5.1.2. Degradable Packaging

- 5.1.3. Recycled Packaging

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Glass

- 5.2.2. Plastic

- 5.2.3. Metal

- 5.2.4. Paper

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical and Healthcare

- 5.3.2. Cosmetics and Personal Care

- 5.3.3. Food and Beverage

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. North America Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Reusable Packaging

- 6.1.2. Degradable Packaging

- 6.1.3. Recycled Packaging

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Glass

- 6.2.2. Plastic

- 6.2.3. Metal

- 6.2.4. Paper

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical and Healthcare

- 6.3.2. Cosmetics and Personal Care

- 6.3.3. Food and Beverage

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Europe Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Reusable Packaging

- 7.1.2. Degradable Packaging

- 7.1.3. Recycled Packaging

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Glass

- 7.2.2. Plastic

- 7.2.3. Metal

- 7.2.4. Paper

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical and Healthcare

- 7.3.2. Cosmetics and Personal Care

- 7.3.3. Food and Beverage

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Asia Pacific Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Reusable Packaging

- 8.1.2. Degradable Packaging

- 8.1.3. Recycled Packaging

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Glass

- 8.2.2. Plastic

- 8.2.3. Metal

- 8.2.4. Paper

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical and Healthcare

- 8.3.2. Cosmetics and Personal Care

- 8.3.3. Food and Beverage

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Latin America Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Reusable Packaging

- 9.1.2. Degradable Packaging

- 9.1.3. Recycled Packaging

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Glass

- 9.2.2. Plastic

- 9.2.3. Metal

- 9.2.4. Paper

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical and Healthcare

- 9.3.2. Cosmetics and Personal Care

- 9.3.3. Food and Beverage

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Middle East and Africa Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Reusable Packaging

- 10.1.2. Degradable Packaging

- 10.1.3. Recycled Packaging

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Glass

- 10.2.2. Plastic

- 10.2.3. Metal

- 10.2.4. Paper

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical and Healthcare

- 10.3.2. Cosmetics and Personal Care

- 10.3.3. Food and Beverage

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 International Paper Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ball Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Westrock Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ardagh Group SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TetraPak International SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crown Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DS Smith PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondi PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Smurfit Kappa Group PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huhtamaki OYJ

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Amcor Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sealed Air Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Genpak LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 International Paper Company*List Not Exhaustive

List of Figures

- Figure 1: Global Green Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 3: North America Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 4: North America Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 11: Europe Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 12: Europe Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 19: Asia Pacific Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 20: Asia Pacific Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 27: Latin America Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 28: Latin America Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Latin America Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Latin America Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 35: Middle East and Africa Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 36: Middle East and Africa Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 37: Middle East and Africa Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Middle East and Africa Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Green Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 10: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 15: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 18: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 19: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 22: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Packaging Industry?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the Green Packaging Industry?

Key companies in the market include International Paper Company*List Not Exhaustive, Sonoco Products Company, Ball Corporation, Westrock Company, Ardagh Group SA, TetraPak International SA, Crown Holdings Inc, BASF SE, DS Smith PLC, Mondi PLC, Smurfit Kappa Group PLC, Huhtamaki OYJ, Amcor Limited, Sealed Air Corporation, Genpak LLC.

3. What are the main segments of the Green Packaging Industry?

The market segments include Process, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 292.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives toward Sustainable Packaging; Downsizing of Packaging; Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials.

6. What are the notable trends driving market growth?

Sustainable Plastic Packaging Solutions to Hold Major Share in Market.

7. Are there any restraints impacting market growth?

Capacity Constraint of Manufacturing Plants; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

July 2022: Mondi and converter FioriniInternational collaborated to develop a new paper packaging option for Italian premium pasta product manufacturer Antico PastificioUmbro. When applied to all pasta products, the new packaging, which is 100% recyclable, could reduce the amount of plastic used by up to 20 tonnes annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Packaging Industry?

To stay informed about further developments, trends, and reports in the Green Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence