Key Insights

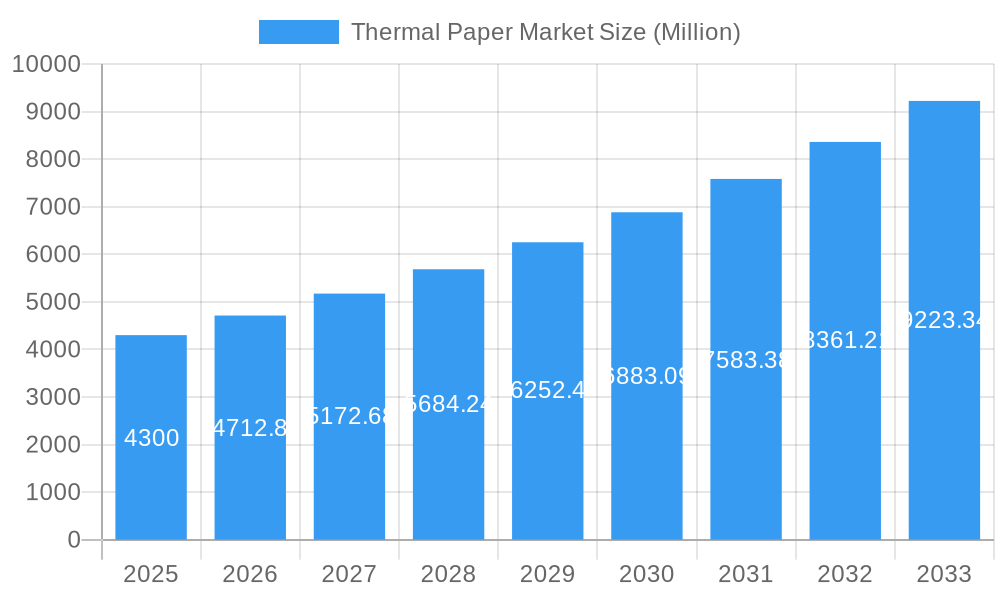

The global thermal paper market, valued at $4.30 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.60% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of point-of-sale (POS) systems across various retail sectors, fueled by the ongoing digitalization of commerce, is a significant contributor. Furthermore, the growth of the healthcare and pharmaceutical industries, demanding thermal paper for labeling and record-keeping, significantly boosts market demand. The entertainment sector, with its reliance on ticketing and event management systems, also contributes to market growth. Technological advancements in thermal paper manufacturing, leading to improved image quality, durability, and eco-friendlier options, further propel market expansion. However, the market faces certain restraints, including fluctuating raw material prices and growing environmental concerns related to the disposal of thermal paper. Competition among established players and the emergence of new entrants also influence market dynamics. Geographical expansion, particularly in developing economies with rising consumer spending and infrastructural development, presents lucrative opportunities for market players. The segmentation by end-user industry (POS, Labels, Entertainment, Medical & Pharmaceutical, Other) allows for targeted strategies based on specific industry needs and growth potential. North America and Europe currently dominate the market, but the Asia-Pacific region is poised for significant growth due to rapid industrialization and expanding retail sectors.

Thermal Paper Market Market Size (In Billion)

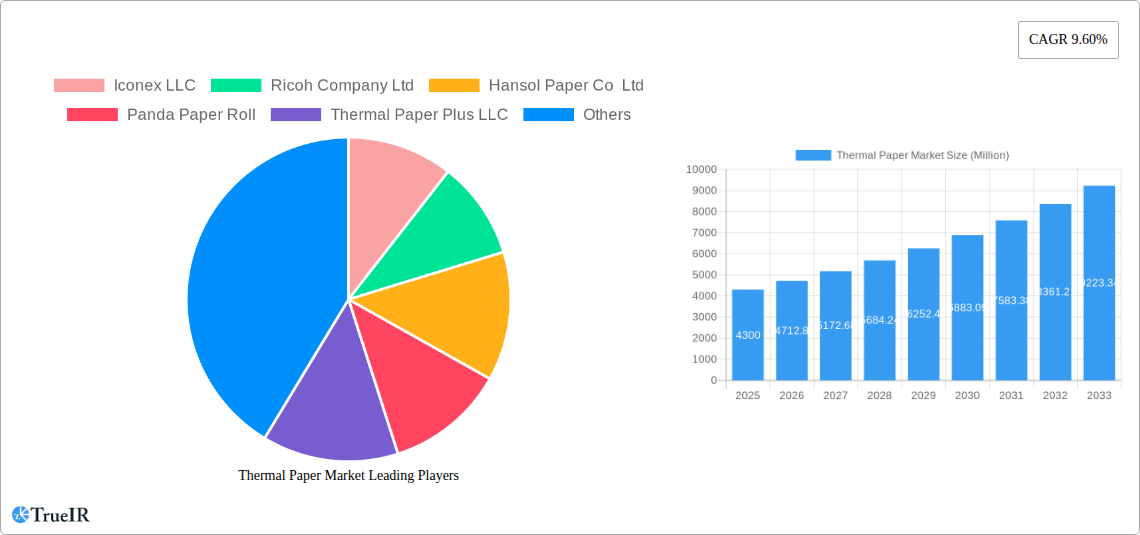

The competitive landscape is characterized by a mix of established international players and regional manufacturers. Key players like Ricoh, Kanzaki Specialty Papers, and Mitsubishi Paper Mills leverage their technological expertise and established distribution networks to maintain their market share. However, smaller, regional players are also contributing significantly, particularly in meeting specific regional demands and offering competitive pricing. Future growth strategies for market participants should focus on product innovation (e.g., developing sustainable thermal paper options), expanding into new geographical markets, and establishing strategic partnerships to leverage complementary technologies and distribution channels. The market's evolution will be shaped by regulatory changes concerning environmental sustainability, technological advancements in printing technologies, and shifts in consumer preferences. A comprehensive understanding of these factors is crucial for players seeking long-term success in this dynamic market.

Thermal Paper Market Company Market Share

Thermal Paper Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Thermal Paper Market, offering invaluable insights for businesses and investors seeking to navigate this evolving landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages extensive data and expert analysis to illuminate key trends, opportunities, and challenges. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Thermal Paper Market Market Structure & Competitive Landscape

The global thermal paper market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive market. Innovation plays a crucial role, driving the development of eco-friendly alternatives and enhanced performance features. Stringent environmental regulations, particularly concerning the use of BPA and other phenols, are shaping market dynamics, pushing manufacturers towards sustainable solutions. Product substitutes, such as electronic displays and digital receipts, pose a competitive threat, although the convenience and cost-effectiveness of thermal paper continue to ensure its relevance. End-user segmentation is diverse, encompassing POS systems, labels, entertainment ticketing, medical and pharmaceutical applications, and other niche segments. M&A activity in the sector has been moderate in recent years, with approximately xx acquisitions recorded between 2019 and 2024, primarily focused on expanding production capacity and technological capabilities.

- Market Concentration: Moderately concentrated, with HHI estimated at xx.

- Innovation Drivers: Development of eco-friendly materials and enhanced performance characteristics.

- Regulatory Impacts: Stringent environmental regulations impacting material composition.

- Product Substitutes: Electronic displays and digital receipts present competitive pressures.

- End-User Segmentation: POS, Labels, Entertainment, Medical & Pharmaceutical, Other.

- M&A Trends: Moderate activity, focused on capacity expansion and technological advancements.

Thermal Paper Market Market Trends & Opportunities

The thermal paper market is experiencing robust and sustained growth, primarily fueled by the escalating adoption of Point-of-Sale (POS) systems across the global retail and hospitality industries. A significant trend is the market's proactive response to environmental consciousness and regulatory mandates through technological advancements. This includes the development and increasing availability of BPA-free and other eco-friendly thermal paper alternatives, catering to a growing demand for sustainable printing solutions. Consumer preference for the convenience and cost-effectiveness of thermal paper in various applications continues to be a strong demand driver. However, the pervasive rise of digital alternatives presents a notable challenge to market expansion. Adoption rates for thermal paper vary considerably across different end-user segments. POS systems remain the most prevalent application, followed by the demand for thermal labels and applications within the entertainment sector. The market is projected to witness continued expansion, though potentially at a more tempered pace due to the highly competitive landscape. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is anticipated to be around xx%. Key opportunities lie in the innovation and development of specialized thermal papers tailored for niche and high-value applications, such as advanced high-resolution medical imaging and the creation of tamper-evident security labels for enhanced product integrity.

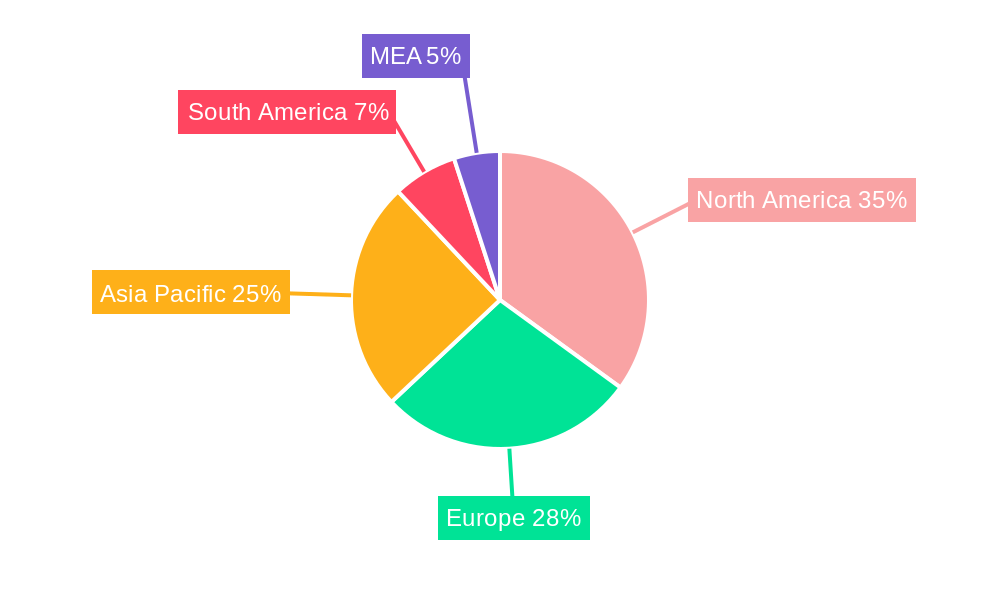

Dominant Markets & Segments in Thermal Paper Market

The Asia-Pacific region currently commands a dominant position in the global thermal paper market. This leadership is attributed to its rapid economic expansion, the burgeoning retail sectors, and a significant surge in the demand for POS systems and thermal labels. Within this region, China and Japan stand out as particularly influential contributors to market growth. North America and Europe also represent substantial and mature markets for thermal paper.

- Key Growth Drivers (Asia-Pacific):

- Accelerated economic development and a notable increase in disposable incomes.

- Continuous expansion of the retail and hospitality industries.

- High and persistent demand for POS systems and various types of thermal labels.

- Supportive government policies that foster industrial growth and technological adoption.

Examining end-user segments, POS systems continue to hold the largest market share. This is a direct consequence of their widespread integration into retail, hospitality, and healthcare environments for transactional printing. The medical and pharmaceutical sector is emerging as a segment with significant growth potential. This growth is propelled by the escalating need for secure, verifiable, and tamper-evident labels essential for pharmaceutical packaging and the precise tracking of medical devices, ensuring patient safety and supply chain integrity.

Thermal Paper Market Product Analysis

Recent product innovations focus heavily on sustainability and performance. Manufacturers are increasingly incorporating BPA-free and other eco-friendly materials, addressing regulatory concerns and consumer preferences. Technological advancements, such as improved coating technologies that enhance image clarity and durability, are driving product differentiation. Market fit is achieved by aligning product features with specific end-user needs, focusing on factors like print quality, longevity, and cost-effectiveness. The ability to meet environmental regulations and corporate sustainability initiatives also represents a significant competitive advantage.

Key Drivers, Barriers & Challenges in Thermal Paper Market

Key Drivers: The primary drivers fueling the thermal paper market include the continuous and widespread adoption of POS systems across various industries, the expanding retail and healthcare sectors, and the consistent demand for convenient and cost-effective printing solutions. Furthermore, ongoing technological advancements, particularly in the development of eco-friendly and high-performance thermal papers, are significant contributors to market growth.

Key Challenges: The market faces significant challenges, including intense competition from an increasing array of digital alternatives. Stringent environmental regulations are shaping material choices and production processes, sometimes leading to increased costs. Fluctuations in the prices of raw materials can impact profitability and market stability. Additionally, potential supply chain disruptions can significantly affect production capabilities and market availability. The industry is under continuous pressure to innovate and adapt its product offerings and manufacturing processes to align with evolving consumer preferences and rapid technological advancements.

Growth Drivers in the Thermal Paper Market Market

The market is propelled by the growth of e-commerce and the resulting demand for shipping labels and receipts, coupled with the expansion of the healthcare sector's need for diagnostic imaging and patient tracking. Technological innovation, leading to the development of sustainable and higher-quality thermal paper, further fuels growth. Government regulations encouraging environmentally friendly materials are also driving market expansion.

Challenges Impacting Thermal Paper Market Growth

The industry faces challenges such as intense competition from digital alternatives, which are gaining traction due to their environmental benefits. Fluctuations in raw material prices, particularly pulp and paper, directly impact production costs and profitability. Supply chain disruptions, potentially arising from geopolitical events or natural disasters, add further complexity. Meeting increasingly stringent environmental regulations while maintaining cost-competitiveness presents an ongoing challenge.

Key Players Shaping the Thermal Paper Market Market

- Iconex LLC

- Ricoh Company Ltd

- Hansol Paper Co Ltd

- Panda Paper Roll

- Thermal Paper Plus LLC

- Thermal Solutions International Inc

- Twin Rivers Paper Company Inc

- Rotolificio Bergamasco Srl

- Gold Huasheng Paper Co Ltd

- Mitsubishi Paper Mills (MPM) Limited

- Bizerba USA Inc

- Koehler Group

- Appvion Operations Inc

- Oji Holdings Corporation

- Kanzaki Specialty Papers Inc (KSP)

- NAKAGAWA Manufacturing (USA) Inc

- ACYPAPER

- Jujo Thermal Limited

- Telemark Diversified Graphic

- Cenveo Inc

- Henan Province JiangHe Paper Co Ltd

Significant Thermal Paper Market Industry Milestones

- June 2023: Appvion introduces its new, sustainable, patent-pending Next Generation technology direct thermal coating, free of phenolic developers. This significantly impacts the market by providing a more environmentally friendly alternative.

- March 2023: Twin Rivers finalized the sale of Plaster Rock Lumber Corporation, focusing its resources on specialty and kraft paper production. This strategic move strengthens its position within the thermal paper market.

Future Outlook for Thermal Paper Market Market

The thermal paper market is on a trajectory for continued and robust growth. This expansion will be sustained by the persistent demand from its core end-user segments and the ongoing introduction of innovative and environmentally responsible products. Strategic avenues for market players involve capitalizing on opportunities in specialized and emerging applications, as well as the development of thermal papers with superior performance characteristics. The future trajectory of the market will be significantly shaped by its ability to harmoniously balance the enduring need for cost-effective and convenient solutions with the escalating global emphasis on environmental sustainability and the increasing prevalence of digital alternatives. Companies that can effectively navigate supply chain complexities and proactively adapt to evolving regulatory landscapes will be best positioned for success in this dynamic and competitive market.

Thermal Paper Market Segmentation

-

1. End-user Industry

- 1.1. Point-of-Sale (POS)

- 1.2. Labels

- 1.3. Entertainment

- 1.4. Medical and Pharmaceutical

- 1.5. Other End-user Industries

Thermal Paper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

Thermal Paper Market Regional Market Share

Geographic Coverage of Thermal Paper Market

Thermal Paper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing POS Utility in Services for Billing Operations; Robust Durability and Print Precision Offered by the Thermal Paper

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices affecting the Production

- 3.4. Market Trends

- 3.4.1. POS to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Paper Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Point-of-Sale (POS)

- 5.1.2. Labels

- 5.1.3. Entertainment

- 5.1.4. Medical and Pharmaceutical

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Thermal Paper Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Point-of-Sale (POS)

- 6.1.2. Labels

- 6.1.3. Entertainment

- 6.1.4. Medical and Pharmaceutical

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Thermal Paper Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Point-of-Sale (POS)

- 7.1.2. Labels

- 7.1.3. Entertainment

- 7.1.4. Medical and Pharmaceutical

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Thermal Paper Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Point-of-Sale (POS)

- 8.1.2. Labels

- 8.1.3. Entertainment

- 8.1.4. Medical and Pharmaceutical

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Iconex LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ricoh Company Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hansol Paper Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Panda Paper Roll

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Thermal Paper Plus LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Thermal Solutions International Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Twin Rivers Paper Company Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Rotolificio Bergamasco Srl

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Gold Huasheng Paper Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Mitsubishi Paper Mills (MPM) Limited

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Bizerba USA Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Koehler Group

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Appvion Operations Inc

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Oji Holdings Corporation

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Kanzaki Specialty Papers Inc (KSP)

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 NAKAGAWA Manufacturing (USA) Inc

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 ACYPAPER

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 Jujo Thermal Limited

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 Telemark Diversified Graphic

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 Cenveo Inc

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.21 Henan Province JiangHe Paper Co Ltd

- 9.2.21.1. Overview

- 9.2.21.2. Products

- 9.2.21.3. SWOT Analysis

- 9.2.21.4. Recent Developments

- 9.2.21.5. Financials (Based on Availability)

- 9.2.1 Iconex LLC

List of Figures

- Figure 1: Global Thermal Paper Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Thermal Paper Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America Thermal Paper Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Thermal Paper Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Thermal Paper Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Thermal Paper Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Thermal Paper Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Thermal Paper Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Thermal Paper Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Thermal Paper Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Thermal Paper Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Thermal Paper Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Thermal Paper Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermal Paper Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Thermal Paper Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Thermal Paper Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Thermal Paper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Thermal Paper Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Thermal Paper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Thermal Paper Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Thermal Paper Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Paper Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Thermal Paper Market?

Key companies in the market include Iconex LLC, Ricoh Company Ltd, Hansol Paper Co Ltd, Panda Paper Roll, Thermal Paper Plus LLC, Thermal Solutions International Inc, Twin Rivers Paper Company Inc, Rotolificio Bergamasco Srl, Gold Huasheng Paper Co Ltd, Mitsubishi Paper Mills (MPM) Limited, Bizerba USA Inc, Koehler Group, Appvion Operations Inc, Oji Holdings Corporation, Kanzaki Specialty Papers Inc (KSP), NAKAGAWA Manufacturing (USA) Inc, ACYPAPER, Jujo Thermal Limited, Telemark Diversified Graphic, Cenveo Inc, Henan Province JiangHe Paper Co Ltd.

3. What are the main segments of the Thermal Paper Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing POS Utility in Services for Billing Operations; Robust Durability and Print Precision Offered by the Thermal Paper.

6. What are the notable trends driving market growth?

POS to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices affecting the Production.

8. Can you provide examples of recent developments in the market?

June 2023: Appvion introduces its new, sustainable, patent-pending Next Generation technology direct thermal coating that is free of phenolic developers, including BPA, BPS, and other phenols. Next Generational Technology coating creates heat-stable, legible, dark images on paper and film labels, tickets, tags, and point-of-sale applications while complying with environmental regulations and corporate sustainability initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Paper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Paper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Paper Market?

To stay informed about further developments, trends, and reports in the Thermal Paper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence