Key Insights

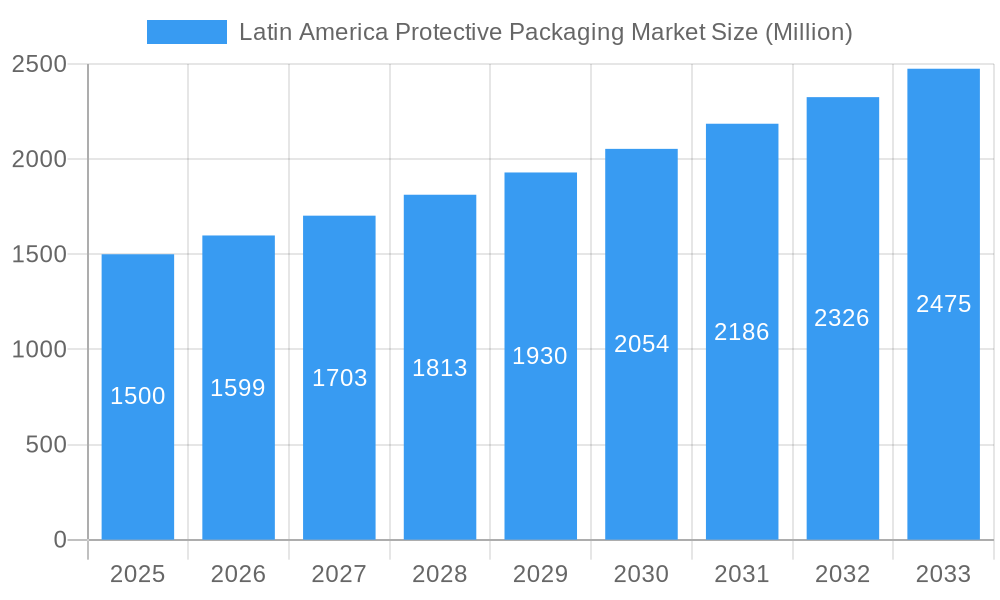

The Latin American protective packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector across Brazil, Mexico, and Argentina necessitates increased demand for secure and efficient packaging solutions to protect goods during transit. Furthermore, the growth of the food and beverage, pharmaceutical, and consumer electronics industries within the region significantly contributes to the market's expansion. Increasing consumer awareness regarding product safety and the rising adoption of sustainable packaging materials, such as paper-based alternatives, also positively influence market dynamics. While challenges remain, such as fluctuating raw material prices and economic volatility in certain Latin American countries, the overall market outlook remains optimistic.

Latin America Protective Packaging Market Market Size (In Billion)

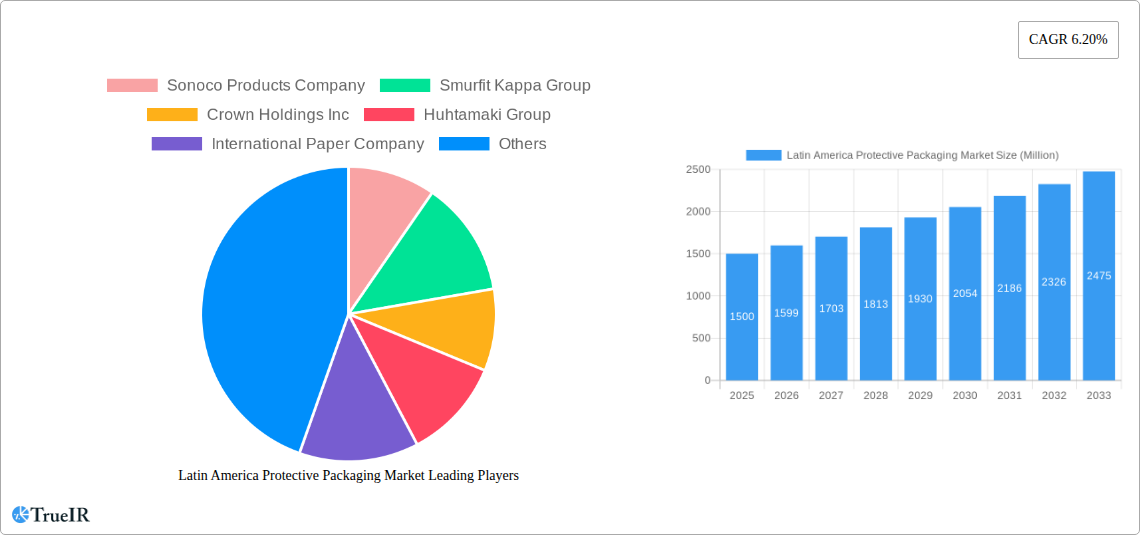

The market segmentation reveals a diverse landscape. Bubble wrap (foam-based) continues to dominate, but there's significant growth potential for insulated shipping containers, particularly flexible mailers and air pillows, driven by e-commerce demand. Brazil, Mexico, and Argentina represent the largest national markets, collectively accounting for a significant portion of the regional revenue. The preference for specific packaging materials varies across sectors; plastics retain a substantial market share due to their cost-effectiveness and durability, while the demand for eco-friendly paper and paperboard alternatives is steadily increasing, reflecting a broader global trend towards sustainability. Major players like Sonoco Products Company, Smurfit Kappa Group, and Sealed Air Corporation are actively competing in this expanding market, leveraging their established distribution networks and innovative product offerings to capitalize on growth opportunities. The forecast period (2025-2033) promises substantial market expansion, driven by ongoing economic growth and evolving consumer preferences in the Latin American region.

Latin America Protective Packaging Market Company Market Share

Latin America Protective Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Latin America protective packaging market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this analysis leverages robust data and expert analysis to illuminate growth trajectories, key players, and emerging trends. The market is projected to reach xx Million by 2033, exhibiting a compelling CAGR of xx% during the forecast period (2025-2033).

Latin America Protective Packaging Market Structure & Competitive Landscape

The Latin American protective packaging market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Key drivers of innovation include the rising demand for sustainable packaging solutions, advancements in material science (e.g., biodegradable plastics), and the growing adoption of e-commerce. Regulatory impacts, such as those related to waste management and material safety, play a significant role, shaping product development and influencing packaging choices. Product substitution is evident, with the gradual shift from traditional materials like expanded polystyrene (EPS) towards eco-friendly alternatives. The end-user segmentation is diverse, with significant demand from the food and beverage, pharmaceutical, and consumer electronics sectors. Mergers and acquisitions (M&A) activity has been moderate, with approximately xx M&A deals recorded in the past five years, primarily focused on expanding geographical reach and product portfolios.

- Market Concentration: HHI estimated at xx.

- Innovation Drivers: Sustainable packaging, material science advancements, e-commerce growth.

- Regulatory Impacts: Waste management regulations, material safety standards.

- Product Substitutes: Biodegradable plastics replacing EPS.

- End-User Segmentation: Food & Beverage, Pharmaceutical, Consumer Electronics, Beauty & Homecare dominate.

- M&A Activity: Approximately xx deals in the last five years.

Latin America Protective Packaging Market Trends & Opportunities

The Latin America protective packaging market is experiencing robust growth, driven by factors such as the expanding e-commerce sector, rising consumer spending, and the increasing focus on supply chain efficiency. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033. This growth is fueled by technological advancements, including the introduction of intelligent packaging solutions and automation in packaging processes. Consumer preferences are shifting towards sustainable and convenient packaging options, driving demand for eco-friendly materials and innovative designs. The competitive landscape is dynamic, with established players investing heavily in R&D and expanding their product portfolios. Market penetration rates vary across different segments and countries, with higher penetration in urban areas and developed economies.

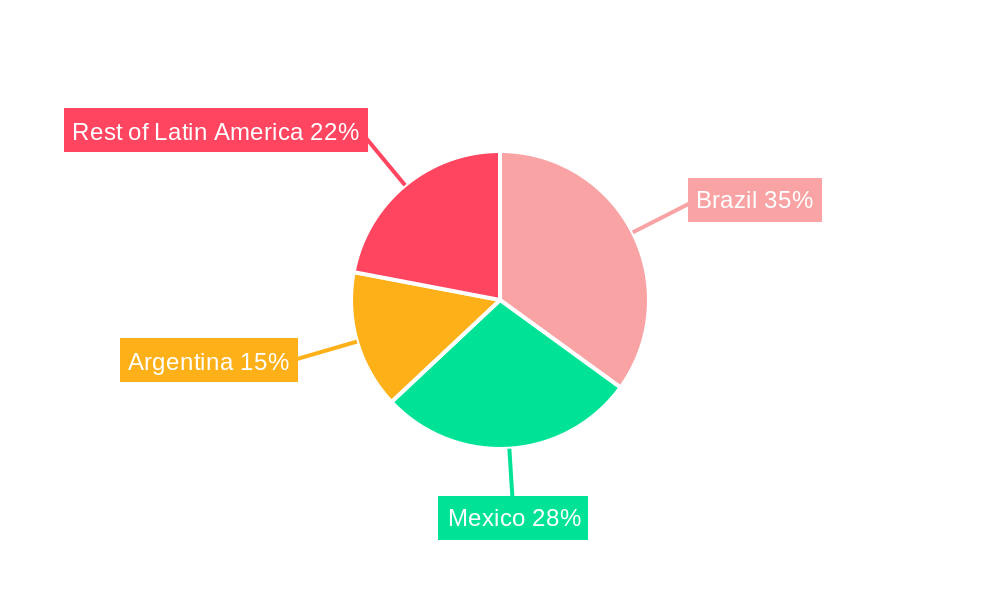

Dominant Markets & Segments in Latin America Protective Packaging Market

Brazil holds the largest share of the Latin American protective packaging market, followed by Mexico and Argentina. Within the segments, Bubble Wraps (foam-based) and Plastics are currently the dominant material types, driven by their cost-effectiveness and versatility. The Food and Beverage sector is the leading end-user vertical, due to the large and growing food processing and retail industries.

- Leading Country: Brazil

- Leading Material Type: Plastics

- Leading Product Type: Bubble Wraps (Foam-based)

- Leading End-User Vertical: Food and Beverage

- Key Growth Drivers in Brazil: Expanding retail sector, growing e-commerce penetration.

- Key Growth Drivers in Mexico: Rising middle class, increased consumer spending.

- Key Growth Drivers in Argentina: Growing industrial activity, improved logistics infrastructure.

Detailed Analysis: The dominance of Brazil is attributed to its large and diversified economy, significant manufacturing activity, and robust consumer demand. The high demand for Bubble Wraps is driven by their cost-effectiveness and suitability for various applications. The strong presence of the Food and Beverage sector reflects the size and growth of this industry in Latin America.

Latin America Protective Packaging Market Product Analysis

The market showcases a range of protective packaging products, including rigid containers, flexible mailers, insulated shipping containers, and air pillows. Recent technological advancements focus on improved cushioning materials, enhanced barrier properties, and sustainable designs. Products are increasingly tailored to specific end-user needs, encompassing solutions for fragile electronics, temperature-sensitive pharmaceuticals, and perishable food items. The competitive advantage lies in offering superior protection, eco-friendly options, and efficient packaging solutions.

Key Drivers, Barriers & Challenges in Latin America Protective Packaging Market

The Latin America protective packaging market is experiencing robust expansion, fueled by a confluence of evolving consumer behaviors, economic trends, and regulatory shifts. Understanding these forces is crucial for stakeholders aiming to capitalize on the region's dynamic landscape.

Key Drivers:

- Surge in E-commerce and Omnichannel Retail: The accelerated adoption of online shopping across Latin America, coupled with the rise of omnichannel strategies, significantly elevates the demand for protective packaging to ensure product integrity during transit and delivery. This trend is particularly pronounced in urban centers and among digitally savvy demographics.

- Growing Demand for Food and Beverage Preservation: As populations grow and consumer preferences shift towards convenience and ready-to-eat options, the need for effective protective packaging solutions that maintain the freshness, safety, and shelf-life of food and beverage products is paramount. This includes specialized materials for temperature control and barrier properties.

- Stringent Regulations on Product Safety and Waste Management: Governments across Latin America are increasingly implementing stricter regulations concerning product safety standards and environmental impact. This is driving demand for protective packaging that not only safeguards goods but also adheres to sustainability mandates, such as increased recyclability and reduced material usage.

- Expansion of Manufacturing and Industrial Sectors: Growth in key industries like automotive, electronics, and pharmaceuticals necessitates robust protective packaging to prevent damage during storage and transportation of sensitive components and finished goods.

- Increased Consumer Awareness of Product Quality: Consumers are becoming more discerning about the quality and condition of products upon arrival. This awareness translates into a demand for packaging that visibly demonstrates care and protection, thereby enhancing brand perception.

Barriers & Challenges:

- Fluctuations in Raw Material Prices: The Latin American market is susceptible to volatility in the prices of key raw materials, including various types of plastics (like polyethylene and polypropylene), paper, and cardboard. Global supply and demand dynamics, geopolitical events, and currency exchange rates can significantly impact production costs and profit margins.

- Supply Chain Disruptions and Logistical Hurdles: The vast geography of Latin America, coupled with infrastructural limitations in certain areas, can lead to significant logistical challenges. Furthermore, global events, such as pandemics or natural disasters, can cause disruptions in the supply chain, affecting the availability and timely delivery of both raw materials and finished packaging products.

- Intense Competition and Price Sensitivity: The market features a mix of established global players and a growing number of local manufacturers, leading to intense competition. This often results in price wars, putting pressure on manufacturers to optimize costs while maintaining quality and innovation. Developing economies within the region can also exhibit higher price sensitivity among consumers and businesses.

- Economic and Political Instability: Several Latin American countries experience periods of economic volatility and political uncertainty. These factors can directly impact consumer spending, business investment, and overall market demand for protective packaging.

- Adoption of Sustainable Alternatives: While a driver, the transition to sustainable packaging materials also presents a challenge. The initial investment in new technologies and the development of cost-effective eco-friendly alternatives can be a barrier for some manufacturers and industries.

Growth Drivers in the Latin America Protective Packaging Market

The market is primarily driven by the expansion of e-commerce, necessitating robust and secure packaging solutions. Rising disposable incomes, particularly in the middle class, fuel increased consumer spending, further boosting packaging demand. Furthermore, stringent government regulations concerning product safety and waste reduction act as drivers by pushing companies toward eco-friendly packaging options.

Challenges Impacting Latin America Protective Packaging Market Growth

The primary challenges impacting the Latin America protective packaging market stem from the inherent vulnerabilities within global and regional supply chains, often exacerbated by external shocks like pandemics and inflationary pressures. Economic instability, prevalent in certain Latin American nations, directly affects consumer purchasing power and business investment, consequently dampening demand for packaging solutions. Furthermore, the competitive landscape is characterized by intense rivalry among both established multinational corporations and emerging local players. This necessitates continuous investment in research and development for innovative, cost-effective, and sustainable packaging solutions, a feat that requires significant strategic planning and operational efficiency.

Key Players Shaping the Latin America Protective Packaging Market

- Sonoco Products Company: A global leader in diversified packaging solutions, offering a wide range of protective packaging products for various industries.

- Smurfit Kappa Group: A prominent provider of paper-based packaging solutions, with a significant presence in Latin America, focusing on sustainable and innovative designs.

- Crown Holdings Inc: Known for its metal packaging, Crown Holdings also offers protective packaging solutions, particularly for beverages and food, ensuring product integrity.

- Huhtamaki Group: A global food-first packaging company, Huhtamaki offers a diverse portfolio including protective packaging for food and consumer goods, with an emphasis on sustainability.

- International Paper Company: A leading producer of fiber-based packaging, International Paper provides a broad array of corrugated packaging solutions essential for protecting goods during transit.

- Storopack Hans Reichenecker GmbH: Specializing in protective packaging systems, Storopack offers solutions for cushioning, void fill, and temperature protection, serving various industrial and e-commerce needs.

- Intertape Polymer Group Inc: A manufacturer of specialty tape and protective packaging solutions, IPG caters to diverse market needs, including industrial, commercial, and retail applications.

- Sealed Air Corporation: A global leader in protective packaging, food packaging, and facility hygiene solutions, Sealed Air offers innovative materials and systems to safeguard products and reduce waste.

Significant Latin America Protective Packaging Market Industry Milestones

- 2022-Q3: Sealed Air Corporation launched a new range of sustainable packaging solutions for the e-commerce sector in Brazil.

- 2021-Q4: Smurfit Kappa Group invested in a new recycling plant in Mexico to support its sustainable packaging initiatives.

- 2020-Q1: Sonoco Products Company expanded its distribution network in Argentina to enhance market reach. (Further milestones require specific data.)

Future Outlook for Latin America Protective Packaging Market

The Latin America protective packaging market is poised for sustained and robust growth, largely propelled by the continued exponential expansion of e-commerce and the persistent rise in consumer demand for quality and convenience across diverse product categories. A pivotal factor shaping this future is the escalating global and regional emphasis on sustainability. This is driving a significant shift towards the development and adoption of eco-friendly packaging solutions, including recyclable, biodegradable, and compostable materials. Strategic opportunities abound for companies that can innovate in these areas, creating tailored packaging solutions that not only protect goods effectively but also align with evolving environmental regulations and consumer preferences. The market presents substantial potential for both established global players seeking to expand their footprint and agile new entrants capable of swiftly adapting to market demands and technological advancements. Navigating the complexities of regional economic variances, regulatory landscapes, and the ongoing competitive pressures will be crucial for achieving success in this dynamic and promising market.

Latin America Protective Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastics

- 1.2. Paper and Paperboard

- 1.3. Other Material Types

-

2. Product Type

-

2.1. Rigid

- 2.1.1. Molded Pulp

- 2.1.2. Paperboard-based Protectors

- 2.1.3. Insulated Shipping Containers

-

2.2. Flexibles (Mailers, Paper Full, and Air Pillows)

- 2.2.1. Bubble Wraps

- 2.3. Foam Based

-

2.1. Rigid

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Pharmaceutical

- 3.3. Consumer Electronics

- 3.4. Beauty and Homecare

- 3.5. Other End-user Verticals

Latin America Protective Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Protective Packaging Market Regional Market Share

Geographic Coverage of Latin America Protective Packaging Market

Latin America Protective Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Trend of E-Commerce

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Protective Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.2. Paper and Paperboard

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid

- 5.2.1.1. Molded Pulp

- 5.2.1.2. Paperboard-based Protectors

- 5.2.1.3. Insulated Shipping Containers

- 5.2.2. Flexibles (Mailers, Paper Full, and Air Pillows)

- 5.2.2.1. Bubble Wraps

- 5.2.3. Foam Based

- 5.2.1. Rigid

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Pharmaceutical

- 5.3.3. Consumer Electronics

- 5.3.4. Beauty and Homecare

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smurfit Kappa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crown Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Paper Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Storopack Hans Reichenecker Gmb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Intertape Polymer Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Latin America Protective Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Protective Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Protective Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Latin America Protective Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Protective Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Latin America Protective Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Protective Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Latin America Protective Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Latin America Protective Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Latin America Protective Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Protective Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Protective Packaging Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Latin America Protective Packaging Market?

Key companies in the market include Sonoco Products Company, Smurfit Kappa Group, Crown Holdings Inc, Huhtamaki Group, International Paper Company, Storopack Hans Reichenecker Gmb, Intertape Polymer Group Inc, Sealed Air Corporation.

3. What are the main segments of the Latin America Protective Packaging Market?

The market segments include Material Type, Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Trend of E-Commerce.

6. What are the notable trends driving market growth?

Food and Beverage Industry to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Protective Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Protective Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Protective Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Protective Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence