Key Insights

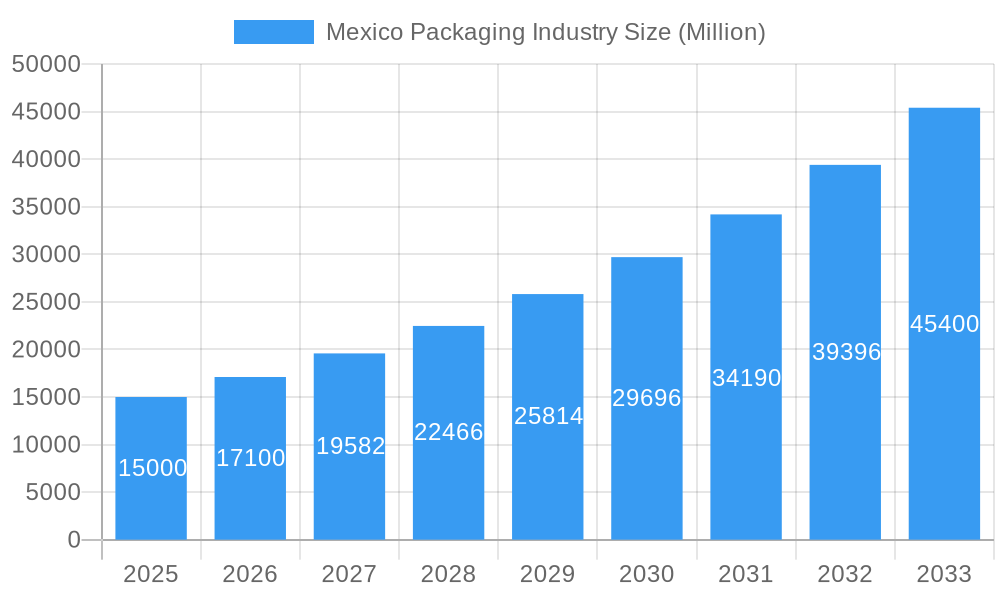

The Mexico packaging industry is projected for significant expansion, driven by a growing consumer base, a thriving e-commerce sector, and increasing demand for convenient and sustainable packaging solutions. The market is expected to maintain a robust Compound Annual Growth Rate (CAGR) of 8.57%. Key growth catalysts include the rising consumption of packaged food and beverages, advancements in the pharmaceutical and personal care sectors, and the adoption of sophisticated packaging technologies to extend product shelf life and enhance appeal. Flexible packaging is forecast to lead market share due to its cost-effectiveness and versatility, followed by rigid packaging, particularly for personal care and pharmaceutical applications. While plastics remain dominant, environmental concerns are accelerating the adoption of sustainable alternatives such as recycled and biodegradable materials. However, raw material price volatility and strict government regulations on packaging waste may pose challenges. Major industry participants, including Amcor PLC and Mondi PLC, are prioritizing research and development for innovative, eco-friendly packaging to align with evolving consumer preferences and regulatory requirements. Regional market concentration reflects Mexico's strong economic performance and expanding industrial infrastructure.

Mexico Packaging Industry Market Size (In Billion)

This dynamic market offers substantial opportunities for both established companies and new entrants. The emphasis on sustainable packaging creates a promising avenue for businesses providing eco-conscious solutions. Furthermore, enhanced automation and technological progress in packaging production are optimizing operations and improving efficiency, leading to cost savings. The continuous growth of e-commerce mandates the use of durable and protective packaging materials, further stimulating demand. Intense competition from domestic and international players necessitates strategic alliances, mergers, acquisitions, and product diversification for sustained growth and competitive advantage. Companies are also focusing on optimizing supply chains and leveraging data analytics to accurately interpret market trends and consumer demands.

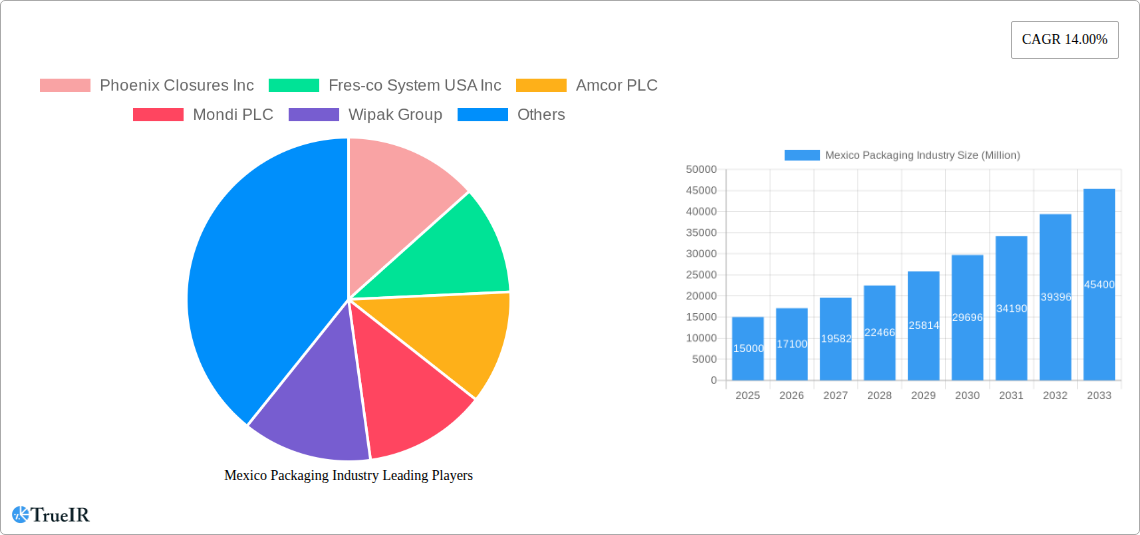

Mexico Packaging Industry Company Market Share

Mexico Packaging Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Mexico packaging industry, offering invaluable insights for businesses, investors, and stakeholders. Leveraging extensive market research and data, this report covers market size, segmentation, key players, growth drivers, challenges, and future outlook for the period 2019-2033. With a focus on high-impact keywords, this report ensures maximum visibility and relevance for industry professionals.

Mexico Packaging Industry Market Structure & Competitive Landscape

The Mexico packaging market exhibits a moderately concentrated structure, with several large multinational corporations and a number of smaller domestic players. The market is characterized by intense competition, driven by innovation, evolving consumer preferences, and increasing regulatory scrutiny. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated landscape. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total transaction value of approximately USD xx Million during the period 2019-2024. Key drivers for innovation include the increasing demand for sustainable packaging solutions, the growing popularity of e-commerce, and the need for enhanced product protection. Regulatory impacts stem from environmental regulations aimed at reducing plastic waste and promoting recycling, alongside labeling requirements for food and beverage packaging. Product substitutes, such as biodegradable and compostable packaging materials, are gaining traction, although their market penetration remains relatively limited. The end-user segmentation is diverse, with significant contributions from the food and beverage, personal care, pharmaceutical, and automotive sectors.

- Market Concentration: Moderately Concentrated (HHI: xx)

- M&A Activity (2019-2024): USD xx Million

- Key Innovation Drivers: Sustainability, E-commerce, Product Protection

- Regulatory Impacts: Environmental regulations, labeling requirements

- Product Substitutes: Biodegradable and compostable packaging

- End-user Segmentation: Food & Beverage, Personal Care, Pharmaceutical, Automotive, others

Mexico Packaging Industry Market Trends & Opportunities

The Mexico packaging market is experiencing robust growth, driven by expanding consumer base, increasing disposable incomes, and a burgeoning e-commerce sector. The market size is estimated at USD xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the adoption of lightweighting and smart packaging technologies, are transforming the industry. Consumer preferences are shifting towards sustainable and convenient packaging solutions, creating opportunities for eco-friendly packaging materials and innovative designs. Competitive dynamics are shaped by price competition, product differentiation, and the ongoing consolidation within the industry. Market penetration of sustainable packaging solutions remains relatively low, but is projected to experience significant growth in the coming years, driven by increased consumer awareness and stringent government regulations.

Dominant Markets & Segments in Mexico Packaging Industry

The food and beverage sector is the dominant end-user vertical in the Mexico packaging market, accounting for approximately xx% of total market value in 2025. Within packaging materials, plastics hold the largest share, followed by paper and cardboard. Flexible packaging is the most widely used packaging type, driven by its versatility and cost-effectiveness. The Northern region of Mexico demonstrates robust growth due to the presence of established manufacturing industries and a strong logistics network.

- Dominant End-user Vertical: Food and Beverage (xx%)

- Dominant Packaging Material: Plastics

- Dominant Packaging Type: Flexible Packaging

- Fastest Growing Region: Northern Mexico

Key Growth Drivers:

- Increasing consumer spending in food & beverage

- Robust growth of e-commerce requiring enhanced packaging

- Expansion of the manufacturing sector

- Government initiatives promoting sustainable packaging

Mexico Packaging Industry Product Analysis

Significant innovations in Mexico's packaging industry are focused on sustainability, enhanced barrier properties, and improved convenience. Advancements in materials science are leading to the development of lighter-weight, recyclable, and compostable packaging options. The introduction of smart packaging technologies, such as integrated sensors and RFID tags, is improving traceability and product safety. These advancements address consumer demand for environmentally friendly and convenient packaging solutions, enhancing the competitiveness of Mexican packaging companies in both domestic and international markets.

Key Drivers, Barriers & Challenges in Mexico Packaging Industry

Key Drivers:

- Rising demand across various end-use sectors.

- Increased adoption of sustainable packaging options.

- Technological advancements in packaging materials and processes.

- Government support for the development of the packaging industry.

Challenges:

- Fluctuations in raw material prices.

- Intense competition from both domestic and international players.

- Stringent environmental regulations and compliance costs.

- Supply chain disruptions impacting timely delivery of packaging materials. These disruptions resulted in a xx% increase in packaging costs in 2022.

Growth Drivers in the Mexico Packaging Industry Market

The Mexican packaging industry's growth is fueled by a rising middle class, increased consumption, and the expanding food and beverage sector. E-commerce boom is also a significant driver, necessitating innovative packaging solutions. Government initiatives towards sustainable practices are encouraging eco-friendly alternatives. Technological improvements in barrier properties and lightweighting further boost the market.

Challenges Impacting Mexico Packaging Industry Growth

Raw material price volatility, stringent environmental regulations, and intense competition represent major challenges. Supply chain disruptions cause delays and increase costs. The need to adapt quickly to changing consumer preferences regarding sustainability adds pressure.

Key Players Shaping the Mexico Packaging Industry Market

- Phoenix Closures Inc

- Fres-co System USA Inc

- Amcor PLC

- Mondi PLC

- Wipak Group

- Constantia Flexibles Group

- Glenroy Inc

- Printpack Inc

- Belmark Inc

- JL Packaging Corporation

- Innovia Films Mexico S A de C V

- Sit Group SpA

Significant Mexico Packaging Industry Industry Milestones

- September 2022: Amcor Rigid Packaging launched the DairySeal line with ClearCor PET barrier technology, enhancing recyclability and performance.

- June 2022: Smurfit Kappa invested USD 23.5 Million in its Nuevo Laredo plant, doubling production and reducing CO2 emissions by up to 40%.

Future Outlook for Mexico Packaging Industry Market

The Mexico packaging market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and supportive government policies. Strategic investments in sustainable packaging solutions and expansion into e-commerce present significant opportunities for market players. The market is expected to maintain a healthy growth trajectory, driven by increased demand from diverse sectors and ongoing innovation.

Mexico Packaging Industry Segmentation

-

1. Packaging Material

- 1.1. Plastics

- 1.2. Metal

- 1.3. Glass

- 1.4. Other Packaging Material

-

2. Packaging Type

-

2.1. Flexible Packaging

- 2.1.1. Pouches & Bags

- 2.1.2. Films and wraps

- 2.1.3. Tubes

-

2.2. Rigid Packaging

- 2.2.1. Bottles and Jars

- 2.2.2. Trays and Containers

- 2.2.3. Other Rigid Packaging Types

-

2.1. Flexible Packaging

-

3. End-user Vertical

- 3.1. Personal Care

- 3.2. Home Care

- 3.3. Automotive

- 3.4. Pharmaceutical

- 3.5. Food and Beverage

- 3.6. Other End-user Verticals

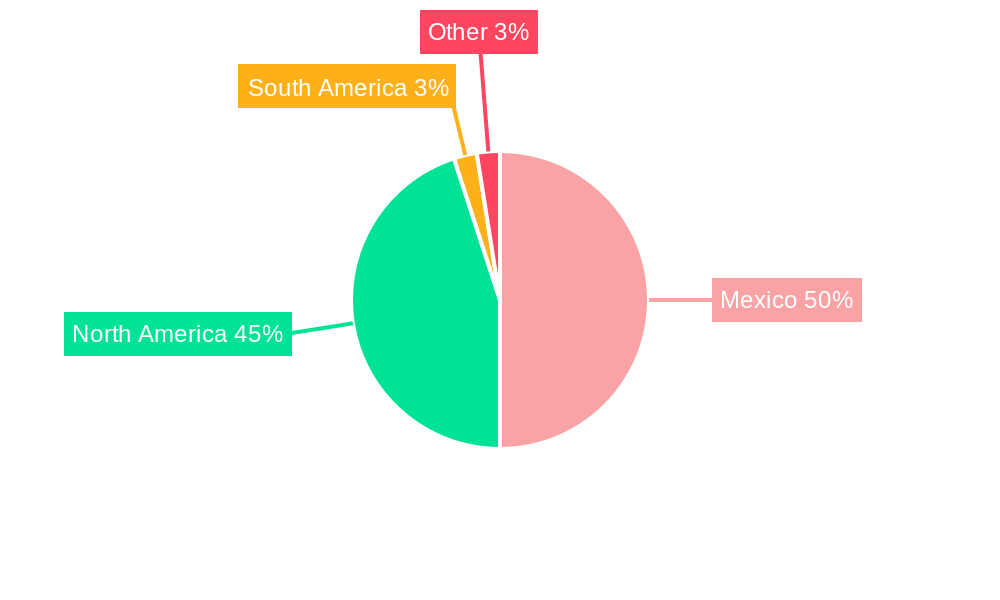

Mexico Packaging Industry Segmentation By Geography

- 1. Mexico

Mexico Packaging Industry Regional Market Share

Geographic Coverage of Mexico Packaging Industry

Mexico Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Product Shelf Life and Changing Lifestyle of People; New Innovative Products

- 3.3. Market Restrains

- 3.3.1. Concerns about the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. Plastics to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Plastics

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Other Packaging Material

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Flexible Packaging

- 5.2.1.1. Pouches & Bags

- 5.2.1.2. Films and wraps

- 5.2.1.3. Tubes

- 5.2.2. Rigid Packaging

- 5.2.2.1. Bottles and Jars

- 5.2.2.2. Trays and Containers

- 5.2.2.3. Other Rigid Packaging Types

- 5.2.1. Flexible Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Personal Care

- 5.3.2. Home Care

- 5.3.3. Automotive

- 5.3.4. Pharmaceutical

- 5.3.5. Food and Beverage

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phoenix Closures Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fres-co System USA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wipak Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constantia Flexibles Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glenroy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Printpack Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belmark Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JL Packaging Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Innovia Films Mexico S A de C V *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sit Group SpA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Phoenix Closures Inc

List of Figures

- Figure 1: Mexico Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Packaging Industry Revenue billion Forecast, by Packaging Material 2020 & 2033

- Table 2: Mexico Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Mexico Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Mexico Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Mexico Packaging Industry Revenue billion Forecast, by Packaging Material 2020 & 2033

- Table 6: Mexico Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Mexico Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Mexico Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Packaging Industry?

The projected CAGR is approximately 8.57%.

2. Which companies are prominent players in the Mexico Packaging Industry?

Key companies in the market include Phoenix Closures Inc, Fres-co System USA Inc, Amcor PLC, Mondi PLC, Wipak Group, Constantia Flexibles Group, Glenroy Inc, Printpack Inc, Belmark Inc, JL Packaging Corporation, Innovia Films Mexico S A de C V *List Not Exhaustive, Sit Group SpA.

3. What are the main segments of the Mexico Packaging Industry?

The market segments include Packaging Material, Packaging Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Longer Product Shelf Life and Changing Lifestyle of People; New Innovative Products.

6. What are the notable trends driving market growth?

Plastics to Drive the Market.

7. Are there any restraints impacting market growth?

Concerns about the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

September 2022: Amcor Rigid Packaging introduced the DairySeal line of packaging that features ClearCor, an advanced PET barrier. The ClearCor PET barrier technology is a concentrated capsulation in the preform center that allows more flexibility and resin options. This technology positively impacts the overall performance of the barrier in the packaging and maintains recyclability. The DairySeal line of packaging can be made with up to 80 percent of recyclable material while maintaining superior taste and performance for the brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Packaging Industry?

To stay informed about further developments, trends, and reports in the Mexico Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence