Key Insights

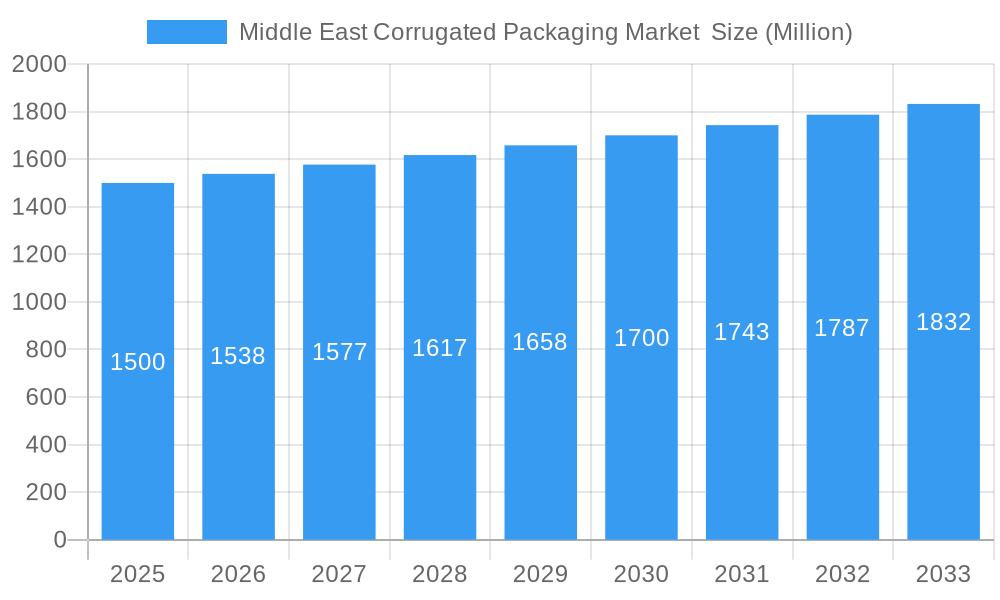

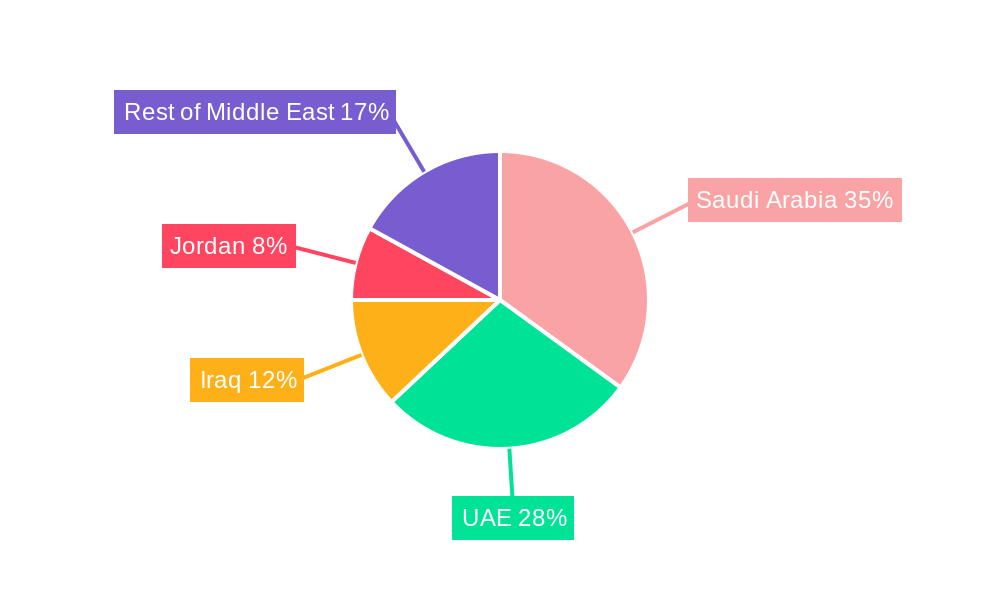

The Middle East corrugated packaging market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), is projected to experience steady growth at a 2.58% CAGR from 2025 to 2033. This growth is fueled by several key drivers, including the expanding food and beverage sector, the burgeoning e-commerce industry driving demand for efficient packaging solutions, and a rise in consumer packaged goods. The increasing preference for sustainable packaging materials is also influencing market dynamics, prompting manufacturers to explore eco-friendly options. Furthermore, the region's robust construction and infrastructure development further boosts demand for corrugated packaging in various applications like protecting construction materials during transit. Segmentation reveals significant contributions from slotted containers and die-cut containers within the "by type" category, while the food and beverage industries dominate the "by end-user" segment. Saudi Arabia and the UAE represent the largest national markets due to their relatively advanced economies and substantial consumer bases. However, growth in other markets like Iraq and Jordan are also anticipated as economies develop and consumer spending increases.

Middle East Corrugated Packaging Market Market Size (In Billion)

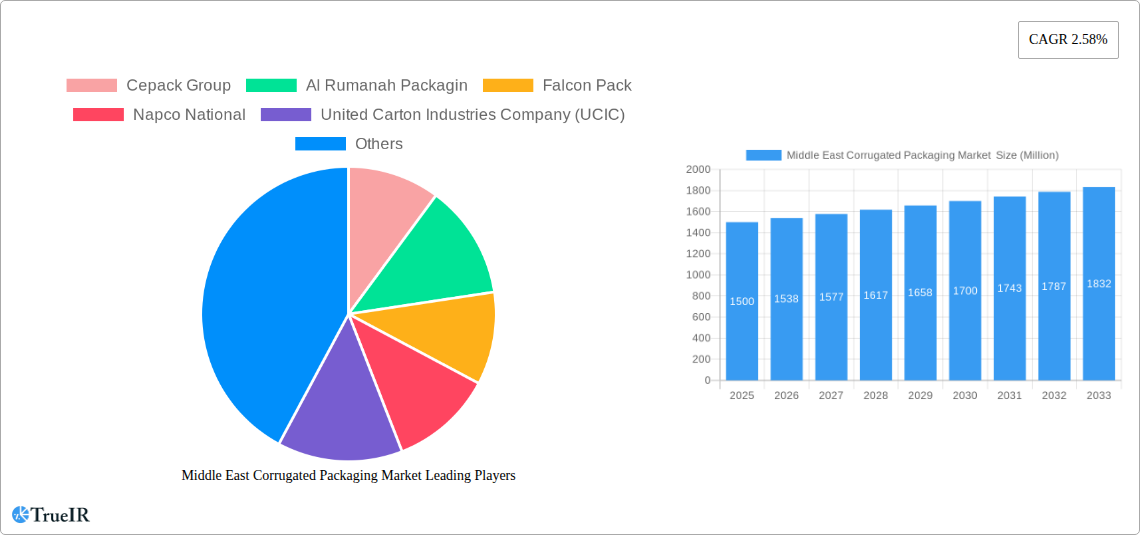

Competitive landscape analysis reveals a mix of both large multinational players like Cepack Group and regional companies like Al Rumanah Packaging. The market is characterized by a moderate level of competition, with companies focusing on product differentiation, cost-effectiveness, and customer service to maintain market share. Future market growth will likely be influenced by technological advancements, including automation in packaging production, along with an increasing emphasis on customization and improved supply chain efficiency. Furthermore, government initiatives promoting sustainable practices will likely shape the adoption of eco-friendly corrugated packaging materials and production methods. Challenges may include price fluctuations in raw materials, such as cardboard, and maintaining sufficient supply chain infrastructure to meet growing demands in diverse markets.

Middle East Corrugated Packaging Market Company Market Share

Middle East Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Middle East corrugated packaging market, offering invaluable insights for industry stakeholders. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your definitive guide to understanding the market's current state, future trends, and key players. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

Middle East Corrugated Packaging Market Structure & Competitive Landscape

The Middle East corrugated packaging market exhibits a moderately concentrated structure, with several major players controlling a significant share. The market's competitive landscape is shaped by factors such as innovation, regulatory changes, and the availability of substitute materials. The market is experiencing a wave of mergers and acquisitions (M&A), reflecting industry consolidation and a push for enhanced market share. The total M&A volume in the period 2019-2024 is estimated at xx Million.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Growing demand for sustainable packaging solutions and advancements in automation are key drivers of innovation.

- Regulatory Impacts: Government regulations concerning packaging waste management and sustainability are influencing market dynamics.

- Product Substitutes: Plastic and other packaging materials are posing some competitive pressure.

- End-User Segmentation: The market is segmented by end-user industries including food, beverages, electrical goods, personal care, and household care, with the food and beverage sector dominating.

- M&A Trends: Strategic acquisitions, like Hotpack Global's acquisition of Al Huraiz Packaging Industry in 2022, are reshaping the competitive landscape.

Middle East Corrugated Packaging Market Trends & Opportunities

The Middle East corrugated packaging market is experiencing robust growth, driven by factors such as rising consumer spending, increasing demand for packaged goods, and economic growth in the region. Technological advancements, like the adoption of automated packaging lines, are enhancing efficiency and production capabilities. The market's CAGR during the forecast period (2025-2033) is projected to be xx%, reflecting a strong growth trajectory. Market penetration rates for various packaging types vary widely based on factors such as consumer preferences and cost. The market is expected to show increased demand for sustainable and eco-friendly solutions. Competitive dynamics are intense with players focusing on innovation, efficiency, and strategic partnerships.

Dominant Markets & Segments in Middle East Corrugated Packaging Market

The Middle East corrugated packaging market is experiencing robust growth, with Saudi Arabia and the United Arab Emirates (UAE) leading the charge as the dominant markets. These nations are followed closely by emerging hubs like Iraq and Jordan, each presenting unique growth opportunities. The market's segmentation by product type is largely dominated by slotted containers, a testament to their unparalleled versatility, cost-effectiveness, and wide-ranging applications across various industries. When considering end-users, the food and beverage industry continues to hold its position as the largest segment. This dominance is a direct reflection of the region's burgeoning population, evolving consumer lifestyles, and the increasing demand for convenient, safely packaged food and drink products.

- Key Growth Drivers in Saudi Arabia: The Kingdom's ambitious Vision 2030 initiatives are a major catalyst, fostering extensive infrastructure development. Significant investments in the food and beverage industry, coupled with government-led campaigns championing sustainable packaging solutions, are further propelling growth.

- Key Growth Drivers in the UAE: The UAE's position as a global e-commerce hub is a significant driver, with the flourishing e-commerce sector demanding efficient and protective packaging. The nation's vibrant and expanding tourism industry also contributes, as does the presence of consumers with high disposable incomes, driving demand for premium and innovative packaging.

- Key Growth Drivers in Iraq: Iraq's market is primarily fueled by a rapidly growing population, which naturally increases the demand for consumer goods and, consequently, packaging. The ongoing improvement in economic conditions and reconstruction efforts are also contributing to market expansion.

- Key Growth Drivers in Jordan: Jordan's growth is being stimulated by a strategic focus on expanding its food processing and manufacturing industries. This includes a push for greater export capabilities, necessitating higher quality and more specialized corrugated packaging.

By Type:

- Slotted Containers: These remain the workhorse of the industry, prized for their high versatility and affordability, making them suitable for a vast array of products.

- Die Cut Containers: Catering to a more sophisticated market, this segment excels in offering sophisticated designs and bespoke features, often commanding premium pricing due to their specialized nature and enhanced branding potential.

- Five Panel Folder Boxes: Known for their easy assembly and attractive aesthetics, these boxes are witnessing increased end-user adoption, particularly in sectors where quick and appealing presentation is key.

- Other Types: While representing a smaller portion of the market, this segment is characterized by niche applications and emerging designs, indicating steady growth potential as specialized needs arise.

By End User:

- Food: This segment consistently leads, driven by the fundamental and high demand for packaged food across the region.

- Beverages: The robust and ever-growing demand for packaged beverages, from water and juices to carbonated drinks and specialty concoctions, strongly supports market growth.

- Electrical Goods: The inherent need for robust and protective packaging for sensitive electronics and appliances ensures sustained demand within this segment.

- Personal Care and Household Care: As consumer spending on packaged personal and household products rises, driven by convenience and evolving lifestyles, this segment's value continues to increase significantly.

- Other End Users: This broad segment encompasses diverse industries such as pharmaceuticals, automotive parts, and textiles, all exhibiting steady growth potential as their packaging needs evolve.

Middle East Corrugated Packaging Market Product Analysis

The Middle East corrugated packaging market is in a phase of dynamic innovation, with a strong emphasis on sustainability and eco-friendliness. Manufacturers are actively introducing solutions that incorporate recycled content, biodegradable materials, and advanced, low-VOC printing technologies. These innovations are not just about environmental responsibility; they are strategically designed to improve product appeal on shelves, enhance product shelf life through better protective qualities, and offer improved recyclability and compostability options, aligning with both consumer preferences and regulatory trends. Furthermore, the market is witnessing a significant integration of automation and digital printing technologies. These advancements are revolutionizing production by enhancing efficiency, reducing lead times, and offering unprecedented levels of customization and personalization. This shift is paving the way for a greater emphasis on value-added services and bespoke packaging solutions, meticulously tailored to meet the unique and evolving requirements of specific clients.

Key Drivers, Barriers & Challenges in Middle East Corrugated Packaging Market

Key Drivers:

- Robust Population Growth and Urbanization: The region's expanding populace and increasing concentration in urban centers directly translate to a higher demand for packaged goods across all consumer categories.

- E-commerce and Online Retail Surge: The rapid expansion of e-commerce platforms and online retail necessitates efficient, durable, and cost-effective packaging solutions to ensure product integrity during transit and delivery.

- Significant Investments in Food and Beverage Manufacturing: Increased investments in local food and beverage production facilities create a sustained demand for packaging materials to support production and distribution.

- Growing Emphasis on Sustainable and Eco-Friendly Packaging: Increasing consumer and regulatory pressure is driving demand for greener packaging alternatives, presenting opportunities for innovative companies.

Key Barriers & Challenges:

- Volatility in Raw Material Prices: Fluctuations in the global prices of essential raw materials, particularly paper pulp and energy, can significantly impact production costs and profitability margins for corrugated packaging manufacturers.

- Stringent Environmental Regulations and Compliance Costs: Evolving environmental regulations, while driving sustainability, can also lead to increased production costs associated with compliance, waste management, and material sourcing.

- Intense Market Competition: The Middle East corrugated packaging market is characterized by a competitive landscape, with both established global players and agile regional entrants vying for market share, leading to price pressures and the need for continuous innovation.

- Supply Chain Disruptions: Geopolitical factors, logistics challenges, and global economic uncertainties can disrupt supply chains, affecting the availability and cost of raw materials and the timely delivery of finished products.

Growth Drivers in the Middle East Corrugated Packaging Market Market

Several factors are driving market expansion, including rising consumer demand, industrial growth, and government support for sustainable packaging initiatives. The strong growth of the e-commerce sector and food processing industries are key contributors to market expansion. Technological advancements and innovations in packaging designs are also fueling the market's progress.

Challenges Impacting Middle East Corrugated Packaging Market Growth

The market faces challenges such as fluctuations in raw material costs and increasing environmental regulations. Competition from alternative packaging materials and supply chain disruptions also pose potential risks. Maintaining quality control while managing rising labor costs and energy prices are constant concerns for industry players.

Key Players Shaping the Middle East Corrugated Packaging Market Market

- Cepack Group

- Al Rumanah Packaging

- Falcon Pack

- Napco National

- United Carton Industries Company (UCIC)

- Unipack Containers & Carton Products LLC

- Universal Carton Industries Group

- Tarboosh Packaging Co LLC

- World Pack Industries LLC

- Green Packaging Boxes Ind LLC

- Arabian Packaging Co LLC

- Queenex Corrugated Carton Factory

Significant Middle East Corrugated Packaging Market Industry Milestones

- October 2022: Hotpack Global strategically acquired Al Huraiz Packaging Industry (AHP), significantly bolstering its market presence and operational capabilities within the United Arab Emirates.

- June 2023: BOBST, a leading global manufacturer of machinery for the folding carton, corrugated board, and liquid packaging industries, enhanced its automation and digitalization offerings through the acquisition of Dücker Robotics, a specialist in robotic solutions for the corrugated sector. This move is expected to drive further innovation in automated packaging production.

- Ongoing Trend: Investment in Sustainable Technologies: Several key players are making substantial investments in upgrading their facilities to incorporate advanced recycling technologies and develop biodegradable packaging solutions, reflecting a broader industry commitment to environmental stewardship.

- Emergence of Smart Packaging Solutions: The market is witnessing early-stage development and adoption of smart packaging features, such as QR codes for traceability and anti-counterfeiting measures, particularly in the food and pharmaceutical sectors.

Future Outlook for Middle East Corrugated Packaging Market Market

The Middle East corrugated packaging market is poised for continued growth, driven by sustained economic expansion, evolving consumer preferences, and technological advancements in the sector. Opportunities exist for companies focusing on sustainable packaging solutions, automation, and customized packaging options. The market's strong fundamentals and positive growth outlook present significant investment potential for both existing and new market entrants.

Middle East Corrugated Packaging Market Segmentation

-

1. Type

- 1.1. Slotted Containers

- 1.2. Die Cut Containers

- 1.3. Five Panel Folder Boxes

- 1.4. Other Types

-

2. End User

- 2.1. Food

- 2.2. Beverages

- 2.3. Electrical Goods

- 2.4. Personal Care and Household Care

- 2.5. Other End Users

Middle East Corrugated Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Corrugated Packaging Market Regional Market Share

Geographic Coverage of Middle East Corrugated Packaging Market

Middle East Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-User Segments

- 3.3. Market Restrains

- 3.3.1. Concerns About Material Availability and Durability of Corrugated-Based Products

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Corrugated Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Slotted Containers

- 5.1.2. Die Cut Containers

- 5.1.3. Five Panel Folder Boxes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Electrical Goods

- 5.2.4. Personal Care and Household Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cepack Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Rumanah Packagin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Falcon Pack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco National

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Carton Industries Company (UCIC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unipack Containers & Carton Products LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Universal Carton Industries Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tarboosh Packaging Co LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 World Pack Industries LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Packaging Boxes Ind LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arabian Packaging Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Queenex Corrugated Carton Factory

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Cepack Group

List of Figures

- Figure 1: Middle East Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Corrugated Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East Corrugated Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Middle East Corrugated Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Corrugated Packaging Market ?

The projected CAGR is approximately 2.58%.

2. Which companies are prominent players in the Middle East Corrugated Packaging Market ?

Key companies in the market include Cepack Group, Al Rumanah Packagin, Falcon Pack, Napco National, United Carton Industries Company (UCIC), Unipack Containers & Carton Products LLC, Universal Carton Industries Group, Tarboosh Packaging Co LLC, World Pack Industries LLC, Green Packaging Boxes Ind LLC, Arabian Packaging Co LLC, Queenex Corrugated Carton Factory.

3. What are the main segments of the Middle East Corrugated Packaging Market ?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-User Segments.

6. What are the notable trends driving market growth?

Food Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Concerns About Material Availability and Durability of Corrugated-Based Products.

8. Can you provide examples of recent developments in the market?

June 2023 - BOBST announced its latest innovations to help converters and brand owners take a big step toward digitalizing the packaging supply chain. BOBST has strengthened its automation and connectivity streams by acquiring 70% of the equity of Dücker Robotics, one of the leaders in using robots in the corrugated board sector, while offering opportunities in the folding carton industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Corrugated Packaging Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Corrugated Packaging Market ?

To stay informed about further developments, trends, and reports in the Middle East Corrugated Packaging Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence