Key Insights

The India Inkjet Printer Market is projected to reach $48.3 billion by 2025, with an anticipated compound annual growth rate (CAGR) of 8.8% from 2025 to 2033. This expansion is propelled by several key drivers. The booming e-commerce landscape is escalating demand for high-volume printing in packaging and labels. Concurrently, the widespread adoption of digital printing technologies across diverse end-user industries such as publishing, commercial printing, advertising, transactional printing, and security is significantly contributing to market growth. Technological advancements in inkjet printers, delivering superior print speeds, enhanced quality, and cost efficiency, are further stimulating market penetration. Government-led digitalization initiatives and a growing middle class with increasing disposable income also bolster this positive market trajectory. However, potential raw material price volatility and intense competition from established firms like Jet Inks Pvt Ltd, Videojet Technologies Inc, and Canon India Pvt Ltd, alongside new domestic and international entrants, present ongoing challenges.

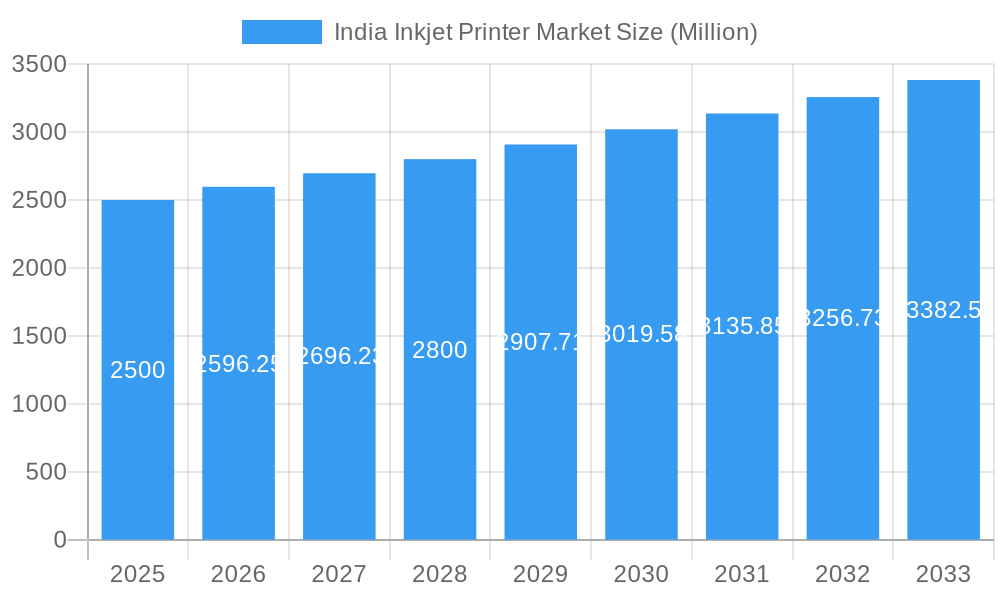

India Inkjet Printer Market Market Size (In Billion)

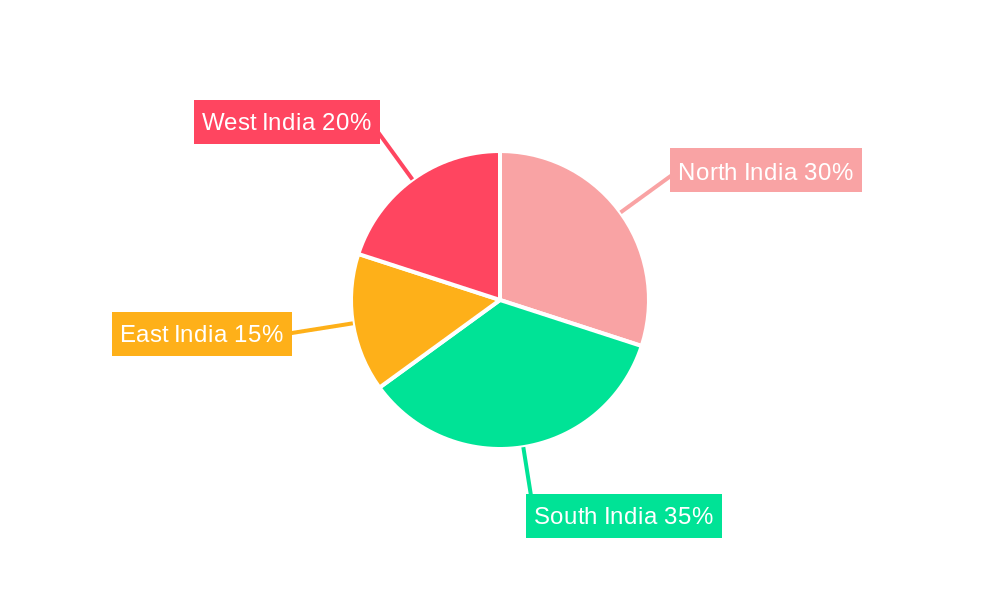

Segmentation analysis reveals promising opportunities within the market. The packaging and labeling sector is anticipated to lead, driven by escalating demand for bespoke and premium packaging solutions across industries. The transactional print segment is also exhibiting substantial growth potential, fueled by the increasing need for efficient and secure document printing in sectors like banking and finance. Regional dynamics indicate potential for accelerated growth in areas such as South India, owing to its strong economic development and industry concentration that fuels inkjet printer demand. Consequently, companies prioritizing customized solutions, cost-effective offerings, and strategic regional expansion are optimally positioned to leverage the growth prospects of the India Inkjet Printer Market. This comprehensive market analysis underscores sustained expansion, creating opportunities for both established market participants and emerging players.

India Inkjet Printer Market Company Market Share

India Inkjet Printer Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the India inkjet printer market, offering invaluable insights for businesses, investors, and industry professionals. We delve into market size, growth trends, competitive landscape, and future projections, covering the period from 2019 to 2033. The report leverages extensive data and analysis to provide a clear and actionable understanding of this rapidly evolving market. With a focus on key segments and leading players, this report is essential for navigating the complexities of the Indian inkjet printer market. The market is expected to reach xx Million by 2033.

India Inkjet Printer Market Market Structure & Competitive Landscape

The Indian inkjet printer market exhibits a moderately concentrated structure, with several major players and a substantial number of smaller, regional participants. The market concentration ratio (CR4) for 2024 is estimated at 45%, indicating moderate dominance by the top four players. Key factors shaping the competitive landscape include:

- Innovation Drivers: Continuous advancements in print technology, such as improved print quality, speed, and cost-effectiveness, are driving market expansion. The emergence of eco-friendly inks and energy-efficient printers is also gaining traction.

- Regulatory Impacts: Government policies related to environmental sustainability and digitalization influence the adoption of inkjet printers. Regulations on ink disposal and waste management pose both challenges and opportunities for market players.

- Product Substitutes: Laser printers, digital printing technologies, and online document sharing platforms present competitive alternatives to inkjet printers. However, the versatility and cost-effectiveness of inkjet printers continue to secure their market share.

- End-User Segmentation: The market caters to diverse end-user industries, including books, commercial print, advertising print, transactional print, labels, packaging, and security printing. Growth in specific sectors significantly impacts market dynamics.

- M&A Trends: The inkjet printer market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. Approximately xx M&A deals were recorded between 2019 and 2024, primarily focused on consolidating market share and expanding technological capabilities.

India Inkjet Printer Market Market Trends & Opportunities

The India inkjet printer market has witnessed robust growth over the past few years, driven by factors such as increasing digitization, rising demand for high-quality printing solutions across diverse sectors, and the expanding e-commerce industry. The market is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033).

Market penetration rates are increasing, particularly in the commercial and transactional print segments. This is attributed to growing adoption of inkjet printers in SMEs and large enterprises for efficient document management, marketing materials, and packaging solutions. Technological shifts toward more efficient and eco-friendly inkjet printers are further bolstering market growth. Consumer preferences are trending towards multi-functional printers (MFPs) with wireless connectivity and cloud integration capabilities. Competitive dynamics are characterized by both price competition and differentiation based on technological innovations and specialized features. The market also presents opportunities for niche players focusing on specialized applications such as security printing and high-volume packaging.

Dominant Markets & Segments in India Inkjet Printer Market

The Packaging segment is currently the dominant market within the India Inkjet Printer market, driven by the growth of e-commerce and the increasing demand for customized packaging solutions. Other key segments include Commercial Print and Labels, which demonstrate substantial growth potential.

Key Growth Drivers for Packaging Segment:

- Expanding e-commerce industry fueling demand for efficient and customized packaging.

- Rise in demand for visually appealing and brand-centric packaging.

- Advancements in inkjet printing technology enabling high-quality, large-scale packaging production.

- Increasing awareness of eco-friendly packaging solutions driving adoption of sustainable inkjet printing options.

Key Growth Drivers for Commercial Print Segment:

- Growth in marketing and advertising activities.

- Demand for high-quality brochures, flyers, and other marketing materials.

- Availability of affordable and high-performance inkjet printers.

Key Growth Drivers for Labels Segment:

- Rise in demand for customized product labels across various industries.

- Advancements in inkjet printing technology enabling high-resolution and durable labels.

- Growing adoption of barcode and RFID technologies integrated with inkjet printing.

India Inkjet Printer Market Product Analysis

Recent product innovations have focused on enhancing print quality, speed, and cost-effectiveness. Advancements in inkjet printhead technology, ink formulations, and printer software have significantly improved the performance and functionality of inkjet printers. Manufacturers are also emphasizing the development of eco-friendly and energy-efficient inkjet printers to address environmental concerns. These advancements make inkjet printers increasingly attractive across a wider range of applications and industries.

Key Drivers, Barriers & Challenges in India Inkjet Printer Market

Key Drivers: Technological advancements leading to increased print quality and speed, the growth of e-commerce and related packaging needs, and government initiatives promoting digitalization are key drivers.

Key Challenges: High initial investment costs for some high-end models, competition from other printing technologies, and fluctuations in ink prices pose significant challenges. Supply chain disruptions can also impact market dynamics, along with the potential for regulatory changes affecting ink and printer components.

Growth Drivers in the India Inkjet Printer Market Market

The growth of the Indian inkjet printer market is significantly propelled by advancements in printing technology, increased demand from various industries, and the burgeoning e-commerce sector. Government initiatives promoting digitalization also contribute to market expansion. Specifically, the adoption of high-quality, cost-effective inkjet printers across industries like packaging, commercial printing, and labeling significantly increases the market size.

Challenges Impacting India Inkjet Printer Market Growth

Challenges include competition from laser printers and other printing technologies, fluctuating ink prices, and potential supply chain disruptions. Regulatory changes affecting ink components and environmental regulations also pose a potential threat to market growth.

Key Players Shaping the India Inkjet Printer Market Market

- Jet Inks Pvt Ltd

- Spravaj Techno Services

- Videojet Technologies Inc

- KGK Jet India Pvt Ltd

- Advanced Industrial Micro Systems

- Colorjet Group

- Control Print Ltd

- Canon India Pvt Ltd

- Linx Printing Technologies

- Konica Minolta Business Solutions India Private Limited

- Brother International (India) Pvt Ltd

- Epson India Pvt Ltd

- Markem-Imaje India Pvt Ltd

Significant India Inkjet Printer Market Industry Milestones

- July 2022: Brother International launched its new A3 Business Inkjet Printer series, enhancing productivity and cost-efficiency for businesses.

- February 2022: Canon strengthened its business inkjet printer lineup with the launch of the MAXIFY GX5070, boosting efficiency and security for various sectors.

Future Outlook for India Inkjet Printer Market Market

The India inkjet printer market is poised for continued growth, driven by technological advancements, increasing demand across diverse sectors, and supportive government policies. Strategic partnerships, focus on innovation, and expansion into niche applications present significant opportunities for market players. The market's growth trajectory is expected to remain positive, supported by the strong economic growth and increasing digital adoption within India.

India Inkjet Printer Market Segmentation

-

1. End-user Industry

- 1.1. Books

- 1.2. Commercial Print

- 1.3. Advertising Print

- 1.4. Transactional Print

- 1.5. Labels

- 1.6. Packaging

- 1.7. Security

- 1.8. Other Pr

India Inkjet Printer Market Segmentation By Geography

- 1. India

India Inkjet Printer Market Regional Market Share

Geographic Coverage of India Inkjet Printer Market

India Inkjet Printer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Consumer Demands and Increasing Adoption of Ink Tank Printers; Increasing Flexibility in terms of Speed and Cost Control

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment; Lack of Skilled Personnel

- 3.4. Market Trends

- 3.4.1. Large Format Inkject Printers to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Inkjet Printer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Books

- 5.1.2. Commercial Print

- 5.1.3. Advertising Print

- 5.1.4. Transactional Print

- 5.1.5. Labels

- 5.1.6. Packaging

- 5.1.7. Security

- 5.1.8. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jet Inks Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Spravaj Techno Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Videojet Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KGK Jet India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Advanced Industrial Micro Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Colorjet Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Control Print Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linx Printing Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Konica Minolta Business Solutions India Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brother International (India) Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Epson India Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Markem-Imaje India Pvt Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Jet Inks Pvt Ltd

List of Figures

- Figure 1: India Inkjet Printer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Inkjet Printer Market Share (%) by Company 2025

List of Tables

- Table 1: India Inkjet Printer Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: India Inkjet Printer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Inkjet Printer Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: India Inkjet Printer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Inkjet Printer Market?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the India Inkjet Printer Market?

Key companies in the market include Jet Inks Pvt Ltd, Spravaj Techno Services, Videojet Technologies Inc, KGK Jet India Pvt Ltd, Advanced Industrial Micro Systems, Colorjet Group, Control Print Ltd, Canon India Pvt Ltd, Linx Printing Technologies, Konica Minolta Business Solutions India Private Limited*List Not Exhaustive, Brother International (India) Pvt Ltd, Epson India Pvt Ltd, Markem-Imaje India Pvt Ltd.

3. What are the main segments of the India Inkjet Printer Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Shift in Consumer Demands and Increasing Adoption of Ink Tank Printers; Increasing Flexibility in terms of Speed and Cost Control.

6. What are the notable trends driving market growth?

Large Format Inkject Printers to Hold Major Share.

7. Are there any restraints impacting market growth?

; High Initial Investment; Lack of Skilled Personnel.

8. Can you provide examples of recent developments in the market?

July 2022 - Brother's International's new A3 Business Inkjet Printer series offers business-class performance, quality, and reliability, all at a low cost per page. Designed to deliver greater productivity possibilities at lower prices, these versatile multifunction centers can print a wide range of media formats and sizes of up to A3 and do it all with greater cost-efficiency, reliability, and the speed businesses today demand. With the built-in wireless, mobile, and web connectivity features, the workforce can enjoy effortless business productivity from just about any device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Inkjet Printer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Inkjet Printer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Inkjet Printer Market?

To stay informed about further developments, trends, and reports in the India Inkjet Printer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence