Key Insights

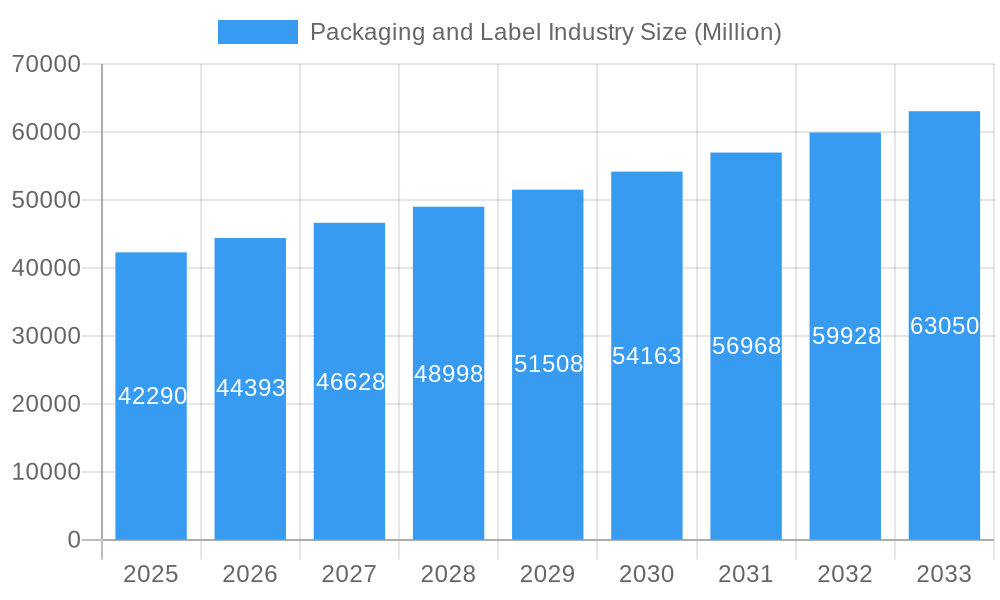

The global packaging and label industry, currently valued at $42.29 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.90% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, along with the expanding pharmaceutical and healthcare industries, are significant drivers of demand for diverse label types, including pressure-sensitive, shrink sleeves, and in-mold labels. E-commerce growth significantly contributes to the demand for efficient and attractive packaging, further boosting the market. Consumer preference for sustainable and eco-friendly packaging materials like paper and bio-plastics (PLA, PO) is also shaping market trends, leading to increased adoption of these materials over traditional options such as PVC and PET. Furthermore, advancements in printing technologies, particularly digital printing, offer increased customization and reduced lead times, enhancing market competitiveness. While regulatory changes and fluctuations in raw material prices may pose some challenges, the overall industry outlook remains positive.

Packaging and Label Industry Market Size (In Billion)

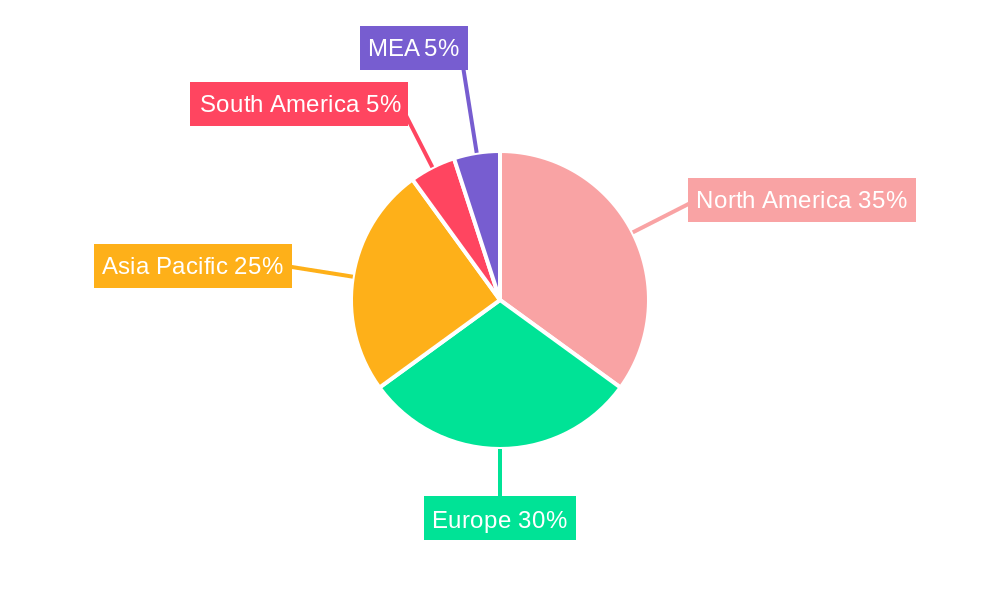

The market segmentation reveals a dynamic landscape. Pressure-sensitive labels dominate the product type segment, followed by shrink and stretch sleeves. Within materials, paper and polyester are gaining traction due to sustainability concerns. Geographically, North America and Europe currently hold significant market share, but Asia-Pacific is anticipated to witness the fastest growth, driven by expanding economies and rising consumerism in countries like China and India. Key players like Avery Dennison, CCL Industries, and others are actively engaged in innovation and strategic partnerships to solidify their market positions and capitalize on emerging trends. The forecast period indicates continued market expansion, with significant opportunities for growth across various segments and regions. However, companies will need to adapt to changing consumer preferences and adopt sustainable practices to maintain a competitive edge.

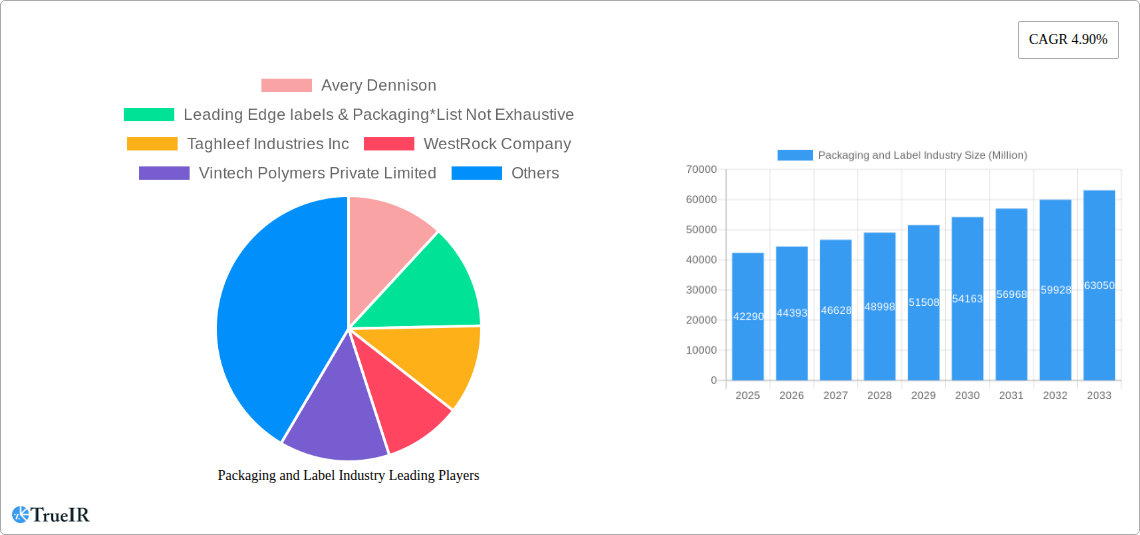

Packaging and Label Industry Company Market Share

Packaging and Label Industry Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the global Packaging and Label Industry, projecting a market value exceeding $XXX Million by 2033. It offers in-depth insights into market segmentation, competitive landscape, growth drivers, and future trends, leveraging extensive data from 2019-2024 (historical period) and forecasting until 2033 (forecast period). The base year for this analysis is 2025. This report is an invaluable resource for industry professionals, investors, and strategists seeking to navigate this rapidly evolving market.

Packaging and Label Industry Market Structure & Competitive Landscape

The global packaging and label industry is characterized by a moderately concentrated market structure, with a few major players holding significant market share. The industry's Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Key players such as Avery Dennison, CCL Industries LLC, and 3M Company exert considerable influence due to their extensive product portfolios, global reach, and technological advancements. However, numerous smaller companies and regional players contribute significantly to market dynamism and innovation.

Innovation Drivers: The industry is driven by ongoing innovation in materials science, printing technologies (digital printing gaining traction), and sustainable packaging solutions.

- Material Innovation: Development of biodegradable, recyclable, and lightweight materials is a key driver, responding to growing environmental concerns.

- Technological Advancements: Automation and digital printing are enhancing efficiency and customization options, catering to diverse customer needs.

- Regulatory Impacts: Stringent environmental regulations (e.g., plastic reduction policies) are pushing for sustainable packaging solutions.

Product Substitutes: The Packaging and label industry faces some level of competition from alternative packaging formats and solutions. While direct substitutes are limited, factors like reusable containers and digital labeling can impact specific segments.

End-User Segmentation: Key end-user industries include Food & Beverages, Pharmaceutical & Healthcare, and Other End-Users (e.g., cosmetics, consumer goods). The Food & Beverages sector currently represents the largest market segment.

M&A Trends: Significant merger and acquisition (M&A) activity has characterized the industry in recent years, reflecting the consolidation trend and companies' pursuit of expanding their market share and capabilities. For example, the acquisition of Hammer Packaging Corporation by Fort Dearborn Company in March 2021 exemplifies this trend. The total value of M&A transactions in the industry between 2019 and 2024 is estimated at $XX Million.

Packaging and Label Industry Market Trends & Opportunities

The global packaging and label market exhibits robust growth, with a Compound Annual Growth Rate (CAGR) estimated at xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Expanding E-commerce: The boom in online retail is driving demand for efficient and attractive packaging solutions, including labels for product identification and branding.

- Growing Consumer Demand: Consumers are increasingly discerning about product packaging, demanding aesthetically pleasing and sustainable solutions.

- Technological Advancements: The adoption of advanced printing technologies like digital printing is revolutionizing the industry, enabling greater customization and cost-effectiveness.

- Focus on Sustainability: The growing environmental consciousness is pushing for sustainable packaging materials (like paper-based solutions) and reduced plastic usage, fostering innovation in this space.

Market penetration rates vary significantly across different segments and geographic regions. Pressure-sensitive labels remain the dominant product type, holding a market share of approximately xx%, while the shrink sleeve and stretch sleeve segments are witnessing considerable growth driven by the increasing demand in food & beverage and other end-user industries.

Competitive dynamics within the market are characterized by intense competition, with leading companies investing heavily in R&D, expanding their product portfolios, and adopting strategic acquisitions to maintain market leadership.

Dominant Markets & Segments in Packaging and Label Industry

The Asia-Pacific region is expected to be the leading market for packaging and labels throughout the forecast period due to its rapid economic growth, expanding consumer base, and substantial manufacturing sector. Within this region, China and India are experiencing particularly high growth rates.

Key Growth Drivers by Segment:

- By Product Type: Linerless labels are experiencing significant growth due to their cost and material efficiency advantages. Functional and Security labels are also witnessing increasing demand, fueled by the need for product authentication and brand protection. The Promotional label segment is driven by the growing marketing and branding activities.

- By End-User Industry: The Food & Beverages sector is the dominant end-user segment, followed by Pharmaceutical & Healthcare due to stringent regulations and requirements for labeling and packaging.

- By Material: Paper-based materials are gaining traction due to sustainability concerns. However, PET, PE, and PVC remain prevalent materials due to their versatility and performance characteristics. The growth of sustainable materials like PLA is driving innovative opportunities in the market.

- By Type: Pressure-sensitive labels are currently dominant, but shrink sleeves and stretch sleeves are displaying high growth potential.

- By Print Process: Flexography printing holds the largest share. Digital printing is gaining significant traction due to its customization and short run capabilities.

Detailed analysis of market dominance shows that a few major companies are actively expanding their regional footprint and offerings. Infrastructure investments in emerging markets and supportive government policies, such as incentives for sustainable packaging solutions are driving growth.

Packaging and Label Industry Product Analysis

Significant product innovations are shaping the packaging and label industry. The focus is on sustainable materials, advanced printing technologies, and smart packaging features. These innovations are improving product protection, enhancing brand appeal, and enabling advanced functionalities like track and trace capabilities. The market fit for these new products is strong due to increasing consumer demand for sustainable packaging and brands seeking to differentiate themselves through innovative packaging solutions.

Key Drivers, Barriers & Challenges in Packaging and Label Industry

Key Drivers: Technological advancements (digital printing, automation), growing consumer demand for sustainable and aesthetically pleasing packaging, and the expanding e-commerce sector are key drivers.

Key Challenges: Fluctuations in raw material prices, stringent regulatory compliance requirements, and intense competition are key challenges. Supply chain disruptions (e.g. xx% increase in transportation costs in 2022) have also had a noticeable impact on profitability and product delivery.

Growth Drivers in the Packaging and Label Industry Market

The growth of the packaging and label industry is driven by increasing demand across various sectors such as food and beverages, pharmaceuticals, and e-commerce. Advancements in printing technologies and the trend toward sustainable packaging solutions are also significant growth drivers. Favorable government regulations in certain regions further support industry expansion.

Challenges Impacting Packaging and Label Industry Growth

The industry faces challenges from fluctuating raw material prices, stringent environmental regulations, and intense competition. Supply chain vulnerabilities and potential disruptions pose significant risks to consistent growth and profitability. Economic downturns can also affect overall demand.

Key Players Shaping the Packaging and Label Industry Market

- Avery Dennison

- Leading Edge labels & Packaging

- Taghleef Industries Inc

- WestRock Company

- Vintech Polymers Private Limited

- Fort Dearborn

- KRIS FLEXIPACKS PVT LTD

- Fort Dearborn Company

- Constantia Flexibles Group GmbH

- Bemis Company

- UPM Raflatac

- Royal Sens Group

- Klockner Pentaplast

- CCL Industries LLC

- 3M Company

- Huhtamaki Group

- Lintec Corporation

- Multi-Color Corporation

- Fuji Seal International Inc

- Lintec

- Mondi

- CPC Packaging

- Berry Global

- GTPL

- Neenah Inc

Significant Packaging and Label Industry Milestones

- March 2021: Fort Dearborn Company acquired Hammer Packaging Corporation, expanding its capacity and geographic reach.

- February 2021: Mondi Group launched a range of sustainable paper-based release liners, promoting environmentally friendly solutions.

Future Outlook for Packaging and Label Industry Market

The packaging and label industry is poised for continued growth, driven by technological advancements, sustainability initiatives, and increasing consumer demand. Strategic opportunities lie in developing innovative, sustainable packaging solutions and expanding into emerging markets. The market potential is substantial, particularly in regions with high economic growth rates and expanding consumer bases.

Packaging and Label Industry Segmentation

-

1. Type

-

1.1. Pressure-Sensitive Label

-

1.1.1. By Print Process

- 1.1.1.1. Offset Printing

- 1.1.1.2. Flexography Printing

- 1.1.1.3. Gravure

- 1.1.1.4. Other Analog Printing Process

- 1.1.1.5. Digital Printing

-

1.1.2. By Product Type

- 1.1.2.1. Liner

- 1.1.2.2. Linerless

- 1.1.2.3. VIP

- 1.1.2.4. Prime

- 1.1.2.5. Functional & Security

- 1.1.2.6. Promotional

-

1.1.3. End-User Industry

- 1.1.3.1. Food & Beverages

- 1.1.3.2. Pharmaceutical & Healthcare

- 1.1.3.3. Other End-Users

-

1.1.1. By Print Process

-

1.2. Shrink & Stretch Sleeve Label

- 1.2.1. Shrink Sleeve

-

1.2.2. By Material

- 1.2.2.1. PVC

- 1.2.2.2. PET

- 1.2.2.3. OPP & OPS

- 1.2.2.4. Other Materials (PO, PLA, etc.)

- 1.3. In-Mold Label

- 1.4. Wet Glue Label

-

1.5. Thermal Transfer Label

- 1.5.1. Paper

- 1.5.2. Polyester

- 1.6. Wrap Around Label

-

1.1. Pressure-Sensitive Label

Packaging and Label Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Packaging and Label Industry Regional Market Share

Geographic Coverage of Packaging and Label Industry

Packaging and Label Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand; Ability to conform to any size and shape

- 3.2.2 and yet provide the necessary protection

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Oil Prices

- 3.4. Market Trends

- 3.4.1. Food and Beverage End-User Segment is Expected to Drive Growth of Labels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure-Sensitive Label

- 5.1.1.1. By Print Process

- 5.1.1.1.1. Offset Printing

- 5.1.1.1.2. Flexography Printing

- 5.1.1.1.3. Gravure

- 5.1.1.1.4. Other Analog Printing Process

- 5.1.1.1.5. Digital Printing

- 5.1.1.2. By Product Type

- 5.1.1.2.1. Liner

- 5.1.1.2.2. Linerless

- 5.1.1.2.3. VIP

- 5.1.1.2.4. Prime

- 5.1.1.2.5. Functional & Security

- 5.1.1.2.6. Promotional

- 5.1.1.3. End-User Industry

- 5.1.1.3.1. Food & Beverages

- 5.1.1.3.2. Pharmaceutical & Healthcare

- 5.1.1.3.3. Other End-Users

- 5.1.1.1. By Print Process

- 5.1.2. Shrink & Stretch Sleeve Label

- 5.1.2.1. Shrink Sleeve

- 5.1.2.2. By Material

- 5.1.2.2.1. PVC

- 5.1.2.2.2. PET

- 5.1.2.2.3. OPP & OPS

- 5.1.2.2.4. Other Materials (PO, PLA, etc.)

- 5.1.3. In-Mold Label

- 5.1.4. Wet Glue Label

- 5.1.5. Thermal Transfer Label

- 5.1.5.1. Paper

- 5.1.5.2. Polyester

- 5.1.6. Wrap Around Label

- 5.1.1. Pressure-Sensitive Label

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure-Sensitive Label

- 6.1.1.1. By Print Process

- 6.1.1.1.1. Offset Printing

- 6.1.1.1.2. Flexography Printing

- 6.1.1.1.3. Gravure

- 6.1.1.1.4. Other Analog Printing Process

- 6.1.1.1.5. Digital Printing

- 6.1.1.2. By Product Type

- 6.1.1.2.1. Liner

- 6.1.1.2.2. Linerless

- 6.1.1.2.3. VIP

- 6.1.1.2.4. Prime

- 6.1.1.2.5. Functional & Security

- 6.1.1.2.6. Promotional

- 6.1.1.3. End-User Industry

- 6.1.1.3.1. Food & Beverages

- 6.1.1.3.2. Pharmaceutical & Healthcare

- 6.1.1.3.3. Other End-Users

- 6.1.1.1. By Print Process

- 6.1.2. Shrink & Stretch Sleeve Label

- 6.1.2.1. Shrink Sleeve

- 6.1.2.2. By Material

- 6.1.2.2.1. PVC

- 6.1.2.2.2. PET

- 6.1.2.2.3. OPP & OPS

- 6.1.2.2.4. Other Materials (PO, PLA, etc.)

- 6.1.3. In-Mold Label

- 6.1.4. Wet Glue Label

- 6.1.5. Thermal Transfer Label

- 6.1.5.1. Paper

- 6.1.5.2. Polyester

- 6.1.6. Wrap Around Label

- 6.1.1. Pressure-Sensitive Label

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure-Sensitive Label

- 7.1.1.1. By Print Process

- 7.1.1.1.1. Offset Printing

- 7.1.1.1.2. Flexography Printing

- 7.1.1.1.3. Gravure

- 7.1.1.1.4. Other Analog Printing Process

- 7.1.1.1.5. Digital Printing

- 7.1.1.2. By Product Type

- 7.1.1.2.1. Liner

- 7.1.1.2.2. Linerless

- 7.1.1.2.3. VIP

- 7.1.1.2.4. Prime

- 7.1.1.2.5. Functional & Security

- 7.1.1.2.6. Promotional

- 7.1.1.3. End-User Industry

- 7.1.1.3.1. Food & Beverages

- 7.1.1.3.2. Pharmaceutical & Healthcare

- 7.1.1.3.3. Other End-Users

- 7.1.1.1. By Print Process

- 7.1.2. Shrink & Stretch Sleeve Label

- 7.1.2.1. Shrink Sleeve

- 7.1.2.2. By Material

- 7.1.2.2.1. PVC

- 7.1.2.2.2. PET

- 7.1.2.2.3. OPP & OPS

- 7.1.2.2.4. Other Materials (PO, PLA, etc.)

- 7.1.3. In-Mold Label

- 7.1.4. Wet Glue Label

- 7.1.5. Thermal Transfer Label

- 7.1.5.1. Paper

- 7.1.5.2. Polyester

- 7.1.6. Wrap Around Label

- 7.1.1. Pressure-Sensitive Label

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure-Sensitive Label

- 8.1.1.1. By Print Process

- 8.1.1.1.1. Offset Printing

- 8.1.1.1.2. Flexography Printing

- 8.1.1.1.3. Gravure

- 8.1.1.1.4. Other Analog Printing Process

- 8.1.1.1.5. Digital Printing

- 8.1.1.2. By Product Type

- 8.1.1.2.1. Liner

- 8.1.1.2.2. Linerless

- 8.1.1.2.3. VIP

- 8.1.1.2.4. Prime

- 8.1.1.2.5. Functional & Security

- 8.1.1.2.6. Promotional

- 8.1.1.3. End-User Industry

- 8.1.1.3.1. Food & Beverages

- 8.1.1.3.2. Pharmaceutical & Healthcare

- 8.1.1.3.3. Other End-Users

- 8.1.1.1. By Print Process

- 8.1.2. Shrink & Stretch Sleeve Label

- 8.1.2.1. Shrink Sleeve

- 8.1.2.2. By Material

- 8.1.2.2.1. PVC

- 8.1.2.2.2. PET

- 8.1.2.2.3. OPP & OPS

- 8.1.2.2.4. Other Materials (PO, PLA, etc.)

- 8.1.3. In-Mold Label

- 8.1.4. Wet Glue Label

- 8.1.5. Thermal Transfer Label

- 8.1.5.1. Paper

- 8.1.5.2. Polyester

- 8.1.6. Wrap Around Label

- 8.1.1. Pressure-Sensitive Label

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure-Sensitive Label

- 9.1.1.1. By Print Process

- 9.1.1.1.1. Offset Printing

- 9.1.1.1.2. Flexography Printing

- 9.1.1.1.3. Gravure

- 9.1.1.1.4. Other Analog Printing Process

- 9.1.1.1.5. Digital Printing

- 9.1.1.2. By Product Type

- 9.1.1.2.1. Liner

- 9.1.1.2.2. Linerless

- 9.1.1.2.3. VIP

- 9.1.1.2.4. Prime

- 9.1.1.2.5. Functional & Security

- 9.1.1.2.6. Promotional

- 9.1.1.3. End-User Industry

- 9.1.1.3.1. Food & Beverages

- 9.1.1.3.2. Pharmaceutical & Healthcare

- 9.1.1.3.3. Other End-Users

- 9.1.1.1. By Print Process

- 9.1.2. Shrink & Stretch Sleeve Label

- 9.1.2.1. Shrink Sleeve

- 9.1.2.2. By Material

- 9.1.2.2.1. PVC

- 9.1.2.2.2. PET

- 9.1.2.2.3. OPP & OPS

- 9.1.2.2.4. Other Materials (PO, PLA, etc.)

- 9.1.3. In-Mold Label

- 9.1.4. Wet Glue Label

- 9.1.5. Thermal Transfer Label

- 9.1.5.1. Paper

- 9.1.5.2. Polyester

- 9.1.6. Wrap Around Label

- 9.1.1. Pressure-Sensitive Label

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure-Sensitive Label

- 10.1.1.1. By Print Process

- 10.1.1.1.1. Offset Printing

- 10.1.1.1.2. Flexography Printing

- 10.1.1.1.3. Gravure

- 10.1.1.1.4. Other Analog Printing Process

- 10.1.1.1.5. Digital Printing

- 10.1.1.2. By Product Type

- 10.1.1.2.1. Liner

- 10.1.1.2.2. Linerless

- 10.1.1.2.3. VIP

- 10.1.1.2.4. Prime

- 10.1.1.2.5. Functional & Security

- 10.1.1.2.6. Promotional

- 10.1.1.3. End-User Industry

- 10.1.1.3.1. Food & Beverages

- 10.1.1.3.2. Pharmaceutical & Healthcare

- 10.1.1.3.3. Other End-Users

- 10.1.1.1. By Print Process

- 10.1.2. Shrink & Stretch Sleeve Label

- 10.1.2.1. Shrink Sleeve

- 10.1.2.2. By Material

- 10.1.2.2.1. PVC

- 10.1.2.2.2. PET

- 10.1.2.2.3. OPP & OPS

- 10.1.2.2.4. Other Materials (PO, PLA, etc.)

- 10.1.3. In-Mold Label

- 10.1.4. Wet Glue Label

- 10.1.5. Thermal Transfer Label

- 10.1.5.1. Paper

- 10.1.5.2. Polyester

- 10.1.6. Wrap Around Label

- 10.1.1. Pressure-Sensitive Label

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avery Dennison

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leading Edge labels & Packaging*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Taghleef Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WestRock Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vintech Polymers Private Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fort Dearborn

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KRIS FLEXIPACKS PVT LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fort Dearborn Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Constantia Flexibles Group GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bemis Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 UPM Raflatc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Royal Sens Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Klockner Pentaplast

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CCL Industries LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 3M Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Huhtamaki Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Lintec Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Multi-Color Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Fuji Seal International Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Lintec

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Mondi

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 CPC Packaging

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Berry Global

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 GTPL

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Neenah Inc

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Avery Dennison

List of Figures

- Figure 1: Global Packaging and Label Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Latin America Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Packaging and Label Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging and Label Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Packaging and Label Industry?

Key companies in the market include Avery Dennison, Leading Edge labels & Packaging*List Not Exhaustive, Taghleef Industries Inc, WestRock Company, Vintech Polymers Private Limited, Fort Dearborn, KRIS FLEXIPACKS PVT LTD, Fort Dearborn Company, Constantia Flexibles Group GmbH, Bemis Company, UPM Raflatc, Royal Sens Group, Klockner Pentaplast, CCL Industries LLC, 3M Company, Huhtamaki Group, Lintec Corporation, Multi-Color Corporation, Fuji Seal International Inc, Lintec, Mondi, CPC Packaging, Berry Global, GTPL, Neenah Inc.

3. What are the main segments of the Packaging and Label Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.29 Million as of 2022.

5. What are some drivers contributing to market growth?

The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand; Ability to conform to any size and shape. and yet provide the necessary protection.

6. What are the notable trends driving market growth?

Food and Beverage End-User Segment is Expected to Drive Growth of Labels.

7. Are there any restraints impacting market growth?

; Fluctuating Oil Prices.

8. Can you provide examples of recent developments in the market?

March 2021 - Dearborn Company has announced that it has acquired Hammer Packaging Corporation. The combined organization takes advantage of Hammer's state-of-the-art technology to enhance Fort Dearborn's leadership position in the decorative label and packaging marketplace by further expanding the company's geographic footprint, capacity, and capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging and Label Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging and Label Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging and Label Industry?

To stay informed about further developments, trends, and reports in the Packaging and Label Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence