Key Insights

The Denmark Oil and Gas Midstream market is projected to reach $32.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.1% through 2033. This expansion is fueled by substantial infrastructure investments in transportation and storage, meeting evolving energy needs. The integration of renewables indirectly supports the midstream sector by demanding advanced logistics for diverse energy carriers. The strategic development of LNG terminals further enhances Denmark's energy security, driving midstream activities.

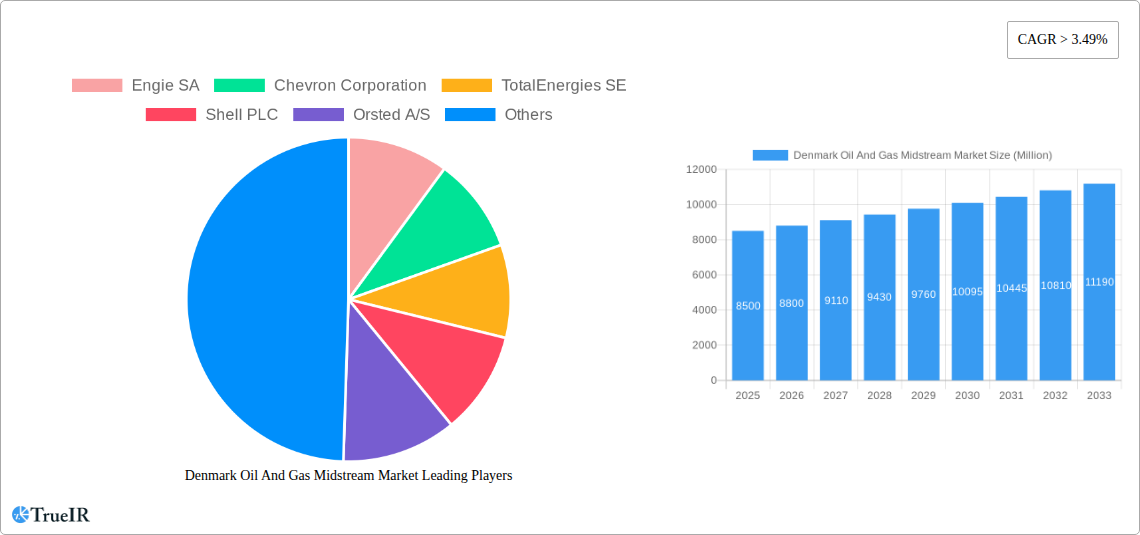

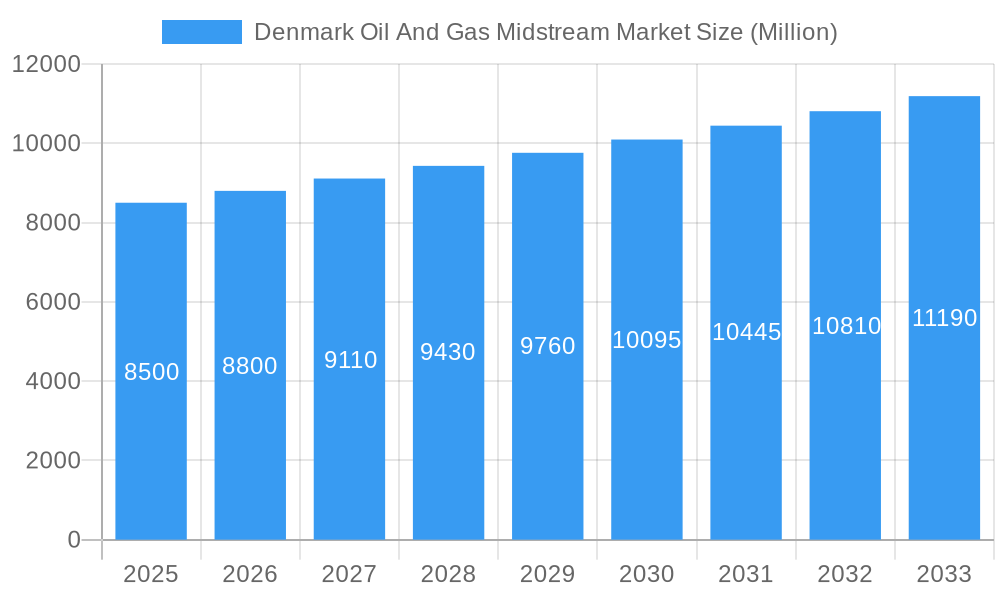

Denmark Oil And Gas Midstream Market Market Size (In Billion)

Key growth drivers include government initiatives for energy independence and oil and gas infrastructure modernization. Technological advancements in pipeline monitoring and integrity management, coupled with a focus on environmental sustainability and emission reduction, are shaping market trends. Potential restraints involve stringent environmental regulations and public opposition to new projects. Nevertheless, the optimization of existing assets and exploration of new distribution channels, supporting the transition to a lower-carbon future, ensure a dynamic Danish midstream sector.

Denmark Oil And Gas Midstream Market Company Market Share

Denmark Oil and Gas Midstream Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Denmark Oil and Gas Midstream Market. Leveraging high-volume keywords such as "Denmark oil and gas," "midstream market," "LNG terminals," "gas transportation," and "oil storage," this report is meticulously structured to offer unparalleled insights for industry professionals. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, it delves into market structure, competitive landscape, key trends, dominant segments, product analysis, and critical growth drivers and challenges. Gain a competitive edge with comprehensive data and strategic recommendations.

Denmark Oil And Gas Midstream Market Market Structure & Competitive Landscape

The Denmark Oil and Gas Midstream Market exhibits a moderately concentrated structure, characterized by the strategic presence of both established international energy giants and specialized local players. Innovation drivers are primarily fueled by the nation's strong commitment to energy security, sustainability mandates, and the increasing integration of renewable energy sources, which directly impact the demand and operational dynamics of midstream infrastructure. Regulatory impacts are significant, with evolving environmental policies and safety standards influencing investment decisions and operational efficiency. While direct product substitutes for essential midstream services like transportation and storage are limited, the increasing adoption of alternative energy carriers and the potential for increased electrification in certain end-use sectors represent indirect competitive pressures. End-user segmentation reveals a dominant reliance on industrial consumers, power generation facilities, and residential heating, all of which are sensitive to energy price fluctuations and supply reliability. Mergers & Acquisitions (M&A) trends are indicative of strategic consolidation and diversification efforts, aiming to optimize asset utilization, expand service offerings, and enhance market reach. For instance, a hypothetical concentration ratio in key pipeline segments might stand at approximately 65% among the top three players. M&A volumes in the recent past have been observed in the range of tens of millions of US Dollars, reflecting targeted acquisitions of specialized assets or stakes in critical infrastructure projects. Understanding these dynamics is crucial for navigating the evolving landscape of Denmark's vital oil and gas midstream sector.

Denmark Oil And Gas Midstream Market Market Trends & Opportunities

The Denmark Oil and Gas Midstream Market is poised for substantial evolution, driven by a confluence of economic, technological, and environmental factors. The projected market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 3.5% from 2025 to 2033, reaching an estimated value of over 15,000 Million USD by the end of the forecast period. This growth is underpinned by a sustained demand for reliable energy transportation and storage solutions, even as Denmark champions its ambitious renewable energy targets. Technological shifts are playing a pivotal role, with increasing investments in modernizing existing pipeline networks, enhancing storage capacities with advanced safety features, and developing sophisticated LNG (Liquefied Natural Gas) import and export infrastructure. The nation's strategic location as a gateway to Northern Europe, coupled with its well-developed maritime infrastructure, positions it as a key hub for LNG trade. Consumer preferences, while increasingly leaning towards sustainable energy, still necessitate the secure and efficient distribution of natural gas and refined oil products for a significant portion of the industrial and residential sectors. This presents a critical opportunity for midstream operators to adapt and diversify their service portfolios. Competitive dynamics are intensifying, with a focus on operational efficiency, cost optimization, and the development of resilient supply chains. The integration of digital technologies, such as AI-powered predictive maintenance for pipelines and advanced inventory management systems for storage facilities, is becoming a key differentiator. Furthermore, the ongoing expansion of renewable energy sources creates new opportunities for midstream companies to support the infrastructure required for the transportation and storage of biofuels and hydrogen in the future. Market penetration rates for advanced LNG regasification technologies are steadily increasing, reflecting a proactive approach to diversifying energy sources and ensuring supply security. The strategic development of robust, interlinked midstream networks will be crucial for maintaining Denmark's energy independence and economic stability. The ongoing efforts to enhance energy interconnectivity within the European Union also present significant cross-border opportunities for Danish midstream operators.

Dominant Markets & Segments in Denmark Oil And Gas Midstream Market

The Denmark Oil and Gas Midstream Market is segmented into Transportation, Storage, and LNG Terminals, each playing a critical role in the nation's energy ecosystem.

Transportation:

The transportation segment, primarily comprising oil and gas pipelines, represents a foundational element of the Danish midstream market. Its dominance is driven by the need for the efficient and continuous movement of crude oil and natural gas from offshore production sites and import terminals to refineries, power plants, and industrial consumers. Key growth drivers include ongoing maintenance and upgrades of existing pipeline infrastructure to ensure operational integrity and meet stringent environmental regulations. Furthermore, the strategic importance of pipelines in facilitating the secure supply of natural gas, especially in light of geopolitical shifts, continues to bolster this segment. Investments in expanding pipeline capacity to accommodate increased import volumes, particularly from Norway and through LNG facilities, are also significant. The regulatory framework surrounding pipeline operations, emphasizing safety and environmental protection, also drives investment in advanced monitoring and leak detection technologies.

Storage:

The storage segment, encompassing crude oil and refined product storage facilities, is another critical component, ensuring supply stability and market flexibility. Growth in this segment is fueled by the need to maintain strategic reserves, manage price volatility, and support seasonal demand fluctuations. Key growth drivers include the expansion of underground gas storage facilities and above-ground tank farms for refined products. The increasing role of Denmark as a regional distribution hub for petroleum products also necessitates enhanced storage capacities. Investments in state-of-the-art safety and containment systems are paramount, driven by environmental concerns and regulatory requirements. The potential for storing biofuels and future hydrogen storage solutions also presents a growing opportunity for innovation within this segment.

LNG Terminals:

The LNG Terminals segment has experienced a surge in strategic importance and investment, particularly in recent years. Its dominance is intrinsically linked to Denmark's efforts to enhance energy security and diversify its natural gas supply sources. Key growth drivers include the increasing global trade of LNG and Denmark's strategic position to serve as a regional hub for LNG regasification and distribution. The development of new Floating Storage and Regasification Units (FSRUs) and the expansion of existing land-based terminal capacities are key indicators of this segment's growth trajectory. Government policies supporting the diversification of energy imports and the reduction of reliance on traditional pipeline gas supplies significantly bolster this sector. The recent operational capacity of the Baltic Pipe LNG receiving terminal, as detailed in the industry developments, underscores the growing significance of LNG infrastructure. The ongoing design and construction projects for new FSRU marine infrastructure further highlight the robust investment and expansion within this segment.

Denmark Oil And Gas Midstream Market Product Analysis

The Denmark Oil and Gas Midstream Market is characterized by its essential products: the secure and efficient transportation of crude oil and natural gas, the reliable storage of these commodities, and the critical regasification and distribution of Liquefied Natural Gas (LNG). Product innovations in this sector are focused on enhancing safety, environmental performance, and operational efficiency. Advancements in pipeline integrity management, including smart monitoring systems and predictive maintenance technologies, are key. In storage, innovations are centered on improving containment systems and developing facilities for a wider range of energy products, including biofuels and potentially hydrogen. LNG terminals are seeing technological advancements in regasification processes, allowing for greater flexibility and responsiveness to market demand. The competitive advantage lies in reliability, cost-effectiveness, and adherence to stringent environmental and safety standards.

Key Drivers, Barriers & Challenges in Denmark Oil And Gas Midstream Market

Key Drivers:

The Denmark Oil and Gas Midstream Market is propelled by several key forces. Energy security and diversification are paramount, especially in the current geopolitical climate, driving demand for robust LNG infrastructure and diversified import routes. Technological advancements in pipeline monitoring, storage solutions, and LNG handling are enhancing efficiency and safety. Government policies supporting energy independence, infrastructure modernization, and environmental compliance act as significant catalysts. The strategic geographical location of Denmark, facilitating regional energy trade, also plays a crucial role. The economic imperative to ensure a stable and affordable energy supply for industrial and residential consumers remains a core driver.

Barriers & Challenges:

Despite its growth potential, the market faces significant barriers and challenges. Stringent environmental regulations and the associated compliance costs can increase operational expenditures. Supply chain disruptions, as witnessed globally, can impact the timely delivery of equipment and materials for infrastructure projects. High initial capital investment for developing and upgrading midstream infrastructure represents a considerable barrier. Public perception and community acceptance regarding new infrastructure projects, particularly pipelines, can lead to delays. The long-term transition to renewable energy presents a strategic challenge, requiring midstream operators to adapt their business models and explore new opportunities in areas like hydrogen transportation and storage. The complexity of obtaining permits and licenses for infrastructure development can also be a time-consuming hurdle.

Growth Drivers in the Denmark Oil And Gas Midstream Market Market

The Denmark Oil and Gas Midstream Market is experiencing significant growth driven by a confluence of strategic initiatives and market dynamics. A primary growth driver is the enhanced focus on energy security and diversification, spurred by global geopolitical events, which has amplified the demand for LNG infrastructure and diversified natural gas import routes. Technological advancements in pipeline integrity management, advanced storage solutions, and efficient LNG regasification processes are not only improving operational efficiency but also enabling the handling of a wider range of energy commodities. Furthermore, supportive government policies that prioritize energy independence, infrastructure modernization, and adherence to stringent environmental standards are creating a favorable investment climate. Denmark's strategic geographical positioning as a key energy hub within Northern Europe allows for expanded opportunities in regional trade and distribution, acting as a significant catalyst for growth in both transportation and terminal segments. The ongoing need to reliably supply energy to key industrial sectors and power generation facilities ensures sustained demand for midstream services.

Challenges Impacting Denmark Oil And Gas Midstream Market Growth

The Denmark Oil and Gas Midstream Market is not without its hurdles, which can significantly impact growth trajectories. Increasingly stringent environmental regulations and the associated capital and operational expenditures for compliance present a continuous challenge for operators. The inherent high cost of capital investment for developing and maintaining complex midstream infrastructure, such as pipelines and LNG terminals, can deter potential investors. Supply chain volatility and potential disruptions can lead to project delays and cost overruns, particularly for specialized equipment and materials. Navigating complex permitting processes and securing community acceptance for new infrastructure projects can be time-consuming and challenging, often facing public scrutiny. Moreover, the long-term global energy transition towards renewables poses a fundamental strategic challenge, necessitating adaptation and diversification of existing midstream assets and business models to remain relevant in a decarbonized future. Competition from alternative energy sources and evolving end-user demands also exert pressure on traditional midstream services.

Key Players Shaping the Denmark Oil And Gas Midstream Market Market

- Engie SA

- Chevron Corporation

- TotalEnergies SE

- Shell PLC

- Orsted A/S

Significant Denmark Oil And Gas Midstream Market Industry Milestones

- November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half the total capacity (6,700 MWh/h), highlighting the growing operational capacity and utilization of key LNG import infrastructure.

- November 2022: GAZ-SYSTEM signed an agreement with Rambøll Danmark A/S to design the construction project for the marine infrastructure related to the construction of the FSRU floating terminal, signifying progress in expanding LNG regasification capabilities and ensuring future energy supply diversification.

Future Outlook for Denmark Oil And Gas Midstream Market Market

The future outlook for the Denmark Oil and Gas Midstream Market is characterized by a strategic evolution towards enhanced energy security, diversification, and sustainability. As Denmark continues to bolster its energy independence, investments in LNG infrastructure, including terminals and associated transportation networks, are expected to remain a priority. The market will likely witness increased focus on upgrading existing pipeline networks for greater efficiency and environmental compliance. Opportunities will emerge in adapting midstream assets for the transportation and storage of emerging energy carriers, such as hydrogen and biofuels, aligning with broader decarbonization goals. Collaboration and strategic partnerships will be crucial for navigating the complexities of the energy transition, optimizing asset utilization, and ensuring a resilient energy supply for both domestic and regional markets. The proactive development of flexible and adaptable midstream solutions will be key to sustained growth and market leadership.

Denmark Oil And Gas Midstream Market Segmentation

- 1. Transportation

- 2. Storage

- 3. LNG Terminals

Denmark Oil And Gas Midstream Market Segmentation By Geography

- 1. Denmark

Denmark Oil And Gas Midstream Market Regional Market Share

Geographic Coverage of Denmark Oil And Gas Midstream Market

Denmark Oil And Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Transportation Sector is expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Engie SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TotalEnergies SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shell PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Orsted A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Engie SA

List of Figures

- Figure 1: Denmark Oil And Gas Midstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Denmark Oil And Gas Midstream Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 2: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 3: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 4: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 5: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 6: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 7: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 10: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 11: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 12: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 13: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 14: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 15: Denmark Oil And Gas Midstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Oil And Gas Midstream Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Denmark Oil And Gas Midstream Market?

Key companies in the market include Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, Orsted A/S.

3. What are the main segments of the Denmark Oil And Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Transportation Sector is expected to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half the total capacity (6,700 MWh/h).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Oil And Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Oil And Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Oil And Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Denmark Oil And Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence