Key Insights

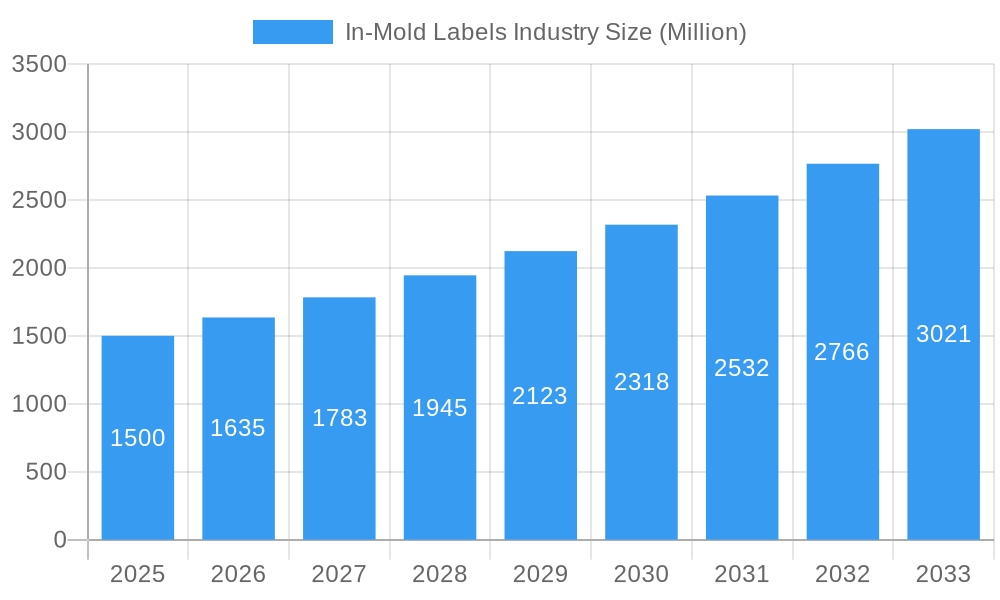

The In-Mold Label (IML) market is poised for substantial expansion, driven by increasing adoption across diverse end-user industries. Projected to achieve a compound annual growth rate (CAGR) of 3.42%, the market is forecast to reach $3.8 billion by 2024. This growth is underpinned by the superior quality, durability, and aesthetic appeal of IMLs compared to conventional labeling. Key sectors like food and beverage, cosmetics, and pharmaceuticals are significant contributors, demanding enhanced shelf life, branding, and tamper-evident packaging solutions. Technological innovations, including smart labels and sustainable materials, are further propelling market growth. Despite potential challenges like raw material price volatility and competition from alternative technologies, consistent demand and industry innovation ensure a positive market outlook.

In-Mold Labels Industry Market Size (In Billion)

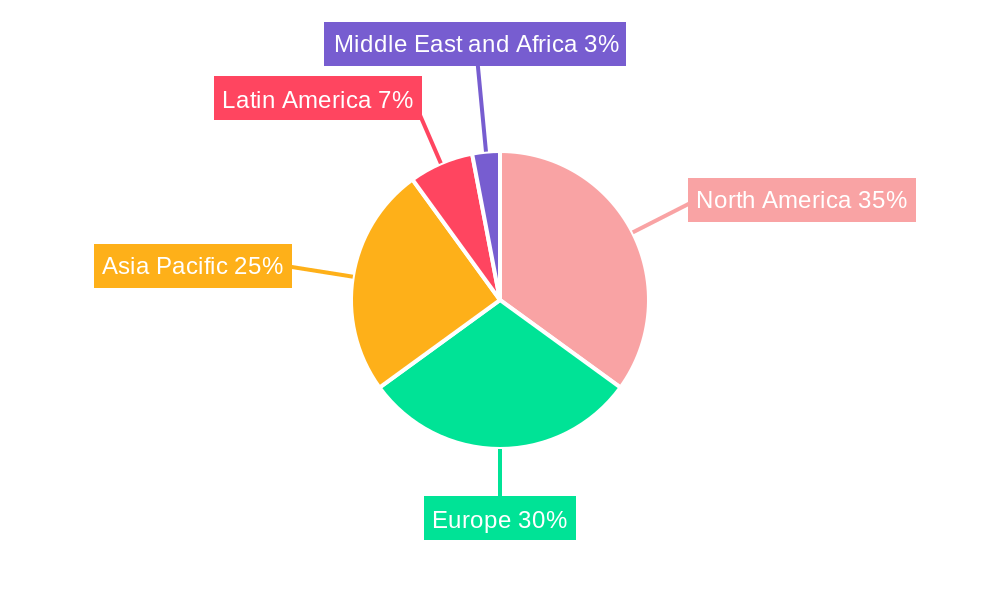

The competitive environment features a blend of global leaders and specialized firms. Major players such as Taghleef Industries Inc, CCL Industries, and Multi-Color Corporation command significant market share through their extensive manufacturing and global presence. Smaller companies contribute to market dynamism by serving niche segments and offering specialized solutions. Regional growth patterns indicate sustained strength in North America and Europe, while the Asia-Pacific region is expected to experience rapid expansion driven by rising disposable incomes and growing demand for packaged goods. Market expansion strategies emphasize innovation, the adoption of sustainable materials, and penetration into emerging markets.

In-Mold Labels Industry Company Market Share

In-Mold Labels Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report provides a deep dive into the In-Mold Labels (IML) industry, projecting a market value exceeding $XX Billion by 2033. Leveraging extensive research and data analysis across the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers invaluable insights for businesses, investors, and stakeholders seeking to navigate this rapidly evolving market.

In-Mold Labels Industry Market Structure & Competitive Landscape

The In-Mold Labels market exhibits a moderately concentrated structure, with several major players holding significant market share. The report analyzes the competitive landscape, revealing a concentration ratio of XX% among the top five players in 2025. Key factors influencing the market structure include:

- Innovation Drivers: Continuous advancements in label materials, printing technologies (e.g., digital printing, high-definition printing), and automation are driving innovation and market expansion.

- Regulatory Impacts: Stringent regulations regarding food safety and environmental compliance impact material selection and manufacturing processes, shaping the competitive landscape.

- Product Substitutes: The report examines the threat of substitute products like shrink sleeves and pressure-sensitive labels, assessing their market penetration and impact on IML market growth.

- End-User Segmentation: Detailed analysis of market segmentation by end-user industries (Food & Beverage, Cosmetics, Pharmaceuticals, Other) reveals varying growth rates and market dynamics.

- M&A Trends: The report quantifies M&A activity in the IML sector, analyzing the volume of deals (XX deals in the last 5 years) and their impact on market consolidation. Qualitative insights highlight strategic motivations driving mergers and acquisitions.

In-Mold Labels Industry Market Trends & Opportunities

The global In-Mold Labels (IML) market is experiencing a period of significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This robust growth is underpinned by a confluence of powerful drivers:

- Market Size Expansion: The IML market is witnessing substantial growth, primarily fueled by escalating demand from diverse end-user industries, with a notable surge in developing economies. The market size is anticipated to reach an impressive $XX Billion in 2025 and is on track to surpass $XX Billion by 2033, signifying a significant upward trajectory.

- Technological Advancements: The industry landscape is being dynamically reshaped by groundbreaking advancements in digital printing, enhanced automation capabilities, and the widespread adoption of eco-friendly and sustainable materials. These innovations are not only streamlining production processes but also unlocking novel avenues for product differentiation and operational efficiencies.

- Evolving Consumer Preferences: A discernible shift in consumer behavior towards packaging that is both visually appealing and exceptionally durable is a key catalyst for IML adoption. Furthermore, the increasing emphasis on brand identity and the desire for premium product presentation are significantly boosting the demand for sophisticated IML solutions.

- Dynamic Competitive Landscape: The IML market is characterized by a highly competitive environment, punctuated by strategic collaborations and partnerships aimed at innovation and market penetration. A comprehensive analysis of the competitive strategies employed by leading players reveals critical insights into market dynamics and future growth trajectories.

Dominant Markets & Segments in In-Mold Labels Industry

Our analysis highlights distinct areas of dominance within the IML market, both geographically and by application. While specific market share figures are proprietary, North America and Europe continue to lead in market share. This leadership is primarily attributed to:

-

Food & Beverage: Remaining the cornerstone of the IML market, this segment thrives on the persistent demand for visually striking and high-performance packaging solutions in the food and beverage sector. Robust growth is anticipated across both mature and emerging markets.

-

Cosmetics: The cosmetics industry is increasingly leveraging IML to create sophisticated and high-value packaging that enhances brand perception and product appeal. The demand for intricate printing capabilities and distinctive design elements is a significant growth driver.

-

Pharmaceuticals: In the pharmaceutical sector, IML plays a crucial role in providing tamper-evident and secure packaging solutions, meeting stringent regulatory requirements and ensuring product integrity.

-

Other End-user Industries: Sectors such as household goods and automotive components are progressively integrating IML into their packaging strategies, reflecting a growing awareness of its benefits.

-

Key Growth Drivers (by region/segment):

- Developed Economies: Characterized by sophisticated consumer bases, advanced logistical infrastructure, and well-established supply chains, these regions offer a stable demand for high-quality IML.

- Developing Economies: Experiencing rapid economic expansion, rising disposable incomes, and a growing appetite for branded and packaged goods, these regions represent a substantial growth frontier for the IML market.

- Technological Innovations: Continuous advancements in printing technologies, particularly digital printing, and automation are leading to greater efficiency, reduced costs, and expanded design possibilities, thereby fueling market adoption.

- Regulatory Compliance: Increasingly stringent regulations across various industries regarding product safety, security, and labeling are driving the adoption of IML for its robust and compliant packaging attributes.

In-Mold Labels Industry Product Analysis

The In-Mold Labels industry is a hotbed of innovation, marked by continuous evolution in material science, printing technologies, and label design. The advent of advanced digital printing techniques is enabling the creation of highly detailed, personalized, and visually impactful labels. Simultaneously, there is a strong and growing emphasis on the development and integration of sustainable materials, driven by heightened environmental consciousness and regulatory pressures. Companies that excel in delivering premium, bespoke solutions tailored to specific end-user needs, while proactively adapting to emerging industry trends, are poised to gain a significant competitive advantage.

Key Drivers, Barriers & Challenges in In-Mold Labels Industry

Key Drivers: Increased demand for high-quality packaging, advancements in printing and automation technologies, and the growing preference for sustainable and eco-friendly materials are driving significant growth within the industry.

Challenges: Fluctuations in raw material prices, stringent regulatory compliance requirements, and intense competition are some of the key challenges impacting market growth. Supply chain disruptions can also significantly affect production and delivery timelines. These challenges often result in increased production costs and potential delays in project implementation.

Growth Drivers in the In-Mold Labels Industry Market

Technological advancements, particularly in digital printing and automation, are major growth drivers. The increasing demand for sustainable and eco-friendly packaging solutions also presents significant opportunities. Favorable government regulations and policies that encourage the use of high-quality packaging further contribute to market growth.

Challenges Impacting In-Mold Labels Industry Growth

The industry faces challenges such as fluctuating raw material costs, increasing compliance costs, and intense competition from alternative packaging solutions. Supply chain disruptions and potential geopolitical instability pose additional risks to market growth.

Key Players Shaping the In-Mold Labels Industry Market

- Taghleef Industries Inc

- Inland Packaging (Inland Label and Marketing Services LLC)

- John Herrod & Associates

- Smyth Companies LLC

- Fort Dearborn Company

- CCL Industries

- Multi-Color Corporation

- Aspasie Inc

- General Press Corporation

- Huhtamaki Group

- List Not Exhaustive

Significant In-Mold Labels Industry Milestones

- 2020: Introduction of a new sustainable IML material by [Company Name], reducing environmental impact.

- 2021: Merger between [Company A] and [Company B], creating a larger market player.

- 2022: Launch of high-definition digital printing technology by [Company Name], improving label quality.

- 2023: Implementation of new automation systems by several major players, enhancing efficiency.

- Further milestones to be added

Future Outlook for In-Mold Labels Industry Market

The trajectory for the In-Mold Labels market remains exceptionally positive, with sustained strong growth anticipated through 2033. This optimistic outlook is powered by ongoing technological innovation, the expanding scope of IML applications across a widening array of industries, and the escalating global demand for sustainable packaging solutions. The market is also expected to be shaped by strategic alliances, mergers, and acquisitions, further consolidating its dynamics. The long-term prognosis for the IML market is one of significant opportunity for continued expansion and market leadership.

In-Mold Labels Industry Segmentation

-

1. End-User Industries

- 1.1. Food & Beverage

- 1.2. Cosmetics

- 1.3. Pharmaceuticals

- 1.4. Other End-user Industries

In-Mold Labels Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

In-Mold Labels Industry Regional Market Share

Geographic Coverage of In-Mold Labels Industry

In-Mold Labels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods

- 3.3. Market Restrains

- 3.3.1. Tedious Mold Production Process; Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Food & Beverage Industry is Expected to Hold the largest Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 5.1.1. Food & Beverage

- 5.1.2. Cosmetics

- 5.1.3. Pharmaceuticals

- 5.1.4. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6. North America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6.1.1. Food & Beverage

- 6.1.2. Cosmetics

- 6.1.3. Pharmaceuticals

- 6.1.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7. Europe In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7.1.1. Food & Beverage

- 7.1.2. Cosmetics

- 7.1.3. Pharmaceuticals

- 7.1.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8. Asia Pacific In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8.1.1. Food & Beverage

- 8.1.2. Cosmetics

- 8.1.3. Pharmaceuticals

- 8.1.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9. Latin America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9.1.1. Food & Beverage

- 9.1.2. Cosmetics

- 9.1.3. Pharmaceuticals

- 9.1.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10. Middle East and Africa In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10.1.1. Food & Beverage

- 10.1.2. Cosmetics

- 10.1.3. Pharmaceuticals

- 10.1.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Taghleef Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inland Packaging (Inland Label and Marketing Services LLC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 John Herrod & Associates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smyth Companies LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fort Dearborn Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi-Color Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aspasie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Press Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Taghleef Industries Inc

List of Figures

- Figure 1: Global In-Mold Labels Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 3: North America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 4: North America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 7: Europe In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 8: Europe In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 11: Asia Pacific In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 12: Asia Pacific In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 15: Latin America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 16: Latin America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 19: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 20: Middle East and Africa In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 2: Global In-Mold Labels Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 4: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 8: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 10: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 12: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Mold Labels Industry?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the In-Mold Labels Industry?

Key companies in the market include Taghleef Industries Inc, Inland Packaging (Inland Label and Marketing Services LLC), John Herrod & Associates, Smyth Companies LLC, Fort Dearborn Company, CCL Industries, Multi-Color Corporation, Aspasie Inc, General Press Corporation, Huhtamaki Group*List Not Exhaustive.

3. What are the main segments of the In-Mold Labels Industry?

The market segments include End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods.

6. What are the notable trends driving market growth?

Food & Beverage Industry is Expected to Hold the largest Share..

7. Are there any restraints impacting market growth?

Tedious Mold Production Process; Interoperability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Mold Labels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Mold Labels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Mold Labels Industry?

To stay informed about further developments, trends, and reports in the In-Mold Labels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence