Key Insights

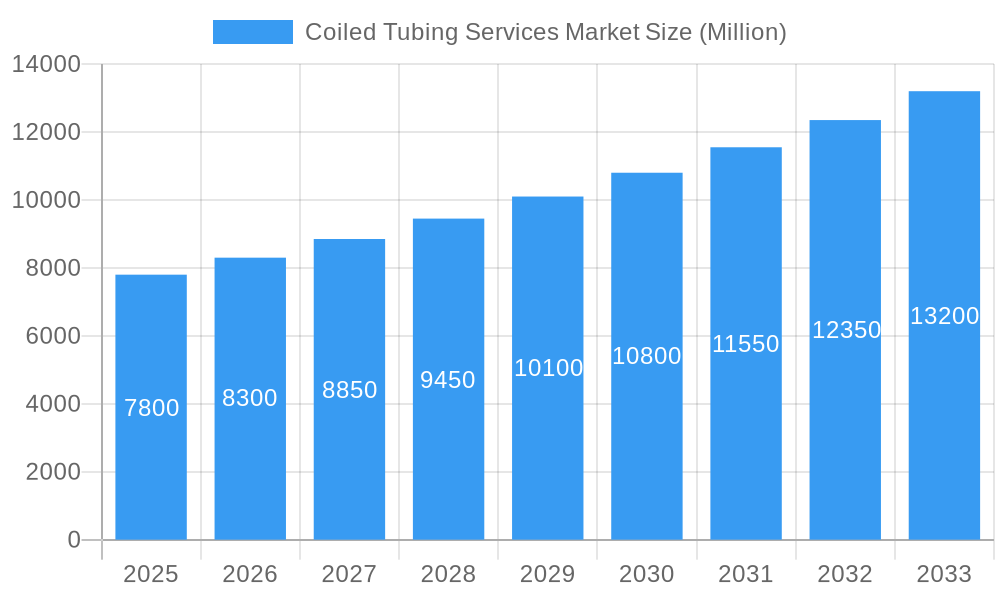

The global Coiled Tubing Services Market is poised for significant expansion, with a projected market size of approximately $7,800 million and a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% between 2025 and 2033. This growth is primarily fueled by the increasing demand for efficient and cost-effective oil and gas exploration and production activities worldwide. The drilling and well intervention applications are expected to dominate the market, driven by the need for enhanced oil recovery (EOR) techniques, wellbore cleanouts, and the deployment of advanced downhole tools in both conventional and unconventional reservoirs. The continuous exploration of mature fields and the development of new reserves, particularly in challenging geological formations, necessitate sophisticated coiled tubing solutions. Furthermore, advancements in coiled tubing technology, including high-strength materials, improved tractor systems, and real-time data acquisition capabilities, are enhancing operational efficiency and safety, thereby stimulating market adoption.

Coiled Tubing Services Market Market Size (In Billion)

The market's trajectory is further shaped by prevailing industry trends such as the growing focus on hydraulic fracturing services in North America and the increasing exploration activities in offshore regions. While the onshore segment is currently the larger contributor, the offshore deployment is anticipated to witness substantial growth due to the industry's push towards deeper waters and more complex subsea infrastructure. Key players like Schlumberger, Halliburton, and Baker Hughes are at the forefront of innovation, investing heavily in research and development to offer integrated coiled tubing solutions. However, the market faces certain restraints, including fluctuating oil prices that can impact upstream investments, stringent environmental regulations, and the high capital expenditure associated with specialized coiled tubing equipment. Despite these challenges, the persistent need for optimized production and the ongoing global energy demand are expected to ensure a favorable growth outlook for the Coiled Tubing Services Market.

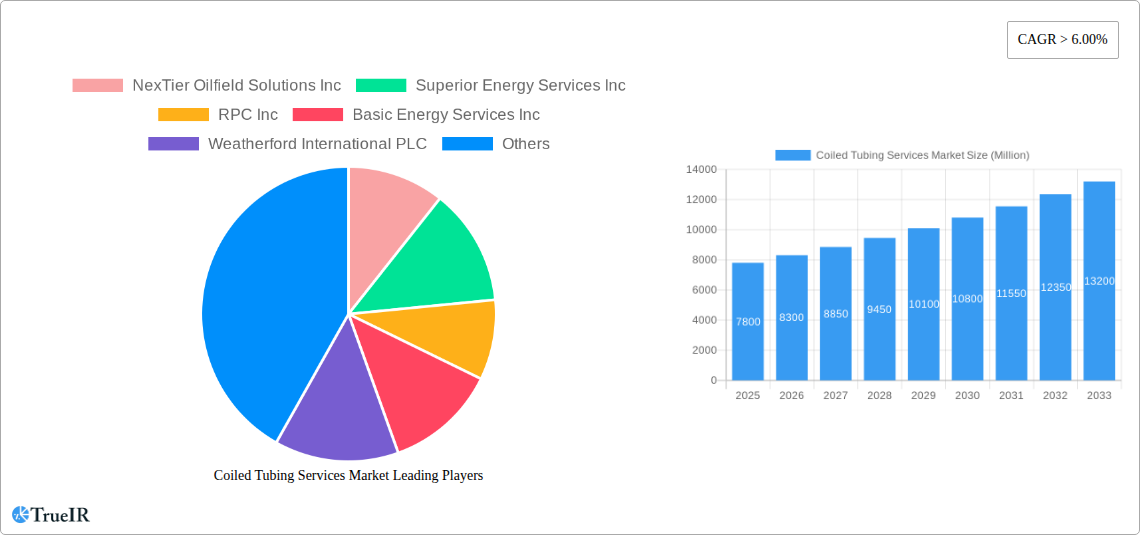

Coiled Tubing Services Market Company Market Share

This in-depth report provides an indispensable guide to the dynamic global Coiled Tubing Services Market. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis delves into the intricate market structure, evolving trends, dominant segments, and the key players shaping the future of coiled tubing operations. Gain critical insights into market size, growth forecasts, technological advancements, and the strategic imperatives driving this vital sector of the oil and gas industry. Whether you are an investor, service provider, or industry stakeholder, this report equips you with the actionable intelligence needed to navigate and capitalize on opportunities within the coiled tubing services landscape.

Coiled Tubing Services Market Market Structure & Competitive Landscape

The global coiled tubing services market exhibits a moderately consolidated structure, characterized by the presence of a few dominant players and a significant number of regional and specialized service providers. The market concentration is influenced by the capital-intensive nature of coiled tubing operations, requiring substantial investments in specialized equipment, skilled personnel, and robust safety protocols. Innovation serves as a primary driver, with companies continuously investing in advanced technologies such as real-time downhole monitoring, intelligent coiled tubing systems, and enhanced downhole tools to improve efficiency, reduce intervention times, and minimize operational risks. Regulatory impacts, particularly stringent environmental and safety regulations in key operating regions, also shape market dynamics by mandating adherence to higher operational standards and influencing investment decisions. Product substitutes, while limited in their direct replacement capability for the unique advantages of coiled tubing, include traditional wireline services and tractor-based conveyance systems, particularly for certain well intervention tasks. End-user segmentation is largely driven by oil and gas exploration and production companies, with a growing emphasis on mature field development and enhanced oil recovery (EOR) initiatives. Mergers and acquisitions (M&A) trends, while subject to market cycles and oil price volatility, are aimed at consolidating market share, expanding service portfolios, and gaining access to new geographical regions. The estimated volume of M&A activities in the historical period averaged at approximately 3-5 significant deals annually, indicating a strategic consolidation drive among key players. Concentration ratios in major operating basins indicate that the top 3-4 companies often account for over 60% of the market share in terms of revenue.

Coiled Tubing Services Market Market Trends & Opportunities

The global coiled tubing services market is on a robust growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is underpinned by several interconnected trends and opportunities. The primary market size growth is driven by the increasing demand for efficient and cost-effective well intervention and completion services, especially in mature oil and gas fields requiring enhanced recovery techniques. Technological shifts are at the forefront, with a significant push towards digitalization and automation. This includes the development and adoption of smart coiled tubing strings equipped with advanced sensors for real-time data acquisition, enabling predictive maintenance and optimized operational execution. The integration of artificial intelligence (AI) and machine learning (ML) algorithms for data analysis is also gaining traction, allowing for more precise decision-making during complex operations. Consumer preferences are evolving towards integrated service solutions that offer a comprehensive package from a single provider, thereby reducing logistical complexities and enhancing overall project efficiency. This demand for integrated services presents a significant opportunity for coiled tubing service companies to expand their offerings beyond basic operations to include stimulation, diagnostics, and production optimization. Competitive dynamics are characterized by a fierce race for technological superiority and operational excellence. Companies are strategically investing in R&D to develop specialized coiled tubing solutions for challenging environments, such as deepwater offshore operations and unconventional resource plays. Market penetration rates for advanced coiled tubing applications, such as multi-stage fracturing and deep well interventions, are expected to increase significantly as operators seek to maximize hydrocarbon recovery from existing and new reserves. The ongoing focus on reducing carbon emissions in the oil and gas industry also presents an opportunity for coiled tubing services, as their efficient and less invasive nature can contribute to lower environmental footprints compared to traditional methods. Furthermore, the increasing number of aging wells worldwide necessitates frequent interventions, creating a sustained demand for coiled tubing services throughout the forecast period. The market is also experiencing a growing demand for services that can be performed rigless, a key advantage of coiled tubing, which reduces overall rig time and associated costs.

Dominant Markets & Segments in Coiled Tubing Services Market

The Onshore segment is currently the dominant force within the Coiled Tubing Services Market, driven by extensive oil and gas exploration and production activities across North America, the Middle East, and parts of Asia. The sheer volume of wells, coupled with the continuous need for maintenance, stimulation, and intervention in mature onshore fields, fuels consistent demand for coiled tubing services. Key growth drivers in the onshore sector include the increasing exploitation of unconventional resources, such as shale gas and oil, which often require specialized intervention techniques like hydraulic fracturing and re-fracturing, where coiled tubing plays a crucial role. Government policies supporting domestic energy production and infrastructure development in various countries also significantly boost onshore activities.

- Key Growth Drivers in Onshore Dominance:

- Extensive reserves of conventional and unconventional hydrocarbons.

- Aging well infrastructure requiring frequent interventions.

- Cost-effective and efficient operational capabilities of coiled tubing.

- Supportive government policies for energy independence and exploration.

- Technological advancements enhancing onshore operational capabilities.

The Well Intervention application segment stands out as the largest and most crucial segment within the coiled tubing services market. This dominance stems from the inherent versatility of coiled tubing in performing a wide array of wellbore operations without the need for tripping the production string. This includes activities such as fishing, milling, cleanouts, logging, perforating, and artificial lift installations. The continuous need to maintain and enhance production from existing wells, particularly in mature fields, drives a sustained demand for well intervention services.

- Key Growth Drivers in Well Intervention Dominance:

- Maximizing production from mature oil and gas fields.

- Addressing wellbore integrity issues and unplanned downtime.

- Performing advanced diagnostics and remedial operations.

- Facilitating the deployment of artificial lift systems.

- Reducing operational costs and time compared to conventional methods.

While Offshore operations represent a smaller but rapidly growing segment, the inherent challenges and higher operational costs associated with offshore environments necessitate highly efficient and specialized solutions. Coiled tubing's ability to perform complex interventions in subsea wells and platforms, often with reduced vessel time, positions it as an indispensable tool. The ongoing exploration and development of deepwater and ultra-deepwater reserves globally, particularly in regions like the Gulf of Mexico, the North Sea, and parts of Asia-Pacific, are significant contributors to the growth of offshore coiled tubing services. The drive for enhanced oil recovery in offshore fields also fuels demand.

- Key Growth Drivers in Offshore Growth:

- Exploration and production in deepwater and ultra-deepwater reserves.

- Need for efficient and less intrusive intervention in subsea wells.

- Cost reduction initiatives in offshore operations.

- Technological advancements enabling offshore coiled tubing operations.

Coiled Tubing Services Market Product Analysis

The coiled tubing services market is characterized by a suite of specialized equipment and technological advancements designed to enhance operational efficiency, safety, and wellbore access. Innovations focus on the development of higher-strength, more flexible coiled tubing strings capable of withstanding extreme pressures and temperatures, as well as complex well geometries. Advanced downhole tools, including high-pressure jetting tools, milling tools, logging sondes, and completion tools, are crucial for a wide range of applications from cleanouts and fishing to selective stimulation and data acquisition. The competitive advantage for service providers lies in their ability to offer integrated solutions, leveraging proprietary technologies and experienced personnel to deliver cost-effective and reliable services. The trend towards smart coiled tubing, incorporating real-time sensors for pressure, temperature, and mechanical stress monitoring, is a significant development, offering enhanced operational control and predictive maintenance capabilities, thereby minimizing non-productive time and reducing overall project costs.

Key Drivers, Barriers & Challenges in Coiled Tubing Services Market

Key Drivers: The Coiled Tubing Services Market is propelled by the relentless demand for efficient well intervention and completion solutions, particularly in mature fields requiring enhanced oil recovery. Technological advancements, such as the development of lighter, stronger coiled tubing and intelligent downhole tools, enable operations in more challenging environments. The drive for cost reduction in oil and gas operations favors coiled tubing's rigless capabilities, significantly lowering overall project expenses. Furthermore, supportive government policies aimed at boosting domestic energy production and ensuring energy security contribute to market growth. The increasing exploration of unconventional resources also presents a consistent demand for coiled tubing services.

Barriers & Challenges: The market faces significant challenges, including the inherent volatility of oil prices, which directly impacts upstream E&P spending and, consequently, demand for coiled tubing services. Stringent environmental regulations and the increasing focus on sustainability necessitate substantial investments in compliance and eco-friendly technologies. Supply chain disruptions, particularly for specialized components and equipment, can lead to project delays and increased costs. The competitive landscape is intense, with price pressure a constant concern. Furthermore, the need for highly skilled and experienced personnel poses a challenge, especially in remote or challenging operating regions. The high capital expenditure required for acquiring and maintaining coiled tubing fleets also acts as a barrier to entry for smaller players.

Growth Drivers in the Coiled Tubing Services Market Market

The growth of the Coiled Tubing Services Market is primarily fueled by the increasing need for efficient and cost-effective well intervention and completion operations, particularly in mature oil and gas fields. Technological advancements continue to play a pivotal role, with innovations in coiled tubing string materials, downhole tool design, and real-time data acquisition systems enhancing operational capabilities and safety. The drive to maximize hydrocarbon recovery from existing reserves, coupled with the economic advantages of coiled tubing's rigless operations, significantly reduces overall project costs and intervention times. Supportive government policies encouraging domestic energy production and the ongoing exploration and development of unconventional resources further bolster market expansion.

Challenges Impacting Coiled Tubing Services Market Growth

Several challenges can impact the growth of the Coiled Tubing Services Market. The cyclical nature of oil prices can lead to fluctuations in upstream spending, directly affecting demand for coiled tubing services. Stringent environmental regulations and the increasing global emphasis on reducing carbon footprints require continuous investment in cleaner technologies and processes. Supply chain vulnerabilities, particularly for specialized equipment and materials, can result in project delays and cost overruns. The competitive intensity within the market can also lead to price pressures, impacting profitability. Furthermore, the requirement for a highly skilled workforce to operate sophisticated coiled tubing equipment presents a persistent challenge.

Key Players Shaping the Coiled Tubing Services Market Market

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

- Weatherford International PLC

- Superior Energy Services Inc

- RPC Inc

- Basic Energy Services Inc

- NexTier Oilfield Solutions Inc

- Trican Well Service Ltd

- Calfrac Well Services Ltd

Significant Coiled Tubing Services Market Industry Milestones

- July 2021: The Abu Dhabi National Oil Company (ADNOC) announced an investment of USD 763.7 million (AED 2.8 billion) in integrated rigless services across six of its artificial islands in the Upper Zakum and Satah Al Razboot (SARB) fields. The scope of the contracts includes coiled tubing services with thru-tubing downhole tools, stimulation services, including equipment and chemicals/fluid systems, surface well-testing services, wireline and production logging services and tools, saturation monitoring, and well integrity. This significant investment underscored the growing importance of integrated rigless solutions and the role of coiled tubing in optimizing offshore field development and production.

Future Outlook for Coiled Tubing Services Market Market

The future outlook for the Coiled Tubing Services Market remains exceptionally promising, driven by sustained demand for efficient well intervention and production optimization. Technological advancements will continue to be a key differentiator, with the increasing adoption of digital solutions, AI-driven analytics, and advanced downhole tools enabling more complex and precise operations. The ongoing global energy transition will also indirectly benefit the market, as coiled tubing's cost-effectiveness and reduced environmental impact compared to traditional methods make it an attractive option for maintaining production from existing assets. Strategic opportunities lie in expanding service portfolios to offer integrated solutions, particularly in unconventional resource plays and deepwater environments, and in developing specialized technologies for carbon capture, utilization, and storage (CCUS) projects. The market is poised for continued growth as operators prioritize maximizing recovery from existing reserves and adapting to evolving energy landscapes.

Coiled Tubing Services Market Segmentation

-

1. Application

- 1.1. Drilling

- 1.2. Completion

- 1.3. Well Intervention

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

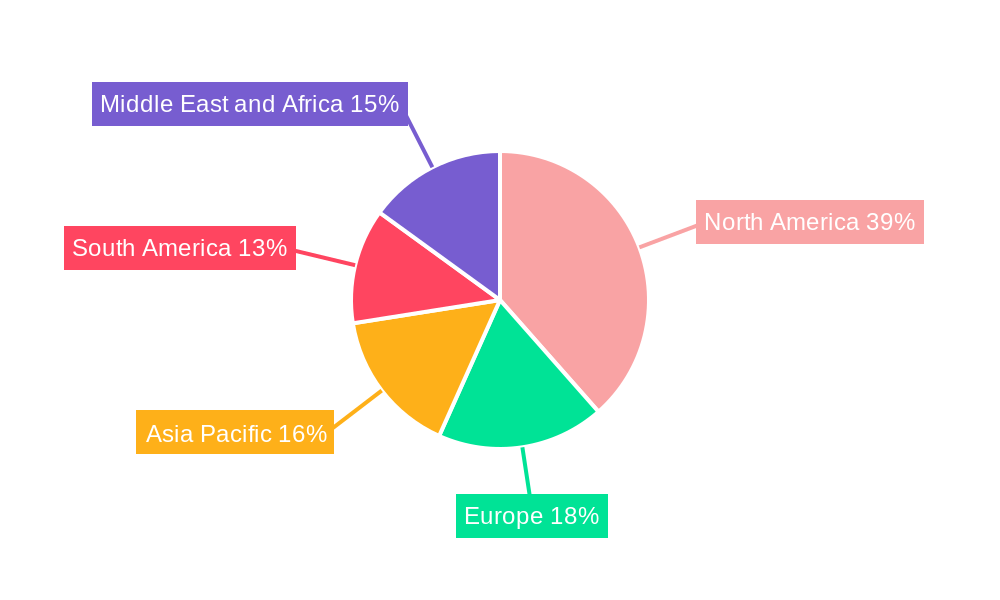

Coiled Tubing Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Coiled Tubing Services Market Regional Market Share

Geographic Coverage of Coiled Tubing Services Market

Coiled Tubing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives

- 3.4. Market Trends

- 3.4.1. Well Intervention Application Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drilling

- 5.1.2. Completion

- 5.1.3. Well Intervention

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drilling

- 6.1.2. Completion

- 6.1.3. Well Intervention

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drilling

- 7.1.2. Completion

- 7.1.3. Well Intervention

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drilling

- 8.1.2. Completion

- 8.1.3. Well Intervention

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drilling

- 9.1.2. Completion

- 9.1.3. Well Intervention

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Coiled Tubing Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drilling

- 10.1.2. Completion

- 10.1.3. Well Intervention

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NexTier Oilfield Solutions Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Superior Energy Services Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RPC Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Basic Energy Services Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Weatherford International PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Trican Well Service Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baker Hughes Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halliburton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Calfrac Well Services Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NexTier Oilfield Solutions Inc

List of Figures

- Figure 1: Global Coiled Tubing Services Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Coiled Tubing Services Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Coiled Tubing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Coiled Tubing Services Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 5: North America Coiled Tubing Services Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 6: North America Coiled Tubing Services Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Coiled Tubing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Coiled Tubing Services Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Coiled Tubing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Coiled Tubing Services Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 11: Europe Coiled Tubing Services Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 12: Europe Coiled Tubing Services Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Coiled Tubing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Coiled Tubing Services Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Coiled Tubing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Coiled Tubing Services Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 17: Asia Pacific Coiled Tubing Services Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 18: Asia Pacific Coiled Tubing Services Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Coiled Tubing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coiled Tubing Services Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Coiled Tubing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Coiled Tubing Services Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 23: South America Coiled Tubing Services Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 24: South America Coiled Tubing Services Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Coiled Tubing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coiled Tubing Services Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Coiled Tubing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Coiled Tubing Services Market Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 29: Middle East and Africa Coiled Tubing Services Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 30: Middle East and Africa Coiled Tubing Services Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coiled Tubing Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 3: Global Coiled Tubing Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 6: Global Coiled Tubing Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 9: Global Coiled Tubing Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 12: Global Coiled Tubing Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 15: Global Coiled Tubing Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Coiled Tubing Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Coiled Tubing Services Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 18: Global Coiled Tubing Services Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coiled Tubing Services Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Coiled Tubing Services Market?

Key companies in the market include NexTier Oilfield Solutions Inc, Superior Energy Services Inc, RPC Inc, Basic Energy Services Inc, Weatherford International PLC, Trican Well Service Ltd*List Not Exhaustive, Baker Hughes Company, Halliburton Company, Schlumberger Limited, Calfrac Well Services Ltd.

3. What are the main segments of the Coiled Tubing Services Market?

The market segments include Application, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities.

6. What are the notable trends driving market growth?

Well Intervention Application Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives.

8. Can you provide examples of recent developments in the market?

In July 2021, The Abu Dhabi National Oil Company (ADNOC) announced an investment of USD 763.7 million (AED 2.8 billion) in integrated rigless services across six of its artificial islands in the Upper Zakum and Satah Al Razboot (SARB) fields. The scope of the contracts includes coiled tubing services with thru-tubing downhole tools, stimulation services, including equipment and chemicals/fluid systems, surface well-testing services, wireline and production logging services and tools, saturation monitoring, and well integrity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coiled Tubing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coiled Tubing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coiled Tubing Services Market?

To stay informed about further developments, trends, and reports in the Coiled Tubing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence