Key Insights

Kenya's flexible packaging market is poised for significant expansion, projected to reach $314.54 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This growth is primarily driven by the expanding food and beverage sector, fueled by increasing urbanization and a rising middle class. The healthcare and pharmaceutical industry's demand for secure and efficient packaging solutions, coupled with evolving consumer preferences for convenience and tamper-evident options such as laminated films and pouches, also significantly contributes to market growth. The market is segmented by end-user industry (food, beverage, healthcare & pharmaceutical, others), material (paper, plastic, metal), and product type (bags & pouches, films & wraps, others). Key contributors to the competitive landscape include Platinum Packaging Ltd, Polyflex Industries Limited, and Silafrica Kenya Limited.

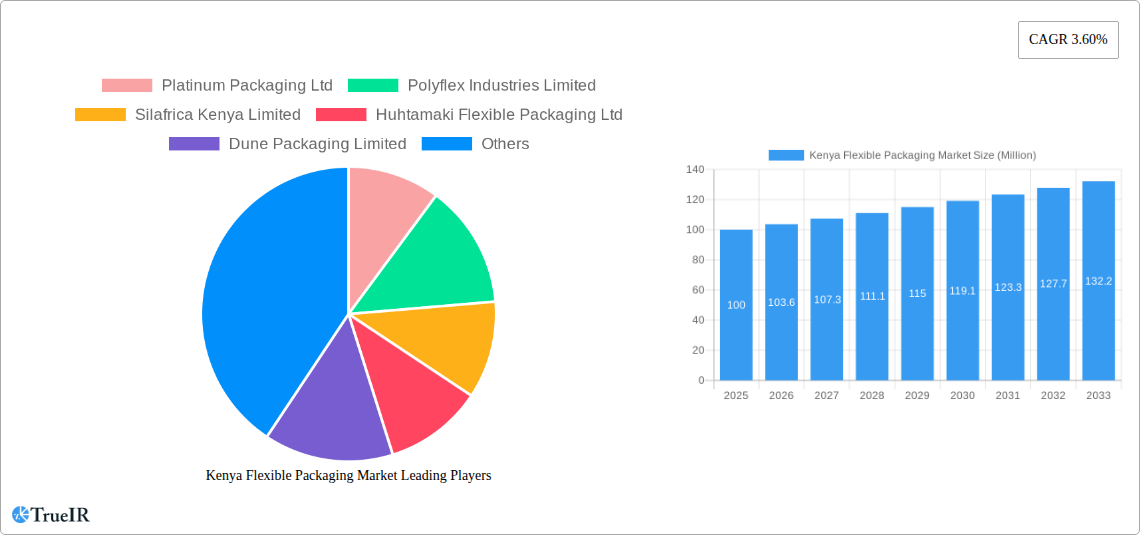

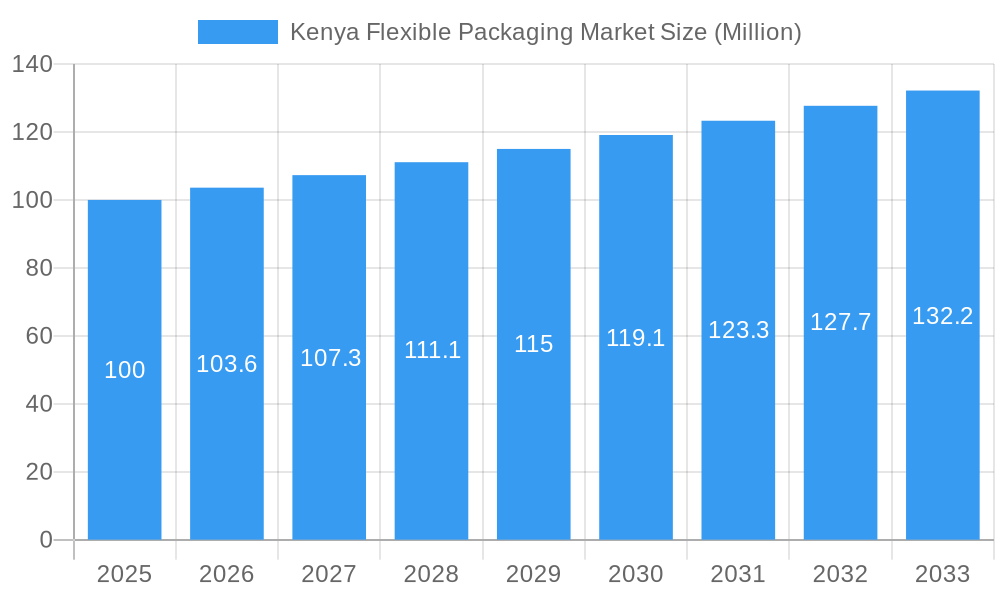

Kenya Flexible Packaging Market Market Size (In Billion)

Market growth is moderated by challenges such as fluctuating raw material prices, particularly for plastic resins. Environmental concerns surrounding plastic waste and the increasing demand for sustainable packaging solutions present both opportunities and challenges. Government regulations promoting eco-friendly packaging further influence the market. Companies are strategically focusing on sustainable materials, product innovation, and advanced manufacturing technologies to leverage growth opportunities. The market's future growth will depend on successfully addressing these challenges and capitalizing on the economic dynamics within Kenya. The forecast period of 2025-2033 indicates substantial growth potential for both existing and new market participants.

Kenya Flexible Packaging Market Company Market Share

Kenya Flexible Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Kenya flexible packaging market, offering invaluable insights for businesses operating within or seeking to enter this rapidly evolving sector. Leveraging extensive research and data covering the period 2019-2033, this report unveils market trends, competitive landscapes, and growth opportunities, providing a crucial roadmap for strategic decision-making. The report features a comprehensive analysis of market size, growth drivers, challenges, and key players, with a specific focus on the forecast period of 2025-2033 and the base year 2025. The market value is expected to reach xx Million by 2033.

Kenya Flexible Packaging Market Market Structure & Competitive Landscape

The Kenyan flexible packaging market exhibits a moderately concentrated structure, with several key players dominating the landscape. The market is characterized by intense competition, driven by innovation in materials, product designs, and printing technologies. Regulatory factors, particularly those concerning environmental sustainability and food safety, significantly influence market dynamics. The increasing adoption of sustainable packaging materials is a crucial innovation driver, impacting market share among existing players and prompting entry by new businesses offering eco-friendly alternatives. Product substitution, largely from traditional rigid packaging to flexible solutions for enhanced convenience and cost-effectiveness, is another prominent trend.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Kenyan flexible packaging market in 2024 was estimated at xx, indicating a moderately concentrated market.

M&A Activity: The acquisition of Platinum Packaging Ltd by Ramco Plexus in May 2022, valued at approximately KES 500 Million (approximately xx Million USD), highlights the ongoing consolidation within the industry. This activity reflects the strategic importance of expanding market share and enhancing operational capabilities. The volume of M&A activity in the Kenyan flexible packaging market from 2019-2024 totaled approximately xx deals.

End-User Segmentation: The market is primarily segmented by end-user industries, with food and beverage holding the largest share, followed by healthcare and pharmaceuticals. Other end-user industries include cosmetics, personal care, and industrial goods. The dominance of food and beverage is primarily attributable to the growing processed food and beverage sector in Kenya.

Kenya Flexible Packaging Market Market Trends & Opportunities

The Kenyan flexible packaging market is experiencing robust growth, driven by factors such as the expanding food and beverage sector, increasing consumer demand for convenient and attractive packaging, and the rising adoption of e-commerce. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This significant growth is fueled by rising disposable incomes, urbanization, and changing consumer preferences towards convenient and on-the-go consumption patterns. Technological advancements, such as the adoption of advanced printing techniques and sustainable materials, are further stimulating market expansion. Competitive dynamics are characterized by innovation, pricing strategies, and brand building, leading to a dynamic and evolving market landscape. Market penetration rates for flexible packaging in various sectors remain relatively high compared to rigid packaging, signifying further growth potential. Specific challenges, such as import restrictions and fluctuating raw material prices, exist but are counterbalanced by robust domestic demand and the ongoing efforts toward localization of production.

Dominant Markets & Segments in Kenya Flexible Packaging Market

The Kenyan flexible packaging market is predominantly driven by domestic demand. While regional trade exists, the significant bulk of consumption stems from within the country. The food and beverage sector constitutes the largest end-user segment, driven by rising processed food consumption and expanding retail channels. Within materials, plastic holds the largest market share, benefiting from its versatility, cost-effectiveness, and wide range of applications. Bags and pouches represent the leading product type, due to their broad applicability across various end-use segments.

- Key Growth Drivers (Food & Beverage Segment):

- Rising disposable incomes and increasing urbanization.

- Growth of the processed food and beverage industry.

- Expansion of modern retail channels, like supermarkets and hypermarkets.

- Increased demand for convenient and attractive packaging.

- Key Growth Drivers (Plastic Material Segment):

- Cost-effectiveness compared to alternative materials.

- Versatility and suitability for various packaging applications.

- Established manufacturing infrastructure and supply chains.

- Key Growth Drivers (Bags & Pouches Segment):

- Wide range of applications across various end-use industries.

- Ease of use and convenience for consumers.

- Cost-effectiveness and efficient production processes.

Kenya Flexible Packaging Market Product Analysis

The Kenyan flexible packaging market showcases a diverse range of products, including bags and pouches, films and wraps, and other specialized packaging solutions. Innovation in this space centers around improved barrier properties, enhanced printing capabilities, and sustainable material options. These advancements cater to the growing demand for extended shelf life, attractive branding, and environmentally friendly packaging solutions. Competitive advantages are increasingly derived from the ability to offer tailored packaging solutions that meet specific customer needs, coupled with efficient and cost-effective production.

Key Drivers, Barriers & Challenges in Kenya Flexible Packaging Market

Key Drivers:

- Growing Food & Beverage Sector: The expansion of the processed food and beverage industry fuels demand for flexible packaging.

- Rising Disposable Incomes: Increased purchasing power drives consumer demand for packaged goods.

- Technological Advancements: Innovations in materials and printing enhance product offerings.

- Government Initiatives: Favorable policies supporting local manufacturing boost the market.

Key Challenges:

- Fluctuating Raw Material Prices: Dependence on imported materials creates price volatility.

- Supply Chain Disruptions: Global supply chain issues impact raw material availability and costs.

- Competition: Intense competition among domestic and international players.

- Environmental Concerns: Growing pressure to adopt sustainable packaging solutions. The plastic waste management challenge places environmental constraints on growth.

Growth Drivers in the Kenya Flexible Packaging Market Market

The Kenyan flexible packaging market is primarily propelled by the expansion of the food and beverage sector, rising disposable incomes, and the adoption of advanced packaging technologies. Government initiatives promoting local manufacturing and investments in infrastructure further contribute to market growth. These factors synergistically drive the demand for flexible packaging solutions, fostering market expansion.

Challenges Impacting Kenya Flexible Packaging Market Growth

Challenges include fluctuating raw material prices, particularly for imported materials, and supply chain vulnerabilities. Intense competition from established players and the rising environmental awareness necessitating sustainable packaging solutions further pose hurdles. Effectively addressing these challenges requires strategic planning and proactive adoption of sustainable practices, along with diversification of supply chains.

Key Players Shaping the Kenya Flexible Packaging Market Market

- Platinum Packaging Ltd

- Polyflex Industries Limited

- Silafrica Kenya Limited

- Huhtamaki Flexible Packaging Ltd

- Dune Packaging Limited

- Statpack Ltd

- Flexipac Limited

- Packaging Industries Ltd

- Paperbags Ltd

- Betatrad Kenya Limited

- List Not Exhaustive

Significant Kenya Flexible Packaging Market Industry Milestones

- May 2022: Ramco Plexus acquired 100% of Platinum Packaging for approximately KES 500 million (xx Million USD), consolidating market share and enhancing production capabilities.

- March 2022: Dune Packaging Limited achieved Superbrands status, reinforcing brand recognition and consumer trust.

Future Outlook for Kenya Flexible Packaging Market Market

The Kenyan flexible packaging market exhibits promising growth prospects. The continued expansion of the food and beverage sector, rising disposable incomes, and technological advancements will drive significant market growth. Opportunities exist for companies to capitalize on the demand for sustainable packaging solutions and customized packaging tailored to specific needs of diverse industries. Further investment in local manufacturing and efficient supply chains will enhance market potential, contributing to sustained growth in the coming years.

Kenya Flexible Packaging Market Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Plastic

- 1.3. Metal

-

2. Product Type

- 2.1. Bags and Pouches

- 2.2. Films and Wraps

- 2.3. Other Products

-

3. End-User

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceutical

- 3.4. Others End-User Industries

Kenya Flexible Packaging Market Segmentation By Geography

- 1. Kenya

Kenya Flexible Packaging Market Regional Market Share

Geographic Coverage of Kenya Flexible Packaging Market

Kenya Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Recycling Infrastructure for Packaging Products; Flexible Packaging is Expected to Register Strong Growth in the Food and Beverages Sector

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs; Growing Usage of Substitute Products (Plastic)

- 3.4. Market Trends

- 3.4.1. Food and Beverage Sectors to Register Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kenya Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bags and Pouches

- 5.2.2. Films and Wraps

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceutical

- 5.3.4. Others End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kenya

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Platinum Packaging Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polyflex Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Silafrica Kenya Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Flexible Packaging Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dune Packaging Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Statpack Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flexipac Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Packaging Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paperbags Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Betatrad Kenya Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platinum Packaging Ltd

List of Figures

- Figure 1: Kenya Flexible Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kenya Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Kenya Flexible Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Kenya Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Kenya Flexible Packaging Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Kenya Flexible Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Kenya Flexible Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Kenya Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Kenya Flexible Packaging Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Kenya Flexible Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kenya Flexible Packaging Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Kenya Flexible Packaging Market?

Key companies in the market include Platinum Packaging Ltd, Polyflex Industries Limited, Silafrica Kenya Limited, Huhtamaki Flexible Packaging Ltd, Dune Packaging Limited, Statpack Ltd, Flexipac Limited, Packaging Industries Ltd, Paperbags Ltd, Betatrad Kenya Limited*List Not Exhaustive.

3. What are the main segments of the Kenya Flexible Packaging Market?

The market segments include Material, Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 314.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Recycling Infrastructure for Packaging Products; Flexible Packaging is Expected to Register Strong Growth in the Food and Beverages Sector.

6. What are the notable trends driving market growth?

Food and Beverage Sectors to Register Strong Growth.

7. Are there any restraints impacting market growth?

Rising Operational Costs; Growing Usage of Substitute Products (Plastic).

8. Can you provide examples of recent developments in the market?

May 2022: Ramco Plexus, a printing and packaging company, received unconditional regulatory approval to take complete control (100% share) of Platinum Packaging in a transaction estimated at approximately KES 500 million. Platinum Packaging manufactures flexible packaging solutions in pouches, reels, digital labels, and sleeves.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kenya Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kenya Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kenya Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Kenya Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence