Key Insights

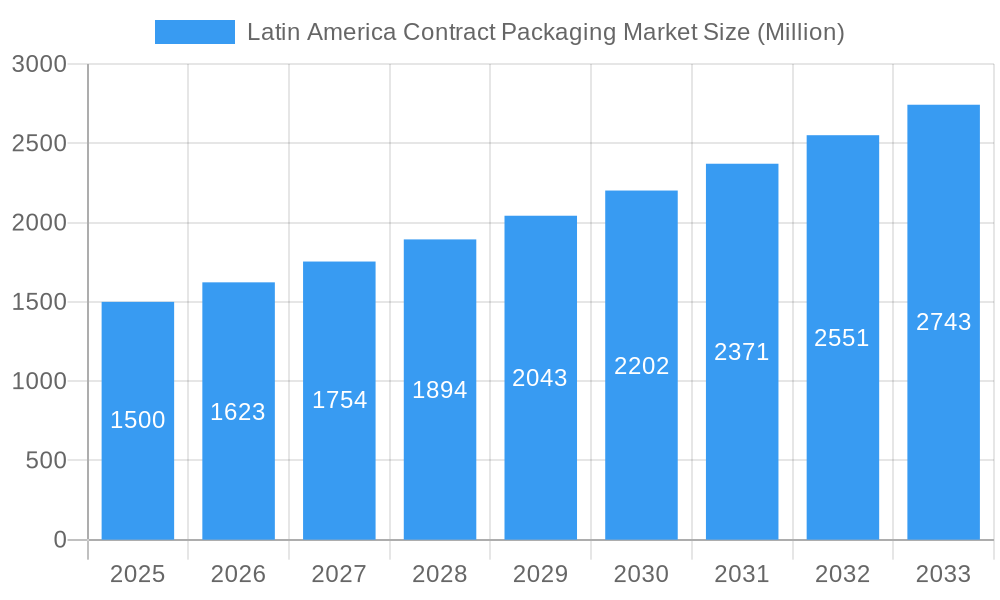

The Latin American contract packaging market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and regional economic activity), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.20% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning food and beverage industry in the region, coupled with increasing demand for pharmaceutical products and a rising preference for convenient, ready-to-consume goods, are significantly boosting contract packaging services. Further growth is facilitated by the rising adoption of advanced packaging technologies for improved product shelf life and enhanced consumer appeal. Companies are increasingly outsourcing packaging to specialize in core competencies, leading to a significant rise in demand for contract packaging solutions. This trend is also driven by the cost-effectiveness and efficiency gains associated with outsourcing non-core functions. However, challenges like fluctuating raw material prices, supply chain disruptions, and a need for skilled labor remain potential restraints to market growth. The market is segmented by end-user industry (food, beverages, pharmaceuticals, household & personal care, others), country (Brazil, Mexico, Argentina, others), and service type (primary, secondary, tertiary packaging). Brazil, Mexico, and Argentina are currently the largest markets within the region, with significant growth potential in other Latin American countries.

Latin America Contract Packaging Market Market Size (In Billion)

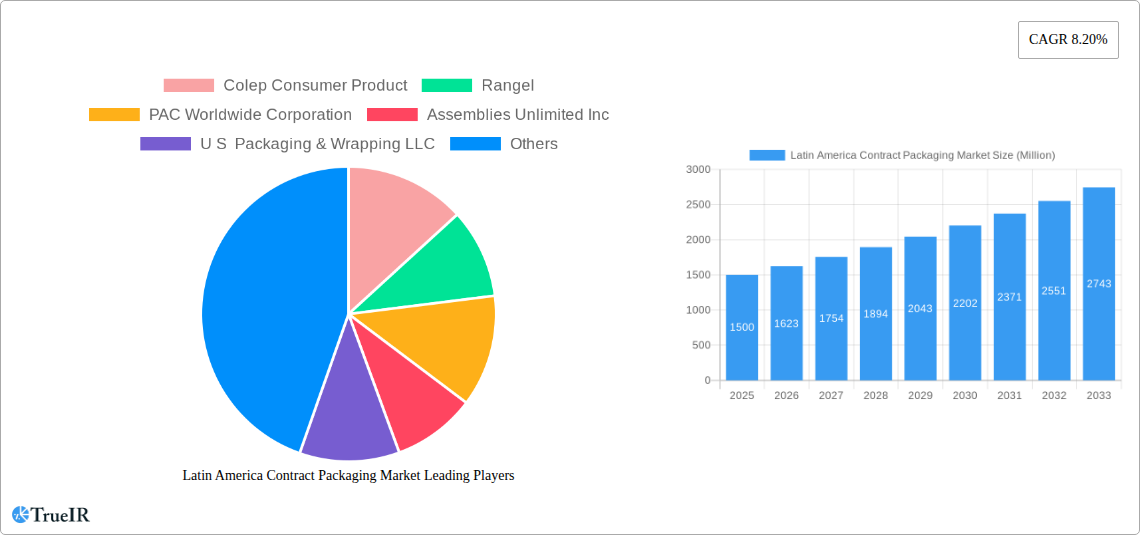

The market's segmentation reveals distinct opportunities. The food and beverage sector is expected to dominate, driven by rising disposable incomes and changing consumer preferences. The pharmaceutical segment is experiencing growth due to increasing healthcare expenditure and demand for sophisticated packaging solutions. Within service types, primary packaging is currently the largest segment, but secondary and tertiary packaging are showing strong growth potential, reflecting the need for integrated supply chain solutions. Key players like Colep Consumer Product, Rangel, PAC Worldwide Corporation, Assemblies Unlimited Inc, U S Packaging & Wrapping LLC, TricorBraun, and VMA LOGDIST are actively shaping market competition through innovation, strategic partnerships, and expansion within the region. The continued focus on sustainability and consumer preference for eco-friendly packaging will likely influence future market developments and necessitate further innovation within the sector. Overall, the Latin American contract packaging market presents significant opportunities for growth and investment in the coming years.

Latin America Contract Packaging Market Company Market Share

Latin America Contract Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the Latin America Contract Packaging Market, offering invaluable insights for industry stakeholders. Leveraging extensive market research and data analysis spanning the period 2019-2033, this report offers a comprehensive understanding of market structure, trends, opportunities, and future outlook. With a focus on key players like Colep Consumer Product, Rangel, PAC Worldwide Corporation, Assemblies Unlimited Inc, U S Packaging & Wrapping LLC, TricorBraun, and VMA LOGDIST, this report is an essential resource for strategic decision-making. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Latin America Contract Packaging Market Structure & Competitive Landscape

The Latin American contract packaging market exhibits a moderately consolidated structure, with a few large players and numerous smaller, regional businesses. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately concentrated market. Innovation is a key driver, particularly in sustainable and functional packaging solutions, driven by consumer demand and stringent environmental regulations. Regulatory changes, particularly concerning food safety and labeling, significantly impact the market, prompting continuous adaptation by packaging companies. Product substitutes, such as private label packaging, exert competitive pressure.

The market is segmented by end-user industry (Food, Beverages, Pharmaceutical, Household and Personal Care, Other End-user Industries), country (Brazil, Mexico, Argentina, Other Countries), and service (Primary, Secondary, Tertiary Packaging). Mergers and Acquisitions (M&A) activity is moderate, with an average of xx deals per year over the historical period (2019-2024). These activities primarily involve smaller companies being acquired by larger players to expand their market reach and service offerings.

Latin America Contract Packaging Market Market Trends & Opportunities

The Latin America contract packaging market is experiencing robust growth, driven by several key factors. The market size reached xx Million in 2024 and is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by increasing consumer demand for packaged goods, the expansion of e-commerce, and a rise in outsourcing by brand owners. Technological advancements, including automation and digitalization in packaging processes, are enhancing efficiency and productivity. Changing consumer preferences towards sustainable and convenient packaging are creating new opportunities for innovative contract packaging solutions. The competitive landscape is characterized by both local and international players, resulting in intense competition and ongoing innovation. Market penetration rates vary across different segments and countries, with Brazil and Mexico currently leading the market.

Dominant Markets & Segments in Latin America Contract Packaging Market

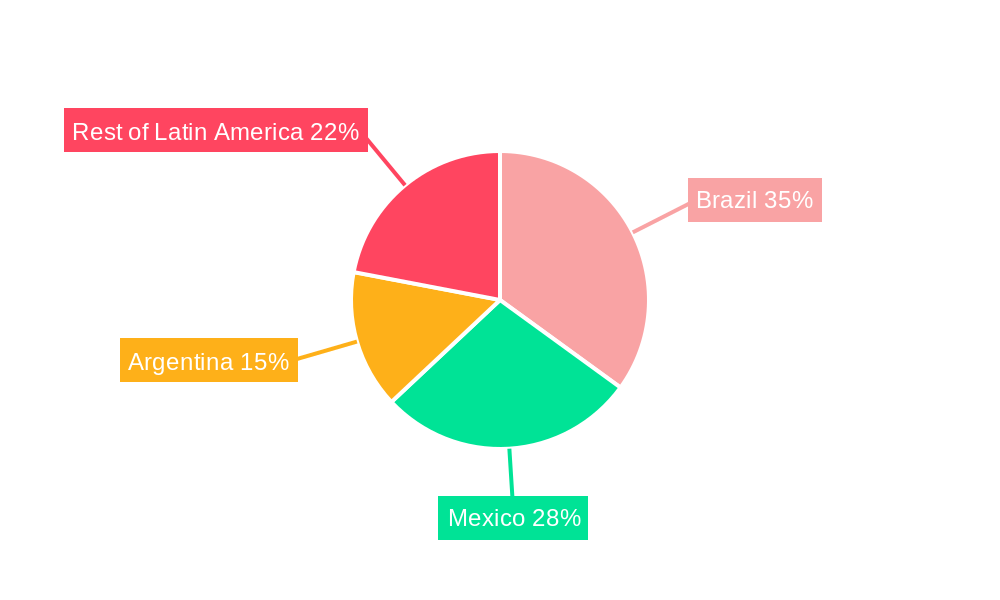

By Country: Brazil and Mexico represent the largest segments, accounting for xx% and xx% of the market, respectively, driven by strong economic growth and a large consumer base. Argentina also holds a significant share, though smaller than Brazil and Mexico. Growth in these countries is further propelled by expanding retail infrastructure and rising disposable incomes.

By End-user Industry: The Food and Beverage sector dominates the contract packaging market, followed by the Pharmaceutical and Household and Personal Care segments. Growth in these sectors is primarily driven by strong consumer demand, stringent quality control requirements, and the increasing trend of outsourcing packaging operations.

By Service: Primary packaging constitutes the largest share of the market, followed by secondary and tertiary packaging. The increasing demand for specialized packaging solutions and sophisticated supply chain management is boosting the growth of secondary and tertiary packaging services.

Latin America Contract Packaging Market Product Analysis

Product innovation in the Latin America contract packaging market centers around sustainable materials, enhanced functionalities, and improved supply chain efficiency. Companies are increasingly focusing on eco-friendly packaging solutions made from recycled and renewable materials to meet growing consumer demand for sustainable products. Advancements in packaging technology, such as smart packaging and tamper-evident seals, are enhancing product security and providing better consumer experience. This trend creates a competitive advantage for packaging providers that can offer innovative and efficient solutions that align with the evolving needs of brand owners.

Key Drivers, Barriers & Challenges in Latin America Contract Packaging Market

Key Drivers: Technological advancements in automation and packaging materials are streamlining processes and reducing costs. The growth of e-commerce is driving demand for specialized packaging solutions for online deliveries. Favorable government policies promoting domestic manufacturing and supporting the growth of the packaging industry are also contributing to market expansion.

Challenges: Fluctuations in raw material prices and supply chain disruptions pose significant challenges. Stringent regulatory compliance requirements and varying standards across different countries add complexity and increase costs. Intense competition among various players necessitates a continuous focus on innovation and cost efficiency. These factors can impact profitability and growth prospects for businesses operating in this market. For example, a recent increase in xx% in the price of xx impacted profitability by xx% for several contract packaging companies.

Growth Drivers in the Latin America Contract Packaging Market Market

The Latin American contract packaging market is fueled by several key drivers, including the rising demand for packaged goods across various sectors (food, beverages, pharmaceuticals, etc.), the e-commerce boom requiring robust packaging solutions, and increasing investments in automation and technological advancements for enhanced efficiency. Moreover, favorable government initiatives promoting industrial growth and the adoption of sustainable packaging practices are bolstering market expansion.

Challenges Impacting Latin America Contract Packaging Market Growth

Significant challenges impede the growth of the Latin American contract packaging market. Supply chain disruptions, driven by factors like geopolitical instability and natural disasters, can cause delays and increase costs. The implementation of increasingly stringent environmental regulations requires continuous adaptation and investment in sustainable solutions, impacting profitability. Fluctuating raw material costs, particularly for key components such as plastics and paper, also negatively impact margins.

Key Players Shaping the Latin America Contract Packaging Market Market

- Colep Consumer Products

- Rangel

- PAC Worldwide Corporation

- Assemblies Unlimited Inc

- U S Packaging & Wrapping LLC

- TricorBraun

- VMA LOGDIST

Significant Latin America Contract Packaging Market Industry Milestones

- November 2022: TricorBraun's acquisition of Merlot Packaging expanded its presence in the North American nutraceutical packaging market.

- March 2022: Aptar Food + Beverage partnered with Chacauhaa Brazil to introduce an innovative inverted packaging solution.

Future Outlook for Latin America Contract Packaging Market Market

The future of the Latin America contract packaging market appears bright, propelled by sustained growth in the packaged goods sector, technological innovations, and the increasing adoption of sustainable packaging practices. Strategic opportunities exist in expanding into niche markets, focusing on customized packaging solutions, and leveraging digital technologies to enhance supply chain efficiency. The market's continued expansion is expected, with growth primarily driven by increasing consumer spending, economic expansion, and the growing popularity of e-commerce.

Latin America Contract Packaging Market Segmentation

-

1. Service

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverages

- 2.3. Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Latin America Contract Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Contract Packaging Market Regional Market Share

Geographic Coverage of Latin America Contract Packaging Market

Latin America Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from E-commerce Industry; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. Competition from In-house packaging

- 3.4. Market Trends

- 3.4.1. Increasing Demand from E-commerce Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Colep Consumer Product

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rangel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PAC Worldwide Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Assemblies Unlimited Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 U S Packaging & Wrapping LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TricorBraun

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VMA LOGDIST

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Colep Consumer Product

List of Figures

- Figure 1: Latin America Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Latin America Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Latin America Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Contract Packaging Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the Latin America Contract Packaging Market?

Key companies in the market include Colep Consumer Product, Rangel, PAC Worldwide Corporation, Assemblies Unlimited Inc, U S Packaging & Wrapping LLC, TricorBraun, VMA LOGDIST.

3. What are the main segments of the Latin America Contract Packaging Market?

The market segments include Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from E-commerce Industry; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Increasing Demand from E-commerce Industry.

7. Are there any restraints impacting market growth?

Competition from In-house packaging.

8. Can you provide examples of recent developments in the market?

November 2022: TricorBraun acquired Vancouver-based Merlot Packaging, a rigid packaging distributor specializing in high-quality closures, serving customers in the nutraceutical segment to further expand its presence in Canada. The company is focusing on combining the expertise of TricorBraun and Merlot to serve nutraceutical customers across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence