Key Insights

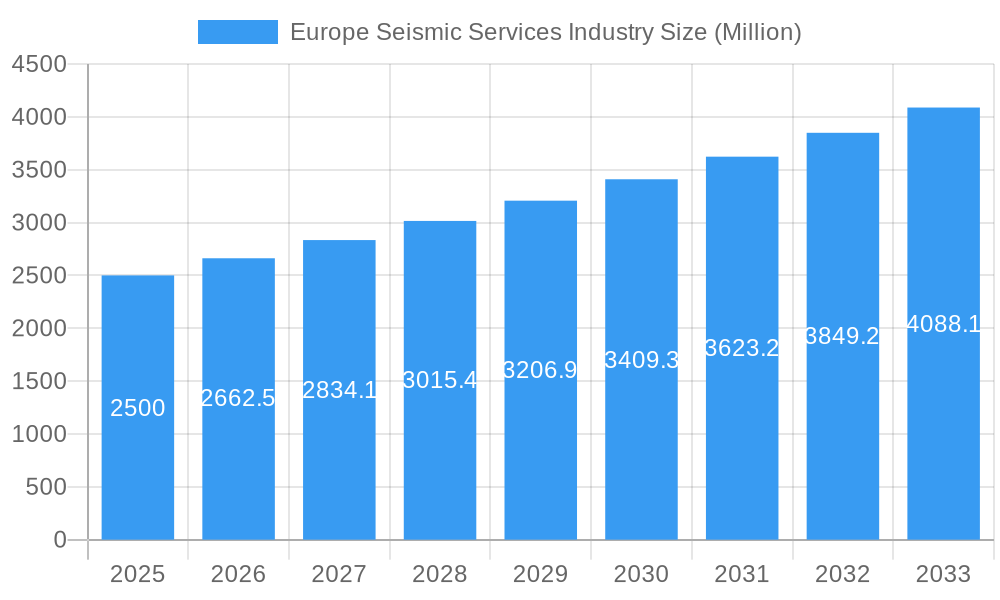

The European seismic services market is projected for significant expansion, driven by escalating demand in hydrocarbon exploration and production across the North Sea and nascent offshore basins. With an estimated market size of $2.08 billion in 2024, the sector anticipates a Compound Annual Growth Rate (CAGR) of 4% from 2024 to 2033. This growth is underpinned by the critical need for new reserve discovery to satisfy ongoing energy requirements and increasing adoption of seismic imaging for offshore wind farm site assessments. Technological innovations, including advanced nodal systems and cloud-based analytics, are boosting efficiency and data fidelity, propelling market growth. Evolving regulatory frameworks promoting efficient resource extraction and environmental monitoring further solidify demand for seismic services.

Europe Seismic Services Industry Market Size (In Billion)

The historical period from 2019 to 2024 showcased market recovery and consistent growth, influenced by oil price dynamics and increased exploration investments. The forecast period (2024-2033) is expected to witness expanded seismic applications beyond oil and gas, including subsurface imaging for geothermal energy and carbon capture and storage (CCS) projects. The industry's resilience and innovation in adapting to shifting energy demands will be paramount to its long-term prosperity. Europe, a key offshore E&P market, will remain a vital contributor to global seismic service revenue, supported by its robust network of specialized providers and research bodies.

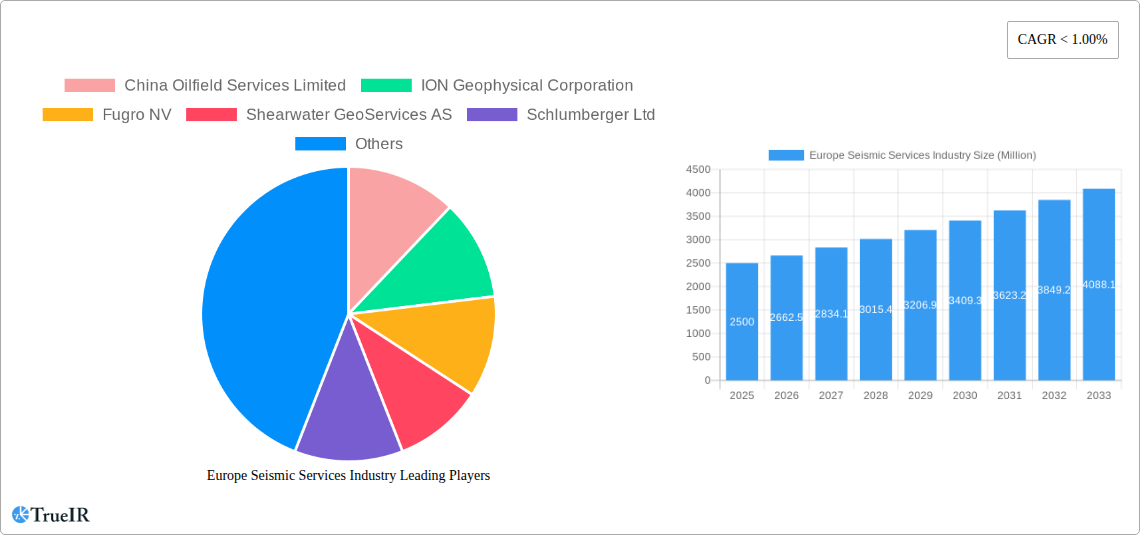

Europe Seismic Services Industry Company Market Share

This dynamic, SEO-optimized report details the Europe Seismic Services Industry, focusing on market size, growth, and future forecasts for enhanced search visibility and audience engagement.

Europe Seismic Services Industry Market Structure & Competitive Landscape

The Europe Seismic Services Industry is characterized by a dynamic and moderately concentrated market structure. Key players like Schlumberger Ltd, Halliburton Company, CGG SA, Fugro NV, and ION Geophysical Corporation exert significant influence, accounting for an estimated 60% of the market share in the base year 2025. Innovation is a primary driver, fueled by advancements in seismic acquisition technologies such as node-based seismic and multi-azimuth surveys, alongside sophisticated data processing algorithms leveraging AI and machine learning. Regulatory frameworks, particularly concerning environmental impact and data security, play a crucial role in shaping operational strategies and R&D investments. Product substitutes, while limited in high-resolution subsurface imaging, include alternative geophysical methods and advanced well logging techniques. End-user segmentation is dominated by the oil and gas exploration and production sector, with a growing interest from offshore wind farm development and infrastructure projects. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and capability enhancement. Recent M&A activity has seen companies like Magseis Fairfield ASA (WGP Group Ltd) and Shearwater GeoServices AS pursuing synergistic opportunities, with an estimated volume of 5 significant M&A deals between 2019 and 2024, and a projected 3 deals in 2025 alone, indicating continued strategic realignment.

Europe Seismic Services Industry Market Trends & Opportunities

The Europe Seismic Services Industry is poised for robust growth, driven by an escalating demand for efficient hydrocarbon exploration and an increasing reliance on seismic data for renewable energy infrastructure planning. The market size is projected to grow from an estimated 10,500 Million in 2025 to 15,800 Million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2%. Technological shifts are central to this expansion, with a significant move towards higher-density seismic surveys, advanced Full Waveform Inversion (FWI) processing, and the integration of cloud-based data management solutions. These innovations enable more accurate subsurface imaging, reducing exploration risks and improving recovery rates. Consumer preferences are increasingly leaning towards integrated service providers offering end-to-end solutions, from data acquisition to interpretation and reservoir characterization. This shift is compelling companies to invest heavily in R&D and strategic partnerships. Competitive dynamics are intensifying, with established players focusing on technological differentiation and cost optimization, while new entrants are exploring niche markets and specialized services. The penetration rate of advanced seismic technologies is expected to rise from 55% in 2025 to over 75% by 2033. The industry is also witnessing a growing emphasis on seismic data for carbon capture and storage (CCS) projects and geothermal energy exploration, presenting new avenues for market penetration and diversification. The drive for energy security in Europe further bolsters the demand for domestic exploration activities, making seismic services indispensable. The increasing complexity of offshore exploration, particularly in deeper waters and challenging geological formations, necessitates sophisticated seismic solutions, thereby creating substantial opportunities for service providers equipped with cutting-edge technology and expertise.

Dominant Markets & Segments in Europe Seismic Services Industry

The Offshore segment is the dominant market within the Europe Seismic Services Industry, accounting for an estimated 70% of market revenue in 2025. This dominance is driven by the significant hydrocarbon reserves located in the North Sea and other European offshore basins, necessitating large-scale seismic surveys. Key growth drivers in the offshore sector include the continuous need for new exploration to meet energy demands, the technological advancements enabling operations in deeper waters, and the substantial investments in offshore infrastructure. Countries such as Norway, the United Kingdom, and the Netherlands are at the forefront of offshore seismic activities.

Data Acquisition represents the largest service segment, capturing an estimated 55% of the market share in 2025. This is directly linked to the substantial investments required for the deployment of advanced seismic vessels and equipment, including towed streamers and ocean-bottom nodes (OBN) for high-resolution imaging. The demand for higher-quality data to reduce drilling risks and optimize production is a primary catalyst for growth in this segment.

The Data Processing and Interpretation segment, while smaller, is experiencing rapid growth, with an estimated 45% market share in 2025. The increasing volume and complexity of seismic data necessitate sophisticated processing techniques, including Full Waveform Inversion (FWI) and machine learning algorithms, to extract maximum value. Investments in advanced software and highly skilled geoscientists are crucial for this segment’s expansion.

While Onshore seismic services constitute a smaller portion, approximately 30% of the market in 2025, it is crucial for specific applications such as unconventional resource exploration, CCS site characterization, and geothermal energy assessments. Growth in the onshore sector is often tied to government initiatives supporting energy transition projects and localized exploration efforts. Policies aimed at decarbonization and the exploration of indigenous energy resources will continue to shape the demand for both onshore and offshore seismic services.

Europe Seismic Services Industry Product Analysis

The Europe Seismic Services Industry is characterized by innovative product offerings, primarily focused on enhancing subsurface imaging accuracy and operational efficiency. Advancements in seismic acquisition hardware, such as multi-component streamers and autonomous underwater vehicles (AUVs) equipped with seismic sensors, are delivering unprecedented data quality. In data processing, the integration of artificial intelligence and machine learning algorithms allows for faster and more precise interpretation, significantly reducing uncertainty in exploration and development projects. Competitive advantages are derived from proprietary processing algorithms, integrated service platforms, and the ability to deploy cutting-edge technology in challenging environments, both onshore and offshore.

Key Drivers, Barriers & Challenges in Europe Seismic Services Industry

Key Drivers:

- Rising Energy Demand: Continued global and European energy needs, particularly for oil and gas, drive exploration activities.

- Technological Advancements: Innovations in seismic acquisition (e.g., OBN, multi-azimuth) and processing (e.g., AI, FWI) improve data accuracy and reduce exploration risks.

- Energy Transition Support: Growing use of seismic data for carbon capture and storage (CCS), geothermal energy, and offshore wind farm site surveys.

- Regulatory Support: Favorable policies encouraging domestic energy exploration and development.

Barriers & Challenges:

- Volatile Oil Prices: Fluctuations in crude oil prices directly impact E&P spending and, consequently, seismic service demand.

- Environmental Regulations: Stringent environmental laws can increase operational costs and limit exploration in sensitive areas.

- Supply Chain Disruptions: Geopolitical events and global logistics issues can impact the availability of specialized equipment and personnel.

- High Capital Investment: The significant upfront cost of seismic vessels and advanced technology creates a barrier to entry.

- Competition: Intense competition among established players and emerging service providers pressures profit margins.

Growth Drivers in the Europe Seismic Services Industry Market

The Europe Seismic Services Industry's growth is primarily propelled by the persistent demand for oil and gas exploration to ensure energy security, coupled with the burgeoning need for detailed subsurface data to support the energy transition. Technological advancements, such as the widespread adoption of advanced seismic acquisition technologies like Ocean Bottom Nodes (OBN) and the sophisticated processing capabilities of Full Waveform Inversion (FWI), are critical enablers. These technologies offer higher resolution and more reliable subsurface imaging, thereby reducing exploration risks and enhancing recovery efficiency. Furthermore, government initiatives and incentives aimed at promoting renewable energy sources, particularly offshore wind farms, are driving demand for seismic surveys for site characterization and infrastructure planning, creating new revenue streams.

Challenges Impacting Europe Seismic Services Industry Growth

Despite promising growth prospects, the Europe Seismic Services Industry faces several significant challenges. The inherent volatility of global oil and gas prices directly impacts the capital expenditure budgets of exploration and production companies, creating uncertainty in demand for seismic services. Increasingly stringent environmental regulations and the growing public scrutiny of fossil fuel exploration can lead to project delays and increased operational costs. Supply chain disruptions, exacerbated by geopolitical tensions and logistical complexities, can affect the timely delivery of critical equipment and spare parts, impacting project timelines and budgets. Intense competition within the industry also exerts downward pressure on pricing and profit margins, requiring companies to constantly innovate and optimize their operations for cost-efficiency.

Key Players Shaping the Europe Seismic Services Industry Market

- Schlumberger Ltd

- Halliburton Company

- CGG SA

- Fugro NV

- ION Geophysical Corporation

- Shearwater GeoServices AS

- BGP Inc China National Petroleum Corporation

- China Oilfield Services Limited

- SeaBird Exploration PLC

- Magseis Fairfield ASA (WGP Group Ltd)

- Polarcus Ltd

- PGS ASA

Significant Europe Seismic Services Industry Industry Milestones

- 2019: PGS ASA expands its fleet with advanced seismic acquisition capabilities, enhancing its offshore service offering.

- 2020: CGG SA partners with technology providers to develop AI-powered seismic data processing solutions.

- 2021: Magseis Fairfield ASA completes a significant merger, creating a stronger player in the OBN seismic market.

- 2022: Fugro NV invests in autonomous marine technology for enhanced offshore seismic data acquisition.

- 2023: Shearwater GeoServices AS secures major contracts for high-density seismic surveys in the North Sea.

- 2024: ION Geophysical Corporation launches a new cloud-based seismic data platform for improved accessibility and collaboration.

- 2025 (Projected): Continued industry consolidation through strategic acquisitions and mergers expected as companies seek to enhance technological capabilities and market reach.

Future Outlook for Europe Seismic Services Industry Market

The future outlook for the Europe Seismic Services Industry is marked by sustained growth and evolving opportunities. The continued demand for hydrocarbon exploration, coupled with the increasing role of seismic data in the energy transition for CCS, geothermal, and offshore wind projects, will be key growth catalysts. Technological innovation, particularly in AI-driven processing and autonomous acquisition systems, will remain central to enhancing efficiency and accuracy. Strategic collaborations and potential further market consolidation are anticipated as companies aim to leverage specialized expertise and expand their service portfolios. The industry is poised to benefit from investments in energy security and infrastructure development across Europe, presenting a promising trajectory for market expansion and profitability in the coming years.

Europe Seismic Services Industry Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

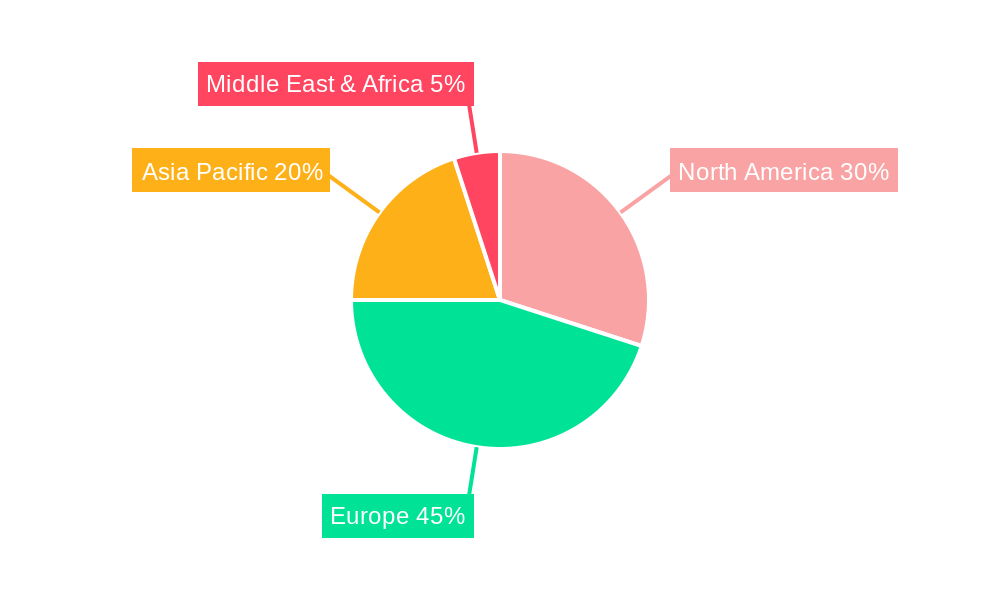

Europe Seismic Services Industry Segmentation By Geography

- 1. Norway

- 2. United Kingdom

- 3. Russia

- 4. Rest of Europe

Europe Seismic Services Industry Regional Market Share

Geographic Coverage of Europe Seismic Services Industry

Europe Seismic Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seismic Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.3.2. United Kingdom

- 5.3.3. Russia

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Norway Europe Seismic Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Seismic Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Russia Europe Seismic Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of Europe Europe Seismic Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Data Acquisition

- 9.1.2. Data Processing and Interpretation

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 China Oilfield Services Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ION Geophysical Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fugro NV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shearwater GeoServices AS

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schlumberger Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CGG SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BGP Inc China National Petroleum Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Halliburton Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SeaBird Exploration PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Magseis Fairfield ASA (WGP Group Ltd)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Polarcus Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PGS ASA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 China Oilfield Services Limited

List of Figures

- Figure 1: Europe Seismic Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Seismic Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Seismic Services Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Europe Seismic Services Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 3: Europe Seismic Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Seismic Services Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Europe Seismic Services Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: Europe Seismic Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Seismic Services Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Europe Seismic Services Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 9: Europe Seismic Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Seismic Services Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Europe Seismic Services Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 12: Europe Seismic Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Seismic Services Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Europe Seismic Services Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 15: Europe Seismic Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seismic Services Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Europe Seismic Services Industry?

Key companies in the market include China Oilfield Services Limited, ION Geophysical Corporation, Fugro NV, Shearwater GeoServices AS, Schlumberger Ltd, CGG SA, BGP Inc China National Petroleum Corporation, Halliburton Company, SeaBird Exploration PLC, Magseis Fairfield ASA (WGP Group Ltd), Polarcus Ltd, PGS ASA.

3. What are the main segments of the Europe Seismic Services Industry?

The market segments include Service, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.08 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seismic Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seismic Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seismic Services Industry?

To stay informed about further developments, trends, and reports in the Europe Seismic Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence