Key Insights

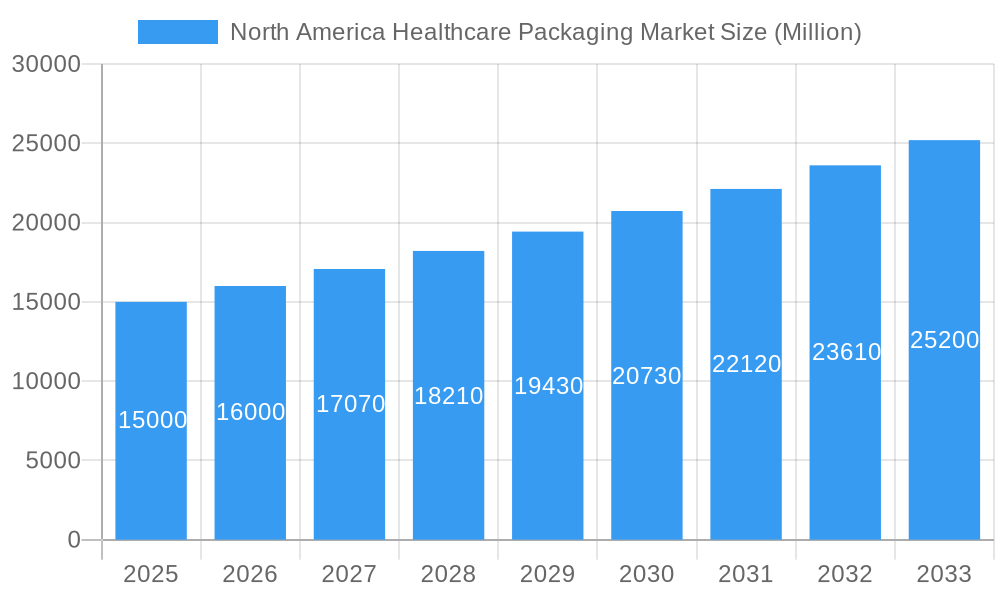

The North American healthcare packaging market is projected for substantial growth, expected to reach $154.85 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 7.46% from 2025 to 2033. This upward trend is driven by the increasing burden of chronic diseases, necessitating advanced drug delivery and medication management solutions. Stringent regulatory mandates for drug safety and efficacy are also spurring the adoption of innovative, tamper-evident packaging. The rise of personalized medicine and tailored drug therapies further fuels market expansion, as manufacturers seek packaging solutions that meet individual patient requirements. Advancements in materials science are also contributing, with a growing emphasis on sustainable and eco-friendly packaging alternatives. The United States leads market share within North America, followed by Canada, due to their robust healthcare expenditures and advanced infrastructure. The pharmaceutical sector is the primary end-user, with medical devices also representing a significant demand driver. Material preferences lean towards glass and plastic for their superior barrier properties and ease of sterilization, though environmental sustainability concerns are promoting research into biodegradable and recyclable options.

North America Healthcare Packaging Market Market Size (In Billion)

Market segmentation highlights robust demand across key product categories, including bottles and containers, vials and ampoules, and cartridges and syringes. These products are crucial for a wide array of pharmaceutical and medical device applications, from liquid medications to injectable drugs and diagnostic kits. The North American healthcare packaging market features intense competition, with established players investing heavily in research and development to innovate and address the evolving needs of the healthcare industry. Future growth opportunities are anticipated in advanced technologies like smart packaging, which can integrate track-and-trace capabilities and temperature monitoring to enhance drug safety and security. The market is poised for sustained expansion, influenced by demographic shifts, technological innovation, and the overarching commitment to improving patient outcomes through superior packaging solutions.

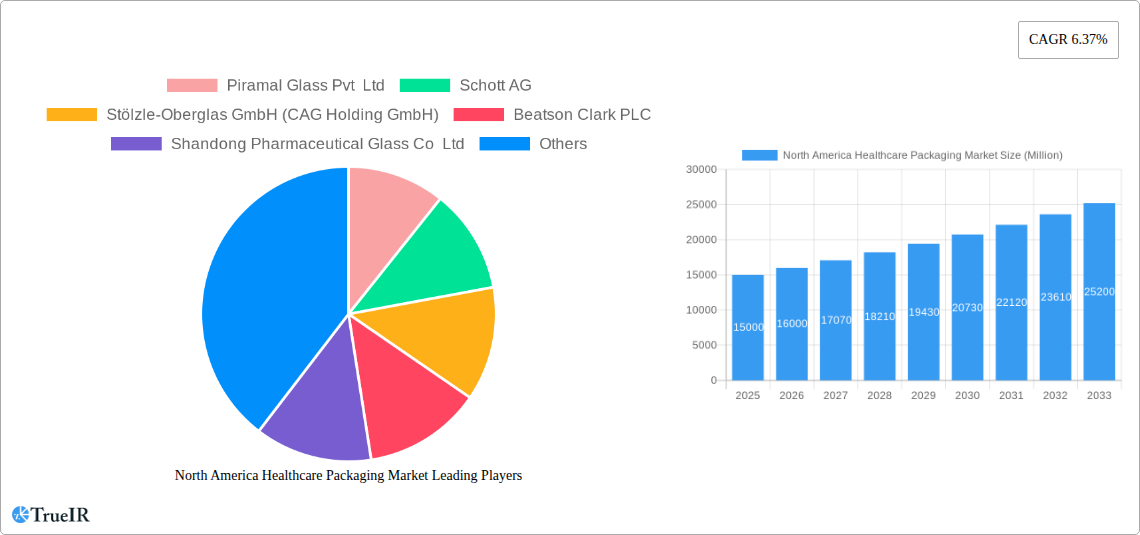

North America Healthcare Packaging Market Company Market Share

This report offers a comprehensive analysis of the North America healthcare packaging market, providing critical insights for stakeholders in the pharmaceutical, medical device, and packaging industries. The analysis covers the period from 2019 to 2033, with a specific focus on the base year 2025, detailing market dynamics, growth drivers, challenges, and future prospects. It includes detailed segmentation by product type, material, country (United States and Canada), and end-user vertical, delivering a granular understanding of this essential market.

North America Healthcare Packaging Market Structure & Competitive Landscape

The North America healthcare packaging market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies continuously developing sustainable and technologically advanced packaging solutions to meet evolving regulatory requirements and consumer preferences. Stringent regulatory frameworks, particularly those related to drug safety and environmental sustainability, significantly influence market dynamics. The market also witnesses the emergence of substitute materials and packaging types, fostering competition and driving innovation. End-user segmentation is dominated by the pharmaceutical industry, followed by medical devices. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, largely driven by consolidation efforts and expansion into new segments. Key competitive strategies include product diversification, technological advancements, and strategic partnerships.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Sustainable packaging, advanced barrier materials, smart packaging technologies.

- Regulatory Impacts: Stringent FDA and Health Canada regulations on drug safety and packaging integrity.

- Product Substitutes: Increased use of biodegradable and recyclable materials.

- End-User Segmentation: Pharmaceuticals (xx%), Medical Devices (xx%), Others (xx%).

- M&A Trends: Approximately xx M&A deals between 2019 and 2024.

North America Healthcare Packaging Market Trends & Opportunities

The North America healthcare packaging market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key factors. The increasing prevalence of chronic diseases and the growing demand for pharmaceuticals and medical devices are driving up the need for efficient and safe packaging. Technological advancements, such as the adoption of smart packaging and serialization technologies, are improving supply chain efficiency and enhancing product traceability. Consumer preference for convenient and user-friendly packaging is also shaping market trends. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants, leading to continuous innovation and price pressure. Market penetration rates for innovative packaging solutions are gradually increasing, driven by factors such as improved product safety and reduced counterfeiting.

Dominant Markets & Segments in North America Healthcare Packaging Market

The United States constitutes the largest market within North America, accounting for xx% of the total market value in 2025. The pharmaceutical segment dominates the end-user vertical, followed by medical devices. Within product types, Bottles and Containers hold the largest market share, followed by Vials and Ampoules. Glass remains the dominant material, although plastic is witnessing increasing adoption due to its cost-effectiveness and versatility.

- Leading Region: United States

- Dominant End-User Vertical: Pharmaceutical

- Largest Product Type Segment: Bottles and Containers

- Predominant Material: Glass

- Key Growth Drivers in the US: Growing pharmaceutical industry, increasing demand for sterile packaging.

- Key Growth Drivers in Canada: Investments in healthcare infrastructure, rising prevalence of chronic diseases.

North America Healthcare Packaging Market Product Analysis

The market is witnessing significant innovation in product design and materials. Advancements in barrier technologies improve product shelf life and stability. The integration of smart packaging features, such as RFID tags and tamper-evident seals, enhances product traceability and security. These innovations cater to the increasing demand for efficient and safe healthcare packaging solutions, enhancing market fit and creating competitive advantages for manufacturers who can deliver advanced and reliable products.

Key Drivers, Barriers & Challenges in North America Healthcare Packaging Market

Key Drivers: Growing pharmaceutical and medical device industries, increasing demand for sterile packaging, technological advancements in materials and design, stringent regulatory requirements driving innovation.

Challenges: Stringent regulations and compliance requirements increase costs and complexity. Supply chain disruptions can lead to significant production delays and cost increases, estimated to impact profitability by xx% in the event of a major disruption. Intense competition among established players and new entrants exerts downward pressure on prices.

Growth Drivers in the North America Healthcare Packaging Market Market

The growth of the North America healthcare packaging market is primarily driven by the expanding pharmaceutical and medical device industries. Stringent regulations governing drug safety and environmental sustainability create opportunities for innovative and compliant packaging solutions. Technological advancements, such as the use of smart packaging and sustainable materials, also contribute significantly to market growth.

Challenges Impacting North America Healthcare Packaging Market Growth

Key challenges include the high cost of compliance with stringent regulatory requirements, supply chain disruptions, and intense competition from both established and emerging players. These challenges can lead to decreased profitability and hinder market expansion.

Key Players Shaping the North America Healthcare Packaging Market Market

- Piramal Glass Pvt Ltd

- Schott AG

- Stölzle-Oberglas GmbH (CAG Holding GmbH)

- Beatson Clark PLC

- Shandong Pharmaceutical Glass Co Ltd

- Nipro Corporation

- Arab Pharmaceutical Glass Co

- Şişecam Group

- Bormioli Pharma AG

- SGD SA (SGD Pharma)

- Gerresheimer AG

- Corning Incorporated

Significant North America Healthcare Packaging Market Industry Milestones

- 2021 (Q3): Gerresheimer AG launched a new sustainable glass vial.

- 2022 (Q1): Schott AG announced a strategic partnership to develop innovative barrier packaging solutions.

- 2023 (Q2): Piramal Glass Pvt Ltd invested in expanding its manufacturing capacity in North America.

- (Further milestones can be added as available)

Future Outlook for North America Healthcare Packaging Market Market

The North America healthcare packaging market is poised for continued growth, driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and the growing emphasis on patient safety and convenience. Strategic opportunities exist for companies that can leverage technological advancements and offer sustainable and innovative packaging solutions. The market's potential is significant, with opportunities for growth in both established and emerging segments.

North America Healthcare Packaging Market Segmentation

-

1. End-user Vertical

- 1.1. Pharmaceutical

- 1.2. Medical Devices

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials and Ampoules

- 2.3. Cartridges and Syringes

- 2.4. Pouch and Bags

- 2.5. Blister Packs

- 2.6. Tubes

- 2.7. Paper Board Boxes

- 2.8. Caps and Closures

- 2.9. Labels

- 2.10. Other Pr

-

3. Material

- 3.1. Glass

- 3.2. Plastic

- 3.3. Other Materials (Paper and Metal)

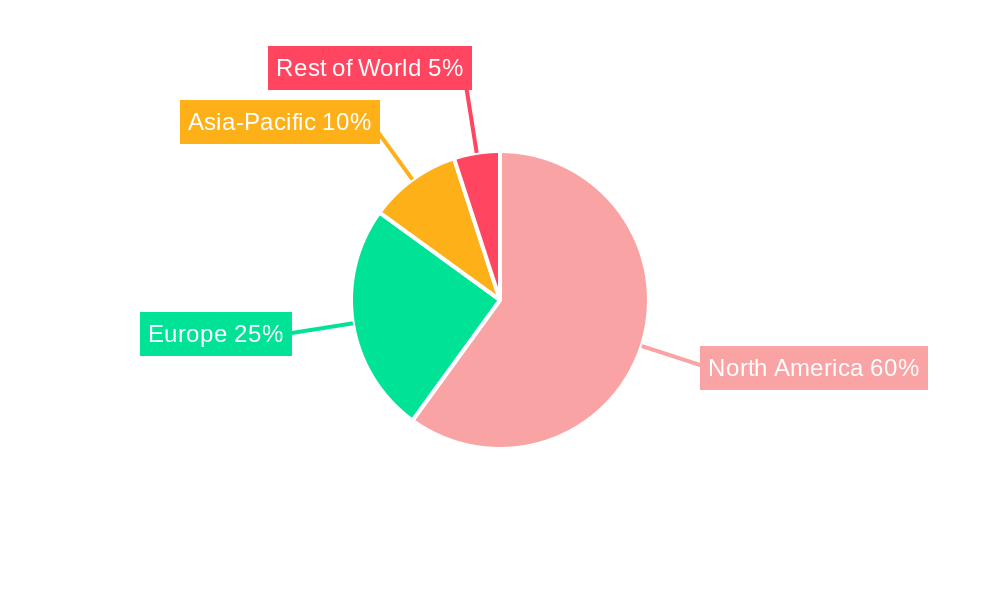

North America Healthcare Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Healthcare Packaging Market Regional Market Share

Geographic Coverage of North America Healthcare Packaging Market

North America Healthcare Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Emphasis on Convenience and Environmental Issues; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling

- 3.3. Market Restrains

- 3.3.1. ; Environmental Concerns Related to Raw Materials for Packaging and Price Competition

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry has Witnessed Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Healthcare Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Pharmaceutical

- 5.1.2. Medical Devices

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials and Ampoules

- 5.2.3. Cartridges and Syringes

- 5.2.4. Pouch and Bags

- 5.2.5. Blister Packs

- 5.2.6. Tubes

- 5.2.7. Paper Board Boxes

- 5.2.8. Caps and Closures

- 5.2.9. Labels

- 5.2.10. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Glass

- 5.3.2. Plastic

- 5.3.3. Other Materials (Paper and Metal)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Piramal Glass Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schott AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stölzle-Oberglas GmbH (CAG Holding GmbH)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beatson Clark PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shandong Pharmaceutical Glass Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nipro Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arab Pharmaceutical Glass Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Şişecam Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bormioli Pharma AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SGD SA (SGD Pharma)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gerresheimer AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Corning Incorporated

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Piramal Glass Pvt Ltd

List of Figures

- Figure 1: North America Healthcare Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Healthcare Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Healthcare Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 2: North America Healthcare Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: North America Healthcare Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 4: North America Healthcare Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Healthcare Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: North America Healthcare Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: North America Healthcare Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 8: North America Healthcare Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Healthcare Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Healthcare Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Healthcare Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Healthcare Packaging Market?

The projected CAGR is approximately 7.46%.

2. Which companies are prominent players in the North America Healthcare Packaging Market?

Key companies in the market include Piramal Glass Pvt Ltd, Schott AG, Stölzle-Oberglas GmbH (CAG Holding GmbH), Beatson Clark PLC, Shandong Pharmaceutical Glass Co Ltd, Nipro Corporation, Arab Pharmaceutical Glass Co, Şişecam Grou, Bormioli Pharma AG, SGD SA (SGD Pharma), Gerresheimer AG, Corning Incorporated.

3. What are the main segments of the North America Healthcare Packaging Market?

The market segments include End-user Vertical, Product Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.85 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Emphasis on Convenience and Environmental Issues; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling.

6. What are the notable trends driving market growth?

Pharmaceutical Industry has Witnessed Significant Growth.

7. Are there any restraints impacting market growth?

; Environmental Concerns Related to Raw Materials for Packaging and Price Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Healthcare Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Healthcare Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Healthcare Packaging Market?

To stay informed about further developments, trends, and reports in the North America Healthcare Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence