Key Insights

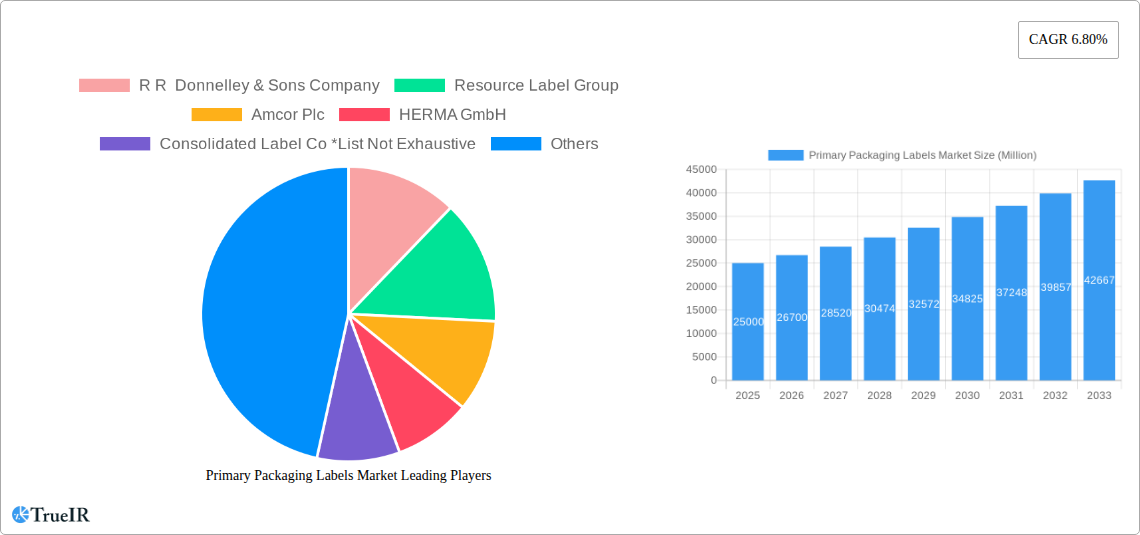

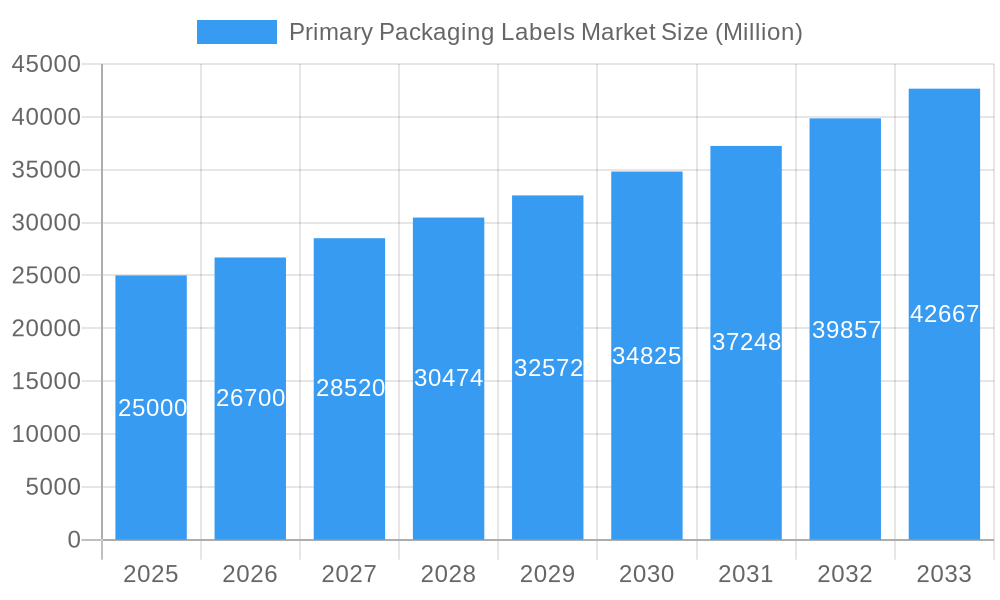

The global primary packaging labels market is experiencing robust growth, driven by the increasing demand for packaged goods across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 6.80% from 2019 to 2024 indicates a significant upward trajectory, projected to continue into the forecast period (2025-2033). Key drivers include the rising adoption of advanced labeling technologies like pressure-sensitive labels and in-mold labels, offering improved product aesthetics, branding opportunities, and enhanced consumer experience. The food and beverage industry remains a dominant end-user, followed by pharmaceuticals and personal care, reflecting the vital role of labels in product identification, information dissemination, and brand recognition. Growth is further fueled by e-commerce expansion, necessitating efficient and tamper-evident labeling solutions. However, fluctuating raw material prices and stringent regulatory compliance requirements present challenges to market expansion. The segmentation analysis reveals a strong preference for pressure-sensitive labels due to their ease of application and cost-effectiveness. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is poised for rapid growth, driven by expanding economies and increasing consumption of packaged goods. Major players such as Avery Dennison, CCL Industries, and Amcor are actively investing in research and development to innovate label materials and application technologies, shaping future market trends.

Primary Packaging Labels Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and specialized regional players. The market's future growth will depend on technological advancements, particularly in sustainable and eco-friendly labeling solutions, catering to the growing consumer preference for environmentally conscious products. Strategic partnerships and mergers and acquisitions are also anticipated to play a significant role in shaping the industry structure. This dynamic market presents substantial opportunities for established players and new entrants alike, demanding constant innovation and adaptation to evolving consumer needs and regulatory standards. Further analysis shows a projected market size exceeding $XX Billion (estimated based on CAGR and assuming a 2024 market size based on industry averages) by 2033.

Primary Packaging Labels Market Company Market Share

Primary Packaging Labels Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a thorough analysis of the Primary Packaging Labels Market, offering invaluable insights for stakeholders across the value chain. Leveraging extensive data from 2019-2024 (Historical Period), 2025 (Base & Estimated Year), and projecting to 2033 (Forecast Period), this study covers market size, segmentation, competitive dynamics, and future growth prospects. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Primary Packaging Labels Market Market Structure & Competitive Landscape

The Primary Packaging Labels Market is characterized by a moderately concentrated structure, featuring a blend of established multinational corporations and agile, specialized label manufacturers. The market concentration ratio (CR4) is estimated at [Insert CR4 Percentage Here]%, underscoring the presence of key industry leaders. Innovation is a critical differentiator, driven by continuous advancements in printing technologies such as digital and flexographic printing, the growing demand for sustainable materials like recycled paper and bioplastics, and the integration of smart packaging solutions including RFID for enhanced functionality and traceability. The market's dynamics are significantly shaped by evolving regulatory frameworks pertaining to food safety, precise labeling requirements, and environmental sustainability mandates. While alternative packaging formats like pouches, shrink films, and cartons present a moderate threat, the inherent advantages of primary packaging labels continue to drive their widespread adoption. The market is strategically segmented by application method, encompassing pressure-sensitive labels, heat shrink and stretch sleeve labels, glue-applied labels, in-mold labels, and other specialized label types. Similarly, end-user industries are broadly categorized into food, beverage, pharmaceutical, personal care, and other diverse sectors.

Mergers and acquisitions (M&A) play a pivotal role in reshaping the competitive landscape, fostering consolidation and driving strategic growth. In 2022 alone, the industry experienced substantial M&A activity, with an estimated [Insert M&A Deal Value Here] Million in transactions, reflecting a clear trend towards consolidation as companies seek to expand their market reach, enhance their product portfolios, and achieve greater operational efficiencies.

- Market Concentration: CR4 estimated at [Insert CR4 Percentage Here]%, indicating a moderate level of industry consolidation.

- Key Innovation Drivers: Continuous advancements in printing technologies, a strong shift towards sustainable and eco-friendly materials, and the integration of smart packaging features.

- Regulatory Influences: Stringent food safety standards, evolving labeling regulations, and increasing environmental compliance requirements significantly impact market strategies.

- Competitive Substitutes: Alternative packaging solutions such as pouches, shrink films, and cartons present a moderate competitive pressure.

- End-User Segmentation: Broad segmentation across food, beverage, pharmaceutical, personal care, and other key industries.

- M&A Trends: Significant consolidation activity observed, with approximately [Insert M&A Deal Value Here] Million in M&A deals recorded in 2022.

Primary Packaging Labels Market Market Trends & Opportunities

The Primary Packaging Labels Market is experiencing robust growth, driven by rising consumer demand for packaged goods, particularly in developing economies. Technological advancements, such as the increased adoption of digital printing, enable faster turnaround times, personalized labeling, and cost-effective solutions. Consumer preferences for sustainable and eco-friendly packaging are creating opportunities for manufacturers offering labels made from recycled materials and with reduced environmental impact. The market is also influenced by evolving brand strategies, with companies increasingly leveraging labels for enhanced branding and product differentiation. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups. This leads to continuous improvement in printing quality, cost reductions, and expanded product offerings. Market penetration rates vary across segments, with pressure-sensitive labels dominating the market, followed by heat shrink and stretch sleeve labels. The overall market is expected to experience a CAGR of xx% from 2025 to 2033, reaching a projected value of xx Million.

Dominant Markets & Segments in Primary Packaging Labels Market

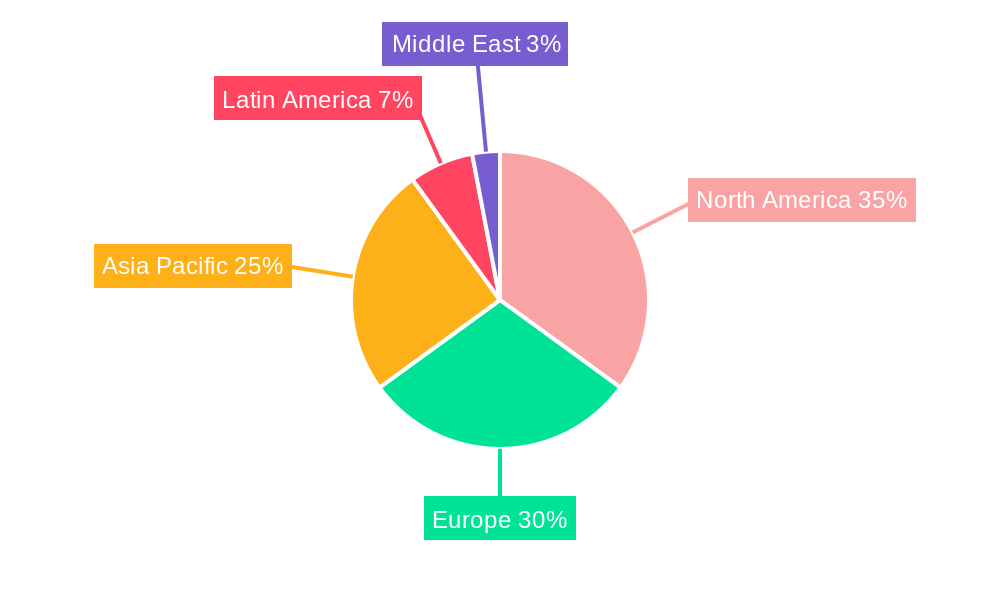

The Pressure Sensitive Labels (PSL) segment stands out as the market leader, primarily due to its exceptional versatility, straightforward application process, and cost-effectiveness, making it the preferred choice across a wide spectrum of industries. The Food and Beverage end-user sector represents the most dominant segment, driven by the sheer volume of packaged food and beverage products consumed globally. Geographically, North America and Europe are at the forefront of the primary packaging labels market, attributed to robust consumer spending power, well-established packaging industries, and rigorous regulatory standards that necessitate high-quality labeling solutions.

- By Application Method:

- Pressure Sensitive Labels: Dominates the market due to unparalleled versatility, ease of application, and cost-efficiency.

- Heat Shrink and Stretch Sleeve Labels: Experiencing strong growth, particularly within the beverage and personal care segments, offering enhanced branding and tamper-evident features.

- Glue Applied Labels: Primarily utilized in niche applications, notably for industrial products where durability and specific adhesion properties are paramount.

- In-Mold Labels: Witnessing increasing adoption, especially in the food and beverage industry, for its durability and premium aesthetic appeal.

- Other Labels: Encompasses specialized label types catering to unique industry needs, holding a moderate market share.

- By End-user Industry:

- Food: The largest and most significant segment, driven by the relentless global demand for packaged food items.

- Beverage: Exhibits strong growth, propelled by the widespread popularity of bottled and canned beverages, requiring efficient and attractive labeling solutions.

- Pharmaceutical: Characterized by high demand for tamper-evident labels, crucial for product security, and labels that adhere to strict regulatory and compliance requirements.

- Personal Care: Demonstrates a growing adoption of visually appealing and informative labels to enhance brand perception and consumer engagement.

- Other End-user Industries: Includes a diverse range of sectors such as industrial, chemical, and household goods, each with specific labeling needs.

Regional Growth Dynamics:

- North America: Fueled by substantial consumer spending, a thriving food and beverage industry, and a mature packaging ecosystem.

- Europe: Driven by stringent regulatory mandates, a strong emphasis on sustainability initiatives, and an advanced, well-established packaging infrastructure.

- Asia-Pacific: Poised for rapid expansion due to a burgeoning middle class, increasing disposable incomes, and a surging demand for a wider variety of packaged consumer goods.

Primary Packaging Labels Market Product Analysis

The market showcases continuous innovation in label materials, printing technologies, and functionalities. Advances in digital printing technology offer greater flexibility, customization, and shorter lead times. Sustainable materials like recycled paper, bioplastics, and compostable films are gaining traction, responding to environmental concerns. Smart label features, such as RFID tags, enable product tracking and enhance supply chain transparency. Competitive advantages are derived from superior print quality, cost-effectiveness, quick turnaround times, sustainable materials, and advanced label functionalities.

Key Drivers, Barriers & Challenges in Primary Packaging Labels Market

Key Drivers:

- The persistent and growing global demand for packaged goods, with particularly strong momentum in emerging economies.

- Continuous technological advancements in printing, enabling greater efficiency, higher quality, and increased personalization options.

- A significant and accelerating trend towards the adoption of sustainable and eco-friendly packaging materials, driven by consumer and regulatory pressures.

- The increasing integration of smart packaging features, enhancing product traceability, providing valuable consumer engagement, and improving supply chain management.

Key Barriers & Challenges:

- Volatility in the prices of essential raw materials, such as paper pulp and adhesives, can significantly impact production costs and profitability.

- Navigating and adhering to complex and often disparate regulatory compliance requirements across various geographical regions and diverse industry sectors.

- The intense competitive landscape, characterized by a large number of manufacturers, necessitates ongoing innovation, aggressive cost optimization, and superior customer service.

- Vulnerability to supply chain disruptions, which can lead to production delays, increased lead times, and elevated operational costs. For instance, a [Insert Transportation Cost Increase Percentage Here]% increase in transportation costs experienced in 2022, driven by logistical challenges, had a negative impact on the profitability of approximately [Insert Percentage of Market Impacted Here]% of the market.

Growth Drivers in the Primary Packaging Labels Market Market

The market is fueled by rising consumer demand for packaged goods, particularly in developing economies. Technological advancements, such as digital printing and sustainable materials, are creating significant opportunities. Government regulations promoting eco-friendly packaging further enhance market growth.

Challenges Impacting Primary Packaging Labels Market Growth

Several critical factors present ongoing challenges to the growth trajectory of the primary packaging labels market. Persistent supply chain disruptions, unpredictable fluctuations in the costs of raw materials, and the intense competitive pressure from numerous market players are significant hurdles. Additionally, stringent regulatory compliance requirements that vary by region and industry, coupled with the increasing adoption of substitute packaging materials, pose further obstacles to achieving accelerated market growth.

Key Players Shaping the Primary Packaging Labels Market Market

Significant Primary Packaging Labels Market Industry Milestones

- March 2022: Heartwood Partners announced the merger of All American Label & Packaging and Western Shield Label & Packaging, expanding pressure-sensitive label production capacity and market reach across North America.

- January 2022: Resource Label Group acquired QSX Labels, further strengthening its position in the New England region and expanding its service offerings.

Future Outlook for Primary Packaging Labels Market Market

The Primary Packaging Labels Market is poised for continued growth, driven by increasing demand for sustainable and innovative packaging solutions. Opportunities exist in the development of smart labels with integrated technologies and the expansion into emerging markets. The market's future trajectory hinges on navigating supply chain challenges, adapting to evolving consumer preferences, and complying with evolving regulatory landscapes.

Primary Packaging Labels Market Segmentation

-

1. Application Method

- 1.1. Pressure Sensitive Labels

- 1.2. Heat Shrink and Stretch Sleeve Labels

- 1.3. Glue Applied Labels

- 1.4. In-Mold Labels

- 1.5. Other Labels

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Personalcare

- 2.5. Other End-user Industries

Primary Packaging Labels Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Primary Packaging Labels Market Regional Market Share

Geographic Coverage of Primary Packaging Labels Market

Primary Packaging Labels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Manufacturing in Developing Economies; Growing Demand from Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Changing Government Regulations and Standards

- 3.4. Market Trends

- 3.4.1. Growing Demand for Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Method

- 5.1.1. Pressure Sensitive Labels

- 5.1.2. Heat Shrink and Stretch Sleeve Labels

- 5.1.3. Glue Applied Labels

- 5.1.4. In-Mold Labels

- 5.1.5. Other Labels

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Personalcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application Method

- 6. North America Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Method

- 6.1.1. Pressure Sensitive Labels

- 6.1.2. Heat Shrink and Stretch Sleeve Labels

- 6.1.3. Glue Applied Labels

- 6.1.4. In-Mold Labels

- 6.1.5. Other Labels

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Personalcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application Method

- 7. Europe Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Method

- 7.1.1. Pressure Sensitive Labels

- 7.1.2. Heat Shrink and Stretch Sleeve Labels

- 7.1.3. Glue Applied Labels

- 7.1.4. In-Mold Labels

- 7.1.5. Other Labels

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Personalcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application Method

- 8. Asia Pacific Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Method

- 8.1.1. Pressure Sensitive Labels

- 8.1.2. Heat Shrink and Stretch Sleeve Labels

- 8.1.3. Glue Applied Labels

- 8.1.4. In-Mold Labels

- 8.1.5. Other Labels

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Personalcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application Method

- 9. Latin America Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Method

- 9.1.1. Pressure Sensitive Labels

- 9.1.2. Heat Shrink and Stretch Sleeve Labels

- 9.1.3. Glue Applied Labels

- 9.1.4. In-Mold Labels

- 9.1.5. Other Labels

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Personalcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application Method

- 10. Middle East Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Method

- 10.1.1. Pressure Sensitive Labels

- 10.1.2. Heat Shrink and Stretch Sleeve Labels

- 10.1.3. Glue Applied Labels

- 10.1.4. In-Mold Labels

- 10.1.5. Other Labels

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Personalcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 R R Donnelley & Sons Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Resource Label Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HERMA GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Consolidated Label Co *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi-Color Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avery Dennison Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fuji Seal International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Oyj

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 R R Donnelley & Sons Company

List of Figures

- Figure 1: Global Primary Packaging Labels Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 3: North America Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 4: North America Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 9: Europe Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 10: Europe Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 15: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 16: Asia Pacific Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 21: Latin America Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 22: Latin America Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 27: Middle East Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 28: Middle East Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 2: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Primary Packaging Labels Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 5: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 8: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 11: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 14: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 17: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primary Packaging Labels Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Primary Packaging Labels Market?

Key companies in the market include R R Donnelley & Sons Company, Resource Label Group, Amcor Plc, HERMA GmbH, Consolidated Label Co *List Not Exhaustive, CCL Industries Inc, Multi-Color Corporation, Avery Dennison Corporation, Fuji Seal International Inc, Huhtamaki Oyj.

3. What are the main segments of the Primary Packaging Labels Market?

The market segments include Application Method, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Manufacturing in Developing Economies; Growing Demand from Food and Beverage Industry.

6. What are the notable trends driving market growth?

Growing Demand for Beverages.

7. Are there any restraints impacting market growth?

Changing Government Regulations and Standards.

8. Can you provide examples of recent developments in the market?

March 2022: Heartwood Partners announced the merger of All American Label & Packaging and Western Shield Label & Packaging, a significant supplier of pressure-sensitive prime labels and packaging solutions to the food & beverage, health & beauty, and industrials sectors. Western Shield and AALP's highest quality standards and advanced operations across California, Texas, Ohio, and Tennessee are ideally positioned to service customers nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Primary Packaging Labels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Primary Packaging Labels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Primary Packaging Labels Market?

To stay informed about further developments, trends, and reports in the Primary Packaging Labels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence