Key Insights

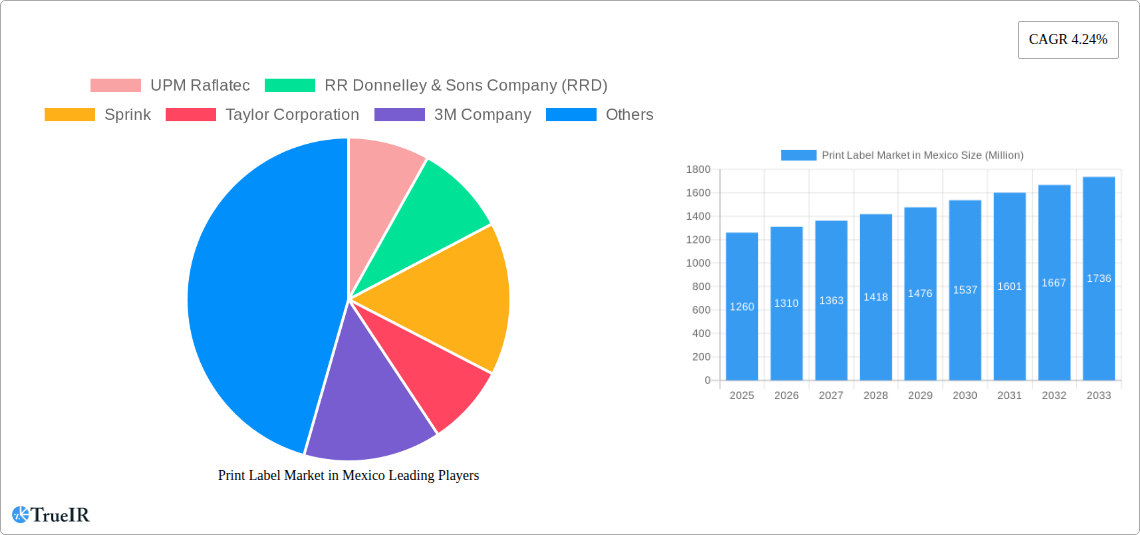

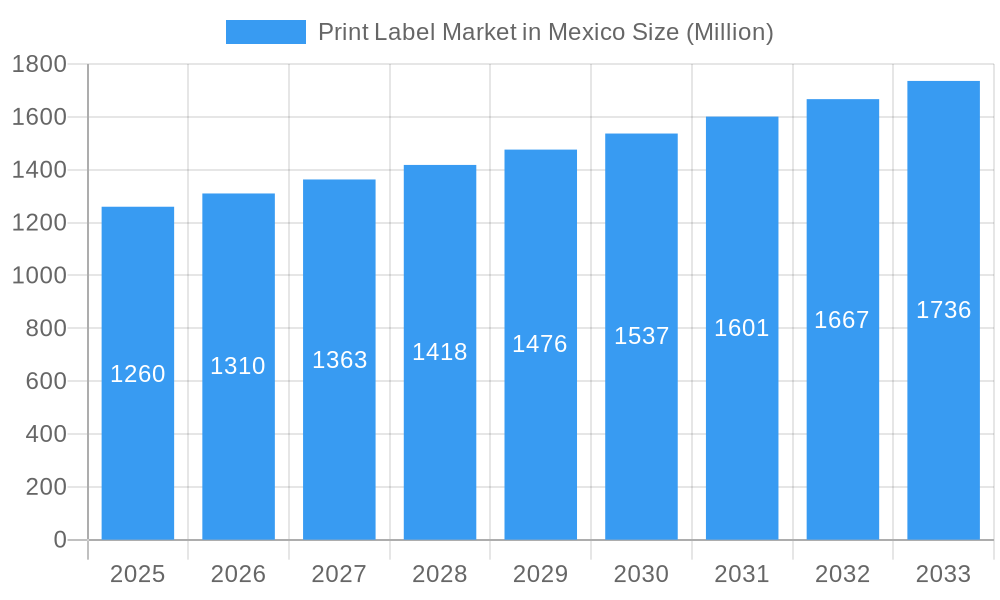

The Mexican print label market, valued at $1.26 billion in 2025, is projected to experience robust growth, driven by a burgeoning food and beverage sector, expanding e-commerce, and increasing demand for sophisticated packaging solutions across various industries. A compound annual growth rate (CAGR) of 4.24% from 2025 to 2033 signifies a steady expansion, fueled by several key factors. The rise of personalized and digitally printed labels caters to evolving consumer preferences, while the adoption of sustainable and eco-friendly labeling materials is gaining traction. Pressure-sensitive labels (PSL) are expected to dominate the market due to their ease of application and versatility. Growth in the healthcare and pharmaceutical sectors, demanding tamper-evident and track-and-trace labels, further boosts market demand. Competition among established players like UPM Raflatec, Avery Dennison, and CCL Industries, alongside local players like STICKER'S PACK SA de CV and Multi-Color Mexico, shapes the market dynamics. However, challenges exist, such as fluctuations in raw material prices and the need to adapt to evolving regulatory requirements. The market's future trajectory hinges on successfully navigating these challenges while capitalizing on emerging opportunities in specialized label segments like in-mold labels and shrink sleeve labels.

Print Label Market in Mexico Market Size (In Billion)

Growth within specific segments will likely outpace the overall market average. For instance, the increasing demand for product traceability and anti-counterfeiting measures is expected to significantly boost the multi-part tracking label segment. Similarly, the growing popularity of e-commerce will fuel demand for pressure-sensitive labels, which are easily integrated into automated packaging processes. The food and beverage sector will continue to be a major driver, demanding high-quality, aesthetically pleasing, and informative labels to attract consumers. While offset printing maintains a strong presence, digital printing is expected to gain significant market share due to its adaptability, short print runs, and cost-effectiveness for personalized labels. Therefore, companies focused on innovation and technological advancements within these sub-segments are likely to experience the most significant returns.

Print Label Market in Mexico Company Market Share

Dynamic Report: Print Label Market in Mexico (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning Print Label Market in Mexico, projecting robust growth from 2025 to 2033. We delve into market structure, competitive dynamics, key segments, and future trends, offering invaluable insights for businesses operating within or seeking to enter this lucrative market. The report covers a period from 2019 to 2033, using 2025 as the base and estimated year. It leverages extensive data analysis to forecast market size, CAGR, and penetration rates, providing a clear roadmap for strategic decision-making.

Print Label Market in Mexico: Market Structure & Competitive Landscape

The Mexican print label market exhibits a moderately concentrated structure, with several large multinational players and a significant number of smaller, local businesses. The market's Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Major players like UPM Raflatec, RR Donnelley & Sons Company (RRD), and Avery Dennison Corporation vie for market share, driving innovation and fierce competition. Innovation is fueled by demand for specialized labels across various end-user industries. The market is subject to various regulatory impacts, including environmental regulations concerning material usage and waste management. Product substitution is minimal, with limited alternatives to printed labels for packaging and identification purposes. The market displays a diverse end-user segmentation, with significant demand across Food & Beverage, Healthcare & Pharmaceutical, and Cosmetics sectors. M&A activity remains moderate, with xx million USD worth of deals recorded in the last five years, mainly focused on consolidating market presence and expanding production capabilities.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx.

- Innovation Drivers: Demand for specialized labels, technological advancements in printing techniques.

- Regulatory Impacts: Environmental regulations concerning materials and waste.

- Product Substitutes: Limited viable alternatives currently exist.

- End-User Segmentation: Strong demand from Food & Beverage, Healthcare & Pharmaceutical, and Cosmetics.

- M&A Trends: Moderate activity, valued at approximately xx million USD over the past five years.

Print Label Market in Mexico: Market Trends & Opportunities

The Mexican print label market is poised for significant growth, driven by several key factors. The market size is projected to reach xx million USD by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the expanding domestic manufacturing sector and increasing consumer demand for packaged goods. A notable shift towards digital printing is observed, offering greater flexibility and shorter lead times compared to traditional methods. Consumer preferences are evolving toward aesthetically appealing, eco-friendly labels, driving innovation in sustainable materials and printing technologies. The competitive landscape remains dynamic, with both local and international players aggressively pursuing market share through strategic investments, product diversification, and technological upgrades. Market penetration rates for various label types are increasing, particularly for pressure-sensitive labels and shrink sleeves.

Dominant Markets & Segments in Print Label Market in Mexico

Pressure-sensitive labels (PSLs) dominate the label type segment, capturing approximately xx% of the market share in 2025, due to their versatility and ease of application. The Food & Beverage sector is the leading end-user industry, driving substantial demand for various label types. The growth of the e-commerce sector further fuels demand for labels. The central region of Mexico exhibits the highest market concentration owing to its well-established manufacturing and distribution networks. Digital printing technology is experiencing significant growth, driven by its flexibility and efficiency in handling short-run print jobs.

- Leading Segment: Pressure-Sensitive Labels (PSL)

- Leading End-user Industry: Food & Beverage

- Fastest-Growing Technology: Digital Printing

- Key Growth Drivers:

- Expanding domestic manufacturing sector

- Rise of e-commerce

- Growing demand for packaged goods

- Adoption of sustainable labeling practices

Print Label Market in Mexico: Product Analysis

The Mexican print label market showcases continuous innovation in label materials, designs, and printing techniques. Technological advancements in digital printing and specialized adhesives are improving label durability, aesthetics, and functionality. Innovations in sustainable materials, such as biodegradable and recycled substrates, are gaining traction, responding to environmentally conscious consumer preferences. These advancements enhance product differentiation and cater to diverse application needs across various end-user industries, contributing significantly to the market's dynamic growth.

Key Drivers, Barriers & Challenges in Print Label Market in Mexico

Key Drivers:

- Growing domestic consumption and industrial production.

- Increasing demand for packaged goods.

- Technological advancements in printing and label materials.

- Favorable government policies supporting industrial growth.

Challenges:

- Fluctuations in raw material prices.

- Intense competition from established and emerging players.

- Regulatory complexities concerning labeling requirements.

- Supply chain vulnerabilities impacting material availability and lead times.

Growth Drivers in the Print Label Market in Mexico Market

The Mexican print label market is driven by the expanding economy, increased consumption of packaged goods across various sectors, and rising demand for sophisticated and sustainable label solutions. Technological advancements, particularly in digital printing, enhance efficiency and customization, while government initiatives focused on sustainable packaging practices contribute positively.

Challenges Impacting Print Label Market in Mexico Growth

Challenges include the volatility of raw material costs, heightened competition, and potential supply chain disruptions impacting timely product delivery. Regulatory compliance across diverse sectors poses an operational complexity and economic pressure on companies.

Key Players Shaping the Print Label Market in Mexico Market

- UPM Raflatec

- RR Donnelley & Sons Company (RRD)

- Sprink

- Taylor Corporation

- 3M Company

- STICKER'S PACK SA de CV

- CCL Industries Inc

- Clondalkin Group

- Avery Dennison Corporation

- Fuji Seal International Inc

- Multi-Color Mexico Corporation

- Papers and Conversions of Mexico

- Eximpro

- Brady Worldwide Inc

Significant Print Label Market in Mexico Industry Milestones

- October 2023: All4Labels expands its Mexican facility to 12,000 square meters, adding five new printing lines and investing USD 4.32 million in equipment, significantly boosting production capacity.

- June 2022: Henkel opens a new hot melt adhesive plant in Guadalupe, Mexico, enhancing the availability of high-performance adhesives crucial for label production.

Future Outlook for Print Label Market in Mexico Market

The Mexican print label market is projected to witness sustained growth, driven by expanding industrial activity, e-commerce boom, and increasing demand for customized and sustainable labels. Strategic investments in advanced printing technologies and eco-friendly materials will further enhance the market's competitiveness and attract new players, fostering dynamic expansion in the coming years.

Print Label Market in Mexico Segmentation

-

1. Print Technology

- 1.1. Offset

- 1.2. Flexography

- 1.3. Rotogravure

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Digital Printing

-

2. Label Type

- 2.1. Wet-glued Labels

- 2.2. Pressure Sensitive Labels (PSL)

- 2.3. Liner less Labels

- 2.4. In-mold Labels

- 2.5. Shrink Sleeve Labels

- 2.6. Multi-part Tracking Label

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceutical

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industrial

- 3.7. Other End-user Industries

Print Label Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Print Label Market in Mexico Regional Market Share

Geographic Coverage of Print Label Market in Mexico

Print Label Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Flexographic Printing to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 5.1.1. Offset

- 5.1.2. Flexography

- 5.1.3. Rotogravure

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Digital Printing

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glued Labels

- 5.2.2. Pressure Sensitive Labels (PSL)

- 5.2.3. Liner less Labels

- 5.2.4. In-mold Labels

- 5.2.5. Shrink Sleeve Labels

- 5.2.6. Multi-part Tracking Label

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceutical

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industrial

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 6. North America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 6.1.1. Offset

- 6.1.2. Flexography

- 6.1.3. Rotogravure

- 6.1.4. Screen

- 6.1.5. Letterpress

- 6.1.6. Digital Printing

- 6.2. Market Analysis, Insights and Forecast - by Label Type

- 6.2.1. Wet-glued Labels

- 6.2.2. Pressure Sensitive Labels (PSL)

- 6.2.3. Liner less Labels

- 6.2.4. In-mold Labels

- 6.2.5. Shrink Sleeve Labels

- 6.2.6. Multi-part Tracking Label

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare and Pharmaceutical

- 6.3.4. Cosmetics

- 6.3.5. Household

- 6.3.6. Industrial

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 7. South America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 7.1.1. Offset

- 7.1.2. Flexography

- 7.1.3. Rotogravure

- 7.1.4. Screen

- 7.1.5. Letterpress

- 7.1.6. Digital Printing

- 7.2. Market Analysis, Insights and Forecast - by Label Type

- 7.2.1. Wet-glued Labels

- 7.2.2. Pressure Sensitive Labels (PSL)

- 7.2.3. Liner less Labels

- 7.2.4. In-mold Labels

- 7.2.5. Shrink Sleeve Labels

- 7.2.6. Multi-part Tracking Label

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare and Pharmaceutical

- 7.3.4. Cosmetics

- 7.3.5. Household

- 7.3.6. Industrial

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 8. Europe Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 8.1.1. Offset

- 8.1.2. Flexography

- 8.1.3. Rotogravure

- 8.1.4. Screen

- 8.1.5. Letterpress

- 8.1.6. Digital Printing

- 8.2. Market Analysis, Insights and Forecast - by Label Type

- 8.2.1. Wet-glued Labels

- 8.2.2. Pressure Sensitive Labels (PSL)

- 8.2.3. Liner less Labels

- 8.2.4. In-mold Labels

- 8.2.5. Shrink Sleeve Labels

- 8.2.6. Multi-part Tracking Label

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare and Pharmaceutical

- 8.3.4. Cosmetics

- 8.3.5. Household

- 8.3.6. Industrial

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 9. Middle East & Africa Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 9.1.1. Offset

- 9.1.2. Flexography

- 9.1.3. Rotogravure

- 9.1.4. Screen

- 9.1.5. Letterpress

- 9.1.6. Digital Printing

- 9.2. Market Analysis, Insights and Forecast - by Label Type

- 9.2.1. Wet-glued Labels

- 9.2.2. Pressure Sensitive Labels (PSL)

- 9.2.3. Liner less Labels

- 9.2.4. In-mold Labels

- 9.2.5. Shrink Sleeve Labels

- 9.2.6. Multi-part Tracking Label

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare and Pharmaceutical

- 9.3.4. Cosmetics

- 9.3.5. Household

- 9.3.6. Industrial

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 10. Asia Pacific Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 10.1.1. Offset

- 10.1.2. Flexography

- 10.1.3. Rotogravure

- 10.1.4. Screen

- 10.1.5. Letterpress

- 10.1.6. Digital Printing

- 10.2. Market Analysis, Insights and Forecast - by Label Type

- 10.2.1. Wet-glued Labels

- 10.2.2. Pressure Sensitive Labels (PSL)

- 10.2.3. Liner less Labels

- 10.2.4. In-mold Labels

- 10.2.5. Shrink Sleeve Labels

- 10.2.6. Multi-part Tracking Label

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare and Pharmaceutical

- 10.3.4. Cosmetics

- 10.3.5. Household

- 10.3.6. Industrial

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPM Raflatec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RR Donnelley & Sons Company (RRD)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sprink

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taylor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STICKER'S PACK SA de CV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clondalkin Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fuji Seal International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Multi-Color Mexico Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Papers and Conversions of Mexico*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eximpro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Brady Worldwide Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 UPM Raflatec

List of Figures

- Figure 1: Global Print Label Market in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 3: North America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 4: North America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 5: North America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 6: North America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 11: South America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 12: South America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 13: South America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 14: South America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 19: Europe Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 20: Europe Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 21: Europe Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 22: Europe Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 27: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 28: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 29: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 30: Middle East & Africa Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 35: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 36: Asia Pacific Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 37: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 38: Asia Pacific Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 2: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Print Label Market in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 6: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 13: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 14: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 20: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 21: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 33: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 34: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 43: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 44: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Print Label Market in Mexico?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the Print Label Market in Mexico?

Key companies in the market include UPM Raflatec, RR Donnelley & Sons Company (RRD), Sprink, Taylor Corporation, 3M Company, STICKER'S PACK SA de CV, CCL Industries Inc, Clondalkin Group, Avery Dennison Corporation, Fuji Seal International Inc, Multi-Color Mexico Corporation, Papers and Conversions of Mexico*List Not Exhaustive, Eximpro, Brady Worldwide Inc.

3. What are the main segments of the Print Label Market in Mexico?

The market segments include Print Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length.

6. What are the notable trends driving market growth?

Flexographic Printing to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

October 2023 - All4Labels relocated to a larger facility spanning over 12,000 square meters in Mexico. It is implementing various new technologies to enhance its nationwide footprint as part of its expansion strategy. The addition of five new printing lines, emphasizing pressure-sensitive labels and shrink sleeves, is set to triple production capacity at the site. In phase two, the company is investing EUR 4 million (USD 4.32 million) in equipment, encompassing digital, flexo, and gravure presses, along with a comprehensive upgrade of its pre-press capabilities. This strategic expansion, coupled with the integration of advanced technologies, solidifies its presence and plays a pivotal role in fueling the growth of the flourishing label market in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Print Label Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Print Label Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Print Label Market in Mexico?

To stay informed about further developments, trends, and reports in the Print Label Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence