Key Insights

The North America Active and Intelligent Packaging market is projected for significant expansion, driven by consumer demand for extended shelf life, enhanced product safety, and superior brand experiences. The market is estimated to be worth $29 billion in 2025 and is forecast to grow at a compound annual growth rate (CAGR) of 9.4% from 2025 to 2033. Key growth drivers include the food and beverage sector's adoption of solutions to minimize waste and maintain freshness, aligning with sustainability goals and supply chain efficiency. The healthcare industry is also leveraging these technologies for advanced drug delivery, tamper-evident packaging, and improved patient safety. Innovations in sensor technology, material science, and printing are enabling more sophisticated and cost-effective solutions. Despite challenges such as high initial investment and regulatory compliance, the long-term benefits, including reduced spoilage and enhanced product security, are driving market growth, particularly in the United States and Canada.

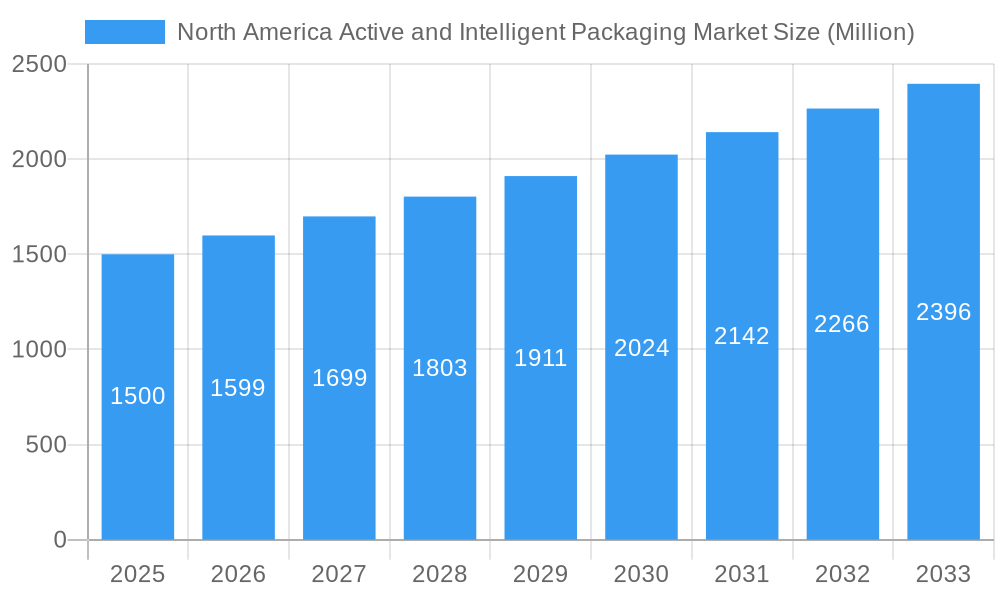

North America Active and Intelligent Packaging Market Market Size (In Billion)

Market segmentation reveals substantial opportunities within North America. Active packaging currently leads in market share, primarily due to its widespread use in extending shelf life and preserving product quality. Intelligent packaging, offering real-time product information, is experiencing rapid growth and is expected to gain significant traction as consumer demand for transparency and traceability increases. Intense market competition is characterized by continuous research and development investments from key players like Amcor Ltd and Sealed Air Corporation. Strategic partnerships and acquisitions further highlight a strong focus on market expansion. The growth of e-commerce and the increasing preference for ready-to-eat meals are also positively impacting this market's trajectory.

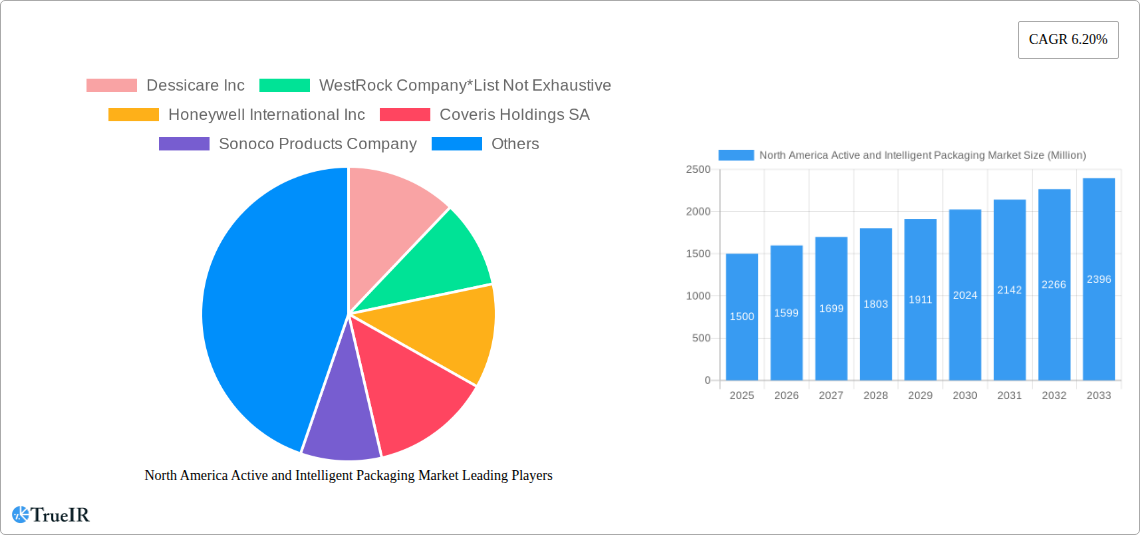

North America Active and Intelligent Packaging Market Company Market Share

North America Active and Intelligent Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America active and intelligent packaging market, offering crucial insights for businesses and investors. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive market research to provide a detailed understanding of market size, growth drivers, challenges, and future outlook. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR. This report meticulously analyzes key segments, prominent players, and significant industry milestones to offer a holistic view of this dynamic market.

North America Active and Intelligent Packaging Market Structure & Competitive Landscape

The North American active and intelligent packaging market is characterized by a moderately concentrated competitive landscape. While several large multinational companies dominate, smaller specialized players also contribute significantly. The market's Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation is a critical driver, with companies constantly developing new materials and technologies to enhance product shelf life, improve traceability, and enhance consumer experience. Regulatory changes concerning food safety and sustainability significantly impact market dynamics. Product substitutes, such as traditional packaging methods, pose a competitive threat, although the increasing demand for extended shelf life and enhanced product information is bolstering the adoption of active and intelligent packaging. The end-user segmentation is diverse, with significant contributions from the food, beverage, healthcare, and personal care sectors. M&A activity in this sector has been moderate over the past five years, with approximately xx mergers and acquisitions recorded between 2019 and 2024, primarily driven by companies seeking to expand their product portfolios and geographic reach. Key players' strategies include strategic partnerships, product diversification, and expansion into new geographical markets.

North America Active and Intelligent Packaging Market Market Trends & Opportunities

The North America active and intelligent packaging market is experiencing significant growth, driven by increasing consumer demand for convenience, enhanced product safety, and sustainable packaging solutions. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, demonstrating a strong CAGR of xx%. Technological advancements, such as the incorporation of sensors, RFID tags, and time-temperature indicators, are transforming the packaging industry. Consumer preferences are shifting towards eco-friendly and sustainable packaging options, creating opportunities for biodegradable and compostable active and intelligent packaging solutions. The increasing adoption of e-commerce and online grocery shopping is also fueling the demand for packaging that ensures product integrity during transit. Competitive dynamics are characterized by both intense competition among established players and the emergence of innovative startups. Market penetration rates for active and intelligent packaging vary across different end-user segments, with higher penetration in the food and healthcare sectors compared to other segments. The growing focus on supply chain transparency and traceability is further driving the adoption of intelligent packaging solutions.

Dominant Markets & Segments in North America Active and Intelligent Packaging Market

By Type: The intelligent packaging segment currently holds a larger market share compared to the active packaging segment, driven by the increasing demand for product traceability and real-time monitoring. Growth is projected to be higher in active packaging due to the increasing focus on extending the shelf life of products and reducing food waste.

By End-user Vertical: The food and beverage sector represents the largest segment, owing to the significant need for extended shelf life and improved product safety. The healthcare sector is also a key segment, driven by the demand for tamper-evident and secure packaging for pharmaceuticals and medical devices.

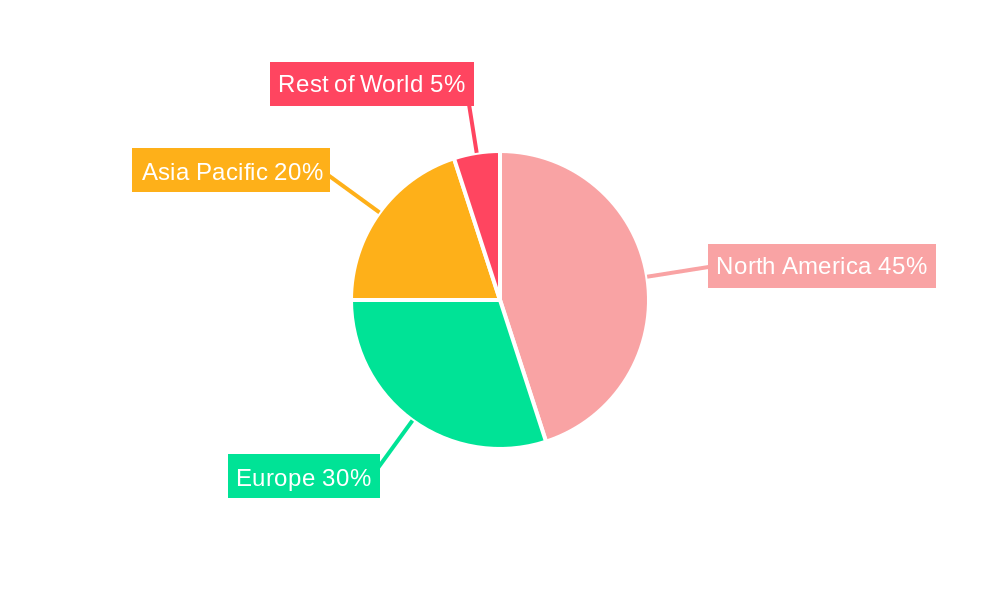

By Country: The United States dominates the North American market, accounting for a larger share of overall revenue, due to its large consumer base, well-established infrastructure, and high adoption rate of advanced packaging technologies. Canada is a significant market, exhibiting steady growth.

Key Growth Drivers:

Stringent Food Safety Regulations: Driving the adoption of active packaging to maintain product quality and prevent spoilage.

Growing E-commerce: Boosting the need for robust packaging that protects products during transit and handling.

Technological Advancements: Continual innovation in packaging materials and sensors expands possibilities.

North America Active and Intelligent Packaging Market Product Analysis

The North American active and intelligent packaging market showcases a wide range of innovative products, including modified atmosphere packaging (MAP), active packaging with antimicrobial agents, and intelligent packaging incorporating sensors and RFID tags. These innovations cater to diverse applications, such as extending shelf life, improving product traceability, and providing real-time information on product condition. Competitive advantages are achieved through superior material properties, enhanced functionality, and cost-effectiveness. Technological advancements, particularly in sensor technology and data analytics, are key differentiators. The market is witnessing a growing trend toward sustainable and eco-friendly packaging materials.

Key Drivers, Barriers & Challenges in North America Active and Intelligent Packaging Market

Key Drivers:

- Increasing consumer demand for convenience and safety.

- Stringent food safety regulations.

- Technological advancements in sensor technology and data analytics.

- Growing focus on sustainability and eco-friendly packaging.

Challenges:

- High initial investment costs for active and intelligent packaging technologies.

- Complexity in integrating different technologies into packaging systems.

- Potential supply chain disruptions impacting the availability of raw materials and components.

- Regulatory hurdles and standardization challenges across different jurisdictions.

Growth Drivers in the North America Active and Intelligent Packaging Market Market

Technological advancements, growing consumer preference for convenience and safety, and stringent government regulations are key drivers. The increasing adoption of e-commerce and the rising demand for sustainable and eco-friendly packaging solutions further fuel market expansion. Economic growth and increasing disposable incomes in North America also contribute to the growth of this market.

Challenges Impacting North America Active and Intelligent Packaging Market Growth

High initial investment costs, complex integration, potential supply chain disruptions, and regulatory hurdles pose significant challenges. Competition from traditional packaging methods and the need for standardization across diverse industries are also factors hindering market growth. The fluctuations in raw material prices can also impact the profitability and growth of the market.

Key Players Shaping the North America Active and Intelligent Packaging Market Market

Significant North America Active and Intelligent Packaging Market Industry Milestones

August 2021: Zai Urban Winery launched organic wine in uniquely designed beverage cans manufactured by Crown Bevcan Europe & Middle East, showcasing innovative packaging for premium products.

August 2021: LOTTE Chemical utilized BASF's Irgastab to produce polypropylene for medical syringes, highlighting the increased demand for packaging in the healthcare sector due to the COVID-19 pandemic.

Future Outlook for North America Active and Intelligent Packaging Market Market

The North American active and intelligent packaging market is poised for continued growth, driven by several factors. Technological advancements will continue to lead to innovative packaging solutions with enhanced functionalities. Growing consumer demand for sustainable and eco-friendly options will further fuel market expansion. Strategic partnerships and mergers and acquisitions will continue to shape the competitive landscape, leading to increased market consolidation. The increasing focus on supply chain transparency and traceability will create opportunities for intelligent packaging solutions with integrated tracking and monitoring capabilities. Overall, the market presents significant growth potential for businesses that can adapt to evolving consumer preferences and technological advancements.

North America Active and Intelligent Packaging Market Segmentation

-

1. Type

-

1.1. Active Packaging

- 1.1.1. Gas Scavengers/Emitters

- 1.1.2. Moisture Scavenger

- 1.1.3. Microwave Susceptors

- 1.1.4. Other Active Packaging Technologies

-

1.2. Intelligent Packaging

- 1.2.1. Coding and Markings

- 1.2.2. Antenna (RFID and NFC)

- 1.2.3. Sensors and Output Devices

- 1.2.4. Other Intelligent Packaging Technologies

-

1.1. Active Packaging

-

2. End-user Vertical

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Personal Care

- 2.5. Other End-user Verticals

North America Active and Intelligent Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Active and Intelligent Packaging Market Regional Market Share

Geographic Coverage of North America Active and Intelligent Packaging Market

North America Active and Intelligent Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. Active Packaging is Observing a Significant Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Active and Intelligent Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Active Packaging

- 5.1.1.1. Gas Scavengers/Emitters

- 5.1.1.2. Moisture Scavenger

- 5.1.1.3. Microwave Susceptors

- 5.1.1.4. Other Active Packaging Technologies

- 5.1.2. Intelligent Packaging

- 5.1.2.1. Coding and Markings

- 5.1.2.2. Antenna (RFID and NFC)

- 5.1.2.3. Sensors and Output Devices

- 5.1.2.4. Other Intelligent Packaging Technologies

- 5.1.1. Active Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Personal Care

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dessicare Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WestRock Company*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coveris Holdings SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Landec Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ball Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crown Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Graphic Packaging International LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sealed Air Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Amcor Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Dessicare Inc

List of Figures

- Figure 1: North America Active and Intelligent Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Active and Intelligent Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: North America Active and Intelligent Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: North America Active and Intelligent Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Active and Intelligent Packaging Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Active and Intelligent Packaging Market?

Key companies in the market include Dessicare Inc, WestRock Company*List Not Exhaustive, Honeywell International Inc, Coveris Holdings SA, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, BASF SE, Graphic Packaging International LLC, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the North America Active and Intelligent Packaging Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 29 billion as of 2022.

5. What are some drivers contributing to market growth?

Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products.

6. What are the notable trends driving market growth?

Active Packaging is Observing a Significant Increase.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

August 2021 - Zai Urban Winery's organic wine was launched in beverage cans. Crown Bevcan Europe & Middle East (Crown) was tasked with bringing this visually engaging story to life as the brand's partner for the manufacture and design of the six unique cans, which feature high-quality graphics and a premium appearance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Active and Intelligent Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Active and Intelligent Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Active and Intelligent Packaging Market?

To stay informed about further developments, trends, and reports in the North America Active and Intelligent Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence