Key Insights

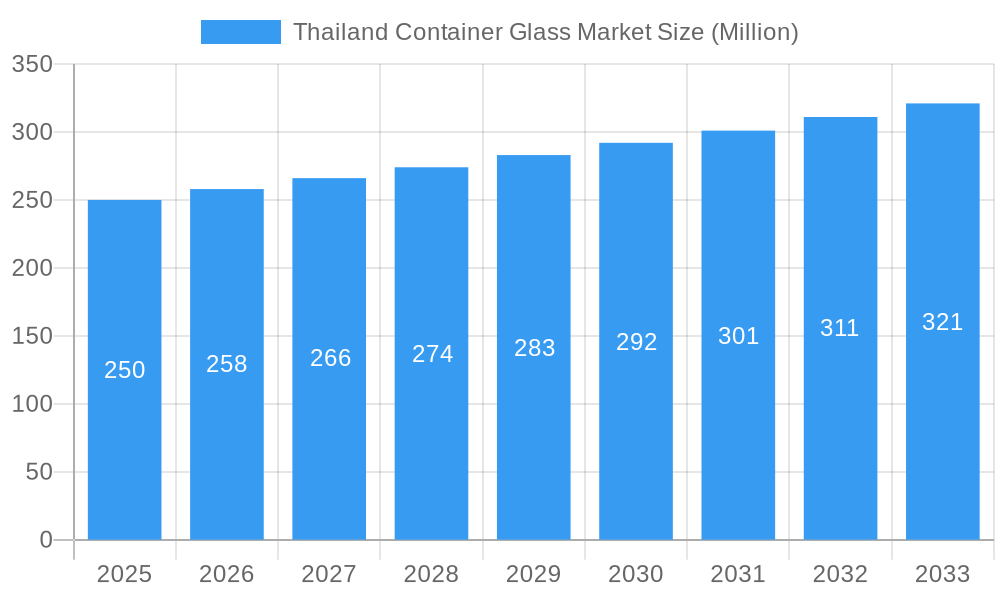

The Thailand container glass market is projected to reach $150 million in 2025, with a robust compound annual growth rate (CAGR) of 3.12% from 2025 to 2033. This expansion is primarily propelled by Thailand's dynamic food and beverage industry, fueled by increasing domestic consumption and tourism. The pharmaceutical sector's demand for premium glass packaging for drug containment and the cosmetics industry's growing preference for sophisticated glass packaging further bolster market growth. Despite challenges from fluctuating raw material costs and competition from alternative packaging, the market's outlook remains strong. A significant driver is the increasing consumer and regulatory preference for sustainable and recyclable glass packaging, alongside stricter regulations on plastic use. Leading companies, including Bangkok Glass Public Co Ltd and Thai Glass Industries Public Company Ltd, are actively investing in advanced manufacturing and diversifying product offerings to meet evolving market needs, fostering innovation and competitive dynamics.

Thailand Container Glass Market Market Size (In Million)

The forecast period (2025-2033) predicts sustained growth in the Thailand container glass market, supported by rising disposable incomes, an expanding middle class, and ongoing economic development. Key growth opportunities lie in continuous innovation of glass container designs, emphasizing enhanced functionality, aesthetic appeal, and sustainability. Addressing potential challenges such as energy price volatility and evolving consumer preferences for lighter packaging will be crucial for market participants to secure a competitive advantage and capitalize on emerging trends. Detailed regional analysis within Thailand can identify specific growth opportunities based on population density, industrial activity, and infrastructure development.

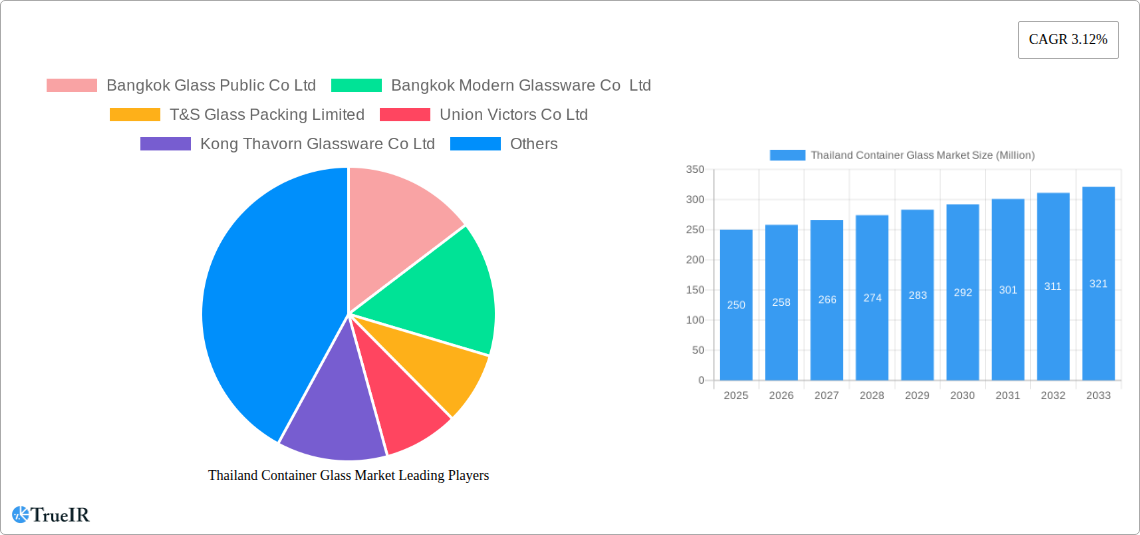

Thailand Container Glass Market Company Market Share

Thailand Container Glass Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Thailand container glass market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a focus on market size, growth drivers, competitive dynamics, and future projections, this report covers the period from 2019 to 2033, with a base year of 2025. The report leverages extensive primary and secondary research to deliver a precise and actionable understanding of this dynamic market. Expect in-depth coverage of key segments, including beverage, food, pharmaceutical, and cosmetic packaging, revealing market trends and opportunities within each. Discover the competitive landscape, identifying key players like Bangkok Glass Public Co Ltd, and exploring strategies for success in this thriving market. The report’s forecast, encompassing the period 2025-2033, utilizes advanced analytical models to project future market values in Millions.

Thailand Container Glass Market Market Structure & Competitive Landscape

The Thailand container glass market exhibits a moderately concentrated structure, with several established players commanding significant market share. Bangkok Glass Public Co Ltd, Bangkok Modern Glassware Co Ltd, T&S Glass Packing Limited, Union Victors Co Ltd, Kong Thavorn Glassware Co Ltd, Siam Glass Industry Co Ltd, Biomed, Tube glass perfume and cosmetic packing, Ocean Glassware, and Thai Glass Industries Public Company Ltd are among the key players. The market concentration ratio (CR4) is estimated at xx% in 2025, indicating a competitive yet somewhat consolidated landscape. Innovation is a crucial driver, with companies investing in advanced manufacturing techniques to enhance efficiency and product quality. Regulatory compliance, including environmental standards, plays a significant role, shaping production practices and impacting market dynamics. While there are some substitutes for glass packaging, such as plastics and aluminum, glass retains a significant advantage due to its recyclability and perceived premium quality. The market has witnessed limited M&A activity in recent years, with a total deal value of approximately xx Million during the 2019-2024 period. Future M&A activity is expected to remain moderate, driven primarily by the consolidation of smaller players and efforts to expand product portfolios. The market is segmented by end-user industry:

- Beverage: This segment accounts for the largest share of the market, driven by demand from the growing beverage industry.

- Food: This segment demonstrates substantial growth driven by increasing demand for processed and packaged food items.

- Pharmaceuticals: The pharmaceutical segment exhibits steady growth reflecting increasing demand for high-quality packaging.

- Cosmetics: This sector exhibits strong growth due to the rise in popularity of cosmetic products in Thailand.

- Other End-User Industries: This segment encompasses various applications, such as household goods, contributing a smaller, yet significant portion of the market.

Thailand Container Glass Market Market Trends & Opportunities

The Thailand container glass market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is estimated at xx Million in 2025, with the potential to reach xx Million by 2033. Several factors contribute to this growth. Firstly, the expanding beverage and food processing industries in Thailand, fueled by rising disposable incomes and changing consumer preferences, are creating significant demand for glass containers. Secondly, technological advancements in glass manufacturing, such as improved automation and energy-efficient production processes, are enhancing the efficiency and cost-effectiveness of glass production. The increasing preference for eco-friendly packaging is further driving the market, as consumers and brands alike are prioritizing sustainable solutions. The trend of premiumization is also positively influencing the market, with the increasing demand for high-quality, aesthetically pleasing glass containers for food and beverage products. Competitive dynamics are characterized by both price competition and the differentiation of products based on features such as design, durability, and functionality. Market penetration rates are highest in urban areas and are gradually increasing in rural areas. The shift towards lightweighting to reduce transportation costs and environmental impact offers further opportunities.

Dominant Markets & Segments in Thailand Container Glass Market

The beverage segment currently holds the dominant position in the Thailand container glass market, accounting for approximately xx% of total market value in 2025. Its dominance is attributed to the significant consumption of packaged beverages in the country. The food segment is also a substantial contributor, exhibiting robust growth potential driven by changing dietary habits.

Key Growth Drivers for the Beverage Segment:

- Growing demand for bottled and canned beverages: Increasing urbanization and changing lifestyles lead to greater reliance on packaged beverages.

- Expansion of the beverage industry: Increased domestic and foreign investment in the beverage sector drives production and packaging needs.

- Government support for the beverage industry: Policies promoting growth in relevant sectors contribute to increased market demand.

Key Growth Drivers for the Food Segment:

- Rise of processed and packaged food: The changing lifestyle of urbanites significantly contributes to the growth.

- Expansion of the food processing industry: Investments in technology and infrastructure increase packaging demands.

- Emphasis on food safety and hygiene: The consumer demand for hygienic packaging boosts glass packaging sales.

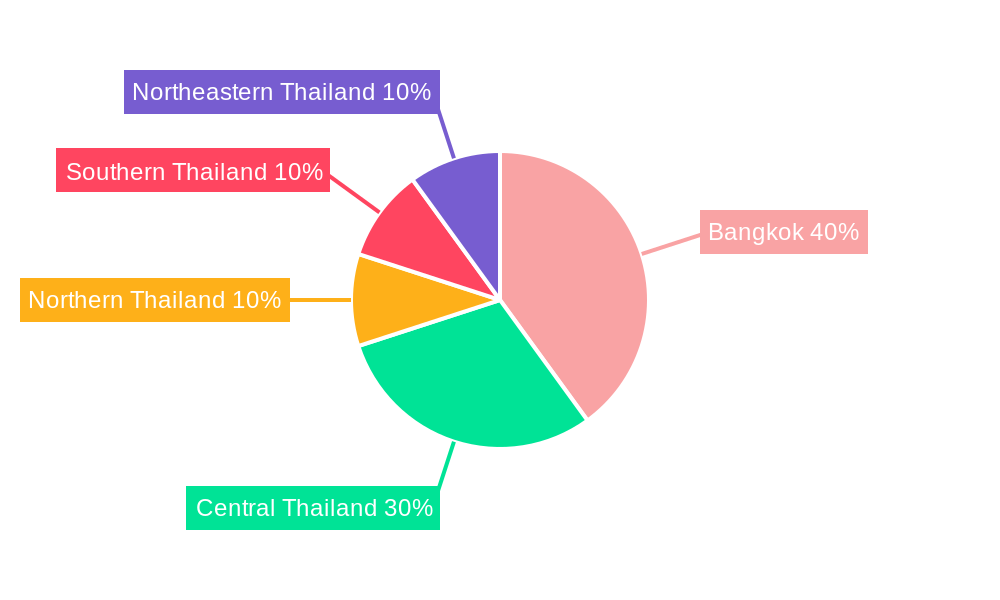

The geographic distribution of the market is largely concentrated in urban areas, with Bangkok and other major cities exhibiting the highest consumption rates.

Thailand Container Glass Market Product Analysis

Product innovation in the Thailand container glass market focuses on lightweighting, improved durability, and enhanced aesthetics. Manufacturers are investing in technologies to create lighter containers, reducing transportation costs and minimizing environmental impact. Advances in design and decoration techniques allow for customized packaging, appealing to consumers' preferences for visually appealing products. The competitive advantages stem from cost efficiency, production capacity, and the ability to provide customized solutions tailored to the specific requirements of customers in different end-user segments, especially in the beverage and food industries.

Key Drivers, Barriers & Challenges in Thailand Container Glass Market

Key Drivers:

- Rising disposable incomes: A growing middle class drives demand for packaged goods.

- Increased consumer preference for eco-friendly packaging: Glass's recyclability makes it an attractive option.

- Advancements in glass manufacturing technology: Efficiency improvements lead to cost reductions.

Key Challenges:

- Fluctuating raw material prices: The cost of raw materials significantly impacts profitability.

- Intense competition: Pressure from alternative packaging materials affects market share.

- Environmental regulations: Meeting stringent environmental standards incurs costs. This can impact smaller players disproportionately, potentially leading to consolidation.

Growth Drivers in the Thailand Container Glass Market Market

Growth is driven by increasing urbanization, rising disposable incomes fueling demand for packaged goods, the expanding food and beverage industries, and a shift towards sustainable packaging solutions. Technological advancements in manufacturing, allowing for cost-effective production, further enhance market growth.

Challenges Impacting Thailand Container Glass Market Growth

Challenges include volatility in raw material prices (particularly silica sand and energy costs), intense competition from alternative packaging materials like plastics and aluminum, stringent environmental regulations, and the need for continuous innovation to meet evolving consumer preferences.

Key Players Shaping the Thailand Container Glass Market Market

- Bangkok Glass Public Co Ltd

- Bangkok Modern Glassware Co Ltd

- T&S Glass Packing Limited

- Union Victors Co Ltd

- Kong Thavorn Glassware Co Ltd

- Siam Glass Industry Co Ltd

- Biomed

- Tube glass perfume and cosmetic packing

- Ocean Glassware

- Thai Glass Industries Public Company Ltd

Significant Thailand Container Glass Market Industry Milestones

- 2021 (Q3): Bangkok Glass Public Co Ltd launched a new lightweight glass bottle for the beverage industry.

- 2022 (Q1): Significant investment in automated manufacturing by Thai Glass Industries Public Company Ltd.

- 2023 (Q2): New environmental regulations implemented, impacting the production process for several companies.

Future Outlook for Thailand Container Glass Market Market

The Thailand container glass market is poised for continued growth, driven by sustained economic expansion, urbanization, and increasing demand for packaged food and beverages. Opportunities exist for companies that can provide innovative, sustainable, and cost-effective solutions. Strategic investments in research and development, coupled with a focus on meeting stringent environmental regulations, will be crucial for success in this dynamic market. The market is projected to witness further consolidation as players seek to achieve economies of scale and enhance their competitive positions.

Thailand Container Glass Market Segmentation

-

1. End-user Industry

- 1.1. Beverage

- 1.2. Food

- 1.3. Pharmaceuticals

- 1.4. Cosmetics

- 1.5. Other End-User Industries

Thailand Container Glass Market Segmentation By Geography

- 1. Thailand

Thailand Container Glass Market Regional Market Share

Geographic Coverage of Thailand Container Glass Market

Thailand Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics

- 3.3. Market Restrains

- 3.3.1. Alternative Forms of Packaging is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. Cosmetics to have a significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.2. Food

- 5.1.3. Pharmaceuticals

- 5.1.4. Cosmetics

- 5.1.5. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bangkok Glass Public Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bangkok Modern Glassware Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 T&S Glass Packing Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Union Victors Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kong Thavorn Glassware Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siam Glass Industry Co Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biomed

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tube glass perfume and cosmetic packing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ocean Glassware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Thai Glass Industries Public Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangkok Glass Public Co Ltd

List of Figures

- Figure 1: Thailand Container Glass Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Thailand Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Container Glass Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Thailand Container Glass Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Thailand Container Glass Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Thailand Container Glass Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Container Glass Market?

The projected CAGR is approximately 3.12%.

2. Which companies are prominent players in the Thailand Container Glass Market?

Key companies in the market include Bangkok Glass Public Co Ltd, Bangkok Modern Glassware Co Ltd, T&S Glass Packing Limited, Union Victors Co Ltd, Kong Thavorn Glassware Co Ltd, Siam Glass Industry Co Ltd *List Not Exhaustive, Biomed, Tube glass perfume and cosmetic packing, Ocean Glassware, Thai Glass Industries Public Company Ltd.

3. What are the main segments of the Thailand Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics.

6. What are the notable trends driving market growth?

Cosmetics to have a significant growth.

7. Are there any restraints impacting market growth?

Alternative Forms of Packaging is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Container Glass Market?

To stay informed about further developments, trends, and reports in the Thailand Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence