Key Insights

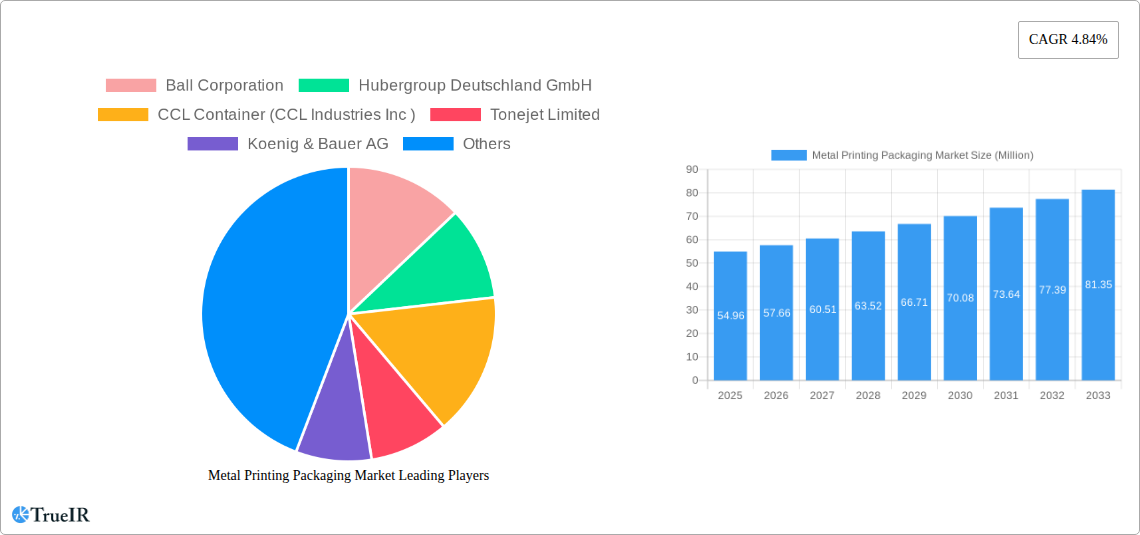

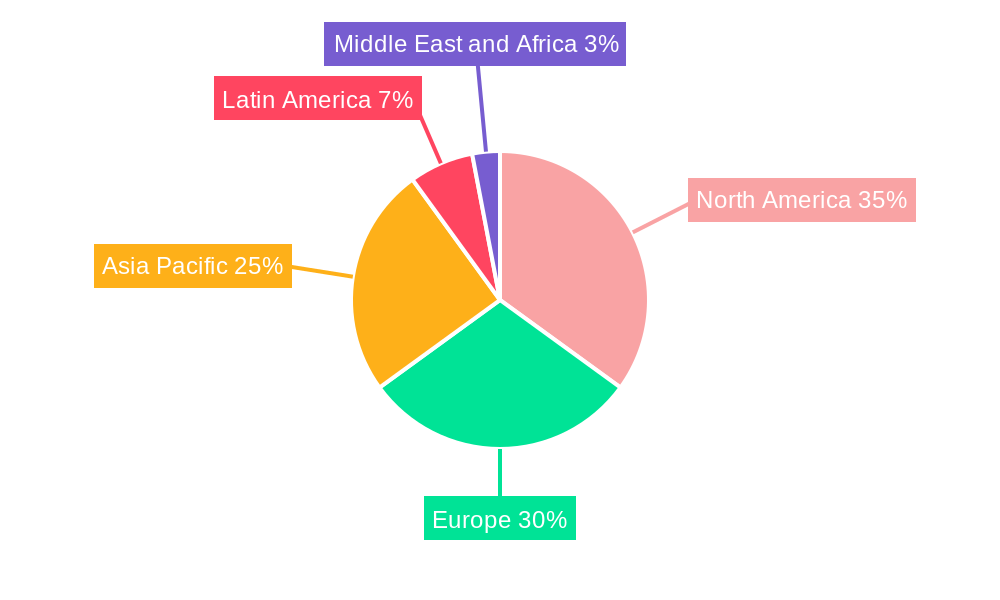

The Metal Printing Packaging Market, valued at $54.96 million in 2025, is projected to experience robust growth, driven by the increasing demand for aesthetically appealing and durable packaging solutions across diverse industries like food and beverages, personal care, and pharmaceuticals. The market's Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. The rising preference for sustainable and recyclable packaging options is significantly impacting market growth, prompting manufacturers to adopt eco-friendly printing processes and materials. Furthermore, advancements in digital printing technologies are offering greater customization and cost-effectiveness, attracting a wider range of businesses. Offset lithography currently dominates the printing process segment, but flexography and digital printing are expected to witness considerable growth due to their versatility and ability to meet evolving consumer demands. Major players like Ball Corporation, Crown Holdings Inc., and CCL Container are shaping the competitive landscape through strategic partnerships, acquisitions, and technological innovations. Regional analysis suggests a strong presence in North America and Europe, with the Asia-Pacific region expected to exhibit significant growth potential due to its expanding consumer base and industrialization. However, factors such as fluctuating raw material prices and stringent environmental regulations pose challenges to market expansion.

Metal Printing Packaging Market Market Size (In Million)

The forecast period (2025-2033) will see a dynamic shift in market shares among printing processes. While offset lithography retains a significant share, the adoption of digital printing, driven by its speed and customization options, is likely to increase steadily. The market's growth trajectory will be influenced by the evolving consumer preferences towards sustainable and personalized packaging, necessitating innovative solutions from packaging manufacturers. Companies are focusing on enhancing their production capabilities to meet the growing demand while simultaneously addressing concerns related to environmental sustainability. The regional distribution of the market is anticipated to remain somewhat concentrated in developed economies initially, but growth in emerging economies will progressively alter this landscape in the long-term, particularly within the Asia-Pacific region.

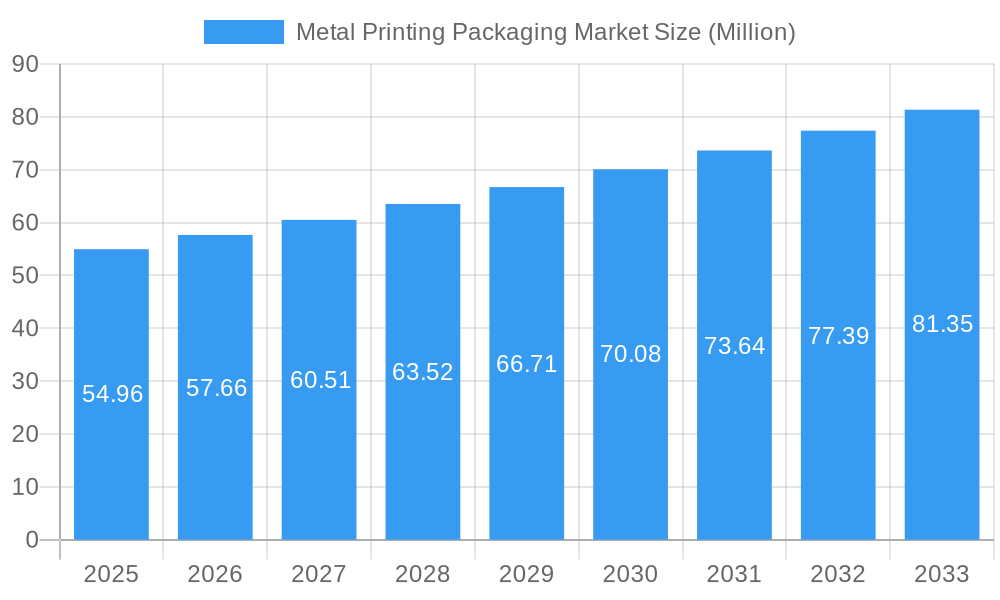

Metal Printing Packaging Market Company Market Share

Metal Printing Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Metal Printing Packaging Market, offering invaluable insights for businesses and investors seeking to navigate this evolving landscape. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive research and data analysis to forecast market trends and opportunities from 2025-2033. This in-depth analysis incorporates key market drivers, challenges, and competitive dynamics, empowering stakeholders with strategic decision-making capabilities. The global market size is projected to reach xx Million by 2033.

Metal Printing Packaging Market Structure & Competitive Landscape

The Metal Printing Packaging market exhibits a moderately consolidated structure, with several key players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation in printing technologies, particularly in digital printing, is a major driver, pushing companies to enhance product offerings and cater to evolving customer preferences. Stringent environmental regulations are impacting packaging choices, favoring sustainable metal packaging solutions. Metal packaging faces competition from alternative materials such as plastic and paperboard, necessitating continuous innovation to maintain market position. The market is segmented by end-user industries, including food & beverage, personal care, and pharmaceuticals, each with specific packaging needs. Mergers and acquisitions (M&A) activity within the sector has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, driven by strategic expansion and consolidation efforts.

- Market Concentration: Moderately consolidated, HHI of xx in 2024.

- Innovation Drivers: Digital printing technologies, sustainable packaging solutions.

- Regulatory Impacts: Emphasis on sustainability and recyclability.

- Product Substitutes: Plastic and paperboard packaging.

- End-User Segmentation: Food & beverage, personal care, pharmaceuticals, etc.

- M&A Trends: Approximately xx deals between 2019 and 2024.

Metal Printing Packaging Market Trends & Opportunities

The Metal Printing Packaging Market is experiencing robust growth, fueled by several key factors. The market size registered xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, particularly in digital printing, are driving efficiency gains and enabling customization. Consumer preferences are shifting towards sustainable and eco-friendly packaging, creating opportunities for metal packaging due to its recyclability. Intense competition among established players and new entrants is stimulating innovation and driving down costs. The market penetration rate for metal printing packaging in the food and beverage sector is estimated at xx% in 2024 and is expected to reach xx% by 2033. The growing demand for convenient and aesthetically appealing packaging is another key driver, prompting companies to invest in advanced printing technologies and innovative designs.

Dominant Markets & Segments in Metal Printing Packaging Market

The global Metal Printing Packaging Market is currently characterized by a strong presence in North America, with Europe and Asia-Pacific closely following. This regional dominance is largely attributed to established industrial bases and significant consumer demand within these areas. Within the printing processes segment, offset lithography continues to command the largest market share. Its enduring appeal stems from a compelling combination of cost-effectiveness for high-volume production and exceptional versatility across a wide range of packaging applications. However, the landscape is rapidly evolving with the substantial growth witnessed in digital printing. This surge is fueled by its unparalleled customization capabilities, enabling brands to cater to niche markets and personalize offerings, alongside significantly reduced lead times, which are crucial for agile product launches and promotional campaigns.

- Key Growth Drivers (North America): A robust and continuously expanding food & beverage industry remains a cornerstone. Additionally, increasingly stringent environmental regulations are pushing for more sustainable packaging solutions, and ongoing technological advancements in printing and material science are enabling innovation.

- Key Growth Drivers (Europe): Europe is witnessing a growing demand for sustainable and circular economy-aligned packaging. The presence of major global packaging companies and a strong consumer consciousness regarding environmental impact are significant drivers.

- Key Growth Drivers (Offset Lithography): Its inherent cost-effectiveness for large print runs, remarkable versatility in handling various finishes and materials, and a well-established infrastructure and skilled workforce continue to solidify its position.

- Key Growth Drivers (Digital Printing): The unparalleled ability to offer high levels of customization, significantly shorter lead times for shorter runs, and the increasing consumer demand for personalized and limited-edition packaging are propelling its adoption.

Metal Printing Packaging Market Product Analysis

Metal printing packaging encompasses a range of products, including cans, bottles, and other containers, each with unique applications. Technological advancements, such as high-definition printing and specialized coatings, are enhancing the aesthetic appeal and functionality of these products. Metal packaging offers advantages such as durability, recyclability, and barrier properties, making it a preferred choice for various industries. The integration of smart packaging features, enabled by advancements in digital printing and sensor technology, is also creating new market opportunities.

Key Drivers, Barriers & Challenges in Metal Printing Packaging Market

Key Drivers:

- Growing demand for sustainable packaging solutions

- Technological advancements in printing and manufacturing processes

- Increasing preference for aesthetically appealing and customized packaging

- Expanding food and beverage industry

Challenges:

- Fluctuating raw material prices (e.g., aluminum)

- Stringent environmental regulations and compliance costs

- Competition from alternative packaging materials (plastic, paperboard)

- Supply chain disruptions and logistical challenges

Growth Drivers in the Metal Printing Packaging Market

The Metal Printing Packaging Market is experiencing robust growth, primarily propelled by a global shift towards sustainable and eco-friendly packaging solutions. Consumers and regulatory bodies alike are increasingly favoring materials with a lower environmental footprint. Complementing this, significant advancements in technological innovation, particularly in the realm of digital printing and advancements in the sustainability of manufacturing processes, are reshaping the market. Economic expansion, especially within emerging markets, is creating new avenues for demand. Furthermore, favorable government regulations that actively promote sustainable practices and incentivize the use of recyclable and reusable materials are playing a crucial role in steering the market's trajectory.

Challenges Impacting Metal Printing Packaging Market Growth

Despite its positive outlook, the Metal Printing Packaging Market faces several significant hurdles. The volatility of raw material prices, particularly for metals like aluminum and tinplate, can lead to unpredictable production costs and impact profitability. Furthermore, stringent environmental regulations, while driving sustainability, can also increase compliance costs and necessitate investments in new technologies or processes. Intense competition from cheaper, less sustainable alternatives, such as certain plastics, poses a constant challenge. Moreover, supply chain disruptions, exacerbated by global events, and inherent logistical complexities in transporting heavy and sometimes bulky metal packaging, can lead to operational difficulties and impact timely delivery.

Key Players Shaping the Metal Printing Packaging Market

- Ball Corporation

- Hubergroup Deutschland GmbH

- CCL Container (CCL Industries Inc)

- Tonejet Limited

- Koenig & Bauer AG

- Crown Holdings Inc

- Envases Metalurgicos de Alava SA

- Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd)

Significant Metal Printing Packaging Market Industry Milestones

- May 2021: Ball Corporation launched its Ball Aluminum Cup, promoting sustainability and reducing plastic waste.

- March 2020: Bierland partnered with Crown Holdings Inc. to switch to metal can packaging.

Future Outlook for Metal Printing Packaging Market

The Metal Printing Packaging Market is confidently poised for continued and accelerated growth. This trajectory is underpinned by a confluence of factors: a persistent and increasing demand for sustainable and aesthetically appealing packaging solutions, ongoing technological advancements that enhance functionality and design, and sustained economic expansion globally. Strategic opportunities abound for market players, particularly in the development of innovative printing technologies that offer enhanced durability, visual impact, and environmental benefits. Further opportunities lie in refining product design to optimize material usage and recyclability, and strategically expanding into new and emerging markets where the demand for premium and sustainable packaging is on the rise. The market's future potential is substantial, driven by evolving consumer preferences for responsible consumption and a definitive industry-wide trend towards environmentally conscious packaging.

Metal Printing Packaging Market Segmentation

-

1. Printing Process

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Digital

- 1.5. Other Printing Technologies

Metal Printing Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Metal Printing Packaging Market Regional Market Share

Geographic Coverage of Metal Printing Packaging Market

Metal Printing Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Evolution of Digital Print Technology

- 3.3. Market Restrains

- 3.3.1. Monitoring issues and lack of standardization

- 3.4. Market Trends

- 3.4.1. Offset Lithography is Expected to Hold a Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Digital

- 5.1.5. Other Printing Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 6. North America Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 6.1.1. Offset Lithography

- 6.1.2. Gravure

- 6.1.3. Flexography

- 6.1.4. Digital

- 6.1.5. Other Printing Technologies

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 7. Europe Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 7.1.1. Offset Lithography

- 7.1.2. Gravure

- 7.1.3. Flexography

- 7.1.4. Digital

- 7.1.5. Other Printing Technologies

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 8. Asia Pacific Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 8.1.1. Offset Lithography

- 8.1.2. Gravure

- 8.1.3. Flexography

- 8.1.4. Digital

- 8.1.5. Other Printing Technologies

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 9. Latin America Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 9.1.1. Offset Lithography

- 9.1.2. Gravure

- 9.1.3. Flexography

- 9.1.4. Digital

- 9.1.5. Other Printing Technologies

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 10. Middle East and Africa Metal Printing Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 10.1.1. Offset Lithography

- 10.1.2. Gravure

- 10.1.3. Flexography

- 10.1.4. Digital

- 10.1.5. Other Printing Technologies

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ball Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hubergroup Deutschland GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CCL Container (CCL Industries Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tonejet Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koenig & Bauer AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crown Holdings Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Envases Metalurgicos de Alava SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Ball Corporation

List of Figures

- Figure 1: Global Metal Printing Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 3: North America Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 4: North America Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 7: Europe Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 8: Europe Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 11: Asia Pacific Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 12: Asia Pacific Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 15: Latin America Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 16: Latin America Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Metal Printing Packaging Market Revenue (Million), by Printing Process 2025 & 2033

- Figure 19: Middle East and Africa Metal Printing Packaging Market Revenue Share (%), by Printing Process 2025 & 2033

- Figure 20: Middle East and Africa Metal Printing Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Metal Printing Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 2: Global Metal Printing Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 4: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 6: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 8: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 10: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Metal Printing Packaging Market Revenue Million Forecast, by Printing Process 2020 & 2033

- Table 12: Global Metal Printing Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Printing Packaging Market?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Metal Printing Packaging Market?

Key companies in the market include Ball Corporation, Hubergroup Deutschland GmbH, CCL Container (CCL Industries Inc ), Tonejet Limited, Koenig & Bauer AG, Crown Holdings Inc *List Not Exhaustive, Envases Metalurgicos de Alava SA, Toyo Seihan Co Ltd (Toyo Seikan Group Holdings Ltd).

3. What are the main segments of the Metal Printing Packaging Market?

The market segments include Printing Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Evolution of Digital Print Technology.

6. What are the notable trends driving market growth?

Offset Lithography is Expected to Hold a Significant Market Growth.

7. Are there any restraints impacting market growth?

Monitoring issues and lack of standardization.

8. Can you provide examples of recent developments in the market?

May 2021 - Ball Corporation launched a first-of-its-kind Ball Aluminum Cup that has the potential to advance sustainability and reduce plastic waste at gatherings irrespective of big and small. It will be available for purchase at major retailers in all 50 states across the U.S. Between May and June; the cups will be available for the first time in more than 18,000 food, drug, and mass retailers, including Kroger, Target, Albertsons, CVS, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Printing Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Printing Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Printing Packaging Market?

To stay informed about further developments, trends, and reports in the Metal Printing Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence