Key Insights

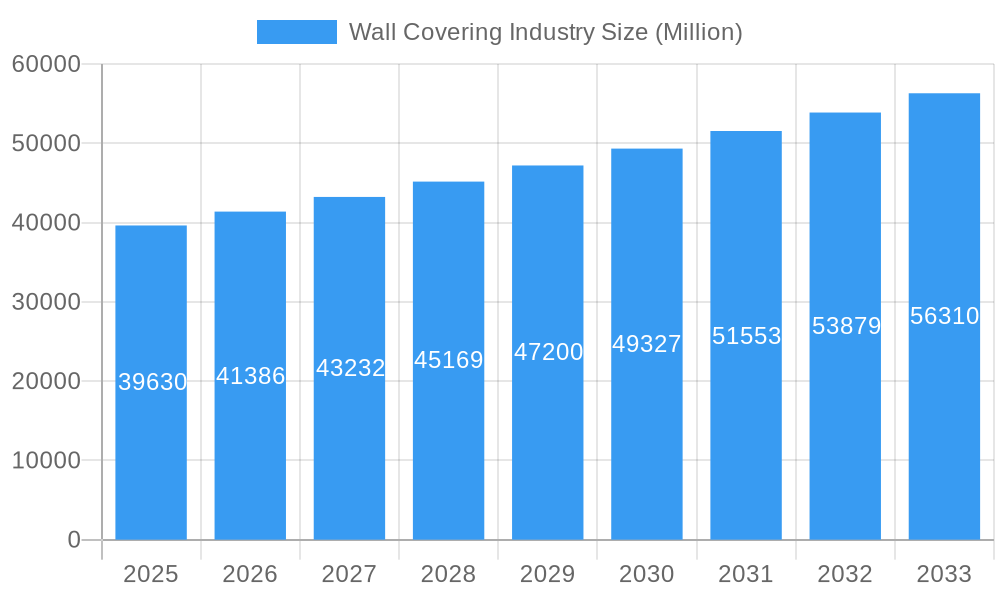

The global wall covering market, valued at $39.63 billion in 2025, is projected to experience steady growth, driven by the increasing demand for aesthetically pleasing and functional interior design solutions in both residential and commercial sectors. A Compound Annual Growth Rate (CAGR) of 4.47% is anticipated from 2025 to 2033, indicating a substantial market expansion. Key growth drivers include rising disposable incomes, particularly in developing economies, fueling demand for home renovations and new construction projects. The shift towards personalized home décor, coupled with the introduction of innovative and sustainable wall covering materials like eco-friendly wallpapers and recyclable wall panels, further contributes to market expansion. The market is segmented by distribution channels (specialty stores, e-commerce, etc.), product types (wallpaper, wall panels, etc.), and applications (residential, commercial). The e-commerce segment is experiencing rapid growth due to the convenience and wide selection it offers. While the residential segment currently dominates, the commercial segment is expected to witness significant growth driven by increasing construction activity in the hospitality and office sectors. Competition is moderately high, with established players like Brewster Home Fashion and Ahlstrom-Munksjö Oyj facing pressure from emerging brands offering innovative and cost-effective solutions. However, the market is also subject to certain restraints, such as fluctuations in raw material prices and increasing environmental concerns regarding the manufacturing and disposal of certain wall covering types. To mitigate these challenges, manufacturers are increasingly adopting sustainable practices and investing in research and development to create eco-friendly options.

Wall Covering Industry Market Size (In Billion)

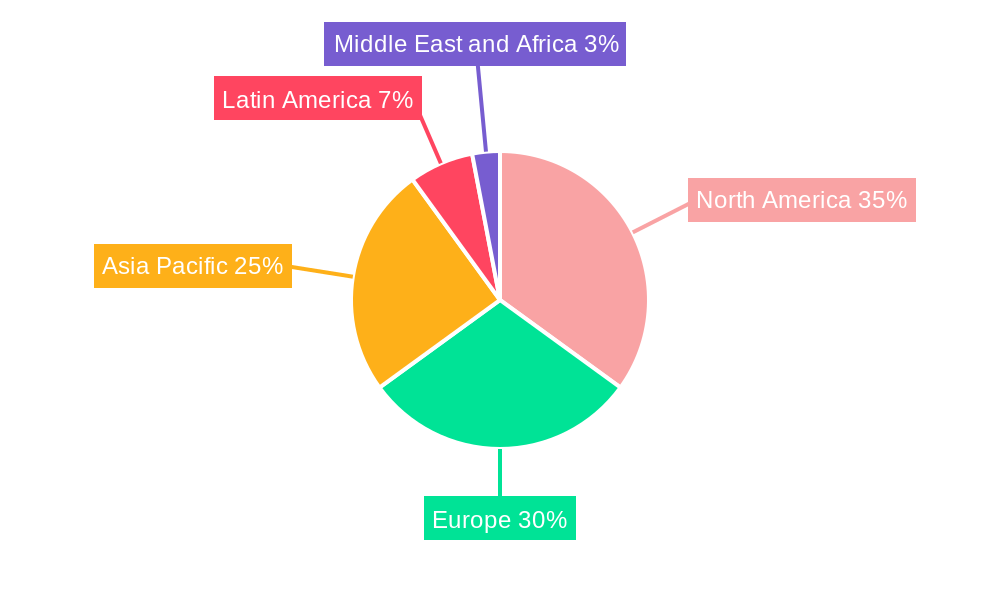

The North American and European regions currently hold significant market shares, reflecting the high levels of disposable income and established home improvement markets in these regions. However, the Asia-Pacific region, particularly China and India, is projected to experience substantial growth due to rapid urbanization and rising middle-class populations. This growth will be driven by increasing construction activity and a growing preference for modern and sophisticated interior designs. Latin America and the Middle East and Africa are also expected to contribute to market expansion, although at a slower pace compared to the Asia-Pacific region. Successful companies will need to adapt to the evolving consumer preferences, focusing on product diversification, sustainable practices, and robust distribution networks to capitalize on the diverse opportunities presented by the global wall covering market.

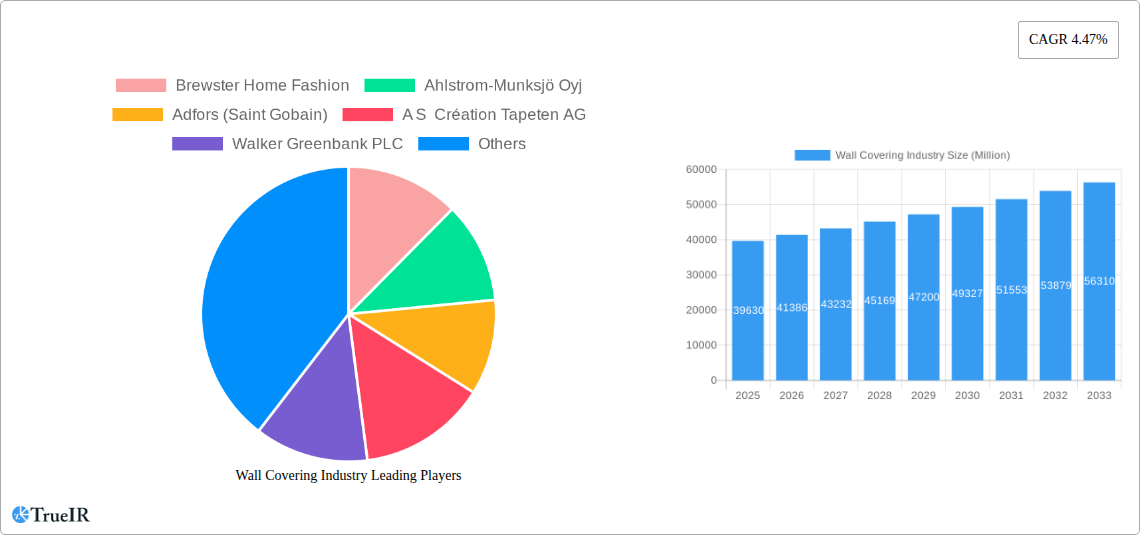

Wall Covering Industry Company Market Share

Wall Covering Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global wall covering industry, covering market size, trends, competitive landscape, and future outlook from 2019 to 2033. With a focus on key players like Brewster Home Fashion, Ahlstrom-Munksjö Oyj, and Asian Paints Ltd, this report offers invaluable insights for businesses and investors seeking to navigate this dynamic market. The report leverages extensive data analysis to project a market valued at $XX Million by 2033, presenting a compelling picture of growth opportunities and challenges.

Wall Covering Industry Market Structure & Competitive Landscape

The global wall covering industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for the industry is estimated at xx, indicating a moderately competitive landscape. Key players, such as Brewster Home Fashion, Ahlstrom-Munksjö Oyj, and Asian Paints Ltd, compete based on product innovation, brand recognition, and distribution network strength.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2024.

- Innovation Drivers: Continuous innovation in materials, designs, and application methods drives market growth. Technological advancements such as digitally printed wallpapers and sustainable materials are key drivers.

- Regulatory Impacts: Building codes and environmental regulations significantly impact material choices and production processes.

- Product Substitutes: Paints, textured plasters, and other wall finishes act as substitutes, influencing market competitiveness.

- End-User Segmentation: The residential segment is the dominant end-user, followed by commercial and industrial applications.

- M&A Trends: The industry has witnessed a moderate level of mergers and acquisitions in recent years, with xx major deals recorded between 2019 and 2024. This activity is driven by efforts to expand product portfolios and gain access to new markets.

Wall Covering Industry Market Trends & Opportunities

The global wall covering market is experiencing robust growth, driven by factors like rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing interiors. The market size reached $XX Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of $XX Million by 2033. This growth is fuelled by several key trends:

- Technological advancements, particularly in digital printing, allow for high-quality, customized designs and improved durability.

- Consumer preferences are shifting towards eco-friendly and sustainable wall coverings, driving innovation in materials and manufacturing processes.

- The rise of e-commerce is disrupting traditional distribution channels, offering consumers greater convenience and choice.

- Growing competition is leading to product diversification and innovative marketing strategies, further expanding market reach.

- Market penetration rates vary significantly across regions and segments, presenting ample opportunities for growth in underserved areas.

Dominant Markets & Segments in Wall Covering Industry

The residential segment dominates the wall covering market, accounting for approximately xx% of the total revenue in 2024. Geographically, North America and Europe are currently leading regions, exhibiting high demand for wall coverings across various segments.

By Distribution Channel:

- Specialty Stores: This channel maintains a strong position, offering personalized service and a wider product selection.

- Home Centers: Home centers are experiencing significant growth, driven by convenience and affordability.

- E-commerce: This rapidly expanding channel is transforming customer purchasing behavior and increasing access to diverse products.

By Product Type:

- Wallpaper: Continues to be the dominant product type, owing to its versatility and affordability.

- Wall Panels: This segment is witnessing growth fueled by its durability and ease of installation.

By Application:

- Residential: This segment dominates the market, driven by increasing homeownership and renovation activity.

Key Growth Drivers:

- Increasing disposable incomes in developing economies are boosting demand for home improvement and interior design products.

- Government initiatives promoting infrastructure development and housing projects are further driving market growth.

Wall Covering Industry Product Analysis

Significant advancements in printing technology are revolutionizing the wall covering industry, enabling the creation of highly detailed, customized designs at scale. The introduction of sustainable materials, like recycled fibers and natural materials, is further enhancing the appeal and environmental footprint of wall coverings. Innovative application methods and improved durability are making these products even more attractive to consumers and contractors alike.

Key Drivers, Barriers & Challenges in Wall Covering Industry

Key Drivers: Rising disposable incomes, urbanization, increasing home renovation activities, and advancements in printing and material technologies are key drivers pushing the growth of the wall covering industry. Government initiatives promoting affordable housing and infrastructure development also contribute significantly.

Challenges: Supply chain disruptions, particularly in raw material sourcing and logistics, can impact production and pricing. Fluctuations in raw material costs also pose a significant challenge. Stringent environmental regulations add to production complexities and costs. Intense competition from substitute products such as paints and other wall finishes puts pressure on prices and margins.

Growth Drivers in the Wall Covering Industry Market

Technological advancements such as digital printing and the use of sustainable materials are driving market growth. Economic factors like rising disposable incomes and increased home renovation activities are significant contributors. Government policies promoting sustainable building practices also support market expansion.

Challenges Impacting Wall Covering Industry Growth

Supply chain disruptions, particularly impacting raw material availability and transportation costs, are major obstacles. Stricter environmental regulations increase production costs and complexity. Competition from substitute products, such as paints and textured wall coverings, further poses challenges.

Key Players Shaping the Wall Covering Industry Market

- Brewster Home Fashion

- Ahlstrom-Munksjö Oyj

- Adfors (Saint Gobain)

- A S Création Tapeten AG

- Walker Greenbank PLC

- Grandeco Wallfashion Group

- Benjamin Moore & Co

- J Josephson Inc

- Asian Paints Ltd

- York Wallcoverings Inc

Significant Wall Covering Industry Milestones

- May 2023: Asian Paints launched its new home studio in Chennai, showcasing its 2023 collection of home décor items, including wallpapers. This expansion enhances their brand visibility and market penetration.

- August 2022: Sanderson Design Group partnered with Disney, securing licensing rights to create wallpapers and textiles based on Disney classics. This collaboration enhances Sanderson's product portfolio and brand appeal.

Future Outlook for Wall Covering Industry Market

The wall covering industry is poised for continued growth, fueled by ongoing technological innovations, evolving consumer preferences, and expansion into new markets. Strategic partnerships, product diversification, and a focus on sustainability will be crucial for success. The market offers significant opportunities for both established players and new entrants seeking to capitalize on its growth potential.

Wall Covering Industry Segmentation

-

1. Product Type

- 1.1. Wall Panel

-

1.2. Wall Paper

- 1.2.1. Vinyl Wallpaper

- 1.2.2. Non-woven Wallpaper

- 1.2.3. Paper-based Wallpaper

- 1.2.4. Fabric Wallpaper

- 1.2.5. Other Wallpaper Types

- 1.3. Tile

- 1.4. Metal Wall Covering

- 1.5. Other Product Types

-

2. Application

- 2.1. Commercial

- 2.2. Residential

-

3. Distribution Channel

- 3.1. Specialty Store

- 3.2. Home Center

- 3.3. Building Material Dealer

- 3.4. Furniture Store

- 3.5. Mass Merchandizer

- 3.6. E-commerce

- 3.7. Other Distribution Channels

Wall Covering Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. South Africa

Wall Covering Industry Regional Market Share

Geographic Coverage of Wall Covering Industry

Wall Covering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Residential Buildings; Availability of Styled Products; Increase in Do-it-yourself (DIY) Trends

- 3.3. Market Restrains

- 3.3.1. Limiting Availability and High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Wall Panel Segment is Expected Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wall Panel

- 5.1.2. Wall Paper

- 5.1.2.1. Vinyl Wallpaper

- 5.1.2.2. Non-woven Wallpaper

- 5.1.2.3. Paper-based Wallpaper

- 5.1.2.4. Fabric Wallpaper

- 5.1.2.5. Other Wallpaper Types

- 5.1.3. Tile

- 5.1.4. Metal Wall Covering

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Store

- 5.3.2. Home Center

- 5.3.3. Building Material Dealer

- 5.3.4. Furniture Store

- 5.3.5. Mass Merchandizer

- 5.3.6. E-commerce

- 5.3.7. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wall Panel

- 6.1.2. Wall Paper

- 6.1.2.1. Vinyl Wallpaper

- 6.1.2.2. Non-woven Wallpaper

- 6.1.2.3. Paper-based Wallpaper

- 6.1.2.4. Fabric Wallpaper

- 6.1.2.5. Other Wallpaper Types

- 6.1.3. Tile

- 6.1.4. Metal Wall Covering

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialty Store

- 6.3.2. Home Center

- 6.3.3. Building Material Dealer

- 6.3.4. Furniture Store

- 6.3.5. Mass Merchandizer

- 6.3.6. E-commerce

- 6.3.7. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wall Panel

- 7.1.2. Wall Paper

- 7.1.2.1. Vinyl Wallpaper

- 7.1.2.2. Non-woven Wallpaper

- 7.1.2.3. Paper-based Wallpaper

- 7.1.2.4. Fabric Wallpaper

- 7.1.2.5. Other Wallpaper Types

- 7.1.3. Tile

- 7.1.4. Metal Wall Covering

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialty Store

- 7.3.2. Home Center

- 7.3.3. Building Material Dealer

- 7.3.4. Furniture Store

- 7.3.5. Mass Merchandizer

- 7.3.6. E-commerce

- 7.3.7. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wall Panel

- 8.1.2. Wall Paper

- 8.1.2.1. Vinyl Wallpaper

- 8.1.2.2. Non-woven Wallpaper

- 8.1.2.3. Paper-based Wallpaper

- 8.1.2.4. Fabric Wallpaper

- 8.1.2.5. Other Wallpaper Types

- 8.1.3. Tile

- 8.1.4. Metal Wall Covering

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialty Store

- 8.3.2. Home Center

- 8.3.3. Building Material Dealer

- 8.3.4. Furniture Store

- 8.3.5. Mass Merchandizer

- 8.3.6. E-commerce

- 8.3.7. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wall Panel

- 9.1.2. Wall Paper

- 9.1.2.1. Vinyl Wallpaper

- 9.1.2.2. Non-woven Wallpaper

- 9.1.2.3. Paper-based Wallpaper

- 9.1.2.4. Fabric Wallpaper

- 9.1.2.5. Other Wallpaper Types

- 9.1.3. Tile

- 9.1.4. Metal Wall Covering

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialty Store

- 9.3.2. Home Center

- 9.3.3. Building Material Dealer

- 9.3.4. Furniture Store

- 9.3.5. Mass Merchandizer

- 9.3.6. E-commerce

- 9.3.7. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Wall Panel

- 10.1.2. Wall Paper

- 10.1.2.1. Vinyl Wallpaper

- 10.1.2.2. Non-woven Wallpaper

- 10.1.2.3. Paper-based Wallpaper

- 10.1.2.4. Fabric Wallpaper

- 10.1.2.5. Other Wallpaper Types

- 10.1.3. Tile

- 10.1.4. Metal Wall Covering

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Residential

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialty Store

- 10.3.2. Home Center

- 10.3.3. Building Material Dealer

- 10.3.4. Furniture Store

- 10.3.5. Mass Merchandizer

- 10.3.6. E-commerce

- 10.3.7. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Wall Covering Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Wall Panel

- 11.1.2. Wall Paper

- 11.1.2.1. Vinyl Wallpaper

- 11.1.2.2. Non-woven Wallpaper

- 11.1.2.3. Paper-based Wallpaper

- 11.1.2.4. Fabric Wallpaper

- 11.1.2.5. Other Wallpaper Types

- 11.1.3. Tile

- 11.1.4. Metal Wall Covering

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Commercial

- 11.2.2. Residential

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Specialty Store

- 11.3.2. Home Center

- 11.3.3. Building Material Dealer

- 11.3.4. Furniture Store

- 11.3.5. Mass Merchandizer

- 11.3.6. E-commerce

- 11.3.7. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Brewster Home Fashion

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ahlstrom-Munksjö Oyj

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Adfors (Saint Gobain)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 A S Création Tapeten AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Walker Greenbank PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Grandeco Wallfashion Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Benjamin Moore & Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 J Josephson Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Asian Paints Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 York Wallcoverings Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Brewster Home Fashion

List of Figures

- Figure 1: Global Wall Covering Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Australia and New Zealand Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Australia and New Zealand Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Australia and New Zealand Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Australia and New Zealand Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Australia and New Zealand Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Australia and New Zealand Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Latin America Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Latin America Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Latin America Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Latin America Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Latin America Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Latin America Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Wall Covering Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Wall Covering Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Middle East and Africa Wall Covering Industry Revenue (Million), by Application 2025 & 2033

- Figure 45: Middle East and Africa Wall Covering Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Wall Covering Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Middle East and Africa Wall Covering Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Middle East and Africa Wall Covering Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Wall Covering Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Wall Covering Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Mexico Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Wall Covering Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 39: Global Wall Covering Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Wall Covering Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Wall Covering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: United Arab Emirates Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Africa Wall Covering Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wall Covering Industry?

The projected CAGR is approximately 4.47%.

2. Which companies are prominent players in the Wall Covering Industry?

Key companies in the market include Brewster Home Fashion, Ahlstrom-Munksjö Oyj, Adfors (Saint Gobain), A S Création Tapeten AG, Walker Greenbank PLC, Grandeco Wallfashion Group, Benjamin Moore & Co, J Josephson Inc, Asian Paints Ltd, York Wallcoverings Inc.

3. What are the main segments of the Wall Covering Industry?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Residential Buildings; Availability of Styled Products; Increase in Do-it-yourself (DIY) Trends.

6. What are the notable trends driving market growth?

Wall Panel Segment is Expected Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Limiting Availability and High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2023: Asian Paints announced the launch of the homes studio in Chennai and the 2023 collection for home decor. The studio offers a garden selection of fabrics, wallpapers, bedding, and rugs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wall Covering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wall Covering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wall Covering Industry?

To stay informed about further developments, trends, and reports in the Wall Covering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence