Key Insights

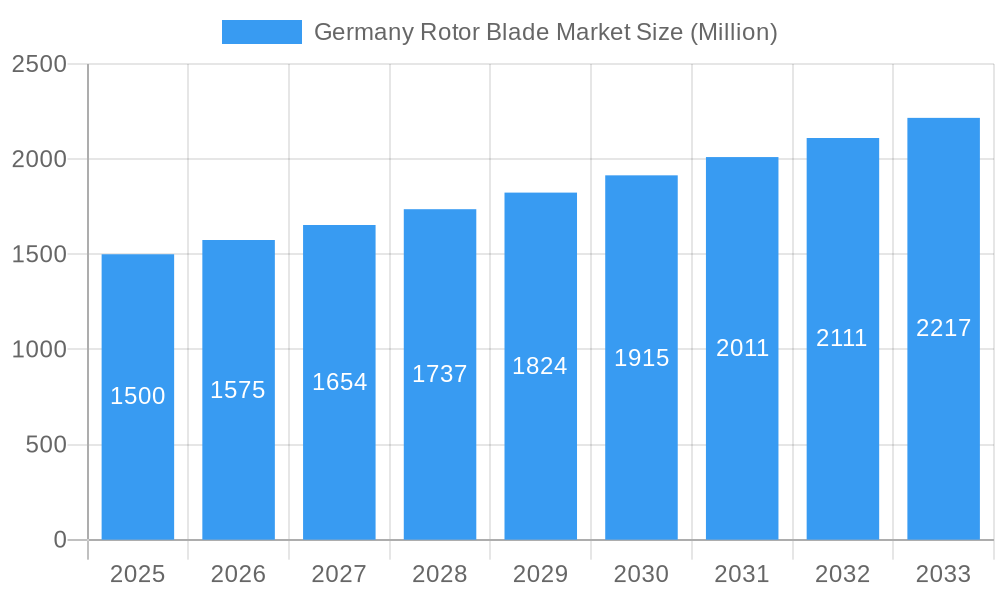

The Germany Rotor Blade Market is projected to experience substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.9%. This expansion is underpinned by Germany's ambitious renewable energy objectives, with a particular emphasis on wind power. The continuous development of onshore wind farms and significant investments in offshore wind projects are the primary catalysts for this market's advancement. Key growth drivers include supportive government policies, escalating demand for sustainable energy alternatives to address climate change, and technological innovations in rotor blade design and manufacturing, leading to improved efficiency and longevity. The market, currently valued at 26.52 billion as of the base year 2025, is anticipated to see considerable value appreciation with the increasing deployment of wind turbines nationwide. The growing scale and complexity of wind energy initiatives are propelling the demand for high-performance rotor blade materials, with carbon fiber and glass fiber composites at the forefront due to their exceptional strength-to-weight ratios and fatigue resistance.

Germany Rotor Blade Market Market Size (In Billion)

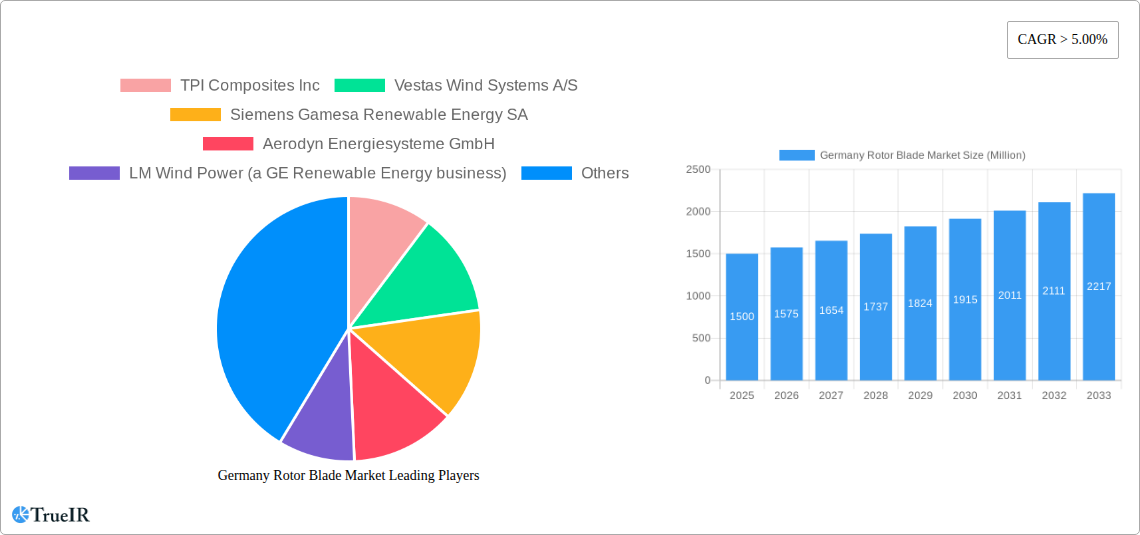

The competitive environment within the Germany Rotor Blade Market is defined by the presence of prominent international and domestic manufacturers, including TPI Composites Inc., Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, and local leaders such as Enercon GmbH and Nordex SE. These entities are actively engaged in research and development to engineer lighter, stronger, and more efficient rotor blades, aligning with the evolving requirements of the wind energy sector. While robust demand and technological progress are favorable, certain challenges may temper market expansion. These include intricate permitting procedures for new wind farm installations, potential disruptions in the supply chain for raw materials, and the capital-intensive nature of producing advanced rotor blades. Nevertheless, the prevailing global shift towards green energy and Germany's pivotal role in Europe's renewable energy landscape indicate that these obstacles are likely to be surmounted, further reinforcing the market's positive trajectory.

Germany Rotor Blade Market Company Market Share

Germany Rotor Blade Market: Comprehensive Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Germany Rotor Blade Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. The study offers a comprehensive overview of the market's structure, competitive landscape, key trends, opportunities, dominant segments, and future outlook, covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, encompassing the Historical Period: 2019–2024.

The Germany rotor blade market is a crucial component of the nation's robust wind energy sector. This report delves into the intricate dynamics of rotor blade manufacturing and supply, encompassing key players, technological advancements, and market segmentation. With Germany's commitment to renewable energy targets, the demand for efficient and advanced rotor blades is set to continue its upward trajectory. This analysis will equip stakeholders with critical insights into market growth, challenges, and emerging opportunities within this vital industry.

Germany Rotor Blade Market Market Structure & Competitive Landscape

The Germany rotor blade market exhibits a moderately concentrated structure, driven by the presence of several global leaders and specialized domestic manufacturers. The innovation drivers are primarily centered around increasing blade efficiency, durability, and cost-effectiveness. Regulatory impacts, stemming from stringent environmental standards and renewable energy policies, significantly shape market dynamics, encouraging the adoption of advanced materials and manufacturing processes. Product substitutes are limited within the direct rotor blade manufacturing segment, with innovation focusing on enhancing existing designs and materials rather than outright replacements. End-user segmentation is largely dictated by the onshore and offshore wind farm deployment locations, each with distinct technical requirements and market demands. Mergers & Acquisitions (M&A) trends are influenced by the pursuit of technological synergy, market expansion, and vertical integration. While precise M&A volumes are dynamic, strategic consolidations are observed as companies aim to secure market share and bolster their product portfolios. Key players are investing heavily in R&D to maintain a competitive edge in a market where technological advancement directly translates to market dominance. The competitive landscape is characterized by a blend of established giants and emerging innovators, all vying for a significant share of the burgeoning Germany wind energy market.

Germany Rotor Blade Market Market Trends & Opportunities

The Germany Rotor Blade Market is poised for substantial growth, driven by a confluence of technological advancements, supportive government policies, and increasing environmental consciousness. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) during the forecast period, signifying a significant expansion in demand for advanced rotor blade solutions. A key trend is the relentless pursuit of larger and more efficient rotor blades to maximize energy capture from wind resources. This includes the development of longer blades, optimized aerodynamic designs, and the integration of smart technologies for performance monitoring and predictive maintenance. The growing emphasis on offshore wind energy installations presents a significant opportunity, as these projects demand larger, more robust, and specialized rotor blades capable of withstanding harsh marine environments. This shift is driving innovation in materials and manufacturing techniques to ensure the longevity and performance of these critical components.

Furthermore, the increasing adoption of advanced composite materials, such as carbon fiber, is a prominent trend. While glass fiber remains a prevalent material due to its cost-effectiveness, the superior strength-to-weight ratio and fatigue resistance of carbon fiber are becoming indispensable for next-generation, high-performance wind turbines, especially in demanding offshore applications. This material shift not only enhances performance but also contributes to lighter and more transportable blade designs, mitigating logistical challenges associated with ever-larger turbine components.

The market is also experiencing a surge in demand for sustainable and recyclable rotor blades. As the wind energy industry matures, concerns regarding the end-of-life disposal of composite materials are growing. Manufacturers are actively investing in research and development to create blades with improved recyclability and explore bio-based composite alternatives. This growing focus on circular economy principles presents a significant opportunity for companies that can offer environmentally friendly rotor blade solutions.

The digitalization of manufacturing processes is another crucial trend. Advanced automation, AI-driven design optimization, and digital twins are being implemented to improve production efficiency, reduce defects, and enable mass customization of rotor blades to meet specific turbine requirements. This technological integration is vital for keeping pace with the increasing complexity and scale of modern wind turbine designs.

Moreover, the Germany government's ambitious renewable energy targets and commitment to reducing carbon emissions provide a strong policy tailwind for the entire wind energy sector, including the rotor blade market. Incentives for renewable energy deployment, investments in grid infrastructure, and supportive regulatory frameworks are creating a fertile ground for market expansion. Opportunities also lie in the repowering of older wind farms, where replacing existing rotor blades with newer, more efficient models can significantly boost energy generation and extend the operational life of the turbines.

The competitive dynamics are evolving, with a focus on strategic partnerships, joint ventures, and technological collaborations to share risks, accelerate innovation, and expand market reach. Companies that can demonstrate superior blade performance, cost-competitiveness, supply chain reliability, and a commitment to sustainability are best positioned to capitalize on the burgeoning opportunities within the Germany Rotor Blade Market. The continuous drive for higher capacity wind turbines necessitates continuous innovation in rotor blade technology, presenting ongoing opportunities for market leaders and agile new entrants alike.

Dominant Markets & Segments in Germany Rotor Blade Market

The Germany Rotor Blade Market is characterized by distinct dominant segments, primarily driven by the Location of Deployment and Blade Material.

Location of Deployment:

Onshore: Historically, the onshore segment has been the bedrock of the Germany rotor blade market. Its dominance is attributed to the established wind farm infrastructure, mature technology, and a broader base of existing installations. Key growth drivers for onshore deployment include:

- Government support and incentives: Continued policy frameworks and feed-in tariffs encouraging onshore wind farm development.

- Grid accessibility: Relatively easier integration of onshore wind farms into existing electricity grids.

- Cost-effectiveness: Onshore installations generally have lower upfront capital expenditure compared to offshore projects, making them attractive for a wider range of investors.

- Technological advancements: Ongoing improvements in turbine efficiency and blade design for onshore applications continue to drive demand for replacement and new installations.

- Repowering projects: The replacement of older, less efficient turbines with newer models is a significant contributor to onshore rotor blade demand.

Offshore: While currently smaller in volume, the offshore segment represents the most dynamic and high-growth area within the Germany rotor blade market. Its dominance is projected to increase significantly in the coming years due to several factors:

- Higher wind speeds and consistency: Offshore locations offer more consistent and stronger wind resources, leading to higher energy yields.

- Technological advancements in offshore turbines: The development of increasingly larger and more powerful offshore wind turbines necessitates the production of exceptionally long and robust rotor blades.

- Germany's strategic focus on offshore wind: Significant government investment and policy support are dedicated to expanding offshore wind capacity as a cornerstone of its renewable energy strategy.

- Expansion into deeper waters: Advances in foundation technologies are enabling the deployment of wind farms further from shore in deeper waters, requiring specialized and larger rotor blades.

- Long-term energy security: Offshore wind is seen as a critical element in securing Germany's future energy supply with predictable renewable output.

Blade Material:

Glass Fiber: Glass fiber remains the most widely used material in the Germany rotor blade market due to its excellent balance of performance, cost-effectiveness, and manufacturability. Its dominance is attributed to:

- Cost-efficiency: Glass fiber composite blades are generally less expensive to produce than those made from carbon fiber.

- Proven reliability: Decades of use have established the reliability and durability of glass fiber in various wind conditions.

- Established manufacturing processes: The industry has well-developed and efficient manufacturing techniques for glass fiber composite blades.

- Suitability for onshore applications: For many onshore turbine sizes, glass fiber offers sufficient strength and performance.

Carbon Fiber: The use of carbon fiber is steadily increasing, particularly in the offshore and high-performance onshore segments. Its market share is growing due to:

- Superior strength-to-weight ratio: Carbon fiber blades are significantly lighter than glass fiber blades of comparable strength, enabling the design of longer, more aerodynamic, and more efficient blades. This is crucial for the large rotor diameters of modern offshore turbines.

- Enhanced stiffness and fatigue resistance: Carbon fiber offers greater resistance to bending and fatigue, leading to longer blade lifespan and reduced maintenance requirements, which are critical in demanding offshore environments.

- Enabling larger rotor diameters: The structural integrity of carbon fiber allows for the construction of the exceptionally long blades required for increasingly powerful wind turbines, especially in the offshore sector.

- Performance optimization: Its properties allow for more precise aerodynamic shaping, leading to improved energy capture and turbine performance.

Other Blade Materials: This category includes emerging materials and hybrid composites, such as basalt fiber or advanced resin systems. While currently holding a smaller market share, these materials are gaining traction due to:

- Potential for enhanced sustainability: Research into bio-based resins and more recyclable composite structures.

- Specific performance advantages: Tailored material properties for niche applications or extreme environmental conditions.

- Ongoing R&D: Continuous exploration of new material combinations to push the boundaries of blade performance and durability.

In conclusion, while the onshore and glass fiber segments currently hold significant market share due to their established presence and cost-effectiveness, the offshore and carbon fiber segments are experiencing the most rapid growth and are poised to shape the future trajectory of the Germany Rotor Blade Market.

Germany Rotor Blade Market Product Analysis

The Germany Rotor Blade Market is characterized by continuous product innovation focused on enhancing aerodynamic efficiency, structural integrity, and longevity. Manufacturers are increasingly developing longer and lighter blades, often leveraging advanced composite materials like carbon fiber to achieve superior strength-to-weight ratios. These advancements are crucial for capturing more energy from lower wind speeds and enabling the construction of larger, more powerful wind turbines, particularly in the offshore sector. Innovations also include optimized blade profiles and tip designs to reduce noise emissions and improve overall performance. Furthermore, the integration of smart technologies and sensors into rotor blades for real-time monitoring of stress, strain, and environmental conditions is a growing trend, facilitating predictive maintenance and optimizing operational efficiency. The competitive advantage for manufacturers lies in their ability to deliver tailored solutions that meet the specific demands of diverse deployment locations and turbine models, while also addressing the growing imperative for sustainability and recyclability in blade design and materials.

Key Drivers, Barriers & Challenges in Germany Rotor Blade Market

Key Drivers:

The Germany Rotor Blade Market is primarily propelled by Germany's ambitious renewable energy targets and its strong commitment to decarbonization.

- Technological Advancements: Continuous innovation in blade design, materials (e.g., carbon fiber), and manufacturing processes leads to more efficient and durable rotor blades, driving demand for upgrades and new installations.

- Economic Incentives and Policy Support: Government subsidies, feed-in tariffs, and favorable regulatory frameworks for wind energy deployment create a conducive environment for market growth.

- Growing Demand for Renewable Energy: Increasing public and corporate demand for clean energy solutions directly fuels the expansion of wind power capacity, thus increasing the need for rotor blades.

- Offshore Wind Expansion: Strategic investments in offshore wind farms, driven by higher wind potential and Germany's energy security goals, are a major growth catalyst for larger and more advanced rotor blades.

Barriers & Challenges:

Despite robust growth, the market faces several significant challenges that can impact its trajectory.

- Supply Chain Constraints and Raw Material Volatility: Disruptions in the global supply chain for key raw materials like carbon fiber and resins, coupled with price volatility, can lead to increased production costs and project delays. For instance, a significant portion of carbon fiber is sourced internationally, making the German market susceptible to global supply chain issues.

- Logistical Complexities of Large Blades: The increasing size of rotor blades presents significant logistical challenges in terms of transportation from manufacturing facilities to wind farm sites, especially for onshore installations. This requires specialized infrastructure and planning, adding to project costs.

- High Production Costs and Competitive Pressure: Manufacturers face continuous pressure to lower production costs to remain competitive. This is exemplified by Nordex SE's decision to discontinue production at its Rostock factory due to high costs, highlighting the intense competition and the need for efficient operations.

- Skilled Labor Shortages: The specialized nature of rotor blade manufacturing and installation requires a skilled workforce. Shortages in qualified personnel can hinder production and project execution.

- Regulatory Hurdles and Permitting Delays: While policy is supportive, complex permitting processes for wind farm developments, especially in sensitive environmental areas, can lead to project delays and uncertainty for rotor blade manufacturers.

- End-of-Life Management of Blades: The growing volume of decommissioned blades presents a significant environmental challenge, necessitating the development of scalable recycling solutions, which are still in their nascent stages.

Growth Drivers in the Germany Rotor Blade Market Market

The Germany Rotor Blade Market's growth is primarily fueled by ambitious national renewable energy targets, pushing for increased wind power capacity. Technological advancements in blade design, aerodynamic efficiency, and the utilization of advanced materials like carbon fiber are key drivers, enabling the production of larger and more efficient blades for both onshore and the rapidly expanding offshore wind sectors. Supportive government policies, including subsidies and favorable regulatory frameworks for wind energy deployment, provide a crucial economic impetus. The increasing global emphasis on decarbonization and energy independence further bolsters demand for wind-generated electricity. Moreover, cost reductions in wind energy technology are making wind power increasingly competitive, driving further investment and, consequently, the demand for rotor blades. The repowering of older wind farms with newer, more efficient turbines also contributes significantly to market growth by requiring replacement rotor blades.

Challenges Impacting Germany Rotor Blade Market Growth

Several challenges can impede the growth of the Germany Rotor Blade Market. Supply chain disruptions and volatility in raw material prices, particularly for specialized composites like carbon fiber, can lead to increased costs and production delays. The sheer logistical complexity of transporting increasingly large rotor blades to installation sites poses significant hurdles, especially for onshore projects. Intense competition and the constant pressure to reduce production costs can strain profit margins for manufacturers, as seen with instances of factory closures due to uncompetitive cost structures. Shortages of skilled labor in manufacturing and installation can also constrain expansion. Furthermore, regulatory complexities and lengthy permitting processes for new wind farm developments can introduce uncertainty and slow down project timelines. Finally, the growing issue of end-of-life management for decommissioned rotor blades presents an environmental challenge and requires scalable, sustainable recycling solutions.

Key Players Shaping the Germany Rotor Blade Market Market

- TPI Composites Inc

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Aerodyn Energiesysteme GmbH

- LM Wind Power (a GE Renewable Energy business)

- Suzlon Energy Limited

- Acciona SA

- Enercon GmbH

- Nordex SE

- Xinjiang Goldwind Science & Technology Co Ltd

Significant Germany Rotor Blade Market Industry Milestones

- March 2022: Nordex SE announced plans to discontinue the production of rotor blades at its factory in Rostock, northern Germany, citing high production costs and a shift in global demand. This move underscores the intense pressure on manufacturers to optimize costs and adapt to evolving market dynamics.

- March 2022: Vestas announced plans to test the rotor blade of its new V236-15.0 MW offshore wind turbine prototype at the Fraunhofer Institute for Wind Energy Systems IWES in Bremerhaven, Germany. This initiative highlights the ongoing development of cutting-edge, high-capacity offshore turbine technology and the critical role of rotor blade innovation. The company aims to commence serial production of these blades by 2024, signifying a major step in advancing offshore wind capabilities.

Future Outlook for Germany Rotor Blade Market Market

The future outlook for the Germany Rotor Blade Market remains exceptionally positive, driven by a persistent commitment to renewable energy and ongoing technological advancements. The market will likely witness continued expansion, with a strong emphasis on larger and more efficient rotor blades tailored for both onshore repowering projects and the burgeoning offshore wind sector. The demand for blades manufactured with advanced materials like carbon fiber will escalate due to their superior performance characteristics, particularly in demanding offshore environments. Furthermore, sustainability will play an increasingly pivotal role, with a growing focus on developing recyclable and bio-based composite materials, presenting significant opportunities for innovative companies. Strategic collaborations, mergers, and acquisitions are anticipated as players seek to consolidate expertise, expand their technological capabilities, and secure market share in this dynamic landscape. The continuous push for higher capacity wind turbines, coupled with supportive government policies and increasing investments in wind energy infrastructure, will ensure sustained growth and innovation within the Germany Rotor Blade Market for the foreseeable future.

Germany Rotor Blade Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Blade Material

- 2.1. Carbon Fiber

- 2.2. Glass Fiber

- 2.3. Other Blade Materials

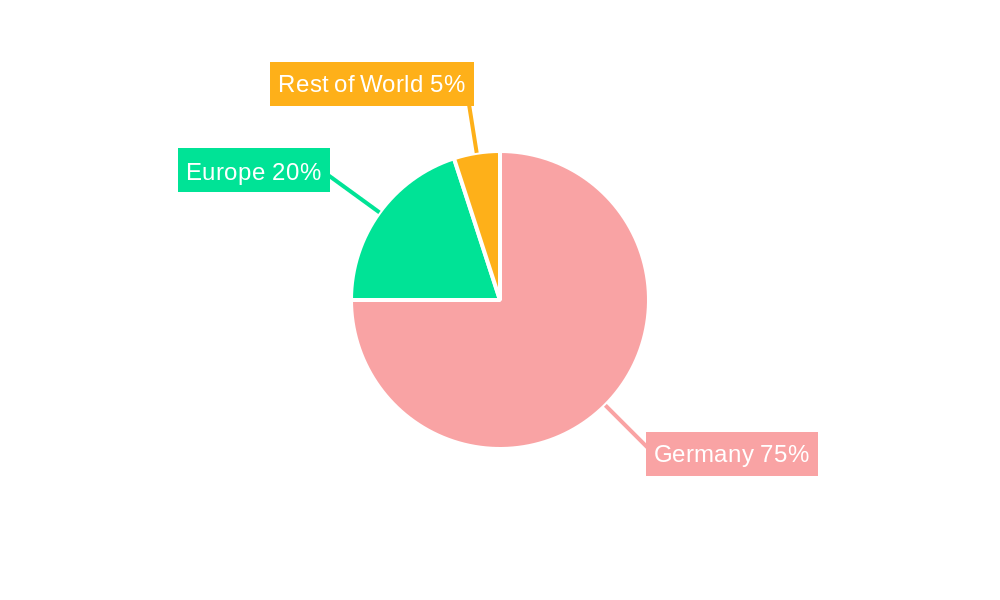

Germany Rotor Blade Market Segmentation By Geography

- 1. Germany

Germany Rotor Blade Market Regional Market Share

Geographic Coverage of Germany Rotor Blade Market

Germany Rotor Blade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Blade Material

- 5.2.1. Carbon Fiber

- 5.2.2. Glass Fiber

- 5.2.3. Other Blade Materials

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TPI Composites Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vestas Wind Systems A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aerodyn Energiesysteme GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LM Wind Power (a GE Renewable Energy business)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Suzlon Energy Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Acciona SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Enercon GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nordex SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xinjiang Goldwind Science & Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TPI Composites Inc

List of Figures

- Figure 1: Germany Rotor Blade Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Rotor Blade Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Rotor Blade Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Germany Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 3: Germany Rotor Blade Market Revenue billion Forecast, by Blade Material 2020 & 2033

- Table 4: Germany Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 5: Germany Rotor Blade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Germany Rotor Blade Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Germany Rotor Blade Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: Germany Rotor Blade Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 9: Germany Rotor Blade Market Revenue billion Forecast, by Blade Material 2020 & 2033

- Table 10: Germany Rotor Blade Market Volume K Unit Forecast, by Blade Material 2020 & 2033

- Table 11: Germany Rotor Blade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Rotor Blade Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Rotor Blade Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Germany Rotor Blade Market?

Key companies in the market include TPI Composites Inc, Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, Aerodyn Energiesysteme GmbH, LM Wind Power (a GE Renewable Energy business), Suzlon Energy Limited, Acciona SA, Enercon GmbH, Nordex SE, Xinjiang Goldwind Science & Technology Co Ltd.

3. What are the main segments of the Germany Rotor Blade Market?

The market segments include Location of Deployment, Blade Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.52 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector.

8. Can you provide examples of recent developments in the market?

In March 2022, Nordex SE announced plans to discontinue the production of rotor blades at its factory in Rostock, northern Germany, amid high production costs and a shift in global demand. The closure is necessary as wind turbine manufacturers are under increasing pressure to lower production costs to remain competitive, and the factory in Rostock is still not competitive despite all the cost-cutting measures taken by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Rotor Blade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Rotor Blade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Rotor Blade Market?

To stay informed about further developments, trends, and reports in the Germany Rotor Blade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence