Key Insights

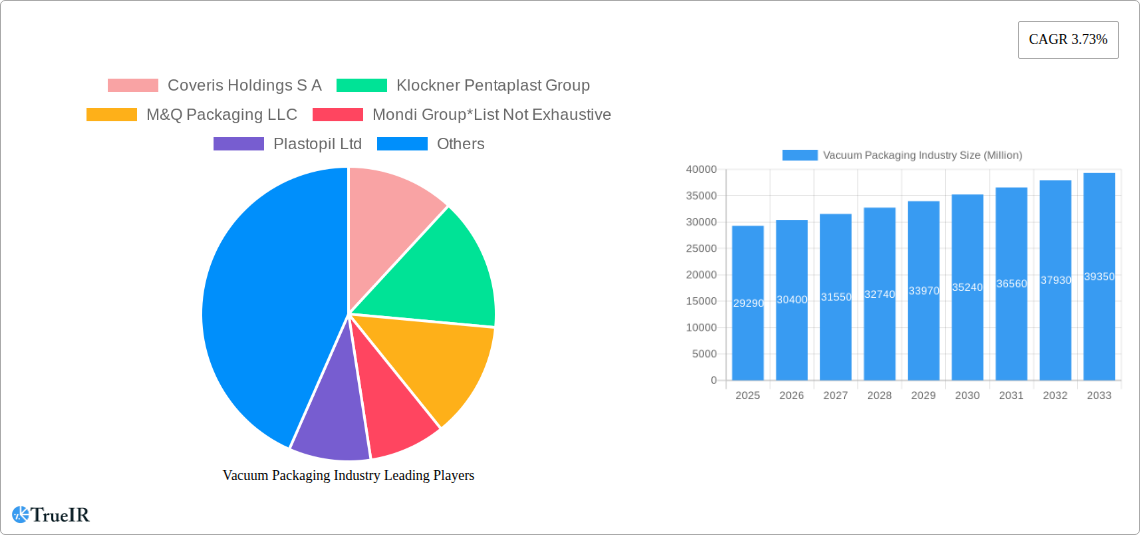

The global vacuum packaging market, valued at $29.29 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 3.73% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for extended shelf life of food products across various segments, particularly in developing economies with burgeoning middle classes, is a significant driver. The healthcare and pharmaceutical sectors are also major contributors, relying on vacuum packaging to maintain the sterility and integrity of medical devices and pharmaceuticals. Furthermore, the rise of e-commerce and the need for secure and damage-free product delivery are bolstering market growth. Technological advancements in vacuum packaging materials, including the development of biodegradable and sustainable options, are also shaping the market landscape. However, fluctuating raw material prices and the potential for environmental concerns related to non-biodegradable materials pose challenges to the industry's sustained growth. The market is segmented by end-user industry (food, healthcare & pharmaceutical, industrial, and others), with the food industry currently holding the largest share. Major players such as Amcor Limited, Berry Global Inc., and Sealed Air Corporation are actively engaged in innovation and expansion to maintain their market positions. Regional growth is expected to vary, with Asia-Pacific anticipated to witness significant expansion due to its rapidly developing economies and increasing consumer demand.

Vacuum Packaging Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, primarily driven by the increasing adoption of vacuum packaging in emerging markets. The shift towards convenient and ready-to-eat meals is further driving demand. However, potential regulatory changes regarding packaging materials and environmental sustainability initiatives will require companies to adapt and adopt eco-friendly solutions. Strategic partnerships, mergers, and acquisitions will likely be prominent features of the competitive landscape as companies strive for market share and technological leadership. The continuous development of more efficient and cost-effective vacuum packaging technologies, alongside a growing awareness of food safety and preservation, will ultimately define the long-term growth trajectory of this sector.

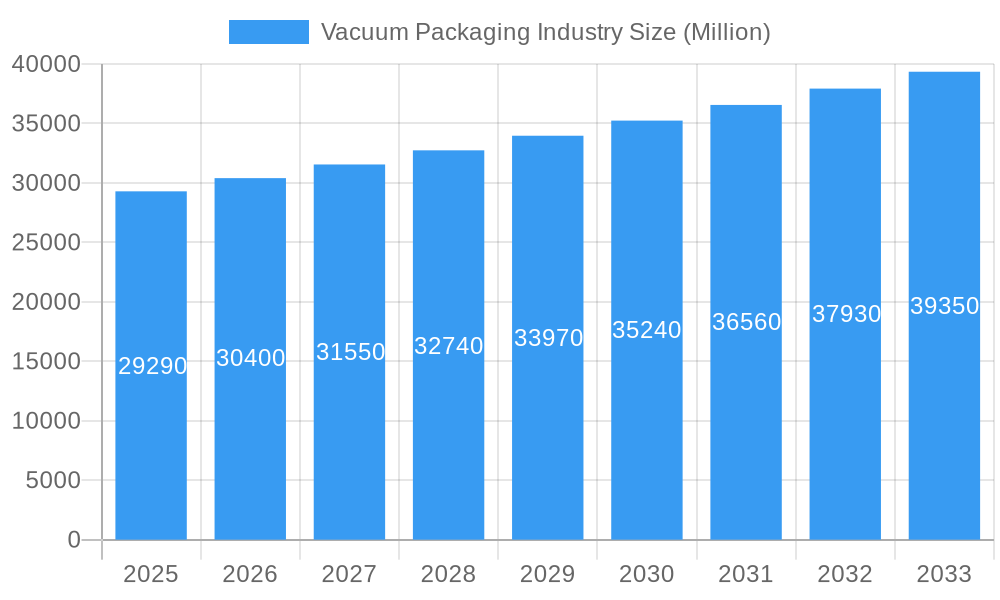

Vacuum Packaging Industry Company Market Share

Vacuum Packaging Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global vacuum packaging industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report projects a market valued at xx Million by 2033, showcasing significant growth opportunities. The analysis encompasses market structure, competitive landscape, dominant segments, key players, and future growth projections. High-impact keywords such as vacuum packaging market, vacuum packaging industry, food packaging, medical packaging, and sustainable packaging are strategically integrated throughout.

Vacuum Packaging Industry Market Structure & Competitive Landscape

The vacuum packaging industry exhibits a moderately concentrated market structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Key players like Amcor Limited, Berry Global Inc., and Sealed Air Corporation are driving innovation through product diversification and technological advancements. The industry is characterized by intense competition, leading to mergers and acquisitions (M&A) to achieve economies of scale and expand market reach. Over the historical period (2019-2024), M&A activity totaled approximately xx Million. This consolidation trend is expected to continue, driving further market concentration.

- High Barriers to Entry: Significant capital investments in manufacturing facilities and technology are required.

- Regulatory Scrutiny: Increasing environmental regulations are influencing material choices and packaging design.

- Product Substitutes: Alternative packaging methods exist, though vacuum packaging often provides superior product protection and extended shelf life.

- End-User Segmentation: The industry serves a diverse range of end-users, including food (largest segment), healthcare & pharmaceutical, industrial, and other sectors.

Vacuum Packaging Industry Market Trends & Opportunities

The global vacuum packaging market is experiencing a period of significant and sustained growth, propelled by evolving consumer expectations and a heightened emphasis on product integrity. A primary catalyst is the surging consumer demand for products with extended shelf-life, which directly addresses concerns about food waste and convenience. Furthermore, the unwavering focus on food safety and preservation throughout the supply chain continues to be a pivotal driver. The market size is projected to reach [Insert Latest Market Value Here] Million USD in 2023 and is anticipated to expand at a robust Compound Annual Growth Rate (CAGR) of [Insert Latest CAGR Here]% during the forecast period (2023-2030). This upward trajectory is underpinned by a confluence of dynamic factors:

- Pioneering Technological Advancements: Continuous innovation in advanced materials science is at the forefront, with a particular emphasis on developing sustainable, recyclable, and biodegradable packaging solutions. These advancements not only meet environmental goals but also enhance barrier properties and product protection, opening new avenues for market penetration.

- Explosive E-commerce Growth: The paradigm shift towards online grocery shopping and the rapid expansion of food delivery services have created an unprecedented demand for packaging that ensures product integrity and freshness during transit. Vacuum packaging, with its ability to extend shelf-life and prevent spoilage, is ideally positioned to capitalize on this trend.

- Evolving Consumer Preferences: Modern consumers are increasingly prioritizing convenience, assured safety, and demonstrable environmental responsibility in their purchasing decisions. Vacuum packaging directly addresses these demands by offering extended freshness, reduced food waste, and the potential for lighter, more sustainable material usage.

- Intensified Competitive Dynamics: The highly competitive landscape among manufacturers is a powerful engine for innovation. This competition fosters the development of superior packaging technologies, more efficient production processes, and ultimately, higher quality products that better serve end-user needs.

- Broadening Market Penetration: The adoption rate of vacuum packaging is steadily increasing across a diverse array of end-user industries, extending beyond traditional sectors. This expanding application scope signifies substantial untapped growth potential and opportunities for market diversification.

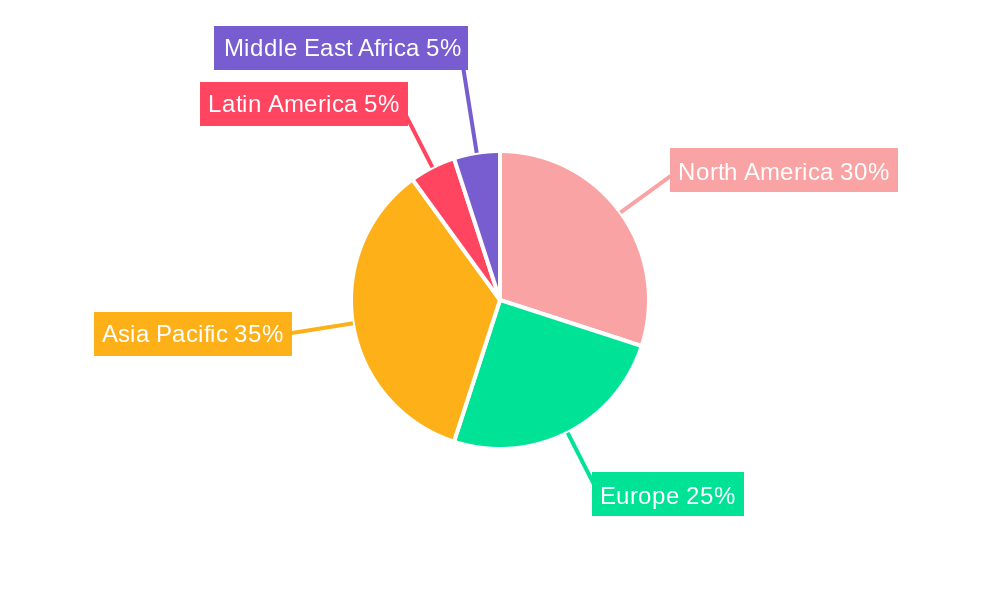

Dominant Markets & Segments in Vacuum Packaging Industry

The food sector remains the undisputed leader in the vacuum packaging market, commanding a substantial share, estimated to be approximately [Insert Latest Food Sector Percentage Here]% of the total market value. Geographically, North America and Europe continue to spearhead market dominance, primarily driven by their high levels of consumer disposable income, sophisticated food processing infrastructures, and established demand for premium food products. However, the Asia-Pacific region is emerging as a powerhouse of future growth, fueled by rapid economic development, a burgeoning middle class, and a significantly rising demand for processed and packaged foods.

- Key Growth Drivers in the Food Sector:

- Escalating demand for convenient, healthy, and ready-to-eat meal solutions.

- Heightened consumer and regulatory awareness regarding food safety, hygiene, and traceability.

- Continuous advancements in packaging technologies that significantly enhance product shelf-life and preserve nutritional value.

- Key Growth Drivers in the Healthcare Sector:

- Stringent regulatory mandates governing the sterilization and integrity of medical device and pharmaceutical packaging.

- Growing imperative for sterile, tamper-evident packaging and extended shelf-life solutions for critical medical supplies and pharmaceuticals.

- Key Growth Drivers in the Industrial Sector:

- An increasing need for specialized, corrosion-inhibiting packaging solutions to protect sensitive industrial components during storage and transit.

- The persistent rise in global industrial production, manufacturing output, and complex supply chains necessitates robust and reliable packaging.

Vacuum Packaging Industry Product Analysis

Vacuum packaging products are constantly evolving, with significant advancements in materials, designs, and functionalities. Modified Atmosphere Packaging (MAP) and vacuum skin packaging are gaining popularity due to their enhanced preservation capabilities. Innovations in biodegradable and compostable films are responding to growing environmental concerns. The key competitive advantage lies in achieving optimal product protection, extended shelf life, and cost-effectiveness while adapting to changing environmental regulations.

Key Drivers, Barriers & Challenges in Vacuum Packaging Industry

Key Drivers: Increasing demand for food preservation, advancements in packaging technologies, and stringent regulatory requirements for food safety are major drivers. Economic growth in emerging markets is also boosting demand.

Challenges: Fluctuating raw material prices, stringent environmental regulations, and intense competition represent key challenges. Supply chain disruptions and labor shortages can also impact production and delivery. The industry faces challenges in balancing cost-effectiveness with sustainability initiatives. For example, the shift towards sustainable materials can increase production costs.

Growth Drivers in the Vacuum Packaging Industry Market

The vacuum packaging market is experiencing robust expansion, propelled by a synergistic interplay of several key factors. The escalating consumer appetite for convenient and time-saving meal options, coupled with a heightened global consciousness surrounding food safety and hygiene standards, are foundational drivers. Furthermore, continuous innovation and sophisticated advancements in packaging technologies are playing a crucial role in enhancing product preservation and extending shelf life. The dynamic economic growth observed in developing economies is also a significant contributor, as it elevates disposable incomes and fuels demand for packaged goods. Compounding these factors, increasingly stringent regulatory frameworks across various industries are actively propelling the adoption of advanced and compliant vacuum packaging solutions.

Challenges Impacting Vacuum Packaging Industry Growth

The industry faces hurdles such as fluctuating raw material costs, stringent environmental regulations, and competitive pressure from alternative packaging methods. Supply chain disruptions and labor shortages can significantly hamper production and delivery timelines. Balancing cost-effectiveness with sustainability goals remains a crucial challenge.

Key Players Shaping the Vacuum Packaging Industry Market

- Coveris Holdings S A

- Klockner Pentaplast Group

- M&Q Packaging LLC

- Mondi Group

- Plastopil Ltd

- Dow Inc

- Swiss Pac Pvt Ltd

- Amcor Limited

- Berry Global Inc

- Sealed Air Corporation

Significant Vacuum Packaging Industry Industry Milestones

- August 2022: Arvid Nordquist, a prominent coffee producer, partnered with Syntegon to implement advanced vacuum coffee packaging. This strategic collaboration is projected to significantly reduce CO2 emissions and decrease reliance on fossil fuels within their packaging operations.

- April 2023: Stora Enso, a leading provider of renewable solutions, launched Trayforma BarrPeel, an innovative and sustainable board material. This material features an easy-peeling functionality and is designed for vacuum skin packs, offering a substantial reduction in plastic usage and contributing to more environmentally friendly packaging alternatives.

Future Outlook for Vacuum Packaging Industry Market

The vacuum packaging industry is poised for continued growth, driven by ongoing technological innovations, increasing demand for sustainable packaging solutions, and expansion into new markets. Strategic partnerships and acquisitions will further shape the market landscape. Opportunities lie in developing innovative, eco-friendly packaging materials and expanding into high-growth regions like Asia-Pacific. The market is expected to witness significant expansion across various end-use segments, particularly in the food and healthcare sectors.

Vacuum Packaging Industry Segmentation

-

1. End-user Industry

- 1.1. Food

- 1.2. Healthcare and Pharmaceutical

- 1.3. Industrial

- 1.4. Other End-user Industries

Vacuum Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. United Arab Emirates

- 5.4. Rest of Middle East and Africa

Vacuum Packaging Industry Regional Market Share

Geographic Coverage of Vacuum Packaging Industry

Vacuum Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Packaged Food Coupled with Increasing Awareness Towards Food Safety; Increasing Demand for Hygienic and Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. High Cost of the Process

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Food

- 5.1.2. Healthcare and Pharmaceutical

- 5.1.3. Industrial

- 5.1.4. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Food

- 6.1.2. Healthcare and Pharmaceutical

- 6.1.3. Industrial

- 6.1.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Food

- 7.1.2. Healthcare and Pharmaceutical

- 7.1.3. Industrial

- 7.1.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Food

- 8.1.2. Healthcare and Pharmaceutical

- 8.1.3. Industrial

- 8.1.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Food

- 9.1.2. Healthcare and Pharmaceutical

- 9.1.3. Industrial

- 9.1.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Vacuum Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Food

- 10.1.2. Healthcare and Pharmaceutical

- 10.1.3. Industrial

- 10.1.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Coveris Holdings S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Klockner Pentaplast Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 M&Q Packaging LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mondi Group*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plastopil Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dow Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Swiss Pac Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amcor Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sealed Air Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Coveris Holdings S A

List of Figures

- Figure 1: Global Vacuum Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Vacuum Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America Vacuum Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Vacuum Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Vacuum Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vacuum Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Vacuum Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Vacuum Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Vacuum Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vacuum Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Vacuum Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Vacuum Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Vacuum Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Vacuum Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Latin America Vacuum Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America Vacuum Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Vacuum Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Vacuum Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Vacuum Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Vacuum Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Vacuum Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Vacuum Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Vacuum Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Vacuum Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Vacuum Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Vacuum Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Mexico Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Brazil Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Vacuum Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Vacuum Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: South Africa Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Arab Emirates Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Vacuum Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vacuum Packaging Industry?

The projected CAGR is approximately 3.73%.

2. Which companies are prominent players in the Vacuum Packaging Industry?

Key companies in the market include Coveris Holdings S A, Klockner Pentaplast Group, M&Q Packaging LLC, Mondi Group*List Not Exhaustive, Plastopil Ltd, Dow Inc, Swiss Pac Pvt Ltd, Amcor Limited, Berry Global Inc, Sealed Air Corporation.

3. What are the main segments of the Vacuum Packaging Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Packaged Food Coupled with Increasing Awareness Towards Food Safety; Increasing Demand for Hygienic and Convenient Packaging.

6. What are the notable trends driving market growth?

Food Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of the Process.

8. Can you provide examples of recent developments in the market?

April 2023: Stora Enso's Trayforma BarrPeel is an innovative, easy-peeling board material for vacuum skin packs that allows for the packing of fresh food on recycled paperboard trays. Trayforma BarrPeel helps brand owners achieve their sustainability goals by removing plastic from less than 10% of the tray.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vacuum Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vacuum Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vacuum Packaging Industry?

To stay informed about further developments, trends, and reports in the Vacuum Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence